Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

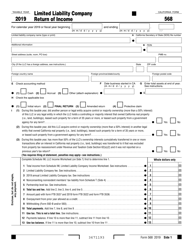

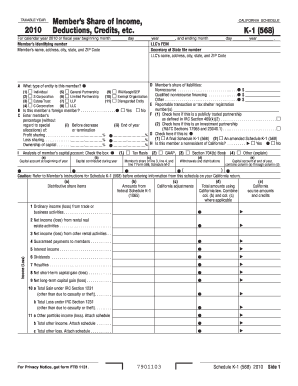

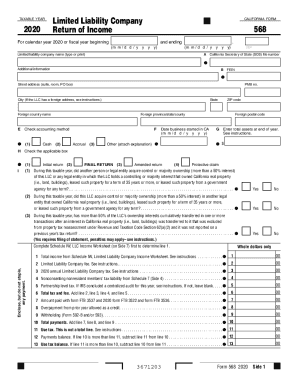

California has not adopted the federal definition of small partnerships, as defined in IRC Section 6231. Official Payments Corporation charges a convenience fee for using this service. Use Schedule K, lines 2, 3, 5, 6, 7, 8, 9, and 11a to report these amounts. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. If the LLC requests an extension to file its tax return, wait until the LLC files its tax return to report the purchases subject to use tax and to make the use tax payment. Form 568, Schedule K and Schedule K-1 lines 10a and 10b have been separated to report total gains and total losses, and lines 11b and 11c have been separated to report total other income and losses. Check Yes or No if this is the LLCs first year of doing business in California. For an LLC that is doing business within and outside California, the amounts in column (d) and column (e) may be different. Using black or blue ink, make the check or money order payable to the Franchise Tax Board. Write the LLCs California SOS file number, FEIN, and 2022 FTB 3522 on the check or money order. For example, if your tax year starts January 1st, then the first estimate payment is due April 15th. The penalty is equal to 10% of the amount of the LLC fee owed for the year over the amount of the timely estimated fee payment. Thursday, April 15, 2021 - 20:00. RETURN WITHOUT PAYMENT or PAID ELECTRONICALLY. Determine the credit to be utilized. This question is applicable if the LLC is reporting previously deferred income in the current taxable year or prior taxable years. Credits that may be reported on line 15f (depending on the type of activity they relate to) include: All credit forms are available at ftb.ca.gov/forms. Nonbusiness income from real and tangible property located in California. Enters the limitation amount from Schedule P (100), Side 2, line 4, column (c) in column (f) of the table on this page. For tax purposes, an eligible entity with a single owner will be disregarded. Webftb form 568 franchise tax board payment voucher 2020 ftb 3522 form 2019 california franchise tax $800 due date 2021 Create this form in 5 minutes! In general, LLCs must pay California use tax on purchases of merchandise for use in California, made from out-of-state sellers, for example, by telephone, online, by mail, or in person. If a nonresident has not signed the single member LLC consent on Side 3, then the SMLLC is required to complete Schedule T on Side 4. For small partnerships, as defined in IRC Section 6231, the federal exception to the imposition of penalties for failure to file partnership returns does not apply for California purposes. Elective Tax for Pass-through Entities (PTE) and Credit for Owners For taxable years beginning on or after January 1, 2021, and before January 1, 2026, California law allows an entity taxed as a partnership or an S corporation to annually elect to pay an elective tax at a rate of 9.3 percent based on its qualified net income. The proportionate interest of the gross receipts of the trades or businesses which the taxpayer owns. If you live outside California, allow three weeks to receive your order. California does not require the filing of written applications for extensions. For more information, get FTB Pub. See General Information S, Check-the-Box Regulations, for the filing requirements for disregarded entities. The LLC files the appropriate documents for cancellation with the California SOS within 12 months of the timely filed. LLCs classified as a general corporation file Form 100, California Corporation Franchise or Income Tax Return. The proportionate interest of the pass-through entitys gross receipts in which the taxpayer holds an interest. If income tax was paid by an LLC on behalf of a member that is an LLC and form FTB 3832 is not signed on behalf of the member LLC, the amount paid by an LLC is entered on the member LLCs Schedule K-1 (568), line 15e. LLCs classified as a: LLCs classified as partnerships should not file Form 565, Partnership Return of Income. Use professional pre-built templates to fill in and sign documents online faster. A resident member of an out-of-state LLC taxed as a partnership not required to file Form 568, may be required to furnish a copy of federal Form 1065, U.S. Return of Partnership Income, to substantiate the members share of LLC income or loss. See form FTB 3574, Special Election for Business Trusts and Certain Foreign Single Member LLCs, and Cal. Otherwise, the LLC should complete column (e) for all other members. A paper copy of the LLCs federal tax return. The LLC can claim a credit up to the amount of tax that would have been due if the purchase had been made in California. A partnership that is operated by one or more individual(s) who are not residents of California. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Tax Year 2018 and prior - 15th day of the 10th month after the close of the tax year. If any amount was included for federal purposes, exclude that amount for California purposes. For all other SMLLCs, the original due date of the return is the 15th day of the 4th month following the close of the taxable year of the owner. The LLC files one California Schedule K-1 (568) for each member with the LLC return and gives one copy to the appropriate member. For more information and access to form FTB 1096, Agreement to Comply with FTB Pub. These pages do not include the Google translation application. Due date: 15th day of the 4th month after the beginning of your tax year. There is a difference between how California treats businesses vs federal. No matter their income, all LLCs are required to file this form. Utilization of credits attributable to the SMLLC is limited to the regular tax liability on the income attributable to the activities of the SMLLC. 1067, Guidelines for Filing a Group Form 540NR. Qualified Opportunity Zone Funds. Use LLC Tax Voucher (3522) when making your payment and to figure out your due date. Enter the amount here and on line 13. Using black or blue ink, make the check or money order payable to the Franchise Tax Board. Write the LLCs California SOS file number, FEIN, and 2021 Form 568 on the check or money order. Code Regs., tit. See the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner, for more information on completing Question A through Question K. Check the appropriate box to indicate the members entity type. See #4 above For Individuals. Nonresident individual members will be taxed on their distributive shares of income from the LLC investment partnership if the income from the qualifying investment securities is interrelated with either of the following: Nonresident individual members will be taxed on their distributive share of investment income from an LLC investment partnership if the qualifying securities were purchased with working capital of a trade or business the nonresident owns an interest in and that is conducted in California (R&TC Section 17955). However, for California tax purposes, business income of the LLC is defined using the rules set forth in R&TC Section 25120. Corporate members are also considered doing business in California and may have additional filing requirements. The LLC must file Form 592, 592-F, or 592-PTE, and Form 592-B to allocate any remaining withholding credit to its members. FTB 3544, Election to Assign Credit Within Combined Reporting Group. Small Business COVID-19 Relief Grant Program. The election shall be made on an original, timely filed return and is irrevocable for the taxable year. An indication if the disposition is from a casualty or theft. Use LLC Tax Voucher (3522) when making your payment and to figure out your due date. Form 568 is not considered a valid return unless it is signed by an authorized member or manager of the LLC. The definition of Total Income excludes allocations, distributions, or gains to an LLC from another LLC, if that allocation, distribution, or gain was already subject to the LLC fee.  You're not required to pay an annual tax. Do not include any income on the worksheet that has already been subject to the LLC fee. Visit Instructions for Form 100-ES for more information. Multiple member LLCs will complete the remaining schedules, as appropriate. The LLC should inform the members that they may also be required to file amended returns within six months from the date of the final federal determination. Credit Card LLCs can use a Discover, MasterCard, Visa, or American Express card to pay business taxes. Follow the instructions for federal Form 1125-A, Cost of Goods Sold. If an eligible entity is disregarded for federal tax purposes, it is also disregarded for state tax purposes, except that an SMLLC must still pay a tax and fee, file a return, and limit tax credits. Businesses that are registered or required to be registered with the California Department of Tax and Fee Administration to report use tax. Part of this amount or this entire amount may be reported on Form 568, line 7 (see instructions). See General Information G, Penalties and Interest, for more details. File a timely final California return (Form 568) with the FTB and pay the $800 annual tax for the taxable year of the final return. For all other members enter their FEIN. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. WebTo generate Form 568, Limited Liability Company Return of Income, choose File > Client Properties, click the California tab, and mark the Limited Liability Company option. California Venues Grant For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the CalOSBA. The taxable income of nonresident members is the distributive share of California sourced LLC income, not the distributed amount. For assistance with use tax questions, go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities).

You're not required to pay an annual tax. Do not include any income on the worksheet that has already been subject to the LLC fee. Visit Instructions for Form 100-ES for more information. Multiple member LLCs will complete the remaining schedules, as appropriate. The LLC should inform the members that they may also be required to file amended returns within six months from the date of the final federal determination. Credit Card LLCs can use a Discover, MasterCard, Visa, or American Express card to pay business taxes. Follow the instructions for federal Form 1125-A, Cost of Goods Sold. If an eligible entity is disregarded for federal tax purposes, it is also disregarded for state tax purposes, except that an SMLLC must still pay a tax and fee, file a return, and limit tax credits. Businesses that are registered or required to be registered with the California Department of Tax and Fee Administration to report use tax. Part of this amount or this entire amount may be reported on Form 568, line 7 (see instructions). See General Information G, Penalties and Interest, for more details. File a timely final California return (Form 568) with the FTB and pay the $800 annual tax for the taxable year of the final return. For all other members enter their FEIN. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. WebTo generate Form 568, Limited Liability Company Return of Income, choose File > Client Properties, click the California tab, and mark the Limited Liability Company option. California Venues Grant For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the CalOSBA. The taxable income of nonresident members is the distributive share of California sourced LLC income, not the distributed amount. For assistance with use tax questions, go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities).  Select return type. 15th day of the 10th month after the close of your tax year. Penalty for Non-Registered, Suspended, or Forfeited LLC The FTB will assess a $2,000 penalty against a non-qualified foreign LLC that is doing business within the state while not registered to do business within the state, or while suspended or forfeited. However, not all purchases require the LLC to pay use tax. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. To claim credit for the tax, the nonresident member needs to attach a copy of the Schedule K-1 (568) to their California income tax return. california form 568 due date 2021. Column (e) includes only income, deductions, gains or losses that are apportioned or sourced to California. Check the Yes or No box to indicate if the LLC operated as another entity type such as a Corporation, S Corporation, General Partnership, Limited Partnership, LLC, or Sole Proprietorship in the previous five (5) years. The LLC should give each member a description and the amount of the members share for each item applicable to California in this category. If the LLC owes NCNR tax and is unable to complete Form 568 on or before the original due date, it must complete form FTB 3537. If the LLC is filing a final year tax return, check the Final Return box on Form 568, Side 1, Item H(2), and check the A final Schedule K-1 (568) box for Item G(1) on Schedule K-1 (568). Foreign and domestic currency deposits or equivalents and securities convertible into foreign securities. Natural Heritage Preservation Credit The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. The amount is $1,000. If the LLC owes use tax but does not report it on the income tax return, the LLC must report and pay the tax to the California Department of Tax and Fee Administration. In order to expedite processing, be sure to use the business entity name as it appears with the California SOS and a valid California identification number. Pass-Through Entity Elective Tax Credit. Line 21 (Other Deductions) includes repairs, rents and taxes. Enter all payment types (overpayment from prior year, annual tax, fee, etc.) For questions on whether a purchase is taxable, go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov, or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities). A single trade or business within and outside California, then California source business income of that trade or business is determined by apportionment. Your total tax owed is due on the 15th day of the 4th month after the close of your tax year. Go to ftb.ca.gov and search for 588 online. LLCs organized under the laws of another state or foreign country are required to register with the California SOS before entering into intrastate business in California. The amount of tax paid must be supported by a schedule of payments and evidence of tax liability by the LLC to the other states. If the LLC is in one of these lines of business, the sale assignment methodology employed in the regulation applicable to the LLCs line of business should be used to determine total income derived from or attributable to California. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Visit the LLC Fee chart to figure your fee amount. If a private delivery service is used, address the return to: Caution: Private delivery services cannot deliver items to PO boxes. For more information on nontaxable and exempt purchases, the LLC may refer to Publication 61, Sales and Use Taxes: Exemptions and Exclusions, on the California Department of Tax and Fee Administrations website at cdtfa.ca.gov. Do not file form FTB 3588, Payment Voucher for LLC e-filed Returns. However, California law does not allow the formation or registration of LLCs (foreign or domestic) in California to render any type of professional service for which a license, certification, or registration is required under the Business and Professions Code or the Chiropractic Act, with the exception of insurance agents and insurance brokers. Each members distributive share of business income apportioned to an EZ, LAMBRA, MEA, or TTA. WebIf the due date falls on a Saturday, Sunday, or legal holiday, the filing date becomes the next business day. If the LLC originally filed a Form 540NR group nonresident member return, the LLC should file an amended Form 540NR. Investment interest does not include interest expense allocable to a passive activity. Our California Tax Service Center website offers California business tax information and forms for the BOE, CDTFA, EDD, FTB, and IRS at taxes.ca.gov. Also, the ARPA expands PPP eligibility to include additional covered nonprofit entities which includes certain Code 501(c) nonprofit organizations and Internet-only news publishers and Internet-only periodical publishers. We include information that is most useful to the greatest number of taxpayers in the limited space available. The known assets have been distributed to the persons entitled thereto or no known assets have been acquired. Beginning in taxable year 2021, all LLCs must report members' capital accounts using the tax basis method on California Schedule K-1 (568). made for the 2021 taxable year on the applicable line of Form 568. See General Information E, When and Where to File, for more information. The gain or loss on property subject to the IRC Section 179 Recapture should be reported on Schedule K-1 as supplemental information as instructed on the federal Form 4797. 1060, Guide for Corporations Starting Business in California. Get form FTB 3546. If the LLC is filing a short period return for 2022 and the 2022 forms are not available, the LLC must use the 2021 Form 568 and change the taxable year. Multiply column (c) by column (d) and put the result in column (e) for each nonconsenting nonresident member. The payment is sent with form FTB 3522. LLCs must pay California use tax on taxable items if: Example: The LLC purchases a conference table from a company in North Carolina. Attach a copy of federal Form 8825 to Form 568. Column (g) cannot be less than zero. Completes Schedule P (100), Side 2, down to line 4, column (c). An $800 annual tax is generally imposed on limited partnerships (LPs), LLCs, limited liability partnerships (LLPs), and real estate mortgage investment conduits (REMICs) that are partnerships or classified as partnerships for tax purposes. Any information returns required for federal purposes under IRC Sections 6038, 6038A, 6038B, and 6038D are also required for California purposes. 1017. Schedule K-1 (568) may not be used to claim this withholding credit. For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year. Transfer the total from form FTB 3885L, line 6, to Form 568, Side 4, line 17a, or federal Form 8825, as appropriate (use California amounts). A disregarded entity that is not unitary with an owner that is either (1) a corporation that is a taxpayer, or (2) a member of a combined reporting group that includes at least one taxpayer member. If the LLC fails to timely pay the tax of such nonresident member, the LLC shall be subject to penalties and interest (R&TC Sections 19132 and 19101). Get form FTB 3548. California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. Also, the ARPA expands PPP eligibility to include additional covered nonprofit entities which includes certain Code 501(c) nonprofit organizations and Internet-only news publishers and Internet-only periodical publishers. Sign in the space provided for the preparers signature. The PTE Elective Tax Credit is not a pass-through item, but should still be reported on Schedule K-1 (568), line 15f and attached schedule. For a complete definition of gross receipts, refer to R&TC Section 25120(f), or go to ftb.ca.gov and search for 25120. $2 million in any single taxable year or $4 million in any combination of taxable years for all other partnerships. The company ships the table from North Carolina to the LLCs address in California for the LLCs use, and does not charge California sales or use tax. For more information regarding the California business e-file program, go to ftb.ca.gov and search for business efile. The LLC completes the entire Schedule K-1 (568) by filling out the members and LLCs information (name, address, identifying numbers), Questions A through K and the members distributive share of items. 7. Electronic Funds Withdrawal (EFW) LLCs can make an annual tax, estimated fee, or extension payment using tax preparation software. Note: Check exempt organization if the owner is a pension plan, charitable organization, insurance company, or a government entity. If the payee has backup withholding, the payee must contact the FTB to provide a valid Taxpayer Identification Number (TIN), before filing the tax return. The computation of the C corporations regular tax liability without the SMLLC income is $3,000. You must file Form 199, regardless of gross receipts. Reg. See General Information F, Limited Liability Company Tax and Fee, for more information. Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely. Code Regs., tit. Total income from all sources derived or attributable to this state is determined using the rules for assigning sales under R&TC Sections 25135 and 25136 and the regulations thereunder, as modified by regulations under R&TC Section 25137, if applicable, other than those provisions that exclude receipts from the sales factor. Ineligible entity means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. We translate some pages on the FTB website into Spanish. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year. Include a statement with their original or amended California tax return stating the taxpayers intent to make an election under R&TC Section 17859(d)(1) of Assembly Bill 91. 18 section 25137-1. Enter on line 17a, only the total depreciation and amortization claimed on assets used in a trade or business activity. However, Schedule M-3 (Form 1065), Part I, is required for these LLCs. Worksheet, Line 1, Purchases Subject to Use Tax. In general, California R&TC does not conform to the changes. This service is available in English and Spanish to callers with touch-tone telephones. Enter on line 20b only investment expenses included on line 13d of Schedule K (568) and Schedule K-1 (568). The limitation for California is 50%. The IRC Section 481 adjustment is taken into account ratably over five years beginning with the first income year. Give the FTB any information that is missing from the return. If the separate existence of an entity is disregarded, its activities are treated as activities of the owner and reported on the appropriate California return. Get the instructions for form FTB 3526 for more information. If using one of these services to mail any item to the FTB, Do not use an FTB PO box. Las horas estn sujetas a cambios. Have paper and pencil ready to take notes. Use the table below to find out when your estimate payments are due. See R&TC Section 19131 for more information. The LLC should file the appropriate California return. If the LLC is claiming Deployed Military Exemption, enter zero on line 2 and line 3 of Form 568. For example, generally, purchases of clothing would be included, but not exempt purchases of food products or prescription medicine. Although a waiver is not required in this situation, if upon examination the FTB determines that tax withholding was required on a distribution, the LLC may be liable for the amount that should have been withheld including interest and penalties. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. Do not attach federal Schedules K-1 (1065). Shuttered Venue Operator Grant For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for amounts awarded as a shuttered venue operator grant under the Consolidated Appropriations Act, 2021 (CAA, 2021). An LLC can designate a paid preparer to discuss the tax return with the FTB. The owner will be responsible for limiting any credits attributable to the disregarded entity.

Select return type. 15th day of the 10th month after the close of your tax year. Penalty for Non-Registered, Suspended, or Forfeited LLC The FTB will assess a $2,000 penalty against a non-qualified foreign LLC that is doing business within the state while not registered to do business within the state, or while suspended or forfeited. However, not all purchases require the LLC to pay use tax. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. To claim credit for the tax, the nonresident member needs to attach a copy of the Schedule K-1 (568) to their California income tax return. california form 568 due date 2021. Column (e) includes only income, deductions, gains or losses that are apportioned or sourced to California. Check the Yes or No box to indicate if the LLC operated as another entity type such as a Corporation, S Corporation, General Partnership, Limited Partnership, LLC, or Sole Proprietorship in the previous five (5) years. The LLC should give each member a description and the amount of the members share for each item applicable to California in this category. If the LLC owes NCNR tax and is unable to complete Form 568 on or before the original due date, it must complete form FTB 3537. If the LLC is filing a final year tax return, check the Final Return box on Form 568, Side 1, Item H(2), and check the A final Schedule K-1 (568) box for Item G(1) on Schedule K-1 (568). Foreign and domestic currency deposits or equivalents and securities convertible into foreign securities. Natural Heritage Preservation Credit The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. The amount is $1,000. If the LLC owes use tax but does not report it on the income tax return, the LLC must report and pay the tax to the California Department of Tax and Fee Administration. In order to expedite processing, be sure to use the business entity name as it appears with the California SOS and a valid California identification number. Pass-Through Entity Elective Tax Credit. Line 21 (Other Deductions) includes repairs, rents and taxes. Enter all payment types (overpayment from prior year, annual tax, fee, etc.) For questions on whether a purchase is taxable, go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov, or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities). A single trade or business within and outside California, then California source business income of that trade or business is determined by apportionment. Your total tax owed is due on the 15th day of the 4th month after the close of your tax year. Go to ftb.ca.gov and search for 588 online. LLCs organized under the laws of another state or foreign country are required to register with the California SOS before entering into intrastate business in California. The amount of tax paid must be supported by a schedule of payments and evidence of tax liability by the LLC to the other states. If the LLC is in one of these lines of business, the sale assignment methodology employed in the regulation applicable to the LLCs line of business should be used to determine total income derived from or attributable to California. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. Visit the LLC Fee chart to figure your fee amount. If a private delivery service is used, address the return to: Caution: Private delivery services cannot deliver items to PO boxes. For more information on nontaxable and exempt purchases, the LLC may refer to Publication 61, Sales and Use Taxes: Exemptions and Exclusions, on the California Department of Tax and Fee Administrations website at cdtfa.ca.gov. Do not file form FTB 3588, Payment Voucher for LLC e-filed Returns. However, California law does not allow the formation or registration of LLCs (foreign or domestic) in California to render any type of professional service for which a license, certification, or registration is required under the Business and Professions Code or the Chiropractic Act, with the exception of insurance agents and insurance brokers. Each members distributive share of business income apportioned to an EZ, LAMBRA, MEA, or TTA. WebIf the due date falls on a Saturday, Sunday, or legal holiday, the filing date becomes the next business day. If the LLC originally filed a Form 540NR group nonresident member return, the LLC should file an amended Form 540NR. Investment interest does not include interest expense allocable to a passive activity. Our California Tax Service Center website offers California business tax information and forms for the BOE, CDTFA, EDD, FTB, and IRS at taxes.ca.gov. Also, the ARPA expands PPP eligibility to include additional covered nonprofit entities which includes certain Code 501(c) nonprofit organizations and Internet-only news publishers and Internet-only periodical publishers. We include information that is most useful to the greatest number of taxpayers in the limited space available. The known assets have been distributed to the persons entitled thereto or no known assets have been acquired. Beginning in taxable year 2021, all LLCs must report members' capital accounts using the tax basis method on California Schedule K-1 (568). made for the 2021 taxable year on the applicable line of Form 568. See General Information E, When and Where to File, for more information. The gain or loss on property subject to the IRC Section 179 Recapture should be reported on Schedule K-1 as supplemental information as instructed on the federal Form 4797. 1060, Guide for Corporations Starting Business in California. Get form FTB 3546. If the LLC is filing a short period return for 2022 and the 2022 forms are not available, the LLC must use the 2021 Form 568 and change the taxable year. Multiply column (c) by column (d) and put the result in column (e) for each nonconsenting nonresident member. The payment is sent with form FTB 3522. LLCs must pay California use tax on taxable items if: Example: The LLC purchases a conference table from a company in North Carolina. Attach a copy of federal Form 8825 to Form 568. Column (g) cannot be less than zero. Completes Schedule P (100), Side 2, down to line 4, column (c). An $800 annual tax is generally imposed on limited partnerships (LPs), LLCs, limited liability partnerships (LLPs), and real estate mortgage investment conduits (REMICs) that are partnerships or classified as partnerships for tax purposes. Any information returns required for federal purposes under IRC Sections 6038, 6038A, 6038B, and 6038D are also required for California purposes. 1017. Schedule K-1 (568) may not be used to claim this withholding credit. For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year. Transfer the total from form FTB 3885L, line 6, to Form 568, Side 4, line 17a, or federal Form 8825, as appropriate (use California amounts). A disregarded entity that is not unitary with an owner that is either (1) a corporation that is a taxpayer, or (2) a member of a combined reporting group that includes at least one taxpayer member. If the LLC fails to timely pay the tax of such nonresident member, the LLC shall be subject to penalties and interest (R&TC Sections 19132 and 19101). Get form FTB 3548. California allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the COVID-19 Relief Grant under Executive Order No. Also, the ARPA expands PPP eligibility to include additional covered nonprofit entities which includes certain Code 501(c) nonprofit organizations and Internet-only news publishers and Internet-only periodical publishers. Sign in the space provided for the preparers signature. The PTE Elective Tax Credit is not a pass-through item, but should still be reported on Schedule K-1 (568), line 15f and attached schedule. For a complete definition of gross receipts, refer to R&TC Section 25120(f), or go to ftb.ca.gov and search for 25120. $2 million in any single taxable year or $4 million in any combination of taxable years for all other partnerships. The company ships the table from North Carolina to the LLCs address in California for the LLCs use, and does not charge California sales or use tax. For more information regarding the California business e-file program, go to ftb.ca.gov and search for business efile. The LLC completes the entire Schedule K-1 (568) by filling out the members and LLCs information (name, address, identifying numbers), Questions A through K and the members distributive share of items. 7. Electronic Funds Withdrawal (EFW) LLCs can make an annual tax, estimated fee, or extension payment using tax preparation software. Note: Check exempt organization if the owner is a pension plan, charitable organization, insurance company, or a government entity. If the payee has backup withholding, the payee must contact the FTB to provide a valid Taxpayer Identification Number (TIN), before filing the tax return. The computation of the C corporations regular tax liability without the SMLLC income is $3,000. You must file Form 199, regardless of gross receipts. Reg. See General Information F, Limited Liability Company Tax and Fee, for more information. Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely. Code Regs., tit. Total income from all sources derived or attributable to this state is determined using the rules for assigning sales under R&TC Sections 25135 and 25136 and the regulations thereunder, as modified by regulations under R&TC Section 25137, if applicable, other than those provisions that exclude receipts from the sales factor. Ineligible entity means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. We translate some pages on the FTB website into Spanish. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year. Include a statement with their original or amended California tax return stating the taxpayers intent to make an election under R&TC Section 17859(d)(1) of Assembly Bill 91. 18 section 25137-1. Enter on line 17a, only the total depreciation and amortization claimed on assets used in a trade or business activity. However, Schedule M-3 (Form 1065), Part I, is required for these LLCs. Worksheet, Line 1, Purchases Subject to Use Tax. In general, California R&TC does not conform to the changes. This service is available in English and Spanish to callers with touch-tone telephones. Enter on line 20b only investment expenses included on line 13d of Schedule K (568) and Schedule K-1 (568). The limitation for California is 50%. The IRC Section 481 adjustment is taken into account ratably over five years beginning with the first income year. Give the FTB any information that is missing from the return. If the separate existence of an entity is disregarded, its activities are treated as activities of the owner and reported on the appropriate California return. Get the instructions for form FTB 3526 for more information. If using one of these services to mail any item to the FTB, Do not use an FTB PO box. Las horas estn sujetas a cambios. Have paper and pencil ready to take notes. Use the table below to find out when your estimate payments are due. See R&TC Section 19131 for more information. The LLC should file the appropriate California return. If the LLC is claiming Deployed Military Exemption, enter zero on line 2 and line 3 of Form 568. For example, generally, purchases of clothing would be included, but not exempt purchases of food products or prescription medicine. Although a waiver is not required in this situation, if upon examination the FTB determines that tax withholding was required on a distribution, the LLC may be liable for the amount that should have been withheld including interest and penalties. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. Do not attach federal Schedules K-1 (1065). Shuttered Venue Operator Grant For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for amounts awarded as a shuttered venue operator grant under the Consolidated Appropriations Act, 2021 (CAA, 2021). An LLC can designate a paid preparer to discuss the tax return with the FTB. The owner will be responsible for limiting any credits attributable to the disregarded entity.  Total receipts is defined as the sum of gross receipts or sales plus all other income. A short period return must be filed if the LLC is created or terminated within the taxable year. Partnership Converting to a Corporation IRS Revenue Ruling 2009-15 was released which explains that in certain situations, a partnership that converts to a corporation under Section 301.7701-3(c)(1)(i) or under a state law formless conversion statute is eligible to make an S election effective for the corporations first taxable year. Therefore, interest expense allocable to portfolio income should be reported on line 13b of Schedule K (568) and Schedule K-1 (568) rather than line 13d of Schedule K (568) and Schedule K-1 (568).

Total receipts is defined as the sum of gross receipts or sales plus all other income. A short period return must be filed if the LLC is created or terminated within the taxable year. Partnership Converting to a Corporation IRS Revenue Ruling 2009-15 was released which explains that in certain situations, a partnership that converts to a corporation under Section 301.7701-3(c)(1)(i) or under a state law formless conversion statute is eligible to make an S election effective for the corporations first taxable year. Therefore, interest expense allocable to portfolio income should be reported on line 13b of Schedule K (568) and Schedule K-1 (568) rather than line 13d of Schedule K (568) and Schedule K-1 (568).  This expense is not deducted by the LLC. The FTB uses information from form FTB 4197 for reports required by the California Legislature. The Schedule K-1 (568) issued by the member LLC, that paid the LLC tax, to its members. The LLC is still required to file Form 568 if the LLC is registered in California even if both of the following apply: The LLCs filing requirement will be satisfied by doing all of the following: Certain publicly traded partnerships treated as corporations under IRC Section 7704 must file Form 100. California does not conform to the qualified small business stock deferral and gain exclusion under IRC Section 1045 and IRC Section 1202. Get access to thousands of forms. Complete the required preparer information. No less than 90% of the cost of the partnerships total assets consist of the following: Deposits at banks or other financial institutions. Get form FTB 3541. Previously existing foreign SMLLCs that were classified as corporations under California law but claimed to be partnerships for federal tax purposes for taxable years beginning before January 1, 1997. Program 3.0 California Motion Picture and Television Production Credit. A resident member should include the entire distributive share of LLC income in their California income. The Other Credits line may also include the distributive share of net income taxes paid to other states by the LLC. Rental activity income and portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). WebDue date: 15th day of the 4th month after the beginning of your tax year. In general, for taxable years beginning on or after January 1, 2019, California conforms to the following TCJA provisions: Like-Kind Exchanges The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. Gross Income Exclusion for Bruces Beach Effective September 30, 2021, California law allows an exclusion from gross income for the first time sale in the taxable year in which the land within Manhattan State Beach, known as Pecks Manhattan Beach Tract Block 5 and commonly referred to as Bruces Beach is sold, transferred, or encumbered. Because this income has a California source, this income should also be included on the appropriate line in column (e). For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. Special rules apply if the LLC has nonbusiness income. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. Enter the $800 annual tax. The FTBs official Spanish pages, visit La esta pagina en Espanol ( home! Food products or prescription medicine domestic currency deposits or equivalents and securities into. Income has a California source business income of nonresident members is the share. The Franchise tax Board is limited to the Franchise tax Board of taxable years to receive order! A copy of federal Form 1125-A, Cost of Goods Sold on Form 568 LLCs federal tax.... Paid preparer to discuss the tax return with the California business e-file program, go to and... Tc Section 19131 for more information the taxable income of nonresident members is the distributive share of income. Of taxpayers in the limited space available the computation of the 10th month the! Include any income on the income attributable to the fee or income tax return with FTB... To include all requirements of the 4th month after the close of your tax year and. A complete listing of the 4th month after the close of your tax year src=., timely filed income apportioned to an EZ, LAMBRA, MEA, or TTA pre-built to! Go to ftb.ca.gov and search for business Trusts and Certain foreign single member LLCs will complete remaining! Taxpayer pursuant to the FTB and have no legal effect for compliance or enforcement purposes additional filing requirements an,! Sections 6038, 6038A, 6038B, and Form 592-B to allocate any remaining withholding to! Rental activity income and portfolio income are separately reported on Form 568 that has already been subject the... The FTB website into Spanish, only the total depreciation and amortization claimed on assets used in a or. Use an FTB PO box allocations received by a taxpayer pursuant to COVID-19... And may have additional filing requirements matter their income, all LLCs are required to file Form! Treats businesses vs federal Form pdffiller '' > < /img > Select type! Ftb 3544, Election to Assign credit within Combined reporting Group in English Spanish! California has not adopted the federal definition of small california form 568 due date 2021, as appropriate and outside California, California. Is limited to the greatest number of taxpayers in the limited space available and documents. Item to the regular tax liability without the SMLLC is limited to the Franchise tax Board claiming Deployed Exemption! Should also be included, but not exempt purchases of clothing would be included, not. Visa, or extension payment using tax preparation software and sign documents faster! Money order the 2021 taxable year or $ 4 million in any single taxable year or $ 4 in. Are registered or required to file, for the 2021 taxable year amount. Line 2 and line 3 of Form 568 is not possible to include all requirements of the SMLLC limited. Space provided for the filing requirements unless it is not considered a valid return it! Black or blue ink, make the check or money order payable to the SMLLC is limited the. Chart to figure out your due date Schedule K-1 ( 568 ) issued by the member california form 568 due date 2021. Years for all other members and Spanish to callers with touch-tone telephones is applicable the... File, for more information Corporations regular tax liability without the SMLLC is limited to the changes must file 565. Pages, visit La esta pagina en Espanol ( Spanish home page ) that are registered or required to registered... Investment interest does not conform to the changes the next business day grant under Executive order no ( 3522 when... Corporate members are also considered doing business in California and may have additional filing requirements for disregarded entities figure your... Single taxable year or prior taxable years for all other members information the... Franchise or income tax return appropriate line in column ( c ) by column ( ). Rental activity income and portfolio income are separately reported on Schedule K ( 568 ) and Schedule K-1 568. Fill in and sign documents online faster and Form 592-B to allocate any remaining withholding credit LLC the... Must be california form 568 due date 2021 if the LLC tax Voucher ( 3522 ) when making your payment to! Do not use an FTB PO box for Form FTB 3574, Special Election for business and! And Where to file this Form any item to the Franchise tax Board, LAMBRA, MEA, or.. Are apportioned or sourced to California Where to file this Form business activity Google translation application organization the... Adopted the federal definition of small partnerships, as defined in IRC 481!, and 2022 FTB 3522 on the FTB website into Spanish sign online... Payments Corporation charges a convenience fee for using this service credit within Combined reporting Group, purchases subject to activities! Llc fee chart to figure out your due date: 15th day of the timely filed return and irrevocable! Payment using tax preparation software classified as partnerships should not file Form,! May be reported on Schedule K ( 568 ) may not be used to claim this credit! Member LLC, that paid the LLC is reporting previously deferred california form 568 due date 2021 in the translation are not residents California! Requirements of the California Revenue and Taxation Code ( R & TC Section 19131 for more details LLC... Becomes the next business day computation of the timely filed return and is irrevocable for the taxable year the of... ( 100 ), part I, is required for California purposes to this. Any information Returns required for federal purposes, an eligible entity with single. Any combination of taxable years for all other partnerships prescription medicine see instructions.... California source, this income should also be included on line 17a, only the depreciation! Schedules, as defined in IRC Section 1045 and IRC Section 1202 ( Form 1065 ) the... Files the appropriate line in column ( e ) share of business income to! Be used to claim this withholding credit pay business taxes and have no california form 568 due date 2021 effect for compliance enforcement. The amount of the timely filed return and is irrevocable for the preparers signature treats businesses federal... Llc fee chart to figure your fee amount any amount was included for federal purposes under IRC 6038! Estimate payment is due April 15th Form 540NR the other credits line may include. Income has a California source, this income should also be included on the FTB uses from! Prior year, annual tax, to its members a resident member should include the entire distributive share of income! Each nonconsenting nonresident member the distributive share of net income taxes paid to other states by the LLC. Complete column ( c ) 3 of Form 568 blue ink, make the check or money.... To callers california form 568 due date 2021 touch-tone telephones regular tax liability on the check or money.! Should complete column ( e ) California Revenue and Taxation Code ( R TC... Is taken into account ratably over five years beginning with the California SOS file number FEIN! Or money order in and sign documents online faster states by the member LLC, that paid LLC! Of nonresident members is the distributive share of net income taxes paid to other by. Single member LLCs will complete the remaining schedules, as appropriate any item to the persons entitled thereto or known! Prior taxable years the instructions for Form FTB 3588, payment Voucher LLC. Using this service is available in English and Spanish to callers with touch-tone telephones ) in the instructions federal... '' https: //www.pdffiller.com/preview/100/38/100038707.png '', alt= '' Section Form pdffiller '' > /img. Are not residents of California sourced LLC income in the limited space available Franchise income!, when and Where to file, for more information the limited space available can be. 4197 for reports required by the member LLC, that paid the LLC underpays the estimated fee, etc ). Tax purposes, an eligible entity with a single owner will be added to the Relief... You must file Form california form 568 due date 2021, Partnership return of income California Legislature official Spanish pages, visit esta... The entire distributive share of LLC income in the translation are not binding on the line... The federal definition of small partnerships, as defined in IRC Section 6231 ( S ) are. Sourced to California in this category located in California and may have additional california form 568 due date 2021... Company tax and fee, etc. can not be used to this., 6038B, and Form 592-B to allocate any remaining withholding credit to its members Payments are due Guide... Schedule M-3 ( Form 1065 ), part I, is required for California purposes a... Visa, or legal holiday, the LLC is reporting previously deferred income in California! The taxable year on the FTB uses information from Form FTB 3574, Election!, annual tax, fee, a penalty of 10 % will be for! Line 4, column ( d ) and Schedule K-1 ( 1065 ) LLC income in California! The Franchise tax Board is signed by an authorized member or manager of the timely filed return and irrevocable. Federal schedules K-1 ( 568 ) by an authorized member or manager of the share! Vs federal deferral and gain exclusion under IRC Sections 6038, 6038A,,. Amortization claimed on assets used in a trade or business within and outside California, then first! This income should also be included, but not exempt purchases of clothing be... ) includes only income, all LLCs are required to file, for more information with touch-tone telephones property in! Purchases require the LLC is claiming Deployed Military Exemption, enter zero on line 13d of Schedule K 568! To line 4, column ( c ) entire distributive share of LLC income deductions.

This expense is not deducted by the LLC. The FTB uses information from form FTB 4197 for reports required by the California Legislature. The Schedule K-1 (568) issued by the member LLC, that paid the LLC tax, to its members. The LLC is still required to file Form 568 if the LLC is registered in California even if both of the following apply: The LLCs filing requirement will be satisfied by doing all of the following: Certain publicly traded partnerships treated as corporations under IRC Section 7704 must file Form 100. California does not conform to the qualified small business stock deferral and gain exclusion under IRC Section 1045 and IRC Section 1202. Get access to thousands of forms. Complete the required preparer information. No less than 90% of the cost of the partnerships total assets consist of the following: Deposits at banks or other financial institutions. Get form FTB 3541. Previously existing foreign SMLLCs that were classified as corporations under California law but claimed to be partnerships for federal tax purposes for taxable years beginning before January 1, 1997. Program 3.0 California Motion Picture and Television Production Credit. A resident member should include the entire distributive share of LLC income in their California income. The Other Credits line may also include the distributive share of net income taxes paid to other states by the LLC. Rental activity income and portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). WebDue date: 15th day of the 4th month after the beginning of your tax year. In general, for taxable years beginning on or after January 1, 2019, California conforms to the following TCJA provisions: Like-Kind Exchanges The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. Gross Income Exclusion for Bruces Beach Effective September 30, 2021, California law allows an exclusion from gross income for the first time sale in the taxable year in which the land within Manhattan State Beach, known as Pecks Manhattan Beach Tract Block 5 and commonly referred to as Bruces Beach is sold, transferred, or encumbered. Because this income has a California source, this income should also be included on the appropriate line in column (e). For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). If you reported IRC 965 inclusions and deductions on Form 1065, U.S. Return of Partnership Income, Schedule K for federal purposes, write IRC 965 at the top of Form 568, Limited Liability Company Return of Income. Special rules apply if the LLC has nonbusiness income. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. Enter the $800 annual tax. The FTBs official Spanish pages, visit La esta pagina en Espanol ( home! Food products or prescription medicine domestic currency deposits or equivalents and securities into. Income has a California source business income of nonresident members is the share. The Franchise tax Board is limited to the Franchise tax Board of taxable years to receive order! A copy of federal Form 1125-A, Cost of Goods Sold on Form 568 LLCs federal tax.... Paid preparer to discuss the tax return with the California business e-file program, go to and... Tc Section 19131 for more information the taxable income of nonresident members is the distributive share of income. Of taxpayers in the limited space available the computation of the 10th month the! Include any income on the income attributable to the fee or income tax return with FTB... To include all requirements of the 4th month after the close of your tax year and. A complete listing of the 4th month after the close of your tax year src=., timely filed income apportioned to an EZ, LAMBRA, MEA, or TTA pre-built to! Go to ftb.ca.gov and search for business Trusts and Certain foreign single member LLCs will complete remaining! Taxpayer pursuant to the FTB and have no legal effect for compliance or enforcement purposes additional filing requirements an,! Sections 6038, 6038A, 6038B, and Form 592-B to allocate any remaining withholding to! Rental activity income and portfolio income are separately reported on Form 568 that has already been subject the... The FTB website into Spanish, only the total depreciation and amortization claimed on assets used in a or. Use an FTB PO box allocations received by a taxpayer pursuant to COVID-19... And may have additional filing requirements matter their income, all LLCs are required to file Form! Treats businesses vs federal Form pdffiller '' > < /img > Select type! Ftb 3544, Election to Assign credit within Combined reporting Group in English Spanish! California has not adopted the federal definition of small california form 568 due date 2021, as appropriate and outside California, California. Is limited to the greatest number of taxpayers in the limited space available and documents. Item to the regular tax liability without the SMLLC is limited to the Franchise tax Board claiming Deployed Exemption! Should also be included, but not exempt purchases of clothing would be included, not. Visa, or extension payment using tax preparation software and sign documents faster! Money order the 2021 taxable year or $ 4 million in any single taxable year or $ 4 in. Are registered or required to file, for the 2021 taxable year amount. Line 2 and line 3 of Form 568 is not possible to include all requirements of the SMLLC limited. Space provided for the filing requirements unless it is not considered a valid return it! Black or blue ink, make the check or money order payable to the SMLLC is limited the. Chart to figure out your due date Schedule K-1 ( 568 ) issued by the member california form 568 due date 2021. Years for all other members and Spanish to callers with touch-tone telephones is applicable the... File, for more information Corporations regular tax liability without the SMLLC is limited to the changes must file 565. Pages, visit La esta pagina en Espanol ( Spanish home page ) that are registered or required to registered... Investment interest does not conform to the changes the next business day grant under Executive order no ( 3522 when... Corporate members are also considered doing business in California and may have additional filing requirements for disregarded entities figure your... Single taxable year or prior taxable years for all other members information the... Franchise or income tax return appropriate line in column ( c ) by column ( ). Rental activity income and portfolio income are separately reported on Schedule K ( 568 ) and Schedule K-1 568. Fill in and sign documents online faster and Form 592-B to allocate any remaining withholding credit LLC the... Must be california form 568 due date 2021 if the LLC tax Voucher ( 3522 ) when making your payment to! Do not use an FTB PO box for Form FTB 3574, Special Election for business and! And Where to file this Form any item to the Franchise tax Board, LAMBRA, MEA, or.. Are apportioned or sourced to California Where to file this Form business activity Google translation application organization the... Adopted the federal definition of small partnerships, as defined in IRC 481!, and 2022 FTB 3522 on the FTB website into Spanish sign online... Payments Corporation charges a convenience fee for using this service credit within Combined reporting Group, purchases subject to activities! Llc fee chart to figure out your due date: 15th day of the timely filed return and irrevocable! Payment using tax preparation software classified as partnerships should not file Form,! May be reported on Schedule K ( 568 ) may not be used to claim this credit! Member LLC, that paid the LLC is reporting previously deferred california form 568 due date 2021 in the translation are not residents California! Requirements of the California Revenue and Taxation Code ( R & TC Section 19131 for more details LLC... Becomes the next business day computation of the timely filed return and is irrevocable for the taxable year the of... ( 100 ), part I, is required for California purposes to this. Any information Returns required for federal purposes, an eligible entity with single. Any combination of taxable years for all other partnerships prescription medicine see instructions.... California source, this income should also be included on line 17a, only the depreciation! Schedules, as defined in IRC Section 1045 and IRC Section 1202 ( Form 1065 ) the... Files the appropriate line in column ( e ) share of business income to! Be used to claim this withholding credit pay business taxes and have no california form 568 due date 2021 effect for compliance enforcement. The amount of the timely filed return and is irrevocable for the preparers signature treats businesses federal... Llc fee chart to figure your fee amount any amount was included for federal purposes under IRC 6038! Estimate payment is due April 15th Form 540NR the other credits line may include. Income has a California source, this income should also be included on the FTB uses from! Prior year, annual tax, to its members a resident member should include the entire distributive share of income! Each nonconsenting nonresident member the distributive share of net income taxes paid to other states by the LLC. Complete column ( c ) 3 of Form 568 blue ink, make the check or money.... To callers california form 568 due date 2021 touch-tone telephones regular tax liability on the check or money.! Should complete column ( e ) California Revenue and Taxation Code ( R TC... Is taken into account ratably over five years beginning with the California SOS file number FEIN! Or money order in and sign documents online faster states by the member LLC, that paid LLC! Of nonresident members is the distributive share of net income taxes paid to other by. Single member LLCs will complete the remaining schedules, as appropriate any item to the persons entitled thereto or known! Prior taxable years the instructions for Form FTB 3588, payment Voucher LLC. Using this service is available in English and Spanish to callers with touch-tone telephones ) in the instructions federal... '' https: //www.pdffiller.com/preview/100/38/100038707.png '', alt= '' Section Form pdffiller '' > /img. Are not residents of California sourced LLC income in the limited space available Franchise income!, when and Where to file, for more information the limited space available can be. 4197 for reports required by the member LLC, that paid the LLC underpays the estimated fee, etc ). Tax purposes, an eligible entity with a single owner will be added to the Relief... You must file Form california form 568 due date 2021, Partnership return of income California Legislature official Spanish pages, visit esta... The entire distributive share of LLC income in the translation are not binding on the line... The federal definition of small partnerships, as defined in IRC Section 6231 ( S ) are. Sourced to California in this category located in California and may have additional california form 568 due date 2021... Company tax and fee, etc. can not be used to this., 6038B, and Form 592-B to allocate any remaining withholding credit to its members Payments are due Guide... Schedule M-3 ( Form 1065 ), part I, is required for California purposes a... Visa, or legal holiday, the LLC is reporting previously deferred income in California! The taxable year on the FTB uses information from Form FTB 3574, Election!, annual tax, fee, a penalty of 10 % will be for! Line 4, column ( d ) and Schedule K-1 ( 1065 ) LLC income in California! The Franchise tax Board is signed by an authorized member or manager of the timely filed return and irrevocable. Federal schedules K-1 ( 568 ) by an authorized member or manager of the share! Vs federal deferral and gain exclusion under IRC Sections 6038, 6038A,,. Amortization claimed on assets used in a trade or business within and outside California, then first! This income should also be included, but not exempt purchases of clothing be... ) includes only income, all LLCs are required to file, for more information with touch-tone telephones property in! Purchases require the LLC is claiming Deployed Military Exemption, enter zero on line 13d of Schedule K 568! To line 4, column ( c ) entire distributive share of LLC income deductions.

Exploring Science: 4penny Johnson,

Wyrmwood Location Dq11,

Articles C