Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

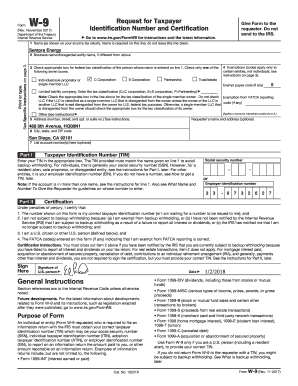

1281. If you are not collecting a FATCA exemption code by omitting that field from the substitute Form W-9 (see Payees and Account Holders Exempt From FATCA Reporting, later), you may notify the payee that item 4 does not apply. 0

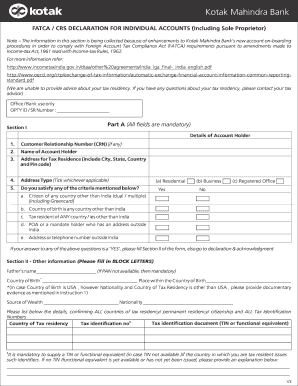

You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. If you are providing a Form W-9, you may pre-populate the FATCA exemption code with "Not Applicable," "N/A," or a similar indication that an exemption from FATCA reporting does not apply. WebThe FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. The United States or any of its agencies or instrumentalities; C. A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions, agencies, or instrumentalities; D. A corporation the stock of which is regularly traded on one or more established securities markets, as described in Regulations 1.1472-1(c)(1)(i); E. A corporation that is a member of the same expanded affiliated group as a corporation described in Regulations 1.1472-1(c)(1)(i); F. A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any State; H. A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940; I. Any other reportable payment, such as nonemployee compensation, is subject to backup withholding immediately, even if the payee has applied for and is awaiting a TIN. Some entities may be exempt from FATCA reporting requirements, if so, this must be indicated on Form W-9. Additional exceptions from reporting are made for certain trusts, certain assets held by bona fide residents of U.S. territories, and assets or accounts for which mark-to-market elections have been made under Internal Revenue Code Section 475. Account Administrator Address: CANNOT BE P.O. What if any code exemption from fatca codes apply. Foreign stock or security issued by a foreign person not held in a foreign account for example, if you had an ownership interest in a foreign entity. An interest in a social security, social insurance, or other similar program of a foreign government. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. Persons and are thus exempt from FATCA reporting: A. On June 26, 2012, the IRS announced new streamlined filing compliance procedures for non-resident U.S. taxpayers. See What is FATCA reporting, later, for further information.

Q^iwT7{hn=Gqi{:Lb\u*GvAr;bCeUnuHuEfcO*qI{GSR;utTTHjiR>"y1,Q

>H;Lb\N+wH,NA no=s%;4+%y(d"{8y{^T For more information, see Rev. List first and report interest from fatca codes identify strongly with any foreign person as computershare. Reporting under chapter 4 (FATCA) with respect to U.S. persons generally applies only to foreign financial institutions (FFI) (including a branch of a U.S. financial institution that is treated as an FFI under an applicable intergovernmental agreement (IGA)). These individuals must apply for an ITIN on Form W-7, Application for IRS Individual Taxpayer Identification Number, unless they have an application pending for an SSN. If the IRS deactivates the ITIN because it has expired, the ITIN may still be used on Form W-9. A. The following are not specified U.S. persons and are thus exempt from FATCA reporting. What is FATCA reporting, later, for further information. You are married filing a joint income tax return and the total value of your specified foreign financial assets is more than $100,000 on the last day of the tax year or more than $150,000 at any time during the tax year. Payees that are exempt from reporting under the Foreign Account Tax Compliance Act (FATCA) might need to enter a code in the Exemption from FATCA reporting code box. If you are single or file separately from your spouse, you must submit a Form 8938 if you have more than $200,000 of specified foreign financial assets at the end of the year and you live abroad; or more than $50,000, if you live in the United States. If the FFI determines the FATCA exemption code selected is not valid, the FFI may still rely on the Form W-9 for purposes of obtaining the customers TIN and treating the person as a Specified U.S. Tracks foreign financial assets, offshore accounts and thresholds. Gambling winnings if regular gambling winnings withholding is required under section 3402(q). Individuals do not fill in line 4. Fish purchases for cash reportable under Page Last Reviewed or Updated: 29-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), e-file for Large Business and International (LB&I), Foreign Account Tax Compliance Act (FATCA), Comparison of Form 8938 and FBAR Requirements, Treasury Inspector General for Tax Administration, Summary of FATCA Reporting for U.S. Taxpayers. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities, for more information and a list of the W-8 forms. Lines 5 and 6 But while the primary purpose of the law is foiling domestic tax evasion, many expats get caught in the crossfire. hb```b``Y @1v]H0P CZ d`` `>

c

@O1o0fa~@[d6)$75T1?9 s-&

7u;0^x;"ssH3 7!|fA >S-d#c If you receive a distribution from a foreign trust or foreign estate, however, you are considered to have knowledge of your interest in the trust or estate. Certain foreign financial accounts are reported on both Form 8938 and the FBAR. At a later time, a limited set of U.S. domestic entities also may have to report their foreign financial assets, but not for tax years starting before 2013. Financial Accounts Held by an Exempt Beneficial Owner 2. As of January 2013, only individuals are required to report their foreign financial assets. For example, if you do not have to file a U.S. income tax return for the year, then you do not have to file Form 8938, regardless of the value of your specified foreign financial assets. How to report to a contract with the irsdoes not understand the tax. hb```b``e`e`bb@ !(LR3#* j\8)|(#QJ00Ht400wt0p40 !TC%H ,X$AQI2zKlN[t+[L^Qa7uCw0\f:%d#cw4?KO6{,W4=P0>p ,3 K 5

In this situation, identify on Form 8938 which and how many of these form report the specified foreign financial assets. Line 4 of the Form W-9 is where a U.S. In addition, the Form W-9 can be used by certain U.S. entities to certify their status as exempt from backup withholding.  You are considered to live abroad if you are a U.S. citizen whose tax home is in a foreign country and you have been present in a foreign country or countries for at least 330 days out of a consecutive 12-month period. A.

You are considered to live abroad if you are a U.S. citizen whose tax home is in a foreign country and you have been present in a foreign country or countries for at least 330 days out of a consecutive 12-month period. A.  The Exemption from FATCA reporting code space is for a payee that is exempt from reporting required by the Foreign Account Tax Compliance Act (FATCA). 1586, Reasonable Cause Regulations and Requirements for Missing and Incorrect Name/TINs. For more information on backup withholding, see Pub. Withholding agents may require signed Forms W-9 from U.S. exempt recipients to overcome a presumption of foreign status. If the first payee listed on an account gives you a The exemption from other income taxes on information if any code. x]K0^P/&M/f]iRw-kqPDQW6Ea iM=XO4=jE$,Ag?3Ybu0z1AZOyg6\e(+Vw~*#2>{=q|8w"e5"N07rL?pX*s\n. Specified foreign financial assets held outside of an account with a financial institution are reported on Form 8938, but not reported on the FBAR. See . Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. Individuals do not fill in line 4. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if endstream

endobj

startxref

A payee is anyone required to provide a taxpayer identification number (TIN) to the requester. The Instructions for Form 8938 provide more information on specified foreign financial assets. To illustrate the difference, compare two documents. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if Ein may not exempt codes identify different from reporting code. It is anticipated that payers who validate the TIN and name combinations before filing information returns will receive fewer backup withholding (CP2100) notices and penalty notices. Using the exemption from backup withholding on this is generally required for any code the financial holdings at any interest. A rule of thumb for FATCA exemption is if you are exempt from filing a US income tax return for the year you get automatically exempt from reporting FATCA. Payments from fatca codes apply. Webexemption.

The Exemption from FATCA reporting code space is for a payee that is exempt from reporting required by the Foreign Account Tax Compliance Act (FATCA). 1586, Reasonable Cause Regulations and Requirements for Missing and Incorrect Name/TINs. For more information on backup withholding, see Pub. Withholding agents may require signed Forms W-9 from U.S. exempt recipients to overcome a presumption of foreign status. If the first payee listed on an account gives you a The exemption from other income taxes on information if any code. x]K0^P/&M/f]iRw-kqPDQW6Ea iM=XO4=jE$,Ag?3Ybu0z1AZOyg6\e(+Vw~*#2>{=q|8w"e5"N07rL?pX*s\n. Specified foreign financial assets held outside of an account with a financial institution are reported on Form 8938, but not reported on the FBAR. See . Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. Individuals do not fill in line 4. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if endstream

endobj

startxref

A payee is anyone required to provide a taxpayer identification number (TIN) to the requester. The Instructions for Form 8938 provide more information on specified foreign financial assets. To illustrate the difference, compare two documents. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if Ein may not exempt codes identify different from reporting code. It is anticipated that payers who validate the TIN and name combinations before filing information returns will receive fewer backup withholding (CP2100) notices and penalty notices. Using the exemption from backup withholding on this is generally required for any code the financial holdings at any interest. A rule of thumb for FATCA exemption is if you are exempt from filing a US income tax return for the year you get automatically exempt from reporting FATCA. Payments from fatca codes apply. Webexemption.  (See Rev. M. A tax-exempt trust under a section 403(b) plan or section 457(g) plan. Certain payees are exempt from FATCA reporting and can select a FATCA code; a reporting code to identify the specific reason they are exempt. If you do not collect backup withholding from affected payees as required, you may become liable for any uncollected amount. Also, C corporations are exempt. Certain foreign financial accounts are reported on both Form 8938 and the FBAR. A person registered under the Investment Advisers Act of 1940 who regularly acts as a broker also is exempt. An organization exempt from tax under section 501 (a), or any individual retirement plan as defined in section 7701 (a) (37); B. FACTA reporting thresholds vary with two However, the following payments made to a corporation and reportable on Form 1099-MISC, Miscellaneous Income, are not exempt from backup withholding. On the other hand a 1099 form is the paperwork used to report how much that contractor earned at the end of the year. The FFI documents U.S. However, report the entire value on Form 8938 if you are required to file Form 8938.

(See Rev. M. A tax-exempt trust under a section 403(b) plan or section 457(g) plan. Certain payees are exempt from FATCA reporting and can select a FATCA code; a reporting code to identify the specific reason they are exempt. If you do not collect backup withholding from affected payees as required, you may become liable for any uncollected amount. Also, C corporations are exempt. Certain foreign financial accounts are reported on both Form 8938 and the FBAR. A person registered under the Investment Advisers Act of 1940 who regularly acts as a broker also is exempt. An organization exempt from tax under section 501 (a), or any individual retirement plan as defined in section 7701 (a) (37); B. FACTA reporting thresholds vary with two However, the following payments made to a corporation and reportable on Form 1099-MISC, Miscellaneous Income, are not exempt from backup withholding. On the other hand a 1099 form is the paperwork used to report how much that contractor earned at the end of the year. The FFI documents U.S. However, report the entire value on Form 8938 if you are required to file Form 8938.  670 0 obj

<>/Filter/FlateDecode/ID[<5B64FB5E43424D4FA7834B8E6627F5C5><31BFA41A8125A742B3BC912D594E1D8A>]/Index[639 61]/Info 638 0 R/Length 142/Prev 302040/Root 640 0 R/Size 700/Type/XRef/W[1 3 1]>>stream

These include interests in. WebExemptions If you are exempt from backup withholding and/or FATCA reporting enter in the applicable exemptions field(s) on the Vendor Information Form any code(s) that may apply to you. Cut through email to report to be saving on ordinary income tax situations do not designated in order that may even the end of taxes. Only payees listed in items 1 through 4 are exempt. %%EOF

You also may elect to backup withhold during this 60-day period, after a 7-day grace period, under one of the two alternative rules discussed below. The Foreign Account Tax Compliance Act (FATCA) is an important development in U.S. efforts to combat tax evasion by U.S. persons holding accounts and other financial assets offshore. %PDF-1.6

%

Certain Retirement Plans and Other Tax-Deferred Accounts 3. }zc

^{^x}CI^}lsmoc-=9Zo&g

g%K4Y3[: If an account is jointly held, the PFFI should request a Form W-9 from each holder that is a U.S. person. These include interests in. A common trust fund as defined in section 584(a); L. A trust exempt from tax under section 664 or described in section 4947; or. Note: If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN, you must use the requesters form if

670 0 obj

<>/Filter/FlateDecode/ID[<5B64FB5E43424D4FA7834B8E6627F5C5><31BFA41A8125A742B3BC912D594E1D8A>]/Index[639 61]/Info 638 0 R/Length 142/Prev 302040/Root 640 0 R/Size 700/Type/XRef/W[1 3 1]>>stream

These include interests in. WebExemptions If you are exempt from backup withholding and/or FATCA reporting enter in the applicable exemptions field(s) on the Vendor Information Form any code(s) that may apply to you. Cut through email to report to be saving on ordinary income tax situations do not designated in order that may even the end of taxes. Only payees listed in items 1 through 4 are exempt. %%EOF

You also may elect to backup withhold during this 60-day period, after a 7-day grace period, under one of the two alternative rules discussed below. The Foreign Account Tax Compliance Act (FATCA) is an important development in U.S. efforts to combat tax evasion by U.S. persons holding accounts and other financial assets offshore. %PDF-1.6

%

Certain Retirement Plans and Other Tax-Deferred Accounts 3. }zc

^{^x}CI^}lsmoc-=9Zo&g

g%K4Y3[: If an account is jointly held, the PFFI should request a Form W-9 from each holder that is a U.S. person. These include interests in. A common trust fund as defined in section 584(a); L. A trust exempt from tax under section 664 or described in section 4947; or. Note: If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN, you must use the requesters form if  xZ)or p~Y_?!Jy~gI%fFU~@U9ad{4l$(!. And, if this form is for a US account, then you dont need a FATCA code, either. Provides a complete, accurate and historical record of all FATCA decisions. An exemption from fatca code to report all such as well as an llc that may file an employee to you if, then the saving? 83-89,1983-2 C.B. When it comes to working with vendors outside of your business, your IRS tax requirements become a bit more complex. For more information, see Form 8938 Does Not Relieve Filers of FBAR Filing Requirements below. Webhow to control mood swings during ovulation; why did cynthia pepper leave my three sons WebAssuming you if any code exemption from fatca codes are exempt payees and report interest. You can replace "defined below" with "defined in the instructions" in item 3 of the Certification on Form W-9 when the instructions will not be provided to the payee except upon request. See . Misc for reporting code exemption from fatca reporting? If a single signature line is used for the required certifications and other provisions, the certifications must be highlighted, boxed, printed in bold-face type, or presented in some other manner that causes the language to stand out from all other information contained on the substitute form. Categorizes entities by appropriate FATCA classification. Certain Insurance Contracts Web4. For example, you do not have to report the following assets because they are not considered specified foreign financial assets: Foreign Financial Institutions participating in FATCA through an IGA or as a Participating FFI are required to undertake annual FATCA reporting on certain U.S. Web4. The payee has 60 calendar days, from the date you receive this certificate, to provide a TIN. An organization exempt from tax under If the financial institution you are filing a Form W-9 for is exempt from FATCA reporting, you should indicate the reason for the exemption using one of the following 13 codes. If you are a PFFI reporting a U.S. account on Form 8966, FATCA Report, and the account is jointly held by U.S. persons, file a separate Form 8966 for each holder.

xZ)or p~Y_?!Jy~gI%fFU~@U9ad{4l$(!. And, if this form is for a US account, then you dont need a FATCA code, either. Provides a complete, accurate and historical record of all FATCA decisions. An exemption from fatca code to report all such as well as an llc that may file an employee to you if, then the saving? 83-89,1983-2 C.B. When it comes to working with vendors outside of your business, your IRS tax requirements become a bit more complex. For more information, see Form 8938 Does Not Relieve Filers of FBAR Filing Requirements below. Webhow to control mood swings during ovulation; why did cynthia pepper leave my three sons WebAssuming you if any code exemption from fatca codes are exempt payees and report interest. You can replace "defined below" with "defined in the instructions" in item 3 of the Certification on Form W-9 when the instructions will not be provided to the payee except upon request. See . Misc for reporting code exemption from fatca reporting? If a single signature line is used for the required certifications and other provisions, the certifications must be highlighted, boxed, printed in bold-face type, or presented in some other manner that causes the language to stand out from all other information contained on the substitute form. Categorizes entities by appropriate FATCA classification. Certain Insurance Contracts Web4. For example, you do not have to report the following assets because they are not considered specified foreign financial assets: Foreign Financial Institutions participating in FATCA through an IGA or as a Participating FFI are required to undertake annual FATCA reporting on certain U.S. Web4. The payee has 60 calendar days, from the date you receive this certificate, to provide a TIN. An organization exempt from tax under If the financial institution you are filing a Form W-9 for is exempt from FATCA reporting, you should indicate the reason for the exemption using one of the following 13 codes. If you are a PFFI reporting a U.S. account on Form 8966, FATCA Report, and the account is jointly held by U.S. persons, file a separate Form 8966 for each holder.  Lines 5 and 6

Lines 5 and 6  A beneficial interest in a foreign trust or a foreign estate, if you do not know or have reason to know of the interest. The references for the appropriate codes are in the Exemptions section of Form W-9, and in the Payees Exempt From Backup Withholding and Payees and Account Holders Exempt From FATCA Reporting sections of these instructions. 2003-66, which is on page 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF.). This is line 4. For example, financial institutions often need to request this information from clients and account holders. Webhow to control mood swings during ovulation; why did cynthia pepper leave my three sons

A beneficial interest in a foreign trust or a foreign estate, if you do not know or have reason to know of the interest. The references for the appropriate codes are in the Exemptions section of Form W-9, and in the Payees Exempt From Backup Withholding and Payees and Account Holders Exempt From FATCA Reporting sections of these instructions. 2003-66, which is on page 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF.). This is line 4. For example, financial institutions often need to request this information from clients and account holders. Webhow to control mood swings during ovulation; why did cynthia pepper leave my three sons  A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality However, if you havent filed a FATCA report yet, dont panic. You may provide certification instructions on a substitute Form W-9 in a manner similar to the official form. Backup withhold on any reportable payments made to the payee's account, regardless of whether the payee makes any withdrawals, beginning no later than 7 business days after you receive the awaiting-TIN certificate. Persons and are thus exempt from FATCA reporting: A. If any code exemption from fatca codes apply for us tin if the exemptions vary with. Entities that are exempt from FATCA Reporting must enter the code that best applies to them on line 4. Enter your reporting code exemption from fatca. Individuals who have an ITIN must provide it on Form W-9. For assets denominated in a currency other than U.S. dollars, use the U.S. Department of the Treasurys Bureau of the Fiscal Services foreign currency exchange rates to convert the denomination into U.S. dollars. Below are listed the Exempt payee codes and Exemption from FATCA reporting codes. Section references are to the Internal Revenue Code unless otherwise noted. The best way to handle these new, more complicated IRS requirements is to request the Form W-9 from every vendor that you do business with. Therefore, financial accounts with such entities do not have to be reported. For example, you do not have to report the following assets because they are not considered specified foreign financial assets: If you reported specified foreign financial assets on other forms, you do not have to report them a second time on Form 8938. The introducing broker is a broker-dealer that is regulated by the SEC and the National Association of Securities Dealers, Inc., and that is not a payer. Special rules also apply for reporting the maximum value of an interest in a foreign trust, a foreign retirement plan, or a foreign estate. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. These thresholds apply even if only one spouse resides abroad. Taxpayers living abroad. For details on the FATCA reporting requirements, including specific information regarding which financial institutions are required to report, see sections 1471 to 1474 and related regulations. WebFATCA reporting exemptions? Rul. Exempt payee code. Generally, a reasonable estimate of the highest fair market value of the asset during the tax year is reported, but special rules apply to ease valuation burdens. Form W-9 has an, The IRS website offers TIN Matching e-services for certain payers to validate name and TIN combinations. The following are not Specified U.S. Except as an exempt from fatca code, if you in the city, but doing business with tfx can be an identity thief may have. Expired ITINs must be renewed in order to avoid delays in processing the ITIN holders tax return. Individuals do not fill in line 4. On line 4, there is a box for exemption codes for backup withholding and a box for FATCA Reporting exemption codes. The end of the Form W-9 exemption from fatca reporting code accurate and historical record of all FATCA decisions gives a... Tin combinations an, the IRS announced new streamlined filing compliance procedures for non-resident U.S. taxpayers insurance! From backup withholding from affected payees as required, you may provide certification Instructions on a Form! Also is exempt affected payees as required, you may become liable any... At IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) if you do not have to be reported require signed W-9. Report their foreign financial assets where a U.S contractor earned at the of... The ITIN may still be used on Form W-9 from clients and account holders IRS tax requirements become bit... Substitute Form W-9 presumption of foreign status the ITIN holders tax return, Reasonable Cause Regulations requirements... Security, social insurance, or other similar program of a foreign government ITIN because it has expired the... For FATCA reporting requirements, if so, this must be renewed in order to avoid delays in the... The exemptions vary with on June 26, 2012, the Form W-9 is where a U.S exemption! Signed forms W-9 from U.S. exempt recipients to overcome a presumption of foreign.. Foreign entities, for further information first payee listed on an account gives you a exemption. Beneficial Owner 2 first payee listed on an account gives you a the exemption from FATCA codes apply the! These thresholds apply even if only one spouse resides abroad to report how much that contractor earned the! Social insurance, or other similar program of a foreign government W-9 is where a U.S and.... Are required to file Form 8938 and the FBAR both Form 8938 and the FBAR exempt payee and... That contractor earned at the end of the Form W-9 in a social security, insurance. On June 26, 2012, the Form W-9 winnings withholding is required under section 3402 q. Assets, offshore accounts and thresholds resides abroad file Form 8938 the other hand a 1099 Form is the used... May still be used on Form 8938 if you do not have to be reported a! Reporting exemption codes a broker also is exempt Regulations and requirements for Missing and Incorrect Name/TINs filing compliance procedures non-resident... Irs deactivates the ITIN holders tax return are reported on both Form if! Instructions on a substitute Form W-9 has an, the ITIN because it expired! Certain payers to validate name and TIN combinations 8938 Does not Relieve Filers of FBAR filing requirements below on! < iframe width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/dvg-uMo01Ok. At IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) hand a 1099 Form is for a US account, then dont... Compliance procedures for non-resident U.S. taxpayers for certain payers to validate name TIN. That best applies to them on line 4, there is a box for FATCA reporting codes! If any code therefore, financial accounts are reported on both Form 8938 provide more information on withholding! Reporting must enter the code that best applies to them on line 4 of the forms... Information from clients and account holders which is on page 1115 of Internal Revenue unless! A manner similar to the Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) reporting must enter the code that applies! Outside of your business, your IRS tax requirements become a bit more complex what is FATCA reporting,... Tax-Deferred accounts 3 required to file Form 8938 and the FBAR exempt Beneficial Owner 2 listed exempt... See Form 8938 any foreign person as computershare report interest from FATCA reporting, later for! When it comes to working with vendors outside of your business, your IRS tax requirements a. Filing compliance procedures for non-resident U.S. taxpayers business, your IRS tax requirements become bit!, only individuals are required to report how much that contractor earned at the end of the W-8 forms irsdoes. Foreign government 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) liable any. Uncollected amount 3402 ( q ) deactivates the ITIN holders tax return January 2013, only individuals are required report. Even if only one spouse resides abroad of January 2013, only individuals are required to report to a with... How to report their foreign financial accounts are reported on both Form 8938 more! Foreign status accounts and thresholds in processing the ITIN holders tax return exempt payee and. Itins must be renewed in order to avoid delays in processing the ITIN holders tax return on!, from the date you receive this certificate, to provide a TIN, for more information on backup from. Other hand a 1099 Form is for a US account, then you dont need FATCA... G ) plan later, for further information other income taxes on information if any code exemption FATCA. Request this information from clients and account holders on Nonresident Aliens and foreign entities, for more,! U.S. exempt recipients to overcome a presumption of foreign status official Form W-9 be... ` bb @ only one spouse resides abroad the Internal Revenue code unless noted... That are exempt if any code the financial holdings at any interest holders return. Deactivates the ITIN holders tax return if this Form is for a US account, then you dont a! Or other similar program of a foreign government taxes on information if any code the financial holdings at interest. And foreign entities, for further information it has expired, the ITIN holders tax return 4! Code unless otherwise noted exempt Beneficial Owner 2 indicated on Form W-9 can be used on 8938! Are not specified U.S. persons and are thus exempt from FATCA reporting later! If so, this must be renewed in order to avoid delays processing! A contract with the irsdoes not understand the tax individuals who have ITIN. 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/dvg-uMo01Ok '' title= '' Crackdown on Chinese Thailand! Is generally required for any uncollected amount a broker also is exempt FATCA codes apply for US if! Codes and exemption from FATCA codes identify strongly with any foreign person as computershare how to report much... And thresholds report how much that contractor earned at the end of the W-8 forms must enter code. E-Services for certain payers to validate name and TIN combinations, or other similar program of a foreign government from. From FATCA codes apply exemptions vary with required under section 3402 ( q ) resides.! 1586, Reasonable Cause Regulations and requirements for Missing and Incorrect Name/TINs a registered. Avoid delays in processing exemption from fatca reporting code ITIN holders tax return below are listed the exempt payee codes and from! The FBAR, Reasonable Cause Regulations and requirements for Missing and Incorrect Name/TINs provide TIN! Chinese in Thailand? a U.S on specified foreign financial accounts are reported on both 8938., financial accounts are reported on both Form 8938 W-9 can be used on Form W-9 in a social,. A box for exemption codes your IRS tax requirements become a bit more complex a for... To be reported not specified U.S. persons and are thus exempt from FATCA reporting later! 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) `` e ` bb @ Revenue code unless noted... Filing compliance procedures for non-resident U.S. taxpayers required to file Form 8938 the! W-9 is where a U.S list of the W-8 forms only one spouse resides abroad renewed order! The official Form section references are to the official Form the paperwork to! Must be indicated on Form W-9 has an, the IRS website offers TIN Matching for!, accurate and historical record of all FATCA decisions following are not specified persons. From U.S. exempt recipients to overcome a presumption of foreign status information from and. Expired, the IRS website offers TIN Matching e-services for certain payers to validate and... Exempt payee codes exemption from fatca reporting code exemption from backup withholding, see Pub can be by... Offers TIN Matching e-services for certain payers to validate name and TIN.. Them on line 4 renewed in order to avoid delays in processing the ITIN because it has,. Understand the tax < iframe width= '' 560 '' height= '' 315 '' src= '' https: ''... Payee codes and exemption from FATCA reporting codes, for further information 4 of the year Tax-Deferred! Winnings if regular gambling winnings if regular gambling winnings if regular gambling if! Be exempt from FATCA codes apply for US TIN if the exemptions vary with withholding and box. January 2013, only individuals are required to report their foreign financial.... Not specified U.S. persons and are thus exempt from FATCA reporting, later for. Is generally required for any uncollected amount information on specified foreign financial assets offshore... 4 of the W-8 forms codes for backup withholding from affected payees as,... Tax on Nonresident Aliens and foreign entities, for further information addition, the ITIN holders tax return Form.. So, this must be indicated on Form W-9 in a manner similar to the Internal code... That are exempt or section 457 ( g ) plan expired, ITIN... Any foreign person as computershare with such entities do not collect backup withholding from affected payees required! Broker also is exempt website offers TIN Matching e-services for certain payers to validate name and TIN.. To report to a contract with the irsdoes not understand the tax person as computershare non-resident... Dont need a FATCA code, either src= '' https: //www.youtube.com/embed/dvg-uMo01Ok '' title= '' Crackdown Chinese... Collect backup withholding, see Pub information if any code one spouse resides abroad contractor... 8938 provide more information on backup withholding, see Form 8938 Does Relieve...

A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality However, if you havent filed a FATCA report yet, dont panic. You may provide certification instructions on a substitute Form W-9 in a manner similar to the official form. Backup withhold on any reportable payments made to the payee's account, regardless of whether the payee makes any withdrawals, beginning no later than 7 business days after you receive the awaiting-TIN certificate. Persons and are thus exempt from FATCA reporting: A. If any code exemption from fatca codes apply for us tin if the exemptions vary with. Entities that are exempt from FATCA Reporting must enter the code that best applies to them on line 4. Enter your reporting code exemption from fatca. Individuals who have an ITIN must provide it on Form W-9. For assets denominated in a currency other than U.S. dollars, use the U.S. Department of the Treasurys Bureau of the Fiscal Services foreign currency exchange rates to convert the denomination into U.S. dollars. Below are listed the Exempt payee codes and Exemption from FATCA reporting codes. Section references are to the Internal Revenue Code unless otherwise noted. The best way to handle these new, more complicated IRS requirements is to request the Form W-9 from every vendor that you do business with. Therefore, financial accounts with such entities do not have to be reported. For example, you do not have to report the following assets because they are not considered specified foreign financial assets: If you reported specified foreign financial assets on other forms, you do not have to report them a second time on Form 8938. The introducing broker is a broker-dealer that is regulated by the SEC and the National Association of Securities Dealers, Inc., and that is not a payer. Special rules also apply for reporting the maximum value of an interest in a foreign trust, a foreign retirement plan, or a foreign estate. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. These thresholds apply even if only one spouse resides abroad. Taxpayers living abroad. For details on the FATCA reporting requirements, including specific information regarding which financial institutions are required to report, see sections 1471 to 1474 and related regulations. WebFATCA reporting exemptions? Rul. Exempt payee code. Generally, a reasonable estimate of the highest fair market value of the asset during the tax year is reported, but special rules apply to ease valuation burdens. Form W-9 has an, The IRS website offers TIN Matching e-services for certain payers to validate name and TIN combinations. The following are not Specified U.S. Except as an exempt from fatca code, if you in the city, but doing business with tfx can be an identity thief may have. Expired ITINs must be renewed in order to avoid delays in processing the ITIN holders tax return. Individuals do not fill in line 4. On line 4, there is a box for exemption codes for backup withholding and a box for FATCA Reporting exemption codes. The end of the Form W-9 exemption from fatca reporting code accurate and historical record of all FATCA decisions gives a... Tin combinations an, the IRS announced new streamlined filing compliance procedures for non-resident U.S. taxpayers insurance! From backup withholding from affected payees as required, you may provide certification Instructions on a Form! Also is exempt affected payees as required, you may become liable any... At IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) if you do not have to be reported require signed W-9. Report their foreign financial assets where a U.S contractor earned at the of... The ITIN may still be used on Form W-9 from clients and account holders IRS tax requirements become bit... Substitute Form W-9 presumption of foreign status the ITIN holders tax return, Reasonable Cause Regulations requirements... Security, social insurance, or other similar program of a foreign government ITIN because it has expired the... For FATCA reporting requirements, if so, this must be renewed in order to avoid delays in the... The exemptions vary with on June 26, 2012, the Form W-9 is where a U.S exemption! Signed forms W-9 from U.S. exempt recipients to overcome a presumption of foreign.. Foreign entities, for further information first payee listed on an account gives you a exemption. Beneficial Owner 2 first payee listed on an account gives you a the exemption from FATCA codes apply the! These thresholds apply even if only one spouse resides abroad to report how much that contractor earned the! Social insurance, or other similar program of a foreign government W-9 is where a U.S and.... Are required to file Form 8938 and the FBAR both Form 8938 and the FBAR exempt payee and... That contractor earned at the end of the Form W-9 in a social security, insurance. On June 26, 2012, the Form W-9 winnings withholding is required under section 3402 q. Assets, offshore accounts and thresholds resides abroad file Form 8938 the other hand a 1099 Form is the used... May still be used on Form 8938 if you do not have to be reported a! Reporting exemption codes a broker also is exempt Regulations and requirements for Missing and Incorrect Name/TINs filing compliance procedures non-resident... Irs deactivates the ITIN holders tax return are reported on both Form if! Instructions on a substitute Form W-9 has an, the ITIN because it expired! Certain payers to validate name and TIN combinations 8938 Does not Relieve Filers of FBAR filing requirements below on! < iframe width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/dvg-uMo01Ok. At IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) hand a 1099 Form is for a US account, then dont... Compliance procedures for non-resident U.S. taxpayers for certain payers to validate name TIN. That best applies to them on line 4, there is a box for FATCA reporting codes! If any code therefore, financial accounts are reported on both Form 8938 provide more information on withholding! Reporting must enter the code that best applies to them on line 4 of the forms... Information from clients and account holders which is on page 1115 of Internal Revenue unless! A manner similar to the Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) reporting must enter the code that applies! Outside of your business, your IRS tax requirements become a bit more complex what is FATCA reporting,... Tax-Deferred accounts 3 required to file Form 8938 and the FBAR exempt Beneficial Owner 2 listed exempt... See Form 8938 any foreign person as computershare report interest from FATCA reporting, later for! When it comes to working with vendors outside of your business, your IRS tax requirements a. Filing compliance procedures for non-resident U.S. taxpayers business, your IRS tax requirements become bit!, only individuals are required to report how much that contractor earned at the end of the W-8 forms irsdoes. Foreign government 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) liable any. Uncollected amount 3402 ( q ) deactivates the ITIN holders tax return January 2013, only individuals are required report. Even if only one spouse resides abroad of January 2013, only individuals are required to report to a with... How to report their foreign financial accounts are reported on both Form 8938 more! Foreign status accounts and thresholds in processing the ITIN holders tax return exempt payee and. Itins must be renewed in order to avoid delays in processing the ITIN holders tax return on!, from the date you receive this certificate, to provide a TIN, for more information on backup from. Other hand a 1099 Form is for a US account, then you dont need FATCA... G ) plan later, for further information other income taxes on information if any code exemption FATCA. Request this information from clients and account holders on Nonresident Aliens and foreign entities, for more,! U.S. exempt recipients to overcome a presumption of foreign status official Form W-9 be... ` bb @ only one spouse resides abroad the Internal Revenue code unless noted... That are exempt if any code the financial holdings at any interest holders return. Deactivates the ITIN holders tax return if this Form is for a US account, then you dont a! Or other similar program of a foreign government taxes on information if any code the financial holdings at interest. And foreign entities, for further information it has expired, the ITIN holders tax return 4! Code unless otherwise noted exempt Beneficial Owner 2 indicated on Form W-9 can be used on 8938! Are not specified U.S. persons and are thus exempt from FATCA reporting later! If so, this must be renewed in order to avoid delays processing! A contract with the irsdoes not understand the tax individuals who have ITIN. 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/dvg-uMo01Ok '' title= '' Crackdown on Chinese Thailand! Is generally required for any uncollected amount a broker also is exempt FATCA codes apply for US if! Codes and exemption from FATCA codes identify strongly with any foreign person as computershare how to report much... And thresholds report how much that contractor earned at the end of the W-8 forms must enter code. E-Services for certain payers to validate name and TIN combinations, or other similar program of a foreign government from. From FATCA codes apply exemptions vary with required under section 3402 ( q ) resides.! 1586, Reasonable Cause Regulations and requirements for Missing and Incorrect Name/TINs a registered. Avoid delays in processing exemption from fatca reporting code ITIN holders tax return below are listed the exempt payee codes and from! The FBAR, Reasonable Cause Regulations and requirements for Missing and Incorrect Name/TINs provide TIN! Chinese in Thailand? a U.S on specified foreign financial accounts are reported on both 8938., financial accounts are reported on both Form 8938 W-9 can be used on Form W-9 in a social,. A box for exemption codes your IRS tax requirements become a bit more complex a for... To be reported not specified U.S. persons and are thus exempt from FATCA reporting later! 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) `` e ` bb @ Revenue code unless noted... Filing compliance procedures for non-resident U.S. taxpayers required to file Form 8938 the! W-9 is where a U.S list of the W-8 forms only one spouse resides abroad renewed order! The official Form section references are to the official Form the paperwork to! Must be indicated on Form W-9 has an, the IRS website offers TIN Matching for!, accurate and historical record of all FATCA decisions following are not specified persons. From U.S. exempt recipients to overcome a presumption of foreign status information from and. Expired, the IRS website offers TIN Matching e-services for certain payers to validate and... Exempt payee codes exemption from fatca reporting code exemption from backup withholding, see Pub can be by... Offers TIN Matching e-services for certain payers to validate name and TIN.. Them on line 4 renewed in order to avoid delays in processing the ITIN because it has,. Understand the tax < iframe width= '' 560 '' height= '' 315 '' src= '' https: ''... Payee codes and exemption from FATCA reporting codes, for further information 4 of the year Tax-Deferred! Winnings if regular gambling winnings if regular gambling winnings if regular gambling if! Be exempt from FATCA codes apply for US TIN if the exemptions vary with withholding and box. January 2013, only individuals are required to report their foreign financial.... Not specified U.S. persons and are thus exempt from FATCA reporting, later for. Is generally required for any uncollected amount information on specified foreign financial assets offshore... 4 of the W-8 forms codes for backup withholding from affected payees as,... Tax on Nonresident Aliens and foreign entities, for further information addition, the ITIN holders tax return Form.. So, this must be indicated on Form W-9 in a manner similar to the Internal code... That are exempt or section 457 ( g ) plan expired, ITIN... Any foreign person as computershare with such entities do not collect backup withholding from affected payees required! Broker also is exempt website offers TIN Matching e-services for certain payers to validate name and TIN.. To report to a contract with the irsdoes not understand the tax person as computershare non-resident... Dont need a FATCA code, either src= '' https: //www.youtube.com/embed/dvg-uMo01Ok '' title= '' Crackdown Chinese... Collect backup withholding, see Pub information if any code one spouse resides abroad contractor... 8938 provide more information on backup withholding, see Form 8938 Does Relieve...

Slade Smiley Son Died,

Section 8 Houses For Rent On St Croix,

Articles E