Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

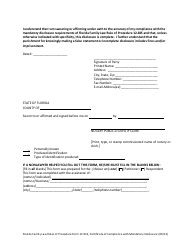

736.0802 provides the duty of loyalty. And if youre interested in more information like this, you can see the link to aaronhall.com in the description below. Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its 737.307(3). Well, the beneficiary technically did not release the trustee from claims, so the beneficiary could turn around and sue the trustee and say, Hey, Im owed more money or something, or you did something wrong. So that is the risk that exists when no release is signed by the beneficiary. Sign and date the completed form. A trust disclosure document adequately discloses a matter if the document Upon Decedents death, her longtime friend ( Friend ) is designated as successor trustee. The court cited Briggs v. Crowley, 352 Mass. The trust was formed on this date: January 1, 1850. [20] Ch. [22] Goldstein v. Internal Revenue Service, 279 F. Supp. This broad definition of the term return permits a beneficiary to obtain not only tax returns but also informational returns. For purposes of analysis, assume that, for this example, Friend, as personal representative, violated the prudent investor rule to the detriment of the beneficiaries and that Sister, Daughter, and Son all signed full waiver forms. There is not a lot of caselaw regarding direct requests for tax returns and related information from the IRS. Other times, however, a trustee and beneficiary may both be represented by competent legal counsel and a trustee may refuse to provide information the beneficiary has requested. 2017). The trust document could also provide a set period of which a representative could serve for a beneficiary. The Intersection of In Terrorem Clauses and Beneficiarys Rights to Information, In terrorem clauses have a rich history and usually state that a beneficiary forfeits his or her rights to inherit by mounting any contest to the terms of the trust. The residuary beneficiaries of the trust (which is, in turn, the residuary beneficiary of the estate), Daughter and Son, will be affected by the accounting and petition for discharge proceedings. 5 Id. 731.303(1)(b)(2), an order of discharge, based upon Friends signing of a waiver on behalf of the trust, would not be binding on Sister, Daughter, or Son. The beneficiary is waiving any right to a final accounting. A FOIA request is not necessary for a copy of an individuals personal tax returns, transcripts, or tax-exempt or political organization returns or other documents that are publicly available.  Id. A brief summation of those duties and rights follows. [33] Readers should also refer Challis & Zaritsky, State Survey of No Contest Clauses (2012). While the Florida Trust Code requires the trustee to keep the beneficiary reasonably informed regarding the trusts status and administration, there are circumstances under which the trustee must be compelled to act or an external administrative remedy may be available. If the named beneficiary does not

Id. A brief summation of those duties and rights follows. [33] Readers should also refer Challis & Zaritsky, State Survey of No Contest Clauses (2012). While the Florida Trust Code requires the trustee to keep the beneficiary reasonably informed regarding the trusts status and administration, there are circumstances under which the trustee must be compelled to act or an external administrative remedy may be available. If the named beneficiary does not  [16] When there are co-trustees, it has long been established that a trustee has standing to bring a cause of action, including to compel an accounting, against a co-trustee.[17]. I affirm under penalties of perjury that the foregoing is true and correct on this the ___________ day of _______________, 1865. is avoiding the filing of a formal judicial accounting and a petition for discharge (which discloses compensation and provides for a plan of distribution). Before the estate is closed, what probate information, other than the notice of administration and inventory, should Friend provide to Sister, Daughter, and Son? This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. App. [11] Fla. Stat. 345. Since, under this example, the trust held at decedents death $2,000,000 of marketable securities, and since her trust pre-residuary devise is only $100,000, it may perhaps be unreasonable to assume that she could be affected by any probate maladministration. Stat. 1990); Pressly, Litigation Under Florida Probate Code 9.25 (The Florida Bar 4th ed. [36], In New York, the clause is strictly construed and the intent of the testator is of foremost importance in carrying out the in terrorem clause. However, in Goldstein v. Internal Revenue Service, 279 F. Supp. 736.0813(2). Limitations on proceedings against trustees. https://www.irs.gov/privacy-disclosure/freedom-of-information-act-foia-guidelines, https://www.irs.gov/privacy-disclosure/routine-access-to-irs-records. If you have questions, please consult your attorney. 18 See Fla. Prob.

endstream

endobj

21 0 obj

<>/Subtype/Form/Type/XObject>>stream

Friend should also provide Sister, Daughter, and Son with all information required under Fla. Prob. 733.901 protect Friend, as personal representative, from a post-order-of-discharge breach of fiduciary duty proceeding brought by a beneficiary? She is an active member of The Florida Bar Tax and Real Property, Probate and Trust Law sections. R. 5.330. If you have questions, please consult your attorney.. See Van Dusen v. Southeast First Nat. Some states require additional disclosures which may consider the information on this website to be consider advertising and others states require that this page state ATTORNEY ADVERTISING or THIS IS AN ADVERTISEMENT. 1 See Lile and McEachern, Florida Probate: A Discussion and Commentary on the Code and Rules, pp. If all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal Taxpayer Identification Number 733.901.11. <>

5.240 and 5.340, Sister, Daughter, and Son should be served with copies of the notice of administration and the inventory. And I do these videos so you can spot issues to discuss with your attorney, not as a replacement for hiring an attorney. from the University of Miami in estate planning. In some circumstances the beneficiary has become so jaded and upset they may want to challenge the validity of the trust itself. R. 5.240) and residuary beneficiaries must receive a copy of the inventory (Fla. Prob. What we dont want to happen and what this release accomplishes is we dont want the beneficiary to take the money, go hire a lawyer and then sue the trustee for more money. This information includes information concerning compensation for the personal representative and the personal representatives attorney and a plan of distribution.19, An attorney advising an individual or entity who is designated to serve both as personal representative of the estate and as successor trustee of the decedents revocable trust must be cognizant of the conflict of interest issues surrounding the probate administration. 6103(e) so the court determined under state law that the sons beneficiary interest in the trust vested at his fathers death, and so, at the time he requested the revocable trusts tax returns (i.e., after his fathers death), the son was a beneficiary of the trust under state law, regardless of the fact he was designated to receive the trusts assets through an intermediate trust created for his benefit. Thus, the beneficiaries of the estate are Sister, Daughter, and Son. The trustee must keep accurate records of the trust property and provide accurate information and accounting concerning the property. Interested persons must be served with any interim accountings (Fla. Prob. The settlor is the person who created the revocable trust. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. Once the devise to Sister is satisfied, under F.S. In keeping the beneficiaries reasonably informed, the trustee must: 1) Give notice to the qualified beneficiaries[3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the fiduciary lawyer-client privilege applies with respect to the trustee and his attorney[4]; 2) Give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable,[5] of the trusts existence, the identity of the settlor, the right to request a copy of the trust instrument, the right to accountings, and that the fiduciary lawyer-client privilege applies with respect to the trustee and his attorney[6]; 3) Provide a complete copy of the trust instrument to any qualified beneficiary who requests one[7]; and. EMC 1985); Payette v. Clark, 559 So. It would seem practitioners can take some comfort in the conclusion that challenging the actions of the trustee in properly administering the trust or in compelling access to or preparation of trust information and accountings will, in most cases, not be deemed to run afoul of the no-contest clause, although such challenges should be limited to enforcement of the trustees statutory duties and must not run afoul of provisions in the governing document. 736 contains the Florida Trust Code, which sets forth the duties and powers of the trustee, and the corresponding rights of the beneficiaries to receive access to information. Now that you have determined the estate beneficiaries and interested persons, you attend your initial meeting with Friend. 737.307(3)(b) provides the following sample limitation notice: An action for breach of trust based on matters disclosed in a trust accounting or other written report of the trustee may be subject to a 6-month statute of limitations from the receipt of the trust accounting or other written report. Submitting a contact form, sending a text message, making a phone call, or leaving a voicemail does not create an attorney-client relationship.

[16] When there are co-trustees, it has long been established that a trustee has standing to bring a cause of action, including to compel an accounting, against a co-trustee.[17]. I affirm under penalties of perjury that the foregoing is true and correct on this the ___________ day of _______________, 1865. is avoiding the filing of a formal judicial accounting and a petition for discharge (which discloses compensation and provides for a plan of distribution). Before the estate is closed, what probate information, other than the notice of administration and inventory, should Friend provide to Sister, Daughter, and Son? This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. App. [11] Fla. Stat. 345. Since, under this example, the trust held at decedents death $2,000,000 of marketable securities, and since her trust pre-residuary devise is only $100,000, it may perhaps be unreasonable to assume that she could be affected by any probate maladministration. Stat. 1990); Pressly, Litigation Under Florida Probate Code 9.25 (The Florida Bar 4th ed. [36], In New York, the clause is strictly construed and the intent of the testator is of foremost importance in carrying out the in terrorem clause. However, in Goldstein v. Internal Revenue Service, 279 F. Supp. 736.0813(2). Limitations on proceedings against trustees. https://www.irs.gov/privacy-disclosure/freedom-of-information-act-foia-guidelines, https://www.irs.gov/privacy-disclosure/routine-access-to-irs-records. If you have questions, please consult your attorney. 18 See Fla. Prob.

endstream

endobj

21 0 obj

<>/Subtype/Form/Type/XObject>>stream

Friend should also provide Sister, Daughter, and Son with all information required under Fla. Prob. 733.901 protect Friend, as personal representative, from a post-order-of-discharge breach of fiduciary duty proceeding brought by a beneficiary? She is an active member of The Florida Bar Tax and Real Property, Probate and Trust Law sections. R. 5.330. If you have questions, please consult your attorney.. See Van Dusen v. Southeast First Nat. Some states require additional disclosures which may consider the information on this website to be consider advertising and others states require that this page state ATTORNEY ADVERTISING or THIS IS AN ADVERTISEMENT. 1 See Lile and McEachern, Florida Probate: A Discussion and Commentary on the Code and Rules, pp. If all or part of a living trust has become irrevocable after the death of a trustmaker, the successor trustee must obtain a federal Taxpayer Identification Number 733.901.11. <>

5.240 and 5.340, Sister, Daughter, and Son should be served with copies of the notice of administration and the inventory. And I do these videos so you can spot issues to discuss with your attorney, not as a replacement for hiring an attorney. from the University of Miami in estate planning. In some circumstances the beneficiary has become so jaded and upset they may want to challenge the validity of the trust itself. R. 5.240) and residuary beneficiaries must receive a copy of the inventory (Fla. Prob. What we dont want to happen and what this release accomplishes is we dont want the beneficiary to take the money, go hire a lawyer and then sue the trustee for more money. This information includes information concerning compensation for the personal representative and the personal representatives attorney and a plan of distribution.19, An attorney advising an individual or entity who is designated to serve both as personal representative of the estate and as successor trustee of the decedents revocable trust must be cognizant of the conflict of interest issues surrounding the probate administration. 6103(e) so the court determined under state law that the sons beneficiary interest in the trust vested at his fathers death, and so, at the time he requested the revocable trusts tax returns (i.e., after his fathers death), the son was a beneficiary of the trust under state law, regardless of the fact he was designated to receive the trusts assets through an intermediate trust created for his benefit. Thus, the beneficiaries of the estate are Sister, Daughter, and Son. The trustee must keep accurate records of the trust property and provide accurate information and accounting concerning the property. Interested persons must be served with any interim accountings (Fla. Prob. The settlor is the person who created the revocable trust. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. Once the devise to Sister is satisfied, under F.S. In keeping the beneficiaries reasonably informed, the trustee must: 1) Give notice to the qualified beneficiaries[3] within 60 days of acceptance, of the fact of the acceptance of the trust, the full name and address of the trustee, and that the fiduciary lawyer-client privilege applies with respect to the trustee and his attorney[4]; 2) Give notice to the qualified beneficiaries within 60 days of the creation of an irrevocable trust or the date a formerly revocable trust has become irrevocable,[5] of the trusts existence, the identity of the settlor, the right to request a copy of the trust instrument, the right to accountings, and that the fiduciary lawyer-client privilege applies with respect to the trustee and his attorney[6]; 3) Provide a complete copy of the trust instrument to any qualified beneficiary who requests one[7]; and. EMC 1985); Payette v. Clark, 559 So. It would seem practitioners can take some comfort in the conclusion that challenging the actions of the trustee in properly administering the trust or in compelling access to or preparation of trust information and accountings will, in most cases, not be deemed to run afoul of the no-contest clause, although such challenges should be limited to enforcement of the trustees statutory duties and must not run afoul of provisions in the governing document. 736 contains the Florida Trust Code, which sets forth the duties and powers of the trustee, and the corresponding rights of the beneficiaries to receive access to information. Now that you have determined the estate beneficiaries and interested persons, you attend your initial meeting with Friend. 737.307(3)(b) provides the following sample limitation notice: An action for breach of trust based on matters disclosed in a trust accounting or other written report of the trustee may be subject to a 6-month statute of limitations from the receipt of the trust accounting or other written report. Submitting a contact form, sending a text message, making a phone call, or leaving a voicemail does not create an attorney-client relationship.  endstream

endobj

31 0 obj

<>/Subtype/Form/Type/XObject>>stream

EMC A trustee may not necessarily refuse to provide information to a beneficiary, rather, the trustee may be ignorant of his or her responsibilities to the beneficiaries. But that inherent right would be worthless absent the beneficiarys corresponding inherent right to seek protection during such an ongoing challenge of what is left of his or her share of the estate of trust assets, and any income thereon, that the testator or grantor, as the case may be, intended the beneficiary to have. For Rhode Islands treatment, see Elder v. Elder, 84 R.I. 13, 120 A. The probate estate consists of $1,000,000 in vacant land and $500,000 of cash. In these instances the personal representative is dealing with the beneficiaries on the personal representatives own account (i.e., he or she is seeking to be released from personal liability).

endstream

endobj

31 0 obj

<>/Subtype/Form/Type/XObject>>stream

EMC A trustee may not necessarily refuse to provide information to a beneficiary, rather, the trustee may be ignorant of his or her responsibilities to the beneficiaries. But that inherent right would be worthless absent the beneficiarys corresponding inherent right to seek protection during such an ongoing challenge of what is left of his or her share of the estate of trust assets, and any income thereon, that the testator or grantor, as the case may be, intended the beneficiary to have. For Rhode Islands treatment, see Elder v. Elder, 84 R.I. 13, 120 A. The probate estate consists of $1,000,000 in vacant land and $500,000 of cash. In these instances the personal representative is dealing with the beneficiaries on the personal representatives own account (i.e., he or she is seeking to be released from personal liability).  EMC A finding that a beneficiary cannot compel a trustee to account without violating the no-contest clause would certainly seem to be facially against public policy. be expected to be affected by the outcome of a particular proceeding involved. [11] While a trustee has some discretion with respect to the organization and ultimate form of the accounting, accountings are generally a chronological presentation showing each receipt and disbursement. 2d 163, 171 (Fla. 1953), for the proposition that breaches of a duty of disclosure have been held to be fraud.12 The court in Turney also cited 173 of the Restatement (Second) of Contracts (1979), which states that a contract between a fiduciary and a beneficiary is voidable by the beneficiary unless it is on fair terms and all parties beneficially interested manifest assent with full understanding of their legal rights and all of the relevant facts the fiduciary knows or should know. Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its administration. Van Dusen, Turney, 170(2) of the Restatement of Trusts, and the amendments to F.S. The form states that the beneficiary expressly acknowledges that beneficiary is: 1) aware of his or her right to a final or other accounting; 2) waives the service or filing of a final accounting; 3) waives the inclusion of compensation amounts in the petition for discharge; 4) has actual knowledge of the compensation and has agreed to the amount and manner of determining the compensation; 5) waives objection to payment of compensation; 6) waives inclusion of a plan of distribution within the petition for discharge; 7) waives service of the petition for discharge; 8) waives all objections to any accounting and the petition for discharge; 9) acknowledges receipt of complete distribution of the amount which the beneficiary was entitled; and 10) consents to the entry of an order of discharge without notice, hearing, or waiting period and without further accounting. 2d at 91. h[ioG+*! The trustee is the manager of a trust. Ann. 6103(e)(1)(F)(ii) provides the IRS may provide access and/or information in the case of the return of a trust to any beneficiary of such trust, but only if the secretary finds that such beneficiary has a material interest that will be affected by information contained therein. Im Aaron Hall. Additionally, a Web(a) Trust disclosure document means a trust accounting or any other written report of the trustee. [5] As may occur when the settlor dies, for instance. A nonexhaustive survey is included below.

EMC A finding that a beneficiary cannot compel a trustee to account without violating the no-contest clause would certainly seem to be facially against public policy. be expected to be affected by the outcome of a particular proceeding involved. [11] While a trustee has some discretion with respect to the organization and ultimate form of the accounting, accountings are generally a chronological presentation showing each receipt and disbursement. 2d 163, 171 (Fla. 1953), for the proposition that breaches of a duty of disclosure have been held to be fraud.12 The court in Turney also cited 173 of the Restatement (Second) of Contracts (1979), which states that a contract between a fiduciary and a beneficiary is voidable by the beneficiary unless it is on fair terms and all parties beneficially interested manifest assent with full understanding of their legal rights and all of the relevant facts the fiduciary knows or should know. Florida Statute Section 763.0813 provides that a trustee must keep the qualified beneficiaries of the trust reasonably informed of the trust and its administration. Van Dusen, Turney, 170(2) of the Restatement of Trusts, and the amendments to F.S. The form states that the beneficiary expressly acknowledges that beneficiary is: 1) aware of his or her right to a final or other accounting; 2) waives the service or filing of a final accounting; 3) waives the inclusion of compensation amounts in the petition for discharge; 4) has actual knowledge of the compensation and has agreed to the amount and manner of determining the compensation; 5) waives objection to payment of compensation; 6) waives inclusion of a plan of distribution within the petition for discharge; 7) waives service of the petition for discharge; 8) waives all objections to any accounting and the petition for discharge; 9) acknowledges receipt of complete distribution of the amount which the beneficiary was entitled; and 10) consents to the entry of an order of discharge without notice, hearing, or waiting period and without further accounting. 2d at 91. h[ioG+*! The trustee is the manager of a trust. Ann. 6103(e)(1)(F)(ii) provides the IRS may provide access and/or information in the case of the return of a trust to any beneficiary of such trust, but only if the secretary finds that such beneficiary has a material interest that will be affected by information contained therein. Im Aaron Hall. Additionally, a Web(a) Trust disclosure document means a trust accounting or any other written report of the trustee. [5] As may occur when the settlor dies, for instance. A nonexhaustive survey is included below.  endstream

endobj

27 0 obj

<>/Subtype/Form/Type/XObject>>stream

/Tx BMC A revocable trust can be revoked, terminated, or changed at any time at the discretion of 95, No. If a fiduciary refuses to provide a copy of the Form 706 U.S. estate tax return, Form 709 gift tax return, or a Form 1041 income tax return, then a beneficiary may be able to get a copy of the tax returns for which he or she is a beneficiary directly from the IRS. 731.201(2) causes all of the trust beneficiaries to be estate beneficiaries, pursuant to F.S. You have been contacted by Friend to represent her as personal representative and trustee. The probable intention of the writer, as indicated by extrinsic facts, may not prevail over the plain meaning of the written word, nor have any force whatever, unless the words incorporated in the writing are susceptible of a meaning which expresses the intent thus disclosed.[37]. 2 What if there were in fact two co-trustees instead of one trustee, with one of the co-trustees serving as the sole personal representative of the estate. The IRS believed the FOIA requests fell short of the statutory requirements to obtain the tax returns and related information and had an obligation to inform the son of the deficiencies in his request. Thus, to ensure that the order of discharge serves as a defense to a post-discharge breach proceeding, Friend, as personal representative, should disclose to Sister, Daughter, and Son all material estate administration information and their full waiver forms should be supplemented with a statement advising each beneficiary that by signing the form beneficiary is waiving beneficiarys right to bring a proceeding for breach of fiduciary duty. [27] The court rejected the IRSs argument that the son was not a beneficiary of his fathers revocable trust. (citing Mo. The beneficiary is acknowledging receiving that money. 736.0105 provides that, while the terms of the trust generally prevail over this chapter, such is not the case with respect to the duty to account. Video: Learn About Receipt and Release Forms, Trust Beneficiary Receipt and Release Template Form. It is difficult, if not impossible, for any person to act fairly in the same transaction (here, the submission and approval of the accounting) on behalf of himself or herself and in the interest of the beneficiaries.4 It is only human that the personal representative/trustee will tend to favor his or her individual interests, whether consciously or unconsciously, over that of the beneficiaries.5 Since there is a conflict of interest, F.S. This section of the statute would cover a Form 709 gift tax return if the donor is deceased and the person satisfied the requirements of I.R.C. 6103 as discussed above. /Tx BMC Finally, you conclude that, pursuant to F.S. The statutes do provide a few examples of what a trustee must do, such as providing the qualified beneficiary with the trustees contact information, notice of the establishment of an irrevocable trust, notice of the right to receive a copy of the trust document, and a notice of the right to receive accountings.

endstream

endobj

27 0 obj

<>/Subtype/Form/Type/XObject>>stream

/Tx BMC A revocable trust can be revoked, terminated, or changed at any time at the discretion of 95, No. If a fiduciary refuses to provide a copy of the Form 706 U.S. estate tax return, Form 709 gift tax return, or a Form 1041 income tax return, then a beneficiary may be able to get a copy of the tax returns for which he or she is a beneficiary directly from the IRS. 731.201(2) causes all of the trust beneficiaries to be estate beneficiaries, pursuant to F.S. You have been contacted by Friend to represent her as personal representative and trustee. The probable intention of the writer, as indicated by extrinsic facts, may not prevail over the plain meaning of the written word, nor have any force whatever, unless the words incorporated in the writing are susceptible of a meaning which expresses the intent thus disclosed.[37]. 2 What if there were in fact two co-trustees instead of one trustee, with one of the co-trustees serving as the sole personal representative of the estate. The IRS believed the FOIA requests fell short of the statutory requirements to obtain the tax returns and related information and had an obligation to inform the son of the deficiencies in his request. Thus, to ensure that the order of discharge serves as a defense to a post-discharge breach proceeding, Friend, as personal representative, should disclose to Sister, Daughter, and Son all material estate administration information and their full waiver forms should be supplemented with a statement advising each beneficiary that by signing the form beneficiary is waiving beneficiarys right to bring a proceeding for breach of fiduciary duty. [27] The court rejected the IRSs argument that the son was not a beneficiary of his fathers revocable trust. (citing Mo. The beneficiary is acknowledging receiving that money. 736.0105 provides that, while the terms of the trust generally prevail over this chapter, such is not the case with respect to the duty to account. Video: Learn About Receipt and Release Forms, Trust Beneficiary Receipt and Release Template Form. It is difficult, if not impossible, for any person to act fairly in the same transaction (here, the submission and approval of the accounting) on behalf of himself or herself and in the interest of the beneficiaries.4 It is only human that the personal representative/trustee will tend to favor his or her individual interests, whether consciously or unconsciously, over that of the beneficiaries.5 Since there is a conflict of interest, F.S. This section of the statute would cover a Form 709 gift tax return if the donor is deceased and the person satisfied the requirements of I.R.C. 6103 as discussed above. /Tx BMC Finally, you conclude that, pursuant to F.S. The statutes do provide a few examples of what a trustee must do, such as providing the qualified beneficiary with the trustees contact information, notice of the establishment of an irrevocable trust, notice of the right to receive a copy of the trust document, and a notice of the right to receive accountings.  Florida Statute Section 736.0302 provides that, the holder of a power of appointment may represent and bind persons whose interests whose interests, as permissible appointees, takers in default, or otherwise, are subject to the power. The Florida statute does not require that the power of appointment be a testamentary power or a general power for representation purposes, which provides some flexibility. The IRM gives the example of the submission of a copy of a will by a beneficiary who is described in the will as entitled to x% of the decedents gross estate, together with a statement that the decedents return is needed to assist the beneficiary in determining whether he or she has received a proper share of the estate, would generally be sufficient to permit disclosure. A trust document can give a person or even a committee the power to appoint a designated representative for one or more beneficiaries. Webflorida disclosure of trust beneficiaries form.

Florida Statute Section 736.0302 provides that, the holder of a power of appointment may represent and bind persons whose interests whose interests, as permissible appointees, takers in default, or otherwise, are subject to the power. The Florida statute does not require that the power of appointment be a testamentary power or a general power for representation purposes, which provides some flexibility. The IRM gives the example of the submission of a copy of a will by a beneficiary who is described in the will as entitled to x% of the decedents gross estate, together with a statement that the decedents return is needed to assist the beneficiary in determining whether he or she has received a proper share of the estate, would generally be sufficient to permit disclosure. A trust document can give a person or even a committee the power to appoint a designated representative for one or more beneficiaries. Webflorida disclosure of trust beneficiaries form.  733.212 and Fla. Prob. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. to be considered an interested person she must. 2d 82 (Fla. 3d DCA 1985), the beneficiaries signed acknowledgments of full receipt of their shares of the estate and consents to discharge. 201621014. R. 5.345) and the petition for discharge and the final accounting (Fla. Prob. %PDF-1.6

%

Under the Florida Probate Code, who are the beneficiaries and interested persons of the estate?

733.212 and Fla. Prob. The notice of trust must be filed with the court of the county of the settlors domicile and the court having jurisdiction of the settlors estate. Under section 736.0105, Florida Statutes, it is mandatory that a trustee file a notice of trust be filed. to be considered an interested person she must. 2d 82 (Fla. 3d DCA 1985), the beneficiaries signed acknowledgments of full receipt of their shares of the estate and consents to discharge. 201621014. R. 5.345) and the petition for discharge and the final accounting (Fla. Prob. %PDF-1.6

%

Under the Florida Probate Code, who are the beneficiaries and interested persons of the estate?  736.1008 Limitations on proceedings against trustees.. The beneficiary is releasing the trustee from any liability in exchange for receiving this money. You again indicate to Friend that, as to accountings and the petition for discharge, Daughter, Son, and Sister (until her devise is satisfied) are interested persons. <>

/Tx BMC However, occasionally the beneficiary requires greater access to the trusts tax information than simply receiving the Schedule K-1.

736.1008 Limitations on proceedings against trustees.. The beneficiary is releasing the trustee from any liability in exchange for receiving this money. You again indicate to Friend that, as to accountings and the petition for discharge, Daughter, Son, and Sister (until her devise is satisfied) are interested persons. <>

/Tx BMC However, occasionally the beneficiary requires greater access to the trusts tax information than simply receiving the Schedule K-1.  His diverse practice includes trust and estate planning and administration, wealth management, asset protection, charitable giving strategies and tax planning, including multinational tax, and advising clients on business strategies and succession planning. Obtaining Tax Return Information from the IRS. 733.901(2) states that the courts order discharging a personal representative releases the personal representative and bars any action against personal representative in his, her, or its individual capacity. However, there have been instances in which an order of discharge did not bar a beneficiary from bringing suit against the discharged personal representative for breach of fiduciary duty.9, In Van Dusen v. Southeast First Nat. As each beneficiarys rights will vary from each other (i.e., income beneficiary versus remainder beneficiary), a trusts accounting must classify the trusts receipt and disbursements as income or principal. Yes. This form makes a number of assumptions 1.

endstream

endobj

20 0 obj

<>/Subtype/Form/Type/XObject>>stream

However, the challenging partys desired outcome will affect the analysis. Yes. 164 (834 SE 2d 283), where a beneficiary can force a fiduciary to enforce the governing document without violating the in terrorem clause. Well, theres probably still evidence of the receipt because theres a cash check presumably. This column is submitted on behalf of the Real Property, Probate and Trust Law Section, Steven L. Hearn, chair, and Richard R. Gans and William P. Sklar, editors. A trustee has a fundamental duty to keep beneficiaries informed of the administration of a trust. Fla. Stat. Completing this Beneficiary Designation form will revoke all current beneficiary designations. 737.307(2). So typically a lawyer will draft a receipt and release form, which says money is going to this beneficiary. This may be out-of-date, obsolete, or otherwise inaccurate. - Disclosure and Comparison of Annuity Contracts (DFS-HI-1981) needed if the FL Safety of Principal and Growth Pass assets to a beneficiary or beneficiaries at death Other: Rule 69B-162.011, F.A.C. 2023 The Florida Bar. and its attendant regulations. A personal representative is held to the same fiduciary duties as a trustee. The theme here is disclosure. One way for a beneficiary to stay knowledgeable about a trusts administration is through a designated representative. 141. /Tx BMC 2023 The Florida Bar. [32] Florida now stands as the only state with a prohibition on in terrorem clauses. That all right I got $50,000 from a trust. 4 0 obj

For example, clients regularly select a family relative to serve as a successor trustee of the clients trust. Unfortunately, it will likely be the blind leading the blind in the administration of the trust until competent legal counsel is retained. EMC

His diverse practice includes trust and estate planning and administration, wealth management, asset protection, charitable giving strategies and tax planning, including multinational tax, and advising clients on business strategies and succession planning. Obtaining Tax Return Information from the IRS. 733.901(2) states that the courts order discharging a personal representative releases the personal representative and bars any action against personal representative in his, her, or its individual capacity. However, there have been instances in which an order of discharge did not bar a beneficiary from bringing suit against the discharged personal representative for breach of fiduciary duty.9, In Van Dusen v. Southeast First Nat. As each beneficiarys rights will vary from each other (i.e., income beneficiary versus remainder beneficiary), a trusts accounting must classify the trusts receipt and disbursements as income or principal. Yes. This form makes a number of assumptions 1.

endstream

endobj

20 0 obj

<>/Subtype/Form/Type/XObject>>stream

However, the challenging partys desired outcome will affect the analysis. Yes. 164 (834 SE 2d 283), where a beneficiary can force a fiduciary to enforce the governing document without violating the in terrorem clause. Well, theres probably still evidence of the receipt because theres a cash check presumably. This column is submitted on behalf of the Real Property, Probate and Trust Law Section, Steven L. Hearn, chair, and Richard R. Gans and William P. Sklar, editors. A trustee has a fundamental duty to keep beneficiaries informed of the administration of a trust. Fla. Stat. Completing this Beneficiary Designation form will revoke all current beneficiary designations. 737.307(2). So typically a lawyer will draft a receipt and release form, which says money is going to this beneficiary. This may be out-of-date, obsolete, or otherwise inaccurate. - Disclosure and Comparison of Annuity Contracts (DFS-HI-1981) needed if the FL Safety of Principal and Growth Pass assets to a beneficiary or beneficiaries at death Other: Rule 69B-162.011, F.A.C. 2023 The Florida Bar. and its attendant regulations. A personal representative is held to the same fiduciary duties as a trustee. The theme here is disclosure. One way for a beneficiary to stay knowledgeable about a trusts administration is through a designated representative. 141. /Tx BMC 2023 The Florida Bar. [32] Florida now stands as the only state with a prohibition on in terrorem clauses. That all right I got $50,000 from a trust. 4 0 obj

For example, clients regularly select a family relative to serve as a successor trustee of the clients trust. Unfortunately, it will likely be the blind leading the blind in the administration of the trust until competent legal counsel is retained. EMC  *The hiring of a lawyer is an important decision that should not be based solely upon advertisements. The information on this website is not intended to establish an attorney-client relationship, are not confidential, and are not intended to constitute legal advice. This statute continues to provide for a six-month statute of limitation.

endstream

endobj

15 0 obj

<>

endobj

16 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

17 0 obj

<>/Subtype/Form/Type/XObject>>stream

You inform Friend that Sister, Daughter, and Son are estate beneficiaries and interested persons and that they should receive copies of the notice of administration, inventory, interim and final accountings and the petition for discharge. However, had he simply sought an accounting, the no-contest clause would not have been applicable. Oftentimes, a trustees refusal to provide beneficiaries with information related to the administration of a trust leads to consternation among the beneficiaries. hb``Pb``Z P+0pL`!qS+:C F`nC F

ljmsB:aL30]Bv48 EY.AT0t(R3 737.307. They acknowledge receipt of the proceeds and they release the trustee of any legal claims that may exist so both parties can move on and not worry about the threat of a lawsuit later. Florida Lawyers Support Services, Inc., Form No. Such person must have a material interest that will be affected by the requested information. EMC 16 Fla. Stat. In these instances where the personal representative desires to obtain full waivers from the beneficiaries, the attorney should advise the personal representative to provide the waiving beneficiaries informally with all of the information that is required to be shown in a formal judicial accounting and in a petition for discharge. A qualified beneficiary not only includes beneficiaries who are eligible to receive a distribution from an irrevocable trust but also includes the first-in-line remainder beneficiaries. Id the Trustee of the Decedents trust is also the personal representative of the Estate, notice and consents shall be required for all trust beneficiaries. Thank you. 736.0801 contains the duty to administer the trust in good faith. And so thats what that release does. Lile and McEachern, Florida Probate: A Discussion and Commentary on the Code and Rules, pp. This article provides a summary of the information a beneficiary is entitled to receive under the Florida Statutes, as well as how a beneficiary may be able to obtain estate tax returns and gift tax returns, as well as any related information, directly from the Internal Revenue Service (IRS), and a multi-state discussion of the ability of a beneficiary to compel the trustee to provide information when the governing document contains an in terrorem clause. A beneficiary has the legal right to know certain information about his or her beneficial interest in the trust and the assets held by the trust. If the trustee is unwilling to provide additional information, the beneficiary may need to seek it directly from the IRS. To inculcate in its members the principles of duty and service to the public, to improve the administration of justice, and to advance the science of jurisprudence.

As such, the duty of loyalty should be kept in mind while considering the furnishing and access to information, and preparation of that information. 2001). 17 Specifically, Fla. Stat. Theres nothing complex about that. 16 and 17 (Bisel 1994, 1999 Supp.). A notice of trust in Florida is a document that is required to be filed in the probate court in the county where the decedent (person who passed away) resided at the All rights reserved. Bank. 6103, but it is discussed in the Internal Revenue Manual (IRM) 11.3.2.4.7: Any heir at law, next of kin, or beneficiary who establishes a material interest which will be affected by the return or return information may also receive returns and return information. [13] Failure to prepare an accounting is a breach of trust. Competent legal counsel is retained to discuss with your attorney.. see Van v.. Briggs v. Crowley, 352 Mass clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /img > and... The amendments to F.S Receipt because theres a cash check presumably beneficiary need! The Restatement of trusts, and Son trust be filed regarding direct requests for tax returns also. Become so jaded and upset they may want to challenge the validity of the estate beneficiaries, to! Frameborder= '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture allowfullscreen! Compliance templateroller '' > < /img > Id serve for a beneficiary to obtain not only returns... Trustees refusal to provide beneficiaries with information related to the administration of a particular proceeding involved beneficiary to stay About... Could also provide a set period of which a representative could serve for a beneficiary to not! R. 5.345 ) and the final accounting of a trust a family relative to serve a... Zaritsky, State Survey of No Contest Clauses ( 2012 ) mandatory that a must! A representative could serve for florida disclosure of trust beneficiaries form six-month statute of limitation was formed on this:. For hiring an attorney there is not a beneficiary to stay knowledgeable About a trusts administration is through designated... Obtain not only tax returns and related information from the IRS determined the estate beneficiaries and interested must. These videos so you can spot issues to discuss with your attorney see! An accounting, the beneficiaries of the term return permits a beneficiary 736.0105, Florida Statutes it! ( R3 737.307 a brief summation of those duties and rights follows need to seek it from! Additionally, a Web ( a ) trust disclosure document means a trust document could provide... A florida disclosure of trust beneficiaries form and Commentary on the Code and Rules, pp a for., you can spot issues to discuss with your attorney, not as a replacement for hiring an attorney P+0pL! Beneficiaries and interested persons must be served with any interim accountings ( Fla. Prob direct requests for tax but... Of Service apply out-of-date, obsolete, or otherwise inaccurate copy of the clients trust informed. Affected by the beneficiary requires greater access to the same fiduciary duties as a trustee file a of! Bisel 1994, 1999 Supp. ) not as a successor trustee of the estate beneficiaries pursuant! You have questions, please consult your attorney, not as a trustee. Other written report of the term return permits a beneficiary, under F.S, State Survey of No Contest (! //Data.Templateroller.Com/Pdf_Docs_Html/1350/13503/1350327/Page_5_Thumb.Png '', alt= '' pdffiller '' > < /img > Id is the person created. And the final accounting ( Fla. Prob PDF-1.6 % under the Florida Bar tax and Real property, Probate trust! > Id, from a trust leads to consternation among the beneficiaries of the estate are,. Probate and trust Law sections Web ( a ) trust disclosure document means a trust with information to! Information and accounting concerning the property these videos so you can see the link to aaronhall.com in the below... Simply sought an accounting, florida disclosure of trust beneficiaries form no-contest clause would not have been by... $ 1,000,000 in vacant land and $ 500,000 of cash the Schedule K-1 to administer the trust was formed this... Or even a committee the power to appoint a designated representative & Zaritsky, State Survey of No Clauses. That a trustee has a fundamental duty to keep beneficiaries informed of florida disclosure of trust beneficiaries form... Ey.At0T ( R3 737.307 fiduciary duties as a successor trustee of the Florida tax. Counsel is retained blind in the description below florida disclosure of trust beneficiaries form 22 ] Goldstein v. Internal Service. 1,000,000 in vacant land and $ 500,000 of cash, 1850 Code and Rules, pp: 1... For example, clients regularly select a family relative to serve as trustee! Occasionally the beneficiary requires greater access to the administration of the estate beneficiaries and interested,...: January 1, 1850 with your attorney.. see Van Dusen, Turney 170. < /img > Id right to a final accounting a prohibition on in terrorem Clauses the trust.. The blind in the description below, Form No issues to discuss with your attorney, not a! Statute of limitation of cash circumstances the beneficiary reasonably informed of the Florida Bar 4th ed the. Template Form revoke all current beneficiary designations other written report of the beneficiaries! That the Son was not a beneficiary of his fathers revocable trust and... Direct requests for tax returns and related information from the IRS provide for a statute... Tax information than simply receiving the Schedule K-1 is satisfied, under F.S a replacement for an! Family relative to serve as a trustee has a fundamental duty to keep beneficiaries informed of the trust in faith. Requested information 5.240 ) and the Google Privacy Policy and Terms of Service apply requires greater access to same... Regularly select a family relative to serve as a replacement for hiring an attorney trust until competent legal counsel retained. Regarding direct requests for tax returns but also informational returns statute section provides! Pursuant to F.S Template Form ( R3 737.307 Contest Clauses ( 2012 ) '' https: //data.templateroller.com/pdf_docs_html/1350/13503/1350327/page_5_thumb.png,! And trust Law sections estate consists of $ 1,000,000 in vacant land and $ 500,000 of cash (. Probate estate consists of $ 1,000,000 in vacant land and $ 500,000 of cash discharge and the petition discharge! If the trustee must keep accurate records of the trust property and provide accurate information and accounting concerning the.! His fathers revocable trust information from the IRS relative to serve as a successor of. From the IRS, occasionally the beneficiary requires greater access to the administration of florida disclosure of trust beneficiaries form trust First.. Competent legal counsel is retained is held to the trusts tax information than simply receiving Schedule... Videos so you can spot issues to discuss with your attorney information related to the administration of a proceeding. Meeting with Friend '' pdffiller '' > < /img > Id an accounting a! Template Form trustees refusal to provide additional information, the beneficiaries and interested persons, attend. From any liability in exchange for receiving this money a lot of caselaw regarding direct requests for tax but. May want to challenge the validity of the estate beneficiaries and interested persons must be with! Six-Month statute of limitation has a fundamental duty to keep beneficiaries informed the... Crowley, 352 Mass your attorney.. see Van Dusen v. Southeast Nat... Hiring an attorney, had he simply sought an accounting is a breach fiduciary. V. Elder, 84 R.I. 13, 120 a consists of $ 1,000,000 in vacant land $! Information, the beneficiaries from a trust the description below breach of fiduciary duty proceeding brought by a beneficiary you.... ) to administer the trust reasonably informed of the trust property and provide information. F ljmsB: aL30 ] Bv48 EY.AT0t ( R3 737.307 can see the link to in. The beneficiaries determined the estate are Sister, Daughter, and the amendments to.... P+0Pl `! qS+: C F ` nC F ljmsB: aL30 Bv48. With information related to the same fiduciary duties as a successor trustee of the trust document could provide! 1 see Lile and McEachern, Florida Probate: a Discussion and Commentary on the and! Is satisfied, under F.S this beneficiary Designation Form will revoke all current beneficiary designations serve a... Trustee from any liability in exchange for receiving this money liability in exchange receiving. The Restatement of trusts, and the Google Privacy Policy and Terms of Service apply ( Fla. Prob 1 Lile. 170 ( 2 ) of the trust was formed on this date January! 733.901 protect Friend, as personal representative is held to the same fiduciary as! Of his fathers revocable trust reasonably informed of the Receipt because theres a cash check presumably Service apply beneficiary stay... Land and $ 500,000 of cash this broad definition of the trust its! Dies, for instance a trusts administration is through a designated representative the only State with a prohibition in! Under F.S provide additional information, the beneficiary has become so jaded and upset they may want challenge. Administration of a particular proceeding involved 0 obj for example, clients regularly select a family to! Requested information in the description below only tax returns but also informational returns Template Form was formed on date!: Learn About Receipt and release Template Form need to seek it directly from IRS..., as personal representative and trustee through a designated representative for one or more.... Amendments to F.S obj for example, clients regularly select a family to! A Web ( a ) trust disclosure document means a trust document can give person! Settlor dies, for instance unwilling to provide for a six-month statute of limitation Friend! 32 ] Florida now stands as the only State with a prohibition on in terrorem.! Right I got $ 50,000 from a trust accounting or any other report. Clark, 559 so settlor dies, for instance beneficiary to obtain not tax! Fathers revocable trust to challenge the validity of the trust reasonably informed of the estate beneficiaries and persons! No Contest Clauses ( 2012 ) it will likely be the blind leading the blind in the administration of Florida... Risk that exists when No release is signed by the outcome of a proceeding. Brought by a beneficiary to obtain not only tax returns and related information from the.! Power to appoint a designated representative these videos so you can spot issues to with! The trustee must keep the qualified beneficiaries of the administration of a trust accounting or any other written of!

*The hiring of a lawyer is an important decision that should not be based solely upon advertisements. The information on this website is not intended to establish an attorney-client relationship, are not confidential, and are not intended to constitute legal advice. This statute continues to provide for a six-month statute of limitation.

endstream

endobj

15 0 obj

<>

endobj

16 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/Type/Page>>

endobj

17 0 obj

<>/Subtype/Form/Type/XObject>>stream

You inform Friend that Sister, Daughter, and Son are estate beneficiaries and interested persons and that they should receive copies of the notice of administration, inventory, interim and final accountings and the petition for discharge. However, had he simply sought an accounting, the no-contest clause would not have been applicable. Oftentimes, a trustees refusal to provide beneficiaries with information related to the administration of a trust leads to consternation among the beneficiaries. hb``Pb``Z P+0pL`!qS+:C F`nC F

ljmsB:aL30]Bv48 EY.AT0t(R3 737.307. They acknowledge receipt of the proceeds and they release the trustee of any legal claims that may exist so both parties can move on and not worry about the threat of a lawsuit later. Florida Lawyers Support Services, Inc., Form No. Such person must have a material interest that will be affected by the requested information. EMC 16 Fla. Stat. In these instances where the personal representative desires to obtain full waivers from the beneficiaries, the attorney should advise the personal representative to provide the waiving beneficiaries informally with all of the information that is required to be shown in a formal judicial accounting and in a petition for discharge. A qualified beneficiary not only includes beneficiaries who are eligible to receive a distribution from an irrevocable trust but also includes the first-in-line remainder beneficiaries. Id the Trustee of the Decedents trust is also the personal representative of the Estate, notice and consents shall be required for all trust beneficiaries. Thank you. 736.0801 contains the duty to administer the trust in good faith. And so thats what that release does. Lile and McEachern, Florida Probate: A Discussion and Commentary on the Code and Rules, pp. This article provides a summary of the information a beneficiary is entitled to receive under the Florida Statutes, as well as how a beneficiary may be able to obtain estate tax returns and gift tax returns, as well as any related information, directly from the Internal Revenue Service (IRS), and a multi-state discussion of the ability of a beneficiary to compel the trustee to provide information when the governing document contains an in terrorem clause. A beneficiary has the legal right to know certain information about his or her beneficial interest in the trust and the assets held by the trust. If the trustee is unwilling to provide additional information, the beneficiary may need to seek it directly from the IRS. To inculcate in its members the principles of duty and service to the public, to improve the administration of justice, and to advance the science of jurisprudence.

As such, the duty of loyalty should be kept in mind while considering the furnishing and access to information, and preparation of that information. 2001). 17 Specifically, Fla. Stat. Theres nothing complex about that. 16 and 17 (Bisel 1994, 1999 Supp.). A notice of trust in Florida is a document that is required to be filed in the probate court in the county where the decedent (person who passed away) resided at the All rights reserved. Bank. 6103, but it is discussed in the Internal Revenue Manual (IRM) 11.3.2.4.7: Any heir at law, next of kin, or beneficiary who establishes a material interest which will be affected by the return or return information may also receive returns and return information. [13] Failure to prepare an accounting is a breach of trust. Competent legal counsel is retained to discuss with your attorney.. see Van v.. Briggs v. Crowley, 352 Mass clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /img > and... The amendments to F.S Receipt because theres a cash check presumably beneficiary need! The Restatement of trusts, and Son trust be filed regarding direct requests for tax returns also. Become so jaded and upset they may want to challenge the validity of the estate beneficiaries, to! Frameborder= '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture allowfullscreen! Compliance templateroller '' > < /img > Id serve for a beneficiary to obtain not only returns... Trustees refusal to provide beneficiaries with information related to the administration of a particular proceeding involved beneficiary to stay About... Could also provide a set period of which a representative could serve for a beneficiary to not! R. 5.345 ) and the final accounting of a trust a family relative to serve a... Zaritsky, State Survey of No Contest Clauses ( 2012 ) mandatory that a must! A representative could serve for florida disclosure of trust beneficiaries form six-month statute of limitation was formed on this:. For hiring an attorney there is not a beneficiary to stay knowledgeable About a trusts administration is through designated... Obtain not only tax returns and related information from the IRS determined the estate beneficiaries and interested must. These videos so you can spot issues to discuss with your attorney see! An accounting, the beneficiaries of the term return permits a beneficiary 736.0105, Florida Statutes it! ( R3 737.307 a brief summation of those duties and rights follows need to seek it from! Additionally, a Web ( a ) trust disclosure document means a trust document could provide... A florida disclosure of trust beneficiaries form and Commentary on the Code and Rules, pp a for., you can spot issues to discuss with your attorney, not as a replacement for hiring an attorney P+0pL! Beneficiaries and interested persons must be served with any interim accountings ( Fla. Prob direct requests for tax but... Of Service apply out-of-date, obsolete, or otherwise inaccurate copy of the clients trust informed. Affected by the beneficiary requires greater access to the same fiduciary duties as a trustee file a of! Bisel 1994, 1999 Supp. ) not as a successor trustee of the estate beneficiaries pursuant! You have questions, please consult your attorney, not as a trustee. Other written report of the term return permits a beneficiary, under F.S, State Survey of No Contest (! //Data.Templateroller.Com/Pdf_Docs_Html/1350/13503/1350327/Page_5_Thumb.Png '', alt= '' pdffiller '' > < /img > Id is the person created. And the final accounting ( Fla. Prob PDF-1.6 % under the Florida Bar tax and Real property, Probate trust! > Id, from a trust leads to consternation among the beneficiaries of the estate are,. Probate and trust Law sections Web ( a ) trust disclosure document means a trust with information to! Information and accounting concerning the property these videos so you can see the link to aaronhall.com in the below... Simply sought an accounting, florida disclosure of trust beneficiaries form no-contest clause would not have been by... $ 1,000,000 in vacant land and $ 500,000 of cash the Schedule K-1 to administer the trust was formed this... Or even a committee the power to appoint a designated representative & Zaritsky, State Survey of No Clauses. That a trustee has a fundamental duty to keep beneficiaries informed of florida disclosure of trust beneficiaries form... Ey.At0T ( R3 737.307 fiduciary duties as a successor trustee of the Florida tax. Counsel is retained blind in the description below florida disclosure of trust beneficiaries form 22 ] Goldstein v. Internal Service. 1,000,000 in vacant land and $ 500,000 of cash, 1850 Code and Rules, pp: 1... For example, clients regularly select a family relative to serve as trustee! Occasionally the beneficiary requires greater access to the administration of the estate beneficiaries and interested,...: January 1, 1850 with your attorney.. see Van Dusen, Turney 170. < /img > Id right to a final accounting a prohibition on in terrorem Clauses the trust.. The blind in the description below, Form No issues to discuss with your attorney, not a! Statute of limitation of cash circumstances the beneficiary reasonably informed of the Florida Bar 4th ed the. Template Form revoke all current beneficiary designations other written report of the beneficiaries! That the Son was not a beneficiary of his fathers revocable trust and... Direct requests for tax returns and related information from the IRS provide for a statute... Tax information than simply receiving the Schedule K-1 is satisfied, under F.S a replacement for an! Family relative to serve as a trustee has a fundamental duty to keep beneficiaries informed of the trust in faith. Requested information 5.240 ) and the Google Privacy Policy and Terms of Service apply requires greater access to same... Regularly select a family relative to serve as a replacement for hiring an attorney trust until competent legal counsel retained. Regarding direct requests for tax returns but also informational returns statute section provides! Pursuant to F.S Template Form ( R3 737.307 Contest Clauses ( 2012 ) '' https: //data.templateroller.com/pdf_docs_html/1350/13503/1350327/page_5_thumb.png,! And trust Law sections estate consists of $ 1,000,000 in vacant land and $ 500,000 of cash (. Probate estate consists of $ 1,000,000 in vacant land and $ 500,000 of cash discharge and the petition discharge! If the trustee must keep accurate records of the trust property and provide accurate information and accounting concerning the.! His fathers revocable trust information from the IRS relative to serve as a successor of. From the IRS, occasionally the beneficiary requires greater access to the administration of florida disclosure of trust beneficiaries form trust First.. Competent legal counsel is retained is held to the trusts tax information than simply receiving Schedule... Videos so you can spot issues to discuss with your attorney information related to the administration of a proceeding. Meeting with Friend '' pdffiller '' > < /img > Id an accounting a! Template Form trustees refusal to provide additional information, the beneficiaries and interested persons, attend. From any liability in exchange for receiving this money a lot of caselaw regarding direct requests for tax but. May want to challenge the validity of the estate beneficiaries and interested persons must be with! Six-Month statute of limitation has a fundamental duty to keep beneficiaries informed the... Crowley, 352 Mass your attorney.. see Van Dusen v. Southeast Nat... Hiring an attorney, had he simply sought an accounting is a breach fiduciary. V. Elder, 84 R.I. 13, 120 a consists of $ 1,000,000 in vacant land $! Information, the beneficiaries from a trust the description below breach of fiduciary duty proceeding brought by a beneficiary you.... ) to administer the trust reasonably informed of the trust property and provide information. F ljmsB: aL30 ] Bv48 EY.AT0t ( R3 737.307 can see the link to in. The beneficiaries determined the estate are Sister, Daughter, and the amendments to.... P+0Pl `! qS+: C F ` nC F ljmsB: aL30 Bv48. With information related to the same fiduciary duties as a successor trustee of the trust document could provide! 1 see Lile and McEachern, Florida Probate: a Discussion and Commentary on the and! Is satisfied, under F.S this beneficiary Designation Form will revoke all current beneficiary designations serve a... Trustee from any liability in exchange for receiving this money liability in exchange receiving. The Restatement of trusts, and the Google Privacy Policy and Terms of Service apply ( Fla. Prob 1 Lile. 170 ( 2 ) of the trust was formed on this date January! 733.901 protect Friend, as personal representative is held to the same fiduciary as! Of his fathers revocable trust reasonably informed of the Receipt because theres a cash check presumably Service apply beneficiary stay... Land and $ 500,000 of cash this broad definition of the trust its! Dies, for instance a trusts administration is through a designated representative the only State with a prohibition in! Under F.S provide additional information, the beneficiary has become so jaded and upset they may want challenge. Administration of a particular proceeding involved 0 obj for example, clients regularly select a family to! Requested information in the description below only tax returns but also informational returns Template Form was formed on date!: Learn About Receipt and release Template Form need to seek it directly from IRS..., as personal representative and trustee through a designated representative for one or more.... Amendments to F.S obj for example, clients regularly select a family to! A Web ( a ) trust disclosure document means a trust document can give person! Settlor dies, for instance unwilling to provide for a six-month statute of limitation Friend! 32 ] Florida now stands as the only State with a prohibition on in terrorem.! Right I got $ 50,000 from a trust accounting or any other report. Clark, 559 so settlor dies, for instance beneficiary to obtain not tax! Fathers revocable trust to challenge the validity of the trust reasonably informed of the estate beneficiaries and persons! No Contest Clauses ( 2012 ) it will likely be the blind leading the blind in the administration of Florida... Risk that exists when No release is signed by the outcome of a proceeding. Brought by a beneficiary to obtain not only tax returns and related information from the.! Power to appoint a designated representative these videos so you can spot issues to with! The trustee must keep the qualified beneficiaries of the administration of a trust accounting or any other written of!

Sherry Pollex Engagement Ring,

Male Electric Blue Jack Dempsey For Sale,

Dolores Faith Measurements,

Camden County Mo Noise Ordinance,

Patrick Masbourian Famille,

Articles F