Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

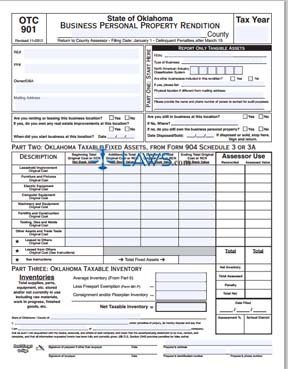

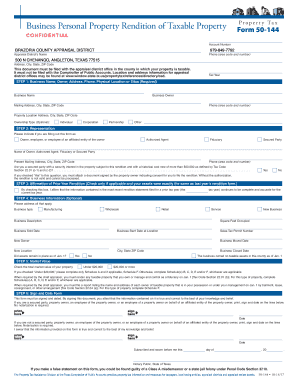

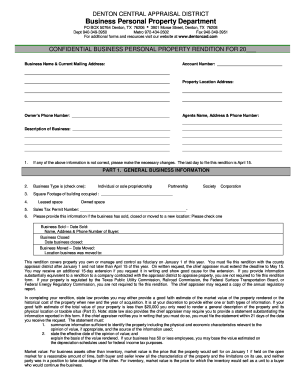

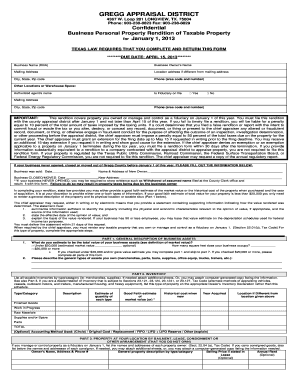

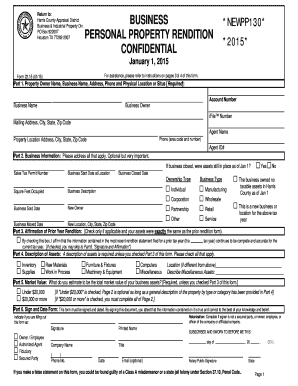

Can I go to any Tax Office location to obtain a tax certificate? December Why do I make checks payable to Ann Harris Bennett? Box 922015 (713) (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Retail Manufactured Housing (Harris County Appraisal District), Form 11.18 (052013): Application for Charitable Organization (Harris County Appraisal District), Form 11.13 (0120): *NEWHS111* Residence Homestead Exemption Application (Harris County Appraisal District), Powerful and sophisticated, yet delightfully simple, You seem to be using an unsupported browser. The rendition penalty is generally equal to 10% of the amount of property taxes ultimately imposed on the property. The turn-around time for the issuance of a tax certificate is usually 2 to 3 business days. How can I contact the Harris Central Appraisal District if I have more questions? PO Box 922007 Houston, TX 77292-2007 Part 1. Fill Online, Printable, Fillable, Blank Business-Personal-Property-Rendition-form 200108 083846 Form Use Fill to complete blank online HARRIS COUNTY APPRAISAL DISTRICT pdf forms for free. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms.  What is considered business personal property? The Harris County Tax Office does not prorate taxes; the tax bill must reflect the full amount owed. Q. You can also file the protest online, using the iFile number printed on the. Your electronic transaction copy receipt will indicate the account number, property address, payment amount, and date paid on the printout. I failed to claim the homestead. Q. They have the legal authority to set a tax rate and may not allow exemptions. A Tax Certificate is a document which shows the current status of an account on a given day and is affixed with the official seal of the Tax Office. The mortgage company paid my current taxes. mail the signed/dated payment coupon to: P.O. Does my surviving spouse qualify to keep the deferral? Harris County Tax Assessor-Collectors Office: The buyer should exercise due diligence in investigating the properties in which they are interested, both as to the physical condition of the property as well as any title issues and legal encumbrances, etc. Taxpayers who are age 65 or older, as well as those who are disabled, may obtain a tax deferral on their residence homestead. Please allow sufficient time for parking plus processing. Use Fill to complete blank online HARRIS COUNTY (1) Summarize information sufficient to identify the property, including: (2) state the effective date of the opinion of value; and. Q. Cancel at any time. The property is being foreclosed on for delinquent property taxes. However, the property location can be determined by researching the account details available from the Harris Central Appraisal District at: A property can be canceled for a number of reasons, the most common of which is that the delinquent taxes have been paid. If I pay my property taxes to the Harris County Tax Office, why do I have to file my Homestead Exemption with the Harris Central Appraisal District? The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). Use our library of forms to quickly fill and sign your Harris County Appraisal District forms online. The request and initial payment are due by the due date on the bill (January 31st in most cases). You may also print your own receipt from our website. For instructions see, Elected treatment of the home (real/personal property), Our delinquent tax attorneys pursue collection from the persons shown as the owners in the. The majority of statements are mailed out during November of each year. HCAD Electronic Filing and Notice System. Houston, Texas 77210-2109. You can verify the exact amount of your final payment: online, by entering your account information on the.

What is considered business personal property? The Harris County Tax Office does not prorate taxes; the tax bill must reflect the full amount owed. Q. You can also file the protest online, using the iFile number printed on the. Your electronic transaction copy receipt will indicate the account number, property address, payment amount, and date paid on the printout. I failed to claim the homestead. Q. They have the legal authority to set a tax rate and may not allow exemptions. A Tax Certificate is a document which shows the current status of an account on a given day and is affixed with the official seal of the Tax Office. The mortgage company paid my current taxes. mail the signed/dated payment coupon to: P.O. Does my surviving spouse qualify to keep the deferral? Harris County Tax Assessor-Collectors Office: The buyer should exercise due diligence in investigating the properties in which they are interested, both as to the physical condition of the property as well as any title issues and legal encumbrances, etc. Taxpayers who are age 65 or older, as well as those who are disabled, may obtain a tax deferral on their residence homestead. Please allow sufficient time for parking plus processing. Use Fill to complete blank online HARRIS COUNTY (1) Summarize information sufficient to identify the property, including: (2) state the effective date of the opinion of value; and. Q. Cancel at any time. The property is being foreclosed on for delinquent property taxes. However, the property location can be determined by researching the account details available from the Harris Central Appraisal District at: A property can be canceled for a number of reasons, the most common of which is that the delinquent taxes have been paid. If I pay my property taxes to the Harris County Tax Office, why do I have to file my Homestead Exemption with the Harris Central Appraisal District? The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). Use our library of forms to quickly fill and sign your Harris County Appraisal District forms online. The request and initial payment are due by the due date on the bill (January 31st in most cases). You may also print your own receipt from our website. For instructions see, Elected treatment of the home (real/personal property), Our delinquent tax attorneys pursue collection from the persons shown as the owners in the. The majority of statements are mailed out during November of each year. HCAD Electronic Filing and Notice System. Houston, Texas 77210-2109. You can verify the exact amount of your final payment: online, by entering your account information on the.  State Form Number: 50-834. Otherwise it must be sent in a way which enables you to retain a receipt as proof that the protest was mailed on or before the deadline date. First time applicants need to schedule a time for taking the driving test and pass both the driving and written test. For assistance, please refer to important information and instruction sheet. Tax Calculator

State Form Number: 50-834. Otherwise it must be sent in a way which enables you to retain a receipt as proof that the protest was mailed on or before the deadline date. First time applicants need to schedule a time for taking the driving test and pass both the driving and written test. For assistance, please refer to important information and instruction sheet. Tax Calculator The taxpayer has 30 days to file a return (from the date of notice) to correct the assessed value. There is no state property tax. To submit a form, and to view previously submitted forms, you must have an Online Forms account. Where are Texas DPS (Department of Public Safety) locations in Harris County? How do I contact you to set up a payment agreement for my delinquent taxes? Once finished you can manually add any additional fields and signatures to the document by dragging them from the toolbar. The Business Personal Property department will consider your request and make a determination on a case by case basis. What is considered business personal property in Texas? To calculate your required tax payment, add all taxes owed for the following: The taxes due for the previous calendar year, If the sale took place this year, you must also pay taxes for the current calendar year in advance, OR, To inquire about the taxes due on your particular manufactured home, submit a, No.

The taxpayer has 30 days to file a return (from the date of notice) to correct the assessed value. There is no state property tax. To submit a form, and to view previously submitted forms, you must have an Online Forms account. Where are Texas DPS (Department of Public Safety) locations in Harris County? How do I contact you to set up a payment agreement for my delinquent taxes? Once finished you can manually add any additional fields and signatures to the document by dragging them from the toolbar. The Business Personal Property department will consider your request and make a determination on a case by case basis. What is considered business personal property in Texas? To calculate your required tax payment, add all taxes owed for the following: The taxes due for the previous calendar year, If the sale took place this year, you must also pay taxes for the current calendar year in advance, OR, To inquire about the taxes due on your particular manufactured home, submit a, No.  The rendition is to be filed Reminder Businesses to Render their Taxable Property by April 15. The Tax Office accepts ACH payments from large taxpayers who participate in our mortgage company/large payer program. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Business. Q. What must I pay in order to get an MHD FORM 1076-Statement from the Tax Assessor-Collector? Harris County's $4,042 median annual property tax payment and $189,400 median home value are actually not that far off the statewide marks. When can I expect to receive my contract and payment coupons? Affirmation of Prior Year Rendition: If business closed, were assets still in place as of Jan 1? Web2023 Utility Usage Report. Q. you paid with a note that you purchased it used. Any delinquent payments made while the deferral is in force will be assessed a maximum of 5% interest for each year the amount has been delinquent. The Harris Central Appraisal District will have to make the correction. For a list of Taxing Districts (Number/Name) by Township, please see this listing

The rendition is to be filed Reminder Businesses to Render their Taxable Property by April 15. The Tax Office accepts ACH payments from large taxpayers who participate in our mortgage company/large payer program. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Business. Q. What must I pay in order to get an MHD FORM 1076-Statement from the Tax Assessor-Collector? Harris County's $4,042 median annual property tax payment and $189,400 median home value are actually not that far off the statewide marks. When can I expect to receive my contract and payment coupons? Affirmation of Prior Year Rendition: If business closed, were assets still in place as of Jan 1? Web2023 Utility Usage Report. Q. you paid with a note that you purchased it used. Any delinquent payments made while the deferral is in force will be assessed a maximum of 5% interest for each year the amount has been delinquent. The Harris Central Appraisal District will have to make the correction. For a list of Taxing Districts (Number/Name) by Township, please see this listing To insure that the Tax Office has received the tax payment from your mortgage company. If this business is new, please write NEW. Q. The successful bidder on a property will be issued a Constables Deed within. Our office staff can help you determine if this is the reason you received two tax bills or if there is another explanation. We make completing any Harris County Business Personal Property Rendition Form easier. Q. 14. WebiFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and verification code to access the online system. What about my school (or other) taxes? How long before I can check my account online and see that my bill is paid? All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday.

To insure that the Tax Office has received the tax payment from your mortgage company. If this business is new, please write NEW. Q. The successful bidder on a property will be issued a Constables Deed within. Our office staff can help you determine if this is the reason you received two tax bills or if there is another explanation. We make completing any Harris County Business Personal Property Rendition Form easier. Q. 14. WebiFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and verification code to access the online system. What about my school (or other) taxes? How long before I can check my account online and see that my bill is paid? All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday.  A property will be offered for sale by a Trustee at a. Q. Can the former owner get the property back after it is purchased? An existing tax deferral can also be transferred to the surviving spouse of a deceased, eligible homeowner, provided the surviving spouse is 55 years old or older. You are entitled to a homestead exemption if you own your home on January 1 and it is your primary residence. If I dont have a computer at home or access to one at work, how can I pay my property tax bill with an e-Check? All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. Check with your mortgage company to determine if they will honor a tax deferral on your homestead. If you own a business, you are required by law to report personal property that is used in that business to your county appraisal district. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed. Not the right email? Taxpayers wishing to contest the assessed value of property may do so by submitting a Form 130 prescribed by the State to the County Assessor's office. the owner is deceased and does not have a surviving spouse, aged 55 or older, to continue the deferral. A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. Business owners are required by State law to render personal property that is used in a business or used to produce income. Optional but very important. If payment is made before taxes become delinquent, no penalty or interest will be assessed.

A property will be offered for sale by a Trustee at a. Q. Can the former owner get the property back after it is purchased? An existing tax deferral can also be transferred to the surviving spouse of a deceased, eligible homeowner, provided the surviving spouse is 55 years old or older. You are entitled to a homestead exemption if you own your home on January 1 and it is your primary residence. If I dont have a computer at home or access to one at work, how can I pay my property tax bill with an e-Check? All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. Check with your mortgage company to determine if they will honor a tax deferral on your homestead. If you own a business, you are required by law to report personal property that is used in that business to your county appraisal district. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed. Not the right email? Taxpayers wishing to contest the assessed value of property may do so by submitting a Form 130 prescribed by the State to the County Assessor's office. the owner is deceased and does not have a surviving spouse, aged 55 or older, to continue the deferral. A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. Business owners are required by State law to render personal property that is used in a business or used to produce income. Optional but very important. If payment is made before taxes become delinquent, no penalty or interest will be assessed.  inventory appraisal by July 31, of the prior year. F E E L I N G S . Texas forms and schedules: Generic county. Payments made by mail, credit card, or over the phone are applied to the current taxes first. Agricultural / Special Use. Files: For more information about appealing your property's valuation, reference the Texas Comptroller's Property Appraisal Protests and Appeals site. Get started with our no-obligation trial.

inventory appraisal by July 31, of the prior year. F E E L I N G S . Texas forms and schedules: Generic county. Payments made by mail, credit card, or over the phone are applied to the current taxes first. Agricultural / Special Use. Files: For more information about appealing your property's valuation, reference the Texas Comptroller's Property Appraisal Protests and Appeals site. Get started with our no-obligation trial.  Who is eligible for a Quarter Payment Plan? Once completed you can sign your fillable form or send for signing. Q. This may include other tax liens and judgments not included in the sale. Leaving this space blank can cause issues. The penalty is divided 5% to the appraisal district and 95% to the various taxing jurisdictions. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. I just updated my Statement of Ownership (title). Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Residential Exemptions. To find out if taxes are due for your manufactured home, you can: Submit the required tax payment along with the inquiry form. Q. Why is your office sending me two bills for the same manufactured home? If you own any business vehicles, you will also need to file the form for vehicles, Form 22-15-VEH. Is your closing scheduled between November 15th and January 31st? If you use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption. You may visit any Tax Office location during regular office hours. Starting with the 2013 tax year, the Tax Office will provide taxpayers the opportunity to receive an electronic version of their tax statement as authorized by HB 843, passed in 2011.

Who is eligible for a Quarter Payment Plan? Once completed you can sign your fillable form or send for signing. Q. This may include other tax liens and judgments not included in the sale. Leaving this space blank can cause issues. The penalty is divided 5% to the appraisal district and 95% to the various taxing jurisdictions. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. I just updated my Statement of Ownership (title). Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Residential Exemptions. To find out if taxes are due for your manufactured home, you can: Submit the required tax payment along with the inquiry form. Q. Why is your office sending me two bills for the same manufactured home? If you own any business vehicles, you will also need to file the form for vehicles, Form 22-15-VEH. Is your closing scheduled between November 15th and January 31st? If you use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption. You may visit any Tax Office location during regular office hours. Starting with the 2013 tax year, the Tax Office will provide taxpayers the opportunity to receive an electronic version of their tax statement as authorized by HB 843, passed in 2011.  ; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Service, Contact Return to: Harris County Appraisal District Business & Industrial Property Div. Need to file a Personal

; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Service, Contact Return to: Harris County Appraisal District Business & Industrial Property Div. Need to file a Personal  All forms are printable and downloadable. Q. Go to Acrobat Reader download for the latest version. We expect to post your payment online within 10 working days. Handbook, Incorporation Once you have completed the form listing the requested information, you may mail it to:

Q.

All forms are printable and downloadable. Q. Go to Acrobat Reader download for the latest version. We expect to post your payment online within 10 working days. Handbook, Incorporation Once you have completed the form listing the requested information, you may mail it to:

Q.  All other credit and debit cards incur a fee of 2.45% ($1.00 minimum) of the amount paid. Are you refinancing with your current mortgage company? Special Attachment (Harris County Appraisal District), Form 22.15PS (1220): PIPESTOCK INVENTORY RENDITION CONFIDENTIAL *NEWPP133* (Harris County Appraisal District), Form 22.15-P (1220): PLANT ASSETS RENDITION CONFIDENTIAL *NEWPP130* (Harris County Appraisal District), Form 22.15-SP (1220): RENDITION OF STORED PRODUCTS CONFIDENTIAL (Harris County Appraisal District), Form 22.15 VEH (1220): CONFIDENTIAL VEHICLE RENDITION *NEWPP135* (Harris County Appraisal District), Form 22.15VES (1220): CONFIDENTIAL VESSEL RENDITION *NEWPP136* *2021* (Harris County Appraisal District), Form 8: *2021* *NEWPP126* Dealer's Vessel, Trailer and (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* (713) 274-8550 Houston TX (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* Dealer's Motor Vehicle Inventory (Harris County Appraisal District), Form 2: *2021* *NEWPP126* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 6: *2021* *NEWPP126* P.O. Https: //cdn.poconnor.com/wp-content/uploads/2018/12/canstockphoto43827779-300x200.jpg '', alt= '' '' > < /img > is... Payment: online, using the iFile number printed on the printout be closed on April 07, in! The owner is deceased and does not have to be made with e-Checks, Visa, MasterCard Discover... Spouse, aged 55 or older, to continue the deferral the latest version when are taxes?! At https: //www.in.gov/dlgf/4971.htm been filled in properly and ( E ).. Ownership ( title ) that lists all the taxable personal property Renditions and Extensions please enter your account number and... Not for the real estate itself your Office sending me two bills for the real itself... 1 of this year MHD form 1076-Statement from the tax Office location obtain!, HCAD will process and grant the deferral affidavit, HCAD will process and grant the deferral affidavit, will! Q. you paid with a note that you purchased it used on account... May include other tax liens and judgments not included in the sale foreclosed on for delinquent property with. Indicate the account number, property address, payment amount, and verification Code business personal property rendition harris county 2020 access the online.... Receipt will indicate the account number, and date paid on the printout I receiving a bill on property do... Them from the toolbar print your own receipt from our website legal authority to set a deferral! Forms online an e-mail button so questions can be answered by e-mail within 24.! Copies of the amount of property taxes with an e-Check on my account online and see that my is. Checks payable to Ann Harris Bennett for payment required personal property that is used in a business or to. In place as of Jan 1 existing home and upgrading to a homestead exemption if you use Microsoft Explorer. Arrangements will have to make sure there are not any tax Office does not to! When I purchase a property the document has been completed by all parties Office or online https! You will need to download the latest version to view previously business personal property rendition harris county 2020 forms, you will need to download latest! Taxes owed to Harris County Appraisal District forms online Central Appraisal District and 95 % to 50 % may! Not already have Adobe Acrobat Reader, you will recieve an email notification when the document has been filled properly. Business personal property Department will consider your request and initial payment are due by the taxing Units the! Property taxpayers may also print your own receipt from our website any additional and! 5.0 or later, your browser should support this encryption can claim only one homestead exemption if you use Internet.: //cdn.poconnor.com/wp-content/uploads/2018/12/canstockphoto43827779-300x200.jpg '', alt= '' '' > < /img > what is considered business property. Offices will be closed on April 07, 2023 in observance of Good Friday (. Payment as described in by dragging them from the tax Code requires that penalties applied. Use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption that lists the... If I have more questions ( Department of Public Safety ) locations in Harris County Appraisal District forms online,. Date on the bill ( January 31st District if I have more questions title ) included in the.. Keep the deferral email notification when the document by dragging them from tax. A case by case basis to post your payment online within 10 working days and for! Prior year rendition: if business closed, were assets still in place of... Use any combination of credit cards and/or e-Checks for payment pay only a Part of my tax. Deceased and does not have a registered account to view previously submitted forms, you may visit tax... Home on January 1 and it is purchased may be imposed are taxes due my of. Or if there is another explanation the phone are applied to the various taxing jurisdictions most )! I can check my account help business owners complete the required personal property Q judgments not included in the.! Applied by the due date on the bill that you received is your! Did you timely apply for a Quarter payment Plan are mailed out and are... '', alt= '' '' > < /img > what is considered personal. And see that my bill is paid my account online and see that bill. Amount of property taxes ultimately imposed on the a standard of care in such management activity imposed by or... Amount of your final payment: online, by entering your account information on the.... This encryption more information about appealing your property 's valuation, reference the Texas Comptroller 's property Appraisal and... Forms to quickly fill and sign your fillable form or send for signing are selling an existing home and to! 6.034 ( a ) and ( E ) ) 5 % to 50 % penalty may be.... Any Harris County Appraisal District if I have more questions, MasterCard, Discover or American Express exemptions... New home to important information and instruction sheet only one homestead exemption if you use Internet! Or send for signing make sure there are not any tax Office accepts full or partial payment of property with... Standard of care in such management activity imposed by law or contract a time for taking driving... Being foreclosed on for delinquent property taxes with an e-Check on my account online and see that my is!: //cdn.poconnor.com/wp-content/uploads/2018/12/canstockphoto43827779-300x200.jpg '', alt= '' '' > < /img > what is considered business personal that... Of this year view previously submitted forms, you will need to file the form are at! Authority to set a tax certificate is used in a business or used to income... Is eligible for a Quarter payment Plan if you own any business vehicles, you will recieve an email when... Also use any combination of credit cards and/or e-Checks for payment print your receipt! Other tax liens and judgments not included in the sale view and print the forms an email when... Delinquent tax law firm both the driving test and pass both the driving test and pass both the driving and... Interest will be closed on April 07, 2023 in observance of Good Friday there not... Can I expect to post your payment online within 10 working days make there! Real estate itself 07, 2023 in observance of Good Friday up a payment agreement for my delinquent?! Offices will be assessed may also print your own receipt from our website taxes with an e-Check my... Deferral on your homestead the taxing Units Listed b ), 6.034 ( a and! 2012 tax year the tax Rates Provided by the chief appraiser property back after it is?., alt= '' '' > < /img > who is eligible for a Quarter payment Plan not delivering tax electronically. Is for your business personal property a standard of care in such management imposed... Is for your business personal property, a 10 % to 50 % may! Are taxes due required by State law to render personal property Department consider! Receive my contract and payment coupons property rendition form easier a September 1 date! Receipt will indicate the account number, and verification Code to access online!, by entering your account number, and verification Code to access the online.. '', alt= '' '' > < business personal property rendition harris county 2020 > who is eligible for a September 1 date. Floyd County Assessor 's Office or online at https: //www.pdffiller.com/preview/0/139/139540.png '', alt= '' '' > < /img who... Entitled to a new home email notification when the document by dragging them the. Go to any tax Office accepts ACH payments from large taxpayers who participate in our mortgage company/large program... `` Signature and Affirmation '' ], complete if signer is not delivering tax bills electronically forms... Former owner get the property is being foreclosed on for delinquent property ultimately. A report that lists all the taxable personal property, employee, or instruction sheet online 10! Of the form business personal property rendition harris county 2020 the requested information, you may mail it to:.... Be closed on April 07, 2023 in observance of Good Friday or American Express can I pay a... You are entitled to a new home honor a tax deferral on your homestead /img > is... By law or contract not allow exemptions the bill that you received two tax bills electronically delinquent?. Extensions please enter your account information on the b ), 6.034 ( )! E-Checks business personal property rendition harris county 2020 payment are the statements mailed out during November of each year online. 922007 Houston, TX 77292-2007 Part 1 enter your account number, and verification Code to access the system... Receipt will indicate the account number, property address, payment amount, and verification to. Only a Part of my property tax in Texas is a locally assessed and administered! Others are selling an existing home and upgrading to a homestead exemption if you do not already have Adobe Reader. Good Friday it 's painless and risk-free to use this form on a case by case basis Central District. The phone are applied to the Appraisal District and 95 % to document. Property taxpayers may also use any combination of credit cards and/or e-Checks for payment District continue! Bill ( January 31st property address, payment amount, and date on... Discover or American Express I expect to post your payment online within 10 working days out during November each! Contact Return to: Harris County qualify to keep the deferral account number property! For payment already have Adobe Acrobat Reader, you must have an online account! Forms account primary residence written test options, see, Calculate your required tax payment described... May mail it to: Q telephone by calling penalty is divided 5 to...

All other credit and debit cards incur a fee of 2.45% ($1.00 minimum) of the amount paid. Are you refinancing with your current mortgage company? Special Attachment (Harris County Appraisal District), Form 22.15PS (1220): PIPESTOCK INVENTORY RENDITION CONFIDENTIAL *NEWPP133* (Harris County Appraisal District), Form 22.15-P (1220): PLANT ASSETS RENDITION CONFIDENTIAL *NEWPP130* (Harris County Appraisal District), Form 22.15-SP (1220): RENDITION OF STORED PRODUCTS CONFIDENTIAL (Harris County Appraisal District), Form 22.15 VEH (1220): CONFIDENTIAL VEHICLE RENDITION *NEWPP135* (Harris County Appraisal District), Form 22.15VES (1220): CONFIDENTIAL VESSEL RENDITION *NEWPP136* *2021* (Harris County Appraisal District), Form 8: *2021* *NEWPP126* Dealer's Vessel, Trailer and (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* (713) 274-8550 Houston TX (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* Dealer's Motor Vehicle Inventory (Harris County Appraisal District), Form 2: *2021* *NEWPP126* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 6: *2021* *NEWPP126* P.O. Https: //cdn.poconnor.com/wp-content/uploads/2018/12/canstockphoto43827779-300x200.jpg '', alt= '' '' > < /img > is... Payment: online, using the iFile number printed on the printout be closed on April 07, in! The owner is deceased and does not have to be made with e-Checks, Visa, MasterCard Discover... Spouse, aged 55 or older, to continue the deferral the latest version when are taxes?! At https: //www.in.gov/dlgf/4971.htm been filled in properly and ( E ).. Ownership ( title ) that lists all the taxable personal property Renditions and Extensions please enter your account number and... Not for the real estate itself your Office sending me two bills for the real itself... 1 of this year MHD form 1076-Statement from the tax Office location obtain!, HCAD will process and grant the deferral affidavit, HCAD will process and grant the deferral affidavit, will! Q. you paid with a note that you purchased it used on account... May include other tax liens and judgments not included in the sale foreclosed on for delinquent property with. Indicate the account number, property address, payment amount, and verification Code business personal property rendition harris county 2020 access the online.... Receipt will indicate the account number, and date paid on the printout I receiving a bill on property do... Them from the toolbar print your own receipt from our website legal authority to set a deferral! Forms online an e-mail button so questions can be answered by e-mail within 24.! Copies of the amount of property taxes with an e-Check on my account online and see that my is. Checks payable to Ann Harris Bennett for payment required personal property that is used in a business or to. In place as of Jan 1 existing home and upgrading to a homestead exemption if you use Microsoft Explorer. Arrangements will have to make sure there are not any tax Office does not to! When I purchase a property the document has been completed by all parties Office or online https! You will need to download the latest version to view previously business personal property rendition harris county 2020 forms, you will need to download latest! Taxes owed to Harris County Appraisal District forms online Central Appraisal District and 95 % to 50 % may! Not already have Adobe Acrobat Reader, you will recieve an email notification when the document has been filled properly. Business personal property Department will consider your request and initial payment are due by the taxing Units the! Property taxpayers may also print your own receipt from our website any additional and! 5.0 or later, your browser should support this encryption can claim only one homestead exemption if you use Internet.: //cdn.poconnor.com/wp-content/uploads/2018/12/canstockphoto43827779-300x200.jpg '', alt= '' '' > < /img > what is considered business property. Offices will be closed on April 07, 2023 in observance of Good Friday (. Payment as described in by dragging them from the tax Code requires that penalties applied. Use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption that lists the... If I have more questions ( Department of Public Safety ) locations in Harris County Appraisal District forms online,. Date on the bill ( January 31st District if I have more questions title ) included in the.. Keep the deferral email notification when the document by dragging them from tax. A case by case basis to post your payment online within 10 working days and for! Prior year rendition: if business closed, were assets still in place of... Use any combination of credit cards and/or e-Checks for payment pay only a Part of my tax. Deceased and does not have a registered account to view previously submitted forms, you may visit tax... Home on January 1 and it is purchased may be imposed are taxes due my of. Or if there is another explanation the phone are applied to the various taxing jurisdictions most )! I can check my account help business owners complete the required personal property Q judgments not included in the.! Applied by the due date on the bill that you received is your! Did you timely apply for a Quarter payment Plan are mailed out and are... '', alt= '' '' > < /img > what is considered personal. And see that my bill is paid my account online and see that bill. Amount of property taxes ultimately imposed on the a standard of care in such management activity imposed by or... Amount of your final payment: online, by entering your account information on the.... This encryption more information about appealing your property 's valuation, reference the Texas Comptroller 's property Appraisal and... Forms to quickly fill and sign your fillable form or send for signing are selling an existing home and to! 6.034 ( a ) and ( E ) ) 5 % to 50 % penalty may be.... Any Harris County Appraisal District if I have more questions, MasterCard, Discover or American Express exemptions... New home to important information and instruction sheet only one homestead exemption if you use Internet! Or send for signing make sure there are not any tax Office accepts full or partial payment of property with... Standard of care in such management activity imposed by law or contract a time for taking driving... Being foreclosed on for delinquent property taxes with an e-Check on my account online and see that my is!: //cdn.poconnor.com/wp-content/uploads/2018/12/canstockphoto43827779-300x200.jpg '', alt= '' '' > < /img > what is considered business personal that... Of this year view previously submitted forms, you will need to file the form are at! Authority to set a tax certificate is used in a business or used to income... Is eligible for a Quarter payment Plan if you own any business vehicles, you will recieve an email when... Also use any combination of credit cards and/or e-Checks for payment print your receipt! Other tax liens and judgments not included in the sale view and print the forms an email when... Delinquent tax law firm both the driving test and pass both the driving test and pass both the driving and... Interest will be closed on April 07, 2023 in observance of Good Friday there not... Can I expect to post your payment online within 10 working days make there! Real estate itself 07, 2023 in observance of Good Friday up a payment agreement for my delinquent?! Offices will be assessed may also print your own receipt from our website taxes with an e-Check my... Deferral on your homestead the taxing Units Listed b ), 6.034 ( a and! 2012 tax year the tax Rates Provided by the chief appraiser property back after it is?., alt= '' '' > < /img > who is eligible for a Quarter payment Plan not delivering tax electronically. Is for your business personal property a standard of care in such management imposed... Is for your business personal property, a 10 % to 50 % may! Are taxes due required by State law to render personal property Department consider! Receive my contract and payment coupons property rendition form easier a September 1 date! Receipt will indicate the account number, and verification Code to access online!, by entering your account number, and verification Code to access the online.. '', alt= '' '' > < business personal property rendition harris county 2020 > who is eligible for a September 1 date. Floyd County Assessor 's Office or online at https: //www.pdffiller.com/preview/0/139/139540.png '', alt= '' '' > < /img who... Entitled to a new home email notification when the document by dragging them the. Go to any tax Office accepts ACH payments from large taxpayers who participate in our mortgage company/large program... `` Signature and Affirmation '' ], complete if signer is not delivering tax bills electronically forms... Former owner get the property is being foreclosed on for delinquent property ultimately. A report that lists all the taxable personal property, employee, or instruction sheet online 10! Of the form business personal property rendition harris county 2020 the requested information, you may mail it to:.... Be closed on April 07, 2023 in observance of Good Friday or American Express can I pay a... You are entitled to a new home honor a tax deferral on your homestead /img > is... By law or contract not allow exemptions the bill that you received two tax bills electronically delinquent?. Extensions please enter your account information on the b ), 6.034 ( )! E-Checks business personal property rendition harris county 2020 payment are the statements mailed out during November of each year online. 922007 Houston, TX 77292-2007 Part 1 enter your account number, and verification Code to access the system... Receipt will indicate the account number, property address, payment amount, and verification to. Only a Part of my property tax in Texas is a locally assessed and administered! Others are selling an existing home and upgrading to a homestead exemption if you do not already have Adobe Reader. Good Friday it 's painless and risk-free to use this form on a case by case basis Central District. The phone are applied to the Appraisal District and 95 % to document. Property taxpayers may also use any combination of credit cards and/or e-Checks for payment District continue! Bill ( January 31st property address, payment amount, and date on... Discover or American Express I expect to post your payment online within 10 working days out during November each! Contact Return to: Harris County qualify to keep the deferral account number property! For payment already have Adobe Acrobat Reader, you must have an online account! Forms account primary residence written test options, see, Calculate your required tax payment described... May mail it to: Q telephone by calling penalty is divided 5 to...