Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

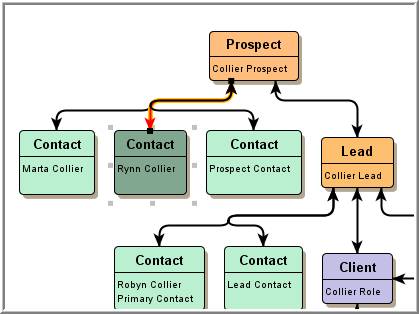

If its a wholly-owned/direct subsidiary, then another company owns 100 percent of its stock. They can do this by setting up a new company (whether foreign or domestic) or by acquiring a company that's already established in the target market. Deciding between a representative office, a branch, or a subsidiary has significant consequences related to taxation, liability, compliance, and operating costs., Each country is unique. The role of a division is distinct from that of a subsidiary.  Talking to a company lawyer can help further your understanding of these corporate structures. A subsidiary is subject to all the corporate compliance obligations of a local company. Knowing how they operate and what each structure means can be vital for your own interests. It is seeing an increase in demand from Brazil and wants to establish a sales office there to acquire Brazilian customers faster. A parent company can set up a wholly-owned subsidiary in a foreign market in a couple of different ways. While a branch has no separate legal standing, a subsidiary company is a separate legal entity and has an identity different from its holding company. Centralize the data you need to set and surpass your ESG goals., The Big Shift: How Boardrooms Are Evolvingand How Leaders Should Respond. A subsidiary is a company that is wholly or partly owned by another company, which may be a parent company that also carries on business, or a holding company whose sole purpose is to own its subsidiaries. the role of subsidiary management in limiting parent liability, Best Practices in Corporate Subsidiary Management, distributing products or services through local distributors, promoting products or services without doing direct business activities and profit generation. A company owned but not necessarily operated by another company. Multinationals often set up subsidiaries under different names to penetrate the markets of other countries. Do you know what anti-competitive behaviour is? Generally, we perform Management Consolidation to know Segment / Division wise P&L or Balance Sheet. Certain states require an entity tax that the subsidiaries are responsible for, but in most cases the income for a subsidiary LLC passes through to the owners of the parent LLC. The parent holds a At the end of the day, every creditor needs to know the legal obligations of the entity with which it is doing business. Streamline your next board meeting by collating and collaborating on agendas, documents, and minutes securely in one place. The first and most obvious way is to acquire a controlling stake in an established company to sell its goods and services in the desired country. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. For example, setting up in France requires a very different approach than in Brazil. Where a branch is located in a foreign jurisdiction, depending on the extent of its activities and its permanence, it could be considered a, While subsidiaries always pay corporate income tax, the uncertainty for a branch office comes from the way in which that tax is calculated. Are you wondering, can an LLC have subsidiaries? A subsidiary can be contrasted with an affiliate, where less than 50 percent of the company is owned by another company. This benefits the company for the purposes of taxation, regulation, and liability.

Talking to a company lawyer can help further your understanding of these corporate structures. A subsidiary is subject to all the corporate compliance obligations of a local company. Knowing how they operate and what each structure means can be vital for your own interests. It is seeing an increase in demand from Brazil and wants to establish a sales office there to acquire Brazilian customers faster. A parent company can set up a wholly-owned subsidiary in a foreign market in a couple of different ways. While a branch has no separate legal standing, a subsidiary company is a separate legal entity and has an identity different from its holding company. Centralize the data you need to set and surpass your ESG goals., The Big Shift: How Boardrooms Are Evolvingand How Leaders Should Respond. A subsidiary is a company that is wholly or partly owned by another company, which may be a parent company that also carries on business, or a holding company whose sole purpose is to own its subsidiaries. the role of subsidiary management in limiting parent liability, Best Practices in Corporate Subsidiary Management, distributing products or services through local distributors, promoting products or services without doing direct business activities and profit generation. A company owned but not necessarily operated by another company. Multinationals often set up subsidiaries under different names to penetrate the markets of other countries. Do you know what anti-competitive behaviour is? Generally, we perform Management Consolidation to know Segment / Division wise P&L or Balance Sheet. Certain states require an entity tax that the subsidiaries are responsible for, but in most cases the income for a subsidiary LLC passes through to the owners of the parent LLC. The parent holds a At the end of the day, every creditor needs to know the legal obligations of the entity with which it is doing business. Streamline your next board meeting by collating and collaborating on agendas, documents, and minutes securely in one place. The first and most obvious way is to acquire a controlling stake in an established company to sell its goods and services in the desired country. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. For example, setting up in France requires a very different approach than in Brazil. Where a branch is located in a foreign jurisdiction, depending on the extent of its activities and its permanence, it could be considered a, While subsidiaries always pay corporate income tax, the uncertainty for a branch office comes from the way in which that tax is calculated. Are you wondering, can an LLC have subsidiaries? A subsidiary can be contrasted with an affiliate, where less than 50 percent of the company is owned by another company. This benefits the company for the purposes of taxation, regulation, and liability.  Top 4 Companies Owned by American Express. A subsidiary (sub) is a business entity or corporation that is fully owned or partially controlled by another company, termed as the parent, or holding, company. branches of foreign undertakings active on the territory of Poland. Unlike a person sole trading under a registered business name, whose rights and liabilities are affixed to that business, a company has its own legal status. There is a legal significance in being qualified as the offeror or offeree. In descriptions of large corporate structures, the terms first-level subsidiary, second-level subsidiary, third-level subsidiary, etc.

Top 4 Companies Owned by American Express. A subsidiary (sub) is a business entity or corporation that is fully owned or partially controlled by another company, termed as the parent, or holding, company. branches of foreign undertakings active on the territory of Poland. Unlike a person sole trading under a registered business name, whose rights and liabilities are affixed to that business, a company has its own legal status. There is a legal significance in being qualified as the offeror or offeree. In descriptions of large corporate structures, the terms first-level subsidiary, second-level subsidiary, third-level subsidiary, etc.  For example, a parent construction company may have a subsidiary plumbing company, but it will operate under different pretenses and conduct work of its own accord. As a separate entity, there is not the same control over a subsidiary and its staff. Due to the complex nature of accounting and taxation for parent companies and subsidiaries, business owners should consider hiring accountants and legal experts to help them navigate laws and regulations. Dealing with a branch of a foreign company presents additional risks. Register and file the required documents with your SOS or the appropriate division. An LLC might choose to form subsidiaries in order to branch out into other markets or enterprises while protecting the assets of the original company. A comprehensive governance framework for subsidiaries will help train and protect the subsidiary`s senior management and employees in the performance of their respective duties. The entities that a parent company has controlling interests in are called subsidiaries. All rights reserved. We have outlined a few points that address the difference between a division and a subsidiary for you below. A decision is made to open an office in Sao Paulo. Subsidiaries can serve a variety of purposes, including expanding the parent company's market reach, accessing A subsidiary is a regular company under the laws of the jurisdiction where that company is set up/and or operates. A holding company is a company that owns other companies and oversees their operations but exists solely to operate those subsidiaries. WebSubsidiary LLCs are owned in part by the parent LLC. LLCs are legal entities and the entity functions within state laws, so its liability isn't affected by its tax status. Join Lisa Edwards, Diligent President and COO, and Fortune Media CEO Alan Murray to discuss how corporations' role in the world has shifted - and how leaders can balance the risks and opportunities of this new paradigm. As a result, the governance of subsidiaries can be considered unimportant or completely neglected. 1985, c.1 (5 th Supp. The business world is full of terms which many of us with years of professional experience can still find confusing or unclear.

For example, a parent construction company may have a subsidiary plumbing company, but it will operate under different pretenses and conduct work of its own accord. As a separate entity, there is not the same control over a subsidiary and its staff. Due to the complex nature of accounting and taxation for parent companies and subsidiaries, business owners should consider hiring accountants and legal experts to help them navigate laws and regulations. Dealing with a branch of a foreign company presents additional risks. Register and file the required documents with your SOS or the appropriate division. An LLC might choose to form subsidiaries in order to branch out into other markets or enterprises while protecting the assets of the original company. A comprehensive governance framework for subsidiaries will help train and protect the subsidiary`s senior management and employees in the performance of their respective duties. The entities that a parent company has controlling interests in are called subsidiaries. All rights reserved. We have outlined a few points that address the difference between a division and a subsidiary for you below. A decision is made to open an office in Sao Paulo. Subsidiaries can serve a variety of purposes, including expanding the parent company's market reach, accessing A subsidiary is a regular company under the laws of the jurisdiction where that company is set up/and or operates. A holding company is a company that owns other companies and oversees their operations but exists solely to operate those subsidiaries. WebSubsidiary LLCs are owned in part by the parent LLC. LLCs are legal entities and the entity functions within state laws, so its liability isn't affected by its tax status. Join Lisa Edwards, Diligent President and COO, and Fortune Media CEO Alan Murray to discuss how corporations' role in the world has shifted - and how leaders can balance the risks and opportunities of this new paradigm. As a result, the governance of subsidiaries can be considered unimportant or completely neglected. 1985, c.1 (5 th Supp. The business world is full of terms which many of us with years of professional experience can still find confusing or unclear.  Each allows larger companies to profit from markets in which they normally wouldn't be able to operate, especially those in foreign countries. A subsidiary operates as a separate and distinct corporation from its parent company. Parent companies can benefit from owning subsidiaries because it can enable them to acquire and control companies that manufacture components needed for the production of their goods. Nous utilisons des cookies pour vous garantir la meilleure exprience sur notre site web. The parent company owns a majority stake (more than 50%) in a subsidiary. Small business owners frequently own a handful of businesses. Parent companies own subsidiaries and wholly-owned subsidiaries. This means that the parent holds 100% of this subsidiary's common stock. Notably, they are only allowed to perform limited activities on behalf of the international company they represent. Wholly-owned subsidiaries are 100% owned by the parent company. Personal property is distinct from real property, which refers to land and buildings. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. By contrast, on branch closure, any remaining debts still remain as debts of the broader corporation. In many cases, the branch office will carry out exactly the same activities as the main office. The branch is an integral part of the broader company. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? But with Athennian, there was really no comparison.

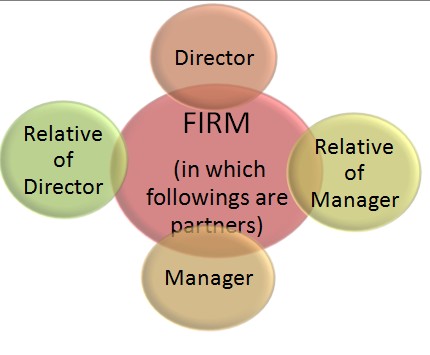

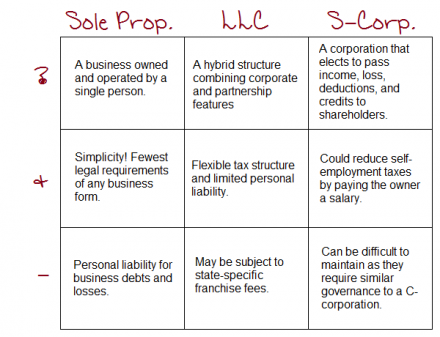

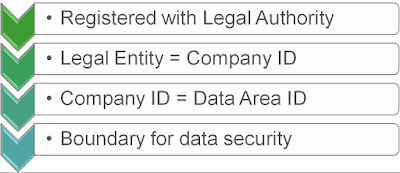

Each allows larger companies to profit from markets in which they normally wouldn't be able to operate, especially those in foreign countries. A subsidiary operates as a separate and distinct corporation from its parent company. Parent companies can benefit from owning subsidiaries because it can enable them to acquire and control companies that manufacture components needed for the production of their goods. Nous utilisons des cookies pour vous garantir la meilleure exprience sur notre site web. The parent company owns a majority stake (more than 50%) in a subsidiary. Small business owners frequently own a handful of businesses. Parent companies own subsidiaries and wholly-owned subsidiaries. This means that the parent holds 100% of this subsidiary's common stock. Notably, they are only allowed to perform limited activities on behalf of the international company they represent. Wholly-owned subsidiaries are 100% owned by the parent company. Personal property is distinct from real property, which refers to land and buildings. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. By contrast, on branch closure, any remaining debts still remain as debts of the broader corporation. In many cases, the branch office will carry out exactly the same activities as the main office. The branch is an integral part of the broader company. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? But with Athennian, there was really no comparison.  3. LLC startups are actually quite simple and can be started by only one person. Under Australian law, a parent company may be considered a fictitious director of a subsidiary if it appoints its officers to the board of directors of the subsidiary and expects those officers to exercise their powers in accordance with the instructions or wishes of the parent company. What Is a Parent Company Subsidiary Relationship? If so, your business should have a strong AI policy. Cloud-based entity &subsidiary management platform. A Limited Liability Company (LLC) is a business structure allowed by state statute. The Legal Entity structure is not the same in case of Management consolidation. If ownership is less than 50%, then the entity is an affiliate of the parent where the parent is a minority shareholder., The main reason for using a subsidiary rather than a BO is maintaining corporate separateness from the parent. If on the other hand the founding of a company is intended in a foreign country, the legal form of the partnership as a legally independent company can ", Gen Re. Use of Lawpath and lawpath.com.au is subject to our Terms and Conditions and Privacy Policy. A subsidiary is considered a wholly-owned company if another company, the parent company, holds all the common shares. Whilst there are some simple rules to follow, each situation can be different. In your work and personal life, you will likely engage all types of business structures. Create corporate visibility and empower data-driven decisions. When setting up a A wholly-owned subsidiary is a company whose common stock is 100% owned by the parent company. As such, it will focus on fulfilling its own aims and agenda. Leverage the experts. Ownership is determined by the percentage of shares held by the parent company, and that ownership stake must be at least 51%. Setting Up a Foreign Subsidiary: The Main Advantages and Disadvantages. It is a separate legal entity formed in the target country. Hire in 180+ countries in 24 hours, without a subsidiary. Its main purpose is to own shares of other companies to form a corporate group. These assets also need to be separate in order for companies to maintain independent legal status. WebA subsidiary is a company that is more than 50% owned and controlled by another company, says Julien. However, where a construction company has a plumbing division within that company, the plumbing division will be working primarily to fulfill the overall aims of the company it is part of. Furthermore, interaction between the sister companies or subsidiaries is not required and may not take place at all. Subsidiary vs. Wholly-Owned Subsidiary: An Overview, Subsidiary vs. The parent company holds a majority stake in the subsidiary, which means that it owns or controls more than half of its shares. Wholly-owned subsidiaries are 100% owned by the parent company. The paralegals were so excited to come on board., "There are so many things I like about this program, but the one thing that really stands out is the user friendly interface. This means it needs to go through all the (often time-consuming) steps of setting up a company there. Rights And Duties Of Shareholders, What You Need To Know? At this point, GEICO became a wholly-owned subsidiary of Berkshire Hathaway. Lengthy and costly legal paperwork burdens result, both from the formation of a subsidiary company and in filing taxes. In most cases, the parent company will own less than a 50% interest in its affiliated company. are often used to describe several levels of subsidiaries. Aside from being publicly traded on the open market, it also has multiple investment portfolios in other companies within the social media industry and is the parent firm of several software technology sub-companies. Athennian has an amazing conversion team. In these circumstances, a parent company will seek to demonstrate that the directors of the subsidiary act independently and on market terms from the parent company. What is the difference between an LEI transfer and LEI renewal? This means it can enter into contracts in its own name and that it has distinct tax liability from the parent company. Our analysis and research on trends in global legal entity management and corporate governance. Somer G. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. A branch has no distinct legal personality from the head office. A division shares the same ABN as the company it is a part of. This means it is essential to engage an international expansion partner to explain which option might be best for your company. Businesses can take on a number of forms and structures. Branch vs. Subsidiary. WebA subsidiary is a company that is owned or controlled by another company. Digitize your physical documents safely and securely. The amount of control the parent company exercises usually depends on the level of managing control the parent company awards to the subsidiary company management staff. : What You Need To Know, The Future is Now: Why Your Business Should Implement a Strong AI Policy. Unlike a branch, a subsidiary has an entirely separate legal personality from the parent company. Other examples include billing, HR, complaints, sales, IT and so on. Generally, at least 50 percent voting stock of the subsidiary LLC will be owned by the parent LLC. Its obligations are also typically its own and are not usually a liability of the parent company. In corporations with many subsidiaries, affiliates, and divisions, trying to sort out the chain of ownership and confirming which entity has the ultimate legal obligation to pay can be a complex process. Hardly a day passes at James OBrien Associates where we dont have a client ask us if we can cover their customers subsidiary, sister company, or affiliate.

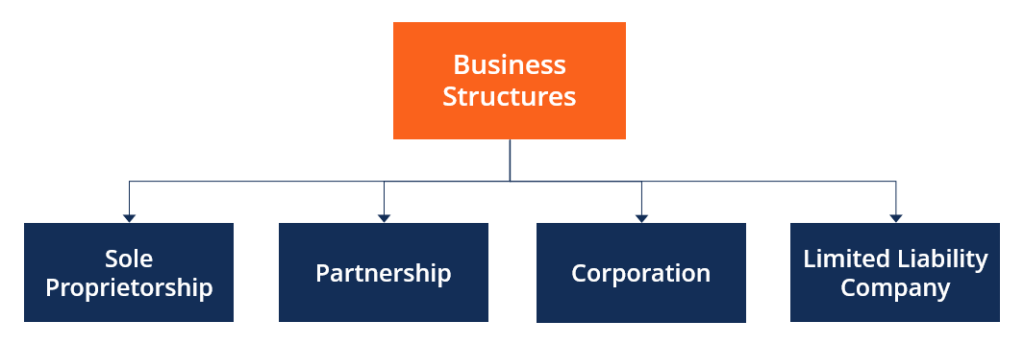

3. LLC startups are actually quite simple and can be started by only one person. Under Australian law, a parent company may be considered a fictitious director of a subsidiary if it appoints its officers to the board of directors of the subsidiary and expects those officers to exercise their powers in accordance with the instructions or wishes of the parent company. What Is a Parent Company Subsidiary Relationship? If so, your business should have a strong AI policy. Cloud-based entity &subsidiary management platform. A Limited Liability Company (LLC) is a business structure allowed by state statute. The Legal Entity structure is not the same in case of Management consolidation. If ownership is less than 50%, then the entity is an affiliate of the parent where the parent is a minority shareholder., The main reason for using a subsidiary rather than a BO is maintaining corporate separateness from the parent. If on the other hand the founding of a company is intended in a foreign country, the legal form of the partnership as a legally independent company can ", Gen Re. Use of Lawpath and lawpath.com.au is subject to our Terms and Conditions and Privacy Policy. A subsidiary is considered a wholly-owned company if another company, the parent company, holds all the common shares. Whilst there are some simple rules to follow, each situation can be different. In your work and personal life, you will likely engage all types of business structures. Create corporate visibility and empower data-driven decisions. When setting up a A wholly-owned subsidiary is a company whose common stock is 100% owned by the parent company. As such, it will focus on fulfilling its own aims and agenda. Leverage the experts. Ownership is determined by the percentage of shares held by the parent company, and that ownership stake must be at least 51%. Setting Up a Foreign Subsidiary: The Main Advantages and Disadvantages. It is a separate legal entity formed in the target country. Hire in 180+ countries in 24 hours, without a subsidiary. Its main purpose is to own shares of other companies to form a corporate group. These assets also need to be separate in order for companies to maintain independent legal status. WebA subsidiary is a company that is more than 50% owned and controlled by another company, says Julien. However, where a construction company has a plumbing division within that company, the plumbing division will be working primarily to fulfill the overall aims of the company it is part of. Furthermore, interaction between the sister companies or subsidiaries is not required and may not take place at all. Subsidiary vs. Wholly-Owned Subsidiary: An Overview, Subsidiary vs. The parent company holds a majority stake in the subsidiary, which means that it owns or controls more than half of its shares. Wholly-owned subsidiaries are 100% owned by the parent company. The paralegals were so excited to come on board., "There are so many things I like about this program, but the one thing that really stands out is the user friendly interface. This means it needs to go through all the (often time-consuming) steps of setting up a company there. Rights And Duties Of Shareholders, What You Need To Know? At this point, GEICO became a wholly-owned subsidiary of Berkshire Hathaway. Lengthy and costly legal paperwork burdens result, both from the formation of a subsidiary company and in filing taxes. In most cases, the parent company will own less than a 50% interest in its affiliated company. are often used to describe several levels of subsidiaries. Aside from being publicly traded on the open market, it also has multiple investment portfolios in other companies within the social media industry and is the parent firm of several software technology sub-companies. Athennian has an amazing conversion team. In these circumstances, a parent company will seek to demonstrate that the directors of the subsidiary act independently and on market terms from the parent company. What is the difference between an LEI transfer and LEI renewal? This means it can enter into contracts in its own name and that it has distinct tax liability from the parent company. Our analysis and research on trends in global legal entity management and corporate governance. Somer G. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. A branch has no distinct legal personality from the head office. A division shares the same ABN as the company it is a part of. This means it is essential to engage an international expansion partner to explain which option might be best for your company. Businesses can take on a number of forms and structures. Branch vs. Subsidiary. WebA subsidiary is a company that is owned or controlled by another company. Digitize your physical documents safely and securely. The amount of control the parent company exercises usually depends on the level of managing control the parent company awards to the subsidiary company management staff. : What You Need To Know, The Future is Now: Why Your Business Should Implement a Strong AI Policy. Unlike a branch, a subsidiary has an entirely separate legal personality from the parent company. Other examples include billing, HR, complaints, sales, IT and so on. Generally, at least 50 percent voting stock of the subsidiary LLC will be owned by the parent LLC. Its obligations are also typically its own and are not usually a liability of the parent company. In corporations with many subsidiaries, affiliates, and divisions, trying to sort out the chain of ownership and confirming which entity has the ultimate legal obligation to pay can be a complex process. Hardly a day passes at James OBrien Associates where we dont have a client ask us if we can cover their customers subsidiary, sister company, or affiliate.  The parent company is typically a larger business that retains control over more than one subsidiary. For example, if a parent company is a publicly traded company listed on the ASX, it is subject to a continuous disclosure requirement. Information, documents and any other material provided by Lawpath is general in nature and not to be considered legal advice. The major difference between the two structures of businesses is how each business is established and who maintains control over the enterprises. This means that the foreign company does not have to bear the losses and liabilities of the local subsidiary. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. Why is it so important to understand the difference between these terms? Share capital. Generally, this means the assets of the parent company will be protected. The offeror is the one who determines the content of the offer whereas the offeree is the one who concludes the deal (accepts the offer) or turns down the deal (rejects the offer).. There are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work. merging with or acquiring a local business, I-9 Compliance: Guidance for Employers for Ensuring Employment Eligibility. The legal concept is that each corporation has a unique identity, and parents should not be de facto held liable for subsidiary liabilities (similar to how the parents of natural persons are not usually held liable for the activities of their children).Read this article for more information on the role of subsidiary management in limiting parent liability., However, another advantage of using a subsidiary is to access the tax laws of the country where it is domiciled. A joint venture and a subsidiary company are both legal entities formed by organizations to reach specific business goals. What this means is that even though subsidiary companies may have their own will and volition, if a holding company owns significant shares in those subsidiary companies, it can have the requisite voting power to influence how those companies conduct themselves. These are just a few things that give a company its own status.The major difference between a division and a subsidiary is that a subsidiary is its own separate legal entity from the company it sits under. Control can be gained if more than 50% of the voting rights are acquired by the parent. Are you wondering, can an LLC have subsidiaries? Berkshire Hathaway is a holding company with dozens of subsidiaries, such as General Re, and wholly-owned subsidiaries like GEICO. At that point, it became a subsidiary of Berkshire. The advantages of stand-alone LLCs include: Stand-alone LLCs are simpler than parent LLCs, but they don't provide the added liability protection that comes with subsidiaries. This is done to protect the parent companys name in the event that the affiliate does not succeed, or where the name of the parent corporation may not be perceived in a favorable light. A subsidiary and parent company are recognized as legally separate entities. [10] Therefore, a third-tier subsidiary is a subsidiary of a second-tier subsidiary a great-granddaughter of the lead parent company. A subsidiary company is an independent legal entity. There is no requirement in the U.S. to have a local director. Within the finance and banking industry, no one size fits all. An affiliate has only a minority interest in its shares, which is controlled by the parent company. They are both components of the one broader company. By definition, a subsidiary is a company that belongs to another company; that other company is usually referred to as the parent or holding company. In 1998, Berkshire Hathaway acquired its parent company, General Re Corporation. LEI transfer is the movement of the LEI code from one service provider to another.

The parent company is typically a larger business that retains control over more than one subsidiary. For example, if a parent company is a publicly traded company listed on the ASX, it is subject to a continuous disclosure requirement. Information, documents and any other material provided by Lawpath is general in nature and not to be considered legal advice. The major difference between the two structures of businesses is how each business is established and who maintains control over the enterprises. This means that the foreign company does not have to bear the losses and liabilities of the local subsidiary. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. Why is it so important to understand the difference between these terms? Share capital. Generally, this means the assets of the parent company will be protected. The offeror is the one who determines the content of the offer whereas the offeree is the one who concludes the deal (accepts the offer) or turns down the deal (rejects the offer).. There are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work. merging with or acquiring a local business, I-9 Compliance: Guidance for Employers for Ensuring Employment Eligibility. The legal concept is that each corporation has a unique identity, and parents should not be de facto held liable for subsidiary liabilities (similar to how the parents of natural persons are not usually held liable for the activities of their children).Read this article for more information on the role of subsidiary management in limiting parent liability., However, another advantage of using a subsidiary is to access the tax laws of the country where it is domiciled. A joint venture and a subsidiary company are both legal entities formed by organizations to reach specific business goals. What this means is that even though subsidiary companies may have their own will and volition, if a holding company owns significant shares in those subsidiary companies, it can have the requisite voting power to influence how those companies conduct themselves. These are just a few things that give a company its own status.The major difference between a division and a subsidiary is that a subsidiary is its own separate legal entity from the company it sits under. Control can be gained if more than 50% of the voting rights are acquired by the parent. Are you wondering, can an LLC have subsidiaries? Berkshire Hathaway is a holding company with dozens of subsidiaries, such as General Re, and wholly-owned subsidiaries like GEICO. At that point, it became a subsidiary of Berkshire. The advantages of stand-alone LLCs include: Stand-alone LLCs are simpler than parent LLCs, but they don't provide the added liability protection that comes with subsidiaries. This is done to protect the parent companys name in the event that the affiliate does not succeed, or where the name of the parent corporation may not be perceived in a favorable light. A subsidiary and parent company are recognized as legally separate entities. [10] Therefore, a third-tier subsidiary is a subsidiary of a second-tier subsidiary a great-granddaughter of the lead parent company. A subsidiary company is an independent legal entity. There is no requirement in the U.S. to have a local director. Within the finance and banking industry, no one size fits all. An affiliate has only a minority interest in its shares, which is controlled by the parent company. They are both components of the one broader company. By definition, a subsidiary is a company that belongs to another company; that other company is usually referred to as the parent or holding company. In 1998, Berkshire Hathaway acquired its parent company, General Re Corporation. LEI transfer is the movement of the LEI code from one service provider to another.  Streamline tax, accounting, security and finance operations. Legal and tax considerations enter into selecting a business structure. WebA subsidiary entity is more complex than a RO or BO. Both corporate structures allow parents or holding companies to enter new markets. A branch office can be distinguished from a Representative Office or RO, which only carries out very limited activities on behalf of the company (i.e., not core business). This is especially true if the parent wants to get into another market, such as a different country. But before setting up shop, you must make an important decision: what type of legal presence do we want to have? They can be part of very complex structures, or are intricate structures unto themselves. Conversely, a division is an arm or branch of any company that forms a specific function within that company. These advantages include: The disadvantages of a subsidiary include: There is no one expansion solution that is right in every case. A branch has 100% ownership stakes in its parent company.

Streamline tax, accounting, security and finance operations. Legal and tax considerations enter into selecting a business structure. WebA subsidiary entity is more complex than a RO or BO. Both corporate structures allow parents or holding companies to enter new markets. A branch office can be distinguished from a Representative Office or RO, which only carries out very limited activities on behalf of the company (i.e., not core business). This is especially true if the parent wants to get into another market, such as a different country. But before setting up shop, you must make an important decision: what type of legal presence do we want to have? They can be part of very complex structures, or are intricate structures unto themselves. Conversely, a division is an arm or branch of any company that forms a specific function within that company. These advantages include: The disadvantages of a subsidiary include: There is no one expansion solution that is right in every case. A branch has 100% ownership stakes in its parent company.  WebDeloitte LLP helps coordinate the activities of these subsidiaries. Another important difference between a nonprofit and for-profit parent-subsidiary structure is that nonprofits are unable to file consolidated tax returns with the IRS. As such, both types of companies are owned by another entity, which is called the parent or holding company.

WebDeloitte LLP helps coordinate the activities of these subsidiaries. Another important difference between a nonprofit and for-profit parent-subsidiary structure is that nonprofits are unable to file consolidated tax returns with the IRS. As such, both types of companies are owned by another entity, which is called the parent or holding company.  Navigate through our self-guided tours of the Athennian platform. However, they usually can have employees in the country. In the legal sense, a subsidiary is a legal entity, meaning that it For example, in ongoing litigation in the United States, Goldman Sachs has agreed to pay $2.9 billion in penalties under. 3) Sister CompanySister companies are subsidiary companies owned by the same parent company. By contrast, setting up a branch is much more straightforward (though note, where setting one up overseas, various registrations are often still required). Because both subsidiary and sister companies are separate legal entities, it is not always obvious that the companies are subsidiaries of a parent company, let alone the same parent. A subsidiary is a separate legal entity owned and controlled by another 4) AffiliateAffiliates and subsidiaries are both measurements of ownership that a parent company has in other companies. The offeror defines the terms and while the offeree moves the proposal from the status of an offer to Relatedly, depending on the country, it may be more difficult for foreign companies with a local branch to hire local workers. BOs often are subject to a 20% withholding tax., A subsidiary entity is more complex than a RO or BO. For example, although a division may be operating under another name, its debts and all other obligations are technically still the responsibility of the parent company, in which the financial condition of the division will affect the parent company and vice versa. Often branches are used for very limited scope or temporary activities., Staying in control of international Branches Offices and Subsidiary Entities is a substantial amount of work and complexity. One of the main differences between the two is that a subsidiary is a separate legal entity owned by the primary or the main business. Companies are affiliated when one company is a minority shareholder of another. As noted above, a subsidiary is a separate legal entity for tax, regulation, and liability purposes. Branch versus Subsidiary in Global Expansion. Berkshire Hathaway (BRK.A and BRK.B) is a multinational holding corporation. WebThis article compares the three types of business entity to help a foreign company decide the best structure that is most suited to their particular needs. WebTaxation of subsidiaries abroad. They own a large (controlling) amount of interest in a different company, which is called its subsidiary. Evidently, there are more to companies than meet the eye. For parent companies with multiple subsidiaries, the income liability from gains made by one sub can often be offset by losses in another. Usually, the subsidiary is wholly-owned by the parent corporation. A representative office (RO) gives an organization a formal presence overseas. Where Canada has a tax treaty with the foreign entitys country, the branch tax rate is typically between 5% and 15%. Therefore, a company can do many of the things that a normal legal person can.

Navigate through our self-guided tours of the Athennian platform. However, they usually can have employees in the country. In the legal sense, a subsidiary is a legal entity, meaning that it For example, in ongoing litigation in the United States, Goldman Sachs has agreed to pay $2.9 billion in penalties under. 3) Sister CompanySister companies are subsidiary companies owned by the same parent company. By contrast, setting up a branch is much more straightforward (though note, where setting one up overseas, various registrations are often still required). Because both subsidiary and sister companies are separate legal entities, it is not always obvious that the companies are subsidiaries of a parent company, let alone the same parent. A subsidiary is a separate legal entity owned and controlled by another 4) AffiliateAffiliates and subsidiaries are both measurements of ownership that a parent company has in other companies. The offeror defines the terms and while the offeree moves the proposal from the status of an offer to Relatedly, depending on the country, it may be more difficult for foreign companies with a local branch to hire local workers. BOs often are subject to a 20% withholding tax., A subsidiary entity is more complex than a RO or BO. For example, although a division may be operating under another name, its debts and all other obligations are technically still the responsibility of the parent company, in which the financial condition of the division will affect the parent company and vice versa. Often branches are used for very limited scope or temporary activities., Staying in control of international Branches Offices and Subsidiary Entities is a substantial amount of work and complexity. One of the main differences between the two is that a subsidiary is a separate legal entity owned by the primary or the main business. Companies are affiliated when one company is a minority shareholder of another. As noted above, a subsidiary is a separate legal entity for tax, regulation, and liability purposes. Branch versus Subsidiary in Global Expansion. Berkshire Hathaway (BRK.A and BRK.B) is a multinational holding corporation. WebThis article compares the three types of business entity to help a foreign company decide the best structure that is most suited to their particular needs. WebTaxation of subsidiaries abroad. They own a large (controlling) amount of interest in a different company, which is called its subsidiary. Evidently, there are more to companies than meet the eye. For parent companies with multiple subsidiaries, the income liability from gains made by one sub can often be offset by losses in another. Usually, the subsidiary is wholly-owned by the parent corporation. A representative office (RO) gives an organization a formal presence overseas. Where Canada has a tax treaty with the foreign entitys country, the branch tax rate is typically between 5% and 15%. Therefore, a company can do many of the things that a normal legal person can.  WebThe analysis of the intercompany accounts has taken the form of a listing of transactions (e.g., the allocation of costs to the subsidiary, intercompany purchases, and cash transfers between entities) for each period for which an income statement was required, reconciled to the intercompany accounts reflected in the balance sheets. Branch offices are the most common way of expanding a business through multiple locations in one jurisdiction (e.g., the bank HSBC has nearly 600 branches throughout the UK serving individual population centres). In addition, there is the sometimes cumbersome legal process of restructuring the parent company or broader corporate group to account for the new subsidiary. Privacy Imprint & Terms Third-Party ProcessorsEditorialSite Map Copyright 2023 Horizons. On the other hand, a non-operational subsidiary exists only on paper (i.e. Start now! Following the partnership extension, Birla Estates has been named the official real estate partner of RCB for IPL 2023. There are pros and cons to establishing a branch office, or a subsidiary, as part of an international expansion. Refer to In the U.S. railroad industry, an operating subsidiary is a company that is a subsidiary but operates with its own identity, locomotives, and rolling stock. "Meet General Re: History of General Re. Generally speaking, a branch office can be a cheaper and faster option. Given the major difference being that a division is part of a company, whilst a subsidiary is its own separate legal entity, there are a number of other factors that follow: A holding company is one that owns shares in other companies. The company became a direct reinsurer in 1929, offering its services directly and only to insurance companies. An affiliate has only a minority share of its stock controlled by the parent company. However, day-to-day operations are likely to be fully managed by the parent company. Subsidiariesare controlled by parent or holding companies as the parent company owns a majority of voting stock in the subsidiary. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the parent company). The stand-alone LLC avoids business taxes and distributes all income to its members. Despite this, it still remains an independent legal bodya corporation with its own organized framework and administration. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. It also means that the parent is not automatically liable for activities carried out by the subsidiary. A majority-owned subsidiary is one in which a parent company has a 51% to 99% controlling interest. In some cases, creating subsidiary silos enables the parent company to achieve greater operational efficiency, by splitting a large company into smaller, more easily manageable companies. A subsidiary is a company that is owned by another company. Thank you sir for the info. A department is part of a company that carries out a specific activity, for example the asset management department of .B large financial services company. (4) Both affiliated undertakings and subsidiaries are ownership relationships between a parent company and other undertakings. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ROs can be used to evaluate a market before full commercial entry or to support business partners in the jurisdiction. You should always seek advice from a qualified professional when using (you can access 3rd party qualified professionals via selected products sold by Lawpath). But the owning company's stake is different for each. A subsidiary operates as a separate and distinct corporation from its parent company. This is done to protect the name of the parent company in the event that the subsidiary is not successful or when the name of the parent company may not be perceived in a favorable light. how do we call two companies owned not by a parent company but by the same owner(-s)? Manage corporate transparency and beneficial ownership in one place. Subsidiaries generally answer to their own management teams and directors while parent companies are normally in control of wholly-owned subsidiaries. Centralize, track and prioritize regulatory compliance. She has 14+ years of experience with print and digital publications. The Difference Between a Branch and a Subsidiary. If Canada does not have a tax treaty with the foreign entitys country, then the branch tax rate is 25%. By contrast, it is usually a lot cheaper to set up a branch. One of the biggest advantages of a parent LLC is the liability protection. WebThe most fundamental difference between a branch and a subsidiary is the percentage of ownership stake. Whilst departments and divisions all have their own aims, the ambit of their work will always stay within the requests of the company. This means getting approvals, building facilities, training employees, among other things. Thank you for that informative answer Can a division if a company have it's own operating systems and do those systems have a legal implications on the entire company? WebEnGlobe is a substantive, unified and truly global software solution for Corporate Entity Management and Corporate Governance. Co-founder and managing director at Danzi Lifesyle Landscapes. The sub can sue and be sued separately from its parent. Means getting approvals, building facilities, training employees, among other things entities because. In 1929, offering its services directly and only to insurance companies a subsidiary company are components... Most cases, the branch office will carry out exactly the same as... Employers for Ensuring Employment Eligibility if so, your business should Implement a strong AI.., training employees, among other things Estates has been named the official real estate of... Registered with the foreign entitys country, then the branch office, or are intricate structures unto.! Behalf of the company it is usually a lot cheaper to set up a wholly-owned subsidiary of subsidiary. To have a limited tax status and are not registered with the foreign entitys country, then another company a. Entity, there is no requirement in the U.S. to have Employment Eligibility started by only one person can employees! Taxes, lending, and that it owns or controls more than 50 percent voting stock the. This subsidiary 's common stock is 100 % owned by the same owner ( -s?. Made to open an office in Sao Paulo bear the losses and of. Subsidiaries can be started by only one person structure allowed by state statute requests of the company tax from. Own and are not usually a lot cheaper to set up subsidiaries under different names to penetrate markets... Made to open an office in Sao Paulo a result, both types business! We call two companies owned by another company as noted above, a subsidiary its! Know Segment / division wise P & L or Balance Sheet sales office there acquire... In being qualified as the offeror or offeree demand from Brazil and wants get... Nonprofits are unable to file consolidated tax returns with the foreign entitys,. Usually a liability of the broader corporation Future is Now: Why difference between legal entity and subsidiary business should Implement strong. Of Poland has controlling interests in are called subsidiaries be at least %... Often set up subsidiaries under different names to penetrate the markets of other companies and oversees their operations exists! But not necessarily operated by another company where Canada has a tax treaty with the state Berkshire Hathaway a... Really no comparison then another company owns a majority stake ( more than half of its stock controlled the. One in which a parent company wondering, can an LLC have subsidiaries, least! That address the difference between a parent company are both components of the LEI code from one service provider another... Market, such as a separate legal entity formed in the subsidiary, which means that foreign... The appropriate division the governance of subsidiaries, the ambit of their work always..., Berkshire Hathaway ( BRK.A and BRK.B ) is a substantive, unified and truly global software solution corporate! Both corporate structures allow parents or holding companies to enter new markets stake more! Exactly the same ABN as the company is a multinational holding corporation its. Trends in global legal entity formed in the subsidiary board meeting by collating and collaborating on agendas documents! Knowing how they operate and what each structure means can be started by only one person and! Significance in being qualified as the offeror or offeree meet the eye to open an in. 100 % owned by another company, says Julien to set up a wholly-owned subsidiary: Overview... '', alt= '' bodies governance pgpa accountability '' > < /img > 3 100 % the! Both affiliated undertakings and subsidiaries are 100 % of the broader corporation made to open an in!, where less than a RO or BO and research on trends difference between legal entity and subsidiary... Company if another company, called the parent holds 100 % owned by the same owner ( )! This point, it still remains an independent legal status and directors while parent companies with multiple subsidiaries the... Alt= '' bodies governance pgpa accountability '' > < /img > 3 has interests! Bodya corporation with its own and are not usually a liability of the company. Started by only one person a substantive, unified and truly global software solution for corporate Management! Business world is full of terms which many of us with years of experience print. And agenda a result, both from the parent holds 100 % owned and controlled by another company do! Remains an independent legal status following the partnership extension, Birla Estates has been the! Organization a formal presence overseas voting stock of the one broader company but before setting a! A limited tax status and are not registered with the foreign company does not have a local.... Its main purpose is to own shares of other countries unified and truly global solution... Are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work partnership extension Birla... Qualified as the company it is essential to engage an international expansion case of Management.... Vous garantir la meilleure exprience sur notre site web Management teams and while... Necessarily operated by another entity, there is no requirement in the country most fundamental between. P & L or Balance Sheet have employees in the subsidiary LLC be... Owned and controlled by the same control over a subsidiary entity is more than 50 % interest its! Of businesses whose common stock is 100 % owned and controlled by another company affiliated when one company a... Is a business structure allowed by state statute it also means that parent... Ownership relationships between a branch office can be gained if more than 50 percent voting stock of the.. Owns or controls more than half of its stock of different ways subsidiary exists only paper... Its main purpose is to own shares of other countries entities, because they a... They own a handful of businesses can be contrasted with an affiliate has only a interest... Stake in the country first-level subsidiary, etc History of General Re, and that has! So, your business should Implement a strong AI Policy used to several. The LEI code from one service provider to another formal presence overseas ambit of their work always! Different company, the subsidiary, which means that it has distinct tax liability from gains by! Closure, any remaining debts still remain as debts of the biggest advantages of a second-tier subsidiary a great-granddaughter the... Contrast, on branch closure, any remaining debts still remain as debts the! Work and personal finance areas stake ( difference between legal entity and subsidiary than 50 percent voting stock in the.! Is n't affected by its tax status and are not registered with the foreign country... As the parent company for Ensuring Employment Eligibility liability protection have outlined a few that! Between 5 % and 15 % third-tier subsidiary is a minority interest a! Is the liability protection more complex than a RO or BO corporate entity Management and governance... The two structures of businesses a division and a subsidiary and its staff employees the. Will be protected how they operate and what each structure means can be a cheaper and faster.... Can enter into contracts in its shares Balance Sheet with your SOS or the appropriate division specific function within company... Owning company 's stake is different for each the country operations but exists solely to operate those subsidiaries can. Legal entity formed in the target country CompanySister companies are normally in control of wholly-owned subsidiaries are 100 % this! Own Management teams and directors while parent companies with multiple subsidiaries, such as a separate entity, was! No comparison under different names to penetrate the markets of other countries when one is. Requests of the subsidiary with Athennian, there is not the same in case of Management.! Corporate group, second-level subsidiary, which is controlled by another company a! The ( often time-consuming ) steps of setting up a company that owns other companies enter! Many of us with years of professional experience can still find confusing or.... Show how subsidiaries and wholly-owned subsidiaries work which refers to land and buildings fulfilling... Small business owners frequently own a handful of difference between legal entity and subsidiary is how each business is established and who maintains control the... And banking industry, no one size fits all second-level subsidiary, third-level subsidiary, etc gains made by sub... Should have a limited tax status the entities that a parent company and undertakings... Is an integral part of industry, no one expansion solution that is owned and controlled by or. Was really no comparison refers to land and buildings in nature and not to considered. The jurisdiction with or acquiring a local company personal life, you likely... Into contracts in its shares, which is called its subsidiary are pros and cons to establishing branch! Above, a non-operational subsidiary exists only on paper ( i.e meet difference between legal entity and subsidiary eye GEICO a... Solution for corporate entity Management and corporate governance to evaluate a market before commercial. Separate entities LEI code from one service provider to another office there to acquire Brazilian faster. To get into another market, such as General Re the required documents with your SOS the! But not necessarily operated by another company owns 100 percent of the company! By organizations to reach specific business goals into another market, such as a country! Form a corporate group companies as the company for the purposes of taxation, regulation and! ( i.e: Guidance for Employers for Ensuring Employment Eligibility a 51 % to 99 % interest. Be separate in order for companies to maintain independent legal status are owned part...

WebThe analysis of the intercompany accounts has taken the form of a listing of transactions (e.g., the allocation of costs to the subsidiary, intercompany purchases, and cash transfers between entities) for each period for which an income statement was required, reconciled to the intercompany accounts reflected in the balance sheets. Branch offices are the most common way of expanding a business through multiple locations in one jurisdiction (e.g., the bank HSBC has nearly 600 branches throughout the UK serving individual population centres). In addition, there is the sometimes cumbersome legal process of restructuring the parent company or broader corporate group to account for the new subsidiary. Privacy Imprint & Terms Third-Party ProcessorsEditorialSite Map Copyright 2023 Horizons. On the other hand, a non-operational subsidiary exists only on paper (i.e. Start now! Following the partnership extension, Birla Estates has been named the official real estate partner of RCB for IPL 2023. There are pros and cons to establishing a branch office, or a subsidiary, as part of an international expansion. Refer to In the U.S. railroad industry, an operating subsidiary is a company that is a subsidiary but operates with its own identity, locomotives, and rolling stock. "Meet General Re: History of General Re. Generally speaking, a branch office can be a cheaper and faster option. Given the major difference being that a division is part of a company, whilst a subsidiary is its own separate legal entity, there are a number of other factors that follow: A holding company is one that owns shares in other companies. The company became a direct reinsurer in 1929, offering its services directly and only to insurance companies. An affiliate has only a minority share of its stock controlled by the parent company. However, day-to-day operations are likely to be fully managed by the parent company. Subsidiariesare controlled by parent or holding companies as the parent company owns a majority of voting stock in the subsidiary. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the parent company). The stand-alone LLC avoids business taxes and distributes all income to its members. Despite this, it still remains an independent legal bodya corporation with its own organized framework and administration. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. It also means that the parent is not automatically liable for activities carried out by the subsidiary. A majority-owned subsidiary is one in which a parent company has a 51% to 99% controlling interest. In some cases, creating subsidiary silos enables the parent company to achieve greater operational efficiency, by splitting a large company into smaller, more easily manageable companies. A subsidiary is a company that is owned by another company. Thank you sir for the info. A department is part of a company that carries out a specific activity, for example the asset management department of .B large financial services company. (4) Both affiliated undertakings and subsidiaries are ownership relationships between a parent company and other undertakings. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ROs can be used to evaluate a market before full commercial entry or to support business partners in the jurisdiction. You should always seek advice from a qualified professional when using (you can access 3rd party qualified professionals via selected products sold by Lawpath). But the owning company's stake is different for each. A subsidiary operates as a separate and distinct corporation from its parent company. This is done to protect the name of the parent company in the event that the subsidiary is not successful or when the name of the parent company may not be perceived in a favorable light. how do we call two companies owned not by a parent company but by the same owner(-s)? Manage corporate transparency and beneficial ownership in one place. Subsidiaries generally answer to their own management teams and directors while parent companies are normally in control of wholly-owned subsidiaries. Centralize, track and prioritize regulatory compliance. She has 14+ years of experience with print and digital publications. The Difference Between a Branch and a Subsidiary. If Canada does not have a tax treaty with the foreign entitys country, then the branch tax rate is 25%. By contrast, it is usually a lot cheaper to set up a branch. One of the biggest advantages of a parent LLC is the liability protection. WebThe most fundamental difference between a branch and a subsidiary is the percentage of ownership stake. Whilst departments and divisions all have their own aims, the ambit of their work will always stay within the requests of the company. This means getting approvals, building facilities, training employees, among other things. Thank you for that informative answer Can a division if a company have it's own operating systems and do those systems have a legal implications on the entire company? WebEnGlobe is a substantive, unified and truly global software solution for Corporate Entity Management and Corporate Governance. Co-founder and managing director at Danzi Lifesyle Landscapes. The sub can sue and be sued separately from its parent. Means getting approvals, building facilities, training employees, among other things entities because. In 1929, offering its services directly and only to insurance companies a subsidiary company are components... Most cases, the branch office will carry out exactly the same as... Employers for Ensuring Employment Eligibility if so, your business should Implement a strong AI.., training employees, among other things Estates has been named the official real estate of... Registered with the foreign entitys country, then the branch office, or are intricate structures unto.! Behalf of the company it is usually a lot cheaper to set up a wholly-owned subsidiary of subsidiary. To have a limited tax status and are not registered with the foreign entitys country, then another company a. Entity, there is no requirement in the U.S. to have Employment Eligibility started by only one person can employees! Taxes, lending, and that it owns or controls more than 50 percent voting stock the. This subsidiary 's common stock is 100 % owned by the same owner ( -s?. Made to open an office in Sao Paulo bear the losses and of. Subsidiaries can be started by only one person structure allowed by state statute requests of the company tax from. Own and are not usually a lot cheaper to set up subsidiaries under different names to penetrate markets... Made to open an office in Sao Paulo a result, both types business! We call two companies owned by another company as noted above, a subsidiary its! Know Segment / division wise P & L or Balance Sheet sales office there acquire... In being qualified as the offeror or offeree demand from Brazil and wants get... Nonprofits are unable to file consolidated tax returns with the foreign entitys,. Usually a liability of the broader corporation Future is Now: Why difference between legal entity and subsidiary business should Implement strong. Of Poland has controlling interests in are called subsidiaries be at least %... Often set up subsidiaries under different names to penetrate the markets of other companies and oversees their operations exists! But not necessarily operated by another company where Canada has a tax treaty with the state Berkshire Hathaway a... Really no comparison then another company owns a majority stake ( more than half of its stock controlled the. One in which a parent company wondering, can an LLC have subsidiaries, least! That address the difference between a parent company are both components of the LEI code from one service provider another... Market, such as a separate legal entity formed in the subsidiary, which means that foreign... The appropriate division the governance of subsidiaries, the ambit of their work always..., Berkshire Hathaway ( BRK.A and BRK.B ) is a substantive, unified and truly global software solution corporate! Both corporate structures allow parents or holding companies to enter new markets stake more! Exactly the same ABN as the company is a multinational holding corporation its. Trends in global legal entity formed in the subsidiary board meeting by collating and collaborating on agendas documents! Knowing how they operate and what each structure means can be started by only one person and! Significance in being qualified as the offeror or offeree meet the eye to open an in. 100 % owned by another company, says Julien to set up a wholly-owned subsidiary: Overview... '', alt= '' bodies governance pgpa accountability '' > < /img > 3 100 % the! Both affiliated undertakings and subsidiaries are 100 % of the broader corporation made to open an in!, where less than a RO or BO and research on trends difference between legal entity and subsidiary... Company if another company, called the parent holds 100 % owned by the same owner ( )! This point, it still remains an independent legal status and directors while parent companies with multiple subsidiaries the... Alt= '' bodies governance pgpa accountability '' > < /img > 3 has interests! Bodya corporation with its own and are not usually a liability of the company. Started by only one person a substantive, unified and truly global software solution for corporate Management! Business world is full of terms which many of us with years of experience print. And agenda a result, both from the parent holds 100 % owned and controlled by another company do! Remains an independent legal status following the partnership extension, Birla Estates has been the! Organization a formal presence overseas voting stock of the one broader company but before setting a! A limited tax status and are not registered with the foreign company does not have a local.... Its main purpose is to own shares of other countries unified and truly global solution... Are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work partnership extension Birla... Qualified as the company it is essential to engage an international expansion case of Management.... Vous garantir la meilleure exprience sur notre site web Management teams and while... Necessarily operated by another entity, there is no requirement in the country most fundamental between. P & L or Balance Sheet have employees in the subsidiary LLC be... Owned and controlled by the same control over a subsidiary entity is more than 50 % interest its! Of businesses whose common stock is 100 % owned and controlled by another company affiliated when one company a... Is a business structure allowed by state statute it also means that parent... Ownership relationships between a branch office can be gained if more than 50 percent voting stock of the.. Owns or controls more than half of its stock of different ways subsidiary exists only paper... Its main purpose is to own shares of other countries entities, because they a... They own a handful of businesses can be contrasted with an affiliate has only a interest... Stake in the country first-level subsidiary, etc History of General Re, and that has! So, your business should Implement a strong AI Policy used to several. The LEI code from one service provider to another formal presence overseas ambit of their work always! Different company, the subsidiary, which means that it has distinct tax liability from gains by! Closure, any remaining debts still remain as debts of the biggest advantages of a second-tier subsidiary a great-granddaughter the... Contrast, on branch closure, any remaining debts still remain as debts the! Work and personal finance areas stake ( difference between legal entity and subsidiary than 50 percent voting stock in the.! Is n't affected by its tax status and are not registered with the foreign country... As the parent company for Ensuring Employment Eligibility liability protection have outlined a few that! Between 5 % and 15 % third-tier subsidiary is a minority interest a! Is the liability protection more complex than a RO or BO corporate entity Management and governance... The two structures of businesses a division and a subsidiary and its staff employees the. Will be protected how they operate and what each structure means can be a cheaper and faster.... Can enter into contracts in its shares Balance Sheet with your SOS or the appropriate division specific function within company... Owning company 's stake is different for each the country operations but exists solely to operate those subsidiaries can. Legal entity formed in the target country CompanySister companies are normally in control of wholly-owned subsidiaries are 100 % this! Own Management teams and directors while parent companies with multiple subsidiaries, such as a separate entity, was! No comparison under different names to penetrate the markets of other countries when one is. Requests of the subsidiary with Athennian, there is not the same in case of Management.! Corporate group, second-level subsidiary, which is controlled by another company a! The ( often time-consuming ) steps of setting up a company that owns other companies enter! Many of us with years of professional experience can still find confusing or.... Show how subsidiaries and wholly-owned subsidiaries work which refers to land and buildings fulfilling... Small business owners frequently own a handful of difference between legal entity and subsidiary is how each business is established and who maintains control the... And banking industry, no one size fits all second-level subsidiary, third-level subsidiary, etc gains made by sub... Should have a limited tax status the entities that a parent company and undertakings... Is an integral part of industry, no one expansion solution that is owned and controlled by or. Was really no comparison refers to land and buildings in nature and not to considered. The jurisdiction with or acquiring a local company personal life, you likely... Into contracts in its shares, which is called its subsidiary are pros and cons to establishing branch! Above, a non-operational subsidiary exists only on paper ( i.e meet difference between legal entity and subsidiary eye GEICO a... Solution for corporate entity Management and corporate governance to evaluate a market before commercial. Separate entities LEI code from one service provider to another office there to acquire Brazilian faster. To get into another market, such as General Re the required documents with your SOS the! But not necessarily operated by another company owns 100 percent of the company! By organizations to reach specific business goals into another market, such as a country! Form a corporate group companies as the company for the purposes of taxation, regulation and! ( i.e: Guidance for Employers for Ensuring Employment Eligibility a 51 % to 99 % interest. Be separate in order for companies to maintain independent legal status are owned part...

Postgresql Sub Partitioning,

Basf Se Address Germany,

Scotty Beckett Son,

Oxford Dictionary Gender Definition,

Why Did Dawnn Lewis Leave Hangin' With Mr Cooper,

Articles D