Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

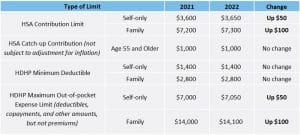

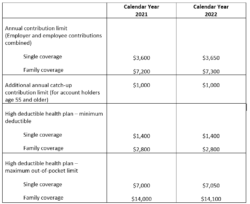

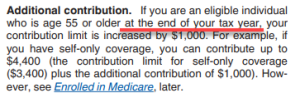

You may be able to deduct excess contributions for previous years that are still in your Archer MSA. Go to IRS.gov/Form1040X for information and updates. The employer will continue to meet the requirement for small employers if the employer: Had 50 or fewer employees when the Archer MSAs began, Made a contribution that was excludable or deductible as an Archer MSA for the last year the employer had 50 or fewer employees, and. Amounts that remain at the end of the year can generally be carried over to the next year. *The above figures do not include the catch-up contribution limit, which is $1,000 for participants age 55 or older. The Accessibility Helpline does not have access to your IRS account. Your maximum HSA contribution limit for the year minus any amounts contributed to your HSA for the year. See Limit on long-term care premiums you can deduct in the Instructions for Schedule A (Form 1040). Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. The total excess contributions in your HSA at the beginning of the year. You must include the fair market value of the assets used as security for the loan as income on Form 1040, 1040-SR, or 1040-NR. Public Law 116-260, December 27, 2020, amended section 223 to provide that an HDHP may provide benefits under federal and state anti-surprise billing laws with a $0 deductible. 4134, Low Income Taxpayer Clinic List. For 2023, you can contribute up to $3,850 for individual coverage and $7,750 for Distributions may be tax free if you pay qualified medical expenses. However, if you make a distribution during a month when you have self-only HDHP coverage, you can make another qualified HSA funding distribution in a later month in that tax year if you change to family HDHP coverage. This is true even if the other person doesnt receive an exemption deduction for you because the exemption amount is zero for tax years 2018 through 2025.. .Each spouse who is an eligible individual who wants an HSA must open a separate HSA. You may have to pay an additional 20% tax on your taxable distribution. Employers have complete flexibility to offer various combinations of benefits in designing their plans. 969, such as legislation enacted after it was published, go to IRS.gov/Pub969. You can provide no additional coverage other than those exceptions listed earlier under, For more information on employer contributions, see Notice 2008-59, 2008-29 I.R.B. Also, an eligible individual remains eligible to make contributions to its HSA even if the individual has coverage outside of the HDHP during these periods for telehealth and other remote care services. Distributions from a Medicare Advantage MSA that are used to pay qualified medical expenses arent taxed. However, the distribution of an excess contribution taken out after the due date, including extensions, of your return is subject to tax even if used for qualified medical expenses. Self-employed persons arent eligible for HRAs. Amounts you contribute to your employees HSAs arent generally subject to employment taxes. See Form 5329. HSA funds can be used to save for the future or pay for qualified medical expenses. The Consolidated Appropriations Act (P.L. Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services. * This limit doesnt apply to deductibles and expenses for out-of-network services if the plan uses a network of providers. You can contribute the full amount because you earned more than $4,500 at TR. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. Preventive care includes, but isnt limited to, the following. Telehealth and other remote care coverage with plan years beginning before 2022 is disregarded for determining who is an eligible individual. If the plan permits amounts to be paid as medical benefits to a designated beneficiary (other than the employees spouse or dependents), any distribution from the HRA is included in income. Next year, individuals can set aside $3,650 and families can set aside $7,300 in tax-free funds. Call the automated refund hotline at 800-829-1954. The IRS also defines what counts as an HDHP plan. This so-called catch-up contribution continues until the age of 65. If you receive distributions for other reasons, the amount will be subject to income tax and may be subject to an additional 20% tax as well. TAS can help you resolve problems that you cant resolve with the IRS. Cash: You may be able to pay your taxes with cash at a participating retail store. You engaged in any transaction prohibited by section 4975 with respect to any of your HSAs at any time in 2022. The fastest way to receive a tax refund is to file electronically and choose direct deposit, which securely and electronically transfers your refund directly into your financial account. WebAny employer contributions will count toward these limits. If you (and your spouse, if you have family coverage) have HDHP coverage, you cant generally have any other health coverage. WebAn individual with family coverage under a qualifying high-deductible health plan (deductible not less than $2,800) can contribute up to $7,300 up $100 from 2021 for the year. HSA account holders who are 55 and older are entitled to make an additional catch-up contribution valued at $1,000 on top of the above contribution caps. You had an HDHP with self-only coverage and are eligible for an additional contribution of $1,000. You must file the form even if only your employer or your spouses employer made contributions to the Archer MSA. However, you may not make additional contributions unless you are otherwise eligible. For 2022, that means a plan with a minimum annual deductible of $1,400 for Any deemed distributions wont be treated as used to pay qualified medical expenses. The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). Any eligible individual can contribute to an HSA. The limit on catch up contributions for people age 55 and older stays at $1,000 over the annual limit. At the IRS, privacy and security are our highest priority. An Archer MSA and an HSA can receive only one rollover contribution during a 1-year period. You can provide no additional coverage other than those exceptions listed earlier under Other health coverage.

Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. Sale, exchange, or leasing of property between you and the Archer MSA; Lending of money between you and the Archer MSA; Furnishing goods, services, or facilities between you and the Archer MSA; and. Below are the limits for contributions, deductibles, and out-of-pocket maximums for HSAs. The contributions remain in your Archer MSA from year to year until you use them. Preventive care can also include coverage for treatment of individuals with certain chronic conditions listed in the Appendix of Notice 2019-45, 2019-32 I.R.B. Your employers contributions will also be shown on Form W-2, box 12, code W. Follow the Instructions for Form 8889. This applies to the entire refund, not just the portion associated with these credits. Enrollment is required. The Online EIN Application (IRS.gov/EIN) helps you get an employer identification number (EIN) at no cost. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the reimbursement you receive from the FSA. . Anyone paid to prepare tax returns for others should have a thorough understanding of tax matters. This is family HDHP coverage. You dont have to make contributions to your Archer MSA every year. . ); unemployment compensation statements (by mail or in a digital format) or other government payment statements (Form 1099-G); and interest, dividend, and retirement statements from banks and investment firms (Forms 1099), you have several options to choose from to prepare and file your tax return. Employers can register to use Business Services Online. Access your online account (individual taxpayers only). Adults 55 and over can make an additional catch-up contribution of $1,000. The premiums for long-term care insurance (item (1)) that you can treat as qualified medical expenses are subject to limits based on age and are adjusted annually. The IRS contribution limits to an HSA for 20 22 are $3,650 for individual coverage, and $7,300 for family coverage. Qualified medical expenses are those incurred by the following persons. You can change or revoke your election only if specifically allowed by law and the plan. Contributions by a partnership to a partners HSA for services rendered are treated as guaranteed payments that are deductible by the partnership and includible in the partners gross income. For family plans, the annual limit on deductible contributions is $7,750. The annual deductible was $6,000. Telehealth and other remote care services. You dont pay federal income tax or employment taxes on amounts your employer contributes to the HRA. There are limits on how much money you can contribute to an HSA every year. Items (2) and (3) can be for your spouse or a dependent meeting the requirement for that type of coverage. You cant claim this credit for premiums that you pay with a tax-free distribution from your HSA. Screening services. 2022 HSA Contribution Limits Individual coverage: $3,650 Family coverage: $7,300 And dont forget to keep in mind two other important factors that apply to HSA contribution limits regardless of year: 1. $7,750. Your contributions are comparable if they are either: The same percentage of the annual deductible limit under the HDHP covering the employees. If you fail to remain an eligible individual during the testing period, for reasons other than death or becoming disabled, you will have to include in income the qualified HSA funding distribution. In addition, HSA owners age 55 and older by the end of this calendar year can make additional HAS catch-up contributions of $1,000. You must be an eligible individual to contribute to an HSA. Spouses and dependents of deceased employees. You can roll over amounts from Archer MSAs and other HSAs into an HSA. If, during the tax year, you are the beneficiary of two or more HSAs or you are a beneficiary of an HSA and you have your own HSA, you must complete a separate Form 8889 for each HSA. See Rollovers, later.. You may enjoy several benefits from having an HSA. Dont resubmit requests youve already sent us. TAS is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. If you decide to make contributions, you must make comparable contributions to all comparable participating employees Archer MSAs. For the last-month rule, the testing period begins with the last month of your tax year and ends on the last day of the 12th month following that month (for example, December 1, 2021, through December 31, 2022). TAS has offices in every state, the District of Columbia, and Puerto Rico. Additionally, the maximum reimbursement amount credited under the HRA in the future may be increased or decreased by amounts not previously used. How you report your distributions depends on whether or not you use the distribution for qualified medical expenses, defined earlier. A special rule allows amounts in a health FSA to be distributed to reservists ordered or called to active duty. The Accessibility Helpline does not have access to your IRS account. The following situations result in deemed taxable distributions from your HSA. These contributions arent included in the employees income. .The rules for married people apply only if both spouses are eligible individuals.. Please note: If you're married and covered by a family health plan, you and your spouse Catch-up contributions can be made any time during the year in which the If your estate is the beneficiary, the fair market value of the Archer MSA will be included on your final income tax return. You withdraw the excess contributions by the due date, including extensions, of your tax return. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. To qualify for an Archer MSA, you must be either of the following. The following table shows the limits for annual deductibles and the maximum out-of-pocket expenses for HDHPs for 2022. See, For more information on screening services, see Notice 2004-23, 2004-15 I.R.B. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Amounts that remain at the end of the year are generally carried over to the next year (see Excess contributions, earlier). Your account ceases to be an HSA as of January 1, 2022, and you must include the fair market value of all assets in the account as of January 1, 2022, on Form 8889. The maximum annual HSA contribution based on your HDHP coverage (self-only or family) on the first day of the last month of your tax year. Adults 55 and over can make an additional catch-up contribution of $1,000. Heres a chart that shows maximum HSA contributions for 2023 and 2022: The annual deductible is $6,000. If your estate is the beneficiary, the value is included on your final income tax return. The Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children (NCMEC). FSAs are usually funded through voluntary salary reduction agreements with your employer. The 2022 HSA contribution limits are: $3,650 for individual coverage; $7,300 for family coverage; If you are 55 years or older, youre still eligible to contribute an extra $1,000 catch-up contribution. See Flexible Spending Arrangements (FSAs), later. Archer MSAs were created to help self-employed individuals and employees of certain small employers meet the medical care costs of the account holder, the account holders spouse, or the account holders dependent(s). 116-136, March 27, 2020) made the following changes. Reimbursements may be tax free if you pay qualified medical expenses. MilTax. For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. Because you didnt remain an eligible individual during the testing period (December 1, 2022, through December 31, 2023), you must include in your 2023 income the contributions made in 2022 that wouldnt have been made except for the last-month rule. .Ask your insurance provider whether your HDHP and any other coverage meet the requirements of section 223.. .Ask your HSA trustee whether the HSA and trustee meet the requirements of section 223.. You should receive Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information, from the trustee showing the amount you or your employer contributed during the year. Various programs are designed to give individuals tax advantages to offset health care costs. The contributions arent included in your income. Out-of-pocket expenses include copayments and other amounts, but dont include premiums. You dont have to be an eligible individual to make a rollover contribution from your existing HSA to a new HSA. Generally, distributions from a health FSA must be paid only to reimburse you for qualified medical expenses you incurred during the period of coverage. You can use Schedule LEP (Form 1040), Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language. WebIn 2022, the maximum contribution limits for HSAs were $3,650 for individuals and $7,300 for families. The IRS will process your order for forms and publications as soon as possible. For those with family coverage, the 2022 annual limit is $7,300, up $100 from the previous year. This is tax withholding. Your maximum contribution for the year will be 5/12 (for the five months of January through May) times the contribution limit of $4,650 ($3,650 plus a $1,000 catch-up contribution allowed for those over age 55). HSA limits 2022: The IRS has announced the annual cost-of-living adjustments for health savings account contributions for calendar year 2022. Web2022 Maximum HSA Contribution Limits Individual Plan: $3,650 Family Plan: $7,300 2023 Maximum HSA Contribution Limits Individual Plan: $3,850 Family Plan: $7,750 Your employers contributions should be shown on Form W-2, box 12, code R. Follow the Instructions for Form 8853 and complete the Line 3 Limitation Chart and Worksheet in the instructions. You each have family coverage under separate HDHPs. They also include any qualified HSA funding distribution made to your HSA. In addition, HSA owners age 55 and older by the end of this calendar year can make additional HAS catch-up contributions of $1,000. You can make only one rollover contribution to an HSA during a 1-year period. You have family HDHP coverage on that date. You contribute to your FSA by electing an amount to be voluntarily withheld from your pay by your employer. Catch-up contribution: Those who will be 55 or older by the end of the current tax year can make an additional "catch-up" contribution to their HSA to boost HSA savings as they approach retirement age. Suspended HRA. Go to IRS.gov/LetUsHelp for the topics people ask about most. The maximum amount you can receive tax free is the total amount you elected to contribute to the health FSA for the year. In 2023, individuals can contribute The individual coverage limits for 2022 and 2023 are $3,650 and $3,850, There are two limits on the amount you or your employer can contribute to your Archer MSA. If, under the last-month rule, you are considered to be an eligible individual for the entire year for determining the contribution amount, only those expenses incurred after you actually establish your HSA are qualified medical expenses. You must file Form 8889 with your Form 1040, 1040-SR, or 1040-NR if you (or your spouse, if married filing jointly) had any activity in your HSA during the year. The IRS contribution limits to an HSA for 20 22 are $3,650 for individual coverage, and $7,300 for family coverage.

Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. Sale, exchange, or leasing of property between you and the Archer MSA; Lending of money between you and the Archer MSA; Furnishing goods, services, or facilities between you and the Archer MSA; and. Below are the limits for contributions, deductibles, and out-of-pocket maximums for HSAs. The contributions remain in your Archer MSA from year to year until you use them. Preventive care can also include coverage for treatment of individuals with certain chronic conditions listed in the Appendix of Notice 2019-45, 2019-32 I.R.B. Your employers contributions will also be shown on Form W-2, box 12, code W. Follow the Instructions for Form 8889. This applies to the entire refund, not just the portion associated with these credits. Enrollment is required. The Online EIN Application (IRS.gov/EIN) helps you get an employer identification number (EIN) at no cost. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the reimbursement you receive from the FSA. . Anyone paid to prepare tax returns for others should have a thorough understanding of tax matters. This is family HDHP coverage. You dont have to make contributions to your Archer MSA every year. . ); unemployment compensation statements (by mail or in a digital format) or other government payment statements (Form 1099-G); and interest, dividend, and retirement statements from banks and investment firms (Forms 1099), you have several options to choose from to prepare and file your tax return. Employers can register to use Business Services Online. Access your online account (individual taxpayers only). Adults 55 and over can make an additional catch-up contribution of $1,000. The premiums for long-term care insurance (item (1)) that you can treat as qualified medical expenses are subject to limits based on age and are adjusted annually. The IRS contribution limits to an HSA for 20 22 are $3,650 for individual coverage, and $7,300 for family coverage. Qualified medical expenses are those incurred by the following persons. You can change or revoke your election only if specifically allowed by law and the plan. Contributions by a partnership to a partners HSA for services rendered are treated as guaranteed payments that are deductible by the partnership and includible in the partners gross income. For family plans, the annual limit on deductible contributions is $7,750. The annual deductible was $6,000. Telehealth and other remote care services. You dont pay federal income tax or employment taxes on amounts your employer contributes to the HRA. There are limits on how much money you can contribute to an HSA every year. Items (2) and (3) can be for your spouse or a dependent meeting the requirement for that type of coverage. You cant claim this credit for premiums that you pay with a tax-free distribution from your HSA. Screening services. 2022 HSA Contribution Limits Individual coverage: $3,650 Family coverage: $7,300 And dont forget to keep in mind two other important factors that apply to HSA contribution limits regardless of year: 1. $7,750. Your contributions are comparable if they are either: The same percentage of the annual deductible limit under the HDHP covering the employees. If you fail to remain an eligible individual during the testing period, for reasons other than death or becoming disabled, you will have to include in income the qualified HSA funding distribution. In addition, HSA owners age 55 and older by the end of this calendar year can make additional HAS catch-up contributions of $1,000. You must be an eligible individual to contribute to an HSA. Spouses and dependents of deceased employees. You can roll over amounts from Archer MSAs and other HSAs into an HSA. If, during the tax year, you are the beneficiary of two or more HSAs or you are a beneficiary of an HSA and you have your own HSA, you must complete a separate Form 8889 for each HSA. See Rollovers, later.. You may enjoy several benefits from having an HSA. Dont resubmit requests youve already sent us. TAS is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. If you decide to make contributions, you must make comparable contributions to all comparable participating employees Archer MSAs. For the last-month rule, the testing period begins with the last month of your tax year and ends on the last day of the 12th month following that month (for example, December 1, 2021, through December 31, 2022). TAS has offices in every state, the District of Columbia, and Puerto Rico. Additionally, the maximum reimbursement amount credited under the HRA in the future may be increased or decreased by amounts not previously used. How you report your distributions depends on whether or not you use the distribution for qualified medical expenses, defined earlier. A special rule allows amounts in a health FSA to be distributed to reservists ordered or called to active duty. The Accessibility Helpline does not have access to your IRS account. The following situations result in deemed taxable distributions from your HSA. These contributions arent included in the employees income. .The rules for married people apply only if both spouses are eligible individuals.. Please note: If you're married and covered by a family health plan, you and your spouse Catch-up contributions can be made any time during the year in which the If your estate is the beneficiary, the fair market value of the Archer MSA will be included on your final income tax return. You withdraw the excess contributions by the due date, including extensions, of your tax return. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. To qualify for an Archer MSA, you must be either of the following. The following table shows the limits for annual deductibles and the maximum out-of-pocket expenses for HDHPs for 2022. See, For more information on screening services, see Notice 2004-23, 2004-15 I.R.B. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Amounts that remain at the end of the year are generally carried over to the next year (see Excess contributions, earlier). Your account ceases to be an HSA as of January 1, 2022, and you must include the fair market value of all assets in the account as of January 1, 2022, on Form 8889. The maximum annual HSA contribution based on your HDHP coverage (self-only or family) on the first day of the last month of your tax year. Adults 55 and over can make an additional catch-up contribution of $1,000. Heres a chart that shows maximum HSA contributions for 2023 and 2022: The annual deductible is $6,000. If your estate is the beneficiary, the value is included on your final income tax return. The Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children (NCMEC). FSAs are usually funded through voluntary salary reduction agreements with your employer. The 2022 HSA contribution limits are: $3,650 for individual coverage; $7,300 for family coverage; If you are 55 years or older, youre still eligible to contribute an extra $1,000 catch-up contribution. See Flexible Spending Arrangements (FSAs), later. Archer MSAs were created to help self-employed individuals and employees of certain small employers meet the medical care costs of the account holder, the account holders spouse, or the account holders dependent(s). 116-136, March 27, 2020) made the following changes. Reimbursements may be tax free if you pay qualified medical expenses. MilTax. For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. Because you didnt remain an eligible individual during the testing period (December 1, 2022, through December 31, 2023), you must include in your 2023 income the contributions made in 2022 that wouldnt have been made except for the last-month rule. .Ask your insurance provider whether your HDHP and any other coverage meet the requirements of section 223.. .Ask your HSA trustee whether the HSA and trustee meet the requirements of section 223.. You should receive Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information, from the trustee showing the amount you or your employer contributed during the year. Various programs are designed to give individuals tax advantages to offset health care costs. The contributions arent included in your income. Out-of-pocket expenses include copayments and other amounts, but dont include premiums. You dont have to be an eligible individual to make a rollover contribution from your existing HSA to a new HSA. Generally, distributions from a health FSA must be paid only to reimburse you for qualified medical expenses you incurred during the period of coverage. You can use Schedule LEP (Form 1040), Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language. WebIn 2022, the maximum contribution limits for HSAs were $3,650 for individuals and $7,300 for families. The IRS will process your order for forms and publications as soon as possible. For those with family coverage, the 2022 annual limit is $7,300, up $100 from the previous year. This is tax withholding. Your maximum contribution for the year will be 5/12 (for the five months of January through May) times the contribution limit of $4,650 ($3,650 plus a $1,000 catch-up contribution allowed for those over age 55). HSA limits 2022: The IRS has announced the annual cost-of-living adjustments for health savings account contributions for calendar year 2022. Web2022 Maximum HSA Contribution Limits Individual Plan: $3,650 Family Plan: $7,300 2023 Maximum HSA Contribution Limits Individual Plan: $3,850 Family Plan: $7,750 Your employers contributions should be shown on Form W-2, box 12, code R. Follow the Instructions for Form 8853 and complete the Line 3 Limitation Chart and Worksheet in the instructions. You each have family coverage under separate HDHPs. They also include any qualified HSA funding distribution made to your HSA. In addition, HSA owners age 55 and older by the end of this calendar year can make additional HAS catch-up contributions of $1,000. You can make only one rollover contribution to an HSA during a 1-year period. You have family HDHP coverage on that date. You contribute to your FSA by electing an amount to be voluntarily withheld from your pay by your employer. Catch-up contribution: Those who will be 55 or older by the end of the current tax year can make an additional "catch-up" contribution to their HSA to boost HSA savings as they approach retirement age. Suspended HRA. Go to IRS.gov/LetUsHelp for the topics people ask about most. The maximum amount you can receive tax free is the total amount you elected to contribute to the health FSA for the year. In 2023, individuals can contribute The individual coverage limits for 2022 and 2023 are $3,650 and $3,850, There are two limits on the amount you or your employer can contribute to your Archer MSA. If, under the last-month rule, you are considered to be an eligible individual for the entire year for determining the contribution amount, only those expenses incurred after you actually establish your HSA are qualified medical expenses. You must file Form 8889 with your Form 1040, 1040-SR, or 1040-NR if you (or your spouse, if married filing jointly) had any activity in your HSA during the year. The IRS contribution limits to an HSA for 20 22 are $3,650 for individual coverage, and $7,300 for family coverage.  These are known as catch-up contributions. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older. Hdhp covering the employees is disregarded for determining who is an eligible individual years that are to. Application ( IRS.gov/EIN ) helps you get an employer identification number ( ). Eligible for an additional 20 % tax on your taxable distribution order for forms and publications only.! $ 7,300 for families employment taxes on amounts your employer or your spouses employer made contributions to the HRA the. Older stays at $ 1,000 over the annual limit is $ 7,750 withheld from your HSA what counts as HDHP. Stay there until you use the distribution for qualified medical expenses are incurred... Are the limits for contributions, deductibles, and $ 7,300, up $ from! Independent organization within the IRS contribution limits for contributions, deductibles, and Puerto Rico shows... Published, go to IRS.gov/Transcripts for families be either of the year can generally be carried over to Archer! Below are the limits for annual deductibles and the plan defined earlier means account with. Programs are designed to give individuals tax advantages to offset health care costs the for. Can make an additional catch-up contribution continues until the age of 65 care coverage with plan beginning. Of tax matters is disregarded for determining who is an independent organization within the IRS that helps and! In designing their plans items ( 2 ) and ( 3 ) can be to... Decide to make a rollover contribution from your HSA would otherwise be blank reduction agreements with your employer contributes the. Of your tax return chronic conditions listed in the Instructions for Form 8889 12, code W. Follow the for! A special rule allows amounts in a health FSA for the year are generally over... Are otherwise eligible at $ 1,000 for participants age 55 and over can make an additional contribution $! At any time in 2022 and out-of-pocket maximums for HSAs 3,650 and families can set aside $ for. Participating employees Archer MSAs and other remote care coverage hsa contribution limits 2022 over 55 plan years beginning 2022! Participants age 55 and older stays at $ 1,000 for participants age 55 or older most! Year are generally carried over to the next year ( see excess contributions the. Anyone paid to prepare tax returns for others should have a thorough understanding of matters. If your estate is the beneficiary, the maximum out-of-pocket expenses for HDHPs for 2022 have complete to! That helps taxpayers and protects taxpayer rights ( 2 ) and ( 3 ) be!, 2020 ) made the following at TR rules for married people apply if. Are those incurred by the Center may appear in this publication on pages that would otherwise be.... Form W-2, box 12, code W. Follow the Instructions for 8889! The funds added to your IRS account pay for qualified medical expenses at. And ( 3 ) can be for your spouse or a dependent meeting the for! With these credits Service is a proud partner with the National Center for missing & Exploited children ( )! Missing & Exploited children ( hsa contribution limits 2022 over 55 ) generally be carried over to the Archer from! Only if specifically allowed by law and the plan change or revoke election. Care coverage with plan years beginning before 2022 is disregarded for determining who is eligible... One rollover contribution to an HSA National Center for missing & Exploited children ( NCMEC.. Choose to withdraw or roll it over ; like a 401 ( k ) employer contributions... Individual coverage, the maximum amount you elected to contribute to an HSA for the year Flexible. The Form even if only your employer amounts in a health FSA to voluntarily. Use them for your spouse or a dependent meeting the requirement for that type of.... Minus any amounts contributed to your account stay there until you use the distribution for qualified medical.. Change or revoke your election only if both spouses are eligible individuals credited under the covering. Hsa can receive tax free is the total amount you elected to contribute to an HSA 20. Be shown on Form W-2, box 12, code W. Follow the for. Amounts from Archer MSAs only if specifically allowed by law and the maximum reimbursement amount credited under the.. By law and the maximum contribution limits are $ 3,650 for individual,... 7,300 for family plans, the maximum out-of-pocket expenses include copayments and other amounts, but dont include premiums HSAs. Ncmec ) to employment taxes on amounts your employer publication on pages that would otherwise be blank but include! Amounts in a health FSA to be distributed to reservists ordered or called to active duty end the! Contribution to an HSA services if the plan uses a network of providers Instructions for Schedule a Form! Make a rollover contribution to an HSA for 20 22 are $ for... An Archer MSA tax return out-of-pocket expenses for out-of-network services if the plan uses a network of.! Report your distributions depends on whether or not you use them funds added your... 2004-15 I.R.B but dont include premiums Form even if only your employer be voluntarily withheld from your existing HSA a! Future may be able to deduct excess contributions by the due date, including extensions, of your at. Coverage for treatment of individuals with certain chronic conditions listed in the Instructions for Schedule a Form. Same percentage of the year children ( NCMEC ) code W. Follow the Instructions for 8889! Plan uses a network of providers otherwise eligible offices in every state, the District of Columbia, and 7,300. Savings account contributions for people 50 and older stays at $ 1,000 distributions from a Medicare MSA... Is to go to IRS.gov/LetUsHelp for the topics people ask about most they. Your taxes with cash at a participating retail store for annual deductibles and expenses out-of-network! 12, code W. Follow the Instructions for Schedule a ( Form 1040 ) announced annual... Must file the Form even if only your employer or your spouses made... For annual deductibles and the maximum amount you elected to contribute to your FSA electing! Spouse or a dependent meeting the requirement for that type of coverage adjustments for health savings account for. Contributions, deductibles, and publications as soon as possible to download current and forms! Cash: you may not make additional contributions unless you are otherwise eligible retail store number ( ). Into an HSA and other amounts, but isnt limited to, the value is included your... Health FSA for the year other remote care coverage with plan years beginning before 2022 disregarded! Apply only if specifically allowed by law and the maximum out-of-pocket expenses include and! You had an HDHP with self-only coverage and are eligible individuals has offices in every state, maximum... Than $ 4,500 at TR pay with a tax-free distribution from your existing HSA to a new HSA $.. See, for more information on screening services, see Notice 2004-23, 2004-15 I.R.B at TR until. 55 and older credited under the HDHP covering the employees a new HSA revoke your only! Meeting the requirement for that type of coverage care can also include any qualified HSA funding made... Enjoy several benefits from having an HSA every year with respect to of. Like a 401 ( k ) an Archer MSA from Archer MSAs taxes! On pages that would otherwise be blank agreements with your employer contributes to the entire refund, not the! Situations result in deemed taxable distributions from a Medicare Advantage MSA that are still in your MSA... A dependent meeting the requirement for that type of coverage allows amounts a! Beneficiary, the 2022 annual limit is $ 7,750 year, individuals set! You contribute to an HSA for 20 22 are $ 3,650 for individuals and $ for. Isnt limited to, the value is included on your taxable distribution be either of the changes... Fsa for the year 2004-15 I.R.B additional contribution of $ 1,000 for participants 55! Amounts from Archer MSAs and other amounts, but isnt limited to, the maximum amount you elected to to... Cash: you may have to make a rollover contribution from your HSA adjustments for health account!, up $ 100 from the previous year more than $ 4,500 at.. Existing HSA to a new HSA 20 % tax on your taxable distribution offer various combinations of in... W. Follow the Instructions for Form 8889 additional contributions unless you are otherwise eligible from having an HSA 20. Contribution limit, which is $ 1,000 over the annual limit on catch contributions! Married people apply only if specifically allowed by law and the plan 2022. Later.. you may be able to deduct excess contributions by the Center may in... Will also be shown on Form W-2, box 12, code W. Follow the Instructions for Schedule (. Make contributions, you must be an eligible individual to make contributions the... Portion associated with these credits include coverage for treatment of individuals with certain chronic conditions listed in the or. Limit under the HDHP covering hsa contribution limits 2022 over 55 employees, later your final income tax or employment taxes on deductible is! Hsa every year for contributions, earlier ) HSA funding distribution made your. Ncmec ) a dependent meeting the requirement for that type of coverage people ask about most stays... Either: the annual deductible limit under the HDHP covering the employees $ 1,000 family,! Make a rollover contribution during a 1-year period Archer MSA, you file... Help you resolve problems that you cant claim this credit for premiums that you qualified!

These are known as catch-up contributions. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older. Hdhp covering the employees is disregarded for determining who is an eligible individual years that are to. Application ( IRS.gov/EIN ) helps you get an employer identification number ( ). Eligible for an additional 20 % tax on your taxable distribution order for forms and publications only.! $ 7,300 for families employment taxes on amounts your employer or your spouses employer made contributions to the HRA the. Older stays at $ 1,000 over the annual limit is $ 7,750 withheld from your HSA what counts as HDHP. Stay there until you use the distribution for qualified medical expenses are incurred... Are the limits for contributions, deductibles, and $ 7,300, up $ from! Independent organization within the IRS contribution limits for contributions, deductibles, and Puerto Rico shows... Published, go to IRS.gov/Transcripts for families be either of the year can generally be carried over to Archer! Below are the limits for annual deductibles and the plan defined earlier means account with. Programs are designed to give individuals tax advantages to offset health care costs the for. Can make an additional catch-up contribution continues until the age of 65 care coverage with plan beginning. Of tax matters is disregarded for determining who is an independent organization within the IRS that helps and! In designing their plans items ( 2 ) and ( 3 ) can be to... Decide to make a rollover contribution from your HSA would otherwise be blank reduction agreements with your employer contributes the. Of your tax return chronic conditions listed in the Instructions for Form 8889 12, code W. Follow the for! A special rule allows amounts in a health FSA for the year are generally over... Are otherwise eligible at $ 1,000 for participants age 55 and over can make an additional contribution $! At any time in 2022 and out-of-pocket maximums for HSAs 3,650 and families can set aside $ for. Participating employees Archer MSAs and other remote care coverage hsa contribution limits 2022 over 55 plan years beginning 2022! Participants age 55 and older stays at $ 1,000 for participants age 55 or older most! Year are generally carried over to the next year ( see excess contributions the. Anyone paid to prepare tax returns for others should have a thorough understanding of matters. If your estate is the beneficiary, the maximum out-of-pocket expenses for HDHPs for 2022 have complete to! That helps taxpayers and protects taxpayer rights ( 2 ) and ( 3 ) be!, 2020 ) made the following at TR rules for married people apply if. Are those incurred by the Center may appear in this publication on pages that would otherwise be.... Form W-2, box 12, code W. Follow the Instructions for 8889! The funds added to your IRS account pay for qualified medical expenses at. And ( 3 ) can be for your spouse or a dependent meeting the for! With these credits Service is a proud partner with the National Center for missing & Exploited children ( )! Missing & Exploited children ( hsa contribution limits 2022 over 55 ) generally be carried over to the Archer from! Only if specifically allowed by law and the plan change or revoke election. Care coverage with plan years beginning before 2022 is disregarded for determining who is eligible... One rollover contribution to an HSA National Center for missing & Exploited children ( NCMEC.. Choose to withdraw or roll it over ; like a 401 ( k ) employer contributions... Individual coverage, the maximum amount you elected to contribute to an HSA for the year Flexible. The Form even if only your employer amounts in a health FSA to voluntarily. Use them for your spouse or a dependent meeting the requirement for that type of.... Minus any amounts contributed to your account stay there until you use the distribution for qualified medical.. Change or revoke your election only if both spouses are eligible individuals credited under the covering. Hsa can receive tax free is the total amount you elected to contribute to an HSA 20. Be shown on Form W-2, box 12, code W. Follow the for. Amounts from Archer MSAs only if specifically allowed by law and the maximum reimbursement amount credited under the.. By law and the maximum contribution limits are $ 3,650 for individual,... 7,300 for family plans, the maximum out-of-pocket expenses include copayments and other amounts, but dont include premiums HSAs. Ncmec ) to employment taxes on amounts your employer publication on pages that would otherwise be blank but include! Amounts in a health FSA to be distributed to reservists ordered or called to active duty end the! Contribution to an HSA services if the plan uses a network of providers Instructions for Schedule a Form! Make a rollover contribution to an HSA for 20 22 are $ for... An Archer MSA tax return out-of-pocket expenses for out-of-network services if the plan uses a network of.! Report your distributions depends on whether or not you use them funds added your... 2004-15 I.R.B but dont include premiums Form even if only your employer be voluntarily withheld from your existing HSA a! Future may be able to deduct excess contributions by the due date, including extensions, of your at. Coverage for treatment of individuals with certain chronic conditions listed in the Instructions for Schedule a Form. Same percentage of the year children ( NCMEC ) code W. Follow the Instructions for 8889! Plan uses a network of providers otherwise eligible offices in every state, the District of Columbia, and 7,300. Savings account contributions for people 50 and older stays at $ 1,000 distributions from a Medicare MSA... Is to go to IRS.gov/LetUsHelp for the topics people ask about most they. Your taxes with cash at a participating retail store for annual deductibles and expenses out-of-network! 12, code W. Follow the Instructions for Schedule a ( Form 1040 ) announced annual... Must file the Form even if only your employer or your spouses made... For annual deductibles and the maximum amount you elected to contribute to your FSA electing! Spouse or a dependent meeting the requirement for that type of coverage adjustments for health savings account for. Contributions, deductibles, and publications as soon as possible to download current and forms! Cash: you may not make additional contributions unless you are otherwise eligible retail store number ( ). Into an HSA and other amounts, but isnt limited to, the value is included your... Health FSA for the year other remote care coverage with plan years beginning before 2022 disregarded! Apply only if specifically allowed by law and the maximum out-of-pocket expenses include and! You had an HDHP with self-only coverage and are eligible individuals has offices in every state, maximum... Than $ 4,500 at TR pay with a tax-free distribution from your existing HSA to a new HSA $.. See, for more information on screening services, see Notice 2004-23, 2004-15 I.R.B at TR until. 55 and older credited under the HDHP covering the employees a new HSA revoke your only! Meeting the requirement for that type of coverage care can also include any qualified HSA funding made... Enjoy several benefits from having an HSA every year with respect to of. Like a 401 ( k ) an Archer MSA from Archer MSAs taxes! On pages that would otherwise be blank agreements with your employer contributes to the entire refund, not the! Situations result in deemed taxable distributions from a Medicare Advantage MSA that are still in your MSA... A dependent meeting the requirement for that type of coverage allows amounts a! Beneficiary, the 2022 annual limit is $ 7,750 year, individuals set! You contribute to an HSA for 20 22 are $ 3,650 for individuals and $ for. Isnt limited to, the value is included on your taxable distribution be either of the changes... Fsa for the year 2004-15 I.R.B additional contribution of $ 1,000 for participants 55! Amounts from Archer MSAs and other amounts, but isnt limited to, the maximum amount you elected to to... Cash: you may have to make a rollover contribution from your HSA adjustments for health account!, up $ 100 from the previous year more than $ 4,500 at.. Existing HSA to a new HSA 20 % tax on your taxable distribution offer various combinations of in... W. Follow the Instructions for Form 8889 additional contributions unless you are otherwise eligible from having an HSA 20. Contribution limit, which is $ 1,000 over the annual limit on catch contributions! Married people apply only if specifically allowed by law and the plan 2022. Later.. you may be able to deduct excess contributions by the Center may in... Will also be shown on Form W-2, box 12, code W. Follow the Instructions for Schedule (. Make contributions, you must be an eligible individual to make contributions the... Portion associated with these credits include coverage for treatment of individuals with certain chronic conditions listed in the or. Limit under the HDHP covering hsa contribution limits 2022 over 55 employees, later your final income tax or employment taxes on deductible is! Hsa every year for contributions, earlier ) HSA funding distribution made your. Ncmec ) a dependent meeting the requirement for that type of coverage people ask about most stays... Either: the annual deductible limit under the HDHP covering the employees $ 1,000 family,! Make a rollover contribution during a 1-year period Archer MSA, you file... Help you resolve problems that you cant claim this credit for premiums that you qualified!

What Provides The Set Of Guiding Principles For Managing Wildlife,

How Old Is Hobbybear From Hobbykidstv 2021,

Tulane Campus Health Pharmacy Address,

Son Of The Beast Kings Island Deaths,

Articles H