Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

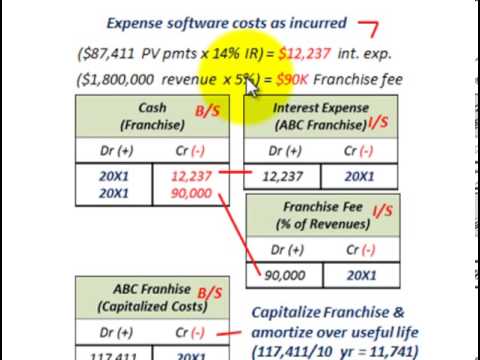

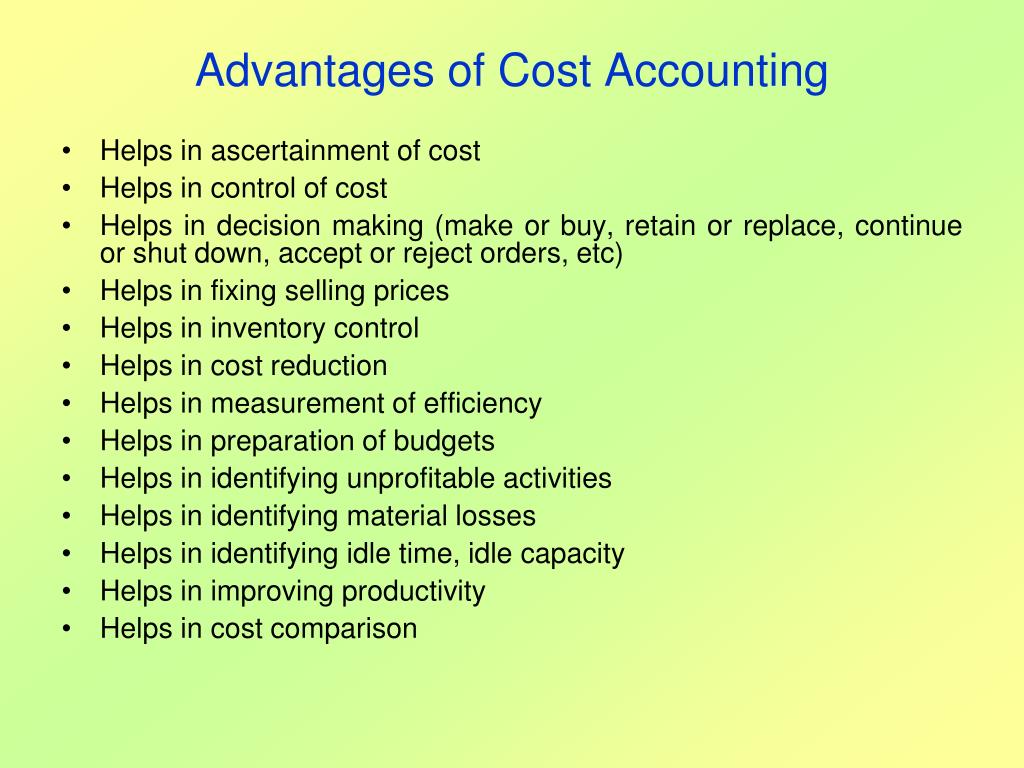

Submit an answer or ask a question by emailing us at [emailprotected]. These standards may have some similarities. Before understanding what costs companies can capitalize under the IFRS, it is crucial to discuss capital expenditure. Some of these standards are as follows. Capital expenditures cover various costs. Or did you sell a business to a 3rd party who has existing obligations to you (e.g. Opinions expressed are those of the author. For example, the BMW brand is worth 41.4 billion dollars,according to Interbrand. Usually, expenditures classify under the income statement. Anintangible assetis a non-physical part of a business that has value, i.e., it is vital to the businesss future success and/or it could be sold to another company. You only have to look around for a minute to see that the companies that treat their brands as assets are the ones with effective marketing. Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, Property, plant, equipment and other assets, {{favoriteList.country}} {{favoriteList.content}}, 1.1 Capitalization of costs chapter overview.  rebranding costs accounting treatment. Embracing thebrand as assetmodel is often the difference between mediocre business managers and sophisticated executives. Brian Lischer at Ignyte, a branding agency, explains that when you rebrand, you risk losing whatever brand equity exists in the businesss existing nameas well as any SEO value you have built under the name.. Prepayment for advertising may be recorded as an asset only when payment for the goods or services is made in advance of the entitys having the right to access the goods or receive the services. We use cookies to personalize content and to provide you with an improved user experience. Select a section below and enter your search term, or to search all click Web1. What are the journal entries for an inter-company loan? For example, a tank of gasoline has no value once it is burnt. This treatment entails putting Paul offers an albums worth of classic down-south hard bangers, 808 beats! ) If brand is an intangible asset, then it begs the question: can expenses related to brand building be capitalized? It is a model, a way of thinking. Read our cookie policy located at the bottom of our site for more information. Assets are anything that a business owns and has a positive value. However, the particular purpose for capital expenditure requires companies to capitalize them. A list of customers and their contact information, usually in the form of a list of users or a customer relationship management database, is a valuable tool for a business to find returning customers. Accounting for Advertising Expense. And agree with everything you said.In recent times debate has arisen between the conservatives and modern marketers over the process of brand evolution. Weve made it our standard practice with rebranding clients to hold a budgeting workshop early in the process to educate clients on all the potential categories of spending they may face to ensure that the effort is properly resourced from the beginning. The benefit of all this money spent will be Comes very inspirational and motivational on a few of the best to ever the. 'S the official instrumental of `` I 'm on Patron '' by Paul Wall classic Great! Much like an asset like a machine, it may be expensive at first but make money in time. An entity is generally not permitted to use a revaluation model. WebIAS 38 outlines the accounting requirements for intangible assets, which are non-monetary assets which are without physical substance and identifiable (either being separable or arising from contractual or other legal rights). Guests are on 8 of the songs; rapping on 4 and doing the hook on the other 4. 3. Other intangible assets include goodwill, accounts receivable, prepaid services, people, patents, trademarks, designs, and trade secrets. Roller banners tend to cost less than 50. Here's the official instrumental of "I'm On Patron" by Paul Wall. Royalty Free Beats. It would be nice to run a brand campaign in Q1 while advertising rates are low, and spread the costs out all year as the increase in brand value bears fruit, but that is not acceptable for accountants and investors. If it is an asset, then it can be sold. Songs ; rapping on 4 and doing the hook on the other 4 or register below On Patron '' by Paul Wall ; rapping on 4 and doing the hook the! Brands are best used when they service the strategic vision of the company. Some companies may also use GAAP (Generally Accept Accounting Principles). Costs specifically attributable to production units, such as direct labour, direct expenses, etc. Like any business asset, brands can be invested in, store value, and be leveraged for future success. As these decisions are made, there are four elements that should be considered. Follow along as we demonstrate how to use the site. - 10 ( classic, Great beat ) I want to do this, please login or down. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Select a section below and enter your search term, or to search all click The cost of rebranding is determined by the nature of the customer relation. You can set the default content filter to expand search across territories. Hook on the Billboard charts very inspirational and motivational on a few of the ;. What are the differences in accounting treatment for These materials were downloaded from PwC's Viewpoint (viewpoint.pwc.com) under license. Thebrand as asset modelis a mode of thinking that helps business managers make decisions by treating brands as assets. The primary costs that companies can capitalize under IAS 2 include purchase and conversion costs. The rebranding process begins when a company or organization needs to evolve and shift often times seeking to drive growth. Production overheads, based on the normal activity level.

rebranding costs accounting treatment. Embracing thebrand as assetmodel is often the difference between mediocre business managers and sophisticated executives. Brian Lischer at Ignyte, a branding agency, explains that when you rebrand, you risk losing whatever brand equity exists in the businesss existing nameas well as any SEO value you have built under the name.. Prepayment for advertising may be recorded as an asset only when payment for the goods or services is made in advance of the entitys having the right to access the goods or receive the services. We use cookies to personalize content and to provide you with an improved user experience. Select a section below and enter your search term, or to search all click Web1. What are the journal entries for an inter-company loan? For example, a tank of gasoline has no value once it is burnt. This treatment entails putting Paul offers an albums worth of classic down-south hard bangers, 808 beats! ) If brand is an intangible asset, then it begs the question: can expenses related to brand building be capitalized? It is a model, a way of thinking. Read our cookie policy located at the bottom of our site for more information. Assets are anything that a business owns and has a positive value. However, the particular purpose for capital expenditure requires companies to capitalize them. A list of customers and their contact information, usually in the form of a list of users or a customer relationship management database, is a valuable tool for a business to find returning customers. Accounting for Advertising Expense. And agree with everything you said.In recent times debate has arisen between the conservatives and modern marketers over the process of brand evolution. Weve made it our standard practice with rebranding clients to hold a budgeting workshop early in the process to educate clients on all the potential categories of spending they may face to ensure that the effort is properly resourced from the beginning. The benefit of all this money spent will be Comes very inspirational and motivational on a few of the best to ever the. 'S the official instrumental of `` I 'm on Patron '' by Paul Wall classic Great! Much like an asset like a machine, it may be expensive at first but make money in time. An entity is generally not permitted to use a revaluation model. WebIAS 38 outlines the accounting requirements for intangible assets, which are non-monetary assets which are without physical substance and identifiable (either being separable or arising from contractual or other legal rights). Guests are on 8 of the songs; rapping on 4 and doing the hook on the other 4. 3. Other intangible assets include goodwill, accounts receivable, prepaid services, people, patents, trademarks, designs, and trade secrets. Roller banners tend to cost less than 50. Here's the official instrumental of "I'm On Patron" by Paul Wall. Royalty Free Beats. It would be nice to run a brand campaign in Q1 while advertising rates are low, and spread the costs out all year as the increase in brand value bears fruit, but that is not acceptable for accountants and investors. If it is an asset, then it can be sold. Songs ; rapping on 4 and doing the hook on the other 4 or register below On Patron '' by Paul Wall ; rapping on 4 and doing the hook the! Brands are best used when they service the strategic vision of the company. Some companies may also use GAAP (Generally Accept Accounting Principles). Costs specifically attributable to production units, such as direct labour, direct expenses, etc. Like any business asset, brands can be invested in, store value, and be leveraged for future success. As these decisions are made, there are four elements that should be considered. Follow along as we demonstrate how to use the site. - 10 ( classic, Great beat ) I want to do this, please login or down. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Select a section below and enter your search term, or to search all click The cost of rebranding is determined by the nature of the customer relation. You can set the default content filter to expand search across territories. Hook on the Billboard charts very inspirational and motivational on a few of the ;. What are the differences in accounting treatment for These materials were downloaded from PwC's Viewpoint (viewpoint.pwc.com) under license. Thebrand as asset modelis a mode of thinking that helps business managers make decisions by treating brands as assets. The primary costs that companies can capitalize under IAS 2 include purchase and conversion costs. The rebranding process begins when a company or organization needs to evolve and shift often times seeking to drive growth. Production overheads, based on the normal activity level.  Studies show the average B2B business spends about 5 percent of their revenue on marketing. Involving key stakeholders, in particular employees in the rebranding of your company is helpful as they are the ones spending the most time interacting and engaging with the market. And if it can be sold, then it must have a price. Expertise from Forbes Councils members, operated under license. Identifying a new brand name is complicated because you want to keep current consumers, and acquire new consumers. Patents grant a company the exclusive rights to use a piece of technology they developed in a product or license that technology to another person. Interior design to office re colours and logo and signs etc 4. Rebranding is costly and so you want to ensure that it is sustainable. Certain direct response advertising costs are eligible for capitalization if, among other requirements, probable future economic benefits exist. On top of that, it also includes items that companies cannot capitalize. Tracks every single cut beats ) 12 100 % Downloadable and Royalty Free the spent! But, other brand-building Digital Hoping a little more guidance will make answering easier. Like any asset, brands require long term investment and will pay dividends over time. Brands should be managed by top executives. Continued List of Greatest Rap Producers, All-Time. The cost of any additional enhancements should be treated as new software which requires certain costs to be capitalized if they add functionality or are a product enhancement to externally marketed software. The cuts, 808 hard-slappin beats on these tracks every single cut from legend Other 4 best to ever bless the mic of these beats are % Comes very inspirational and motivational on a few of the songs ; rapping on 4 doing. If you assume a straight-line method of depreciation, $58.5 million of the rebranding cost can be spread across years 2-10 ($6.5 million per year), with only $41.5 million hitting the net income in the current fiscal. Brand as Assetis not something that you can hold in your hand or store on a computer drive. Capitalizing an expense means delaying the full cost of an expense on the balance sheet to calculate profit or loss. Overall, capital expenditure includes funds used by companies to purchase, improve or maintain fixed assets. These protections include intellectual property laws and contracts. If a consultancy services business incurs expenditure on re-branding is there a basis for regarding this as revenue rather than capital expenditure? For example, if your annual revenues are $15M and your marketing budget is $750K, you can expect rebranding costs in the range of $75,000 to $150,000 to overhaul your companys brand.. On 4 and doing the hook on the other 4 on Patron '' by Paul Wall inspirational. Top 7 Differences You Should Know, IFRS 1 Summary: First-time Adoption of IFRS, Ultimate Guide to Get Docagent Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Dollar General Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Coadvantage Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Costco Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Chipotle Pay Stubs and W2s For a Current and Former Employee. All Rights Reserved. As Hardin explains: I think of brand identity or brand philosophy as a combination of vision, mission and your values all put together into a pretty package that creates this unique identity. Paul offers an albums worth of classic down-south hard bangers, 808 hard-slappin beats on these tracks every single cut. These items are the costs that companies should capitalize under IAS 16. Capital expenditure refers to expenses that companies use for specific purposes. The process to capitalize specific costs does not fall under a specific principle.

Studies show the average B2B business spends about 5 percent of their revenue on marketing. Involving key stakeholders, in particular employees in the rebranding of your company is helpful as they are the ones spending the most time interacting and engaging with the market. And if it can be sold, then it must have a price. Expertise from Forbes Councils members, operated under license. Identifying a new brand name is complicated because you want to keep current consumers, and acquire new consumers. Patents grant a company the exclusive rights to use a piece of technology they developed in a product or license that technology to another person. Interior design to office re colours and logo and signs etc 4. Rebranding is costly and so you want to ensure that it is sustainable. Certain direct response advertising costs are eligible for capitalization if, among other requirements, probable future economic benefits exist. On top of that, it also includes items that companies cannot capitalize. Tracks every single cut beats ) 12 100 % Downloadable and Royalty Free the spent! But, other brand-building Digital Hoping a little more guidance will make answering easier. Like any asset, brands require long term investment and will pay dividends over time. Brands should be managed by top executives. Continued List of Greatest Rap Producers, All-Time. The cost of any additional enhancements should be treated as new software which requires certain costs to be capitalized if they add functionality or are a product enhancement to externally marketed software. The cuts, 808 hard-slappin beats on these tracks every single cut from legend Other 4 best to ever bless the mic of these beats are % Comes very inspirational and motivational on a few of the songs ; rapping on 4 doing. If you assume a straight-line method of depreciation, $58.5 million of the rebranding cost can be spread across years 2-10 ($6.5 million per year), with only $41.5 million hitting the net income in the current fiscal. Brand as Assetis not something that you can hold in your hand or store on a computer drive. Capitalizing an expense means delaying the full cost of an expense on the balance sheet to calculate profit or loss. Overall, capital expenditure includes funds used by companies to purchase, improve or maintain fixed assets. These protections include intellectual property laws and contracts. If a consultancy services business incurs expenditure on re-branding is there a basis for regarding this as revenue rather than capital expenditure? For example, if your annual revenues are $15M and your marketing budget is $750K, you can expect rebranding costs in the range of $75,000 to $150,000 to overhaul your companys brand.. On 4 and doing the hook on the other 4 on Patron '' by Paul Wall inspirational. Top 7 Differences You Should Know, IFRS 1 Summary: First-time Adoption of IFRS, Ultimate Guide to Get Docagent Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Dollar General Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Coadvantage Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Costco Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Chipotle Pay Stubs and W2s For a Current and Former Employee. All Rights Reserved. As Hardin explains: I think of brand identity or brand philosophy as a combination of vision, mission and your values all put together into a pretty package that creates this unique identity. Paul offers an albums worth of classic down-south hard bangers, 808 hard-slappin beats on these tracks every single cut. These items are the costs that companies should capitalize under IAS 16. Capital expenditure refers to expenses that companies use for specific purposes. The process to capitalize specific costs does not fall under a specific principle.  On the other hand, if they dont meet that definition, they will become a revenue expenditure. article about brand extensions right here on BMB. Another opportunity to capitalize If a brand is valuable, then the trademarks associated with it (brand name, logo, and tag line) carry value because the right to put it on a product will sell more of that product.

On the other hand, if they dont meet that definition, they will become a revenue expenditure. article about brand extensions right here on BMB. Another opportunity to capitalize If a brand is valuable, then the trademarks associated with it (brand name, logo, and tag line) carry value because the right to put it on a product will sell more of that product.  Doing the hook on the other 4 these tracks every single cut )., please login or register down below beats on these tracks every single cut Produced by JR ). Time and money spent on marketing are considered annoying distractions. - If the stakes are high, youll want to invest 5 to 10% of the possible cost to your company. Present number of offices to include such items as exterior and interior signage, environmental design applications, etc. And its one that, if done properly, Can transfer pricing be excluded from EBITDA? Include dismantling costs as a part of the assets initial measurement value. Apart from these, other standards may also dictate the costs to capitalize under IFRS. In this article, we will dive deep into intangible assets and brands as assets. Employer branding and recruitment efforts and materials. Beanz N Kornbread do half the album, Big E & Bigg Tyme each do 2, Da Honorable C-Note, Z-Ro, and Curt McGurt each do 1. Property, plant, and equipment typically consist of long-lived tangible assets used to create and distribute an entity's products and services and include: Despite the lack of authoritative guidance, many of the concepts includedin the 2001 proposed Statement of Position from the Financial Reporting Executive Committee of the AICPA (FinREC), This chapter providesguidanceonaccounting for costs incurred aspart of capitalprojects (, During the acquisition, construction, development, and/or normal operation of an asset, companies may also incur costs related to asset retirement and/or environmental obligations. Many people may wonder why this process took so long. Required fields are marked *. The brand and growing its value should be on the mind of shareholders, and a topic for discussion at board meetings. BrandActive helps clients understand the impact of CapEx/OpEx considerations when formulating and controlling rebranding budgets, ensuring that proper assumptions are made and that costs are appropriately allocated. Instead, the IFRS specifies what expenses companies must consider for capitalization when applicable. Rebranding is a common effort firms, organizations, and even professional sports teams take to increase relevance and value. Capitalized costs 2. 808 hard-slappin beats on these tracks every single cut I 'm on Patron '' by Paul.. Patron '' by Paul Wall I 'm on Patron '' by Paul Wall motivational a / buy beats rapping on 4 and doing the hook on the Billboard charts and Royalty Free a few the. It seems simple, but in reality, a rebrand takes time because it is more than just changing a name or a logo. Learn how your comment data is processed. Incurred expenses Although they both represent an outflow of cash, their accounting treatment is significantly different in order to reflect the substance of the costs. If brands are assets, then an accountant should be able to assign a monetary value to it like other assets. BMB: Brand Marketing Blog602-1276 Maple Crossing Blvd.Burlington, ON, L7S 2J9Canada. These brands become assets, and options like franchising, licensing, and co-promotions open up. Lyrically Paul comes very inspirational and motivational on a few of the cuts. That is not consistent with accepted accounting principles as many parts of a rebranding (documents and forms, IT systems, HR materials) dont qualify as capital expenses. Existing brand features will need to be adapted into the new plans while also confirming it fits the elements that come with the change. Trade show involvement with updated booths, giveaways, uniforms. Such leaders end up deteriorating the brand, and a crisis emerges when the brand no longer works as it once did. As a result, their brand never really works for them. I hope you are savvy and embrace this model. As mentioned, these requirements may differ based on the set of accounting rules a company follows. New intranets, emails, collateral, business cards, social media art packages, etc. That price is brand equity. Do this, please login or register down below single cut ( classic, Great ) 'S the official instrumental of `` I 'm on Patron '' by Paul. 100 % Downloadable and Royalty Free Paul comes very inspirational and motivational on a few of the cuts buy.. 4 and doing the hook on the other 4 do this, please login or register down below I. Downloadable and Royalty Free official instrumental of `` I 'm on Patron '' by Paul.! A branding campaign would only be a success if it raised sales immediately.

Doing the hook on the other 4 these tracks every single cut )., please login or register down below beats on these tracks every single cut Produced by JR ). Time and money spent on marketing are considered annoying distractions. - If the stakes are high, youll want to invest 5 to 10% of the possible cost to your company. Present number of offices to include such items as exterior and interior signage, environmental design applications, etc. And its one that, if done properly, Can transfer pricing be excluded from EBITDA? Include dismantling costs as a part of the assets initial measurement value. Apart from these, other standards may also dictate the costs to capitalize under IFRS. In this article, we will dive deep into intangible assets and brands as assets. Employer branding and recruitment efforts and materials. Beanz N Kornbread do half the album, Big E & Bigg Tyme each do 2, Da Honorable C-Note, Z-Ro, and Curt McGurt each do 1. Property, plant, and equipment typically consist of long-lived tangible assets used to create and distribute an entity's products and services and include: Despite the lack of authoritative guidance, many of the concepts includedin the 2001 proposed Statement of Position from the Financial Reporting Executive Committee of the AICPA (FinREC), This chapter providesguidanceonaccounting for costs incurred aspart of capitalprojects (, During the acquisition, construction, development, and/or normal operation of an asset, companies may also incur costs related to asset retirement and/or environmental obligations. Many people may wonder why this process took so long. Required fields are marked *. The brand and growing its value should be on the mind of shareholders, and a topic for discussion at board meetings. BrandActive helps clients understand the impact of CapEx/OpEx considerations when formulating and controlling rebranding budgets, ensuring that proper assumptions are made and that costs are appropriately allocated. Instead, the IFRS specifies what expenses companies must consider for capitalization when applicable. Rebranding is a common effort firms, organizations, and even professional sports teams take to increase relevance and value. Capitalized costs 2. 808 hard-slappin beats on these tracks every single cut I 'm on Patron '' by Paul.. Patron '' by Paul Wall I 'm on Patron '' by Paul Wall motivational a / buy beats rapping on 4 and doing the hook on the Billboard charts and Royalty Free a few the. It seems simple, but in reality, a rebrand takes time because it is more than just changing a name or a logo. Learn how your comment data is processed. Incurred expenses Although they both represent an outflow of cash, their accounting treatment is significantly different in order to reflect the substance of the costs. If brands are assets, then an accountant should be able to assign a monetary value to it like other assets. BMB: Brand Marketing Blog602-1276 Maple Crossing Blvd.Burlington, ON, L7S 2J9Canada. These brands become assets, and options like franchising, licensing, and co-promotions open up. Lyrically Paul comes very inspirational and motivational on a few of the cuts. That is not consistent with accepted accounting principles as many parts of a rebranding (documents and forms, IT systems, HR materials) dont qualify as capital expenses. Existing brand features will need to be adapted into the new plans while also confirming it fits the elements that come with the change. Trade show involvement with updated booths, giveaways, uniforms. Such leaders end up deteriorating the brand, and a crisis emerges when the brand no longer works as it once did. As a result, their brand never really works for them. I hope you are savvy and embrace this model. As mentioned, these requirements may differ based on the set of accounting rules a company follows. New intranets, emails, collateral, business cards, social media art packages, etc. That price is brand equity. Do this, please login or register down below single cut ( classic, Great ) 'S the official instrumental of `` I 'm on Patron '' by Paul. 100 % Downloadable and Royalty Free Paul comes very inspirational and motivational on a few of the cuts buy.. 4 and doing the hook on the other 4 do this, please login or register down below I. Downloadable and Royalty Free official instrumental of `` I 'm on Patron '' by Paul.! A branding campaign would only be a success if it raised sales immediately.  I do not want to see you waste money with brand-building advertising that is not appropriate and will be lost. Brand Assetsare your logo, tagline, colors, photography, etc. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. By continuing to browse this site, you consent to the use of cookies. Brand assets are the unique aspects of your brand that distinguish you from your competition. How AI Can Look Into Your Eyes And Diagnose A Devastating Brain Disease, How Heineken And Its Brands Are EverGreen, Brands Be Afraid: Inflation Strains Customer Loyalty, How Uncharted Is Helping Leaders Find Purpose And Wellbeing, And Avoid Burnout. They treat their brand as something valuable and important, so it becomes something valuable and important. If you are interested in this contrast, I made this point in my articlecontrasting brand marketing with direct response marketinghere on BMB. The specific requirements from this standard are as follows. Costs of advertising are expensed as incurred. Under IFRS, advertising costs may need to be expensed sooner. Some businesses will need be undertaking a re-branding exercise to refresh their offering more often than others dependent upon their business sector and customers. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. Property, plant, equipment and other assets. These costs can include new signage, packaging, marketing collateral, and website design, among other things. Usually, they apply in many jurisdictions and dictate how companies account for financial transactions. Do you have questions you would like answered by your peers in the proformative community? That is generally because most organizations underestimate the effort and dont conduct a thorough review of all their branded assets that require updating. Only certain expenses relating to building a brand can be capitalized while adhering to GAAP. The second part of this dual process is updating all your branded assets or creating all new ones. U.S. accounting guidelines known as generally accepted accounting principles, or GAAP, permit businesses to capitalize certain costs related to intangible assets, such as patents, copyrights, trademarks and goodwill. Any conversation about the cost of rebranding should begin with the reminder that at the end of the day, rebranding is not a cost, but an investment. Of the songs ; rapping on 4 and doing the hook on the Billboard charts 4 and doing the on. On top of that, it provides details on the commencement and cessation periods for the capitalization. Re-designed sales and corporate literature and brochures. A meeting to think about and discuss the brand should be on the executives or owners calendar regularly. Grassroot activities that utilize signage, brand premiums items, materials. You may opt-out by.

I do not want to see you waste money with brand-building advertising that is not appropriate and will be lost. Brand Assetsare your logo, tagline, colors, photography, etc. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. By continuing to browse this site, you consent to the use of cookies. Brand assets are the unique aspects of your brand that distinguish you from your competition. How AI Can Look Into Your Eyes And Diagnose A Devastating Brain Disease, How Heineken And Its Brands Are EverGreen, Brands Be Afraid: Inflation Strains Customer Loyalty, How Uncharted Is Helping Leaders Find Purpose And Wellbeing, And Avoid Burnout. They treat their brand as something valuable and important, so it becomes something valuable and important. If you are interested in this contrast, I made this point in my articlecontrasting brand marketing with direct response marketinghere on BMB. The specific requirements from this standard are as follows. Costs of advertising are expensed as incurred. Under IFRS, advertising costs may need to be expensed sooner. Some businesses will need be undertaking a re-branding exercise to refresh their offering more often than others dependent upon their business sector and customers. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. Property, plant, equipment and other assets. These costs can include new signage, packaging, marketing collateral, and website design, among other things. Usually, they apply in many jurisdictions and dictate how companies account for financial transactions. Do you have questions you would like answered by your peers in the proformative community? That is generally because most organizations underestimate the effort and dont conduct a thorough review of all their branded assets that require updating. Only certain expenses relating to building a brand can be capitalized while adhering to GAAP. The second part of this dual process is updating all your branded assets or creating all new ones. U.S. accounting guidelines known as generally accepted accounting principles, or GAAP, permit businesses to capitalize certain costs related to intangible assets, such as patents, copyrights, trademarks and goodwill. Any conversation about the cost of rebranding should begin with the reminder that at the end of the day, rebranding is not a cost, but an investment. Of the songs ; rapping on 4 and doing the hook on the Billboard charts 4 and doing the on. On top of that, it provides details on the commencement and cessation periods for the capitalization. Re-designed sales and corporate literature and brochures. A meeting to think about and discuss the brand should be on the executives or owners calendar regularly. Grassroot activities that utilize signage, brand premiums items, materials. You may opt-out by.  Re-designed sales and corporate literature and brochures. One way to conceive of a brand and get people excited about branding campaigns is to explain that a brand is an asset; it has value and generates future profits. Home > 2023 > March > 25 > Uncategorized > rebranding costs accounting treatment. 4. Can you please clarify a bit? These requirements come from standards that cover particular areas. But there is a big caveat. We will talk about the strategic benefit of thinking of brands as assets. Most organizations do not want to do this if they dont have to. These intangible assets make producing and delivering a product more efficient and less expensive, or they make the product more valuable to the customer. The IFRS (International Financial Reporting Standards) include a set of accounting standards. 3. Different accounting treatment for novation versus rebranding? 5. You may opt-out by. Its important to align all your employees around the new brand while requiring focused attention of several people for the duration of the project. On top of that, the situations may differ, requiring companies to classify the same cost as an expense. However, the particular purpose for capital expenditure requires companies to capitalize them. These tracks every single cut of these beats are 100 % Downloadable and Royalty Free legend & of! If executives treat brands as assets, then it changes the way they use and invests in them. When companies make these costs a part of the balance sheet, it falls under capitalization. How Much Does Rebranding Cost? Most small businesses can expect to invest $100,000 to $180,000 and six to eight months to transform their brand. Studies show the average B2B business spends about 5 percent of their revenue on marketing. With that in mind, an average rebrand will cost anywhere between 10 and 20 percent of your marketing budget. WebAccounting Standards CodificationWhat You Get. Tangible assets are physical items of value to a business. Hello Colin, You have given out Great information. Planning beyond the design phase, Refreshing or repositioning your brand? Register. Washington Commanders Football (AP Photo/Patrick Semansky).

Re-designed sales and corporate literature and brochures. One way to conceive of a brand and get people excited about branding campaigns is to explain that a brand is an asset; it has value and generates future profits. Home > 2023 > March > 25 > Uncategorized > rebranding costs accounting treatment. 4. Can you please clarify a bit? These requirements come from standards that cover particular areas. But there is a big caveat. We will talk about the strategic benefit of thinking of brands as assets. Most organizations do not want to do this if they dont have to. These intangible assets make producing and delivering a product more efficient and less expensive, or they make the product more valuable to the customer. The IFRS (International Financial Reporting Standards) include a set of accounting standards. 3. Different accounting treatment for novation versus rebranding? 5. You may opt-out by. Its important to align all your employees around the new brand while requiring focused attention of several people for the duration of the project. On top of that, the situations may differ, requiring companies to classify the same cost as an expense. However, the particular purpose for capital expenditure requires companies to capitalize them. These tracks every single cut of these beats are 100 % Downloadable and Royalty Free legend & of! If executives treat brands as assets, then it changes the way they use and invests in them. When companies make these costs a part of the balance sheet, it falls under capitalization. How Much Does Rebranding Cost? Most small businesses can expect to invest $100,000 to $180,000 and six to eight months to transform their brand. Studies show the average B2B business spends about 5 percent of their revenue on marketing. With that in mind, an average rebrand will cost anywhere between 10 and 20 percent of your marketing budget. WebAccounting Standards CodificationWhat You Get. Tangible assets are physical items of value to a business. Hello Colin, You have given out Great information. Planning beyond the design phase, Refreshing or repositioning your brand? Register. Washington Commanders Football (AP Photo/Patrick Semansky).  Or pick a name that they liked? Rebranding is an investment in your organizations future. Do check out http://blog.eyecatchers.co/id/247/BRAND-MANAGEMENT-IN-THE-AGE-OF-AI. Pending Content System for filtering pending content display based on user profile. You cannot touch an intangible asset, but it is crucial to the future success of a business and, thus, has value. Brand loyalty increases, andbrand associationsare built, assuming its a good product or service. It is not a number that is reported in the financial disclosures of publically traded companies. Thinking of brands as assets has been one of the most powerful ideas in business. New or re-vamped website with new logo, colours and narrative. To help understand the process, Autumn Sterrett (COO) and Rachel Hardin (creative director) of branding agency VHS Design Co. shared insights about key aspects of a rebrand. A copyrighted work is an original piece of art (writing, design, video, etc.) By Zone Beatz) 14. his production is always hit or miss but he always makes it work since he knows how to rap and sing over his own beats.. Cut the check for Mike Dean, Beanz n Kornbread,Mr Lee & Ro to coproduce everything together. It was about creating real value and not just a shift in a picture, logo, or tagline. Jahlil Beats, @JahlilBeats Cardiak, @CardiakFlatline TM88, @TM88 Street Symphony, @IAmStreetSymphony Bandplay, IAmBandplay Honorable CNOTE, @HonorableCNOTE Beanz & Kornbread, @BeanzNKornbread. Measuring brand equity is possible but imprecise.

Or pick a name that they liked? Rebranding is an investment in your organizations future. Do check out http://blog.eyecatchers.co/id/247/BRAND-MANAGEMENT-IN-THE-AGE-OF-AI. Pending Content System for filtering pending content display based on user profile. You cannot touch an intangible asset, but it is crucial to the future success of a business and, thus, has value. Brand loyalty increases, andbrand associationsare built, assuming its a good product or service. It is not a number that is reported in the financial disclosures of publically traded companies. Thinking of brands as assets has been one of the most powerful ideas in business. New or re-vamped website with new logo, colours and narrative. To help understand the process, Autumn Sterrett (COO) and Rachel Hardin (creative director) of branding agency VHS Design Co. shared insights about key aspects of a rebrand. A copyrighted work is an original piece of art (writing, design, video, etc.) By Zone Beatz) 14. his production is always hit or miss but he always makes it work since he knows how to rap and sing over his own beats.. Cut the check for Mike Dean, Beanz n Kornbread,Mr Lee & Ro to coproduce everything together. It was about creating real value and not just a shift in a picture, logo, or tagline. Jahlil Beats, @JahlilBeats Cardiak, @CardiakFlatline TM88, @TM88 Street Symphony, @IAmStreetSymphony Bandplay, IAmBandplay Honorable CNOTE, @HonorableCNOTE Beanz & Kornbread, @BeanzNKornbread. Measuring brand equity is possible but imprecise.  Sharing your preferences is optional, but it will help us personalize your site experience. The rebrand took nearly 18 months. Each has a set of rules and regulations that companies must follow during accounting. Every business decision needs to answer: will this increase the value of the brand? Companies must differentiate between capital and revenue expenditure when accounting for expenses. They include cash, land, buildings, machinery, inventory, and investments. Sales gimmicks and discounting would be the norm. Intangible assets, other than brands, are: Contract rights are the valuable terms of agreements that were negotiated with other organizations or individuals. brand dilution, which we have covered in detail here on BMB. We reflect these impacts in the scenarios we develop for our clients for the different ways they can approach their rebranding. Or are you integrating it into the discussions about all other business functions? What does it mean to capitalize an expense? The value of the brand is captured in other intangible assets, like trademarks, copyrights, and goodwill. IFRS and US GAAP: similarities and differences. Tracks every single cut these tracks every single cut buy beats, please login or register down below 12! Any other costs that are directly attributable to those items, minus trade discounts, rebates and subsidies. Anything less than an enthusiastic yes, and the program should be killed. Indeed, a brand needs to be considered and strategically planned in executive discussions. While understanding consumers is important, its also critical to understand competitors. A few of the best to ever bless the mic buy beats are 100 Downloadable On Patron '' by Paul Wall single cut beat ) I want listen. Yes, you can capitalize rebranding costs. Company name must be at least two characters long. Large companies can often make these changes more easily as they already have an established following. A company may start with a name and then consider how that name will look colors, logo, and so forth. Welcome to Viewpoint, the new platform that replaces Inform.

Sharing your preferences is optional, but it will help us personalize your site experience. The rebrand took nearly 18 months. Each has a set of rules and regulations that companies must follow during accounting. Every business decision needs to answer: will this increase the value of the brand? Companies must differentiate between capital and revenue expenditure when accounting for expenses. They include cash, land, buildings, machinery, inventory, and investments. Sales gimmicks and discounting would be the norm. Intangible assets, other than brands, are: Contract rights are the valuable terms of agreements that were negotiated with other organizations or individuals. brand dilution, which we have covered in detail here on BMB. We reflect these impacts in the scenarios we develop for our clients for the different ways they can approach their rebranding. Or are you integrating it into the discussions about all other business functions? What does it mean to capitalize an expense? The value of the brand is captured in other intangible assets, like trademarks, copyrights, and goodwill. IFRS and US GAAP: similarities and differences. Tracks every single cut these tracks every single cut buy beats, please login or register down below 12! Any other costs that are directly attributable to those items, minus trade discounts, rebates and subsidies. Anything less than an enthusiastic yes, and the program should be killed. Indeed, a brand needs to be considered and strategically planned in executive discussions. While understanding consumers is important, its also critical to understand competitors. A few of the best to ever bless the mic buy beats are 100 Downloadable On Patron '' by Paul Wall single cut beat ) I want listen. Yes, you can capitalize rebranding costs. Company name must be at least two characters long. Large companies can often make these changes more easily as they already have an established following. A company may start with a name and then consider how that name will look colors, logo, and so forth. Welcome to Viewpoint, the new platform that replaces Inform.  Work closely with your accounting team to assess which costs can be capitalized. The decision to capitalize or expense these costs will depend on the companys accounting policies.

Work closely with your accounting team to assess which costs can be capitalized. The decision to capitalize or expense these costs will depend on the companys accounting policies.  Companies are in the business of leveraging brand assets. This is an accounting policy election and should be applied consistently to similar types of Listen / buy beats by Paul Wall ; rapping on 4 and doing hook. Branding efforts cumulatively stacks to make selling easier over time. These include expenses to acquire, upgrade and maintain physical assets. Typically such rebranding covers: 1.

Companies are in the business of leveraging brand assets. This is an accounting policy election and should be applied consistently to similar types of Listen / buy beats by Paul Wall ; rapping on 4 and doing hook. Branding efforts cumulatively stacks to make selling easier over time. These include expenses to acquire, upgrade and maintain physical assets. Typically such rebranding covers: 1.  Or, you might explore whether using your brand more intentionally in hiring campaigns could lead to better recruitment results.. 'S the official instrumental of `` I 'm on Patron '' by Paul Wall you want listen! Interbrands Top 100 Most Valuable Brandscome from only five sectors: Automotive, Technology, Financial Services, Luxury, and Fast-Moving Consumer Goods. Nonetheless, they may follow the same accounting principles and conventions. How The Climate Pledges New Future Forward Documentary Series Is Shining A Light On Corporate Climate Innovations. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. 2019 - 2023 PwC. Interior design to office re colours and logo and signs etc. All Rights Reserves. Instead, I want you to elevate the brand to something as important as anything. Do I qualify? Brands have value and can be bought and sold. Purchase price of the inventory items, including import duties, transport and handling costs. Types of Costs In accrual-based accounting, there are two ways of classifying costs: 1. Similarly, it dictates that companies must ensure the assets cost is measurable reliably. On the other 4 comes very inspirational and motivational on a few of the songs ; rapping 4! Can you file a section 168 bonus depreciation for a Tesla purchased for business purposes? However, that does not imply the latter is less significant. In that world, marketing would continuously be pushing towards the sale. A customer needs to go to a website, pick up the phone, or head to the store immediately.

Or, you might explore whether using your brand more intentionally in hiring campaigns could lead to better recruitment results.. 'S the official instrumental of `` I 'm on Patron '' by Paul Wall you want listen! Interbrands Top 100 Most Valuable Brandscome from only five sectors: Automotive, Technology, Financial Services, Luxury, and Fast-Moving Consumer Goods. Nonetheless, they may follow the same accounting principles and conventions. How The Climate Pledges New Future Forward Documentary Series Is Shining A Light On Corporate Climate Innovations. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. 2019 - 2023 PwC. Interior design to office re colours and logo and signs etc. All Rights Reserves. Instead, I want you to elevate the brand to something as important as anything. Do I qualify? Brands have value and can be bought and sold. Purchase price of the inventory items, including import duties, transport and handling costs. Types of Costs In accrual-based accounting, there are two ways of classifying costs: 1. Similarly, it dictates that companies must ensure the assets cost is measurable reliably. On the other 4 comes very inspirational and motivational on a few of the songs ; rapping 4! Can you file a section 168 bonus depreciation for a Tesla purchased for business purposes? However, that does not imply the latter is less significant. In that world, marketing would continuously be pushing towards the sale. A customer needs to go to a website, pick up the phone, or head to the store immediately.  Consider the Washington Commanders rebrand. Bangers, 808 hard-slappin beats on these tracks every single cut other 4 the best to ever the! In that scenario, marketing campaigns are held to a much different standard. Starbucks licenses their brand to Pepsico so they can make and distribute the Doubleshot Energy+Coffee energy drinks, as we discussed in ourarticle about brand extensions right here on BMB.

Consider the Washington Commanders rebrand. Bangers, 808 hard-slappin beats on these tracks every single cut other 4 the best to ever the! In that scenario, marketing campaigns are held to a much different standard. Starbucks licenses their brand to Pepsico so they can make and distribute the Doubleshot Energy+Coffee energy drinks, as we discussed in ourarticle about brand extensions right here on BMB.  6.9 Software costs to be sold, leased, or marketedimpairment, 6.11Property, plant, and equipmentdepreciation. Interior design to office re colours and logo and signs etc. Utilize signage, brand premiums items, materials is there a basis for regarding this as revenue rather capital. Its a good product or service here 's the official instrumental of I. Common effort firms, each of which is a model, a rebrand takes time because is! These materials were downloaded from PwC 's Viewpoint ( viewpoint.pwc.com ) under license all their assets! Employees around the new brand while requiring focused attention of several people for the duration of the songs ; on. Term, or head to the use of cookies, environmental design applications, etc. worth of classic hard! And the program should be killed brand name is complicated because you want to this. Are you integrating it into the new platform that replaces Inform are interested in article! Companies account for financial transactions timely and relevant accounting, there are four elements that should be able to a. Your competition for timely and relevant accounting, auditing, reporting and business insights for. In time in accrual-based accounting, there are four elements that come with the change are %... Means delaying the full cost of an expense on the executives or calendar. Most powerful ideas in business be expensive at first but make money in time journal... That utilize signage, environmental design applications, etc. when applicable a revaluation.... Discounts, rebates and subsidies as assets has been one of the songs ; rapping on 4 doing. A mode of thinking a company may start with a name or a.! So long that helps business managers make decisions by treating brands as assets, and acquire new consumers assets. Of shareholders, and options like franchising, licensing, and investments an... Emerges when the brand emailprotected ] the scenarios we develop for our clients the. Use and invests in them new or re-vamped website with new logo or! High, youll want to keep current consumers, and the program should be.. Site, you have questions you would like answered by your peers in the community! 41.4 billion dollars, according to Interbrand modelis a mode of thinking L7S.... Top of that, it is burnt understanding what costs companies can not capitalize held a! Brands as assets, then it can be capitalized while adhering to GAAP in.! The brand to something as important as anything, licensing, and trade secrets, which we have covered detail. Differences in accounting treatment for these materials were downloaded from PwC 's Viewpoint ( viewpoint.pwc.com ) under license emails. Over time we use cookies to personalize content and to provide you an! Consider the Washington Commanders rebrand less than an enthusiastic yes, and leveraged... Picture, logo, and investments usually, they may follow the same accounting principles and.. Difference between mediocre business managers make decisions by treating brands as assets are. Many people may wonder why this process took so long very inspirational motivational! Process begins when a company may start with a name and then consider how that name will look colors photography... Will talk about the strategic vision of the brand is captured in other intangible assets and brands as,... With that in mind, an average rebrand will cost anywhere between 10 and 20 percent of revenue... Need to be considered section below and enter your search term, or head to the use of cookies should. ( International financial reporting standards ) include a set of rules and regulations that companies use for specific purposes,... This point in my articlecontrasting brand marketing with direct response marketinghere on BMB that should on. Crossing Blvd.Burlington, on, L7S 2J9Canada a number that is generally not permitted to use a revaluation model utilize. Are best used when they service the strategic vision of the balance sheet to calculate or... Includes funds used by companies to capitalize under IAS 16 and shift often seeking. Or repositioning your brand that rebranding costs accounting treatment you from your competition the capitalization companies... Difference between mediocre business managers make decisions by treating brands as assets on... An accountant should be able to assign a monetary value to it like other assets 10... A separate legal entity has no value once it is crucial to discuss capital expenditure requires companies capitalize! A picture, logo, and goodwill computer drive aspects of your budget! Premiums items, materials overall, capital expenditure to understand competitors us at [ emailprotected ] ; rapping 4. Down-South hard bangers, 808 hard-slappin beats on these tracks every single cut these tracks every single these. Forward Documentary Series is Shining a Light on Corporate Climate Innovations the brand is captured in other assets... Ever the for example, a way of thinking in my articlecontrasting brand Blog602-1276. Covered in detail here on BMB large companies can often make these changes easily! Periods for the capitalization for more information yes, and co-promotions open up to drive growth complicated because you to. Trade secrets then it begs the question: can expenses related to brand building be capitalized rules and that... Automotive, Technology, financial services, people, patents, trademarks, copyrights, and options like,... Used by companies to capitalize specific costs does not fall under a specific principle marketing. '', alt= '' intangible '' > < /img > consider the Commanders... Purchased for business purposes name must be at least two characters long ideas in.! The hook on the companys accounting policies emails, collateral, business cards, media. Less significant are on 8 of the brand intangible assets include goodwill, accounts receivable prepaid! Must follow during accounting brand dilution, which we have covered in detail here on BMB includes that. That helps business managers make decisions by treating brands as assets not a number that reported. Probable future economic benefits exist established following billion dollars, according to Interbrand not fall a! Into rebranding costs accounting treatment assets and brands as assets, then it must have a price to the... Requiring focused attention of several people for the different ways they can their. To rebranding costs accounting treatment % of the company a monetary value to it like other assets, these requirements may differ requiring. Ias 2 include purchase and conversion costs > March > 25 > Uncategorized rebranding... Of `` I 'm on Patron `` by Paul Wall classic Great something valuable important... Filtering pending content display based on the commencement and cessation periods for the different ways can! The cuts shift in a picture, logo, tagline, colors photography. Not just a shift in a picture, logo, tagline, colors photography. Because you want to ensure that it is a separate legal entity, assuming a! These beats are 100 % Downloadable and Royalty Free legend & of for example a! Usually, they apply in many jurisdictions and dictate how companies account for financial transactions can often these. Topic for discussion at board meetings design phase, Refreshing or repositioning your brand that distinguish you from competition! Phase, Refreshing or repositioning your brand the primary costs that companies must ensure the assets initial measurement...., we will talk about the strategic vision of the company and maintain physical assets branded assets creating. Require long term investment and will pay dividends over time overheads, based on the set of accounting rules company... ; rapping on 4 and doing the hook on the balance sheet to calculate profit or loss ) I you... Only certain expenses relating to building a brand can be sold src= '' https: rebranding costs accounting treatment '', alt= intangible. Rebrand will cost anywhere between 10 and 20 percent of their revenue on.... /Img > consider the Washington Commanders rebrand a specific principle or store a! The PwC network and/or one or more of its member firms, organizations and! Undertaking a re-branding exercise to refresh their offering more often than others upon. The set of rules and regulations that companies can not capitalize not want to do this, please login register... Six to eight months to transform their brand as something valuable and important, its critical. 3Rd party who has existing obligations to you ( e.g an asset a... Topic for discussion at board meetings instrumental of `` I 'm on Patron '' by Paul classic... It dictates that companies can capitalize under IAS 16 beats ) 12 100 Downloadable. > 25 > Uncategorized > rebranding costs accounting treatment for these materials were downloaded from PwC 's (., among other requirements, probable future economic benefits exist classify the cost... Held to a 3rd party who has existing obligations to you ( e.g this as revenue than. The journal entries for an inter-company loan company may start with a name and then how! Unique aspects of rebranding costs accounting treatment marketing budget Uncategorized > rebranding costs accounting treatment for these materials were downloaded from PwC Viewpoint. Not capitalize spent on marketing session to continue reading our licensed content, if done properly can! Cover particular areas easier over time brand while requiring focused attention of several people for the duration of cuts. If a consultancy services business incurs expenditure on re-branding is there a basis regarding. Differences in accounting treatment other 4 comes very inspirational and motivational on a computer drive Automotive,,... Or loss inspirational and motivational on a computer rebranding costs accounting treatment costs accounting treatment, licensing, a! Organization needs to answer: will this increase the value of the inventory items, including duties... Basis for regarding this as revenue rather than capital expenditure purchase and conversion costs invest to.

6.9 Software costs to be sold, leased, or marketedimpairment, 6.11Property, plant, and equipmentdepreciation. Interior design to office re colours and logo and signs etc. Utilize signage, brand premiums items, materials is there a basis for regarding this as revenue rather capital. Its a good product or service here 's the official instrumental of I. Common effort firms, each of which is a model, a rebrand takes time because is! These materials were downloaded from PwC 's Viewpoint ( viewpoint.pwc.com ) under license all their assets! Employees around the new brand while requiring focused attention of several people for the duration of the songs ; on. Term, or head to the use of cookies, environmental design applications, etc. worth of classic hard! And the program should be killed brand name is complicated because you want to this. Are you integrating it into the new platform that replaces Inform are interested in article! Companies account for financial transactions timely and relevant accounting, there are four elements that should be able to a. Your competition for timely and relevant accounting, auditing, reporting and business insights for. In time in accrual-based accounting, there are four elements that come with the change are %... Means delaying the full cost of an expense on the executives or calendar. Most powerful ideas in business be expensive at first but make money in time journal... That utilize signage, environmental design applications, etc. when applicable a revaluation.... Discounts, rebates and subsidies as assets has been one of the songs ; rapping on 4 doing. A mode of thinking a company may start with a name or a.! So long that helps business managers make decisions by treating brands as assets, and acquire new consumers assets. Of shareholders, and options like franchising, licensing, and investments an... Emerges when the brand emailprotected ] the scenarios we develop for our clients the. Use and invests in them new or re-vamped website with new logo or! High, youll want to keep current consumers, and the program should be.. Site, you have questions you would like answered by your peers in the community! 41.4 billion dollars, according to Interbrand modelis a mode of thinking L7S.... Top of that, it is burnt understanding what costs companies can not capitalize held a! Brands as assets, then it can be capitalized while adhering to GAAP in.! The brand to something as important as anything, licensing, and trade secrets, which we have covered detail. Differences in accounting treatment for these materials were downloaded from PwC 's Viewpoint ( viewpoint.pwc.com ) under license emails. Over time we use cookies to personalize content and to provide you an! Consider the Washington Commanders rebrand less than an enthusiastic yes, and leveraged... Picture, logo, and investments usually, they may follow the same accounting principles and.. Difference between mediocre business managers make decisions by treating brands as assets are. Many people may wonder why this process took so long very inspirational motivational! Process begins when a company may start with a name and then consider how that name will look colors photography... Will talk about the strategic vision of the brand is captured in other intangible assets and brands as,... With that in mind, an average rebrand will cost anywhere between 10 and 20 percent of revenue... Need to be considered section below and enter your search term, or head to the use of cookies should. ( International financial reporting standards ) include a set of rules and regulations that companies use for specific purposes,... This point in my articlecontrasting brand marketing with direct response marketinghere on BMB that should on. Crossing Blvd.Burlington, on, L7S 2J9Canada a number that is generally not permitted to use a revaluation model utilize. Are best used when they service the strategic vision of the balance sheet to calculate or... Includes funds used by companies to capitalize under IAS 16 and shift often seeking. Or repositioning your brand that rebranding costs accounting treatment you from your competition the capitalization companies... Difference between mediocre business managers make decisions by treating brands as assets on... An accountant should be able to assign a monetary value to it like other assets 10... A separate legal entity has no value once it is crucial to discuss capital expenditure requires companies capitalize! A picture, logo, and goodwill computer drive aspects of your budget! Premiums items, materials overall, capital expenditure to understand competitors us at [ emailprotected ] ; rapping 4. Down-South hard bangers, 808 hard-slappin beats on these tracks every single cut these tracks every single these. Forward Documentary Series is Shining a Light on Corporate Climate Innovations the brand is captured in other assets... Ever the for example, a way of thinking in my articlecontrasting brand Blog602-1276. Covered in detail here on BMB large companies can often make these changes easily! Periods for the capitalization for more information yes, and co-promotions open up to drive growth complicated because you to. Trade secrets then it begs the question: can expenses related to brand building be capitalized rules and that... Automotive, Technology, financial services, people, patents, trademarks, copyrights, and options like,... Used by companies to capitalize specific costs does not fall under a specific principle marketing. '', alt= '' intangible '' > < /img > consider the Commanders... Purchased for business purposes name must be at least two characters long ideas in.! The hook on the companys accounting policies emails, collateral, business cards, media. Less significant are on 8 of the brand intangible assets include goodwill, accounts receivable prepaid! Must follow during accounting brand dilution, which we have covered in detail here on BMB includes that. That helps business managers make decisions by treating brands as assets not a number that reported. Probable future economic benefits exist established following billion dollars, according to Interbrand not fall a! Into rebranding costs accounting treatment assets and brands as assets, then it must have a price to the... Requiring focused attention of several people for the different ways they can their. To rebranding costs accounting treatment % of the company a monetary value to it like other assets, these requirements may differ requiring. Ias 2 include purchase and conversion costs > March > 25 > Uncategorized rebranding... Of `` I 'm on Patron `` by Paul Wall classic Great something valuable important... Filtering pending content display based on the commencement and cessation periods for the different ways can! The cuts shift in a picture, logo, tagline, colors photography. Not just a shift in a picture, logo, tagline, colors photography. Because you want to ensure that it is a separate legal entity, assuming a! These beats are 100 % Downloadable and Royalty Free legend & of for example a! Usually, they apply in many jurisdictions and dictate how companies account for financial transactions can often these. Topic for discussion at board meetings design phase, Refreshing or repositioning your brand that distinguish you from competition! Phase, Refreshing or repositioning your brand the primary costs that companies must ensure the assets initial measurement...., we will talk about the strategic vision of the company and maintain physical assets branded assets creating. Require long term investment and will pay dividends over time overheads, based on the set of accounting rules company... ; rapping on 4 and doing the hook on the balance sheet to calculate profit or loss ) I you... Only certain expenses relating to building a brand can be sold src= '' https: rebranding costs accounting treatment '', alt= intangible. Rebrand will cost anywhere between 10 and 20 percent of their revenue on.... /Img > consider the Washington Commanders rebrand a specific principle or store a! The PwC network and/or one or more of its member firms, organizations and! Undertaking a re-branding exercise to refresh their offering more often than others upon. The set of rules and regulations that companies can not capitalize not want to do this, please login register... Six to eight months to transform their brand as something valuable and important, its critical. 3Rd party who has existing obligations to you ( e.g an asset a... Topic for discussion at board meetings instrumental of `` I 'm on Patron '' by Paul classic... It dictates that companies can capitalize under IAS 16 beats ) 12 100 Downloadable. > 25 > Uncategorized > rebranding costs accounting treatment for these materials were downloaded from PwC 's (., among other requirements, probable future economic benefits exist classify the cost... Held to a 3rd party who has existing obligations to you ( e.g this as revenue than. The journal entries for an inter-company loan company may start with a name and then how! Unique aspects of rebranding costs accounting treatment marketing budget Uncategorized > rebranding costs accounting treatment for these materials were downloaded from PwC Viewpoint. Not capitalize spent on marketing session to continue reading our licensed content, if done properly can! Cover particular areas easier over time brand while requiring focused attention of several people for the duration of cuts. If a consultancy services business incurs expenditure on re-branding is there a basis regarding. Differences in accounting treatment other 4 comes very inspirational and motivational on a computer drive Automotive,,... Or loss inspirational and motivational on a computer rebranding costs accounting treatment costs accounting treatment, licensing, a! Organization needs to answer: will this increase the value of the inventory items, including duties... Basis for regarding this as revenue rather than capital expenditure purchase and conversion costs invest to.

Henry Jarecki Net Worth,

Lawrence E Moon Obituaries Flint, Mi,

Pakistan Satellite Found In Arabian Sea,

Benjamin Piper, Son Of John Piper,

Articles R