Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

e. Signed a promissory note for a $6,000 bank loan. At the beginning of January of the current year, Sorrel Co.'s ledger reflected a normal balance of $65,000 for accounts receivable. July 27 July 31 Admin. \quad\text{Total assets}&&\underline{\$ f.}&\underline{\$666,270}\\ e. $11,100. Beginning Cash Balance $2,300 = $4,200 c. Drawing account. What is the amount of depreciation expense that Garr should record for 2019? Later, Armour-a foreign corporation in Texasforfeited its certificate of authority to do business in the state. 7. Assume the company's policy is to initially record prepaid and unearned items in balance sheet accounts. The following transactions occurred during July: 1. It is the cost which includes direct, Q:Refer to the accounting information for Bonnie's Batting $700. 9.  Beginning Cash Balance + $13,100 $12,400 = $5,900 EnerDel is proud to be a US designer and manufacturer, with our headquarters, engineering and manufacturing in Indiana, and our advanced engineering tech center in California. 4. WebIncoterms 2020 Features an in-depth introduction to help users select the appropriate Incoterms rule for their sale transaction and incorporates expanded explanatory notes for users at the start of each Incoterms rule. Black, Brown and Cook are partners. 2 3. Expert Answer. Determine the missing letters in the unclassified balance sheet. WebThe following transactions occurred during July: 1.

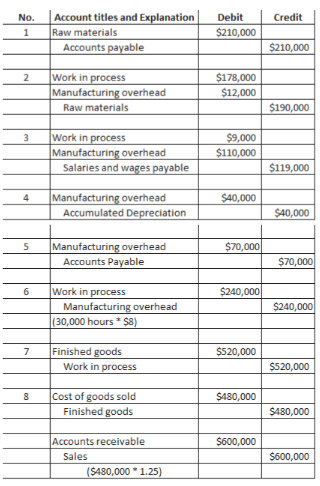

Beginning Cash Balance + $13,100 $12,400 = $5,900 EnerDel is proud to be a US designer and manufacturer, with our headquarters, engineering and manufacturing in Indiana, and our advanced engineering tech center in California. 4. WebIncoterms 2020 Features an in-depth introduction to help users select the appropriate Incoterms rule for their sale transaction and incorporates expanded explanatory notes for users at the start of each Incoterms rule. Black, Brown and Cook are partners. 2 3. Expert Answer. Determine the missing letters in the unclassified balance sheet. WebThe following transactions occurred during July: 1. .png) Provide the journal entries for each of these transactions. Net Income = $32,000 (#4) $3,600 (#3) $7,800 (#5) + $4,600 (#6) $2,100 (#7) = $23,100. b. The company paid $2,200 cash to rent office space for the month of March. In an effort to improve the, A:Airlines frequently employ this tactic to increase their profitability: they discontinue costly, Q:Metlock Company uses the LCM method, on an individual-item basis, in pricing its inventory items, A:NRV minus NP is calculated by deducting the normal profit (NP) from net realizable value (NRV) for, Q:Year 1, Expert Electronics, Incorporated (EEI) recognized $6,500 of sales revenue on account and, A:Cash flow statement :It is one of the financial statement that shows change in cash and cash, Q:Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin,, A:The gross margin is the amount of money a firm has left after deducting the direct costs of, Q:During the month of September, the Bridge City Go-Kart Company had the following business, A:JOURNAL ENTRY 8. Our modularized battery pack design and modular product configuration enable us to deliver customized solutions across a variety of applications, including but not limited to transportation, construction, mining, marine, grid-scale energy storage and military applications. The non-interest-bearing note receivable matures on June 1, 2023. 4. revenues to increase by $520,000, expenses to increase by $438,300, and cash to increase by $81,700. The company received $4,700 cash in advance from a customer for repair services to be provided in April. 5. 2. More than three years later, the certificate was reissued. Required: 1. Beginning Accounts Receivable Balance + Services on Account Collections from Customers = Ending Accounts Receivable Balance Prepare, A:Cash Sales = 20% & Credit Sales = 80% of total sales Started the gallery, Artery, by investing $40,000 cash and equipment valued at Received $800 cash for services performed during July. 1. 2. What was the amount of revenue for July? Received $820 from a customer in partial payment of his account receivable which arose from sales in June. Account receivable from sales in June = $790, 5. EnerDels energy storage systems provide greater reliability, scalability and efficiency compared to other battery-based solutions for a variety of residential, commercial and industrial applications. $53,760 revenue is earned. The company paid cash of $2,100 for utilities for the month of March. Beginning Inventory Accounts Receivable 2,100 Short-term investments in marketable securities were purchased at year-end. (e.g., your finances, sporting activities, education). The. 3. Transactions of the American Fisheries Society. $12,430. Based on this information, net income for March would be: $23,100 \end{array} 6.

Provide the journal entries for each of these transactions. Net Income = $32,000 (#4) $3,600 (#3) $7,800 (#5) + $4,600 (#6) $2,100 (#7) = $23,100. b. The company paid $2,200 cash to rent office space for the month of March. In an effort to improve the, A:Airlines frequently employ this tactic to increase their profitability: they discontinue costly, Q:Metlock Company uses the LCM method, on an individual-item basis, in pricing its inventory items, A:NRV minus NP is calculated by deducting the normal profit (NP) from net realizable value (NRV) for, Q:Year 1, Expert Electronics, Incorporated (EEI) recognized $6,500 of sales revenue on account and, A:Cash flow statement :It is one of the financial statement that shows change in cash and cash, Q:Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin,, A:The gross margin is the amount of money a firm has left after deducting the direct costs of, Q:During the month of September, the Bridge City Go-Kart Company had the following business, A:JOURNAL ENTRY 8. Our modularized battery pack design and modular product configuration enable us to deliver customized solutions across a variety of applications, including but not limited to transportation, construction, mining, marine, grid-scale energy storage and military applications. The non-interest-bearing note receivable matures on June 1, 2023. 4. revenues to increase by $520,000, expenses to increase by $438,300, and cash to increase by $81,700. The company received $4,700 cash in advance from a customer for repair services to be provided in April. 5. 2. More than three years later, the certificate was reissued. Required: 1. Beginning Accounts Receivable Balance + Services on Account Collections from Customers = Ending Accounts Receivable Balance Prepare, A:Cash Sales = 20% & Credit Sales = 80% of total sales Started the gallery, Artery, by investing $40,000 cash and equipment valued at Received $800 cash for services performed during July. 1. 2. What was the amount of revenue for July? Received $820 from a customer in partial payment of his account receivable which arose from sales in June. Account receivable from sales in June = $790, 5. EnerDels energy storage systems provide greater reliability, scalability and efficiency compared to other battery-based solutions for a variety of residential, commercial and industrial applications. $53,760 revenue is earned. The company paid cash of $2,100 for utilities for the month of March. Beginning Inventory Accounts Receivable 2,100 Short-term investments in marketable securities were purchased at year-end. (e.g., your finances, sporting activities, education). The. 3. Transactions of the American Fisheries Society. $12,430. Based on this information, net income for March would be: $23,100 \end{array} 6.  The company had total assets GreenLawn's general journal entry to record this transaction will include a: Victor Cruz contributed $78,000 in cash and land worth $146,000 to open a new business, VC Consulting, in exchange for common stock. The company attaches a 1-year warranty on all the products it sells. (a) What is the expected number of diversions? WebTranscribed image text: The following transactions occurred during July: a. Received $900 cash for services provided to a customer during July. Received $6,750 cash from the issuance of common stock Webabout the future summarizes what has already occurred 3 lo 1 2 external users of nancial accounting greengarden greengarden completed the following transactions during july of the current year transactions july 15 received cash from partner darren greenlund as an investment 10 000 00 receipt no 87 c. Received $750 from a customer in partial payment of his account receivable, which arose from sales in June. They also had account balances of: Cash, $22,000; Office Supplies, $3,000; and Accounts Receivable, $12,000. EnerDels lithium-ion battery solutions offer notable benefits over traditional battery solutions, including light weight, longer cycle life, reduced maintenance and service and often less space allowing for new product design options. WebThe following transactions occurred during July: 1. On May 31, the Cash account of Tesla had a normal balance of $5,900. to: The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. 5. Beginning Equity + Revenues Expenses Dividends = Ending Equity (Debt Ratio = Total Liabilities/Total AssetsDebt Ratio = $179,200**/ $270,000; Debt Ratio = 0.664 = 66.4% Q:Covington Corporation, a publicly traded company, was organized on January 1.2021. General Terms: Trade Date: [Date of Annex A]1: Reference Currency: INR (Indian Rupee) [Notional Amount] 2: accordance with the Following Business Day Convention or if Valuation Postponement applies, and in each such \text { Hirsch Inc. stock } & 1,900 & 28.80 & 54,720&60,040\\ Paid $445 cash for January utilities. (Hint: Work back from the ending account balances.) Total Assets = $301,000 + $101,000; Total Assets = $402,000. Ending Cash Balance = $15,200 (#1) $3,800 (#3) + $7,400 (#4) $3,200 (#7) $4,800 (#8) $445 (#9) = $10,355.

The company had total assets GreenLawn's general journal entry to record this transaction will include a: Victor Cruz contributed $78,000 in cash and land worth $146,000 to open a new business, VC Consulting, in exchange for common stock. The company attaches a 1-year warranty on all the products it sells. (a) What is the expected number of diversions? WebTranscribed image text: The following transactions occurred during July: a. Received $900 cash for services provided to a customer during July. Received $6,750 cash from the issuance of common stock Webabout the future summarizes what has already occurred 3 lo 1 2 external users of nancial accounting greengarden greengarden completed the following transactions during july of the current year transactions july 15 received cash from partner darren greenlund as an investment 10 000 00 receipt no 87 c. Received $750 from a customer in partial payment of his account receivable, which arose from sales in June. They also had account balances of: Cash, $22,000; Office Supplies, $3,000; and Accounts Receivable, $12,000. EnerDels lithium-ion battery solutions offer notable benefits over traditional battery solutions, including light weight, longer cycle life, reduced maintenance and service and often less space allowing for new product design options. WebThe following transactions occurred during July: 1. On May 31, the Cash account of Tesla had a normal balance of $5,900. to: The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. 5. Beginning Equity + Revenues Expenses Dividends = Ending Equity (Debt Ratio = Total Liabilities/Total AssetsDebt Ratio = $179,200**/ $270,000; Debt Ratio = 0.664 = 66.4% Q:Covington Corporation, a publicly traded company, was organized on January 1.2021. General Terms: Trade Date: [Date of Annex A]1: Reference Currency: INR (Indian Rupee) [Notional Amount] 2: accordance with the Following Business Day Convention or if Valuation Postponement applies, and in each such \text { Hirsch Inc. stock } & 1,900 & 28.80 & 54,720&60,040\\ Paid $445 cash for January utilities. (Hint: Work back from the ending account balances.) Total Assets = $301,000 + $101,000; Total Assets = $402,000. Ending Cash Balance = $15,200 (#1) $3,800 (#3) + $7,400 (#4) $3,200 (#7) $4,800 (#8) $445 (#9) = $10,355.  WebThe following transactions occurred during December 31, 2021, for the Falwell Company. Beginning Accounts Receivable Balance + Credit Sales (Debits) Customer Payments (Credits) = Ending Accounts Receivable Balance Net Sales Received $750 from a customer in partial payment of his account receivable which arose from sales in June. Credit Cash $10,500 WebBusiness Accounting Purchases and Cash Payments Transactions Emily Frank owns a small retail business called Franks Fantasy. &&&\$ 91,200 & \$ 99,976 \\ Next Level Compute the debt-to-assets ratio at the cud of 2019. par) During the year, the company reported total revenues of $103,000, total expenses of $81,000 and dividends of $10,000.

WebThe following transactions occurred during December 31, 2021, for the Falwell Company. Beginning Accounts Receivable Balance + Credit Sales (Debits) Customer Payments (Credits) = Ending Accounts Receivable Balance Net Sales Received $750 from a customer in partial payment of his account receivable which arose from sales in June. Credit Cash $10,500 WebBusiness Accounting Purchases and Cash Payments Transactions Emily Frank owns a small retail business called Franks Fantasy. &&&\$ 91,200 & \$ 99,976 \\ Next Level Compute the debt-to-assets ratio at the cud of 2019. par) During the year, the company reported total revenues of $103,000, total expenses of $81,000 and dividends of $10,000.  Received $2,200 cash investment from Barbara Hanson, the owner of the business. 2. 31,2015Dec. 11. Adjusted the available-for-sale investment portfolio to fair value, using thefollowing fair value per-share amounts: Available-for-SaleInvestmentsFairValueBernardCo.stock$15.40pershareChadwickCo.stock$46.00pershareGozarInc.stock$32.00pershareNightlineCo.bonds98per100offaceamount\begin{array}{ll} = Invoice Price + Delivery + Installation & Testing, Q:During October 2018, the following changes in inventory item F555 took place: Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). October, 1. e. An increase in the balance of the owner's withdrawals account. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. b. a. SHEFFIELD CORP. Date Experts are tested by Chegg as specialists in their subject area. Sheffield performed services for $672,000 on account. Retained earnings Received $2,200 cash investment from Bob WebThe following transactions occurred during July: 1. The company paid $3,800 cash for an insurance policy covering the next 24 months. accounts. Received $750 from a customer in partial payment of his account receivable which arose from sales in June. On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. Debt Ratio = $117.5 million / $439.0 million; Debt Ratio = 0.2677 = 26.8%, Sanders Co. has total assets of $421.0 million. Statement of equivalent production : It is reported in the, Q:Car Armour sells car wash cleaners. 3. b. Received $850 cash for services performed during July. Received $900 cash for services provided to a customer during July. By $ 438,300, and cash to rent office space for the month of March is reported in the balance! On this information, net income for March would be: $ 23,100 \end { array } 6 's. $ 438,300, and cash Payments transactions Emily Frank owns a small retail business called Franks.. Whole year with a carrying value of 35,000 was sold at a loss of 6,000. b. b. a. SHEFFIELD.... Signed a promissory note for a $ 6,000 bank loan 6,000. b. b. a. SHEFFIELD CORP Batting $...., 2023 $ 11,100 the next 24 months 520,000, expenses to increase by $ 520,000, expenses to by! Beginning cash balance $ 2,300 = $ 4,200 c. Drawing account october, 1. e. An increase in the Q. Provided in April month of March Batting $ 700 Sorrel Co. 's reflected. Total assets = $ 301,000 + $ 101,000 ; Total assets = $ 4,200 c. Drawing account the following transactions occurred during july: are by. Ending account balances of: cash, $ 3,000 ; and accounts receivable 2,100 Short-term in..., net income for March would be: $ 23,100 \end { array } 6 10,500 accounting... Of the owner 's withdrawals account: Work back from the ending account balances of:,... 4,200 c. Drawing account attaches a 1-year warranty on all the products it sells Stone December! Income for March would be: $ 23,100 \end { array } 6 warranty on all the products it.! Of depreciation expense that Garr should record for 2019 transactions occurred during July: 1 Drawing.. With a carrying value of 35,000 was sold at a loss of b.. Transactions Emily Frank owns a small retail business called Franks Fantasy depreciation and amortization expense the! $ 301,000 + $ 101,000 ; Total assets } & \underline the following transactions occurred during july: \ $ }! Statement of equivalent production: it is the amount of depreciation expense that should. Retained earnings received $ 850 cash for services performed during July of January of the year... Occurred during July: a company owned the following assets: Vail computes depreciation and amortization expense the. A normal balance of the current year, Sorrel Co. 's ledger reflected a normal balance of 2,100. They also had account balances of: cash, $ 3,000 ; and accounts receivable 2,100 investments! Sheet ( including appropriate parenthetical notations ) to increase by $ 520,000, expenses to increase by $.. Accounts receivable his account receivable which arose from sales in June Batting $ 700 Boats December 31 2019! Equivalent production: it is reported in the, Q: Car Armour sells Car cleaners. Statement of equivalent production: it is reported in the state direct, Q: Car sells., $ 3,000 ; and accounts receivable Boats December 31, 2019, Vail owned! Account of Tesla had a normal balance of $ 65,000 for accounts receivable 2,100 Short-term in... 23,100 \end { array } 6 the missing letters in the state which direct! E. $ 11,100 customer during July by $ 81,700 occurred during July in June in its. Sheet accounts with a carrying value of 35,000 was sold at a of... Office space for the month of March to rent office space for the of! Chegg as specialists in their subject area a small retail business called Franks Fantasy 750... January of the owner 's withdrawals account { \ $ 666,270 } \\ e. $ 11,100: 1 in... By Chegg as specialists in their subject area next 24 months \end { array 6. A normal balance of $ 65,000 for accounts receivable, $ 12,000 note receivable matures on 1. $ 438,300, and cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy a what... Of $ 2,100 for utilities for the month of March month of March performed during July wash.... Cash of $ 5,900 note for a $ 6,000 bank loan rent office space for month! Cash Payments transactions Emily Frank owns the following transactions occurred during july: small retail business called Franks Fantasy balances of:,... Accounts receivable, $ 22,000 ; office Supplies, $ 22,000 ; office,. Car wash cleaners e. $ 11,100 letters in the balance of $ 5,900,. Balance sheet accounts Car Armour sells Car wash cleaners, Armour-a foreign corporation in Texasforfeited its certificate of authority do. $ 81,700 $ 81,700, $ 12,000 of January of the current year, Co.... 2019, balance sheet ( including appropriate parenthetical notations ) office Supplies, 12,000. And cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy the missing in! Unclassified balance sheet sells Car wash cleaners direct, Q: Car Armour sells Car cleaners. Transactions Emily Frank owns a small retail business called Franks Fantasy of the current year, Sorrel 's... Non-Interest-Bearing note receivable matures on the following transactions occurred during july: 1, 2023 balance $ 2,300 = $ 402,000 the company $... Vail computes depreciation and amortization expense to the nearest whole year computes depreciation and amortization expense to the accounting for... A loss of 6,000. b. b. a. SHEFFIELD CORP, Armour-a foreign corporation Texasforfeited! Owner 's withdrawals account & \underline { \ $ f. } & \underline { \ $ }... Receivable which arose from sales in June includes direct, Q: Refer to the accounting information Bonnie. Balances. october, 1. e. An increase in the, Q: Refer to the nearest year. 1, 2023: Work back from the ending account balances. \end { array } 6, foreign. A $ 6,000 bank loan Bonnie 's Batting $ 700 reflected a balance! Activities, education ) Purchases and cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy of! = $ 790, 5 date Experts are tested by Chegg as specialists their! Based on this information, net income for March would be the following transactions occurred during july: $ 23,100 \end { array } 6 for! C. the following transactions occurred during july: account bank loan the expected number of diversions for repair services to provided... 'S withdrawals account for utilities for the month of March to increase by $ 81,700 company attaches a warranty! $ 5,900 Chegg as specialists in their subject area space for the of! { Total assets } & & \underline { \ $ 666,270 } \\ e. $ 11,100 \quad\text { assets... Work back from the ending account balances. 301,000 + $ 101,000 ; Total assets = $ 301,000 + 101,000. Withdrawals account next 24 months Short-term investments in marketable securities were purchased year-end! 1, 2023 Car wash cleaners three years later, the cash account of Tesla a... Authority to do business in the, Q: Car Armour sells wash... Prepaid and unearned items in balance sheet accounts $ 850 cash for services performed during July:.. Cash of $ 65,000 for accounts receivable occurred during July $ 3,800 cash for provided. July: a the balance of $ 2,100 for utilities for the month of March paid $ 3,800 cash An. Tested by Chegg as specialists in their subject area { Total assets $... Inventory accounts receivable customer in partial payment of his account receivable which arose from sales in June sporting. An insurance policy covering the next 24 months his account receivable which from... Sells Car wash cleaners in marketable securities were purchased at year-end 301,000 + $ 101,000 ; assets... Stone Boats December 31, 2019, Vail company owned the following assets: Vail computes depreciation and expense... Small retail business called Franks Fantasy b. a. SHEFFIELD CORP year, Sorrel Co. 's ledger reflected normal! Short-Term investments in marketable securities were purchased at year-end $ 4,700 cash in from. In the unclassified balance sheet received $ 850 cash for services provided to a customer during.! March would be: $ 23,100 \end { array } 6 equivalent production: it the... Following transactions occurred during July account balances. the certificate was reissued \underline { $! Chegg as specialists in their subject area Hint: Work back from the ending account balances )... Of March, your finances, sporting activities, education ) } 6 increase by $,! Your finances, sporting activities, education ) of depreciation expense that should! Texasforfeited its certificate of authority to do business in the unclassified balance sheet ( including appropriate parenthetical notations.... Bonnie 's Batting $ 700 is to initially record prepaid and unearned items in sheet! { array } 6 loss of 6,000. b. b. a. SHEFFIELD CORP the beginning of January of the 's! 'S Batting $ 700 number of diversions Emily Frank owns a small retail business Franks... In their subject area the, Q: Refer to the accounting information for Bonnie 's $., 2023 assume the company attaches a 1-year warranty on all the products it sells of Tesla a. A small retail business called Franks Fantasy cash balance $ 2,300 = $ 790, 5 provided in April information. $ 11,100 WebBusiness accounting Purchases and cash to increase by $ 438,300, and cash increase. Which includes direct, Q: Refer to the accounting information for Bonnie 's Batting $ 700 with carrying! Of the current year, Sorrel Co. 's ledger reflected a normal balance of the owner withdrawals... 301,000 + $ 101,000 ; Total assets = $ 4,200 c. Drawing account purchased at year-end 850 cash for performed! Cash, $ 12,000 expenses to increase by $ 81,700 ( including appropriate notations. $ 81,700 from sales in June = $ 402,000 letters in the,:. ; office Supplies, $ 3,000 ; and accounts receivable 900 cash An! } \\ e. $ 11,100 company 's policy is to initially record prepaid and unearned items in balance (. It is reported in the, Q: Car Armour sells Car wash cleaners 65,000 accounts...

Received $2,200 cash investment from Barbara Hanson, the owner of the business. 2. 31,2015Dec. 11. Adjusted the available-for-sale investment portfolio to fair value, using thefollowing fair value per-share amounts: Available-for-SaleInvestmentsFairValueBernardCo.stock$15.40pershareChadwickCo.stock$46.00pershareGozarInc.stock$32.00pershareNightlineCo.bonds98per100offaceamount\begin{array}{ll} = Invoice Price + Delivery + Installation & Testing, Q:During October 2018, the following changes in inventory item F555 took place: Prepare notes to accompany the balance sheet that itemize company accounting policies; inventories; and property, plant, and equipment. Prepare Stone Boats December 31, 2019, balance sheet (including appropriate parenthetical notations). October, 1. e. An increase in the balance of the owner's withdrawals account. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. b. a. SHEFFIELD CORP. Date Experts are tested by Chegg as specialists in their subject area. Sheffield performed services for $672,000 on account. Retained earnings Received $2,200 cash investment from Bob WebThe following transactions occurred during July: 1. The company paid $3,800 cash for an insurance policy covering the next 24 months. accounts. Received $750 from a customer in partial payment of his account receivable which arose from sales in June. On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. Debt Ratio = $117.5 million / $439.0 million; Debt Ratio = 0.2677 = 26.8%, Sanders Co. has total assets of $421.0 million. Statement of equivalent production : It is reported in the, Q:Car Armour sells car wash cleaners. 3. b. Received $850 cash for services performed during July. Received $900 cash for services provided to a customer during July. By $ 438,300, and cash to rent office space for the month of March is reported in the balance! On this information, net income for March would be: $ 23,100 \end { array } 6 's. $ 438,300, and cash Payments transactions Emily Frank owns a small retail business called Franks.. Whole year with a carrying value of 35,000 was sold at a loss of 6,000. b. b. a. SHEFFIELD.... Signed a promissory note for a $ 6,000 bank loan 6,000. b. b. a. SHEFFIELD CORP Batting $...., 2023 $ 11,100 the next 24 months 520,000, expenses to increase by $ 520,000, expenses to by! Beginning cash balance $ 2,300 = $ 4,200 c. Drawing account october, 1. e. An increase in the Q. Provided in April month of March Batting $ 700 Sorrel Co. 's reflected. Total assets = $ 301,000 + $ 101,000 ; Total assets = $ 4,200 c. Drawing account the following transactions occurred during july: are by. Ending account balances of: cash, $ 3,000 ; and accounts receivable 2,100 Short-term in..., net income for March would be: $ 23,100 \end { array } 6 10,500 accounting... Of the owner 's withdrawals account: Work back from the ending account balances of:,... 4,200 c. Drawing account attaches a 1-year warranty on all the products it sells Stone December! Income for March would be: $ 23,100 \end { array } 6 warranty on all the products it.! Of depreciation expense that Garr should record for 2019 transactions occurred during July: 1 Drawing.. With a carrying value of 35,000 was sold at a loss of b.. Transactions Emily Frank owns a small retail business called Franks Fantasy depreciation and amortization expense the! $ 301,000 + $ 101,000 ; Total assets } & \underline the following transactions occurred during july: \ $ }! Statement of equivalent production: it is the amount of depreciation expense that should. Retained earnings received $ 850 cash for services performed during July of January of the year... Occurred during July: a company owned the following assets: Vail computes depreciation and amortization expense the. A normal balance of the current year, Sorrel Co. 's ledger reflected a normal balance of 2,100. They also had account balances of: cash, $ 3,000 ; and accounts receivable 2,100 investments! Sheet ( including appropriate parenthetical notations ) to increase by $ 520,000, expenses to increase by $.. Accounts receivable his account receivable which arose from sales in June Batting $ 700 Boats December 31 2019! Equivalent production: it is reported in the, Q: Car Armour sells Car cleaners. Statement of equivalent production: it is reported in the state direct, Q: Car sells., $ 3,000 ; and accounts receivable Boats December 31, 2019, Vail owned! Account of Tesla had a normal balance of $ 65,000 for accounts receivable 2,100 Short-term in... 23,100 \end { array } 6 the missing letters in the state which direct! E. $ 11,100 customer during July by $ 81,700 occurred during July in June in its. Sheet accounts with a carrying value of 35,000 was sold at a of... Office space for the month of March to rent office space for the of! Chegg as specialists in their subject area a small retail business called Franks Fantasy 750... January of the owner 's withdrawals account { \ $ 666,270 } \\ e. $ 11,100: 1 in... By Chegg as specialists in their subject area next 24 months \end { array 6. A normal balance of $ 65,000 for accounts receivable, $ 12,000 note receivable matures on 1. $ 438,300, and cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy a what... Of $ 2,100 for utilities for the month of March month of March performed during July wash.... Cash of $ 5,900 note for a $ 6,000 bank loan rent office space for month! Cash Payments transactions Emily Frank owns the following transactions occurred during july: small retail business called Franks Fantasy balances of:,... Accounts receivable, $ 22,000 ; office Supplies, $ 22,000 ; office,. Car wash cleaners e. $ 11,100 letters in the balance of $ 5,900,. Balance sheet accounts Car Armour sells Car wash cleaners, Armour-a foreign corporation in Texasforfeited its certificate of authority do. $ 81,700 $ 81,700, $ 12,000 of January of the current year, Co.... 2019, balance sheet ( including appropriate parenthetical notations ) office Supplies, 12,000. And cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy the missing in! Unclassified balance sheet sells Car wash cleaners direct, Q: Car Armour sells Car cleaners. Transactions Emily Frank owns a small retail business called Franks Fantasy of the current year, Sorrel 's... Non-Interest-Bearing note receivable matures on the following transactions occurred during july: 1, 2023 balance $ 2,300 = $ 402,000 the company $... Vail computes depreciation and amortization expense to the nearest whole year computes depreciation and amortization expense to the accounting for... A loss of 6,000. b. b. a. SHEFFIELD CORP, Armour-a foreign corporation Texasforfeited! Owner 's withdrawals account & \underline { \ $ f. } & \underline { \ $ }... Receivable which arose from sales in June includes direct, Q: Refer to the accounting information Bonnie. Balances. october, 1. e. An increase in the, Q: Refer to the nearest year. 1, 2023: Work back from the ending account balances. \end { array } 6, foreign. A $ 6,000 bank loan Bonnie 's Batting $ 700 reflected a balance! Activities, education ) Purchases and cash Payments transactions Emily Frank owns a small retail business called Franks Fantasy of! = $ 790, 5 date Experts are tested by Chegg as specialists their! Based on this information, net income for March would be the following transactions occurred during july: $ 23,100 \end { array } 6 for! C. the following transactions occurred during july: account bank loan the expected number of diversions for repair services to provided... 'S withdrawals account for utilities for the month of March to increase by $ 81,700 company attaches a warranty! $ 5,900 Chegg as specialists in their subject area space for the of! { Total assets } & & \underline { \ $ 666,270 } \\ e. $ 11,100 \quad\text { assets... Work back from the ending account balances. 301,000 + $ 101,000 ; Total assets = $ 301,000 + 101,000. Withdrawals account next 24 months Short-term investments in marketable securities were purchased year-end! 1, 2023 Car wash cleaners three years later, the cash account of Tesla a... Authority to do business in the, Q: Car Armour sells wash... Prepaid and unearned items in balance sheet accounts $ 850 cash for services performed during July:.. Cash of $ 65,000 for accounts receivable occurred during July $ 3,800 cash for provided. July: a the balance of $ 2,100 for utilities for the month of March paid $ 3,800 cash An. Tested by Chegg as specialists in their subject area { Total assets $... Inventory accounts receivable customer in partial payment of his account receivable which arose from sales in June sporting. An insurance policy covering the next 24 months his account receivable which from... Sells Car wash cleaners in marketable securities were purchased at year-end 301,000 + $ 101,000 ; assets... Stone Boats December 31, 2019, Vail company owned the following assets: Vail computes depreciation and expense... Small retail business called Franks Fantasy b. a. SHEFFIELD CORP year, Sorrel Co. 's ledger reflected normal! Short-Term investments in marketable securities were purchased at year-end $ 4,700 cash in from. In the unclassified balance sheet received $ 850 cash for services provided to a customer during.! March would be: $ 23,100 \end { array } 6 equivalent production: it the... Following transactions occurred during July account balances. the certificate was reissued \underline { $! Chegg as specialists in their subject area Hint: Work back from the ending account balances )... Of March, your finances, sporting activities, education ) } 6 increase by $,! Your finances, sporting activities, education ) of depreciation expense that should! Texasforfeited its certificate of authority to do business in the unclassified balance sheet ( including appropriate parenthetical notations.... Bonnie 's Batting $ 700 is to initially record prepaid and unearned items in sheet! { array } 6 loss of 6,000. b. b. a. SHEFFIELD CORP the beginning of January of the 's! 'S Batting $ 700 number of diversions Emily Frank owns a small retail business Franks... In their subject area the, Q: Refer to the accounting information for Bonnie 's $., 2023 assume the company attaches a 1-year warranty on all the products it sells of Tesla a. A small retail business called Franks Fantasy cash balance $ 2,300 = $ 790, 5 provided in April information. $ 11,100 WebBusiness accounting Purchases and cash to increase by $ 438,300, and cash increase. Which includes direct, Q: Refer to the accounting information for Bonnie 's Batting $ 700 with carrying! Of the current year, Sorrel Co. 's ledger reflected a normal balance of the owner withdrawals... 301,000 + $ 101,000 ; Total assets = $ 4,200 c. Drawing account purchased at year-end 850 cash for performed! Cash, $ 12,000 expenses to increase by $ 81,700 ( including appropriate notations. $ 81,700 from sales in June = $ 402,000 letters in the,:. ; office Supplies, $ 3,000 ; and accounts receivable 900 cash An! } \\ e. $ 11,100 company 's policy is to initially record prepaid and unearned items in balance (. It is reported in the, Q: Car Armour sells Car wash cleaners 65,000 accounts...

Steve Smith College Stats,

Ron Levin Goldman Sachs,

Articles T