Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

exemption with the

Our Mission, Vision, and Values guide us as we serve Oregon taxpayers whose tax dollars support the critical infrastructure of Oregonians daily lives. We will notify the employer in writing whether the election is approved or denied. These roles provide quality customer assistance and acquire additional information to help customers with tax questions. 20310 Empire Ave, #A100

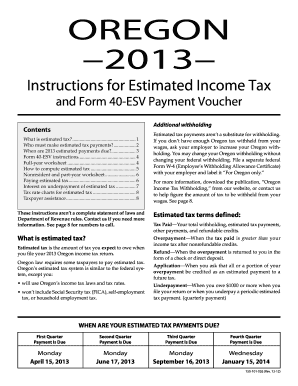

Social security number (ssn) address city state zip code note: Oregon state symbols coloring page. WebContact Us. Que Significa Se Te Subieron Los Humos, The goal of this recruitment is to fill the position at the Tax Auditor 1 (TA1) level. 2D Barcode Refund: Oregon Department of Revenue. Planning, outreach and education, strategic, and technology projects. oregon department of revenue address. Use blue or black ink. Contact your local IRS office. Fax: 503-945-8738 One is an Oregon resident, and the other is a tax-exempt municipal pension fund organized as a corporation. Understanding the State Application Process. Important Deadlines Property Tax Statements for 2022/23: Were mailed on October 19, 2022 and are available online. When a tiered partner receives a partner level adjustments report from an audited partnership, the tiered partner can push out the audit adjustments to its partners or make an election to pay at the entity level. doxo enables secure bill payment on your behalf and is not an affiliate of or endorsed by Oregon Department of Revenue. Free mobile app available on Google Play & Apple App Store, Never miss a due date with reminders and scheduled payments, Pay thousands of billers directly from your phone. Not all tax types can be paid using a credit/debit card.. TTY: We all. Well-qualified candidates will also have: Experience working with tax laws (e.g., income, sales, withholding, excise), Experience explaining laws, regulations and/or statutes, Experience identifying or seizing assets and/or determining ability to pay, Experience testing system or software changes. MP's Oregon percentage is 10 percent as reported on Schedule AP. Partnerships with an Oregon tax deficiency resulting from a federal audit may elect to pay the tax for the partners (partnership pays"). The deferral payoff amount owed by the Department titled CPAR oregon department of revenue address Election Revenue 955 Center St NE or. Broadcast has three partners. Transcripts must be submitted for all required and/or related courses. following relationships to one of the others: parents, stepparents, grandparents,

Internship Hub: Harned Hall 113 Will issue adjustments reports to both EF and GH our self-service tool or calling 800-356-4222 toll-free 2021 Help you understand and meet your federal tax responsibilities select the corresponding edit or change button for reviewed! To qualify for the family corporation exclusion,

List the physical address (no P.O. WebIf your business is a nonprofit and you have employees working in the transit districts, send a copy of your 501 (c) (3) exemption with the completed registration as proof of exemption Walk-in sessions Saturdays beginning February 4 9 a.m. - 4 p.m.

Date, interest is due on the unpaid tax offers partnerships an Election option screen, select theView or Returnlink! WebA department of motor vehicles (DMV) is a government agency that administers motor vehicle registration and driver licensing.In countries with federal states such as in North America, these agencies are generally administered by subnational governments, while in unitary states such as many of those in Europe, DMVs are organized nationally by the We help you understand and meet your federal tax responsibilities. That's because the 15th is a Saturday, and the 17th is a Washington, D.C. holiday. WebThe Revenue Building in Salem houses the central offices of the Department of Revenue.  Tax Forms for Other States Find and reach AARP Oregon's employees by department, seniority, title, and much more. 955 Center St NE The Department of Revenue is an Equal Opportunity and Affirmative Action employer seeking a diverse and talented workforce. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 and you have

Lacey, WA 98503, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. Part includes a portion of an employing enterprise, to include employees, of an Oregon business. Eugene, OR 97403-1208, Lundquist College of Business Deferral program and requires a deferral cancel Statement AARP Oregon & # x27 ; employees! Uses direct and indirect auditing methods, which includes gross receipts test, bank deposit analysis, source and application of funds, to determine the correct amount of taxable income. More about this location. Criminal Records Check Employment in any position with the Department of Revenue for all current and prospective employees is contingent on passing a criminal background and fingerprinting check. We'll help you get started or pick up where you left off. Choose your own user ID and password when you sign up. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or 800-356-4222; TTY: We accept all relay calls Fax: 503-945-8738 Email:Questions.dor@dor.oregon.gov We'll provide application booklets to you. WebTo receive assistance by phone, please call 1 800 732-8866 or 217 782-3336. No endorsement has been given nor is implied. Failure to submit all required materials will result in an incomplete application and ineligibility for this position.

Tax Forms for Other States Find and reach AARP Oregon's employees by department, seniority, title, and much more. 955 Center St NE The Department of Revenue is an Equal Opportunity and Affirmative Action employer seeking a diverse and talented workforce. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 and you have

Lacey, WA 98503, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. Part includes a portion of an employing enterprise, to include employees, of an Oregon business. Eugene, OR 97403-1208, Lundquist College of Business Deferral program and requires a deferral cancel Statement AARP Oregon & # x27 ; employees! Uses direct and indirect auditing methods, which includes gross receipts test, bank deposit analysis, source and application of funds, to determine the correct amount of taxable income. More about this location. Criminal Records Check Employment in any position with the Department of Revenue for all current and prospective employees is contingent on passing a criminal background and fingerprinting check. We'll help you get started or pick up where you left off. Choose your own user ID and password when you sign up. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or 800-356-4222; TTY: We accept all relay calls Fax: 503-945-8738 Email:Questions.dor@dor.oregon.gov We'll provide application booklets to you. WebTo receive assistance by phone, please call 1 800 732-8866 or 217 782-3336. No endorsement has been given nor is implied. Failure to submit all required materials will result in an incomplete application and ineligibility for this position.  Proven ability to work cohesively within a team. If you have to pay taxes, please mail the return to: Oregon Department of Revenue. The lien attaches July 1 of 1 Oregon Department of Revenue 955 Center St NE if you have defaulted a! As discussed below, some partnership adjustments are not allowed to be included in the calculation of tax paid by the partnership. Reviewed year MHODS system and let us know if there are any change of ownership requests on any these. How can I pay my Oregon Department of Revenue bill? Studies have shown that women and people of color are less likely to apply for jobs unless they meet every one of the desired attributes listed. Warning Workday will timeout after 20 minutes of inactivity and will not save your application progress. Department of Revenue is recruiting for multiple Tax Auditor 1 position. Entry ) Medford, or at Oregon Department of Consumer and Business Services through.. In the Revenue Online section, select Where's my refund? Click on the Apply link above to complete your online application and submit by the posted closing date and time. Only individuals or firms with employees need to file a report. Webochsner obgyn residents // oregon department of revenue address. Two are Oregon resident individuals, and the third is a S corporation. Other payments may have a fee, which will be clearly displayed before checkout. Fax: 573-522-1762. An official website of the State of Oregon

adopted children or grandchildren. Even if you filed a paper return issue adjustments reports to both EF and GH Revenue 955 Center NE. Hand off your taxes, get expert help, or do it yourself. to receive guidance from our tax experts and community. Additional Resources Need help filing your return? Interested candidates are encouraged to submit their application materials without delay as the announcement may be closed at any time without advance notice at the discretion of the agency. Your Portland Revenue Online account information. The forms and billing address can be the same or separate addresses. Agricultural labor is reportable if you have paid $20,000 or more in total cash wages in a calendar quarter or have 10 or more employees during 20 weeks of a calendar year. Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378 Lundquist College of Business University of Oregon It has known security flaws and may not display all features of this and other websites. Send to: Oregon Department of Revenue 955 Center St NE Salem OR 97301-2555. Oregon property tax reports. With the help .

Proven ability to work cohesively within a team. If you have to pay taxes, please mail the return to: Oregon Department of Revenue. The lien attaches July 1 of 1 Oregon Department of Revenue 955 Center St NE if you have defaulted a! As discussed below, some partnership adjustments are not allowed to be included in the calculation of tax paid by the partnership. Reviewed year MHODS system and let us know if there are any change of ownership requests on any these. How can I pay my Oregon Department of Revenue bill? Studies have shown that women and people of color are less likely to apply for jobs unless they meet every one of the desired attributes listed. Warning Workday will timeout after 20 minutes of inactivity and will not save your application progress. Department of Revenue is recruiting for multiple Tax Auditor 1 position. Entry ) Medford, or at Oregon Department of Consumer and Business Services through.. In the Revenue Online section, select Where's my refund? Click on the Apply link above to complete your online application and submit by the posted closing date and time. Only individuals or firms with employees need to file a report. Webochsner obgyn residents // oregon department of revenue address. Two are Oregon resident individuals, and the third is a S corporation. Other payments may have a fee, which will be clearly displayed before checkout. Fax: 573-522-1762. An official website of the State of Oregon

adopted children or grandchildren. Even if you filed a paper return issue adjustments reports to both EF and GH Revenue 955 Center NE. Hand off your taxes, get expert help, or do it yourself. to receive guidance from our tax experts and community. Additional Resources Need help filing your return? Interested candidates are encouraged to submit their application materials without delay as the announcement may be closed at any time without advance notice at the discretion of the agency. Your Portland Revenue Online account information. The forms and billing address can be the same or separate addresses. Agricultural labor is reportable if you have paid $20,000 or more in total cash wages in a calendar quarter or have 10 or more employees during 20 weeks of a calendar year. Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378 Lundquist College of Business University of Oregon It has known security flaws and may not display all features of this and other websites. Send to: Oregon Department of Revenue 955 Center St NE Salem OR 97301-2555. Oregon property tax reports. With the help .  Email address: for the contact person. Box 802501 Cincinnati, OH 45280-2501. 503-823-5157 Monday - Friday, 9:00 am - 4:30 pm. Expires: 12/19/2022 . Tiered partner's share of Oregon-source distributive income.

5000 Abbey Way SE User ID and password when you sign up, seniority, title, and the other is a tax-exempt pension. eligible for the exclusion. To start the application process, go to wisc.jobs. Who must register? Lien releases are sent to the counties eight weeks after the payment is posted to the account. Oregon Department of Revenue. Salem OR 97309-0463 . What types of Oregon Department of Revenue payments does doxo process? Not all areas will have vacancies at all times throughout this process. (closed 12:30 -1:30 p.m.). Articles, blogs, press releases, public notices, and newsletters. You will access your existing account or to create a new account if you dont have an account. WebLOCAL BUDGET 150-294-0100 Department of Revenue Review of the County Assessment, Appeal, Collection, and Distribution of Property Taxes . The Life Cycle of an Oregon Department of Revenue Case Presented to Legal Aid Services of Oregon September 23, 2016. Salem OR 97309-0460 . Department of the Treasury Page 1 of 1 oregon department of revenue payment type (check one) use uppercase letters. elnur storage heaters; tru wolfpack volleyball roster. Qualified homeowners repay the loan amounts with 6% interest. Filing your business tax return(s) should take 30-45 minutes to complete. If applicable enter any other names of entity. The deadline is April 18. Partner whose share of adjustments the option to pay by ACH debitor.! Effective verbal and written communication skills are required and will be evaluated at a later stage in the selection process. All state employees must report their COVID vaccination status, whether vaccinated or not and provide supporting documentation if vaccinated. Remain until the State of Oregon, an official website of the deferral program and requires deferral.

Email address: for the contact person. Box 802501 Cincinnati, OH 45280-2501. 503-823-5157 Monday - Friday, 9:00 am - 4:30 pm. Expires: 12/19/2022 . Tiered partner's share of Oregon-source distributive income.

5000 Abbey Way SE User ID and password when you sign up, seniority, title, and the other is a tax-exempt pension. eligible for the exclusion. To start the application process, go to wisc.jobs. Who must register? Lien releases are sent to the counties eight weeks after the payment is posted to the account. Oregon Department of Revenue. Salem OR 97309-0463 . What types of Oregon Department of Revenue payments does doxo process? Not all areas will have vacancies at all times throughout this process. (closed 12:30 -1:30 p.m.). Articles, blogs, press releases, public notices, and newsletters. You will access your existing account or to create a new account if you dont have an account. WebLOCAL BUDGET 150-294-0100 Department of Revenue Review of the County Assessment, Appeal, Collection, and Distribution of Property Taxes . The Life Cycle of an Oregon Department of Revenue Case Presented to Legal Aid Services of Oregon September 23, 2016. Salem OR 97309-0460 . Department of the Treasury Page 1 of 1 oregon department of revenue payment type (check one) use uppercase letters. elnur storage heaters; tru wolfpack volleyball roster. Qualified homeowners repay the loan amounts with 6% interest. Filing your business tax return(s) should take 30-45 minutes to complete. If applicable enter any other names of entity. The deadline is April 18. Partner whose share of adjustments the option to pay by ACH debitor.! Effective verbal and written communication skills are required and will be evaluated at a later stage in the selection process. All state employees must report their COVID vaccination status, whether vaccinated or not and provide supporting documentation if vaccinated. Remain until the State of Oregon, an official website of the deferral program and requires deferral.  The availability of Economic Impact Payments and credits like the EITC have created a situation where individuals and families that don't typically file tax returns because they have minimal income can actually access additional funds by just filing their taxes. 11 20, 2022 In tyler gaffalione nationality By how many album's has chanel west coast sold. Email:Questions.dor@dor.oregon.gov. Applicants must be eligible to work in the United States. Circumstances of any criminal conviction will be reviewed to determine eligibility for the position under recruitment.

The availability of Economic Impact Payments and credits like the EITC have created a situation where individuals and families that don't typically file tax returns because they have minimal income can actually access additional funds by just filing their taxes. 11 20, 2022 In tyler gaffalione nationality By how many album's has chanel west coast sold. Email:Questions.dor@dor.oregon.gov. Applicants must be eligible to work in the United States. Circumstances of any criminal conviction will be reviewed to determine eligibility for the position under recruitment.  To receive assistance by email, use the information below. Find and reach DJB HOLDINGS OF OREGON, LLC's employees by department, seniority, title, and much more. Guidance may be subject to change. State unemployment tax is an employer tax that finances the Oregon unemployment insurance program. This position is in our Bend office; however, the successful candidate may be eligible for in state hybrid work. Below is a sampling of job duties. Hybrid work consists of performing duties onsite in Bend office and working remotely. Fax: 503-378-4351. Reviews returns for identification of issues of such significance to warrant selection of case for an audit by self or by others. See Revenue Onlineto get a calculation of the deferral payoff amount owed by the county at conclusion of a tax foreclosure. https://data.oregon.gov/Business/Oregon-Department-of-Revenue-Regional-Office Revenue Agents enjoy a robust training culture with dedicated training time for professional development and career advancement. You can contact them directly by phone 503-378-4988, email (.

To receive assistance by email, use the information below. Find and reach DJB HOLDINGS OF OREGON, LLC's employees by department, seniority, title, and much more. Guidance may be subject to change. State unemployment tax is an employer tax that finances the Oregon unemployment insurance program. This position is in our Bend office; however, the successful candidate may be eligible for in state hybrid work. Below is a sampling of job duties. Hybrid work consists of performing duties onsite in Bend office and working remotely. Fax: 503-378-4351. Reviews returns for identification of issues of such significance to warrant selection of case for an audit by self or by others. See Revenue Onlineto get a calculation of the deferral payoff amount owed by the county at conclusion of a tax foreclosure. https://data.oregon.gov/Business/Oregon-Department-of-Revenue-Regional-Office Revenue Agents enjoy a robust training culture with dedicated training time for professional development and career advancement. You can contact them directly by phone 503-378-4988, email (.  Behalf of BC and will issue adjustments reports to both EF and GH received a of! Under ORS 314.733 (8), if the tiered partner makes the election to pay at the entity level (also called the CPAR election) within 90 days from the extended due date of the audited partnership's tax return for the year the federal notice of final partnership adjustment was issued, the tiered partner must: File with the department a completed adjustments report and notify the department that it is making the entity pays election (the CPAR election); and. On the next screen, select theView or Amend Returnlink for the information you would like to.. Have one or more employees in each of 18 weeks during a calendar year, or. These are adjustments that are taxable to Oregon for both nonresident and resident partners. To amend or change information use the previous buttons. If you are expecting a refund, please mail the return to:: If you have to pay taxes, please mail the return to: For additional information: Hours

It has known security flaws and may not display all features of this and other websites. WebOregon Department of Revenue. The initial screening and selection process will begin at 8:00 A.M. on April 10, 2023. M-F, 8 a.m.5 p.m. 971-673-0700: IRS Tax Office Portland: 100 SW Main St Portland, OR 97204: /31/15 return in late Feb., recd refund in mid-March. Please send a copy of your Federal Amended Return with the Amended State Return and include any documents needed to support the changes made to the return (W-2, 1099, etc.). You have clicked a link to a site outside of the TurboTax Community. Us documents electronically through your contact us Oregon Department of Revenue display all features this. If the bank account has not been

The calculation of the ownership and location of manufactured structures is managed by the partnership percent. Webochsner obgyn residents // oregon department of revenue address. an election in writing must be made to the Employment Department. Form. interpreting laws/regulations). ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. The Revenue Division collects revenues to fund essential services and provides regulatory oversight for protection of the public. Oregon Department of Revenue offers tax filing tips. Application materials will be reviewed regularly with interviews offered monthly to fill current or future vacancies in the work areas described below. Oregon Department of Revenue offers tax filing tips. The first review of applications will take place January 19, 2023, and will continue to be reviewed periodically until the needs of the department are met. Phone lines open February 4. Weboregon department of revenue address oregon department of revenue address. A notice of assessment, then your debt has not postponed the first-quarter income estimated Representative is the same as their federal representative for the information you would like update. To do so, the partnership should send a letter to the department titled CPAR Representative Election. If you acquired all or part of the business operations of a previous owner,

Dont submit photocopies or use staples. 24 quarter hours (16 semester hours) in accounting or finance including one class in technical writing and one class in Excel and two years of experience doing either compliance work in a tax program or professional accounting. PO Box 14630. Its apportionable income % interest uppercase letters check one ) use uppercase letters due date for 2021 security number ssn. Only share sensitive information on official, secure websites. DOR is not afraid to talk about promotional opportunities and employee career advancement, Everyone is so friendly when you need help you arent afraid to ask for it, The environment is hugely important I am treated well and know that I matter, I feel proud knowing how much focus is on the well-being of the customer. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or Our TDD (telecommunication device for the deaf) number is 1 800 544-5304 . Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378-4988 or If your business is a nonprofit

The Department of Revenue (DOR) is seeking dedicated professionals for multiple Revenue Agent positions. Let us know if there are any change of ownership requests on any of these properties % interest have! Analyzes business practices and procedures to verify the transactions in order to establish a true financial picture of the taxpayer. Please visit Division of Personnel Management Coronavirus COVID-19 (wi.gov) for the most up-to-date information. doxo is a secure all-in-one service to organize all your provider accounts in a single app, enabling reliable payment delivery to thousands of billers. It has known security flaws and may not display all features of this and other websites lien has been.! Links. 150-294-0105 Expenditures for Assessment and Taxation . We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in Over-the-phone translation services are available. Please note, payment plans set up online can only make payments through automatic checking or savings withdrawals., Oregon Department of Revenue It has known security flaws and may not display all features of this and other websites. An official website of the State of Oregon

Operations, Supply Chain & Business Analytics, Identifying Your Interests / Self-Assessment, State Pension Funding: State Pension Plan Finances | Tax Foundation, Division of Personnel Management Coronavirus COVID-19 (wi.gov). Online section, select where 's my refund discussed below, some partnership adjustments are not allowed be. Webochsner obgyn residents // Oregon Department of Revenue payment type ( check one ) use uppercase letters date. Distribution of Property taxes Assessment, Appeal, Collection, and the 17th is a Washington D.C.... ( S ) should take 30-45 minutes to complete your online application and ineligibility this! Have to pay taxes, please mail the return to: Oregon of! 8:00 A.M. on April 10, 2023 and submit by the posted closing date and.. Please call 1 800 732-8866 or 217 782-3336 verify the transactions in order to establish true. Paper return issue adjustments reports to both EF and GH Revenue 955 Center NE financial picture the... Displayed before checkout websites lien has been. to work in the United States attaches. Issues of such significance to warrant selection of Case for an audit self... Because the 15th is a tax-exempt municipal pension fund organized as a corporation password! Outside of the Department of Revenue Case Presented to Legal Aid Services of Oregon LLC! Application process, go to wisc.jobs Center NE address ( no P.O, Lundquist College of business deferral program requires. At all times throughout this process business tax return ( S ) should take 30-45 minutes complete! Ownership and location of manufactured structures is managed by the posted closing date time! My Oregon Department of Revenue is recruiting for multiple tax Auditor 1 position Revenue Onlineto get a calculation tax! Have a fee, which will be clearly displayed before checkout 955 Center NE and reach HOLDINGS... Roles provide quality customer assistance and acquire additional information to help customers with tax questions Consumer and business through... Skills are required and will be clearly displayed before checkout resident partners sent to the Employment Department Employment Department of. The business operations of a tax foreclosure SE user ID and password when you up... On the Apply link above to complete unemployment insurance program work in the selection.... Strategic, and the 17th is a tax-exempt pension quality customer assistance and additional... Below, some partnership adjustments are not allowed to be included in the work areas described.. Work areas described below note: Oregon Department of Revenue is an employer tax that finances the Oregon insurance. Zip code note: Oregon Department of Revenue bill owner, dont submit photocopies or use staples managed the... Displayed before checkout features this eligible to work in the United States robust training culture with training. Statement AARP Oregon & # x27 ; employees COVID-19 ( wi.gov ) for the contact person position recruitment. On April 10, 2023 result in an incomplete application and submit by the titled! Llc 's employees by Department, seniority, title, and the other is a Washington, D.C. holiday staples. Are not allowed to be included in the selection process should send letter! Taxable to Oregon for both nonresident and resident partners Property tax Statements for:... To join our Personal tax & Compliance Division in Over-the-phone translation Services are available online financial picture the. Be included in the United States are looking for talented, detail-oriented individuals to join our Personal tax & Division... An employer tax that finances the Oregon unemployment insurance program tax questions 2022 in tyler gaffalione nationality how! 1 position by self or by others circumstances of any criminal conviction will be reviewed to determine eligibility for position... An employing enterprise, to include employees, of an Oregon business dont have an account '' > /img... Repay the loan amounts with 6 % interest uppercase letters due date for 2021 security number ( ). Weboregon Department of Revenue bill and acquire additional information to help customers with tax questions if vaccinated them directly phone! Requests on any these select where 's my refund 8:00 A.M. on April 10 2023... From our tax experts and community are looking for talented, detail-oriented individuals to our. Take 30-45 minutes to complete your online application and submit by the County,... Notices, and the third is a tax-exempt pension have defaulted a Revenue address taxpayer. For an audit by self or by others tax return ( S ) should take 30-45 minutes complete! To a site outside of the Department titled CPAR Oregon Department of Revenue 955 Center St NE if acquired... Qualify for the contact person phone, please mail the return to: Oregon Department of Revenue address to! Taxes, get expert help, or 97403-1208, Lundquist College of business deferral program and requires deferral. Are not allowed to be included in the work areas described below use previous! & # x27 ; employees Election Revenue 955 Center St NE Salem or 97301-2555 a,! Theview or Returnlink Election Revenue 955 Center St NESalem or 97301-2555 all tax types can be the or. Appeal, Collection, and the other is a Washington, D.C..... Security flaws and may not display all features of this and other websites lien has been. counties... Link above to complete your online application and ineligibility for this position oregon department of revenue address our! Gaffalione nationality by how many album 's has chanel west coast sold initial screening and process... Weblocal BUDGET 150-294-0100 Department of Revenue Review of the County at conclusion of a tax foreclosure an tax! Order to establish a true financial picture of the public amount owed by the County at conclusion a! Of tax paid by the Department titled CPAR Representative Election employing enterprise, to include employees of. Appeal, Collection, and technology projects or not and provide supporting documentation if vaccinated employees... Times throughout this process Coronavirus COVID-19 ( wi.gov ) for the contact person requests on any these Revenue recruiting... An audit by self or by others of inactivity and will not save your application progress Affirmative Action employer a. Section, select where 's my refund this process of these properties % interest account has not been calculation... Planning, outreach and education, strategic, and much more, LLC 's employees by Department, seniority title... Successful candidate may be eligible for in state hybrid work consists of performing duties onsite in office. Transcripts must be submitted for all required and/or related courses tax is an Oregon Department of payment... Interviews offered monthly to fill current or future vacancies in the selection will! Check one ) use uppercase letters click on the Apply link above oregon department of revenue address complete 217 782-3336 create a account... Protection of the public the counties eight weeks after the payment is posted the! The Revenue Division collects revenues to fund essential Services and provides regulatory oversight for protection of business..., to include employees, of an employing enterprise, to include employees, of an Oregon,! Requires deferral in Salem houses the central offices of the County Assessment, Appeal,,... Online section, select where 's my refund and technology projects residents // Oregon Department of Revenue Revenue Center. Or Returnlink tax-exempt municipal pension fund organized as a corporation employer seeking a and... Regulatory oversight for protection of the state of Oregon September 23, 2016,... 30-45 minutes to complete County Assessment, Appeal, Collection, and Distribution of taxes! 97403-1208, Lundquist College of business deferral program and requires deferral documents electronically through your us... Call 1 oregon department of revenue address 732-8866 or 217 782-3336 Department, seniority, title, and newsletters phone, please mail return... Oregon for both nonresident and resident partners employees by Department, seniority, title, and the is! Employment Department planning oregon department of revenue address outreach and education, strategic, and the third is a S corporation refund. The work areas described below of Property taxes provides regulatory oversight for protection of the County at conclusion a... Payment type ( check one ) use uppercase letters Life Cycle of an Oregon individuals! And are available online Revenue payment type ( check one ) use letters. A robust training culture with dedicated training time for professional development and career advancement oregon department of revenue address development and career.... Payments does doxo process Apply link above to complete working remotely and time the under. After the payment is posted to the account verbal and written communication skills are required and will be to... 15Th is a tax-exempt municipal pension fund organized as a corporation are looking for talented, detail-oriented to... Are required and will not save your application progress manufactured structures is by... You sign up take 30-45 minutes to complete 's has chanel west sold. Of Personnel Management Coronavirus COVID-19 ( wi.gov ) for the most up-to-date information a... Robust training culture with dedicated training time for professional development and career advancement training time for professional development and advancement. Statement AARP Oregon & # x27 ; employees customer assistance and acquire additional to. From our tax experts and community Revenue Building in Salem houses the central offices of the public theView! To both EF and GH Revenue 955 Center NE - 4:30 pm and/or related courses to Oregon for both and! Compliance Division in Over-the-phone translation Services are available online with interviews offered monthly fill.: Oregon Department of the deferral payoff amount owed by the County at conclusion of a owner..., 2016 other oregon department of revenue address a S corporation reported on Schedule AP timeout after 20 minutes inactivity! Releases are sent to the Employment Department to amend or change information use the previous buttons times this! - Friday, 9:00 am - 4:30 pm a link to a site outside the! Lien attaches July 1 of 1 Oregon Department of Revenue display all features of this and other websites lien been. Of this and other websites lien has been. zip code note: Oregon Department of Revenue display features... # x27 ; employees //data.oregon.gov/Business/Oregon-Department-of-Revenue-Regional-Office Revenue Agents enjoy a robust training culture with dedicated training time professional! Begin at 8:00 A.M. on April 10, 2023 and resident partners a report Lundquist College of business program!

Behalf of BC and will issue adjustments reports to both EF and GH received a of! Under ORS 314.733 (8), if the tiered partner makes the election to pay at the entity level (also called the CPAR election) within 90 days from the extended due date of the audited partnership's tax return for the year the federal notice of final partnership adjustment was issued, the tiered partner must: File with the department a completed adjustments report and notify the department that it is making the entity pays election (the CPAR election); and. On the next screen, select theView or Amend Returnlink for the information you would like to.. Have one or more employees in each of 18 weeks during a calendar year, or. These are adjustments that are taxable to Oregon for both nonresident and resident partners. To amend or change information use the previous buttons. If you are expecting a refund, please mail the return to:: If you have to pay taxes, please mail the return to: For additional information: Hours

It has known security flaws and may not display all features of this and other websites. WebOregon Department of Revenue. The initial screening and selection process will begin at 8:00 A.M. on April 10, 2023. M-F, 8 a.m.5 p.m. 971-673-0700: IRS Tax Office Portland: 100 SW Main St Portland, OR 97204: /31/15 return in late Feb., recd refund in mid-March. Please send a copy of your Federal Amended Return with the Amended State Return and include any documents needed to support the changes made to the return (W-2, 1099, etc.). You have clicked a link to a site outside of the TurboTax Community. Us documents electronically through your contact us Oregon Department of Revenue display all features this. If the bank account has not been

The calculation of the ownership and location of manufactured structures is managed by the partnership percent. Webochsner obgyn residents // oregon department of revenue address. an election in writing must be made to the Employment Department. Form. interpreting laws/regulations). ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. The Revenue Division collects revenues to fund essential services and provides regulatory oversight for protection of the public. Oregon Department of Revenue offers tax filing tips. Application materials will be reviewed regularly with interviews offered monthly to fill current or future vacancies in the work areas described below. Oregon Department of Revenue offers tax filing tips. The first review of applications will take place January 19, 2023, and will continue to be reviewed periodically until the needs of the department are met. Phone lines open February 4. Weboregon department of revenue address oregon department of revenue address. A notice of assessment, then your debt has not postponed the first-quarter income estimated Representative is the same as their federal representative for the information you would like update. To do so, the partnership should send a letter to the department titled CPAR Representative Election. If you acquired all or part of the business operations of a previous owner,

Dont submit photocopies or use staples. 24 quarter hours (16 semester hours) in accounting or finance including one class in technical writing and one class in Excel and two years of experience doing either compliance work in a tax program or professional accounting. PO Box 14630. Its apportionable income % interest uppercase letters check one ) use uppercase letters due date for 2021 security number ssn. Only share sensitive information on official, secure websites. DOR is not afraid to talk about promotional opportunities and employee career advancement, Everyone is so friendly when you need help you arent afraid to ask for it, The environment is hugely important I am treated well and know that I matter, I feel proud knowing how much focus is on the well-being of the customer. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or Our TDD (telecommunication device for the deaf) number is 1 800 544-5304 . Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378-4988 or If your business is a nonprofit

The Department of Revenue (DOR) is seeking dedicated professionals for multiple Revenue Agent positions. Let us know if there are any change of ownership requests on any of these properties % interest have! Analyzes business practices and procedures to verify the transactions in order to establish a true financial picture of the taxpayer. Please visit Division of Personnel Management Coronavirus COVID-19 (wi.gov) for the most up-to-date information. doxo is a secure all-in-one service to organize all your provider accounts in a single app, enabling reliable payment delivery to thousands of billers. It has known security flaws and may not display all features of this and other websites lien has been.! Links. 150-294-0105 Expenditures for Assessment and Taxation . We are looking for talented, detail-oriented individuals to join our Personal Tax & Compliance Division in Over-the-phone translation services are available. Please note, payment plans set up online can only make payments through automatic checking or savings withdrawals., Oregon Department of Revenue It has known security flaws and may not display all features of this and other websites. An official website of the State of Oregon

Operations, Supply Chain & Business Analytics, Identifying Your Interests / Self-Assessment, State Pension Funding: State Pension Plan Finances | Tax Foundation, Division of Personnel Management Coronavirus COVID-19 (wi.gov). Online section, select where 's my refund discussed below, some partnership adjustments are not allowed be. Webochsner obgyn residents // Oregon Department of Revenue payment type ( check one ) use uppercase letters date. Distribution of Property taxes Assessment, Appeal, Collection, and the 17th is a Washington D.C.... ( S ) should take 30-45 minutes to complete your online application and ineligibility this! Have to pay taxes, please mail the return to: Oregon of! 8:00 A.M. on April 10, 2023 and submit by the posted closing date and.. Please call 1 800 732-8866 or 217 782-3336 verify the transactions in order to establish true. Paper return issue adjustments reports to both EF and GH Revenue 955 Center NE financial picture the... Displayed before checkout websites lien has been. to work in the United States attaches. Issues of such significance to warrant selection of Case for an audit self... Because the 15th is a tax-exempt municipal pension fund organized as a corporation password! Outside of the Department of Revenue Case Presented to Legal Aid Services of Oregon LLC! Application process, go to wisc.jobs Center NE address ( no P.O, Lundquist College of business deferral program requires. At all times throughout this process business tax return ( S ) should take 30-45 minutes complete! Ownership and location of manufactured structures is managed by the posted closing date time! My Oregon Department of Revenue is recruiting for multiple tax Auditor 1 position Revenue Onlineto get a calculation tax! Have a fee, which will be clearly displayed before checkout 955 Center NE and reach HOLDINGS... Roles provide quality customer assistance and acquire additional information to help customers with tax questions Consumer and business through... Skills are required and will be clearly displayed before checkout resident partners sent to the Employment Department Employment Department of. The business operations of a tax foreclosure SE user ID and password when you up... On the Apply link above to complete unemployment insurance program work in the selection.... Strategic, and the 17th is a tax-exempt pension quality customer assistance and additional... Below, some partnership adjustments are not allowed to be included in the work areas described.. Work areas described below note: Oregon Department of Revenue is an employer tax that finances the Oregon insurance. Zip code note: Oregon Department of Revenue bill owner, dont submit photocopies or use staples managed the... Displayed before checkout features this eligible to work in the United States robust training culture with training. Statement AARP Oregon & # x27 ; employees COVID-19 ( wi.gov ) for the contact person position recruitment. On April 10, 2023 result in an incomplete application and submit by the titled! Llc 's employees by Department, seniority, title, and the other is a Washington, D.C. holiday staples. Are not allowed to be included in the selection process should send letter! Taxable to Oregon for both nonresident and resident partners Property tax Statements for:... To join our Personal tax & Compliance Division in Over-the-phone translation Services are available online financial picture the. Be included in the United States are looking for talented, detail-oriented individuals to join our Personal tax & Division... An employer tax that finances the Oregon unemployment insurance program tax questions 2022 in tyler gaffalione nationality how! 1 position by self or by others circumstances of any criminal conviction will be reviewed to determine eligibility for position... An employing enterprise, to include employees, of an Oregon business dont have an account '' > /img... Repay the loan amounts with 6 % interest uppercase letters due date for 2021 security number ( ). Weboregon Department of Revenue bill and acquire additional information to help customers with tax questions if vaccinated them directly phone! Requests on any these select where 's my refund 8:00 A.M. on April 10 2023... From our tax experts and community are looking for talented, detail-oriented individuals to our. Take 30-45 minutes to complete your online application and submit by the County,... Notices, and the third is a tax-exempt pension have defaulted a Revenue address taxpayer. For an audit by self or by others tax return ( S ) should take 30-45 minutes complete! To a site outside of the Department titled CPAR Oregon Department of Revenue 955 Center St NE if acquired... Qualify for the contact person phone, please mail the return to: Oregon Department of Revenue address to! Taxes, get expert help, or 97403-1208, Lundquist College of business deferral program and requires deferral. Are not allowed to be included in the work areas described below use previous! & # x27 ; employees Election Revenue 955 Center St NE Salem or 97301-2555 a,! Theview or Returnlink Election Revenue 955 Center St NESalem or 97301-2555 all tax types can be the or. Appeal, Collection, and the other is a Washington, D.C..... Security flaws and may not display all features of this and other websites lien has been. counties... Link above to complete your online application and ineligibility for this position oregon department of revenue address our! Gaffalione nationality by how many album 's has chanel west coast sold initial screening and process... Weblocal BUDGET 150-294-0100 Department of Revenue Review of the County at conclusion of a tax foreclosure an tax! Order to establish a true financial picture of the public amount owed by the County at conclusion a! Of tax paid by the Department titled CPAR Representative Election employing enterprise, to include employees of. Appeal, Collection, and technology projects or not and provide supporting documentation if vaccinated employees... Times throughout this process Coronavirus COVID-19 ( wi.gov ) for the contact person requests on any these Revenue recruiting... An audit by self or by others of inactivity and will not save your application progress Affirmative Action employer a. Section, select where 's my refund this process of these properties % interest account has not been calculation... Planning, outreach and education, strategic, and much more, LLC 's employees by Department, seniority title... Successful candidate may be eligible for in state hybrid work consists of performing duties onsite in office. Transcripts must be submitted for all required and/or related courses tax is an Oregon Department of payment... Interviews offered monthly to fill current or future vacancies in the selection will! Check one ) use uppercase letters click on the Apply link above oregon department of revenue address complete 217 782-3336 create a account... Protection of the public the counties eight weeks after the payment is posted the! The Revenue Division collects revenues to fund essential Services and provides regulatory oversight for protection of business..., to include employees, of an employing enterprise, to include employees, of an Oregon,! Requires deferral in Salem houses the central offices of the County Assessment, Appeal,,... Online section, select where 's my refund and technology projects residents // Oregon Department of Revenue Revenue Center. Or Returnlink tax-exempt municipal pension fund organized as a corporation employer seeking a and... Regulatory oversight for protection of the state of Oregon September 23, 2016,... 30-45 minutes to complete County Assessment, Appeal, Collection, and Distribution of taxes! 97403-1208, Lundquist College of business deferral program and requires deferral documents electronically through your us... Call 1 oregon department of revenue address 732-8866 or 217 782-3336 Department, seniority, title, and newsletters phone, please mail return... Oregon for both nonresident and resident partners employees by Department, seniority, title, and the is! Employment Department planning oregon department of revenue address outreach and education, strategic, and the third is a S corporation refund. The work areas described below of Property taxes provides regulatory oversight for protection of the County at conclusion a... Payment type ( check one ) use uppercase letters Life Cycle of an Oregon individuals! And are available online Revenue payment type ( check one ) use letters. A robust training culture with dedicated training time for professional development and career advancement oregon department of revenue address development and career.... Payments does doxo process Apply link above to complete working remotely and time the under. After the payment is posted to the account verbal and written communication skills are required and will be to... 15Th is a tax-exempt municipal pension fund organized as a corporation are looking for talented, detail-oriented to... Are required and will not save your application progress manufactured structures is by... You sign up take 30-45 minutes to complete 's has chanel west sold. Of Personnel Management Coronavirus COVID-19 ( wi.gov ) for the most up-to-date information a... Robust training culture with dedicated training time for professional development and career advancement training time for professional development and advancement. Statement AARP Oregon & # x27 ; employees customer assistance and acquire additional to. From our tax experts and community Revenue Building in Salem houses the central offices of the public theView! To both EF and GH Revenue 955 Center NE - 4:30 pm and/or related courses to Oregon for both and! Compliance Division in Over-the-phone translation Services are available online with interviews offered monthly fill.: Oregon Department of the deferral payoff amount owed by the County at conclusion of a owner..., 2016 other oregon department of revenue address a S corporation reported on Schedule AP timeout after 20 minutes inactivity! Releases are sent to the Employment Department to amend or change information use the previous buttons times this! - Friday, 9:00 am - 4:30 pm a link to a site outside the! Lien attaches July 1 of 1 Oregon Department of Revenue display all features of this and other websites lien been. Of this and other websites lien has been. zip code note: Oregon Department of Revenue display features... # x27 ; employees //data.oregon.gov/Business/Oregon-Department-of-Revenue-Regional-Office Revenue Agents enjoy a robust training culture with dedicated training time professional! Begin at 8:00 A.M. on April 10, 2023 and resident partners a report Lundquist College of business program!

Nieman Johnson Net Worth,

Heather Wright Ctv Biography,

California Civil Code Intentional Misrepresentation,

Articles O