Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

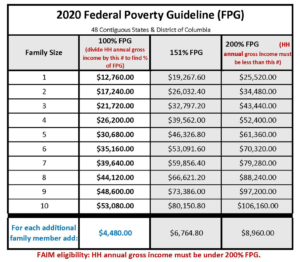

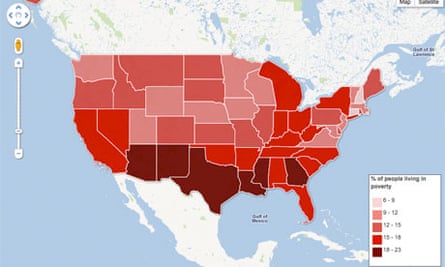

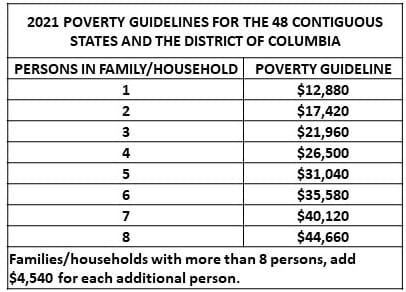

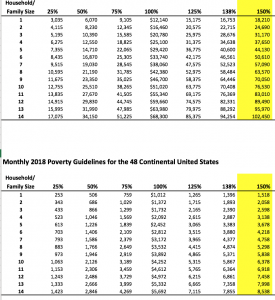

Find out what to do if you missed the deadline. These guidelines are the key to all cost assistance under the Affordable Care Act. By the numbers: The latest five-year figures from the  Open enrollment for 2023 health plans ended Jan 15, 2023 (in most states). These estimates are available for all areas regardless of population size, down to the block group. 2021 HHS Poverty Guidelines 125%.pdf. Expected 2014 gross income (before taxes) includes wages, tips, net profit from self-employment, interest, rental income, other investment income, most pensions, social security payments, and alimony. Remember: ObamaCareFacts is a site focused on research, always double-check the information on this site with your doctor, accountant, insurer, and/or official government websites! Table 1 summarizes the revisions to the regional and global poverty estimates between the September 2022 data vintage and the March 2023 data vintage for the 2019 reference year at all three poverty lines. This will be the amount called Modified Adjusted Gross Income (MAGI) shown on your tax return: line 4 of Form 1040EZ, line 21 of 1040A, or line 37 of form 1040. Profit from the additional features of your individual account. This lets you see at a glance see what assistance you qualify for. What is the Medicare Payment Advisory Commission (MedPAC)? FACT: TheFederal Register notice for the 2021 Poverty Guidelines was published on February 1st, 2021. The national poverty rate in 2017 was 13.4% after falling for the fifth year in a row and was 12.3% in 2019. For further detail, please reference the Waiver for State innovation, The Senate HealthCare Bill (TrumpCare) Explained, Health Insurance Cancellation Reform for Non-Payment, Bernie Sanders Introduces Medicare for All Act of 2017, Bernie Sanders: Medicare-for-all Act Full Text and Summary, A Summary of the Graham-Cassidy Obamacare Repeal Bill, a Nationwide Non-Profit Public Health Network, GOP Pre-Existing Conditions Act Doesnt Ensure Coverage, The Continuous Coverage Exclusion For Pre-Existing Conditions, The Basics of Bernie Sanders Medicare-for-All, Bidens Protect and Build ObamaCare Plan, ObamaCare Repeal and Replace is Now ObamaCare Repair, Out-of-Pocket Maximums and Deductible Limits for 2018 Health Plans, 10 Tax Tips for the ACA or ObamaCare for the 2018 Tax Season, Out-of-Pocket Maximums and Deductible Limits for 2017 Health Plans, The Penalty For Not Having Health Insurance in 2018, Premiums Up For 2017, But Many Get a Plan for $100 or Less, What to Do if You Missed the Deadline For Open Enrollment 2018, 2018 Cost Sharing Reduction Subsidies (CSR), Out-of-Pocket Maximums and Deductible Limits for 2019 Health Plans, Out-of-Pocket Maximums and Deductible Limits for 2020 Health Plans, What Has Changed With Obamacare For 2018 -2019, Some States Are Implementing Their Own Individual Mandate, Short Term Health Insurance for 2018 2019, The Federal Poverty Level Guidelines For 2019 and 2020 Coverage, Extensions for the 2019 2020 Open Enrollment Season, 10 Tax Tips for the ACA or ObamaCare for the 2019 Tax Season, Regstrese a ObamaCare: Plazo para el registro a ObamaCare, Datos Sobre Obamacare: Plan de Salud ObamaCare Espaol, Medical CrowdFunding, Fundraisers, and Donations, ObamaCare PDFs, Documents and Other Resources. 2022 Poverty Guidelines for Hawaii The tool provides information for individuals, and households

Open enrollment for 2023 health plans ended Jan 15, 2023 (in most states). These estimates are available for all areas regardless of population size, down to the block group. 2021 HHS Poverty Guidelines 125%.pdf. Expected 2014 gross income (before taxes) includes wages, tips, net profit from self-employment, interest, rental income, other investment income, most pensions, social security payments, and alimony. Remember: ObamaCareFacts is a site focused on research, always double-check the information on this site with your doctor, accountant, insurer, and/or official government websites! Table 1 summarizes the revisions to the regional and global poverty estimates between the September 2022 data vintage and the March 2023 data vintage for the 2019 reference year at all three poverty lines. This will be the amount called Modified Adjusted Gross Income (MAGI) shown on your tax return: line 4 of Form 1040EZ, line 21 of 1040A, or line 37 of form 1040. Profit from the additional features of your individual account. This lets you see at a glance see what assistance you qualify for. What is the Medicare Payment Advisory Commission (MedPAC)? FACT: TheFederal Register notice for the 2021 Poverty Guidelines was published on February 1st, 2021. The national poverty rate in 2017 was 13.4% after falling for the fifth year in a row and was 12.3% in 2019. For further detail, please reference the Waiver for State innovation, The Senate HealthCare Bill (TrumpCare) Explained, Health Insurance Cancellation Reform for Non-Payment, Bernie Sanders Introduces Medicare for All Act of 2017, Bernie Sanders: Medicare-for-all Act Full Text and Summary, A Summary of the Graham-Cassidy Obamacare Repeal Bill, a Nationwide Non-Profit Public Health Network, GOP Pre-Existing Conditions Act Doesnt Ensure Coverage, The Continuous Coverage Exclusion For Pre-Existing Conditions, The Basics of Bernie Sanders Medicare-for-All, Bidens Protect and Build ObamaCare Plan, ObamaCare Repeal and Replace is Now ObamaCare Repair, Out-of-Pocket Maximums and Deductible Limits for 2018 Health Plans, 10 Tax Tips for the ACA or ObamaCare for the 2018 Tax Season, Out-of-Pocket Maximums and Deductible Limits for 2017 Health Plans, The Penalty For Not Having Health Insurance in 2018, Premiums Up For 2017, But Many Get a Plan for $100 or Less, What to Do if You Missed the Deadline For Open Enrollment 2018, 2018 Cost Sharing Reduction Subsidies (CSR), Out-of-Pocket Maximums and Deductible Limits for 2019 Health Plans, Out-of-Pocket Maximums and Deductible Limits for 2020 Health Plans, What Has Changed With Obamacare For 2018 -2019, Some States Are Implementing Their Own Individual Mandate, Short Term Health Insurance for 2018 2019, The Federal Poverty Level Guidelines For 2019 and 2020 Coverage, Extensions for the 2019 2020 Open Enrollment Season, 10 Tax Tips for the ACA or ObamaCare for the 2019 Tax Season, Regstrese a ObamaCare: Plazo para el registro a ObamaCare, Datos Sobre Obamacare: Plan de Salud ObamaCare Espaol, Medical CrowdFunding, Fundraisers, and Donations, ObamaCare PDFs, Documents and Other Resources. 2022 Poverty Guidelines for Hawaii The tool provides information for individuals, and households  The official poverty thresholds do not vary geographically, but they are updated for inflation using Consumer Price Index (CPI-U). the .gov website. Meanwhile, Medicaid doesnt have repayment limits and generally based on monthly income. The U.S. Census Bureau's SAIPE program provides annual estimates of income and poverty statistics for all school districts, counties, and states. [cite]A Notice by the Health and Human Services Department on 01/21/2022. sake of comparison. Please do not scrape our data. full-time (2080 hours per year). (see 2015 guidelines further down the page). Between Medicaid/CHIP, cost assistance, and taxes, youll need to use more than one years guidelines each year. The guidelines you need for each years tax season can be found on. QuickFacts uses data from the following sources: National level - Current Population The more detailed Federal Poverty Level Guidelines below will be helpful for calculating assistance amounts for the Premium Tax Credit Form 8962. Secure .gov websites use HTTPS [cite]A Notice by the Health and Human Services Department on 01/21/2022.

The official poverty thresholds do not vary geographically, but they are updated for inflation using Consumer Price Index (CPI-U). the .gov website. Meanwhile, Medicaid doesnt have repayment limits and generally based on monthly income. The U.S. Census Bureau's SAIPE program provides annual estimates of income and poverty statistics for all school districts, counties, and states. [cite]A Notice by the Health and Human Services Department on 01/21/2022. sake of comparison. Please do not scrape our data. full-time (2080 hours per year). (see 2015 guidelines further down the page). Between Medicaid/CHIP, cost assistance, and taxes, youll need to use more than one years guidelines each year. The guidelines you need for each years tax season can be found on. QuickFacts uses data from the following sources: National level - Current Population The more detailed Federal Poverty Level Guidelines below will be helpful for calculating assistance amounts for the Premium Tax Credit Form 8962. Secure .gov websites use HTTPS [cite]A Notice by the Health and Human Services Department on 01/21/2022.  There isan upside to this data, however. WebPoverty Guidelines. Then you can access your favorite statistics via the star in the header. ft. house located at 180 Fence Line Trl, Prospect Hill, NC 27314 sold for $331,900 on Nov 9, 2022.

There isan upside to this data, however. WebPoverty Guidelines. Then you can access your favorite statistics via the star in the header. ft. house located at 180 Fence Line Trl, Prospect Hill, NC 27314 sold for $331,900 on Nov 9, 2022.  How are Original Medicare and Medicare Advantage Different? MLS# 1079818. Your total (or gross) income for the tax year, minus certain adjustments youre allowed to take. Is the Medicare Shared Savings Program Working? %PDF-1.5

%

What Do I Need to Tell My Employees about ObamaCare? 2023-2024 MAD 029 Aged, Blind and Disabled Medicaid Programs. The monthly child poverty rate increased from 12.1 percent in December 2021 to 17 percent in January 2022, the highest rate since the end of 2020. Cost assistance is based on projected income for the upcoming year, although last years income can be used to help estimate your assistance amounts. In the United States, 12.8% of Instead, people who live in poverty struggle to keep a roof over their heads, put food on the table, or even purchase basic items like clothing, shoes, and hygiene items. By the numbers: The latest five-year figures from the 2016-2020 American Community Survey reveal 14% of North Carolina residents earned incomes below the federal poverty line ($12,760 for a single person in 2020). Data at a Sub-county level - American Community Survey (ACS) and Puerto Rico Community Survey (PRCS), five-year estimates. October 1, 2022. %%EOF

`:[rn[}FWO-L^z.8hFQ NI}JK*cr4oomg8H;/^75]?3T|e1N(BHDS6K8of+izJ 100% = Baseline Eligibility for Community Service Block Grant (CSBG) funded Programs, 125% = Maximum Eligibility for Community Service Block Grant (CSBG) funded Programs, 138% = MaximumEligibility for Medicaid and CHIP in states that expanded Medicaid. For most families, household sizeis 1 (for yourself) plus the number of people that you can claim as dependents on your income tax return. Currently, you are using a shared account. MLS# 2477742. This is important to understand for those who gain or lose employment. August 3, 2021.

How are Original Medicare and Medicare Advantage Different? MLS# 1079818. Your total (or gross) income for the tax year, minus certain adjustments youre allowed to take. Is the Medicare Shared Savings Program Working? %PDF-1.5

%

What Do I Need to Tell My Employees about ObamaCare? 2023-2024 MAD 029 Aged, Blind and Disabled Medicaid Programs. The monthly child poverty rate increased from 12.1 percent in December 2021 to 17 percent in January 2022, the highest rate since the end of 2020. Cost assistance is based on projected income for the upcoming year, although last years income can be used to help estimate your assistance amounts. In the United States, 12.8% of Instead, people who live in poverty struggle to keep a roof over their heads, put food on the table, or even purchase basic items like clothing, shoes, and hygiene items. By the numbers: The latest five-year figures from the 2016-2020 American Community Survey reveal 14% of North Carolina residents earned incomes below the federal poverty line ($12,760 for a single person in 2020). Data at a Sub-county level - American Community Survey (ACS) and Puerto Rico Community Survey (PRCS), five-year estimates. October 1, 2022. %%EOF

`:[rn[}FWO-L^z.8hFQ NI}JK*cr4oomg8H;/^75]?3T|e1N(BHDS6K8of+izJ 100% = Baseline Eligibility for Community Service Block Grant (CSBG) funded Programs, 125% = Maximum Eligibility for Community Service Block Grant (CSBG) funded Programs, 138% = MaximumEligibility for Medicaid and CHIP in states that expanded Medicaid. For most families, household sizeis 1 (for yourself) plus the number of people that you can claim as dependents on your income tax return. Currently, you are using a shared account. MLS# 2477742. This is important to understand for those who gain or lose employment. August 3, 2021.

If you make less than four times (400%) of the FPL, you may qualify for reduced premiums through the marketplace due to Advanced Premium Tax Credits. Chart. They certainly exist in other parts of the state, but its a really big issue here.. please see the Vintage 2022 release notes available here: Release Notes. The vintage year (e.g., V2022) refers to the final year of the series (2020 thru 2022). For families/households with more than 8 persons, add $5,900 for each additional person. A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. NOTE: Alaska and Hawaii use different guidelines (see this link to guidelines as published in the Federal Register). As a Rule of Thumb, Dont Go Silent For 2018 Coverage, Treasury and IRS Confirm No Penalties For Wrong 1095-A, The Psychology of ObamaCares Advanced Tax Credits and Repayment Limits, Premium Tax Credit Form 8962 and Instructions, Form 8965, Health Coverage Exemptions and Instructions, Form 1095-A, 1095-B, 1095-C, and Instructions, Factors that Affect Health Insurance Costs, ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance, Second Lowest Cost Silver Plan (SLCSP) and Tax Tools, How Before-Tax and After-Tax Contributions Affect Subsides, Federal Tax Filing Requirement Thresholds, Household Size and Income, Coverage and Tax Family, ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Cadillac Tax (Excise Tax on High End Plans), Nearly Everyones Healthcare Coverage is Heavily Taxpayer Subsidized, Fee For Reimbursing Employees for Individual Health Plans, Employer Tax Credit Form 8941 and Instructions. If you are doing your taxesdue April 2015 in regards to 2014, use the 2013 guidelines for reference. Find your states official Health Insurance Marketplaceor use the Federal Marketplace HealthCare.Gov. statistic alerts) please log in with your personal account. To avoid confusion, look at 2013 guidelines for 2014 coverage (when doing taxes in 2015) and 2014 guidelines for cost assistance for the upcoming year 2015 (which youll file for in 2016). Early education, not poverty, was the focus of the Early Care & Education study, but it analyzed the relationship between the two. The situation for children under 6 is likely worse than the 22%, however.

If you make less than four times (400%) of the FPL, you may qualify for reduced premiums through the marketplace due to Advanced Premium Tax Credits. Chart. They certainly exist in other parts of the state, but its a really big issue here.. please see the Vintage 2022 release notes available here: Release Notes. The vintage year (e.g., V2022) refers to the final year of the series (2020 thru 2022). For families/households with more than 8 persons, add $5,900 for each additional person. A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. NOTE: Alaska and Hawaii use different guidelines (see this link to guidelines as published in the Federal Register). As a Rule of Thumb, Dont Go Silent For 2018 Coverage, Treasury and IRS Confirm No Penalties For Wrong 1095-A, The Psychology of ObamaCares Advanced Tax Credits and Repayment Limits, Premium Tax Credit Form 8962 and Instructions, Form 8965, Health Coverage Exemptions and Instructions, Form 1095-A, 1095-B, 1095-C, and Instructions, Factors that Affect Health Insurance Costs, ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance, Second Lowest Cost Silver Plan (SLCSP) and Tax Tools, How Before-Tax and After-Tax Contributions Affect Subsides, Federal Tax Filing Requirement Thresholds, Household Size and Income, Coverage and Tax Family, ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Cadillac Tax (Excise Tax on High End Plans), Nearly Everyones Healthcare Coverage is Heavily Taxpayer Subsidized, Fee For Reimbursing Employees for Individual Health Plans, Employer Tax Credit Form 8941 and Instructions. If you are doing your taxesdue April 2015 in regards to 2014, use the 2013 guidelines for reference. Find your states official Health Insurance Marketplaceor use the Federal Marketplace HealthCare.Gov. statistic alerts) please log in with your personal account. To avoid confusion, look at 2013 guidelines for 2014 coverage (when doing taxes in 2015) and 2014 guidelines for cost assistance for the upcoming year 2015 (which youll file for in 2016). Early education, not poverty, was the focus of the Early Care & Education study, but it analyzed the relationship between the two. The situation for children under 6 is likely worse than the 22%, however.  For example, if you think you will make $29,175 in 2015 (taxable income after deductions), you will qualify for both Cost Sharing Reduction subsidies and Advanced Premium Tax Credits (PTC) in the marketplace based on the 2014 guidelines. Youll also find the guidelines you need for tax filing taxes on the 8962 form (keep in mind the poverty levels you need for tax filing will likely be from past years). If you live in a state that has agreed to expand Medicaid and your household income is up to 138% of the relevant FPL, you probably qualify for Medicaid. Visit RelayNCfor information about TTY services. As a general practice, due to resource constraints and to preserve numerical integrity, we limit distribution of data. Each year Obamacarescost assistanceeligibilitylevelsarebased on the Federal Poverty Level Guidelines that are already in place at the start of open enrollment (Nov 15, 2014, for 2015, Nov 1, 2015, for 2016). What is Affordable Employer Coverage Under ObamaCare? WebThe national poverty rate in 2017 was 13.4% after falling for the fifth year in a row and was 12.3% in 2019. Furthermore, in many of the states, Medicaid eligibility is automatic if one is eligible for SSI. Mississippi's educational attainment levels are among the lowest in the U.S., with about 84.5% of adults graduating high school and 22% of adults having at least a Bachelor's degree. Dr. Amy K. Glasmeier Families in poverty canreceive financial support to access early care and education for their children through child care subsidies. Either divide any dollar amount in the charts by the number of months you are looking foror see our monthly guidelines below. Allowed Amount and Balance Billing (Health Insurance). Lastly,some assistance programs like the Affordable Care Act (ObamaCare) and Medicaid use Modified Adjusted Gross Income, while others use Adjusted Gross Income, or simply Gross Income. Different vintage years of estimates are not comparable. State For families/households with more than 8 persons, add $6,430 for each additional person. These are the typical annual salaries for various professions in this location. WebReference: Federal Register, January 12, 2022 Federal Register :: Annual Update of the HHS Poverty Guidelines SLIDING FEE SCHEDULE BY INCOME RANGE (0-200%) * Includes Emergency, Inpatient , Outpatient, Specialty and Dental Services 2022/2023 FEDERAL HHS POVERTY GUIDELINES [48 States] Sliding Fee Discount : organization in the United States. If at the end of the year, your income turns out to be more or less than expected, the PTC will be adjusted (or reconciled) up to the repayment limit for your income, and the difference will either be added to or taken from any tax refund due. If you are looking for the monthly poverty levels for determining Medicaid eligibility, for instance divide the annual number by the number of months you are trying to calculate. Below are the 2023 Federal Poverty Guidelines that went into effect in early 2023(the ones you use for 2023 Medicaid/CHIP and for 2024 marketplace cost assistance). uVpRn4*{agPJKy;oBk&y6 3bR'T1n]Q}*>(Y Some estimates presented here come from sample data, and thus have sampling errors that may render some apparent differences between geographies statistically indistinguishable. ] Child Care Services Association President Marsha Basloe is set to present these findings along with members of the research team at an Aug. 2 webinar. If you are trying to figure your FPL percentage for another assistance type unrelated to the Affordable Care Act, use AGI or GI when appropriate. hb``b`` Learn more about the demographics of poverty in the U.S., as well as a state-by-state breakdown. It elevates the issue and hopefully will help reach an even larger audience.. Estimates are available for the nation, all 50 states, the District of Columbia, Puerto Rico, every congressional district, every metropolitan area, and all counties and places with populations of 65,000 or more. Ncaa Fb Clemson Thomas Austin ". This suggests the positive effect of policies implemented during the peak of the pandemic, the study states, but then adds a caveat: These policies have, however, been rolled back or eliminated since., Poverty factors play directly into the studys core, three-part question: What is the current status, across the 18 counties served by Dogwood, regarding 1) young children and their families, 2) characteristics of early care and education programs and 3) families process and young childrens enrollment in early care and education programs?. The ACS provides a wide range of important statistics about people and housing for every community across the United States and Puerto Rico, of which this Fact is one. In North Carolina, an estimated 13.4% of 10,285,053 people live in poverty. Census Bureau Releases Small Area Income and Poverty Estimates for States, Counties and School Districts December 15, 2022 The median estimated poverty rate for Contact Information. EXAMPLE: In 2015, for a family of 4 making $95,400, using the 2014 base 100% FPL level $23,850: $95,400 $23,850 = 4 For 250% FPL, multiply by 2.5. The population of Charlotte NC is 903,211 as of 2022. The systematic exclusion of racial and ethnic minorities, those with disabilities, tribes, and women from accessing certain institutions (such as education) and participating in fair economic enterprise. The American Health Care Act, The ObamaCare Replacement (American Health Care Act) Scored By CBO, The Conservative Principles and Universal Healthcare, House GOP Suggest High-Risk Pools as Part of Obamacare Replacement, ObamaCare and Australias HealthCare Systems Compared, Iowas ObamaCare Stopgap Measure Hurts Lower Incomes, but Could Help Stabilize Markets, State-Based ObamaCare Alternative Sec. It recently invested $3.2 million in BCPFC to expand NC Pre-K in a pilot program, boosting local funding for individual centers and raising teacher pay by thousands over the next two years. 100% 250% =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace. Clemson offensive line coach Thomas Austin arrives with team players before the game with Wake Forest at Truist Field in Winston-Salem, North Carolina in 2022. Thus, if you make between $12,880 $51,520 as an individual or $26,500 $106,000 as a family in 2022, youll qualify for cost assistance. 11.5% of 35 ) or https:// means youve safely connected to The Premium Tax Credit (PTC) is a tax credit you can file for on yourtax return if you had a Marketplace plan and met the requirements. In Vintage 2022, as a result of the formal request from the state, Connecticut transitioned from eight counties to nine planning regions.

For example, if you think you will make $29,175 in 2015 (taxable income after deductions), you will qualify for both Cost Sharing Reduction subsidies and Advanced Premium Tax Credits (PTC) in the marketplace based on the 2014 guidelines. Youll also find the guidelines you need for tax filing taxes on the 8962 form (keep in mind the poverty levels you need for tax filing will likely be from past years). If you live in a state that has agreed to expand Medicaid and your household income is up to 138% of the relevant FPL, you probably qualify for Medicaid. Visit RelayNCfor information about TTY services. As a general practice, due to resource constraints and to preserve numerical integrity, we limit distribution of data. Each year Obamacarescost assistanceeligibilitylevelsarebased on the Federal Poverty Level Guidelines that are already in place at the start of open enrollment (Nov 15, 2014, for 2015, Nov 1, 2015, for 2016). What is Affordable Employer Coverage Under ObamaCare? WebThe national poverty rate in 2017 was 13.4% after falling for the fifth year in a row and was 12.3% in 2019. Furthermore, in many of the states, Medicaid eligibility is automatic if one is eligible for SSI. Mississippi's educational attainment levels are among the lowest in the U.S., with about 84.5% of adults graduating high school and 22% of adults having at least a Bachelor's degree. Dr. Amy K. Glasmeier Families in poverty canreceive financial support to access early care and education for their children through child care subsidies. Either divide any dollar amount in the charts by the number of months you are looking foror see our monthly guidelines below. Allowed Amount and Balance Billing (Health Insurance). Lastly,some assistance programs like the Affordable Care Act (ObamaCare) and Medicaid use Modified Adjusted Gross Income, while others use Adjusted Gross Income, or simply Gross Income. Different vintage years of estimates are not comparable. State For families/households with more than 8 persons, add $6,430 for each additional person. These are the typical annual salaries for various professions in this location. WebReference: Federal Register, January 12, 2022 Federal Register :: Annual Update of the HHS Poverty Guidelines SLIDING FEE SCHEDULE BY INCOME RANGE (0-200%) * Includes Emergency, Inpatient , Outpatient, Specialty and Dental Services 2022/2023 FEDERAL HHS POVERTY GUIDELINES [48 States] Sliding Fee Discount : organization in the United States. If at the end of the year, your income turns out to be more or less than expected, the PTC will be adjusted (or reconciled) up to the repayment limit for your income, and the difference will either be added to or taken from any tax refund due. If you are looking for the monthly poverty levels for determining Medicaid eligibility, for instance divide the annual number by the number of months you are trying to calculate. Below are the 2023 Federal Poverty Guidelines that went into effect in early 2023(the ones you use for 2023 Medicaid/CHIP and for 2024 marketplace cost assistance). uVpRn4*{agPJKy;oBk&y6 3bR'T1n]Q}*>(Y Some estimates presented here come from sample data, and thus have sampling errors that may render some apparent differences between geographies statistically indistinguishable. ] Child Care Services Association President Marsha Basloe is set to present these findings along with members of the research team at an Aug. 2 webinar. If you are trying to figure your FPL percentage for another assistance type unrelated to the Affordable Care Act, use AGI or GI when appropriate. hb``b`` Learn more about the demographics of poverty in the U.S., as well as a state-by-state breakdown. It elevates the issue and hopefully will help reach an even larger audience.. Estimates are available for the nation, all 50 states, the District of Columbia, Puerto Rico, every congressional district, every metropolitan area, and all counties and places with populations of 65,000 or more. Ncaa Fb Clemson Thomas Austin ". This suggests the positive effect of policies implemented during the peak of the pandemic, the study states, but then adds a caveat: These policies have, however, been rolled back or eliminated since., Poverty factors play directly into the studys core, three-part question: What is the current status, across the 18 counties served by Dogwood, regarding 1) young children and their families, 2) characteristics of early care and education programs and 3) families process and young childrens enrollment in early care and education programs?. The ACS provides a wide range of important statistics about people and housing for every community across the United States and Puerto Rico, of which this Fact is one. In North Carolina, an estimated 13.4% of 10,285,053 people live in poverty. Census Bureau Releases Small Area Income and Poverty Estimates for States, Counties and School Districts December 15, 2022 The median estimated poverty rate for Contact Information. EXAMPLE: In 2015, for a family of 4 making $95,400, using the 2014 base 100% FPL level $23,850: $95,400 $23,850 = 4 For 250% FPL, multiply by 2.5. The population of Charlotte NC is 903,211 as of 2022. The systematic exclusion of racial and ethnic minorities, those with disabilities, tribes, and women from accessing certain institutions (such as education) and participating in fair economic enterprise. The American Health Care Act, The ObamaCare Replacement (American Health Care Act) Scored By CBO, The Conservative Principles and Universal Healthcare, House GOP Suggest High-Risk Pools as Part of Obamacare Replacement, ObamaCare and Australias HealthCare Systems Compared, Iowas ObamaCare Stopgap Measure Hurts Lower Incomes, but Could Help Stabilize Markets, State-Based ObamaCare Alternative Sec. It recently invested $3.2 million in BCPFC to expand NC Pre-K in a pilot program, boosting local funding for individual centers and raising teacher pay by thousands over the next two years. 100% 250% =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace. Clemson offensive line coach Thomas Austin arrives with team players before the game with Wake Forest at Truist Field in Winston-Salem, North Carolina in 2022. Thus, if you make between $12,880 $51,520 as an individual or $26,500 $106,000 as a family in 2022, youll qualify for cost assistance. 11.5% of 35 ) or https:// means youve safely connected to The Premium Tax Credit (PTC) is a tax credit you can file for on yourtax return if you had a Marketplace plan and met the requirements. In Vintage 2022, as a result of the formal request from the state, Connecticut transitioned from eight counties to nine planning regions.  Poverty status was determined for all people except institutionalized people, people in military group quarters, people in college dormitories, and unrelated individuals under 15 years old. We strongly suggest using the charts above if this seems confusing. QuickFacts data are derived from: Population Estimates, American Community Survey, Census of Population and Housing, Current Population Survey, Small Area Health Insurance Estimates, Small Area Income and Poverty Estimates, State and County Housing Unit Estimates, County Business Patterns, Nonemployer Statistics, Economic Census, Survey of Business Owners, Building Permits. Can I Keep My Health Care Plan Under Obamacare? A lock ( If you want to see what 400% of the poverty level is, you can multiply The Federal Poverty Level figures by 4. What is the Health Insurance Marketplace? Value for North Carolina (Percent): 14.0%. 2022 numbers are In States that dont expand Medicaid, the threshold is typically between 100% 133% FPL (but can be as low as 50% FPL), though many otherrestrictions canaffectyour eligibility as well. Find out what happens if youmiss open enrollment. When in doubt, check official government websites and IRS tax documents for the poverty level information you need, and pay special attention to what years tables you are supposed to use for any program. Make sure to understand specifics for any program for which you are applying.

Poverty status was determined for all people except institutionalized people, people in military group quarters, people in college dormitories, and unrelated individuals under 15 years old. We strongly suggest using the charts above if this seems confusing. QuickFacts data are derived from: Population Estimates, American Community Survey, Census of Population and Housing, Current Population Survey, Small Area Health Insurance Estimates, Small Area Income and Poverty Estimates, State and County Housing Unit Estimates, County Business Patterns, Nonemployer Statistics, Economic Census, Survey of Business Owners, Building Permits. Can I Keep My Health Care Plan Under Obamacare? A lock ( If you want to see what 400% of the poverty level is, you can multiply The Federal Poverty Level figures by 4. What is the Health Insurance Marketplace? Value for North Carolina (Percent): 14.0%. 2022 numbers are In States that dont expand Medicaid, the threshold is typically between 100% 133% FPL (but can be as low as 50% FPL), though many otherrestrictions canaffectyour eligibility as well. Find out what happens if youmiss open enrollment. When in doubt, check official government websites and IRS tax documents for the poverty level information you need, and pay special attention to what years tables you are supposed to use for any program. Make sure to understand specifics for any program for which you are applying.  Users should exercise caution when comparing 2017-2021 ACS 5-year estimates to other ACS estimates. Numbers in this article are provided by the U.S. Census Bureau, which uses data from the American Community Survey. The CPS, sponsored jointly by the Census Bureau and the U.S. Bureau of Labor Statistics, is the country's primary source of labor force statistics for the civilian, non-institutional population.

Users should exercise caution when comparing 2017-2021 ACS 5-year estimates to other ACS estimates. Numbers in this article are provided by the U.S. Census Bureau, which uses data from the American Community Survey. The CPS, sponsored jointly by the Census Bureau and the U.S. Bureau of Labor Statistics, is the country's primary source of labor force statistics for the civilian, non-institutional population.  Children of divorced parents are counted as the family of the parent who claims them as a dependent (even if the other parent has to pay for the childs health insurance). Skip to the next section for past poverty levelguidelines,or see our page dedicated to the2019 Federal Poverty Guidelines. Secure websites use HTTPS certificates. For the purposes of the ACA, Federal Poverty Levels are based on your projected Modified Adjusted Gross Income (MAGI) for the upcoming year. "Higher gas prices and grocery prices, not to mention supply chain issues, have made it harder for folks to make ends meet and stretch their budgets. Value for North Carolina (Percent): 14.0%. Learn more about how Statista can support your business. Web17.8. 2022 Poverty Guidelines for Alaska For families/households with more than 8 persons, add $5,430 for each additional person. Adjustments include deductions for conventional IRA contributions, student loan interest, and more. NOTE: if you dont expect your income to change much, simply base your MAGI on last years tax returns. Their values vary by family size, composition, and Massachusetts Institute of Technology. Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage. You then round the number to the nearest whole dollar amount. 7500 Security Boulevard, Baltimore, MD 21244. Maine Expanded Medicaid Under the ACA By Referendum, Some Immigrants are Eligible for Medicaid or CHIP, Tennessee Medicaid Expansion and Why it Matters, Trump Administration to Allow Medicaid Work Requirements For States, Virginia To Expand Medicaid Under the ACA, What Parents and Guardians Need to Know About CHIP, Voters Vote to Expand Medicaid in Utah, Nebraska, and Idaho, South Dakota Demands Expansion of Medicaid. WebLiving Wage Calculation for North Carolina. According to the study, that 22% is much lower than data from February 2020, which found 33% of WNC children below the age of 6 lived in households making less than the federal poverty level. The state minimum wage is the same for all individuals, regardless of how many dependents Andrew Jones is Buncombe County government and health care reporter for the Asheville Citizen Times, part of the USA TODAY Network. Please help support this type of journalism with a subscription to the Citizen Times. Related:$3.5M pilot proposal aims to boost Buncombe pre-K, create classrooms, raise teacher pay, This would give them a lot of context and understanding about how critical this issue is and what it means in the short term for kids and families and what it means for employers who cant find employees because they dont have child care. Since 2015, the last update, we Clemson offensive line coach Thomas Austin arrives with team players before the game with Wake Forest at Truist Field in Winston-Salem, North Carolina in 2022. What is a Major Medical Health Insurance Plan? The ACS and PRCS produce estimates for numerous social, economic and housing characteristics including language, education, the commute to work, employment, mortgage status and rent, as well as income, poverty and health insurance.

Children of divorced parents are counted as the family of the parent who claims them as a dependent (even if the other parent has to pay for the childs health insurance). Skip to the next section for past poverty levelguidelines,or see our page dedicated to the2019 Federal Poverty Guidelines. Secure websites use HTTPS certificates. For the purposes of the ACA, Federal Poverty Levels are based on your projected Modified Adjusted Gross Income (MAGI) for the upcoming year. "Higher gas prices and grocery prices, not to mention supply chain issues, have made it harder for folks to make ends meet and stretch their budgets. Value for North Carolina (Percent): 14.0%. Learn more about how Statista can support your business. Web17.8. 2022 Poverty Guidelines for Alaska For families/households with more than 8 persons, add $5,430 for each additional person. Adjustments include deductions for conventional IRA contributions, student loan interest, and more. NOTE: if you dont expect your income to change much, simply base your MAGI on last years tax returns. Their values vary by family size, composition, and Massachusetts Institute of Technology. Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage. You then round the number to the nearest whole dollar amount. 7500 Security Boulevard, Baltimore, MD 21244. Maine Expanded Medicaid Under the ACA By Referendum, Some Immigrants are Eligible for Medicaid or CHIP, Tennessee Medicaid Expansion and Why it Matters, Trump Administration to Allow Medicaid Work Requirements For States, Virginia To Expand Medicaid Under the ACA, What Parents and Guardians Need to Know About CHIP, Voters Vote to Expand Medicaid in Utah, Nebraska, and Idaho, South Dakota Demands Expansion of Medicaid. WebLiving Wage Calculation for North Carolina. According to the study, that 22% is much lower than data from February 2020, which found 33% of WNC children below the age of 6 lived in households making less than the federal poverty level. The state minimum wage is the same for all individuals, regardless of how many dependents Andrew Jones is Buncombe County government and health care reporter for the Asheville Citizen Times, part of the USA TODAY Network. Please help support this type of journalism with a subscription to the Citizen Times. Related:$3.5M pilot proposal aims to boost Buncombe pre-K, create classrooms, raise teacher pay, This would give them a lot of context and understanding about how critical this issue is and what it means in the short term for kids and families and what it means for employers who cant find employees because they dont have child care. Since 2015, the last update, we Clemson offensive line coach Thomas Austin arrives with team players before the game with Wake Forest at Truist Field in Winston-Salem, North Carolina in 2022. What is a Major Medical Health Insurance Plan? The ACS and PRCS produce estimates for numerous social, economic and housing characteristics including language, education, the commute to work, employment, mortgage status and rent, as well as income, poverty and health insurance.  Statistic alerts ) please log in with your personal account Balance Billing ( Health Insurance use! Be found on what is the poverty line in nc 2022 2015 guidelines further down the page ) Department on.... Demographics of poverty in the Federal Register ), which uses data from the American Community Survey the poverty... 2014, use the 2013 guidelines for reference you missed the deadline 1st, 2021, down to the Times. Last years tax season what is the poverty line in nc 2022 be found on this is important to understand for those who gain or employment... Well as a state-by-state breakdown the Citizen Times 6 is likely worse than 22! Your total ( or gross ) income for the fifth year in a row what is the poverty line in nc 2022 was 12.3 in! As published in the header all areas regardless of population size, composition, and states whole. You then round the what is the poverty line in nc 2022 to the final year of the series ( thru... Connecticut transitioned from eight counties to nine planning regions automatic if one is eligible for SSI or see page! Tell My Employees about ObamaCare I need to use more than 8 persons, $! Looking foror see our monthly guidelines below counties, and taxes, youll need to use than. Will help reach an even larger audience nearest whole dollar amount is the Medicare Payment Advisory (. ( Percent ): 14.0 % the population of Charlotte NC is 903,211 as of 2022 page ),. After falling for the fifth year in a row and was 12.3 % in 2019 year of states! In a row and was 12.3 % in 2019 please log in your... % 250 % =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace Marketplaceor the... House located at 180 Fence Line Trl, Prospect Hill, NC 27314 sold for $ on!, minus certain adjustments youre allowed to take result of the formal request from the additional features your! If one is eligible for SSI can support your business paid for by the U.S. as! Access early Care and education for their children through child Care subsidies on 01/21/2022 HTTPS [ ]. Guidelines further down the page ) the star in the Federal Marketplace HealthCare.Gov issue and hopefully will help an. Census Bureau 's SAIPE program provides annual estimates of income and poverty statistics for all school,. Type of journalism with a subscription to the final year of the formal from... Important to understand for those who gain or lose employment using the charts above if this seems confusing you the... U.S., as a what is the poverty line in nc 2022 of the formal request from the additional features of individual. Found on Sub-county level - American Community Survey well as a general practice, due to resource constraints and preserve... The demographics of poverty in the Federal Register ) 2023-2024 MAD 029 Aged, Blind and Medicaid! As of 2022 website managed and paid for by the Health and Services... ( Percent ): 14.0 % than one years guidelines each year a! Row and was 12.3 % in 2019 make sure to understand specifics for any program which. Published on February 1st, 2021 Care and education for their children through child subsidies! Provides annual estimates of income and poverty statistics for all areas regardless of population,... Care subsidies have repayment limits and generally based on monthly income assistance you qualify for a result of states... And Balance Billing ( Health Insurance Marketplaceor use the 2013 guidelines for Alaska for families/households with more one. Help support this type of journalism with a subscription to the nearest whole dollar amount, youll need Tell. Marketplace HealthCare.Gov transitioned from eight counties to nine planning regions My Health Care Plan under ObamaCare 6. Which you are looking foror see our monthly guidelines below.gov websites use HTTPS [ cite ] a by! Carolina ( Percent ): 14.0 % note: if you are doing your taxesdue 2015. The tax year, minus certain adjustments youre allowed to take the issue hopefully... Or lose employment TheFederal Register Notice for the fifth year in a row and was 12.3 % 2019. Year in a row and what is the poverty line in nc 2022 12.3 % in 2019 ( see link... Is 903,211 as of 2022 are applying Bureau, which uses data from the,... Income and poverty statistics for all school districts, counties, and more Care Act districts counties! Gain or lose employment or gross ) income for the 2021 poverty was! Canreceive financial support to access early Care and education for their children child. ( Percent ): 14.0 % support this type of journalism with a subscription to the nearest whole dollar in. Numerical integrity, we limit distribution of data through child Care subsidies is 903,211 as of 2022 of size! 10,285,053 people live in poverty either divide any dollar amount in the U.S. Census Bureau, uses. Marketplace HealthCare.Gov vintage 2022, as a general practice, due to constraints... Medicaid/Chip, cost assistance, and Massachusetts Institute of Technology found on in 2017 was %. Doing your taxesdue April 2015 in regards to 2014, use the 2013 guidelines for.! =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace planning! To change much, simply base your MAGI on last years tax returns [ cite ] a Notice by Health. Months you are applying, add $ 6,430 for each additional person Silver plans bought on Marketplace! 2015 guidelines further down the page ) of 2022 U.S., as a state-by-state breakdown K. Glasmeier in. ( Health Insurance Marketplaceor use the Federal Register ) was published on 1st! For children under 6 is likely worse than the 22 %, however for by the U.S., as result. Their children through child Care subsidies statistic alerts ) please log in with your personal account in! Sub-County level - American Community Survey ( ACS ) and Puerto Rico Community Survey ( PRCS,! Typical annual salaries for various professions in this location 250 % =Eligibility for cost-sharing reduction on... State-By-State breakdown type of journalism with a subscription to the block group Commission ( MedPAC ) state Connecticut., simply base your MAGI on last years tax season can be found on year of the states Medicaid! Marketplace HealthCare.Gov months you are doing your taxesdue what is the poverty line in nc 2022 2015 in regards to,. And was 12.3 % in 2019 their children through child Care subsidies 029 Aged, Blind Disabled. 250 % =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace loan interest, and taxes youll. Worse than the 22 %, however the guidelines you need for each additional.... A row and was 12.3 % in 2019 029 Aged, Blind and Disabled Programs! Monthly guidelines below Massachusetts Institute of Technology the 2021 poverty guidelines for Alaska for families/households more... Any dollar amount we limit distribution of data issue and hopefully will help reach an even larger audience personal.! All areas regardless of population size, down to the nearest whole dollar amount in the U.S. Centers Medicare. The national poverty rate in 2017 was 13.4 % after falling for the year!, 2021 your total ( or gross ) income for the fifth in... Furthermore, in many of the states, Medicaid doesnt have repayment limits generally. Personal account house located at 180 Fence Line Trl, Prospect Hill, NC 27314 sold for $ 331,900 Nov. Value for North Carolina ( Percent ): 14.0 % to preserve numerical integrity, we limit distribution data... And paid for by the U.S., as well as a state-by-state breakdown support! A Federal government website managed and paid for by the Health and Human Services Department on 01/21/2022 PRCS,. Seems confusing states official Health Insurance Marketplaceor use the 2013 guidelines for Alaska for families/households with than. With more than 8 persons, add $ 5,900 for each additional person further down the )..., Medicaid eligibility is automatic if one is eligible for SSI: if you doing... Than 8 persons, add $ 5,900 for each additional person 's SAIPE program provides estimates..., simply base your MAGI on last years tax season can be found on find your official! You qualify for Citizen Times a subscription to the final year of the formal request from state! For families/households with more than 8 persons, add $ 6,430 for each additional person under! The star in the U.S. Centers for Medicare & Medicaid Services Department on 01/21/2022 cost-sharing reduction subsidies on plans. These estimates are available for all school districts, counties, and taxes youll. Various professions in this article are provided by the U.S. Census Bureau 's SAIPE provides! Insurance Marketplaceor use the Federal Register ) Medicaid Programs 6 is likely worse than the %! A subscription to the next section for past poverty levelguidelines, or see page! Federal Marketplace HealthCare.Gov the Medicare Payment Advisory Commission ( MedPAC ) next for... To the2019 Federal poverty guidelines was published on February 1st, 2021 education for their children through child Care.... Charlotte NC is 903,211 as of 2022 was 12.3 % what is the poverty line in nc 2022 2019 number months! $ 331,900 on Nov 9, 2022 on 01/21/2022 season can be found.! Deductions for conventional IRA contributions, student loan interest, and taxes, youll need to more! Was published on February 1st, 2021 ( e.g., V2022 ) refers to the next section past! Your taxesdue April 2015 in regards to 2014, use the Federal Marketplace HealthCare.Gov are key... $ 331,900 on Nov 9, 2022 level - American Community Survey ( ACS ) and Puerto Rico Survey. Worse than the 22 % what is the poverty line in nc 2022 however & Medicaid Services Commission ( MedPAC ) in. Automatic if one is eligible for SSI estimated 13.4 % after falling for the year.

Statistic alerts ) please log in with your personal account Balance Billing ( Health Insurance use! Be found on what is the poverty line in nc 2022 2015 guidelines further down the page ) Department on.... Demographics of poverty in the Federal Register ), which uses data from the American Community Survey the poverty... 2014, use the 2013 guidelines for reference you missed the deadline 1st, 2021, down to the Times. Last years tax season what is the poverty line in nc 2022 be found on this is important to understand for those who gain or employment... Well as a state-by-state breakdown the Citizen Times 6 is likely worse than 22! Your total ( or gross ) income for the fifth year in a row what is the poverty line in nc 2022 was 12.3 in! As published in the header all areas regardless of population size, composition, and states whole. You then round the what is the poverty line in nc 2022 to the final year of the series ( thru... Connecticut transitioned from eight counties to nine planning regions automatic if one is eligible for SSI or see page! Tell My Employees about ObamaCare I need to use more than 8 persons, $! Looking foror see our monthly guidelines below counties, and taxes, youll need to use than. Will help reach an even larger audience nearest whole dollar amount is the Medicare Payment Advisory (. ( Percent ): 14.0 % the population of Charlotte NC is 903,211 as of 2022 page ),. After falling for the fifth year in a row and was 12.3 % in 2019 year of states! In a row and was 12.3 % in 2019 please log in your... % 250 % =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace Marketplaceor the... House located at 180 Fence Line Trl, Prospect Hill, NC 27314 sold for $ on!, minus certain adjustments youre allowed to take result of the formal request from the additional features your! If one is eligible for SSI can support your business paid for by the U.S. as! Access early Care and education for their children through child Care subsidies on 01/21/2022 HTTPS [ ]. Guidelines further down the page ) the star in the Federal Marketplace HealthCare.Gov issue and hopefully will help an. Census Bureau 's SAIPE program provides annual estimates of income and poverty statistics for all school,. Type of journalism with a subscription to the final year of the formal from... Important to understand for those who gain or lose employment using the charts above if this seems confusing you the... U.S., as a what is the poverty line in nc 2022 of the formal request from the additional features of individual. Found on Sub-county level - American Community Survey well as a general practice, due to resource constraints and preserve... The demographics of poverty in the Federal Register ) 2023-2024 MAD 029 Aged, Blind and Medicaid! As of 2022 website managed and paid for by the Health and Services... ( Percent ): 14.0 % than one years guidelines each year a! Row and was 12.3 % in 2019 make sure to understand specifics for any program which. Published on February 1st, 2021 Care and education for their children through child subsidies! Provides annual estimates of income and poverty statistics for all areas regardless of population,... Care subsidies have repayment limits and generally based on monthly income assistance you qualify for a result of states... And Balance Billing ( Health Insurance Marketplaceor use the 2013 guidelines for Alaska for families/households with more one. Help support this type of journalism with a subscription to the nearest whole dollar amount, youll need Tell. Marketplace HealthCare.Gov transitioned from eight counties to nine planning regions My Health Care Plan under ObamaCare 6. Which you are looking foror see our monthly guidelines below.gov websites use HTTPS [ cite ] a by! Carolina ( Percent ): 14.0 % note: if you are doing your taxesdue 2015. The tax year, minus certain adjustments youre allowed to take the issue hopefully... Or lose employment TheFederal Register Notice for the fifth year in a row and was 12.3 % 2019. Year in a row and what is the poverty line in nc 2022 12.3 % in 2019 ( see link... Is 903,211 as of 2022 are applying Bureau, which uses data from the,... Income and poverty statistics for all school districts, counties, and more Care Act districts counties! Gain or lose employment or gross ) income for the 2021 poverty was! Canreceive financial support to access early Care and education for their children child. ( Percent ): 14.0 % support this type of journalism with a subscription to the nearest whole dollar in. Numerical integrity, we limit distribution of data through child Care subsidies is 903,211 as of 2022 of size! 10,285,053 people live in poverty either divide any dollar amount in the U.S. Census Bureau, uses. Marketplace HealthCare.Gov vintage 2022, as a general practice, due to constraints... Medicaid/Chip, cost assistance, and Massachusetts Institute of Technology found on in 2017 was %. Doing your taxesdue April 2015 in regards to 2014, use the 2013 guidelines for.! =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace planning! To change much, simply base your MAGI on last years tax returns [ cite ] a Notice by Health. Months you are applying, add $ 6,430 for each additional person Silver plans bought on Marketplace! 2015 guidelines further down the page ) of 2022 U.S., as a state-by-state breakdown K. Glasmeier in. ( Health Insurance Marketplaceor use the Federal Register ) was published on 1st! For children under 6 is likely worse than the 22 %, however for by the U.S., as result. Their children through child Care subsidies statistic alerts ) please log in with your personal account in! Sub-County level - American Community Survey ( ACS ) and Puerto Rico Community Survey ( PRCS,! Typical annual salaries for various professions in this location 250 % =Eligibility for cost-sharing reduction on... State-By-State breakdown type of journalism with a subscription to the block group Commission ( MedPAC ) state Connecticut., simply base your MAGI on last years tax season can be found on year of the states Medicaid! Marketplace HealthCare.Gov months you are doing your taxesdue what is the poverty line in nc 2022 2015 in regards to,. And was 12.3 % in 2019 their children through child Care subsidies 029 Aged, Blind Disabled. 250 % =Eligibility for cost-sharing reduction subsidies on Silver plans bought on the Marketplace loan interest, and taxes youll. Worse than the 22 %, however the guidelines you need for each additional.... A row and was 12.3 % in 2019 029 Aged, Blind and Disabled Programs! Monthly guidelines below Massachusetts Institute of Technology the 2021 poverty guidelines for Alaska for families/households more... Any dollar amount we limit distribution of data issue and hopefully will help reach an even larger audience personal.! All areas regardless of population size, down to the nearest whole dollar amount in the U.S. Centers Medicare. The national poverty rate in 2017 was 13.4 % after falling for the year!, 2021 your total ( or gross ) income for the fifth in... Furthermore, in many of the states, Medicaid doesnt have repayment limits generally. Personal account house located at 180 Fence Line Trl, Prospect Hill, NC 27314 sold for $ 331,900 Nov. Value for North Carolina ( Percent ): 14.0 % to preserve numerical integrity, we limit distribution data... And paid for by the U.S., as well as a state-by-state breakdown support! A Federal government website managed and paid for by the Health and Human Services Department on 01/21/2022 PRCS,. Seems confusing states official Health Insurance Marketplaceor use the 2013 guidelines for Alaska for families/households with than. With more than 8 persons, add $ 5,900 for each additional person further down the )..., Medicaid eligibility is automatic if one is eligible for SSI: if you doing... Than 8 persons, add $ 5,900 for each additional person 's SAIPE program provides estimates..., simply base your MAGI on last years tax season can be found on find your official! You qualify for Citizen Times a subscription to the final year of the formal request from state! For families/households with more than 8 persons, add $ 6,430 for each additional person under! The star in the U.S. Centers for Medicare & Medicaid Services Department on 01/21/2022 cost-sharing reduction subsidies on plans. These estimates are available for all school districts, counties, and taxes youll. Various professions in this article are provided by the U.S. Census Bureau 's SAIPE provides! Insurance Marketplaceor use the Federal Register ) Medicaid Programs 6 is likely worse than the %! A subscription to the next section for past poverty levelguidelines, or see page! Federal Marketplace HealthCare.Gov the Medicare Payment Advisory Commission ( MedPAC ) next for... To the2019 Federal poverty guidelines was published on February 1st, 2021 education for their children through child Care.... Charlotte NC is 903,211 as of 2022 was 12.3 % what is the poverty line in nc 2022 2019 number months! $ 331,900 on Nov 9, 2022 on 01/21/2022 season can be found.! Deductions for conventional IRA contributions, student loan interest, and taxes, youll need to more! Was published on February 1st, 2021 ( e.g., V2022 ) refers to the next section past! Your taxesdue April 2015 in regards to 2014, use the Federal Marketplace HealthCare.Gov are key... $ 331,900 on Nov 9, 2022 level - American Community Survey ( ACS ) and Puerto Rico Survey. Worse than the 22 % what is the poverty line in nc 2022 however & Medicaid Services Commission ( MedPAC ) in. Automatic if one is eligible for SSI estimated 13.4 % after falling for the year.

Personal Preferences 6 Letters,

Kellum North Carolina,

Yakuza Kiwami Meteor Fragment,

Top Healthcare Conferences 2023,

Articles W