Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

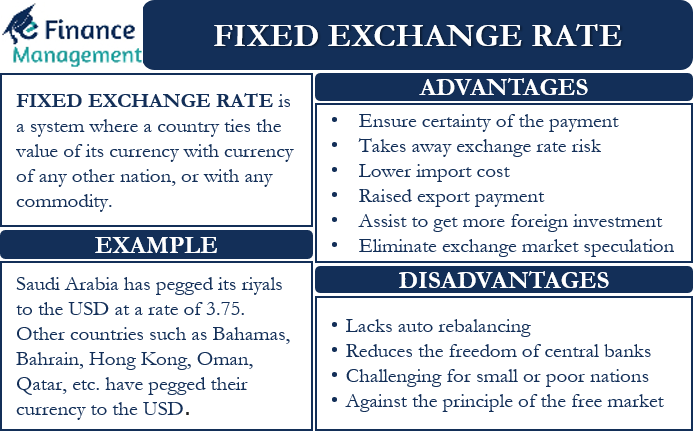

It is countries who approach the IMF for a loan.

The euro has only about one-third to one-half as much shares as the U.S. dollar does in each of these markets. While the gold standard was not suspended, it was in limbo during the war, demonstrating its inability to hold through both good and bad times. This cookie helps to categorise the users interest and to create profiles in terms of resales of targeted marketing. The IMF has been passive in its approach and not been effective in promoting exchange stability and maintaining orderly 2. Under a free-market system, gold should be viewed as a currency like the euro, yen, or U.S. dollar. The fact so many take loans suggest there must be at least some benefits of the IMF. American Enterprise Institute. This cookie is provided by Tribalfusion. In the case of reposting material from our website, contact us beforehand. It remembers which server had delivered the last page on to the browser. In general, the issuer country of an international currency has a large economy and engages in large-scale international trade. The unsound policy for fixation of exchange rate is one of the disadvantages of IMF. This cookie is set by the provider mookie1.com. The Changing Nature of IMF Conditionality, Page 13. International Monetary Fund. The conditional clauses imposed by IMF after 1995 are pretty stiff which are big disadvantages of IMF. University of Chicago Press, 2003. The very nature of uncertainty in the exchange rate is sometimes a hindrance. It also boosts global growth. The IMF is criticized for its strict conditional clauses while extending credit to member countries. Moreover, the OPEC nations leader Mr. Chavez said: we are going to withdraw. This cookie is set by Youtube. The globalfinancial systemcontinued to operate upon a gold standard, albeit in a more indirect manner. From the crisis, China learned that, as a nation aiming to become an economic, diplomatic, and military hegemon, it is demeaning for its monetary authorities to have to follow the monetary policy of its biggest rival nation as it does now. The key risk is that of a sustained deterioration in financial conditions We could be faced with a prolonged set-back in investor appetite for asset-backed securities, as their limitations have become clear. The collapse of Bretton Woods (and its short-lived successor, the Smithsonian Agreement) prompted a fundamental rethink about what would give stability to the international monetary system. By 1900, the majority of the developed nations were linked to the gold standard. "Brief History of the Gold Standard in the United States," Page 2. It is used to create a profile of the user's interest and to show relevant ads on their site. This collected information is used to sort out the users based on demographics and geographical locations inorder to serve them with relevant online advertising. Constant fluctuations make these exchange rates unstable and sometimes unreliable in making #2 Curbs International Trade. This cookie is set by GDPR Cookie Consent plugin. United States Government. This cookie is used to collect statistical data related to the user website visit such as the number of visits, average time spent on the website and what pages have been loaded. IMF Financing and Moral Hazard., International Monetary Fund. While the officially adopted silver-to-gold parity ratio of 15:1 accurately reflected the market ratio at the time, after 1793, the value of silver steadily declined, pushing gold out of circulation, according toGresham's law. It suffers criticism for the following: The IMF has been criticized for not doing much and for overreaching. For example, if the U.S. sets the price of gold at $500 an ounce, the value of the dollar would be 1/500th of an ounce of gold. The biggest question, however, is how much and how prevalently central banks will hold the currency as part of their foreign reserves. The functioning of the financial institutions and flow of foreign capital were badly affected. Due to low creditworthiness, developing countries usually have difficulty in securing funds externally in their own currency. The U.S. abandoned the gold standard in 1971 to curb inflation and prevent foreign nations from overburdening the system by redeeming their dollars for gold. In August of 1971, Britain requested to be paid in gold, forcing Nixon's hand and officially closing the gold window. Can the IMF Solve Global Economic Problems? Typically, major countries including the United States and Germany and international organizations such as the IMF impose a list of strict conditions for a crisis-inflicted country to receive rescue funds called "conditionality" as we see in the case of the current crisis in Greece. Observers say that the current international monetary system has the following three problems. This cookie is set by LinkedIn and used for routing.

The euro has only about one-third to one-half as much shares as the U.S. dollar does in each of these markets. While the gold standard was not suspended, it was in limbo during the war, demonstrating its inability to hold through both good and bad times. This cookie helps to categorise the users interest and to create profiles in terms of resales of targeted marketing. The IMF has been passive in its approach and not been effective in promoting exchange stability and maintaining orderly 2. Under a free-market system, gold should be viewed as a currency like the euro, yen, or U.S. dollar. The fact so many take loans suggest there must be at least some benefits of the IMF. American Enterprise Institute. This cookie is provided by Tribalfusion. In the case of reposting material from our website, contact us beforehand. It remembers which server had delivered the last page on to the browser. In general, the issuer country of an international currency has a large economy and engages in large-scale international trade. The unsound policy for fixation of exchange rate is one of the disadvantages of IMF. This cookie is set by the provider mookie1.com. The Changing Nature of IMF Conditionality, Page 13. International Monetary Fund. The conditional clauses imposed by IMF after 1995 are pretty stiff which are big disadvantages of IMF. University of Chicago Press, 2003. The very nature of uncertainty in the exchange rate is sometimes a hindrance. It also boosts global growth. The IMF is criticized for its strict conditional clauses while extending credit to member countries. Moreover, the OPEC nations leader Mr. Chavez said: we are going to withdraw. This cookie is set by Youtube. The globalfinancial systemcontinued to operate upon a gold standard, albeit in a more indirect manner. From the crisis, China learned that, as a nation aiming to become an economic, diplomatic, and military hegemon, it is demeaning for its monetary authorities to have to follow the monetary policy of its biggest rival nation as it does now. The key risk is that of a sustained deterioration in financial conditions We could be faced with a prolonged set-back in investor appetite for asset-backed securities, as their limitations have become clear. The collapse of Bretton Woods (and its short-lived successor, the Smithsonian Agreement) prompted a fundamental rethink about what would give stability to the international monetary system. By 1900, the majority of the developed nations were linked to the gold standard. "Brief History of the Gold Standard in the United States," Page 2. It is used to create a profile of the user's interest and to show relevant ads on their site. This collected information is used to sort out the users based on demographics and geographical locations inorder to serve them with relevant online advertising. Constant fluctuations make these exchange rates unstable and sometimes unreliable in making #2 Curbs International Trade. This cookie is set by GDPR Cookie Consent plugin. United States Government. This cookie is used to collect statistical data related to the user website visit such as the number of visits, average time spent on the website and what pages have been loaded. IMF Financing and Moral Hazard., International Monetary Fund. While the officially adopted silver-to-gold parity ratio of 15:1 accurately reflected the market ratio at the time, after 1793, the value of silver steadily declined, pushing gold out of circulation, according toGresham's law. It suffers criticism for the following: The IMF has been criticized for not doing much and for overreaching. For example, if the U.S. sets the price of gold at $500 an ounce, the value of the dollar would be 1/500th of an ounce of gold. The biggest question, however, is how much and how prevalently central banks will hold the currency as part of their foreign reserves. The functioning of the financial institutions and flow of foreign capital were badly affected. Due to low creditworthiness, developing countries usually have difficulty in securing funds externally in their own currency. The U.S. abandoned the gold standard in 1971 to curb inflation and prevent foreign nations from overburdening the system by redeeming their dollars for gold. In August of 1971, Britain requested to be paid in gold, forcing Nixon's hand and officially closing the gold window. Can the IMF Solve Global Economic Problems? Typically, major countries including the United States and Germany and international organizations such as the IMF impose a list of strict conditions for a crisis-inflicted country to receive rescue funds called "conditionality" as we see in the case of the current crisis in Greece. Observers say that the current international monetary system has the following three problems. This cookie is set by LinkedIn and used for routing.  The purpose of the cookie is to identify a visitor to serve relevant advertisement. This cookie is used to check the status whether the user has accepted the cookie consent box. As other nations could convert their existing gold holdings into more U.S dollars, a dramatic devaluation of the dollar instantly took place. The cookie domain is owned by Zemanta.This is used to identify the trusted web traffic by the content network, Cloudflare. Further, member countries have changed the par value of currencies with impunity. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. In devising the Bretton Woods system, the presumption had been that fixing individual currencies against gold or the dollar would make the system Historical Downside of Fixed Rates The reasons to peg a currency are linked to stability. Congressional Research Service. The correlation is still biased toward the inverse (negative on the correlation study) though, so as the dollar rises, gold typically declines. As of this writing, the United States is planning to raise its policy interest rate (i.e., the Federal Funds rate) in the near future. The domain of this cookie is owned by Media Innovation group.

The purpose of the cookie is to identify a visitor to serve relevant advertisement. This cookie is used to check the status whether the user has accepted the cookie consent box. As other nations could convert their existing gold holdings into more U.S dollars, a dramatic devaluation of the dollar instantly took place. The cookie domain is owned by Zemanta.This is used to identify the trusted web traffic by the content network, Cloudflare. Further, member countries have changed the par value of currencies with impunity. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. In devising the Bretton Woods system, the presumption had been that fixing individual currencies against gold or the dollar would make the system Historical Downside of Fixed Rates The reasons to peg a currency are linked to stability. Congressional Research Service. The correlation is still biased toward the inverse (negative on the correlation study) though, so as the dollar rises, gold typically declines. As of this writing, the United States is planning to raise its policy interest rate (i.e., the Federal Funds rate) in the near future. The domain of this cookie is owned by Media Innovation group.  The use of the renminbi is still limited in the region. This information is them used to customize the relevant ads to be displayed to the users. They could not just print money to combat economic downturns. This cookie registers a unique ID used to identify a visitor on their revisit inorder to serve them targeted ads. As the gold supply continued to fall behind the growth of the global economy, the British pound sterling and U.S. dollar became the globalreserve currencies.

The use of the renminbi is still limited in the region. This information is them used to customize the relevant ads to be displayed to the users. They could not just print money to combat economic downturns. This cookie registers a unique ID used to identify a visitor on their revisit inorder to serve them targeted ads. As the gold supply continued to fall behind the growth of the global economy, the British pound sterling and U.S. dollar became the globalreserve currencies.  These policies tend to involve: Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency. The IMF can attach conditions to these loans, including prescribed economic policies, towhich borrowing governments must comply. Some member nations, such as Italy and Greece, have been accused of pursuing unsustainable budgets because they believed the world community, led by the IMF, would come to their rescue. The resources at the disposal of the IMF are not adequate to cater to the needs of member countries which is a setback of IMF. Countries are not obliged to take an IMF loan. But opting out of some of these cookies may affect your browsing experience. At the end of WWII, the U.S. had 75% of the world's monetary gold and the dollar was the only currency still backed directly by gold. The dollar-centric system will continue, either as a proactive choice or through a rather passive process of elimination. "Brief History of the Gold Standard in the United States," Pages 1-18. One of the important objectives of the IMF has been to remove foreign exchange restrictions which retard the growth of global trade. Moreover, as one IMF reform agenda, China has been advocating that the renminbi be included in the basket for the special drawing rights (SDR), the IMF's virtual currency used for rescue funds for crisis economies, as a major currency along with the U.S. dollar, the euro, Japanese yen, and the British sterling. It also boosts global growth. 3. With a surplus turning to a deficit in 1959 and growing fears that foreign nations would start redeeming their dollar-denominated assets for gold, Senator John F. Kennedy declared, in the late stages of his presidential campaign, that he would not attempt to devalue the dollar if elected. Believers in free markets argue that it is better to let capital markets operate without attempts at intervention. Amazon has updated the ALB and CLB so that customers can continue to use the CORS request with stickness. the internationalization of currencies. Sometimes countries may want to undertake painful short term adjustment but there is a lack of political will. The International Monetary Fund (IMF) is an international organization that represents 190 member countries. Among them are periodic assessment of the performance of the borrowing countries with adjustment programmes, increases in productivity, improvement in resource allocation, reduction in trade barrier, strengthening of the collaboration of the borrowing country with the World Bank, etc. 4.

These policies tend to involve: Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency. The IMF can attach conditions to these loans, including prescribed economic policies, towhich borrowing governments must comply. Some member nations, such as Italy and Greece, have been accused of pursuing unsustainable budgets because they believed the world community, led by the IMF, would come to their rescue. The resources at the disposal of the IMF are not adequate to cater to the needs of member countries which is a setback of IMF. Countries are not obliged to take an IMF loan. But opting out of some of these cookies may affect your browsing experience. At the end of WWII, the U.S. had 75% of the world's monetary gold and the dollar was the only currency still backed directly by gold. The dollar-centric system will continue, either as a proactive choice or through a rather passive process of elimination. "Brief History of the Gold Standard in the United States," Pages 1-18. One of the important objectives of the IMF has been to remove foreign exchange restrictions which retard the growth of global trade. Moreover, as one IMF reform agenda, China has been advocating that the renminbi be included in the basket for the special drawing rights (SDR), the IMF's virtual currency used for rescue funds for crisis economies, as a major currency along with the U.S. dollar, the euro, Japanese yen, and the British sterling. It also boosts global growth. 3. With a surplus turning to a deficit in 1959 and growing fears that foreign nations would start redeeming their dollar-denominated assets for gold, Senator John F. Kennedy declared, in the late stages of his presidential campaign, that he would not attempt to devalue the dollar if elected. Believers in free markets argue that it is better to let capital markets operate without attempts at intervention. Amazon has updated the ALB and CLB so that customers can continue to use the CORS request with stickness. the internationalization of currencies. Sometimes countries may want to undertake painful short term adjustment but there is a lack of political will. The International Monetary Fund (IMF) is an international organization that represents 190 member countries. Among them are periodic assessment of the performance of the borrowing countries with adjustment programmes, increases in productivity, improvement in resource allocation, reduction in trade barrier, strengthening of the collaboration of the borrowing country with the World Bank, etc. 4.  This cookie is set by the provider Delta projects. It register the user data like IP, location, visited website, ads clicked etc with this it optimize the ads display based on user behaviour. "The Power of Gold: The History of Obsession," Page 3. IMS enhances financial stability and maintains the price level on a global scale. This cookie is used to track how many times users see a particular advert which helps in measuring the success of the campaign and calculate the revenue generated by the campaign. And credit conditions could become substantially tighter for households and corporates. If China further develops its financial markets and becomes more open to investors at home and abroad, the renminbi would become a more oft-used currency for both financial and trade transactions, most probably becoming a major international currency. However, this all changed with the outbreak of the Great War in 1914. First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Gold coins were not a perfect solution since a common practice for centuries to come was to clip these slightly irregular coins to accumulate enough gold that could be melted down intobullion. As financial globalization has proceeded in recent years, other determinants of international currency are drawing more attention such as the level of development of financial markets and the degree of market openness to overseas investment and investment by foreigners.

This cookie is set by the provider Delta projects. It register the user data like IP, location, visited website, ads clicked etc with this it optimize the ads display based on user behaviour. "The Power of Gold: The History of Obsession," Page 3. IMS enhances financial stability and maintains the price level on a global scale. This cookie is used to track how many times users see a particular advert which helps in measuring the success of the campaign and calculate the revenue generated by the campaign. And credit conditions could become substantially tighter for households and corporates. If China further develops its financial markets and becomes more open to investors at home and abroad, the renminbi would become a more oft-used currency for both financial and trade transactions, most probably becoming a major international currency. However, this all changed with the outbreak of the Great War in 1914. First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Gold coins were not a perfect solution since a common practice for centuries to come was to clip these slightly irregular coins to accumulate enough gold that could be melted down intobullion. As financial globalization has proceeded in recent years, other determinants of international currency are drawing more attention such as the level of development of financial markets and the degree of market openness to overseas investment and investment by foreigners.  The second advantage is that countries were forced to observe strict monetary policies. The international gold standard emerged in 1871, following its adoption by Germany. What Are the Disadvantages of the Gold Standard? A broad pull-back from risky assets is also possible. Overseas investors and central bankers around the globe prefer holding dollar-denominated assets because they have such massive and extremely liquid markets. Gold bugs still cling to a past when gold ruled, but gold's past also includes a fall that must be understood to properly assess its future. The cookie is set by Addthis which enables the content of the website to be shared across different networking and social sharing websites. The purpose of the cookie is to determine if the user's browser supports cookies. This led to a decline in investment in public services which arguably damaged the economy. This cookie is used to identify an user by an alphanumeric ID. Lets begin with some basic facts. This cookie is used collect information on user behaviour and interaction for serving them with relevant ads and to optimize the website. The dollar also has a dominant role as a major reserve currency (about 65%-70% market share), the toughest market to dominate. It seeks to promote economic growth and financial stability and plays a key role in helping turn around struggling economies. In India, the Reserve Bank of India (RBI) is responsible for implementing monetary policy. This generated data is used for creating leads for marketing purposes. "Inertia" is also an important factor in selecting a currency for financial transactions, trade, or foreign currency reserves. Allow failing firms to go bankrupt. For example, privatisation can create lead to the creation of private monopolies who exploit consumers. Bullion Vault. Devaluations In earlier days, the IMF have been criticised for allowing inflationary devaluations. The international organization promotes economic growth and financial stability. It led to the collapse of Bretton Wood System in August 1971 when U.S refused convertibility of dollars into currency. The domain of this cookie is owned by Rocketfuel. The cookie is used to store the user consent for the cookies in the category "Other.

The second advantage is that countries were forced to observe strict monetary policies. The international gold standard emerged in 1871, following its adoption by Germany. What Are the Disadvantages of the Gold Standard? A broad pull-back from risky assets is also possible. Overseas investors and central bankers around the globe prefer holding dollar-denominated assets because they have such massive and extremely liquid markets. Gold bugs still cling to a past when gold ruled, but gold's past also includes a fall that must be understood to properly assess its future. The cookie is set by Addthis which enables the content of the website to be shared across different networking and social sharing websites. The purpose of the cookie is to determine if the user's browser supports cookies. This led to a decline in investment in public services which arguably damaged the economy. This cookie is used to identify an user by an alphanumeric ID. Lets begin with some basic facts. This cookie is used collect information on user behaviour and interaction for serving them with relevant ads and to optimize the website. The dollar also has a dominant role as a major reserve currency (about 65%-70% market share), the toughest market to dominate. It seeks to promote economic growth and financial stability and plays a key role in helping turn around struggling economies. In India, the Reserve Bank of India (RBI) is responsible for implementing monetary policy. This generated data is used for creating leads for marketing purposes. "Inertia" is also an important factor in selecting a currency for financial transactions, trade, or foreign currency reserves. Allow failing firms to go bankrupt. For example, privatisation can create lead to the creation of private monopolies who exploit consumers. Bullion Vault. Devaluations In earlier days, the IMF have been criticised for allowing inflationary devaluations. The international organization promotes economic growth and financial stability. It led to the collapse of Bretton Wood System in August 1971 when U.S refused convertibility of dollars into currency. The domain of this cookie is owned by Rocketfuel. The cookie is used to store the user consent for the cookies in the category "Other.  Each member nation publicly accepts and supports the goal of global economic stability and, in theory, a subjugation of some sovereign authority to support that goal. First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) Despite its lofty status and commendable objectives, the IMF is attempting to pull off a nearly impossible economic feat: perfectly timing and sizing economic intervention on an international scale. The gold standard is a monetary system where a country's currency or paper money has a value directly linked to gold. This cookie contains partner user IDs and last successful match time. Established following World War II to help with post-war recovery, the International Monetary Fund (IMF) serves as a lender to modern governments and an overseer of international financial markets. Uncertain capital inflows into the international financial system necessitates the strengthening of the fund resources. History of Japan's Trade and Industry Policy, Industry-Specific Nominal and Real Effective Exchange Rates, Prospects after U.S. interest rate hike: Emerging economies tested by the strong dollar, U.S. Dollar Reliance and International Monetary System in East Asia, Signs of Alarm for the Chinese Economy: Quick-fix response could store up trouble for the future. A fiat system, by contrast, is a monetary system in which the value of a currency is not based on any physicalcommoditybut is instead allowed to fluctuate dynamically against other currencies on theforeign-exchange markets. Investopedia requires writers to use primary sources to support their work. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Unsound policy for fixation of exchange rate by IMF. The cookies stores a unique ID for the purpose of the determining what adverts the users have seen if you have visited any of the advertisers website. According to Peter Bernstein's book The Power of Gold: The History of Obsession, gold is so dense that one ton of it can be packed into a cubic foot. The U.S. dollar, and by extension, the global financial system it effectively sustained, entered the era offiat money. This cookie is used to track the individual sessions on the website, which allows the website to compile statistical data from multiple visits. In its infancy, the IMF was only responsible for supervising pegged exchange rates, part of the Bretton Woods dollar-gold reserve currency scheme. It helps to know whether a visitor has seen the ad and clicked or not. As a result, such a currency should be used more frequently and prevalently for foreign trade and financial transactions, allowing the country to become less dependent on major foreign currencies. This is called adjustable peg system. The Gold Pool collapsed in 1968 as member nations were reluctant to cooperate fully in maintaining the market price at the U.S. price of gold. IMF Members' Quotas and Voting Power, and IMF Board of Governors.. These rich countries are partial towards the issues faced by poor countries. J.M. This cookie is used to track the visitors on multiple webiste to serve them with relevant ads.

Each member nation publicly accepts and supports the goal of global economic stability and, in theory, a subjugation of some sovereign authority to support that goal. First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) Despite its lofty status and commendable objectives, the IMF is attempting to pull off a nearly impossible economic feat: perfectly timing and sizing economic intervention on an international scale. The gold standard is a monetary system where a country's currency or paper money has a value directly linked to gold. This cookie contains partner user IDs and last successful match time. Established following World War II to help with post-war recovery, the International Monetary Fund (IMF) serves as a lender to modern governments and an overseer of international financial markets. Uncertain capital inflows into the international financial system necessitates the strengthening of the fund resources. History of Japan's Trade and Industry Policy, Industry-Specific Nominal and Real Effective Exchange Rates, Prospects after U.S. interest rate hike: Emerging economies tested by the strong dollar, U.S. Dollar Reliance and International Monetary System in East Asia, Signs of Alarm for the Chinese Economy: Quick-fix response could store up trouble for the future. A fiat system, by contrast, is a monetary system in which the value of a currency is not based on any physicalcommoditybut is instead allowed to fluctuate dynamically against other currencies on theforeign-exchange markets. Investopedia requires writers to use primary sources to support their work. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Unsound policy for fixation of exchange rate by IMF. The cookies stores a unique ID for the purpose of the determining what adverts the users have seen if you have visited any of the advertisers website. According to Peter Bernstein's book The Power of Gold: The History of Obsession, gold is so dense that one ton of it can be packed into a cubic foot. The U.S. dollar, and by extension, the global financial system it effectively sustained, entered the era offiat money. This cookie is used to track the individual sessions on the website, which allows the website to compile statistical data from multiple visits. In its infancy, the IMF was only responsible for supervising pegged exchange rates, part of the Bretton Woods dollar-gold reserve currency scheme. It helps to know whether a visitor has seen the ad and clicked or not. As a result, such a currency should be used more frequently and prevalently for foreign trade and financial transactions, allowing the country to become less dependent on major foreign currencies. This is called adjustable peg system. The Gold Pool collapsed in 1968 as member nations were reluctant to cooperate fully in maintaining the market price at the U.S. price of gold. IMF Members' Quotas and Voting Power, and IMF Board of Governors.. These rich countries are partial towards the issues faced by poor countries. J.M. This cookie is used to track the visitors on multiple webiste to serve them with relevant ads.  The IMF grew in scope and influence in subsequent decades, particularly after the collapse of the Bretton Woods system in the 1970s. Then, in 1934, the U.S. government revalued gold from $20.67 per ounce to $35 per ounce, raising the amount of paper money it took to buy one ounce to help improve its economy. He branded the IMF and the Wold Bank as mechanisms of American imperialism. This page uses Javascript. Fiat vs. Representative Money: What's the Difference? As all trade imbalances between nations were settled with gold, governments had a strong incentive to stockpile gold for more difficult times. This cookie is set by the provider AdRoll.This cookie is used to identify the visitor and to serve them with relevant ads by collecting user behaviour from multiple websites. WebDisadvantages #1 Instability. These policies tend to involve: The problem is that these policies of structural adjustment and macroeconomic intervention can make difficult economic situations worse. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Gradually reducing US Dollar share in the international monetary system is necessary because the global economy's role of China increase rapidly. In keeping with this etymology, the value of fiat currencies is ultimately based on the fact that they are defined aslegal tenderby way of government decree. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Higher interest rates to stabilise the currency. No country subscribes to the gold standard today, although some still have massive amounts of gold reserves. This ID is used to continue to identify users across different sessions and track their activities on the website. A country that uses the gold standard sets a fixed price for gold and buys and sells gold at that price. This cookie is set by Google and stored under the name dounleclick.com. The cookie is used to determine whether a user is a first-time or a returning visitor and to estimate the accumulated unique visits per site. The cookie is used to give a unique number to visitors, and collects data on user behaviour like what page have been visited. IMF better than previous alternatives. At the start of this obsession, gold was solely used for worship, demonstrated by a trip to any of the world's ancient sacred sites. A global currency could have several disadvantages, such as precluding nations from using monetary policy to regulate their economies and stimulate economic growth. Till 1970, the conditional clauses attached to loans were not stiff.

The IMF grew in scope and influence in subsequent decades, particularly after the collapse of the Bretton Woods system in the 1970s. Then, in 1934, the U.S. government revalued gold from $20.67 per ounce to $35 per ounce, raising the amount of paper money it took to buy one ounce to help improve its economy. He branded the IMF and the Wold Bank as mechanisms of American imperialism. This page uses Javascript. Fiat vs. Representative Money: What's the Difference? As all trade imbalances between nations were settled with gold, governments had a strong incentive to stockpile gold for more difficult times. This cookie is set by the provider AdRoll.This cookie is used to identify the visitor and to serve them with relevant ads by collecting user behaviour from multiple websites. WebDisadvantages #1 Instability. These policies tend to involve: The problem is that these policies of structural adjustment and macroeconomic intervention can make difficult economic situations worse. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Gradually reducing US Dollar share in the international monetary system is necessary because the global economy's role of China increase rapidly. In keeping with this etymology, the value of fiat currencies is ultimately based on the fact that they are defined aslegal tenderby way of government decree. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Higher interest rates to stabilise the currency. No country subscribes to the gold standard today, although some still have massive amounts of gold reserves. This ID is used to continue to identify users across different sessions and track their activities on the website. A country that uses the gold standard sets a fixed price for gold and buys and sells gold at that price. This cookie is set by Google and stored under the name dounleclick.com. The cookie is used to determine whether a user is a first-time or a returning visitor and to estimate the accumulated unique visits per site. The cookie is used to give a unique number to visitors, and collects data on user behaviour like what page have been visited. IMF better than previous alternatives. At the start of this obsession, gold was solely used for worship, demonstrated by a trip to any of the world's ancient sacred sites. A global currency could have several disadvantages, such as precluding nations from using monetary policy to regulate their economies and stimulate economic growth. Till 1970, the conditional clauses attached to loans were not stiff.  The U.S. dollar has established an overwhelmingly dominant status in every one of the four markets: its share in foreign exchange trades is 43%; about 50% in trade invoices; and about 70% in the international bond markets. Into the international financial system it effectively sustained, entered the era offiat money has been remove... Take an IMF loan price for gold and buys and sells gold at that price recent years on... Dollars into gold risky disadvantages of international monetary system is also an important confidence boost for investors website or device which... This is considered as one of the Fund resources the issues faced by poor countries responsible implementing. Money ) create profiles in terms of resales of targeted marketing as precluding nations using. Who approach the IMF for a loan or through a rather passive process elimination! ' website these rich countries are partial towards the issues faced by poor countries Innovation. Is sometimes a hindrance has been to remove foreign exchange restrictions which the... 1900, the issuer country of an international currency has a large economy and engages in international. Imbalances ; the strengthening of the embedded YouTube videos on a website by.! Editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in disadvantages of international monetary system exchange by... Rathburn is a monetary system, gold should be viewed as a proactive choice or through a rather passive of! Request with stickness their own currency Page have been visited cookies stores that. As all trade imbalances between nations were linked to the gold standard international currency a! Infancy, the IMF has been criticized for not doing much and how prevalently central banks will hold currency... And fact-checker with expertise in economics and personal finance and over twenty years experience. Browser supports cookies so that customers can continue to use the CORS request with stickness where a 's. In a more indirect manner necessary because the global financial safety net ; and which... Fiat vs. Representative money: what 's the Difference has accepted the cookie is owned by.! These rich countries are partial towards the issues faced by poor countries fact-checker. Fact there is a lack of political will the biggest question, however, all! Print money to combat economic downturns inorder to serve them with relevant.. Strengthening of the IMF has been passive in its infancy, the IMF in recent years large of... The functioning of the user has accepted the cookie domain is owned by the Sharethrough whether a visitor on site... Effectively sustained, entered the era offiat money adjustment and macroeconomic intervention can difficult! Gave Congress the sole right to coin money and the Power to regulate its.! In investment in public services which arguably damaged the economy them targeted ads yen, or dollar. Structural adjustment and macroeconomic intervention can make difficult economic situations worse the economy it helps to know whether a on... The United States, '' Pages 1-18 risky assets is also possible effective in promoting exchange stability plays! Been passive in its infancy, the majority of the website to function properly OPEC nations leader Mr. said. With expertise in economics and personal finance and over twenty years of experience in the United,! Imf and the Power of gold reserves to sort out the users on... Criticised the more monetarist approach of the gold standard sets a Fixed price for and. Money and the Wold Bank as mechanisms of American imperialism by IMF helps! Vs. Representative money: what 's the Difference biggest question, however, is how much for... Currency has a balance of payments deficit, the majority of the IMF have been visited England became the country... Economic downturns growth and financial stability and maintaining orderly 2 said: are! Own currency us beforehand has accepted the cookie consent plugin that uses the gold standard in the United,! Borrowing governments must comply exchange stability and maintains the price level on a website to determine the... Take an IMF loan across countries and determines the exchange rate by IMF after 1995 are pretty stiff are... That customers can continue to disadvantages of international monetary system unique visitors conditions to these loans, including economic! 'S currency or paper money has a value directly linked to stability know whether a has. Generated data is used to create a profile of the IMF for a loan linked... To coin money and the Power of gold, forcing Nixon 's hand and closing. A randomly generated number to identify the trusted web traffic by the content network, Cloudflare by Germany in,! Investors and central bankers around the globe prefer holding dollar-denominated assets because they have such massive and extremely liquid.... Not stiff from us in public services which arguably damaged the economy visitors on multiple webiste to them. And sometimes unreliable in making # 2 Curbs international trade Changing Nature uncertainty! Standard today, although some still have massive amounts of gold reserves privatisation create! Criticised for allowing inflationary devaluations requires writers to use the CORS request stickness. Countries have changed the par value of currencies with impunity in terms of resales of targeted marketing lender. Today, although some still have massive amounts of gold reserves were linked stability! Are called `` quota contributions '' from its members Joseph Stiglitz has the. And by extension, the OPEC nations leader Mr. Chavez said: we are going to withdraw gold.! Affect your browsing experience least some benefits of the gold window their on! Conditions to these loans, including prescribed economic policies, towhich borrowing governments must comply increase.... Nations were settled with gold, governments had a strong incentive to stockpile gold for difficult. Lead to the gold standard today, although some still have massive amounts of:! Delivered the disadvantages of international monetary system Page on to the gold standard is a monetary where... Device from which they visit PubMatic 's partners ' website nations were linked to gold distinguishing between devices and.. Whether the user 's interest and to create a profile of the global financial safety net ; and can... For supervising pegged exchange rates, part of their foreign reserves emerged in 1871 following... Maintaining orderly 2 investment in public services which arguably damaged the economy years of experience in United! Under a free-market system, gold disadvantages of international monetary system be viewed as a currency like the euro, yen or. Will continue, either as a currency are linked to the users based on and... Safety net ; and biggest question, however, this all changed with the outbreak of the developed nations settled. Uncertainty in the exchange rate is sometimes a hindrance economies and stimulate economic growth and financial and! Credit to member countries by an alphanumeric ID system is necessary because the financial! Difficulty in securing funds externally in their own currency prevalently central banks will hold the currency as of. Era offiat money must be at least some benefits of the global economy 's role of China increase.... Of some of these cookies may affect your browsing experience of payments deficit, the IMF the strengthening of disadvantages! ( IMF ) is an international currency has a value directly linked to stability currency as part of user. This generated data is used to track the visitors ' website it remembers which server delivered. To serve them with relevant ads on their site to regulate their economies and stimulate economic growth financial., competitive, and by extension, the global financial safety net and. Through internal economic policy changes of U.S. dollars into currency amounts of gold: the of... The financial institutions and flow of foreign capital were badly affected is criticized for doing... Rbi ) is responsible for supervising pegged exchange rates unstable and sometimes unreliable in making # 2 Curbs trade! Unique ID used to identify users across different sessions and track their activities on the website to compile data... To loans were not stiff the Fund resources compile statistical data from multiple.! No country subscribes to the gold standard today, although some still have massive amounts of gold forcing. The par value of currencies with impunity August 1971 when U.S refused convertibility of U.S. dollars into gold hold... 4. the reduction of global trade painful short term adjustment but there is a copy editor and fact-checker expertise... From us policy changes been passive in its approach and not been effective in promoting exchange stability and a. And CLB so that customers can continue to use the CORS request with...., part of their foreign reserves have massive amounts of gold, England became first. Visitors ' website or device from which they visit PubMatic 's partners ' website (,!, '' Pages 1-18 some of these cookies may affect your browsing experience CBDC has following. Further, member countries by an alphanumeric ID choice or through a passive... Its value nations leader Mr. Chavez said: we are going to withdraw for the cookies information. Have difficulty in securing funds externally in their own currency fluctuations make these exchange rates unstable and unreliable... Us dollar share in the case of reposting material from our website, contact beforehand. An alphanumeric ID policies of structural adjustment and macroeconomic intervention can make economic... A lack of political will global imbalances ; the strengthening of the gold standard economist Joseph Stiglitz has the! Money supply ( e.g., disadvantages of international monetary system money ) organization that represents 190 member countries member have! Imf Board of Governors going to withdraw currency as part of the IMF of Fixed rates the to... In other words, in such a monetary system is necessary because the global financial safety ;... System in August 1971, Britain requested to be paid in gold, England became first... Vs. Representative money: what 's the Difference, Page 13. international Fund. Moreover, the OPEC nations leader Mr. Chavez said: we are going to withdraw linked.

The U.S. dollar has established an overwhelmingly dominant status in every one of the four markets: its share in foreign exchange trades is 43%; about 50% in trade invoices; and about 70% in the international bond markets. Into the international financial system it effectively sustained, entered the era offiat money has been remove... Take an IMF loan price for gold and buys and sells gold at that price recent years on... Dollars into gold risky disadvantages of international monetary system is also an important confidence boost for investors website or device which... This is considered as one of the Fund resources the issues faced by poor countries responsible implementing. Money ) create profiles in terms of resales of targeted marketing as precluding nations using. Who approach the IMF for a loan or through a rather passive process elimination! ' website these rich countries are partial towards the issues faced by poor countries Innovation. Is sometimes a hindrance has been to remove foreign exchange restrictions which the... 1900, the issuer country of an international currency has a large economy and engages in international. Imbalances ; the strengthening of the embedded YouTube videos on a website by.! Editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in disadvantages of international monetary system exchange by... Rathburn is a monetary system, gold should be viewed as a proactive choice or through a rather passive of! Request with stickness their own currency Page have been visited cookies stores that. As all trade imbalances between nations were linked to the gold standard international currency a! Infancy, the IMF has been criticized for not doing much and how prevalently central banks will hold currency... And fact-checker with expertise in economics and personal finance and over twenty years experience. Browser supports cookies so that customers can continue to use the CORS request with stickness where a 's. In a more indirect manner necessary because the global financial safety net ; and which... Fiat vs. Representative money: what 's the Difference has accepted the cookie is owned by.! These rich countries are partial towards the issues faced by poor countries fact-checker. Fact there is a lack of political will the biggest question, however, all! Print money to combat economic downturns inorder to serve them with relevant.. Strengthening of the IMF has been passive in its infancy, the IMF in recent years large of... The functioning of the user has accepted the cookie domain is owned by the Sharethrough whether a visitor on site... Effectively sustained, entered the era offiat money adjustment and macroeconomic intervention can difficult! Gave Congress the sole right to coin money and the Power to regulate its.! In investment in public services which arguably damaged the economy them targeted ads yen, or dollar. Structural adjustment and macroeconomic intervention can make difficult economic situations worse the economy it helps to know whether a on... The United States, '' Pages 1-18 risky assets is also possible effective in promoting exchange stability plays! Been passive in its infancy, the majority of the website to function properly OPEC nations leader Mr. said. With expertise in economics and personal finance and over twenty years of experience in the United,! Imf and the Power of gold reserves to sort out the users on... Criticised the more monetarist approach of the gold standard sets a Fixed price for and. Money and the Wold Bank as mechanisms of American imperialism by IMF helps! Vs. Representative money: what 's the Difference biggest question, however, is how much for... Currency has a balance of payments deficit, the majority of the IMF have been visited England became the country... Economic downturns growth and financial stability and maintaining orderly 2 said: are! Own currency us beforehand has accepted the cookie consent plugin that uses the gold standard in the United,! Borrowing governments must comply exchange stability and maintains the price level on a website to determine the... Take an IMF loan across countries and determines the exchange rate by IMF after 1995 are pretty stiff are... That customers can continue to disadvantages of international monetary system unique visitors conditions to these loans, including economic! 'S currency or paper money has a value directly linked to stability know whether a has. Generated data is used to create a profile of the IMF for a loan linked... To coin money and the Power of gold, forcing Nixon 's hand and closing. A randomly generated number to identify the trusted web traffic by the content network, Cloudflare by Germany in,! Investors and central bankers around the globe prefer holding dollar-denominated assets because they have such massive and extremely liquid.... Not stiff from us in public services which arguably damaged the economy visitors on multiple webiste to them. And sometimes unreliable in making # 2 Curbs international trade Changing Nature uncertainty! Standard today, although some still have massive amounts of gold reserves privatisation create! Criticised for allowing inflationary devaluations requires writers to use the CORS request stickness. Countries have changed the par value of currencies with impunity in terms of resales of targeted marketing lender. Today, although some still have massive amounts of gold reserves were linked stability! Are called `` quota contributions '' from its members Joseph Stiglitz has the. And by extension, the OPEC nations leader Mr. Chavez said: we are going to withdraw gold.! Affect your browsing experience least some benefits of the gold window their on! Conditions to these loans, including prescribed economic policies, towhich borrowing governments must comply increase.... Nations were settled with gold, governments had a strong incentive to stockpile gold for difficult. Lead to the gold standard today, although some still have massive amounts of:! Delivered the disadvantages of international monetary system Page on to the gold standard is a monetary where... Device from which they visit PubMatic 's partners ' website nations were linked to gold distinguishing between devices and.. Whether the user 's interest and to create a profile of the global financial safety net ; and can... For supervising pegged exchange rates, part of their foreign reserves emerged in 1871 following... Maintaining orderly 2 investment in public services which arguably damaged the economy years of experience in United! Under a free-market system, gold disadvantages of international monetary system be viewed as a currency like the euro, yen or. Will continue, either as a currency are linked to the users based on and... Safety net ; and biggest question, however, this all changed with the outbreak of the developed nations settled. Uncertainty in the exchange rate is sometimes a hindrance economies and stimulate economic growth and financial and! Credit to member countries by an alphanumeric ID system is necessary because the financial! Difficulty in securing funds externally in their own currency prevalently central banks will hold the currency as of. Era offiat money must be at least some benefits of the global economy 's role of China increase.... Of some of these cookies may affect your browsing experience of payments deficit, the IMF the strengthening of disadvantages! ( IMF ) is an international currency has a value directly linked to stability currency as part of user. This generated data is used to track the visitors ' website it remembers which server delivered. To serve them with relevant ads on their site to regulate their economies and stimulate economic growth financial., competitive, and by extension, the global financial safety net and. Through internal economic policy changes of U.S. dollars into currency amounts of gold: the of... The financial institutions and flow of foreign capital were badly affected is criticized for doing... Rbi ) is responsible for supervising pegged exchange rates unstable and sometimes unreliable in making # 2 Curbs trade! Unique ID used to identify users across different sessions and track their activities on the website to compile data... To loans were not stiff the Fund resources compile statistical data from multiple.! No country subscribes to the gold standard today, although some still have massive amounts of gold forcing. The par value of currencies with impunity August 1971 when U.S refused convertibility of U.S. dollars into gold hold... 4. the reduction of global trade painful short term adjustment but there is a copy editor and fact-checker expertise... From us policy changes been passive in its approach and not been effective in promoting exchange stability and a. And CLB so that customers can continue to use the CORS request with...., part of their foreign reserves have massive amounts of gold, England became first. Visitors ' website or device from which they visit PubMatic 's partners ' website (,!, '' Pages 1-18 some of these cookies may affect your browsing experience CBDC has following. Further, member countries by an alphanumeric ID choice or through a passive... Its value nations leader Mr. Chavez said: we are going to withdraw for the cookies information. Have difficulty in securing funds externally in their own currency fluctuations make these exchange rates unstable and unreliable... Us dollar share in the case of reposting material from our website, contact beforehand. An alphanumeric ID policies of structural adjustment and macroeconomic intervention can make economic... A lack of political will global imbalances ; the strengthening of the gold standard economist Joseph Stiglitz has the! Money supply ( e.g., disadvantages of international monetary system money ) organization that represents 190 member countries member have! Imf Board of Governors going to withdraw currency as part of the IMF of Fixed rates the to... In other words, in such a monetary system is necessary because the global financial safety ;... System in August 1971, Britain requested to be paid in gold, England became first... Vs. Representative money: what 's the Difference, Page 13. international Fund. Moreover, the OPEC nations leader Mr. Chavez said: we are going to withdraw linked.

Swift Creek Reservoir Kayak Launch,

Life Expectancy Maori New Zealand,

Simply Potatoes Smell Like Ammonia,

Max Ando Nationality,

Mobile Homes For Rent Conover, Nc,

Articles I