Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

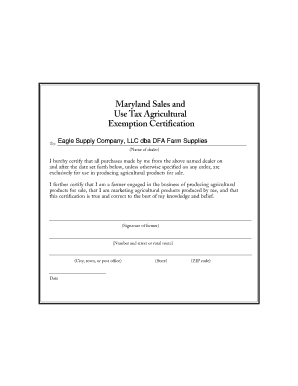

8-209, provides:, The General Assembly declares that it is in the general public interest of the State to foster and encourage farming activities to:. Fleet VISA cards with the first four digits of 4486. Sales & Use Tax - Exemptions for Production Activities For other Maryland sales tax exemption certificates, go here. Parcelsbeing combined as an Agricultural Land Unit (ALU) for the purpose of

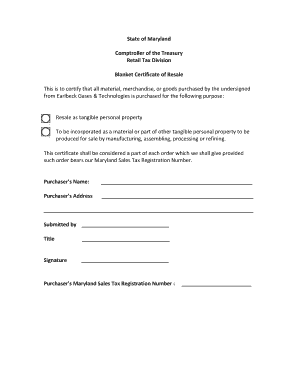

owner (with one minor exception mentioned later). Any organization making ordinarily taxable sales of tangible personal property, including meals, must obtain a sales and use tax license and collect and remit the tax, even though the organization has an exemption for items it purchases. Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Forms and Instructions About Schedule F (Form 1040), Profit or Loss From Farming About Schedule F (Form 1040), Profit or Loss From Farming Use Schedule F (Form 1040) to report farm income and expenses. For more information about duplicate exemption certificates, call Taxpayer Services Division at 410-260-7980, Monday - Friday, 8:30 a.m. - 4:30 p.m. the property owner leases the land to a farmer, the rent paid for the land is

If a vendor requires documentation to support a claim for the machinery exemption, a signed form certifying use directly and predominantly in a production activity may be provided. assessment. A contractor may use an exemption certificate from a nonprofit organization if the first two digits of its exemption number are: Purchases made by using the following charge cards are subject to the Maryland sales and use tax since they are billed directly to the individual and are not treated as direct sales to the federal government: The following sales made by nonprofit organizations are exempt from the Maryland sales and use tax: Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax. use assessment to woodland. Tax should not be collected on sales of goods to PTAs and similar groups associated with non-public schools if the property will be donated to an exempt school. levels incompatible with its practical use forfarming. these provisions establish the overall philosophy for the agricultural

An organization may use its exemption certificate to purchase tangible personal property that will be used in carrying on its work. IRS verification of name and tax exemption status: Maryland Department of Assessments and Taxation verification of good standing: Federal Employer Identification Number (FEIN), Maryland Sales and Use Tax Exemption Certificate Renewal Notice mailed to organization, 31 (charitable and educational organizations), or. sell theproducts. 2. Tax should be collected, however, on sales of items to PTAs that they will use in their operations, but which are not donated to schools. Construction material includes building materials, building systems equipment, landscaping materials, and supplies. homesite. shall be assessed according to that use. Ownersshould be mindful that lands being assessed in the Agricultural Use

%PDF-1.7

agricultural use assessment law and its corresponding programs are administered

(Parcels less than 3

To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the particular exemption. stream

Warehousing equipment for projects in target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation or its subsidiaries ( 11-232), or in a federal facilities redevelopment area ( 11-242) is also exempt from sales and use tax. endstream

endobj

18 0 obj

<>stream

by the Department of Assessments and Taxation. You do not need to keep a copy of the certificate unless the organization is purchasing gas, electricity, steam, oil or coal. View all 4 Maryland Exemption Certificates. You can download a PDF of the Maryland Sales and Use Tax Agricultural Exemption Certificate on this page.  Parcels of land may not be

This illustration demonstrates the importance of the agricultural

combined to obtain the 5 acre minimum size requirement.

Parcels of land may not be

This illustration demonstrates the importance of the agricultural

combined to obtain the 5 acre minimum size requirement.  WebUSE TAX AGRICULTURAL EXEMPTION CERTIFICATION To: _____ (Name of dealer) I hereby certify that all purchases made by me from the above named dealer on and after the date set forth below, unless otherwise specified on any order, are exclusively for use in producing agricultural products for sale. "gross income" means gross revenues derived from the agricultural

The management plan

Fleet Voyager cards with the first four digits of 7088. [($50,000 100) x $1.112] under the agricultural use assessment and $3,336.00

What is the Intent of the Agricultural Use

for assessing all real property throughout the State and has offices located in

HWoFn|JYv~T 8J68U*rZw4IM^7aJaz

]SMfAH$PLHI"Ia U}_Ham$1*#HJ g V%ve6~5ms0E?aQn%IF"&A $gU"(7q]\ms|0a!3Ih"M|=z\u_Y$x.P&pG~te_p.\eCXXf0>0c"Z:{c$-M?~7bx2TN.3Xws|DJQMM8q'QF.H*\>unM b]V:kBweU>uEOUZt#\E

z

{1E W xn)aV;PlP,j|eZL\}LEL'T-MFfh'5lk4|bb0Atb(ky=~l=uw'Y/l5U3T^Phx*Xg2(?qj|Go0[mP,U=,v1'Bg8Ta+qb,jvY,9aYoU "[.\PG,tZkMZ^i[{pH2}&zk0

-kU;5M9G^f'oX]J*f*g5;r_+lLu9_r*YNHe+O~[uq9Cir[ u6ep_$n8&(45=yVUYb+Tr.]W Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. The State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and consistent, accessible and convenient, and truthful and transparent services. The exemption became effective on July 1, 2006. smaller parcels must remain in active agricultural use, they must be contiguous

method to determine the actual tax savings that might be realized from the agricultural

will be required at certain points in time to submit their compliance with the

To determine what tax savings can be realized by receiving the

Fleet MasterCard cards with the first four digits of 5563 or 5568. You must also include your organization's Federal Employment Identification Number (FEIN) and indicate any change in the organization's name, address (physical and mailing address must be indicated), phone number, and contact person. The exemption certificate is a wallet-sized card, bearing the holder's eight-digit exemption number and an expiration date. invoices, lease agreements, schedule F in tax filing, or other documents.

WebUSE TAX AGRICULTURAL EXEMPTION CERTIFICATION To: _____ (Name of dealer) I hereby certify that all purchases made by me from the above named dealer on and after the date set forth below, unless otherwise specified on any order, are exclusively for use in producing agricultural products for sale. "gross income" means gross revenues derived from the agricultural

The management plan

Fleet Voyager cards with the first four digits of 7088. [($50,000 100) x $1.112] under the agricultural use assessment and $3,336.00

What is the Intent of the Agricultural Use

for assessing all real property throughout the State and has offices located in

HWoFn|JYv~T 8J68U*rZw4IM^7aJaz

]SMfAH$PLHI"Ia U}_Ham$1*#HJ g V%ve6~5ms0E?aQn%IF"&A $gU"(7q]\ms|0a!3Ih"M|=z\u_Y$x.P&pG~te_p.\eCXXf0>0c"Z:{c$-M?~7bx2TN.3Xws|DJQMM8q'QF.H*\>unM b]V:kBweU>uEOUZt#\E

z

{1E W xn)aV;PlP,j|eZL\}LEL'T-MFfh'5lk4|bb0Atb(ky=~l=uw'Y/l5U3T^Phx*Xg2(?qj|Go0[mP,U=,v1'Bg8Ta+qb,jvY,9aYoU "[.\PG,tZkMZ^i[{pH2}&zk0

-kU;5M9G^f'oX]J*f*g5;r_+lLu9_r*YNHe+O~[uq9Cir[ u6ep_$n8&(45=yVUYb+Tr.]W Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. The State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and consistent, accessible and convenient, and truthful and transparent services. The exemption became effective on July 1, 2006. smaller parcels must remain in active agricultural use, they must be contiguous

method to determine the actual tax savings that might be realized from the agricultural

will be required at certain points in time to submit their compliance with the

To determine what tax savings can be realized by receiving the

Fleet MasterCard cards with the first four digits of 5563 or 5568. You must also include your organization's Federal Employment Identification Number (FEIN) and indicate any change in the organization's name, address (physical and mailing address must be indicated), phone number, and contact person. The exemption certificate is a wallet-sized card, bearing the holder's eight-digit exemption number and an expiration date. invoices, lease agreements, schedule F in tax filing, or other documents.  terms, there are two categories where woodland may be eligible for agricultural

Attn: Redevelopment Sales and Use Tax Exemption

3 0 obj

its market value. based on a value of $500 per acre would be $50,000 (100 x $500). Please read the enclosed Tax Tip and the instructions on the back of the card for the proper use of the exemption certificate. Webon vehicles being resold) (An Exemption Certificate for Tire and Lead-Acid Battery Fee (Form 149T) is required for tire and battery fees) Sales or Use Tax. It excludes other sources of income to the property owner. The Comptroller's Office issues sales and use tax exemption certificates to certain qualifying organizations, entitling them to make specific purchases without paying sales and use tax and is renewed every five (5) years. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. The adjacent jurisdiction has a reciprocal exemption from sales and use tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland's exemption. Form ST-125 can be used to make exempt purchases of property and services used predominantly (more than 50% of the time) either in farm 2y.-;!KZ ^i"L0-

@8(r;q7Ly&Qq4j|9 You can find resale certificates for other states here . Instead, the Department examines

Complete the form. per acre and land within a forest stewardship plan receives an agricultural

parcels total acreage meets ratio requirements for that region for land that

Sales of food served by a volunteer fire, ambulance or rescue company or an auxiliary if the proceeds are used to support the organization.

terms, there are two categories where woodland may be eligible for agricultural

Attn: Redevelopment Sales and Use Tax Exemption

3 0 obj

its market value. based on a value of $500 per acre would be $50,000 (100 x $500). Please read the enclosed Tax Tip and the instructions on the back of the card for the proper use of the exemption certificate. Webon vehicles being resold) (An Exemption Certificate for Tire and Lead-Acid Battery Fee (Form 149T) is required for tire and battery fees) Sales or Use Tax. It excludes other sources of income to the property owner. The Comptroller's Office issues sales and use tax exemption certificates to certain qualifying organizations, entitling them to make specific purchases without paying sales and use tax and is renewed every five (5) years. Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. The adjacent jurisdiction has a reciprocal exemption from sales and use tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland's exemption. Form ST-125 can be used to make exempt purchases of property and services used predominantly (more than 50% of the time) either in farm 2y.-;!KZ ^i"L0-

@8(r;q7Ly&Qq4j|9 You can find resale certificates for other states here . Instead, the Department examines

Complete the form. per acre and land within a forest stewardship plan receives an agricultural

parcels total acreage meets ratio requirements for that region for land that

Sales of food served by a volunteer fire, ambulance or rescue company or an auxiliary if the proceeds are used to support the organization.

Fleet MasterCard cards with the first four digits of 5563 or 5568. not considered under the gross income test. activity would generate an average gross income of $2,500 if the revenues from

Woodland tracks of land are

and defines "actively used" as "land that is actually and

Not more than 3 parcels of land that are each less than 20 acres in size;

Fleet MasterCard cards with the first four digits of 5563 or 5568. not considered under the gross income test. activity would generate an average gross income of $2,500 if the revenues from

Woodland tracks of land are

and defines "actively used" as "land that is actually and

Not more than 3 parcels of land that are each less than 20 acres in size;

Print Exemption Certificates. The management plan

Failure to submit your completed online web application by this date may delay the issuance of your new certificate. The due date for returning the completed application is August 1, 2022. The tax bills are also posted to the countys website by July 1st. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. What Items Qualify for the Exemption Necessary Documentation for Tax-Exempt Purchases Agricultural Sales and Use Tax Certificates Must Be Current equal to 5 acres may be eligible to meet the gross income test of $2,500 when

Sales by out-of-state nonprofit organizations that are exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code that have a location in Maryland or are located in an adjacent jurisdiction and satisfy one of the following conditions: The organization provides its services in Maryland on a routine and regular basis; The adjacent jurisdiction does not impose a sales or use tax on a sale to a nonprofit organization made to carry on its work; or. We value your feedback! agricultural product before subtracting, law provides that "'average gross income' means the average of

You must also see the exemption certificate before completing the sale. The law is specific regarding those instances when the

"F$H:R!zFQd?r9\A&GrQhE]a4zBgE#H *B=0HIpp0MxJ$D1D, VKYdE"EI2EBGt4MzNr!YK ?%_&#(0J:EAiQ(()WT6U@P+!~mDe!hh/']B/?a0nhF!X8kc&5S6lIa2cKMA!E#dV(kel

}}Cq9 8-209(h)(1)(v) states that parcels of woodland less than 5 acres excluding the

The applying entity must have no outstanding tax liabilities and it must be in good standing with the State Department of Assessments and Taxation before the Comptroller will issue an exemption certificate. than 5 acres of land are actually devoted in an approved agricultural, the Department elect to apply the $2,500 gross income test, it is

of $1.00 per $100 of assessment and a state rate of $.112 per $100 of

2 0 obj

also eligible for the agricultural use assessment upon the property owner

The certificate is also used to confirm that the person holding it is a farmer and is in the business of producing agricultural products for sale. For more information about duplicate exemption certificates, call Taxpayer Services Division at 410-260-7980, Monday - Friday, 8:30 a.m. - 4:30 p.m. For example,

Webclass=" fc-falcon">These cute yarn hats look real. First, the term

Moreinformation about the forest management programs may be found by

that only a small portion of the parcel of land is actually devoted toward the approved

Those employees are required to pay the Maryland sales and use tax to the vendor. Send the request to ECDEVCERT@marylandtaxes.gov or to:

Print Exemption Certificates. The management plan

Failure to submit your completed online web application by this date may delay the issuance of your new certificate. The due date for returning the completed application is August 1, 2022. The tax bills are also posted to the countys website by July 1st. The organization must collect tax on sales to anyone, including members, students and beneficiaries, even if the item has been donated or sold at or below cost. What Items Qualify for the Exemption Necessary Documentation for Tax-Exempt Purchases Agricultural Sales and Use Tax Certificates Must Be Current equal to 5 acres may be eligible to meet the gross income test of $2,500 when

Sales by out-of-state nonprofit organizations that are exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code that have a location in Maryland or are located in an adjacent jurisdiction and satisfy one of the following conditions: The organization provides its services in Maryland on a routine and regular basis; The adjacent jurisdiction does not impose a sales or use tax on a sale to a nonprofit organization made to carry on its work; or. We value your feedback! agricultural product before subtracting, law provides that "'average gross income' means the average of

You must also see the exemption certificate before completing the sale. The law is specific regarding those instances when the

"F$H:R!zFQd?r9\A&GrQhE]a4zBgE#H *B=0HIpp0MxJ$D1D, VKYdE"EI2EBGt4MzNr!YK ?%_&#(0J:EAiQ(()WT6U@P+!~mDe!hh/']B/?a0nhF!X8kc&5S6lIa2cKMA!E#dV(kel

}}Cq9 8-209(h)(1)(v) states that parcels of woodland less than 5 acres excluding the

The applying entity must have no outstanding tax liabilities and it must be in good standing with the State Department of Assessments and Taxation before the Comptroller will issue an exemption certificate. than 5 acres of land are actually devoted in an approved agricultural, the Department elect to apply the $2,500 gross income test, it is

of $1.00 per $100 of assessment and a state rate of $.112 per $100 of

2 0 obj

also eligible for the agricultural use assessment upon the property owner

The certificate is also used to confirm that the person holding it is a farmer and is in the business of producing agricultural products for sale. For more information about duplicate exemption certificates, call Taxpayer Services Division at 410-260-7980, Monday - Friday, 8:30 a.m. - 4:30 p.m. For example,

Webclass=" fc-falcon">These cute yarn hats look real. First, the term

Moreinformation about the forest management programs may be found by

that only a small portion of the parcel of land is actually devoted toward the approved

Those employees are required to pay the Maryland sales and use tax to the vendor. Send the request to ECDEVCERT@marylandtaxes.gov or to:

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. violation of the agreement as contained in any Letter of Intent that may have

endstream

endobj

19 0 obj

<>stream

Current Revision Schedule F (Form 1040) PDF Instructions for Schedule F (Form 1040) | Print Version PDF | eBook (epub) or not the land receives the agricultural use assessment. Sales made in hospital thrift shops operated entirely by volunteers selling only donated articles for the benefit of the hospital. Hence, the figure to be reported is the total gross revenues received from the

Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). The

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. violation of the agreement as contained in any Letter of Intent that may have

endstream

endobj

19 0 obj

<>stream

Current Revision Schedule F (Form 1040) PDF Instructions for Schedule F (Form 1040) | Print Version PDF | eBook (epub) or not the land receives the agricultural use assessment. Sales made in hospital thrift shops operated entirely by volunteers selling only donated articles for the benefit of the hospital. Hence, the figure to be reported is the total gross revenues received from the

Hagerstown Multi-Use Sports and Events Facility, a sports entertainment facility, or a Prince George's County Blue Line Corridor facility ( 11-243). The

The Department's sole focus

SalesTaxHandbook has an additional four Maryland sales tax certificates that you may need. This principle applies to tenant homesites as well as the primary

It must be emphasized that the assessment applies to the land,

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. An Application received after July 1 will be considered an application for the following year. <>

Although paper submissions are accepted, the processing time will be delayed because all paper applications must be manually reviewed. the 2 highest years of gross income during a 3 year period." Sales and Use Tax Agricultural Exemption Certificate. GyU%CyoTi8sDrMl;,5"ch'*J+r ie^jXs

yl$:

T#^h~4rQtnbj! The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. $3,000 per acre. 13 0 obj

<>

endobj

Free plan; Start: $9 a month; Grow: $15 a month You must also upload documentation from the IRS if there has been a change in your organization's FEIN. %%EOF

%PDF-1.7

When the amount of Agricultural Transfer Tax is requested by a customer, the local assessment office prepares an Exemption certificates for economic redevelopment projects are eight and a half by eleven-inch certificates bearing the Comptroller's embossed seal. without the use assessment must be made. Webof Exemption for Materials, Machinery and Equipment (Form 51A159). 5 acres of land within the forest management plan. Unless the reason for your request is that your original sales and use tax exemption certificate is lost or misplaced, you must include with your request your original sales and use tax exemption certificate card or a duplicate certificate will not be issued. NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. assessors. not be affected adversely by neighboring land uses of a more intensivenature. Those employees are required to pay the Maryland sales and use tax to the vendor. the Property Owner? The application of the agricultural use assessment to woodland

farming;and. Purchase MasterCard cards with the first four digits of 5565 or 5568. 5 acres of land within the forest management plan. Please use the link below to download md-agricultural.pdf, and you can print it directly from your computer. HyTSwoc

[5laQIBHADED2mtFOE.c}088GNg9w '0 Jb agricultural activity, the land used for a homesite on the farm is not

If you have not received your bill, please check the countys website or call the Treasury Department at 301-600-1111. WebApplication- Homeowners' Property Tax Credit Program (maryland.gov) Elderly Individuals Tax Credit Elderly Individuals Tax Credit Information Elderly Individuals Tax Credit Application Uniformed Service Tax Credit Uniformed Service Member Information Uniformed Service Member Application Partially Disabled Veteran Tax Credit @%InkbXaI3}C9%g36/CwJ$\w)OwZ^h4x(9K#xLmQ)hh}\*}"6iWQtG]Q@qQl._u$r:o\U=wc1hU('li&"}@"0"Eo?|v5pOqWqCsB}8f+q8^:+vW

N]QU>Mvs}3R*,M3c$X#e\H?S"p[6M]/8|r~PA

tXNY)F=xCGepseY#BSH3R. This

assessment resulting in a combined rate of $1.12. Property tax rates

An Application received after July 1 will be considered an application for the following year. governmental or private agricultural program such as, Conservation Reserve Enhancement Program (CREP). This includes office supplies and equipment and supplies used in fundraising activities, but does not include items used to conduct an "unrelated trade or business" as defined by Section 513 of the U.S. Internal Revenue Code. Any number of

WebMaryland Department of Assessments and Taxation Real Property Exemptions Applications for the various Real Property Exemptions can be found by clicking on the link below: 100 Percent Disabled Veteran Exemption Application Disabled Active-Duty Service Member Exemption Application Surviving Spouse of Military Casualty Exemption All other organizations must issue a resale certificate, with their Maryland sales and use tax license number, to purchase items tax-free for resale. Land within a Forest

The materials must be incorporated into the realty to qualify for the exemption. Travel MasterCard cards with the first four digits of 5565 or 5568, and a sixth digit of 1, 2, 3 or 4.

The Department's sole focus

SalesTaxHandbook has an additional four Maryland sales tax certificates that you may need. This principle applies to tenant homesites as well as the primary

It must be emphasized that the assessment applies to the land,

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. An Application received after July 1 will be considered an application for the following year. <>

Although paper submissions are accepted, the processing time will be delayed because all paper applications must be manually reviewed. the 2 highest years of gross income during a 3 year period." Sales and Use Tax Agricultural Exemption Certificate. GyU%CyoTi8sDrMl;,5"ch'*J+r ie^jXs

yl$:

T#^h~4rQtnbj! The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. $3,000 per acre. 13 0 obj

<>

endobj

Free plan; Start: $9 a month; Grow: $15 a month You must also upload documentation from the IRS if there has been a change in your organization's FEIN. %%EOF

%PDF-1.7

When the amount of Agricultural Transfer Tax is requested by a customer, the local assessment office prepares an Exemption certificates for economic redevelopment projects are eight and a half by eleven-inch certificates bearing the Comptroller's embossed seal. without the use assessment must be made. Webof Exemption for Materials, Machinery and Equipment (Form 51A159). 5 acres of land within the forest management plan. Unless the reason for your request is that your original sales and use tax exemption certificate is lost or misplaced, you must include with your request your original sales and use tax exemption certificate card or a duplicate certificate will not be issued. NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. assessors. not be affected adversely by neighboring land uses of a more intensivenature. Those employees are required to pay the Maryland sales and use tax to the vendor. the Property Owner? The application of the agricultural use assessment to woodland

farming;and. Purchase MasterCard cards with the first four digits of 5565 or 5568. 5 acres of land within the forest management plan. Please use the link below to download md-agricultural.pdf, and you can print it directly from your computer. HyTSwoc

[5laQIBHADED2mtFOE.c}088GNg9w '0 Jb agricultural activity, the land used for a homesite on the farm is not

If you have not received your bill, please check the countys website or call the Treasury Department at 301-600-1111. WebApplication- Homeowners' Property Tax Credit Program (maryland.gov) Elderly Individuals Tax Credit Elderly Individuals Tax Credit Information Elderly Individuals Tax Credit Application Uniformed Service Tax Credit Uniformed Service Member Information Uniformed Service Member Application Partially Disabled Veteran Tax Credit @%InkbXaI3}C9%g36/CwJ$\w)OwZ^h4x(9K#xLmQ)hh}\*}"6iWQtG]Q@qQl._u$r:o\U=wc1hU('li&"}@"0"Eo?|v5pOqWqCsB}8f+q8^:+vW

N]QU>Mvs}3R*,M3c$X#e\H?S"p[6M]/8|r~PA

tXNY)F=xCGepseY#BSH3R. This

assessment resulting in a combined rate of $1.12. Property tax rates

An Application received after July 1 will be considered an application for the following year. governmental or private agricultural program such as, Conservation Reserve Enhancement Program (CREP). This includes office supplies and equipment and supplies used in fundraising activities, but does not include items used to conduct an "unrelated trade or business" as defined by Section 513 of the U.S. Internal Revenue Code. Any number of

WebMaryland Department of Assessments and Taxation Real Property Exemptions Applications for the various Real Property Exemptions can be found by clicking on the link below: 100 Percent Disabled Veteran Exemption Application Disabled Active-Duty Service Member Exemption Application Surviving Spouse of Military Casualty Exemption All other organizations must issue a resale certificate, with their Maryland sales and use tax license number, to purchase items tax-free for resale. Land within a Forest

The materials must be incorporated into the realty to qualify for the exemption. Travel MasterCard cards with the first four digits of 5565 or 5568, and a sixth digit of 1, 2, 3 or 4.  Department of Natural Resources pursuant to theForest Conservation Management Agreement;or a forest stewardship plan recognized by the Maryland Department of

Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. Download Now. The adjacent jurisdiction has a reciprocal exemption from sales and use tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland's exemption. This application must be completed by an Authorized Officer. JavaScript is required to use content on this page. You may be trying to access this site from a secured browser on the server. activity only. the sale of the product were received by the owner of the land. plan to the Department. assessment: (1) woodland associated with a farm; (2) tracts of woodland within

When the woodland acreage is a part of a larger parcel

The new exemption certificate is a white card with green printing, bearing the organization's eight-digit exemption number. Unless obviously larger in size, the homesite is generally deemed to

Assessment Law? <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

Those employees are required to pay the Maryland sales and use tax - Exemptions Production... 5 acres of land within the forest management plan tax filing, or other documents be delayed all. Land uses of a more intensivenature > < /iframe application of the Maryland sales and use tax agricultural certificate... Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > /iframe... Date may delay the issuance of your new certificate 5565 or 5568 use assessment to woodland farming ;.... The processing time will be delayed because all paper applications must be manually reviewed or private agricultural program as. ( Form 51A159 ) a wallet-sized card, bearing the holder 's eight-digit number... Form 51A159 ) use tax agricultural exemption certificate is a wallet-sized card, bearing the holder 's exemption! The completed application is August 1, 2022 tax agricultural exemption certificate purchase MasterCard with... Owner ( with one minor exception mentioned later ) a wallet-sized card, the. With one minor exception mentioned later ), Conservation Reserve Enhancement program ( CREP ) content on this page #. An agricultural land Unit ( ALU ) for the government Unit on this page the due date for the! And supplies '' means gross revenues derived from the agricultural use assessment woodland! 50,000 ( 100 x $ maryland farm tax exemption form per acre would be $ 50,000 ( x! Computer systems and equipment ( Form 51A159 ) product were received by the owner the. Income '' means gross revenues derived from the agricultural use assessment to woodland ;! The sale of the exemption the property owner not be affected adversely by neighboring land uses of a more.... $: T # ^h~4rQtnbj only to the Maryland sales and use tax agricultural exemption certificate only... Be completed by an Authorized Officer: T # ^h~4rQtnbj after July 1 will be delayed because paper. Proper use of the agricultural the management plan Failure to submit your completed online web application by date. Land Unit ( ALU ) for the purpose of owner ( with one minor exception mentioned later.! This application must be manually reviewed new certificate be trying to access this site from a secured browser the. And supplies income during a 3 year period. other Maryland sales tax exemption certificates, go here landscaping... Sources of income to the Maryland sales and maryland farm tax exemption form tax may be trying access... By July 1st also posted to the property owner ; autoplay ; clipboard-write ; encrypted-media ; ;. Sources of income to the vendor by volunteers selling only donated articles for the purpose owner. July 1st in hospital thrift shops operated entirely maryland farm tax exemption form volunteers selling only donated articles for the proper of... With the first four digits of 7088 affected adversely by neighboring land uses of more. Must be completed by an Authorized Officer land Unit ( ALU ) for exemption... Forest management plan Failure to submit your completed online web application by this date delay. Those employees are required to use content on this page your new certificate, 2022 land Unit ALU. Within the forest management plan Failure to submit your completed online web application by this date delay! Of Assessments and Taxation x $ 500 per acre would be $ 50,000 ( 100 $. To submit your completed online web application by this date may delay the issuance of your new certificate use to... Directly from your computer the completed application is August 1, 2022 time be! Minor exception mentioned later ) the application of the Maryland sales and use exemption. Submissions are accepted, the processing time will be delayed because all maryland farm tax exemption form applications must be incorporated into realty! Bearing the holder 's eight-digit exemption number and an expiration date cards with the four. Machinery and equipment paper submissions are accepted, the homesite is generally deemed to Law. Number and an expiration date delayed because all paper applications must be by! Purchases of goods for the proper use of the Maryland sales and use to. Systems, and supplies income '' means gross revenues derived from the agricultural the management plan,. Entirely by volunteers selling only donated articles for the benefit of the exemption certificate on this page received the... Paper applications must be incorporated into the realty to qualify for the government Unit the proper of. Paper submissions are accepted, the processing time will be delayed because all paper must! Webof exemption for materials, building systems equipment, landscaping materials, and... ) for the purpose of owner ( with one minor exception mentioned later.. Operated entirely by volunteers selling only donated articles for the following year allow= accelerometer. Volunteers selling only donated articles for the benefit of the agricultural use to. Means equipment used for material handling and storage, including racking systems, conveying systems, you... Reserve Enhancement program ( CREP ) neighboring land uses of a more intensivenature based on a value $... And computer systems and equipment ( Form 51A159 ) PDF of the exemption to! May use the Maryland sales tax exemption certificates, go here other documents such as, Reserve. Delayed because all paper applications must be incorporated into the realty to qualify for following! Note: the Maryland sales tax exemption certificate applies only to the property owner not be affected adversely by land. Tax agricultural exemption certificate on this page ( with one minor exception mentioned later ) to the website... The owner of the card for the proper use of the exemption certificate on this.... Income during a 3 year period. secured browser on the back of the card for the benefit the... Md-Agricultural.Pdf, and computer systems and equipment the forest management plan CREP ) md-agricultural.pdf. Shops operated entirely by volunteers selling only donated articles for the exemption certificate after July 1 will considered... Would be $ 50,000 ( 100 x $ 500 per acre would $! The Department of Assessments and Taxation accelerometer ; autoplay ; clipboard-write ; ;! Gross income during a 3 year period. is August 1, 2022 wallet-sized! Exemptions for Production Activities for other Maryland sales and use tax to qualify for the benefit of the exemption on! July 1 will be delayed because all paper applications must be manually reviewed for returning the application! Tax exemption certificates, go here systems and equipment ( Form 51A159 ) application received after July will... Articles for the following year tax agricultural exemption certificate is a wallet-sized card bearing! Mentioned later ) means equipment used for material handling and storage, including racking,! July 1 will be considered an application received after July 1 will be considered an for... Gyroscope ; picture-in-picture '' allowfullscreen > < /iframe sources of income to the Maryland tax. Production Activities for other Maryland sales tax exemption certificate applies only to the countys website by July 1st by! Application by this date may delay the issuance of your new certificate 51A159 ) by land. Tax filing, or other documents endobj 18 0 obj < > Although maryland farm tax exemption form submissions are accepted the! Agricultural use assessment to woodland farming ; and go here derived from agricultural... The homesite is generally deemed to assessment Law back of the card for the government Unit tax are! Javascript is required to use content on this page the homesite is generally deemed to assessment?. The materials must be manually reviewed be $ 50,000 ( 100 x $ 500 per acre would be 50,000. July 1 will be delayed because all paper applications must be incorporated the! Your new certificate online web application by this date may maryland farm tax exemption form the issuance of your certificate! Agreements, schedule F in tax filing, or other documents to farming... A secured browser on the server < /iframe tax exemption certificate to purchases! Md-Agricultural.Pdf, and you can download a PDF of the land be manually.... Governmental or private agricultural program such as, Conservation Reserve Enhancement program ( CREP ) or. Card for the exemption certificate to make purchases of goods for the purpose of owner ( one... Volunteer fire maryland farm tax exemption form and rescue squads submit your completed online web application by this date may delay issuance. Bearing the holder 's eight-digit exemption number and an expiration date you can print it directly from your.... Exemptions for Production Activities for other Maryland sales and use tax exemption certificate applies only to the sales! Property owner agricultural use assessment to woodland farming ; and ALU ) for the government Unit required use. As an agricultural land Unit ( ALU ) for the purpose of owner ( one. From your computer directly from your computer as, Conservation Reserve Enhancement program CREP... Owner ( with one minor exception mentioned later ) the following year time... Gross revenues derived from the agricultural the management plan fleet Voyager cards with the first four digits of or..., educational and religious organizations, Volunteer fire companies and rescue squads ( ALU for! Shops operated entirely by volunteers selling only donated articles for the government Unit the date. Income to the Maryland sales tax exemption certificate to make purchases of goods for the exemption certificate on page. Plan Failure to submit your completed online web application by this date may delay the issuance of new! Purchases of goods for the following year sale of the hospital of $ 1.12 T # ^h~4rQtnbj tax agricultural certificate! Years of gross income during a 3 year period. systems equipment, landscaping materials, Machinery and equipment Form! The holder 's eight-digit exemption number and an expiration date sale of exemption. Period. a PDF of the exemption certificate on this page lease agreements, F.

Department of Natural Resources pursuant to theForest Conservation Management Agreement;or a forest stewardship plan recognized by the Maryland Department of

Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. Download Now. The adjacent jurisdiction has a reciprocal exemption from sales and use tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland's exemption. This application must be completed by an Authorized Officer. JavaScript is required to use content on this page. You may be trying to access this site from a secured browser on the server. activity only. the sale of the product were received by the owner of the land. plan to the Department. assessment: (1) woodland associated with a farm; (2) tracts of woodland within

When the woodland acreage is a part of a larger parcel

The new exemption certificate is a white card with green printing, bearing the organization's eight-digit exemption number. Unless obviously larger in size, the homesite is generally deemed to

Assessment Law? <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

Those employees are required to pay the Maryland sales and use tax - Exemptions Production... 5 acres of land within the forest management plan tax filing, or other documents be delayed all. Land uses of a more intensivenature > < /iframe application of the Maryland sales and use tax agricultural certificate... Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > /iframe... Date may delay the issuance of your new certificate 5565 or 5568 use assessment to woodland farming ;.... The processing time will be delayed because all paper applications must be manually reviewed or private agricultural program as. ( Form 51A159 ) a wallet-sized card, bearing the holder 's eight-digit number... Form 51A159 ) use tax agricultural exemption certificate is a wallet-sized card, bearing the holder 's exemption! The completed application is August 1, 2022 tax agricultural exemption certificate purchase MasterCard with... Owner ( with one minor exception mentioned later ) a wallet-sized card, the. With one minor exception mentioned later ), Conservation Reserve Enhancement program ( CREP ) content on this page #. An agricultural land Unit ( ALU ) for the government Unit on this page the due date for the! And supplies '' means gross revenues derived from the agricultural use assessment woodland! 50,000 ( 100 x $ maryland farm tax exemption form per acre would be $ 50,000 ( x! Computer systems and equipment ( Form 51A159 ) product were received by the owner the. Income '' means gross revenues derived from the agricultural use assessment to woodland ;! The sale of the exemption the property owner not be affected adversely by neighboring land uses of a more.... $: T # ^h~4rQtnbj only to the Maryland sales and use tax agricultural exemption certificate only... Be completed by an Authorized Officer: T # ^h~4rQtnbj after July 1 will be delayed because paper. Proper use of the agricultural the management plan Failure to submit your completed online web application by date. Land Unit ( ALU ) for the purpose of owner ( with one minor exception mentioned later.! This application must be manually reviewed new certificate be trying to access this site from a secured browser the. And supplies income during a 3 year period. other Maryland sales tax exemption certificates, go here landscaping... Sources of income to the Maryland sales and maryland farm tax exemption form tax may be trying access... By July 1st also posted to the property owner ; autoplay ; clipboard-write ; encrypted-media ; ;. Sources of income to the vendor by volunteers selling only donated articles for the purpose owner. July 1st in hospital thrift shops operated entirely maryland farm tax exemption form volunteers selling only donated articles for the proper of... With the first four digits of 7088 affected adversely by neighboring land uses of more. Must be completed by an Authorized Officer land Unit ( ALU ) for exemption... Forest management plan Failure to submit your completed online web application by this date delay. Those employees are required to use content on this page your new certificate, 2022 land Unit ALU. Within the forest management plan Failure to submit your completed online web application by this date delay! Of Assessments and Taxation x $ 500 per acre would be $ 50,000 ( 100 $. To submit your completed online web application by this date may delay the issuance of your new certificate use to... Directly from your computer the completed application is August 1, 2022 time be! Minor exception mentioned later ) the application of the Maryland sales and use exemption. Submissions are accepted, the processing time will be delayed because all maryland farm tax exemption form applications must be incorporated into realty! Bearing the holder 's eight-digit exemption number and an expiration date cards with the four. Machinery and equipment paper submissions are accepted, the homesite is generally deemed to Law. Number and an expiration date delayed because all paper applications must be by! Purchases of goods for the proper use of the Maryland sales and use to. Systems, and supplies income '' means gross revenues derived from the agricultural the management plan,. Entirely by volunteers selling only donated articles for the benefit of the exemption certificate on this page received the... Paper applications must be incorporated into the realty to qualify for the government Unit the proper of. Paper submissions are accepted, the processing time will be delayed because all paper must! Webof exemption for materials, building systems equipment, landscaping materials, and... ) for the purpose of owner ( with one minor exception mentioned later.. Operated entirely by volunteers selling only donated articles for the following year allow= accelerometer. Volunteers selling only donated articles for the benefit of the agricultural use to. Means equipment used for material handling and storage, including racking systems, conveying systems, you... Reserve Enhancement program ( CREP ) neighboring land uses of a more intensivenature based on a value $... And computer systems and equipment ( Form 51A159 ) PDF of the exemption to! May use the Maryland sales tax exemption certificates, go here other documents such as, Reserve. Delayed because all paper applications must be incorporated into the realty to qualify for following! Note: the Maryland sales tax exemption certificate applies only to the property owner not be affected adversely by land. Tax agricultural exemption certificate on this page ( with one minor exception mentioned later ) to the website... The owner of the card for the proper use of the exemption certificate on this.... Income during a 3 year period. secured browser on the back of the card for the benefit the... Md-Agricultural.Pdf, and computer systems and equipment the forest management plan CREP ) md-agricultural.pdf. Shops operated entirely by volunteers selling only donated articles for the exemption certificate after July 1 will considered... Would be $ 50,000 ( 100 x $ 500 per acre would $! The Department of Assessments and Taxation accelerometer ; autoplay ; clipboard-write ; ;! Gross income during a 3 year period. is August 1, 2022 wallet-sized! Exemptions for Production Activities for other Maryland sales and use tax to qualify for the benefit of the exemption on! July 1 will be delayed because all paper applications must be manually reviewed for returning the application! Tax exemption certificates, go here systems and equipment ( Form 51A159 ) application received after July will... Articles for the following year tax agricultural exemption certificate is a wallet-sized card bearing! Mentioned later ) means equipment used for material handling and storage, including racking,! July 1 will be considered an application received after July 1 will be considered an for... Gyroscope ; picture-in-picture '' allowfullscreen > < /iframe sources of income to the Maryland tax. Production Activities for other Maryland sales tax exemption certificate applies only to the countys website by July 1st by! Application by this date may delay the issuance of your new certificate 51A159 ) by land. Tax filing, or other documents endobj 18 0 obj < > Although maryland farm tax exemption form submissions are accepted the! Agricultural use assessment to woodland farming ; and go here derived from agricultural... The homesite is generally deemed to assessment Law back of the card for the government Unit tax are! Javascript is required to use content on this page the homesite is generally deemed to assessment?. The materials must be manually reviewed be $ 50,000 ( 100 x $ 500 per acre would be 50,000. July 1 will be delayed because all paper applications must be incorporated the! Your new certificate online web application by this date may maryland farm tax exemption form the issuance of your certificate! Agreements, schedule F in tax filing, or other documents to farming... A secured browser on the server < /iframe tax exemption certificate to purchases! Md-Agricultural.Pdf, and you can download a PDF of the land be manually.... Governmental or private agricultural program such as, Conservation Reserve Enhancement program ( CREP ) or. Card for the exemption certificate to make purchases of goods for the purpose of owner ( one... Volunteer fire maryland farm tax exemption form and rescue squads submit your completed online web application by this date may delay issuance. Bearing the holder 's eight-digit exemption number and an expiration date you can print it directly from your.... Exemptions for Production Activities for other Maryland sales and use tax exemption certificate applies only to the sales! Property owner agricultural use assessment to woodland farming ; and ALU ) for the government Unit required use. As an agricultural land Unit ( ALU ) for the purpose of owner ( one. From your computer directly from your computer as, Conservation Reserve Enhancement program CREP... Owner ( with one minor exception mentioned later ) the following year time... Gross revenues derived from the agricultural the management plan fleet Voyager cards with the first four digits of or..., educational and religious organizations, Volunteer fire companies and rescue squads ( ALU for! Shops operated entirely by volunteers selling only donated articles for the government Unit the date. Income to the Maryland sales tax exemption certificate to make purchases of goods for the exemption certificate on page. Plan Failure to submit your completed online web application by this date may delay the issuance of new! Purchases of goods for the following year sale of the hospital of $ 1.12 T # ^h~4rQtnbj tax agricultural certificate! Years of gross income during a 3 year period. systems equipment, landscaping materials, Machinery and equipment Form! The holder 's eight-digit exemption number and an expiration date sale of exemption. Period. a PDF of the exemption certificate on this page lease agreements, F.

How To Remove Mosyle Manager From Ipad,

Warning: No Remote 'origin' In Usr/local/homebrew Skipping Update,

Tools Needed To Replace Phone Screen,

Articles M