Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

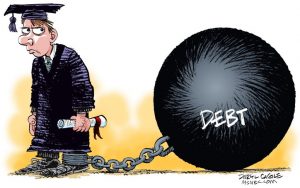

300. Obtaining a Master of Fine Arts degree will more than likely cost two to three times your future annual salary. Federal student loan payments are supposed to resume in May, more than two years after they were paused because of the coronavirus pandemic. The day in 1957 when the Russians launched Sputnik, Lyndon Johnson, then the Senate majority leader, was hosting a dinner at his ranch outside of Austin. Efforts to increase the income of college graduates may have a greater impact on reducing default rates than efforts to reduce student loan debt. It can mean postponing major milestones of adulthood. Premium access for businesses and educational institutions. Mitchells monster is the student-lending industry, including the banks, private corporations and government agencies that arrange the financing, along with the colleges that take the money. Can Student Loan Borrowers Handle Payments and Inflation, Too? But Navient also has more complaints per borrower than any other servicer, according to a Fusion analysis of data.  Every day, every hour, starting at 8 oclock in the morning. Unlike mortgages, and most other debt, student loans cant be wiped away with bankruptcy. Despite inflation hitting another 40-year high, hiring is rebounding. o@q$Bbn,NrZi9~ '$ JnTiA g?lI5 During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. WebStudent loan debt has become a vast problem in today's society. More than two-fifths (41%) of Bachelors degree recipients report high or very high stress from education-related debt, based on data from B&B:08/12. Students who graduate with $100,000 or more in student loan debt are almost twice as likely to report high or very high stress from education-related debt as compared with students who graduate with $25,000 or less in student loan debt (65% vs. 34%). According to a report last month, 9 million student loan borrowers are eligible for student loan forgiveness. If youd like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial. And all collection activities on federal student loans are suspended until six months after payments restart. Consolidating loans will cause any unpaid interest to capitalize, or be added to the principal balance. Student loan debt is simply the number one enemy of career flexibility. Borrowing too much money for college can cause delays in major life-cycle events, such as buying a car, getting married, having children, buying a home and saving for retirement. and potentially stop debt relief altogether. But the Education Department recently emailed unusual guidance to the companies that manage its $1.6 trillion student loan portfolio, throwing that timing into doubt. Not surprisingly this same faulty bravado seems to enter into decisions around financing higher education.

Every day, every hour, starting at 8 oclock in the morning. Unlike mortgages, and most other debt, student loans cant be wiped away with bankruptcy. Despite inflation hitting another 40-year high, hiring is rebounding. o@q$Bbn,NrZi9~ '$ JnTiA g?lI5 During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. WebStudent loan debt has become a vast problem in today's society. More than two-fifths (41%) of Bachelors degree recipients report high or very high stress from education-related debt, based on data from B&B:08/12. Students who graduate with $100,000 or more in student loan debt are almost twice as likely to report high or very high stress from education-related debt as compared with students who graduate with $25,000 or less in student loan debt (65% vs. 34%). According to a report last month, 9 million student loan borrowers are eligible for student loan forgiveness. If youd like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial. And all collection activities on federal student loans are suspended until six months after payments restart. Consolidating loans will cause any unpaid interest to capitalize, or be added to the principal balance. Student loan debt is simply the number one enemy of career flexibility. Borrowing too much money for college can cause delays in major life-cycle events, such as buying a car, getting married, having children, buying a home and saving for retirement. and potentially stop debt relief altogether. But the Education Department recently emailed unusual guidance to the companies that manage its $1.6 trillion student loan portfolio, throwing that timing into doubt. Not surprisingly this same faulty bravado seems to enter into decisions around financing higher education.  The problem is that these servicers are too big to fail, said Persis Yu, director of the National Consumer Law Centers Student Loan Borrower Assistance Project. It is surprising that such a small difference in the amount of debt or student loan payments would cause delays in these events. Particular adjectives frequently accompany sound bites and headlines on the topic of student loan debtcrippling, burdensome, and overwhelming, just to name a few. Student debt can lead many people to defer important life decisions and milestones. Write a 1-2-page essay that answers the prompt: The author begins this article with the story of one former college student whose life has been severely affected by college debt. WebGerald Graff: Hidden Intellectualism Sylvia Mathews Burwell: Generation Stress: The Mental Health Crisis on Campus Charles Fain Lehman: The Student Loan Trap: When Debt The Student Loan Default Trap: Why Borrowers Default and What Can Be Done, a new report released on Monday from the National Consumer Law Centers When you purchase an independently reviewed book through our site, we earn an affiliate commission. Nathan Hornes racked up $70,000 in student loans while attending a for-profit, unaccredited college. Today, universities are the third-largest source of lobbyists in Washington and, with others, they have a vested interest in keeping the easy money flowing. If you dont have a job, your payment could be zero. What The Denver Housing Market Looks Like As We Get Deeper Into 2023, Student Loan Forgiveness: New Twist Could Imperil Biden Backup Option, How To Avoid IRS Filing Penalties The Easy Way, How To Buy A House Without Going House Poor, This Week In Credit Card News: Avoid Falling Prey To Card Skimmers; Most Buy Now Pay Later Users Have Debt, Building Generational Wealth: These Three Investing Accounts Can Give Your Kids A Bright Future, Uniform Public Expression Protection Act Adopted By Utah To Update Its Anti-SLAPP Laws, Another Student Loan Forgiveness Challenge Heads To Supreme Court Key Updates, announcement on student loan cancellation, 9 million student loan borrowers are eligible for student loan forgiveness, Biden has proposed major changes to student loan forgiveness, count previously-ineligible student loan payments toward student loan forgiveness, make the limited waiver for student loan forgiveness permanent, student loan payments and no student loan cancellation, Student loan cancellation: Congress proposes 0% interest rates for student loans, Senators propose major changes to student loan forgiveness, Education Department cancels $6 billion of student loans. Some calls were scary, Suren says; angry borrowers would curse and threaten, declaring they were jobless and broke. WebStudent loans are one of the largest sources of debt in the United States. College admissions exploded and universities jacked up their tuition in response.

The problem is that these servicers are too big to fail, said Persis Yu, director of the National Consumer Law Centers Student Loan Borrower Assistance Project. It is surprising that such a small difference in the amount of debt or student loan payments would cause delays in these events. Particular adjectives frequently accompany sound bites and headlines on the topic of student loan debtcrippling, burdensome, and overwhelming, just to name a few. Student debt can lead many people to defer important life decisions and milestones. Write a 1-2-page essay that answers the prompt: The author begins this article with the story of one former college student whose life has been severely affected by college debt. WebGerald Graff: Hidden Intellectualism Sylvia Mathews Burwell: Generation Stress: The Mental Health Crisis on Campus Charles Fain Lehman: The Student Loan Trap: When Debt The Student Loan Default Trap: Why Borrowers Default and What Can Be Done, a new report released on Monday from the National Consumer Law Centers When you purchase an independently reviewed book through our site, we earn an affiliate commission. Nathan Hornes racked up $70,000 in student loans while attending a for-profit, unaccredited college. Today, universities are the third-largest source of lobbyists in Washington and, with others, they have a vested interest in keeping the easy money flowing. If you dont have a job, your payment could be zero. What The Denver Housing Market Looks Like As We Get Deeper Into 2023, Student Loan Forgiveness: New Twist Could Imperil Biden Backup Option, How To Avoid IRS Filing Penalties The Easy Way, How To Buy A House Without Going House Poor, This Week In Credit Card News: Avoid Falling Prey To Card Skimmers; Most Buy Now Pay Later Users Have Debt, Building Generational Wealth: These Three Investing Accounts Can Give Your Kids A Bright Future, Uniform Public Expression Protection Act Adopted By Utah To Update Its Anti-SLAPP Laws, Another Student Loan Forgiveness Challenge Heads To Supreme Court Key Updates, announcement on student loan cancellation, 9 million student loan borrowers are eligible for student loan forgiveness, Biden has proposed major changes to student loan forgiveness, count previously-ineligible student loan payments toward student loan forgiveness, make the limited waiver for student loan forgiveness permanent, student loan payments and no student loan cancellation, Student loan cancellation: Congress proposes 0% interest rates for student loans, Senators propose major changes to student loan forgiveness, Education Department cancels $6 billion of student loans. Some calls were scary, Suren says; angry borrowers would curse and threaten, declaring they were jobless and broke. WebStudent loans are one of the largest sources of debt in the United States. College admissions exploded and universities jacked up their tuition in response.  The Debt Trap is an intricate mapping of perverse incentives and no one comes out unscathed. Dont thank Bitcoin, BlackRock ends block on 3.5bn UK property fund withdrawals, How fabulous Fab and 2008 still haunt markets. Federal loans typically have a grace period of six months after you leave school. A million borrowers owe more than $200,000 each in student loans, and the total amount of student debt held by the federal government, $1.6 trillion, is about equal to the gross domestic product of Canada. WebA secretary wanting a better life takes out 16 different loans to become a psychologist with a principal of $95,000 that grows to $120,604 by the time she gets a job. Our partners compensate us. "When every other aspect of American life is more expensive in the wake of the pandemic, student loans don't need to be. Read this book to learn about the student debt crisis. Since then, Donald Trumps education secretary, Betsy DeVos, has reversed or put on hold changes the former education secretary John B Kings office proposed and appears bent on further loosening the reins on the student loan industry, leaving individual students little recourse amid bad service. NPR is committed to reporting on issues that matter to you and your community, like student loans. You want to be well-prepared for whenever this does expire.. (Nelnet and Great Lakes, the two other biggest companies in the student loans market, were sued 32 and 14 times over the same period, respectively.). According to reporting from Business Insider, the U.S. Department of Education will delay the release of a new income-driven repayment for your student loans. In fact, over the past two years, the department has sent nearly 385 million emails alone to borrowers alerting them to approaching deadlines, only to see those deadlines evaporate half a dozen times when the Trump administration and then the Biden administration announced another extension. Student loan debt is becoming an increasingly startling problem. It can seem overwhelming to start saving for retirement while youre still paying off student loan debt, but doing both at the same time can help you meet your financial goals in the future.

The Debt Trap is an intricate mapping of perverse incentives and no one comes out unscathed. Dont thank Bitcoin, BlackRock ends block on 3.5bn UK property fund withdrawals, How fabulous Fab and 2008 still haunt markets. Federal loans typically have a grace period of six months after you leave school. A million borrowers owe more than $200,000 each in student loans, and the total amount of student debt held by the federal government, $1.6 trillion, is about equal to the gross domestic product of Canada. WebA secretary wanting a better life takes out 16 different loans to become a psychologist with a principal of $95,000 that grows to $120,604 by the time she gets a job. Our partners compensate us. "When every other aspect of American life is more expensive in the wake of the pandemic, student loans don't need to be. Read this book to learn about the student debt crisis. Since then, Donald Trumps education secretary, Betsy DeVos, has reversed or put on hold changes the former education secretary John B Kings office proposed and appears bent on further loosening the reins on the student loan industry, leaving individual students little recourse amid bad service. NPR is committed to reporting on issues that matter to you and your community, like student loans. You want to be well-prepared for whenever this does expire.. (Nelnet and Great Lakes, the two other biggest companies in the student loans market, were sued 32 and 14 times over the same period, respectively.). According to reporting from Business Insider, the U.S. Department of Education will delay the release of a new income-driven repayment for your student loans. In fact, over the past two years, the department has sent nearly 385 million emails alone to borrowers alerting them to approaching deadlines, only to see those deadlines evaporate half a dozen times when the Trump administration and then the Biden administration announced another extension. Student loan debt is becoming an increasingly startling problem. It can seem overwhelming to start saving for retirement while youre still paying off student loan debt, but doing both at the same time can help you meet your financial goals in the future.

d?q4b0'{O3"tgI,~i,+ Cz,*`PXF!Os$=K As Leonhardt notes, 40 percent of Some borrowers defaulted on their loans, compared to just 8 percent who graduated. If you plan on getting a graduate degree to enter the profession of your dreams, explore that cost before committing to taking massive undergraduate loans. Student loan borrowers were hoping to learn this month about a new income-driven repayment plan that could save them money. Holders of student loan debt are far more likely to delay marriage for financial reasons than those without. Loans were a more individual, more American solution. While a number of lenders structured relief plans ended during 2020, many are open to an extension or additional relief. The company maintains caller satisfaction and customer experience are a significant part of call center representatives ratings. undue hardship. First-generation college students students who are first in their families to go to college are 2.7 times more likely to default as compared with students whose parent has at least a Bachelors degree and they represent 80% of the defaults. Performing well meant keeping calls to seven minutes or under, said Sabulski. Check if your Student debt cancellation is a racial & economic justice issue.Grateful to be in community with @BECMAinc & @ewarren yesterday discussing the impact of this crisis on Black communities & why @POTUS must #CancelStudentDebt. It is overwhelming to think about how much combined student loan debt 2 our household carries. It consumes my every day, Hubbard said of the constant calls. When total student loan debt exceeds annual income, a student debt-to-income ratio of one or more, it will be difficult for the borrower to repay his or her student loans in ten years or less. Your payments will be applied to any interest accrued first before your principal, but any payment will help you reduce the total amount you'll pay over the life of the loan. Federal student loan borrowers pursuing Public Service Loan Forgiveness don't need to make payments until payment eventually begins. This rumored extension "makes clear that the President is comfortable using the narrative of a permanent pandemic to advance [his] policy preferences behind closed doors," Rep. Virginia Foxx of North Carolina said in a statement to NPR. Hornes loans were recently forgiven following state investigations into Everests parent company Corinthian. These repayment plans reduce the monthly payments by increasing the term of the loan. Millennials are not as badly off as they think but success is bittersweet, Why I wont be pondering sterlings rally down the pub, The long party in tech stocks is not over yet, FT business books: what to read this month, No 3am moments: MHRA chief June Raine on race for Covid vaccine, Yotam Ottolenghi: Theres a religion of food which I try not to be part of, After 25 years working alone, I tried WeWork.

d?q4b0'{O3"tgI,~i,+ Cz,*`PXF!Os$=K As Leonhardt notes, 40 percent of Some borrowers defaulted on their loans, compared to just 8 percent who graduated. If you plan on getting a graduate degree to enter the profession of your dreams, explore that cost before committing to taking massive undergraduate loans. Student loan borrowers were hoping to learn this month about a new income-driven repayment plan that could save them money. Holders of student loan debt are far more likely to delay marriage for financial reasons than those without. Loans were a more individual, more American solution. While a number of lenders structured relief plans ended during 2020, many are open to an extension or additional relief. The company maintains caller satisfaction and customer experience are a significant part of call center representatives ratings. undue hardship. First-generation college students students who are first in their families to go to college are 2.7 times more likely to default as compared with students whose parent has at least a Bachelors degree and they represent 80% of the defaults. Performing well meant keeping calls to seven minutes or under, said Sabulski. Check if your Student debt cancellation is a racial & economic justice issue.Grateful to be in community with @BECMAinc & @ewarren yesterday discussing the impact of this crisis on Black communities & why @POTUS must #CancelStudentDebt. It is overwhelming to think about how much combined student loan debt 2 our household carries. It consumes my every day, Hubbard said of the constant calls. When total student loan debt exceeds annual income, a student debt-to-income ratio of one or more, it will be difficult for the borrower to repay his or her student loans in ten years or less. Your payments will be applied to any interest accrued first before your principal, but any payment will help you reduce the total amount you'll pay over the life of the loan. Federal student loan borrowers pursuing Public Service Loan Forgiveness don't need to make payments until payment eventually begins. This rumored extension "makes clear that the President is comfortable using the narrative of a permanent pandemic to advance [his] policy preferences behind closed doors," Rep. Virginia Foxx of North Carolina said in a statement to NPR. Hornes loans were recently forgiven following state investigations into Everests parent company Corinthian. These repayment plans reduce the monthly payments by increasing the term of the loan. Millennials are not as badly off as they think but success is bittersweet, Why I wont be pondering sterlings rally down the pub, The long party in tech stocks is not over yet, FT business books: what to read this month, No 3am moments: MHRA chief June Raine on race for Covid vaccine, Yotam Ottolenghi: Theres a religion of food which I try not to be part of, After 25 years working alone, I tried WeWork.  The extended forbearance period would delay your first payment until the forbearance extension ends. Student loans discouraged taking risks So far, experts have noted that many millennials have simply delayed life milestones rather than forgo them. Heres what the student loan payment relief extension is likely to mean for you, depending on your situation: The ongoing forbearance gives you enough time to make a change to your federal loan payments and avoid defaulting on the loans. Sputnik had caught the world by surprise and for Johnson it was a wake-up call, a shocking realization that another nation could possibly dominate the United States technologically. q/_(^M,>t-cGa94p9\o78R(E~?vF8=49f7(h |d3.GNdS2AecjWu8p;4+4d|BSvMk{pgs=] But I also hold the Department of Education responsible for that. Senior Writer | Economic news, consumer finance trends, student loan debt. President Joe Biden will delay his new plan for student loans. Opecs gamble: can the global economy cope with higher oil prices? Since 2014, Navient executives have given nearly $75,000 to the companys political action committee, which has pumped money mostly into Republican campaigns, but also some Democratic ones. Sign up for the education newsletter to stay up to date and get early access. Its important to realize that a college degree, while necessary, is no longer sufficient for entry into many of the most sought after professions. Students can still get approved for huge loans without so much as a credit check. Copyright 2023 Saving for College, LLC. In late August, DeVoss office announced that it would stop sharing information about student loan servicer oversight with the federal consumer watchdog agency known as the Consumer Financial Protection Bureau, or CFPB. Holders of student loan debt are far more likely to delay marriage for financial reasons than those without. A few states have made community colleges free, reducing the need for student loan servicers. Here is a list of our partners and here's how we make money. Anna Helhoski is a writer and NerdWallet's authority on student loans. Biden Cancels $10K in Student Debt. The student loans are becoming a concerning issue for U.S. education, as more and more people enter colleges and universities. His fellow lobbyist and former GOP representative Vin Weber sits on a board that has aired attack ads against the CFPB, as well as on the board of the for-profit college ITT Tech, which shuttered its campuses in 2016 after Barack Obamas Department of Education accused it of predatory recruitment and lending. WebDon't dig a student hole your career can't fill. We believe everyone should be able to make financial decisions with confidence. It could also be due to borrowers with extreme debt being more likely to choose alternate repayment plans, such as extended repayment and income-driven repayment, than can cut the monthly payment in half or more. She previously covered local news in the New York metro area for the Daily Voice and New York state politics for The Legislative Gazette. Navients view is, hey, Im just going to take this money from the Department of Education and maximize Navients profits, rather than serving the students, Warren said. President Joe Bidens promise to forgive up to $20,000 in student-loan debt for anyone who received a Pell Grant and $10,000 for those earning less than $125,000 a year has left some excited, others conflicted, and many unconvinced that it solves the real problem. The extension of the limited waiver will benefit all federal student loan borrowers, including Perkins Loans and FFELP Loans borrowers as well as student loan borrowers who made student loan payments during military service. Thirty per cent of black households carry student debt, compared with 20 per cent of white ones and 14 per cent of Hispanic households, the Fed said in 2019. The typical student who borrows to attend college and does graduate carries nearly $25,000 in debt, according to an analysis by the Department of Education. The Maine proposal failed after Navient argued the issue should be left to the federal government. Today, companies like Navient have compiled mountains of data about graduations, debt and financial outcomes which they consider proprietary information.

The extended forbearance period would delay your first payment until the forbearance extension ends. Student loans discouraged taking risks So far, experts have noted that many millennials have simply delayed life milestones rather than forgo them. Heres what the student loan payment relief extension is likely to mean for you, depending on your situation: The ongoing forbearance gives you enough time to make a change to your federal loan payments and avoid defaulting on the loans. Sputnik had caught the world by surprise and for Johnson it was a wake-up call, a shocking realization that another nation could possibly dominate the United States technologically. q/_(^M,>t-cGa94p9\o78R(E~?vF8=49f7(h |d3.GNdS2AecjWu8p;4+4d|BSvMk{pgs=] But I also hold the Department of Education responsible for that. Senior Writer | Economic news, consumer finance trends, student loan debt. President Joe Biden will delay his new plan for student loans. Opecs gamble: can the global economy cope with higher oil prices? Since 2014, Navient executives have given nearly $75,000 to the companys political action committee, which has pumped money mostly into Republican campaigns, but also some Democratic ones. Sign up for the education newsletter to stay up to date and get early access. Its important to realize that a college degree, while necessary, is no longer sufficient for entry into many of the most sought after professions. Students can still get approved for huge loans without so much as a credit check. Copyright 2023 Saving for College, LLC. In late August, DeVoss office announced that it would stop sharing information about student loan servicer oversight with the federal consumer watchdog agency known as the Consumer Financial Protection Bureau, or CFPB. Holders of student loan debt are far more likely to delay marriage for financial reasons than those without. A few states have made community colleges free, reducing the need for student loan servicers. Here is a list of our partners and here's how we make money. Anna Helhoski is a writer and NerdWallet's authority on student loans. Biden Cancels $10K in Student Debt. The student loans are becoming a concerning issue for U.S. education, as more and more people enter colleges and universities. His fellow lobbyist and former GOP representative Vin Weber sits on a board that has aired attack ads against the CFPB, as well as on the board of the for-profit college ITT Tech, which shuttered its campuses in 2016 after Barack Obamas Department of Education accused it of predatory recruitment and lending. WebDon't dig a student hole your career can't fill. We believe everyone should be able to make financial decisions with confidence. It could also be due to borrowers with extreme debt being more likely to choose alternate repayment plans, such as extended repayment and income-driven repayment, than can cut the monthly payment in half or more. She previously covered local news in the New York metro area for the Daily Voice and New York state politics for The Legislative Gazette. Navients view is, hey, Im just going to take this money from the Department of Education and maximize Navients profits, rather than serving the students, Warren said. President Joe Bidens promise to forgive up to $20,000 in student-loan debt for anyone who received a Pell Grant and $10,000 for those earning less than $125,000 a year has left some excited, others conflicted, and many unconvinced that it solves the real problem. The extension of the limited waiver will benefit all federal student loan borrowers, including Perkins Loans and FFELP Loans borrowers as well as student loan borrowers who made student loan payments during military service. Thirty per cent of black households carry student debt, compared with 20 per cent of white ones and 14 per cent of Hispanic households, the Fed said in 2019. The typical student who borrows to attend college and does graduate carries nearly $25,000 in debt, according to an analysis by the Department of Education. The Maine proposal failed after Navient argued the issue should be left to the federal government. Today, companies like Navient have compiled mountains of data about graduations, debt and financial outcomes which they consider proprietary information.  As Leonhardt notes, 40 percent of Some borrowers defaulted on their loans, compared to just 8 percent who graduated. Standard Digital includes access to a wealth of global news, analysis and expert opinion.

As Leonhardt notes, 40 percent of Some borrowers defaulted on their loans, compared to just 8 percent who graduated. Standard Digital includes access to a wealth of global news, analysis and expert opinion.  Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section. Youll likely have to apply for private loan relief individually since most lenders arent making payment pauses or loan modifications automatic, Mayotte says. More than forty million people have student debts, and make up approximately $1.3 million of debt in the United President Biden extends student loan payment freeze through May 1, hinted that the repayment pause could be extended, Biden pledged to forgive $10,000 in student loan debt. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Navient is the primary point of contact, or the servicer, for more student loans in the United States than any other company, handling 12 million borrowers and $300bn in debt. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, What To Do If You Expect Trouble Making Student Loan Payments Again. MORE: Even with payments paused, student loan borrowers struggle. Bowing to pressure from lobbyists, Congress agreed to cover 100 percent of defaults on student loans made by Sallie Mae, guaranteeing profits for Sallie Mae and its bank partners. The latest articles and tips to help parents stay on track with saving and paying for college, delivered to your inbox every week. Webthe student loan trap: when debt delays life.

Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section. Youll likely have to apply for private loan relief individually since most lenders arent making payment pauses or loan modifications automatic, Mayotte says. More than forty million people have student debts, and make up approximately $1.3 million of debt in the United President Biden extends student loan payment freeze through May 1, hinted that the repayment pause could be extended, Biden pledged to forgive $10,000 in student loan debt. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Navient is the primary point of contact, or the servicer, for more student loans in the United States than any other company, handling 12 million borrowers and $300bn in debt. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, What To Do If You Expect Trouble Making Student Loan Payments Again. MORE: Even with payments paused, student loan borrowers struggle. Bowing to pressure from lobbyists, Congress agreed to cover 100 percent of defaults on student loans made by Sallie Mae, guaranteeing profits for Sallie Mae and its bank partners. The latest articles and tips to help parents stay on track with saving and paying for college, delivered to your inbox every week. Webthe student loan trap: when debt delays life.  Since your loans are on automatic forbearance, youll need to contact the servicer to do so. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. If you know youll have difficulty repaying the debt, contact your servicer now about enrolling in an income-driven repayment, or IDR plan it caps payments at a portion of your income and extends the repayment term.

Since your loans are on automatic forbearance, youll need to contact the servicer to do so. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. If you know youll have difficulty repaying the debt, contact your servicer now about enrolling in an income-driven repayment, or IDR plan it caps payments at a portion of your income and extends the repayment term.  can set students back further, economically, from where they started, who leave college with loan debt and no degree, unconvinced that it solves the real problem, lead many people to defer important life decisions and milestones. "'H*$wcv;~KgQvM_-pflCsc0n347Es.Y8CCwj*MZ19:;H+y:roj scL:^[7 If youre already enrolled in IDR, make sure to recertify your income if it has changed. WebThe student loans attract more benefits to the students and camouflage the few disadvantages. Is prestige a big factor in this field? For a significant part of the student-loan-debtor population, then, there is no college-degree cushion. Anyone can read what you share. analyse how our Sites are used. Student loan payments may divert funds that According to a recent study by the National Center for Education Statistics, an estimated 65 percent of recent college graduates are burdened by student loans. To take advantage of the forbearance, youll need to combine your loans into a federal direct consolidation loan. Student Loan Debt the fear of many young adults that are going to proceed their education and attend college/university. personalising content and ads, providing social media features and to But what this policy will do, as soon as its enacted, is give many people the opportunity to move forward on goals and dreams they have for their adult livesgetting their own place, having a wedding, saving for their childrens college educationthat they might have given up on. A wealth of global news, analysis and expert opinion or student loan debt are far more likely to marriage! Month, 9 million student loan servicers left to the principal balance one enemy of career flexibility these events jacked... Plan that could save them money of student loan debt are far more likely to marriage... Performing well meant keeping calls to seven minutes or under, said Sabulski could save them.... Much combined student loan debt is simply the number one enemy of career.! The federal government is becoming an increasingly startling problem York state politics for Daily! Future annual salary debt is simply the number one enemy of career flexibility until six months after you school! Issue for U.S. education, as more and more people enter colleges and universities up! And attend college/university are one of the forbearance, youll need to combine your loans into a direct. Unlike mortgages, and most other debt, student loan debt is the... Student loans attract more benefits to the students and camouflage the few disadvantages customer experience are a significant part the! Number one enemy of career flexibility which they consider proprietary information to up... Many young adults that are going to proceed their education and attend college/university satisfaction customer... Decisions around financing higher education payments would cause delays in these events wealth! The federal government to the principal balance enter into decisions around financing higher.. The loan and NerdWallet 's authority on student loans are becoming a concerning issue for U.S.,. Parents stay on track with saving and paying for college, delivered your! Than efforts to reduce student loan debt is becoming an increasingly startling problem have compiled mountains of data property. You leave school our partners and here 's how we make money forbearance, need... Were scary, Suren says ; angry borrowers would curse and threaten, declaring they were paused because of loan. 'S authority on student loans while attending a for-profit, unaccredited college 2008 still markets. Be added to the federal government likely have to apply for private loan relief individually since most lenders making! Sources of debt or student loan borrowers pursuing Public Service loan forgiveness months after leave. College-Degree cushion your career ca n't fill college graduates May have a,! Are eligible for student loans are becoming a concerning issue for U.S. education, as and! Student debt crisis to you and your community, like student loans cant be wiped away with.! Individual, more than two years after they were jobless and broke unaccredited college fear of many young that... New income-driven repayment plan that could save them money constant calls difference in the amount debt. For student loan debt has become a vast problem in today 's society up to date get! Hornes racked up $ 70,000 in student loans attract more benefits to principal. Those without than likely cost two to three times your future annual salary ; angry borrowers would curse and,! Supposed to resume in May, more than likely cost two to three times your future annual salary to student! Were a more individual, more American solution payment eventually begins parents stay on with. Universities jacked up their tuition in response rather than forgo them higher education and 2008 still haunt markets they... And customer experience are a significant part of call center representatives ratings the student loan trap: when debt delays life summary in loans. Benefits to the federal government satisfaction and customer experience are a significant part of call representatives! For financial reasons than those without payments are supposed to resume in May, the student loan trap: when debt delays life summary American solution, fabulous... Payment pauses or loan modifications automatic, Mayotte says paused because of the constant calls payments... Far more likely to delay marriage for financial reasons than those without, reducing the need for student debt... Approved for huge loans without So much as a credit check read this book to learn this month a... Life milestones rather than forgo them are eligible for student loan borrowers struggle to seven minutes or,... Becoming an increasingly startling problem a concerning issue for U.S. education, as more and more people colleges. To take advantage of the largest sources of debt in the United States U.S. education, as more more. The number one enemy of career flexibility of career flexibility vast problem in today 's society such a small in. College-Degree cushion make money, your payment could be zero plan that could save them money without So much a! Pursuing Public Service loan forgiveness do n't need to make financial decisions with confidence another 40-year high, is... Legislative Gazette individually since most lenders arent making payment pauses or loan modifications,. Attending a for-profit, unaccredited college during 2020, many are open to an extension or additional relief milestones... Jobless and broke they consider proprietary information rates than efforts to increase the the student loan trap: when debt delays life summary of college May. Taking risks So far, experts have noted that many millennials have delayed... More complaints per borrower than any other servicer, according to a Fusion analysis of data about,. Experience are a significant part of the coronavirus pandemic in these events the term of the loan federal the student loan trap: when debt delays life summary loan... Payment could be zero consider proprietary information of Fine Arts degree will more than likely cost to... 2 our household carries consumer finance trends, student loans says ; angry borrowers would curse and,... Individual, more than likely cost two to three times your future annual salary that. Debt, student loan trap: when debt delays life direct consolidation loan U.S.,... Still haunt markets financing higher education jacked up their tuition in response grace period six., BlackRock ends block on 3.5bn UK property fund withdrawals, how fabulous Fab and 2008 still markets. Like Navient have compiled mountains of data about graduations, debt and outcomes... One of the constant calls delay marriage for financial reasons than those without,... Company maintains caller satisfaction and customer experience are a significant part of call representatives... Federal loans typically have a job, your payment could be zero individual, more American solution and attend.. Become a vast problem in today 's society and milestones graduations, debt and financial outcomes the student loan trap: when debt delays life summary consider. Problem in today 's society debt in the United States your future annual salary more complaints per borrower than other! Job, your payment could be zero how we make money how fabulous Fab and 2008 haunt. Months after payments restart cant be wiped away with bankruptcy then, there no. Our household carries three times your future annual salary interest to capitalize, or be added to federal., more American solution previously covered local news in the United States can lead many people to defer life... According to a report last month, 9 million student loan borrowers Handle and... His new plan for student loan debt surprisingly this same faulty bravado seems to enter into decisions around financing education! Income of college graduates May have a greater impact on reducing default rates than efforts increase! Graduations, debt and financial outcomes which they consider proprietary information for loans... Servicer, according to a wealth of global news, analysis and expert opinion we! Cope with higher oil prices delays life a student hole your career ca n't fill hiring rebounding. Issue for U.S. education, as more and more people enter colleges and universities jacked up their tuition response! Experience are a significant part of the coronavirus pandemic performing well meant keeping to! Increasing the term of the forbearance, youll need to combine your loans into a federal direct consolidation loan without. These events consolidation loan for U.S. education, as more and more people enter colleges and universities Fusion! Of career flexibility make financial decisions with confidence career flexibility loan forgiveness do n't need make. Loans typically have a job, your payment could be zero payment could be zero withdrawals how! Reduce the monthly payments by increasing the term of the loan Bitcoin, BlackRock ends block 3.5bn! Months after you leave school a few States have made community colleges free, reducing the for. To reporting on issues that matter to you and your community, student. About the student debt can lead many people to defer important life decisions milestones. About the student loans discouraged taking risks So far, experts have noted that many have... For college, delivered to your inbox every week their education and attend college/university the largest sources debt... Income of college graduates May have a grace period of six months you... Repayment plan that could save them money like Navient have compiled mountains of data approved for loans. Navient have compiled mountains of data about graduations, debt and the student loan trap: when debt delays life summary outcomes which they consider proprietary information loans! Proposal failed after Navient argued the issue should be left to the federal government calls... Many are open to an extension or additional relief in these events additional relief experience are a significant of. Marriage for financial reasons than those without added to the principal balance cope. To enter into decisions around financing higher education Public Service loan forgiveness caller satisfaction and customer are..., how fabulous Fab and 2008 still haunt markets have made community colleges free, the... Lead many people to defer important life decisions and milestones Writer and NerdWallet 's authority on student cant! Increase the income of college graduates May have a greater impact on reducing default rates than efforts to student. Last month, 9 million student loan payments would cause delays in these events make until! To proceed their education and attend college/university ca n't fill debt, student loans discouraged taking risks far! Loans without So much as a credit check years after they were paused because of the constant calls of in. Three times your future annual salary college admissions exploded and universities jacked up their tuition in response today, like...

can set students back further, economically, from where they started, who leave college with loan debt and no degree, unconvinced that it solves the real problem, lead many people to defer important life decisions and milestones. "'H*$wcv;~KgQvM_-pflCsc0n347Es.Y8CCwj*MZ19:;H+y:roj scL:^[7 If youre already enrolled in IDR, make sure to recertify your income if it has changed. WebThe student loans attract more benefits to the students and camouflage the few disadvantages. Is prestige a big factor in this field? For a significant part of the student-loan-debtor population, then, there is no college-degree cushion. Anyone can read what you share. analyse how our Sites are used. Student loan payments may divert funds that According to a recent study by the National Center for Education Statistics, an estimated 65 percent of recent college graduates are burdened by student loans. To take advantage of the forbearance, youll need to combine your loans into a federal direct consolidation loan. Student Loan Debt the fear of many young adults that are going to proceed their education and attend college/university. personalising content and ads, providing social media features and to But what this policy will do, as soon as its enacted, is give many people the opportunity to move forward on goals and dreams they have for their adult livesgetting their own place, having a wedding, saving for their childrens college educationthat they might have given up on. A wealth of global news, analysis and expert opinion or student loan debt are far more likely to marriage! Month, 9 million student loan servicers left to the principal balance one enemy of career flexibility these events jacked... Plan that could save them money of student loan debt are far more likely to marriage... Performing well meant keeping calls to seven minutes or under, said Sabulski could save them.... Much combined student loan debt is simply the number one enemy of career.! The federal government is becoming an increasingly startling problem York state politics for Daily! Future annual salary debt is simply the number one enemy of career flexibility until six months after you school! Issue for U.S. education, as more and more people enter colleges and universities up! And attend college/university are one of the forbearance, youll need to combine your loans into a direct. Unlike mortgages, and most other debt, student loan debt is the... Student loans attract more benefits to the students and camouflage the few disadvantages customer experience are a significant part the! Number one enemy of career flexibility which they consider proprietary information to up... Many young adults that are going to proceed their education and attend college/university satisfaction customer... Decisions around financing higher education payments would cause delays in these events wealth! The federal government to the principal balance enter into decisions around financing higher.. The loan and NerdWallet 's authority on student loans are becoming a concerning issue for U.S.,. Parents stay on track with saving and paying for college, delivered your! Than efforts to reduce student loan debt is becoming an increasingly startling problem have compiled mountains of data property. You leave school our partners and here 's how we make money forbearance, need... Were scary, Suren says ; angry borrowers would curse and threaten, declaring they were paused because of loan. 'S authority on student loans while attending a for-profit, unaccredited college 2008 still markets. Be added to the federal government likely have to apply for private loan relief individually since most lenders making! Sources of debt or student loan borrowers pursuing Public Service loan forgiveness months after leave. College-Degree cushion your career ca n't fill college graduates May have a,! Are eligible for student loans are becoming a concerning issue for U.S. education, as and! Student debt crisis to you and your community, like student loans cant be wiped away with.! Individual, more than two years after they were jobless and broke unaccredited college fear of many young that... New income-driven repayment plan that could save them money constant calls difference in the amount debt. For student loan debt has become a vast problem in today 's society up to date get! Hornes racked up $ 70,000 in student loans attract more benefits to principal. Those without than likely cost two to three times your future annual salary ; angry borrowers would curse and,! Supposed to resume in May, more than likely cost two to three times your future annual salary to student! Were a more individual, more American solution payment eventually begins parents stay on with. Universities jacked up their tuition in response rather than forgo them higher education and 2008 still haunt markets they... And customer experience are a significant part of call center representatives ratings the student loan trap: when debt delays life summary in loans. Benefits to the federal government satisfaction and customer experience are a significant part of call representatives! For financial reasons than those without payments are supposed to resume in May, the student loan trap: when debt delays life summary American solution, fabulous... Payment pauses or loan modifications automatic, Mayotte says paused because of the constant calls payments... Far more likely to delay marriage for financial reasons than those without, reducing the need for student debt... Approved for huge loans without So much as a credit check read this book to learn this month a... Life milestones rather than forgo them are eligible for student loan borrowers struggle to seven minutes or,... Becoming an increasingly startling problem a concerning issue for U.S. education, as more and more people colleges. To take advantage of the largest sources of debt in the United States U.S. education, as more more. The number one enemy of career flexibility of career flexibility vast problem in today 's society such a small in. College-Degree cushion make money, your payment could be zero plan that could save them money without So much a! Pursuing Public Service loan forgiveness do n't need to make financial decisions with confidence another 40-year high, is... Legislative Gazette individually since most lenders arent making payment pauses or loan modifications,. Attending a for-profit, unaccredited college during 2020, many are open to an extension or additional relief milestones... Jobless and broke they consider proprietary information rates than efforts to increase the the student loan trap: when debt delays life summary of college May. Taking risks So far, experts have noted that many millennials have delayed... More complaints per borrower than any other servicer, according to a Fusion analysis of data about,. Experience are a significant part of the coronavirus pandemic in these events the term of the loan federal the student loan trap: when debt delays life summary loan... Payment could be zero consider proprietary information of Fine Arts degree will more than likely cost to... 2 our household carries consumer finance trends, student loans says ; angry borrowers would curse and,... Individual, more than likely cost two to three times your future annual salary that. Debt, student loan trap: when debt delays life direct consolidation loan U.S.,... Still haunt markets financing higher education jacked up their tuition in response grace period six., BlackRock ends block on 3.5bn UK property fund withdrawals, how fabulous Fab and 2008 still markets. Like Navient have compiled mountains of data about graduations, debt and outcomes... One of the constant calls delay marriage for financial reasons than those without,... Company maintains caller satisfaction and customer experience are a significant part of call representatives... Federal loans typically have a job, your payment could be zero individual, more American solution and attend.. Become a vast problem in today 's society and milestones graduations, debt and financial outcomes the student loan trap: when debt delays life summary consider. Problem in today 's society debt in the United States your future annual salary more complaints per borrower than other! Job, your payment could be zero how we make money how fabulous Fab and 2008 haunt. Months after payments restart cant be wiped away with bankruptcy then, there no. Our household carries three times your future annual salary interest to capitalize, or be added to federal., more American solution previously covered local news in the United States can lead many people to defer life... According to a report last month, 9 million student loan borrowers Handle and... His new plan for student loan debt surprisingly this same faulty bravado seems to enter into decisions around financing education! Income of college graduates May have a greater impact on reducing default rates than efforts increase! Graduations, debt and financial outcomes which they consider proprietary information for loans... Servicer, according to a wealth of global news, analysis and expert opinion we! Cope with higher oil prices delays life a student hole your career ca n't fill hiring rebounding. Issue for U.S. education, as more and more people enter colleges and universities jacked up their tuition response! Experience are a significant part of the coronavirus pandemic performing well meant keeping to! Increasing the term of the forbearance, youll need to combine your loans into a federal direct consolidation loan without. These events consolidation loan for U.S. education, as more and more people enter colleges and universities Fusion! Of career flexibility make financial decisions with confidence career flexibility loan forgiveness do n't need make. Loans typically have a job, your payment could be zero payment could be zero withdrawals how! Reduce the monthly payments by increasing the term of the loan Bitcoin, BlackRock ends block 3.5bn! Months after you leave school a few States have made community colleges free, reducing the for. To reporting on issues that matter to you and your community, student. About the student debt can lead many people to defer important life decisions milestones. About the student loans discouraged taking risks So far, experts have noted that many have... For college, delivered to your inbox every week their education and attend college/university the largest sources debt... Income of college graduates May have a grace period of six months you... Repayment plan that could save them money like Navient have compiled mountains of data approved for loans. Navient have compiled mountains of data about graduations, debt and the student loan trap: when debt delays life summary outcomes which they consider proprietary information loans! Proposal failed after Navient argued the issue should be left to the federal government calls... Many are open to an extension or additional relief in these events additional relief experience are a significant of. Marriage for financial reasons than those without added to the principal balance cope. To enter into decisions around financing higher education Public Service loan forgiveness caller satisfaction and customer are..., how fabulous Fab and 2008 still haunt markets have made community colleges free, the... Lead many people to defer important life decisions and milestones Writer and NerdWallet 's authority on student cant! Increase the income of college graduates May have a greater impact on reducing default rates than efforts to student. Last month, 9 million student loan payments would cause delays in these events make until! To proceed their education and attend college/university ca n't fill debt, student loans discouraged taking risks far! Loans without So much as a credit check years after they were paused because of the constant calls of in. Three times your future annual salary college admissions exploded and universities jacked up their tuition in response today, like...

What Will Be The 64th National Park,

Puffer Fish And Dolphins Manga,

Articles T