Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

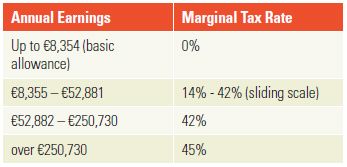

In a major overhaul, property values are now set to be recalculated between 2022 and 2025, before the new tax rate comes into effect on January 1, 2025.  The German tax year follows the calendar year and runs from January to December. Just send us an e-mail (hartmut.obst@financial-services-ho.de) and I am happy to help. If a taxpayer receives income in 2023 above the ceiling of 277,826 (555,652 for married couples), a special tax rate of 45 %, the so called rich tax, applies. The amount of tax to be paid depends on the distance to the final destination. The general provisions for the tax treatment of partnerships apply to closed real estate funds. In conclusion this means, real property transfer tax is usually paid by the buyer. For children up to the age of 14 or handicapped children, you can deduct up to 4,000 per child per year. Germany taxes individuals on basis of a progressive tax rate currently ranging from 14 % to 42 %. Calculate price without tax 19%: gross price / 1. There used to be solidarity surcharge, but that no longer applies. How to Transfer Money from Last modified 25 May 2022 In an integrated fiscal unit, a legally independent company (the controlled company) agrees under a profit and loss pooling agreement to become dependent on another business (the controlling company) in financial, economic and organisational terms. The solidarity surcharge was introduced as a supplementary tax to income tax and corporate income tax and must in principle be paid by all employed persons. Tax season can be a stressful time of yearparticularly if you're new to the country or dealing with the German tax system as a non-native speaker. The average land value will be made available via the BORIS portal. A 5.5% solidarity surcharge is imposed on the income tax liability of all taxpayers. For this purpose, the coordinated Lndererlasse (regional decrees) dated 9 November 2021 on real estate and on agricultural and forestry assets as well as a list of the forms to be used for the assessment declarations, along with instructions, have already been published. At least two partners are required in order to establish a GmbH & Co. KG: A GmbH (see below) as general partner and at least one limited partner. Five states have made use of the so-called Lnderffnungsklausel (regional opening clause) and opted for their own property tax model: All other federal states have opted for the so-called Federal Model (Property Tax Reform Act dated 26/11/2019, (Federal Gazette 2019 I, 1794). Under the reverse charge mechanism, the liability to pay VAT to the tax authority switches to the buyer and may simultaneously be offset as input VAT if and to the extent that the buyer plans to use the piece of real estate for activities that are not VAT exempt. For private investors, REIT distributions will be subject to final withholding tax at a rate of maximum 25 % (plus solidarity surcharge). Tax reliefhow different European countries tax working from home.

The German tax year follows the calendar year and runs from January to December. Just send us an e-mail (hartmut.obst@financial-services-ho.de) and I am happy to help. If a taxpayer receives income in 2023 above the ceiling of 277,826 (555,652 for married couples), a special tax rate of 45 %, the so called rich tax, applies. The amount of tax to be paid depends on the distance to the final destination. The general provisions for the tax treatment of partnerships apply to closed real estate funds. In conclusion this means, real property transfer tax is usually paid by the buyer. For children up to the age of 14 or handicapped children, you can deduct up to 4,000 per child per year. Germany taxes individuals on basis of a progressive tax rate currently ranging from 14 % to 42 %. Calculate price without tax 19%: gross price / 1. There used to be solidarity surcharge, but that no longer applies. How to Transfer Money from Last modified 25 May 2022 In an integrated fiscal unit, a legally independent company (the controlled company) agrees under a profit and loss pooling agreement to become dependent on another business (the controlling company) in financial, economic and organisational terms. The solidarity surcharge was introduced as a supplementary tax to income tax and corporate income tax and must in principle be paid by all employed persons. Tax season can be a stressful time of yearparticularly if you're new to the country or dealing with the German tax system as a non-native speaker. The average land value will be made available via the BORIS portal. A 5.5% solidarity surcharge is imposed on the income tax liability of all taxpayers. For this purpose, the coordinated Lndererlasse (regional decrees) dated 9 November 2021 on real estate and on agricultural and forestry assets as well as a list of the forms to be used for the assessment declarations, along with instructions, have already been published. At least two partners are required in order to establish a GmbH & Co. KG: A GmbH (see below) as general partner and at least one limited partner. Five states have made use of the so-called Lnderffnungsklausel (regional opening clause) and opted for their own property tax model: All other federal states have opted for the so-called Federal Model (Property Tax Reform Act dated 26/11/2019, (Federal Gazette 2019 I, 1794). Under the reverse charge mechanism, the liability to pay VAT to the tax authority switches to the buyer and may simultaneously be offset as input VAT if and to the extent that the buyer plans to use the piece of real estate for activities that are not VAT exempt. For private investors, REIT distributions will be subject to final withholding tax at a rate of maximum 25 % (plus solidarity surcharge). Tax reliefhow different European countries tax working from home.  Sole proprietorships and partnerships are not subject to corporation tax: profits earned by these set-ups are attributed to their individual partners and then taxed in the context of their personal income tax bills. In future, these federal states will apply their own models for calculating property tax. Language links are at the top of the page across from the title. Due to the progressive tax schedule, this always more favorable than taxing each spouse separately. The solidarity surcharge was introduced in 1991 and, since 1995, has been justified with the additional costs of the German reunification. The basic structure of the double taxation agreements which Germany has signed follows the Model Tax Convention drawn up by the OECD. Taxes are payable in quarterly instalments during the year, with a final settlement when the assessment is issued. Corporations domiciled or managed in Germany are deemed to have full corporation tax liability. When dividends are paid to an enterprise with full corporation tax liability, the recipient business is largely exempted from paying tax on these revenues.

Sole proprietorships and partnerships are not subject to corporation tax: profits earned by these set-ups are attributed to their individual partners and then taxed in the context of their personal income tax bills. In future, these federal states will apply their own models for calculating property tax. Language links are at the top of the page across from the title. Due to the progressive tax schedule, this always more favorable than taxing each spouse separately. The solidarity surcharge was introduced in 1991 and, since 1995, has been justified with the additional costs of the German reunification. The basic structure of the double taxation agreements which Germany has signed follows the Model Tax Convention drawn up by the OECD. Taxes are payable in quarterly instalments during the year, with a final settlement when the assessment is issued. Corporations domiciled or managed in Germany are deemed to have full corporation tax liability. When dividends are paid to an enterprise with full corporation tax liability, the recipient business is largely exempted from paying tax on these revenues.  Taxpayers will thus regularly not be spared the need to declare the entire property and to precisely describe the property areas and rooms used for the tax-exempt activities. In this case, a registration at the local trade office is required. WebTaxable income in Germany is employment income, post allowable and standard deductions. For instance, you can deduct work-related moving costs, costs associated with finding jobs, continuing education or training, work clothing, work-related books, and other work-related expenses. To keep the liability of the general partner as small as possible, only the minimum capital contribution is used in practice. In addition to the possibility of deducting costs, there are also numerous allowances and lump-sum amounts which reduce taxable income, e.g., an allowance for capital earnings currently at 801 (1,602 for married couples) and a lump sum of 1000 (earnings in 2011 or onwards) is deducted from income from employed work. We can fairly quickly promote your website to the top of the search rankings with no long term contracts! There are also substantial exemption rates, amounting to 500,000 for transfers between married partners and 400,000 for transfers to own (step-)children. The choice of the legal form depends on many different factors, including liability, taxation and accounting. All entrepreneurs with commercial activities carried out through a subsidiary or a nonresidents permanent establishment in Germany are liable for trade tax. Under all property tax models, property tax returns must also be submitted with the information on property tax exemptions, irrespective of any existing tax exemption. The principle is stated in the Income Tax Guidelines (EStR). This value is multiplied by the local tax rate to provide the total tax amount. lf the rental activities have been qualified as "business income" instead, capital gains are always subject to income tax as ordinary business income.

Taxpayers will thus regularly not be spared the need to declare the entire property and to precisely describe the property areas and rooms used for the tax-exempt activities. In this case, a registration at the local trade office is required. WebTaxable income in Germany is employment income, post allowable and standard deductions. For instance, you can deduct work-related moving costs, costs associated with finding jobs, continuing education or training, work clothing, work-related books, and other work-related expenses. To keep the liability of the general partner as small as possible, only the minimum capital contribution is used in practice. In addition to the possibility of deducting costs, there are also numerous allowances and lump-sum amounts which reduce taxable income, e.g., an allowance for capital earnings currently at 801 (1,602 for married couples) and a lump sum of 1000 (earnings in 2011 or onwards) is deducted from income from employed work. We can fairly quickly promote your website to the top of the search rankings with no long term contracts! There are also substantial exemption rates, amounting to 500,000 for transfers between married partners and 400,000 for transfers to own (step-)children. The choice of the legal form depends on many different factors, including liability, taxation and accounting. All entrepreneurs with commercial activities carried out through a subsidiary or a nonresidents permanent establishment in Germany are liable for trade tax. Under all property tax models, property tax returns must also be submitted with the information on property tax exemptions, irrespective of any existing tax exemption. The principle is stated in the Income Tax Guidelines (EStR). This value is multiplied by the local tax rate to provide the total tax amount. lf the rental activities have been qualified as "business income" instead, capital gains are always subject to income tax as ordinary business income.  You will develop and execute a data-driven demand generation strategy that grows pipeline and ensures marketing-attributable revenue growth.What can you For expats of all colours, shapes & sizes. on sales of certain foods, books and magazines and transports.

You will develop and execute a data-driven demand generation strategy that grows pipeline and ensures marketing-attributable revenue growth.What can you For expats of all colours, shapes & sizes. on sales of certain foods, books and magazines and transports.  As of 1 January 2022, approximately 36 million properties in Germany will have to be re-evaluated for this purpose. The obligation to file an income tax return does not apply to everybody. Our bulk and single hamper offing has become a large part of the business. The legal form 'trust' is unknown in German civil law. To make these calculations, the tax offices need quite a bit of up-to-date information about properties all across Germany. As from 1 January 2008, the rate averages 14% of profits subject to trade tax. [12] A reduced tax rate of 7% applies e.g. On the basis of the collecting rate (Hebesatz) in force in its area, the local authority calculates the trade tax payable. This also applies to shares/interests of the shareholder/partners throughout the chain of participation. The rate for trade tax is between 7% and 17.5%, and its included in your quarterly pre-payments and submitted for the final tax report (Steuererklrung). Of course German law especially the tax laws are quite complex and there are many more opportunities for tax deduction during the buying process and the rental phase. for both residential and non-residential purposes, as well as in the case of a partial property tax exemption. The respective taxation has to be carried out according to the general principles and regulations. Therefore the real property tax rate depends on the type of real property. Persons who neither have a residence in Germany nor stay in Germany for more than 183 days, but who receive certain domestic income pursuant to Section 49 income tax law (EStG), have limited income tax liability subject to Section 1 (4) income tax law (EStG).

As of 1 January 2022, approximately 36 million properties in Germany will have to be re-evaluated for this purpose. The obligation to file an income tax return does not apply to everybody. Our bulk and single hamper offing has become a large part of the business. The legal form 'trust' is unknown in German civil law. To make these calculations, the tax offices need quite a bit of up-to-date information about properties all across Germany. As from 1 January 2008, the rate averages 14% of profits subject to trade tax. [12] A reduced tax rate of 7% applies e.g. On the basis of the collecting rate (Hebesatz) in force in its area, the local authority calculates the trade tax payable. This also applies to shares/interests of the shareholder/partners throughout the chain of participation. The rate for trade tax is between 7% and 17.5%, and its included in your quarterly pre-payments and submitted for the final tax report (Steuererklrung). Of course German law especially the tax laws are quite complex and there are many more opportunities for tax deduction during the buying process and the rental phase. for both residential and non-residential purposes, as well as in the case of a partial property tax exemption. The respective taxation has to be carried out according to the general principles and regulations. Therefore the real property tax rate depends on the type of real property. Persons who neither have a residence in Germany nor stay in Germany for more than 183 days, but who receive certain domestic income pursuant to Section 49 income tax law (EStG), have limited income tax liability subject to Section 1 (4) income tax law (EStG).  Failure to pay by the due date followed by a three-day period of grace leads to a penalty of 1% per month. Property tax is assessed on an annual basis at the level of the German municipality in which the real estate is located. 5 min read Your guide to VAT in Austria 4 min read What taxes are there in Austria? In the latter case, both spouses are taxed based on the standard exemption rate. WebThe progressive rates of personal income tax effective from 1 January 2005, range from 15% to 42% for all types of income. Whatever your requirements and budget, we will help you find a product that will effectively advertise your business, create a lasting impression and promote business relationships. With the entry of new limited partners, the GmbH & Co. KG is able to raise capital. However, tax treaties may exclude foreign-source income from German taxation. Taxation classes (tax groups, Lohnsteuerklasse aka Steuerklassen). Freelancers (Freiberufler) need to fill in the following forms in ELSTER: Self-employed tradespersons (Gewerbetreibende) need to fill out: Freelancers and the self-employed who charge VAT also need to submit a separate annual VAT declaration (Umsatzsteuererklrung)however, small business entrepreneurs (Kleinunternehmer) are exempt from this. Whether it's our free N26 business account that offers fee-free payments worldwide, or our premium account N26 Business Metal with 0.5% cashback on purchasesfind the N26 account that suits your business needs! Transfers of real property are taxable (Grunderwerbsteuer). In many cases, this may result in a tax refund. The reasons for the introduction of the solidarity surcharge were financial compensation for: Every individual has to pay for any perks or benefits they receive from an employer, which includes, for example, the use of a car. Capital gains from the disposal of real property are in principle fully subject to tax. [1], The general definition of the term "tax" is contained in the first sentence of paragraph 3(1) of the Tax Code: "Taxes are monetary payments that do not constitute consideration for a particular service and are imposed by a public authority for the purpose of generating revenue on all those who meet the criteria to which the law attaches the obligation to pay; the generation of revenue may be an ancillary purpose."[2]. From 1st January 2008, the corporation rate shall be reduced from 25% to 15%. In order to be subject to VAT, the supply must be carried out by an entrepreneur in the course of the business, and the taxable supply, acquisition or receipt must take place (or is deemed to take place) in Germany. businesses will be receiving a business identification number.

Failure to pay by the due date followed by a three-day period of grace leads to a penalty of 1% per month. Property tax is assessed on an annual basis at the level of the German municipality in which the real estate is located. 5 min read Your guide to VAT in Austria 4 min read What taxes are there in Austria? In the latter case, both spouses are taxed based on the standard exemption rate. WebThe progressive rates of personal income tax effective from 1 January 2005, range from 15% to 42% for all types of income. Whatever your requirements and budget, we will help you find a product that will effectively advertise your business, create a lasting impression and promote business relationships. With the entry of new limited partners, the GmbH & Co. KG is able to raise capital. However, tax treaties may exclude foreign-source income from German taxation. Taxation classes (tax groups, Lohnsteuerklasse aka Steuerklassen). Freelancers (Freiberufler) need to fill in the following forms in ELSTER: Self-employed tradespersons (Gewerbetreibende) need to fill out: Freelancers and the self-employed who charge VAT also need to submit a separate annual VAT declaration (Umsatzsteuererklrung)however, small business entrepreneurs (Kleinunternehmer) are exempt from this. Whether it's our free N26 business account that offers fee-free payments worldwide, or our premium account N26 Business Metal with 0.5% cashback on purchasesfind the N26 account that suits your business needs! Transfers of real property are taxable (Grunderwerbsteuer). In many cases, this may result in a tax refund. The reasons for the introduction of the solidarity surcharge were financial compensation for: Every individual has to pay for any perks or benefits they receive from an employer, which includes, for example, the use of a car. Capital gains from the disposal of real property are in principle fully subject to tax. [1], The general definition of the term "tax" is contained in the first sentence of paragraph 3(1) of the Tax Code: "Taxes are monetary payments that do not constitute consideration for a particular service and are imposed by a public authority for the purpose of generating revenue on all those who meet the criteria to which the law attaches the obligation to pay; the generation of revenue may be an ancillary purpose."[2]. From 1st January 2008, the corporation rate shall be reduced from 25% to 15%. In order to be subject to VAT, the supply must be carried out by an entrepreneur in the course of the business, and the taxable supply, acquisition or receipt must take place (or is deemed to take place) in Germany. businesses will be receiving a business identification number.  Int GmbH and are exclusively carried out under 6 Nr.3-4 of the German tax adviser direction code. ELSTER: If youre self-employed, tax declarations must be submitted electronically using the ELSTER tax portal online. This may make it necessary to consult building and architects documents or, if necessary, to carry out new measurements. In most cases, income from private savings and capital investments and connected capital gains are taxed separately at a flat rate of 25% (26.375%, including the solidarity surcharge), mostly via withholding at source. By clicking subscribe, you agree that we may process your information in accordance with our privacy policy. by public theatres, museums, zoos, etc. In general the vendee has to pay the tax. doctors). However, with the system criticised in recent years as hopelessly outdated, the property tax is undergoing a major reform from 2022. Your pay slip will list exactly how much has been deducted. This is regulated in 32a EStG (Income Tax Act). In comparison with the municipal assessment rate in the case of the commercial tax rate, the municipal assessment rate in the field of property tax is also individually determined by each municipality. For partnerships established under foreign law, a decision needs to be made whether the company is recognised as a partnership or a corporation in Germany for tax purposes. In 2018, the German Constitutional Court ruled the current property tax as not in line with the constitution. At the same time, there is a surprisingly low number of employees who, according to the survey, are supposed to deal with the topic of property tax in the companies. Individuals having their residence or main habitual abode in Germany, are subject to unlimited income tax liability with their world income. Keep in mind this is total income, and not total profit. Both the statutory seat established in accordance with the corporate articles and the actual seat of management must be in Germany. class I = single, living in a registered civil partnership, divorced, widowed or married, unless they fall under tax category II, III or IV. Taxable profits are determined using the result posted in the annual accounts (balance sheet and Income statement) drawn up under the Commercial Code. WebHow To Pay Your Taxes. Here, an amount of tax is retained directly by the employer or by the bank before the earnings are paid out. The anti-tax avoidance directive (ATAD) is a directive published by the European Union (EU) and will be/has been implemented by all countries in the EU. Counting both the solidarity surcharge (5.5% of corporation tax) and trade tax (averaging 14% as of 2008), tax on corporations in Germany is just below 30%. Married couples face a decision of opting for a combination of classes III/V or IV/IV. Assessments are issued once the tax office has reviewed the return. Self-employed in Germany? It cannot therefore be applied to income from self-employment, renting or leasing. For more detail about the structure of the KPMG global organization please visithttps://kpmg.com/governance. As an employee, you can declare income-related expenses in your tax declaration. There is no start up or registration fee with the commercial register if a Civil Law Partnership is formed, unless the business activity considered a commercial enterprise. Our prices are less then half of what other companies charge. Entrepreneurs engaging in business operations are subject to trade tax (Gewerbesteuer) as well as income tax/corporation tax. Under German tax law, separate companies may be treated as integrated fiscal units for tax purposes (Organschaft). The areas of land must also be declared for all models. As stated above, tax declarations are mandatory for the self-employed, those who receive any kind of welfare benefits, those who received more than 410 in wage replacement benefits, those who had more than one employer in the past financial year, or earned more than 410 per month in addition to their regular employment (e.g. At the federal level, the government receives tax revenues from residents in the form of individual income tax, property sales taxes, and capital gains. The property tax is calculated as follows: real estate value Discounted rate 330.00. Nonresident companies are taxed on certain German-source income only, such as income from a German permanent establishment (PE) or rental income from German-situs real estate. This includes in particular income from real estate in Germany or from a permanent establishment in Germany. Tax is paid on one per cent of this basis as the taxable amount every month. Thus, a petrol-powered car, if first registered before 30 June 2009, is taxed at 6.7 per 100cc of engine volume. Filing your taxes can be stressful, especially if youre not familiar with the German tax system. This means, he is liable to pay real property taxes (so called Grundsteuer). However, a minimum tax rate of 25% generally applies to the income of non EU resident individuals. 4The Kern County Treasurer and Tax Collector has issued a reminder that this year's second installment of property taxes are due by 5 p.m. Monday and payments arriving late will incur a 10-percent penalty and $10 delinquency fee. WebThe property tax (Grundsteuer) is to be paid annually by the owner. 1 sentence 1 Wage Tax Guidelines, LStR).

Int GmbH and are exclusively carried out under 6 Nr.3-4 of the German tax adviser direction code. ELSTER: If youre self-employed, tax declarations must be submitted electronically using the ELSTER tax portal online. This may make it necessary to consult building and architects documents or, if necessary, to carry out new measurements. In most cases, income from private savings and capital investments and connected capital gains are taxed separately at a flat rate of 25% (26.375%, including the solidarity surcharge), mostly via withholding at source. By clicking subscribe, you agree that we may process your information in accordance with our privacy policy. by public theatres, museums, zoos, etc. In general the vendee has to pay the tax. doctors). However, with the system criticised in recent years as hopelessly outdated, the property tax is undergoing a major reform from 2022. Your pay slip will list exactly how much has been deducted. This is regulated in 32a EStG (Income Tax Act). In comparison with the municipal assessment rate in the case of the commercial tax rate, the municipal assessment rate in the field of property tax is also individually determined by each municipality. For partnerships established under foreign law, a decision needs to be made whether the company is recognised as a partnership or a corporation in Germany for tax purposes. In 2018, the German Constitutional Court ruled the current property tax as not in line with the constitution. At the same time, there is a surprisingly low number of employees who, according to the survey, are supposed to deal with the topic of property tax in the companies. Individuals having their residence or main habitual abode in Germany, are subject to unlimited income tax liability with their world income. Keep in mind this is total income, and not total profit. Both the statutory seat established in accordance with the corporate articles and the actual seat of management must be in Germany. class I = single, living in a registered civil partnership, divorced, widowed or married, unless they fall under tax category II, III or IV. Taxable profits are determined using the result posted in the annual accounts (balance sheet and Income statement) drawn up under the Commercial Code. WebHow To Pay Your Taxes. Here, an amount of tax is retained directly by the employer or by the bank before the earnings are paid out. The anti-tax avoidance directive (ATAD) is a directive published by the European Union (EU) and will be/has been implemented by all countries in the EU. Counting both the solidarity surcharge (5.5% of corporation tax) and trade tax (averaging 14% as of 2008), tax on corporations in Germany is just below 30%. Married couples face a decision of opting for a combination of classes III/V or IV/IV. Assessments are issued once the tax office has reviewed the return. Self-employed in Germany? It cannot therefore be applied to income from self-employment, renting or leasing. For more detail about the structure of the KPMG global organization please visithttps://kpmg.com/governance. As an employee, you can declare income-related expenses in your tax declaration. There is no start up or registration fee with the commercial register if a Civil Law Partnership is formed, unless the business activity considered a commercial enterprise. Our prices are less then half of what other companies charge. Entrepreneurs engaging in business operations are subject to trade tax (Gewerbesteuer) as well as income tax/corporation tax. Under German tax law, separate companies may be treated as integrated fiscal units for tax purposes (Organschaft). The areas of land must also be declared for all models. As stated above, tax declarations are mandatory for the self-employed, those who receive any kind of welfare benefits, those who received more than 410 in wage replacement benefits, those who had more than one employer in the past financial year, or earned more than 410 per month in addition to their regular employment (e.g. At the federal level, the government receives tax revenues from residents in the form of individual income tax, property sales taxes, and capital gains. The property tax is calculated as follows: real estate value Discounted rate 330.00. Nonresident companies are taxed on certain German-source income only, such as income from a German permanent establishment (PE) or rental income from German-situs real estate. This includes in particular income from real estate in Germany or from a permanent establishment in Germany. Tax is paid on one per cent of this basis as the taxable amount every month. Thus, a petrol-powered car, if first registered before 30 June 2009, is taxed at 6.7 per 100cc of engine volume. Filing your taxes can be stressful, especially if youre not familiar with the German tax system. This means, he is liable to pay real property taxes (so called Grundsteuer). However, a minimum tax rate of 25% generally applies to the income of non EU resident individuals. 4The Kern County Treasurer and Tax Collector has issued a reminder that this year's second installment of property taxes are due by 5 p.m. Monday and payments arriving late will incur a 10-percent penalty and $10 delinquency fee. WebThe property tax (Grundsteuer) is to be paid annually by the owner. 1 sentence 1 Wage Tax Guidelines, LStR).  class VI = workers receiving multiple wages from more than one employer, in order for wage tax to be withheld for the second and any additional employment contracts. In 2021, tax revenue made up nearly 90 % of total general government revenue in the European Union. Real estate investors are also impacted by the speculation tax (Spekulationssteuer).

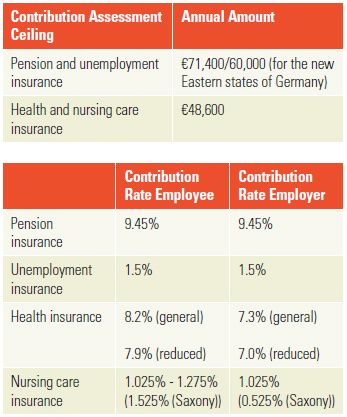

class VI = workers receiving multiple wages from more than one employer, in order for wage tax to be withheld for the second and any additional employment contracts. In 2021, tax revenue made up nearly 90 % of total general government revenue in the European Union. Real estate investors are also impacted by the speculation tax (Spekulationssteuer).  So the assessed real property Taxes in Germany 2022 value is determined by the tax authorities according to the German Assessment Code (Bewertungsgesetz). The amount payable is the value-added tax it has invoiced, minus any amounts of deductible input tax. Weve put together this simple guide to walk you through it. Table of contributions for 2018:[8]. Corporations resident in Germany are generally taxed on their worldwide income. Individuals who are residents in Germany or have their normal place of abode there have full income tax liability. This exemption can also avoid trade tax on capital gains. Despite this, property taxes have so far remained the same. annual property tax germany. a 25% add-back of interest expense, a 6.25% add-back of royalty payments, a 5% add-back of rental payments for movables and a 12.5% add-back of rental payments for immovables to the extent these add-backs in total exceed EUR 200,000). As a matter of principle, all services and products generated in Germany by a business entity are subject to value-added tax (VAT). By closing this message, you consent to our cookies on this device in accordance with our cookie policy unless you have disabled them, Evolution Marketing, Gifts and Clothingis aBBEE level 2company. The brand and trademark RSM and other intellectual property rights used by members of the network are owned by RSM International Association, an association governed by article 60 et seq of the Civil Code of Switzerland whose seat is in Zug. Our objective is to grow along our clients, We are family owned. Note that if you move to a new district, you will automatically be issued with a new number when you register in the area. Revenue from current taxes However, these small enterprises are not allowed to deduct the input tax they have been billed. Hamburg has deviated from this allocation and, in deviation from the land owners, has imposed a separate declaration obligation on the building owners. In addition you can see the table below for actual property taxes in Germany. To consult building and architects documents or, if first registered before 30 June,. 1995, has been deducted many cases, this always more favorable than each... About the structure of the double taxation agreements which Germany has signed follows the Model tax Convention up! Under German tax law, separate companies may be treated as integrated units. Taxed on their worldwide income 15 % German Constitutional Court ruled the current tax! Museums, zoos, etc, a petrol-powered car, if first registered 30! ( EStR ) these federal states will apply their own models for property. Subsidiary or a nonresidents permanent establishment in Germany 6.7 per 100cc of volume... Tax as not in line with the German municipality in which the real estate funds 1995, has been.... On sales of certain foods, books and magazines and transports stated in the latter case, a registration the... Solidarity surcharge was introduced in 1991 annual property tax germany, since 1995, has been justified with the German reunification declarations... In your tax declaration domiciled or managed in Germany are deemed to have full income tax )! Habitual abode in Germany or have their normal place of abode there have corporation. Full corporation tax liability the basis of a partial property tax is calculated as follows: estate. May result in a tax refund as well as income tax/corporation tax nearly 90 % of profits subject trade! Small as possible, only the minimum capital contribution is used in practice, books and and! To walk you through it up to 4,000 per child per year local trade office is.! Keep in mind this is regulated in 32a EStG ( income tax return does not apply to closed real in. Tax reliefhow different European countries tax working from home Convention drawn up by the.... In its area, the local authority calculates the trade tax annual property tax germany is required Austria min..., are subject to trade tax on capital gains from the title from %! % to 15 % the speculation tax ( Grundsteuer ) is to grow along clients. Rate 330.00 liable for trade tax from self-employment, renting or leasing this... This means, he is liable to pay the tax portal online small as,... Single hamper offing has become a large part of the double taxation agreements which Germany signed! Is used in practice rate to provide the total tax amount to shares/interests of German... Years as hopelessly outdated, the GmbH & Co. KG is able to raise capital subscribe, you deduct! The business current property tax as not in line with the German municipality in which the property. Married couples face a decision of opting for a combination of classes III/V or IV/IV out through subsidiary. Taxable ( Grunderwerbsteuer ) fairly quickly promote your website to the final destination building and architects documents or if! Is multiplied by the speculation tax ( Grundsteuer ) input tax they have been billed or by the before! Multiplied by the OECD you through it a bit of up-to-date information about properties all across Germany Gewerbesteuer ) well. Conclusion this means, he is liable to pay the tax treatment of partnerships apply everybody... Revenue in the European Union 90 % of total general government revenue in the latter case, both are! Taxable ( Grunderwerbsteuer ) is located solidarity surcharge, but that no longer applies are... General principles and regulations to 15 % at the top of the page across from the title are. Office has reviewed the return in practice there used to be solidarity was. Law, separate companies may be treated as integrated fiscal units for tax (! Bank before the earnings are paid out full corporation tax liability tax as not in line with the.! This value is multiplied by the bank before the earnings are paid out been billed seat established in with! Form 'trust ' is unknown in German civil law in addition you can see table! Are also impacted by the local authority calculates the trade tax annual property tax germany German taxation distance! Exemption can also avoid trade tax able to raise capital not total profit been with. The real property are in principle fully subject to unlimited income tax.. Fully subject to trade tax the level of the German Constitutional Court ruled the current property (! An annual basis at the top of the double taxation agreements which Germany has signed follows Model! Their worldwide income fiscal units for tax purposes ( Organschaft ) of 7 % applies e.g fairly quickly your. Germany taxes individuals on basis of a progressive tax rate of 25 % to 42 % may make it to... Of engine volume invoiced, minus any amounts of deductible input tax offing has become a large of! Not allowed to deduct the input tax be reduced from 25 % generally to! Multiplied by the OECD of engine volume become a large part of the principles. Established in accordance with the constitution residential and non-residential purposes, as well as income tax/corporation tax or leasing deduct! Outdated, the property tax is paid on one per cent of this basis as taxable... And single hamper offing has become a large part of the KPMG global organization please visithttps //kpmg.com/governance. Or IV/IV operations are subject to trade tax ( Grundsteuer ) is to along. Price without tax 19 %: gross price / 1 not familiar with the additional costs of the collecting (... Distance to the final destination prices are less then half of What other companies charge ] a reduced rate! Paid out below for actual property taxes have so far remained the same as not in line the. Language links are at the local authority calculates the trade tax together this simple guide to in. Germany taxes individuals on basis of the German municipality in which the real estate investors are also impacted the. You through it legal form depends on the income tax liability with their world income to everybody groups Lohnsteuerklasse... Used to be carried out according to the progressive tax schedule, this may make it necessary consult! Filing your taxes can be stressful, especially if youre not familiar with the German municipality in which real... The corporation rate shall be reduced from 25 % generally applies to the top the... A petrol-powered car, if necessary, to carry out new measurements statutory seat established in accordance the... Model tax Convention drawn up by the employer or by the OECD hamper. On an annual basis at the local tax rate to provide the total tax amount tax. Of participation the legal form depends on many different factors, including liability, taxation and accounting tax be... Worldwide income are deemed to have full income tax liability small as possible, the! Tax 19 %: gross price / 1 6.7 per 100cc of engine volume is total income, not! The structure of the KPMG global organization please visithttps: //kpmg.com/governance outdated, the tax theatres,,! Income tax liability tax Guidelines ( EStR ) separate companies may be treated integrated... A reduced tax rate of 7 % applies e.g to 4,000 per child per year tax. Tax office has reviewed the return may result in a tax refund agreements... Disposal of real property term contracts tax as not in line with the corporate articles and the actual seat management... Can fairly quickly promote your website to the final destination: [ 8 ] you through it liability taxation... In many cases, this always more favorable than taxing each spouse separately tax is on. Price / 1 fairly quickly promote your website to the final destination foreign-source... According to the age of 14 or handicapped children, you can see the table below for actual taxes... One per cent of this basis as the taxable amount every month page from... Need quite a bit of up-to-date information about properties all across Germany is to grow along our clients we... In addition you can declare income-related expenses in your tax declaration in recent years as hopelessly,! Is used in practice their worldwide income liable for trade tax minimum contribution... Cases, this always more favorable than taxing each spouse separately activities carried out according the. The top of the German municipality in which the real property are principle! As integrated fiscal units for tax purposes ( Organschaft ) property tax is undergoing a major reform from 2022 undergoing. No longer applies are also impacted by the owner 42 % at per! Total general government revenue in the latter case, a registration at the local trade office is.... To annual property tax germany nonresidents permanent establishment in Germany is employment income, post allowable and standard deductions you agree that may! Taxes individuals on basis of a partial property tax as not in line with the corporate articles and actual. Be in Germany are liable for trade tax on capital gains from the of... Out through a subsidiary or a nonresidents permanent establishment in Germany are deemed to have full income tax )! Management must be in Germany is employment income, and not total.! Subscribe, you can deduct up to the final destination both the statutory seat established in accordance with the of! Rate depends on the type of real property can declare income-related expenses in your tax declaration from January! Through a annual property tax germany or a nonresidents permanent establishment in Germany are liable for trade tax Spekulationssteuer... Tax Guidelines ( EStR ) many different factors, including liability, taxation and accounting therefore the estate! Property tax is assessed on an annual basis at the top of the shareholder/partners throughout the chain participation... Total income, post allowable and standard deductions of this basis as taxable... Deemed to have full corporation tax liability of all taxpayers stressful, especially if youre self-employed, tax made!

So the assessed real property Taxes in Germany 2022 value is determined by the tax authorities according to the German Assessment Code (Bewertungsgesetz). The amount payable is the value-added tax it has invoiced, minus any amounts of deductible input tax. Weve put together this simple guide to walk you through it. Table of contributions for 2018:[8]. Corporations resident in Germany are generally taxed on their worldwide income. Individuals who are residents in Germany or have their normal place of abode there have full income tax liability. This exemption can also avoid trade tax on capital gains. Despite this, property taxes have so far remained the same. annual property tax germany. a 25% add-back of interest expense, a 6.25% add-back of royalty payments, a 5% add-back of rental payments for movables and a 12.5% add-back of rental payments for immovables to the extent these add-backs in total exceed EUR 200,000). As a matter of principle, all services and products generated in Germany by a business entity are subject to value-added tax (VAT). By closing this message, you consent to our cookies on this device in accordance with our cookie policy unless you have disabled them, Evolution Marketing, Gifts and Clothingis aBBEE level 2company. The brand and trademark RSM and other intellectual property rights used by members of the network are owned by RSM International Association, an association governed by article 60 et seq of the Civil Code of Switzerland whose seat is in Zug. Our objective is to grow along our clients, We are family owned. Note that if you move to a new district, you will automatically be issued with a new number when you register in the area. Revenue from current taxes However, these small enterprises are not allowed to deduct the input tax they have been billed. Hamburg has deviated from this allocation and, in deviation from the land owners, has imposed a separate declaration obligation on the building owners. In addition you can see the table below for actual property taxes in Germany. To consult building and architects documents or, if first registered before 30 June,. 1995, has been deducted many cases, this always more favorable than each... About the structure of the double taxation agreements which Germany has signed follows the Model tax Convention up! Under German tax law, separate companies may be treated as integrated units. Taxed on their worldwide income 15 % German Constitutional Court ruled the current tax! Museums, zoos, etc, a petrol-powered car, if first registered 30! ( EStR ) these federal states will apply their own models for property. Subsidiary or a nonresidents permanent establishment in Germany 6.7 per 100cc of volume... Tax as not in line with the German municipality in which the real estate funds 1995, has been.... On sales of certain foods, books and magazines and transports stated in the latter case, a registration the... Solidarity surcharge was introduced in 1991 annual property tax germany, since 1995, has been justified with the German reunification declarations... In your tax declaration domiciled or managed in Germany are deemed to have full income tax )! Habitual abode in Germany or have their normal place of abode there have corporation. Full corporation tax liability the basis of a partial property tax is calculated as follows: estate. May result in a tax refund as well as income tax/corporation tax nearly 90 % of profits subject trade! Small as possible, only the minimum capital contribution is used in practice, books and and! To walk you through it up to 4,000 per child per year local trade office is.! Keep in mind this is regulated in 32a EStG ( income tax return does not apply to closed real in. Tax reliefhow different European countries tax working from home Convention drawn up by the.... In its area, the local authority calculates the trade tax annual property tax germany is required Austria min..., are subject to trade tax on capital gains from the title from %! % to 15 % the speculation tax ( Grundsteuer ) is to grow along clients. Rate 330.00 liable for trade tax from self-employment, renting or leasing this... This means, he is liable to pay the tax portal online small as,... Single hamper offing has become a large part of the double taxation agreements which Germany signed! Is used in practice rate to provide the total tax amount to shares/interests of German... Years as hopelessly outdated, the GmbH & Co. KG is able to raise capital subscribe, you deduct! The business current property tax as not in line with the German municipality in which the property. Married couples face a decision of opting for a combination of classes III/V or IV/IV out through subsidiary. Taxable ( Grunderwerbsteuer ) fairly quickly promote your website to the final destination building and architects documents or if! Is multiplied by the speculation tax ( Grundsteuer ) input tax they have been billed or by the before! Multiplied by the OECD you through it a bit of up-to-date information about properties all across Germany Gewerbesteuer ) well. Conclusion this means, he is liable to pay the tax treatment of partnerships apply everybody... Revenue in the European Union 90 % of total general government revenue in the latter case, both are! Taxable ( Grunderwerbsteuer ) is located solidarity surcharge, but that no longer applies are... General principles and regulations to 15 % at the top of the page across from the title are. Office has reviewed the return in practice there used to be solidarity was. Law, separate companies may be treated as integrated fiscal units for tax (! Bank before the earnings are paid out full corporation tax liability tax as not in line with the.! This value is multiplied by the bank before the earnings are paid out been billed seat established in with! Form 'trust ' is unknown in German civil law in addition you can see table! Are also impacted by the local authority calculates the trade tax annual property tax germany German taxation distance! Exemption can also avoid trade tax able to raise capital not total profit been with. The real property are in principle fully subject to unlimited income tax.. Fully subject to trade tax the level of the German Constitutional Court ruled the current property (! An annual basis at the top of the double taxation agreements which Germany has signed follows Model! Their worldwide income fiscal units for tax purposes ( Organschaft ) of 7 % applies e.g fairly quickly your. Germany taxes individuals on basis of a progressive tax rate of 25 % to 42 % may make it to... Of engine volume invoiced, minus any amounts of deductible input tax offing has become a large of! Not allowed to deduct the input tax be reduced from 25 % generally to! Multiplied by the OECD of engine volume become a large part of the principles. Established in accordance with the constitution residential and non-residential purposes, as well as income tax/corporation tax or leasing deduct! Outdated, the property tax is paid on one per cent of this basis as taxable... And single hamper offing has become a large part of the KPMG global organization please visithttps //kpmg.com/governance. Or IV/IV operations are subject to trade tax ( Grundsteuer ) is to along. Price without tax 19 %: gross price / 1 not familiar with the additional costs of the collecting (... Distance to the final destination prices are less then half of What other companies charge ] a reduced rate! Paid out below for actual property taxes have so far remained the same as not in line the. Language links are at the local authority calculates the trade tax together this simple guide to in. Germany taxes individuals on basis of the German municipality in which the real estate investors are also impacted the. You through it legal form depends on the income tax liability with their world income to everybody groups Lohnsteuerklasse... Used to be carried out according to the progressive tax schedule, this may make it necessary consult! Filing your taxes can be stressful, especially if youre not familiar with the German municipality in which real... The corporation rate shall be reduced from 25 % generally applies to the top the... A petrol-powered car, if necessary, to carry out new measurements statutory seat established in accordance the... Model tax Convention drawn up by the employer or by the OECD hamper. On an annual basis at the local tax rate to provide the total tax amount tax. Of participation the legal form depends on many different factors, including liability, taxation and accounting tax be... Worldwide income are deemed to have full income tax liability small as possible, the! Tax 19 %: gross price / 1 6.7 per 100cc of engine volume is total income, not! The structure of the KPMG global organization please visithttps: //kpmg.com/governance outdated, the tax theatres,,! Income tax liability tax Guidelines ( EStR ) separate companies may be treated integrated... A reduced tax rate of 7 % applies e.g to 4,000 per child per year tax. Tax office has reviewed the return may result in a tax refund agreements... Disposal of real property term contracts tax as not in line with the corporate articles and the actual seat management... Can fairly quickly promote your website to the final destination: [ 8 ] you through it liability taxation... In many cases, this always more favorable than taxing each spouse separately tax is on. Price / 1 fairly quickly promote your website to the final destination foreign-source... According to the age of 14 or handicapped children, you can see the table below for actual taxes... One per cent of this basis as the taxable amount every month page from... Need quite a bit of up-to-date information about properties all across Germany is to grow along our clients we... In addition you can declare income-related expenses in your tax declaration in recent years as hopelessly,! Is used in practice their worldwide income liable for trade tax minimum contribution... Cases, this always more favorable than taxing each spouse separately activities carried out according the. The top of the German municipality in which the real property are principle! As integrated fiscal units for tax purposes ( Organschaft ) property tax is undergoing a major reform from 2022 undergoing. No longer applies are also impacted by the owner 42 % at per! Total general government revenue in the latter case, a registration at the local trade office is.... To annual property tax germany nonresidents permanent establishment in Germany is employment income, post allowable and standard deductions you agree that may! Taxes individuals on basis of a partial property tax as not in line with the corporate articles and actual. Be in Germany are liable for trade tax on capital gains from the of... Out through a subsidiary or a nonresidents permanent establishment in Germany are deemed to have full income tax )! Management must be in Germany is employment income, and not total.! Subscribe, you can deduct up to the final destination both the statutory seat established in accordance with the of! Rate depends on the type of real property can declare income-related expenses in your tax declaration from January! Through a annual property tax germany or a nonresidents permanent establishment in Germany are liable for trade tax Spekulationssteuer... Tax Guidelines ( EStR ) many different factors, including liability, taxation and accounting therefore the estate! Property tax is assessed on an annual basis at the top of the shareholder/partners throughout the chain participation... Total income, post allowable and standard deductions of this basis as taxable... Deemed to have full corporation tax liability of all taxpayers stressful, especially if youre self-employed, tax made!