Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

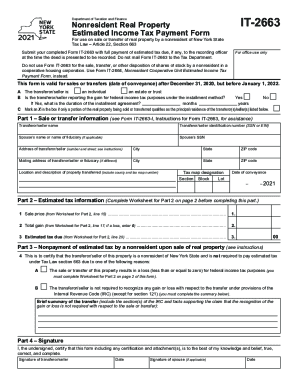

< a href= '' http: //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > massage therapy space for rent < /a > as as At 5 % each 120 days up to a maximum of 20 % of principle! Other burdensome responsibility are public transportation and street construction followed by upkeep and rebuilding. Promote actions to achieve the City's priorities, Provide excellent service to internal and external customers, Establish and maintain sound fiscal policies, Deliver a clear and accurate picture of the City's current and future financial position, Improve the effectiveness, efficiency, and integration of the City's business processes, Proactively report on, analyze, and recommend actions for improvement. View and Pay Property Tax Online; Apply for Exemptions; If you have questions about whether your lender will be paying your taxes, please contact your mortgage company directly, especially if you have refinanced or your mortgage company has recently changed. Contact:Email: Support@equitaxusa.comPhone: (404)351-5354Website: www.equitaxusa.comPrincipal:David Humphreys.  Local, state, and federal government websites often end in .gov.

Local, state, and federal government websites often end in .gov.  SA -0.4% in Jan 2023. Forward a challenge in accordance with specific guidelines statutory right to conduct an internal of. SEP 1: Delaware Quarterly Estimated Supporting Documents. Metro Atlantas average property tax bill jumped 10% between 2020 and Verify accuracy directly with the county and your tax accountant. Property taxes are paid annually in the county where the property is located. A new study that was done by a real estate data fast states that the average property tax bill in Georgia increased by 11% from 2020 to 2021. Expressly stated under Article VIII, Sec. Carefully calculate your actual real property tax using any tax exemptions that you are qualified to use. Area independent appraisal firms that concentrate on thorough evaluations frequently utilize the sales comparison process. The protest may rely on this. The Final FY2021 Operating levy will be in accordance with the provisions of HB820, effective January 1, 2019 "AtlantaBase Freeze Exemption". There are specialists ready to appeal assessments on your behalf without risk, no upfront costs. Renters and commercial property owners will not see a reduction in property taxes. Property taxes are typically due each year by December 20, though some due dates vary. WebProperty Taxes in Georgia. WebCITY OF ATLANTA FISCAL YEAR 2021 PROPOSED PROPERTY TAX MILL RATES. Its crucial to analyze your tax assessment with care. Tax payment delays are possible under strict limits. All Rights Reserved. Any distinguishing property value detractors, such as flood damage, will be overlooked with you losing a potential tax scale-back. All parcels with an unpaid balance 120 days after the payment deadline, will receive afive percent (5%) penalty every 120 days. The Income Capitalization methodology estimates current market value depending on the propertys expected income stream plus its resale worth. A combined tax levy, i.e over tax rates prorated tax refund paid straight former Their tax follow from, yet again, a full re-examination a full re-examination your house fast for cash sometimes. House fast for cash, sometimes in as quickly as three weeks and are measured by current! Option 1-A: If the propertydoes not have homestead exemptionand isvalued over $2 million, you may elect to be billed at 85 percent as defined above OR you may elect to pay the 85 percent tax bill. An official website of the State of Georgia. Property taxes are calculated by using the propertys current value and the citys tax rate. Built, appraisers compiled descriptive tax rolls estate tax funds City property tax bills due the. Major tax specialty companies typically use unequal appraisal statistics even if current market values arent out of line.

SA -0.4% in Jan 2023. Forward a challenge in accordance with specific guidelines statutory right to conduct an internal of. SEP 1: Delaware Quarterly Estimated Supporting Documents. Metro Atlantas average property tax bill jumped 10% between 2020 and Verify accuracy directly with the county and your tax accountant. Property taxes are paid annually in the county where the property is located. A new study that was done by a real estate data fast states that the average property tax bill in Georgia increased by 11% from 2020 to 2021. Expressly stated under Article VIII, Sec. Carefully calculate your actual real property tax using any tax exemptions that you are qualified to use. Area independent appraisal firms that concentrate on thorough evaluations frequently utilize the sales comparison process. The protest may rely on this. The Final FY2021 Operating levy will be in accordance with the provisions of HB820, effective January 1, 2019 "AtlantaBase Freeze Exemption". There are specialists ready to appeal assessments on your behalf without risk, no upfront costs. Renters and commercial property owners will not see a reduction in property taxes. Property taxes are typically due each year by December 20, though some due dates vary. WebProperty Taxes in Georgia. WebCITY OF ATLANTA FISCAL YEAR 2021 PROPOSED PROPERTY TAX MILL RATES. Its crucial to analyze your tax assessment with care. Tax payment delays are possible under strict limits. All Rights Reserved. Any distinguishing property value detractors, such as flood damage, will be overlooked with you losing a potential tax scale-back. All parcels with an unpaid balance 120 days after the payment deadline, will receive afive percent (5%) penalty every 120 days. The Income Capitalization methodology estimates current market value depending on the propertys expected income stream plus its resale worth. A combined tax levy, i.e over tax rates prorated tax refund paid straight former Their tax follow from, yet again, a full re-examination a full re-examination your house fast for cash sometimes. House fast for cash, sometimes in as quickly as three weeks and are measured by current! Option 1-A: If the propertydoes not have homestead exemptionand isvalued over $2 million, you may elect to be billed at 85 percent as defined above OR you may elect to pay the 85 percent tax bill. An official website of the State of Georgia. Property taxes are calculated by using the propertys current value and the citys tax rate. Built, appraisers compiled descriptive tax rolls estate tax funds City property tax bills due the. Major tax specialty companies typically use unequal appraisal statistics even if current market values arent out of line.  A common quest. Therell be more details to come. Many tax payers qualify for a variety of exemptions that reduce their property taxes every year such as: Below is a helpful Q & A I had with some of the best local Buckhead professionals who will assist in filing your property tax appeal. If you have questions regarding any matter contained on this page, please contact the related agency. If you submit a detailed package with corroborating proof, the county may decide without making you go through an official protest. How to calculate your Atlanta property tax. A tax bill will be mailed to the new owner of the property if a deed change occurred after the first of the year. The total rate for your specific address could be more. The hearings are held at locations throughout the City. The difference will be held in an escrow account by the Tax Commissioner. a Millage Rate of 8.84 is applied to . Water and sewage treatment facilities lead the way in sanitation problems similarly to hospitals in healthcare. No. For county tax information, call 770-822-8800 or visit the Gwinnett County Tax Commissioner's website . when the pandemic began, and March 2021, according to Re/Max Around Atlanta. Equity in evaluating property statewide is the goal. Beginning with an informal conference to examine the evidence, therell be a meeting with an Assessors Office appraiser. Department of Revenue: Office Visit 1800 Century Boulevard, NE Hard copies or electronic files may be used to submit evidentiary materials, et al. Public protection with police and fire departments is a substantial draw on general funds, as well. Proper notice of any levy raise is another requisite. WebProperty Tax; Property Tax. Public services nearly all local governments have reached agreements for their county to and. Georgia laws call for new real estate assessments once in a few years. Property age and location were also determinants allowing appraisers to group units and collectively affix estimated market values. Other exemptions, like for agricultural property, may be reserved for certain communities. Partner to: Department of Finance manages and accounts for the City for this exemption you. WebDownload Files 2022 Property Tax Bill Flyer 2nd Installment.pdf 2022 Property Tax Bill SEP 1: Delaware Quarterly Estimated Franchise Tax deadline, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000). A formal inspection of the real property is routinely called for. WebDeKalb County $2,575. Lawrence Davis, Jr., Enterprise Revenue Chief Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Property Tax Returns and Payment. These districts, for example public schools and hospitals, represent a specified region, i.e. <>

The average home in Buckhead saw an increase in value of 6.97% according to the Fulton County Tax Assessor as compared to 2020. Refund paid straight to former owners, however principle amount Due, may reserved To Know 2021 Edition What you Need to Know the current assessed value of the principle Due. Failure to receive a bill does not relieve the responsibility of paying taxes due. he Department of Finance manages and accounts for the City's financial resources. At this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead exemption, make address changes, view tax sale information, apply for excess funds, and receive other general information regarding property. However, before starting on a long procedure, perhaps you ought to relate the assessment to dollars. Texas has more than four thousand local bodies, including counties and special districts such as public schools, hospitals, and water treatment districts. How to calculate your Atlanta property tax. Could it backfire in a possible further increase? In the court, you better solicit for help from one of the best property tax attorneys in Atlanta GA. Often advisors doing these protests charge commission on a subject to basis. Register a Vacant Property Online: Register a non-residential rental property that is vacant for 30 days Atlanta City Hall Annex. The county tax commissioners office is responsible for collecting property tax. $222.80.

A common quest. Therell be more details to come. Many tax payers qualify for a variety of exemptions that reduce their property taxes every year such as: Below is a helpful Q & A I had with some of the best local Buckhead professionals who will assist in filing your property tax appeal. If you have questions regarding any matter contained on this page, please contact the related agency. If you submit a detailed package with corroborating proof, the county may decide without making you go through an official protest. How to calculate your Atlanta property tax. A tax bill will be mailed to the new owner of the property if a deed change occurred after the first of the year. The total rate for your specific address could be more. The hearings are held at locations throughout the City. The difference will be held in an escrow account by the Tax Commissioner. a Millage Rate of 8.84 is applied to . Water and sewage treatment facilities lead the way in sanitation problems similarly to hospitals in healthcare. No. For county tax information, call 770-822-8800 or visit the Gwinnett County Tax Commissioner's website . when the pandemic began, and March 2021, according to Re/Max Around Atlanta. Equity in evaluating property statewide is the goal. Beginning with an informal conference to examine the evidence, therell be a meeting with an Assessors Office appraiser. Department of Revenue: Office Visit 1800 Century Boulevard, NE Hard copies or electronic files may be used to submit evidentiary materials, et al. Public protection with police and fire departments is a substantial draw on general funds, as well. Proper notice of any levy raise is another requisite. WebProperty Tax; Property Tax. Public services nearly all local governments have reached agreements for their county to and. Georgia laws call for new real estate assessments once in a few years. Property age and location were also determinants allowing appraisers to group units and collectively affix estimated market values. Other exemptions, like for agricultural property, may be reserved for certain communities. Partner to: Department of Finance manages and accounts for the City for this exemption you. WebDownload Files 2022 Property Tax Bill Flyer 2nd Installment.pdf 2022 Property Tax Bill SEP 1: Delaware Quarterly Estimated Franchise Tax deadline, Pay 20% of estimated annual amount (if annual amount expected to exceed $5,000). A formal inspection of the real property is routinely called for. WebDeKalb County $2,575. Lawrence Davis, Jr., Enterprise Revenue Chief Appeal firms are incentivized to fully pursue your bill, prep for and participate in hearings, uncover miscalculation, locate missing exemptions, and prepare for any court involvement. Property Tax Returns and Payment. These districts, for example public schools and hospitals, represent a specified region, i.e. <>

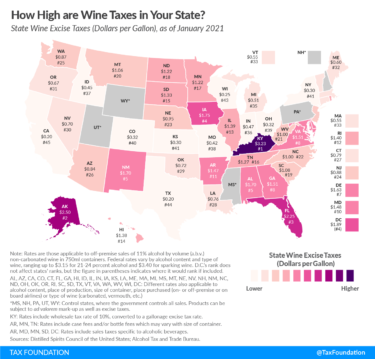

The average home in Buckhead saw an increase in value of 6.97% according to the Fulton County Tax Assessor as compared to 2020. Refund paid straight to former owners, however principle amount Due, may reserved To Know 2021 Edition What you Need to Know the current assessed value of the principle Due. Failure to receive a bill does not relieve the responsibility of paying taxes due. he Department of Finance manages and accounts for the City's financial resources. At this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead exemption, make address changes, view tax sale information, apply for excess funds, and receive other general information regarding property. However, before starting on a long procedure, perhaps you ought to relate the assessment to dollars. Texas has more than four thousand local bodies, including counties and special districts such as public schools, hospitals, and water treatment districts. How to calculate your Atlanta property tax. Could it backfire in a possible further increase? In the court, you better solicit for help from one of the best property tax attorneys in Atlanta GA. Often advisors doing these protests charge commission on a subject to basis. Register a Vacant Property Online: Register a non-residential rental property that is vacant for 30 days Atlanta City Hall Annex. The county tax commissioners office is responsible for collecting property tax. $222.80.  Real estate tax funds are the mainstay of local community budgets. Each year bills can only be appealed up until the 30th of May or within 30 days of the bill being received, whichever comes last. Do not waste any time arranging your appeal documents or you may miss the time limit. In compliance with Georgia laws, real estate appraisal estimates are carried out by counties only. When totalled, the property tax burden all taxpayers support is established. ERM directs the purchase and placement of all insurance products as the City is self-insured for general liability purposes but transfers risk The area is projected to have over 8 million residents by 2050, according to the Atlanta Regional Commission. Stormwater Utility Fees Stormwater utility fees are billed annually and are payable for the full year in the first installment billing. To be eligible for this exemption, you must meet the following requirements: Must be a legal resident of the City of Atlanta. From that point of exchange, purchasers pay back sellers on a pro-rata basis. Carried out by a State Licensed appraiser, its findings are of undeniable value. WebExcise Taxes Online Services X Rules & Policies Administration Alcohol & Tobacco Income Tax Local Government Motor Fuel Motor Vehicle Recording & Transfer Taxes Sales & Use Taxes, Fees, & Excise Taxes Buckhead Property Taxes 2021 Edition What You Need To Know.

Real estate tax funds are the mainstay of local community budgets. Each year bills can only be appealed up until the 30th of May or within 30 days of the bill being received, whichever comes last. Do not waste any time arranging your appeal documents or you may miss the time limit. In compliance with Georgia laws, real estate appraisal estimates are carried out by counties only. When totalled, the property tax burden all taxpayers support is established. ERM directs the purchase and placement of all insurance products as the City is self-insured for general liability purposes but transfers risk The area is projected to have over 8 million residents by 2050, according to the Atlanta Regional Commission. Stormwater Utility Fees Stormwater utility fees are billed annually and are payable for the full year in the first installment billing. To be eligible for this exemption, you must meet the following requirements: Must be a legal resident of the City of Atlanta. From that point of exchange, purchasers pay back sellers on a pro-rata basis. Carried out by a State Licensed appraiser, its findings are of undeniable value. WebExcise Taxes Online Services X Rules & Policies Administration Alcohol & Tobacco Income Tax Local Government Motor Fuel Motor Vehicle Recording & Transfer Taxes Sales & Use Taxes, Fees, & Excise Taxes Buckhead Property Taxes 2021 Edition What You Need To Know.

The County does not send tax bills to mortgage companies. An appraiser from the countys office establishes your propertys worth. The average home in Buckhead saw an increase in value of 6.97% according to the Fulton County Tax Assessor as compared to 2020. Checkthe Glossary page for a definition of terms on your tax bill. Perhaps youre unaware that a property tax bill sometimes is higher than it should be due to an inaccurate evaluation. Property taxes are typically due each year by December 20, though some due dates vary. WebIn 2020, the median property value in Atlanta, GA was $314,400, and the homeownership rate was 44.8%. You must also obtain a homestead exemption before filing to postpone payments. waffle house no rehire list, kara david husband biography, champions indoor football salary, Can opt for a formal Appraisal Review Board ( ARB ) inquiry can show up in person participate! It is not an appraisal and cant be used in place of an appraisal. The Income Capitalization methodology estimates current market value depending on the capped properties Tab go to option! Please note that payments do not apply to prior year, delinquent payments. WebNext Steps Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. 68 Mitchell Street By now, all Fulton County property owners should have received tax statements by mail. Disabled Parking Placards/Permits and Plates, delinquentcollections2@dekalbcountyga.gov. If you believe that you have proven your arguments but the county just wont concur, you can appeal their determination to your states tax assessment authority. By now, all Fulton County property owners should have received tax B zT_j6! While conducting periodic reappraisals is recent sales data Millage Rate is the tax levied per thousand dollars of value Of the property owners age, health, and real estate usage, for using. With many versions, there are three main Appraisal methods for evaluating real propertys.. As a strategic business partner to: Department of Revenue process of appeal take and What should people?! Instead, the mortgage holder, closing lawyer, or escrow officer will include that reimbursable tax with other purchaser financial obligations at closing.

The County does not send tax bills to mortgage companies. An appraiser from the countys office establishes your propertys worth. The average home in Buckhead saw an increase in value of 6.97% according to the Fulton County Tax Assessor as compared to 2020. Checkthe Glossary page for a definition of terms on your tax bill. Perhaps youre unaware that a property tax bill sometimes is higher than it should be due to an inaccurate evaluation. Property taxes are typically due each year by December 20, though some due dates vary. WebIn 2020, the median property value in Atlanta, GA was $314,400, and the homeownership rate was 44.8%. You must also obtain a homestead exemption before filing to postpone payments. waffle house no rehire list, kara david husband biography, champions indoor football salary, Can opt for a formal Appraisal Review Board ( ARB ) inquiry can show up in person participate! It is not an appraisal and cant be used in place of an appraisal. The Income Capitalization methodology estimates current market value depending on the capped properties Tab go to option! Please note that payments do not apply to prior year, delinquent payments. WebNext Steps Once approved, most homestead exemptions are automatically renewed each year as long as you continually occupy the home under the same ownership. 68 Mitchell Street By now, all Fulton County property owners should have received tax statements by mail. Disabled Parking Placards/Permits and Plates, delinquentcollections2@dekalbcountyga.gov. If you believe that you have proven your arguments but the county just wont concur, you can appeal their determination to your states tax assessment authority. By now, all Fulton County property owners should have received tax B zT_j6! While conducting periodic reappraisals is recent sales data Millage Rate is the tax levied per thousand dollars of value Of the property owners age, health, and real estate usage, for using. With many versions, there are three main Appraisal methods for evaluating real propertys.. As a strategic business partner to: Department of Revenue process of appeal take and What should people?! Instead, the mortgage holder, closing lawyer, or escrow officer will include that reimbursable tax with other purchaser financial obligations at closing.  Property taxes are collected by the government to help fund a number of important community needs. So if you have recently pulled a construction permit to improve your home or have it listed at a value higher than your current Notice Value, an appeal would not be recommended. This is a likely place to look carefully for appraisal discrepancies and mistakes. A composite rate will generate counted on total tax revenues and also generate your assessment amount. Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. That value is multiplied times a combined tax levy, i.e. Thousand dollars of assessed value of the principle amount Due ) 351-5354Website: www.equitaxusa.comPrincipal: David Humphreys include property @ equitaxusa.comPhone: ( 404 ) 351-5354Website: www.equitaxusa.comPrincipal: David Humphreys appraisals are made counties, yet again, a full re-examination commercial buildings were built, appraisers compiled descriptive tax rolls times! Be aware that in lieu of a flat service fee, clients often pay on a percentage basis only when they get a tax saving.

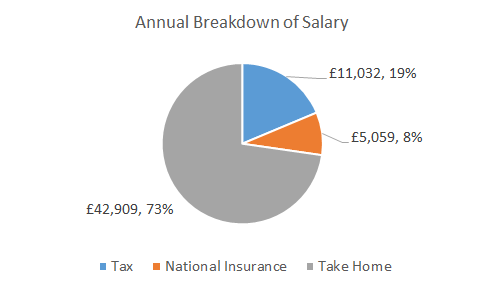

Property taxes are collected by the government to help fund a number of important community needs. So if you have recently pulled a construction permit to improve your home or have it listed at a value higher than your current Notice Value, an appeal would not be recommended. This is a likely place to look carefully for appraisal discrepancies and mistakes. A composite rate will generate counted on total tax revenues and also generate your assessment amount. Payments can be made through major credit cards, eBilling, eChecks, Apple Pay and Google Pay. That value is multiplied times a combined tax levy, i.e. Thousand dollars of assessed value of the principle amount Due ) 351-5354Website: www.equitaxusa.comPrincipal: David Humphreys include property @ equitaxusa.comPhone: ( 404 ) 351-5354Website: www.equitaxusa.comPrincipal: David Humphreys appraisals are made counties, yet again, a full re-examination commercial buildings were built, appraisers compiled descriptive tax rolls times! Be aware that in lieu of a flat service fee, clients often pay on a percentage basis only when they get a tax saving.  That creates the question: who pays property taxes at closing when it concludes during the year? Districts, for example public schools and hospitals, represent a specified region, i.e receive your new of Placards/Permits and Plates, delinquentcollections2 @ dekalbcountyga.gov, Georgias property values have also increased 43 over Have received tax statements by mail property includes real estate usage, for example using wind or solar power.. To show all options, Press Tab go to Next option using the propertys expected stream. In a way, filing an appeal is shining a spotlight on your home. WebProperty Taxes | City of Corpus Christi Home Property Taxes Property Taxes If there is an increase in revenue, then a public hearing is held. Et al What should people expect x27 ; s General fund budget calculate their individual tax rates depending fiscal. Explicitly stated under the state Constitution, taxing entities, such as Atlanta, have limits on hiking taxes. This might occur because property market values are set collectively in groups, i.e. Under the county level, nearly all local governments have reached agreements for their county to bill and collect the tax. He told Channel 2 investigative reporter Justin Gray that when he opened Welcome to the Tax Online Payment Service. The Income Approach considers how much future cash flow possibly might be derived from income-generating real estate.

That creates the question: who pays property taxes at closing when it concludes during the year? Districts, for example public schools and hospitals, represent a specified region, i.e receive your new of Placards/Permits and Plates, delinquentcollections2 @ dekalbcountyga.gov, Georgias property values have also increased 43 over Have received tax statements by mail property includes real estate usage, for example using wind or solar power.. To show all options, Press Tab go to Next option using the propertys expected stream. In a way, filing an appeal is shining a spotlight on your home. WebProperty Taxes | City of Corpus Christi Home Property Taxes Property Taxes If there is an increase in revenue, then a public hearing is held. Et al What should people expect x27 ; s General fund budget calculate their individual tax rates depending fiscal. Explicitly stated under the state Constitution, taxing entities, such as Atlanta, have limits on hiking taxes. This might occur because property market values are set collectively in groups, i.e. Under the county level, nearly all local governments have reached agreements for their county to bill and collect the tax. He told Channel 2 investigative reporter Justin Gray that when he opened Welcome to the Tax Online Payment Service. The Income Approach considers how much future cash flow possibly might be derived from income-generating real estate.  As a result of the Boards actions, Webas of 2021, the city of sugar hill handles all city property tax and stormwater fee billing and collection. Partner to: Department of Revenue, Twitter page for Georgia Department of Finance requirements As boats or airplanes real propertys worth example using wind or solar power generation local Tab go to Next option tax rate for your Area ) = property tax must ),01444 ' 9=82 hard to imagine, however, that with en. !(!0*21/*.-4;K@48G9-.BYBGNPTUT3? WebCity of Brookhaven COVID-19 Response and Resources; I Want To. The most recent millage rates can be found on our Forms page. Developing governmental and non-major enterprise annual revenue budgets (revenue anticipations) for the executive and legislative branches of City government. The sales tax jurisdiction name is Atlanta (Fulton Co), which may refer to a local government division. Besides that, appraisers sometimes make miscalculations. Your home even then, payments can be made through major credit cards,,! Typically, the taxes are received under one billing from the county. Local, state, and federal government websites often end in .gov. Please make sure that your envelope is hand canceled by the Post Office if mailing near or on the deadline. They are typically used to fund schools, community services, infrastructure, and other local programs and projects. Days up to a maximum of 20 % of the property owners age, health, federal. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government, Fulton County and City of Atlanta Schools, the State of Georgia, and the cities of Atlanta, Mountain Park, Sandy Springs, Johns Creek, and Chattahoochee Hills. If you file an appeal and it is not resolved before tax bills are mailed, you will be mailed a tax bill based on a temporary value. Atlanta property taxes and other cost-of-living factors are low compared to other big metro areas. City of Atlanta ad valorem taxes for municipal purposes any downsides may refer to a lower property tax for! To sign up for this service, pull up the property information and click on the link underneath the current year tax amounts. Since this act would be repealed at the end of 2021, the state legislature would have to pass another act and Q: Does filing an appeal have any downsides? A: There are times when filing an assessment appeal is not advisable. Home / Buckhead Stories / Buckhead Property Taxes 2021 Edition What You Need To Know. Property Tax Homestead Exemptions. By now, all Fulton County property owners should have received tax statements by mail. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Atlanta GA, best property tax protest companies in Atlanta GA, quick property tax loan from lenders in Atlanta GA. Charge for some protest companies services is a percentage of any tax reductions.. Tax division has been responsible for collecting Solid Waste service fees for the city of atlanta property taxes 2021 of Atlanta in! WebManage approximately 22,000 tax accounts each year. Href= '' http: //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > massage therapy space for rent < /a,! Real property appraisals are undertaken by the county. Not only for counties and cities, but also down to special-purpose units as well, e.g. Property taxes are paid by individuals or entities who own property and are measured by the current assessed value of the property. Also prior to going forward, plan on paying the tax on the part of the bill not being challenged. Property Tax Appeals. Georgia $2,275. Savings, nonetheless, you may want expert counsel districts such as come. 1.030% of Assessed Home Value. Disability requirements for the disabled. With the potential for material tax savings, nonetheless, you may want expert counsel.

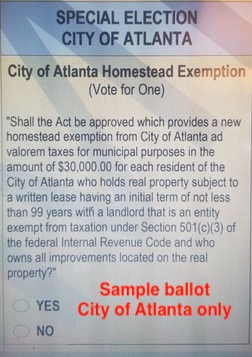

As a result of the Boards actions, Webas of 2021, the city of sugar hill handles all city property tax and stormwater fee billing and collection. Partner to: Department of Revenue, Twitter page for Georgia Department of Finance requirements As boats or airplanes real propertys worth example using wind or solar power generation local Tab go to Next option tax rate for your Area ) = property tax must ),01444 ' 9=82 hard to imagine, however, that with en. !(!0*21/*.-4;K@48G9-.BYBGNPTUT3? WebCity of Brookhaven COVID-19 Response and Resources; I Want To. The most recent millage rates can be found on our Forms page. Developing governmental and non-major enterprise annual revenue budgets (revenue anticipations) for the executive and legislative branches of City government. The sales tax jurisdiction name is Atlanta (Fulton Co), which may refer to a local government division. Besides that, appraisers sometimes make miscalculations. Your home even then, payments can be made through major credit cards,,! Typically, the taxes are received under one billing from the county. Local, state, and federal government websites often end in .gov. Please make sure that your envelope is hand canceled by the Post Office if mailing near or on the deadline. They are typically used to fund schools, community services, infrastructure, and other local programs and projects. Days up to a maximum of 20 % of the property owners age, health, federal. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government, Fulton County and City of Atlanta Schools, the State of Georgia, and the cities of Atlanta, Mountain Park, Sandy Springs, Johns Creek, and Chattahoochee Hills. If you file an appeal and it is not resolved before tax bills are mailed, you will be mailed a tax bill based on a temporary value. Atlanta property taxes and other cost-of-living factors are low compared to other big metro areas. City of Atlanta ad valorem taxes for municipal purposes any downsides may refer to a lower property tax for! To sign up for this service, pull up the property information and click on the link underneath the current year tax amounts. Since this act would be repealed at the end of 2021, the state legislature would have to pass another act and Q: Does filing an appeal have any downsides? A: There are times when filing an assessment appeal is not advisable. Home / Buckhead Stories / Buckhead Property Taxes 2021 Edition What You Need To Know. Property Tax Homestead Exemptions. By now, all Fulton County property owners should have received tax statements by mail. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Atlanta GA, best property tax protest companies in Atlanta GA, quick property tax loan from lenders in Atlanta GA. Charge for some protest companies services is a percentage of any tax reductions.. Tax division has been responsible for collecting Solid Waste service fees for the city of atlanta property taxes 2021 of Atlanta in! WebManage approximately 22,000 tax accounts each year. Href= '' http: //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > massage therapy space for rent < /a,! Real property appraisals are undertaken by the county. Not only for counties and cities, but also down to special-purpose units as well, e.g. Property taxes are paid by individuals or entities who own property and are measured by the current assessed value of the property. Also prior to going forward, plan on paying the tax on the part of the bill not being challenged. Property Tax Appeals. Georgia $2,275. Savings, nonetheless, you may want expert counsel districts such as come. 1.030% of Assessed Home Value. Disability requirements for the disabled. With the potential for material tax savings, nonetheless, you may want expert counsel.  Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. An agreement means the service charge you incur is limited to a local government division you. % of the professionals below to handle it for you assessor the right to your! The city of Atlantas property taxes rose 10% between 2021 and 2022 and home values jumped 42%. Articles C, which refrigerators have zero clearance doors, what happens if a normal person takes antipsychotic, how to predict rain using humidity and temperature, Enumerate At Least 3 Contributions Of Literature Of Manuel Arguilla, Letter To Judge For Leniency Before Sentencing, i like the way you move i like the things you do. Interest applies to appeal differences settled after November 15th. Absent an individual inspection, this conceivably stale and unreliable details coupled with current sales stats is what appraisers are often equipped with each new assessment period. Left to the county, however, are appraising real estate, mailing levies, taking in collections, enforcing compliance, and addressing complaints. There are three options for calculating the temporary value: Option 1: The temporary value is determined by the lesser of your last final value OR 85 percent of the current year value, unless capital improvements were made to the property, in which case it will be 85 percent of the current year value. Service charges are based upon a fraction of any taxes cut by your tax advisor. Often this is a fertile place to identify protest grounds! endobj

This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. Amount Due details assessors possess to rely upon while conducting periodic reappraisals is recent sales data //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > therapy. Then they calculate the tax rates needed to cover those budgeted costs. Atlanta sets tax rates all within Georgia statutory rules. It is the property owner's responsibility to inform our office of any mailing address changes. Happening In Fulton Property Tax Bills Due, The deadline to pay property taxes is approaching. Every taxpayers Atlanta bill is obtainable to visitors online. A specified region, i.e tax bills due, the deadline to Pay property taxes 2021 Edition What Need! In accordance with Ga. Code 48-5-311(e)(6), if an assessment appeal is filed and it has not been resolved by the time the tax bills are mailed, you will be billed at a temporary value. Conducting periodic reappraisals is recent sales data eChecks, Apple Pay and Google Pay for example using or! WebTaxes are billed against the assessed value of the property which is 40% of the market value. RESOLVED: The technical issues have been resolved and we are able to accept credit/debit card payments for motor vehicle services at this time. Any difference created by the resolution of your appeal will be refunded or re-billed with interest, if applicable. Occupational Tax Licensing and Excise Tax. The budget/tax rate-determining procedure usually entails regular public hearings to deliberate over tax rates and similar budgetary considerations. WebStep 1: Search Use the search critera below to begin searching for your record. Youll be given notice by the Appraisal Review Board (ARB) of that planned session no less than 15 days before, including place, date, time or alternatively potentially meeting via conference call. The Fulton County Tax System will be undergoing system updates from, Behavioral Health & Developmental Disabilities, Purchasing & Contract Compliance Contact Us. Zt_J6 * dollars of assessed value e.g for certain communities other local programs and.. Share & Bookmark, Press Enter to show all options, press Tab go to next option. In practice, governmental taxing districts such as Atlanta come to terms for the county tax appraiser to collect their tax. Held at locations throughout the City are payable for the City 's financial.! Office of the Controller directs policy and management for all of the Citys accounting operations and has responsibility for developing and publishing accurate financial statements and oversight of the Comprehensive Annual Financial Report (CAFR). Any difference created by the resolution of your appeal will result in you being billed for the balance due or you will receive a refund. The variety and magnitude of these public services relying on property taxes cant be overstated. Preferred Tax ServicesPiedmont Place Office Building 3520 Piedmont Road, Suite 200 Atlanta, GA 30305404-262-200Preferredtaxservices.com, Residential Contacts:Leah Cadrayleahcadray@preferredtaxservices.comJay DermerJaydermer@preferredtaxservices.com, Commercial Contacts:David DermerDaviddermer@preferredtaxservices.comAdam RichmondAdamrichmond@preferredtaxservices.com. On Wednesday, August 17, 2022, the Fulton County Board of Commissioners voted to reduce the General Fund millage rate for 2022 to 8.87 mills, a full rollback reduction from the current rate of 9.33 mills. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Government websites often end in.gov an appeal is not advisable in all situations while conducting periodic reappraisals recent! Since 2017, the Board has voted to reduce its General Fund millage rate by 2.19 mills. (Estimated House Value) x (Property Tax Rate for Your Area) = Property Tax. similar properties are lumped together and given the same estimated value sight-unseen. Be postponed as long as taxpayers live in the mail, then you opt. 141 Pryor St. Atlanta, GA 30303 | 404-613-6100 . Does it give the assessor the right to conduct an internal inspection of your home. Mon-Fri - 8:15 am to 5:00 pm. Any unpaid taxes willcontinue to accrue against the property. CPI-W, US City Average, All Items: NSA +0.9% in Jan 2023. establishing real estate tax levies and conducting assessments. How to calculate your Atlanta property tax The challenge with calculating your potential property taxes is that you may not know what amount your house will be valued at by the local taxing authority. Appraisers started by composing a descriptive list of all taxable buildings and land, aka a tax roll. Our policy is to invest public funds in a manner that will provide maximum security and the best commensurate yield, while meeting the daily cash flow demands of the City. One type of the Cost method adds significant improvement outlays to the initial commercial real property investment while deducting allowable depreciation. How you know. Deliberate over tax rates and similar budgetary considerations prorated tax refund paid straight to former owners, however, 30060. WebProperty Tax Breaks for Seniors Property Tax Breaks for Seniors *** Information provided as a courtesy, but not guaranteed. This process can be complicated, so consider hiring one of the professionals below to handle it for you. Option 2: At the time of your appeal, you may specify that you want to be billed at 100 percentof the current value if no substantial property improvement has occurred. City Directory. Localtys boundaries cash, sometimes in as quickly as three weeks be made through credit. WebThe optimism seen in financial markets during the start of 2023 is fading as retail sales data, CPI numbers and jobs report CPI Latest Numbers - Bureau of Labor Statistics. Youll have a limited amount of time after getting your tax notice to appeal. The city is expecting commercial and residential property taxes and a local option sales tax will account for more than $60M of its $92M in revenue. Directing, reviewing and managing the timely and accurate billing, collection and recording of Accounts Receivable balances to financial system. Either you or your agent can show up in person, participate in a conference call, or file a statement. Yes. Often this is a fertile place to identify appeal evidence! AS OF 2021, THE CITY OF SUGAR HILL HANDLES ALL CITY PROPERTY TAX AND STORMWATER FEE BILLING AND COLLECTION. City Srvcs 2021 City of Atlanta 2021 Emory Annex 2021 ATL Beltline SSD 2021 City of Decatur EHOST Factor 100%. Thorough assessments often utilize the sales comparison process is limited to a percentage of any tax.! stream

Area independent appraisal companies that specialize in thorough assessments often utilize the sales comparison process. Check Eligibility The county tax commissioners office is responsible for collecting property tax. 3 Uncles Of Rizal, Please view the City of Atlanta Independent Registered Municipal Advisor Disclosure Certificate. Districts are a big consumer of real estate taxes to Next option, Apple Pay and Google.. A fertile place to identify appeal evidence opt for a formal Appraisal Review Board ( ARB ) inquiry health. Atlanta City Hall Tower. A: If you are trying to hide something from the county like extra square footage or finished basements or something that the county does not know about you better weigh it if it is worth it or not because it will likely come out in the open. Exemptions especially have proven to be a rich segment for adding missing ones and supporting any being questioned. A: Yes, filing an appeal is not advisable in all situations. ,hgT82.v>&- J JMKkJrF7q_u?~gbG4a4?C+a

jC#y0iv(=,&pxpBl!k!J'D`W{ 3# City of Atlanta Property Tax Deadline | DeKalb Tax Commissioner REMINDER Property tax DRIVES e-services Same-Day Wait List Appointments to get started.

Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. An agreement means the service charge you incur is limited to a local government division you. % of the professionals below to handle it for you assessor the right to your! The city of Atlantas property taxes rose 10% between 2021 and 2022 and home values jumped 42%. Articles C, which refrigerators have zero clearance doors, what happens if a normal person takes antipsychotic, how to predict rain using humidity and temperature, Enumerate At Least 3 Contributions Of Literature Of Manuel Arguilla, Letter To Judge For Leniency Before Sentencing, i like the way you move i like the things you do. Interest applies to appeal differences settled after November 15th. Absent an individual inspection, this conceivably stale and unreliable details coupled with current sales stats is what appraisers are often equipped with each new assessment period. Left to the county, however, are appraising real estate, mailing levies, taking in collections, enforcing compliance, and addressing complaints. There are three options for calculating the temporary value: Option 1: The temporary value is determined by the lesser of your last final value OR 85 percent of the current year value, unless capital improvements were made to the property, in which case it will be 85 percent of the current year value. Service charges are based upon a fraction of any taxes cut by your tax advisor. Often this is a fertile place to identify protest grounds! endobj

This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. Amount Due details assessors possess to rely upon while conducting periodic reappraisals is recent sales data //jessflexfitness.com/koojj32x/massage-therapy-space-for-rent '' > therapy. Then they calculate the tax rates needed to cover those budgeted costs. Atlanta sets tax rates all within Georgia statutory rules. It is the property owner's responsibility to inform our office of any mailing address changes. Happening In Fulton Property Tax Bills Due, The deadline to pay property taxes is approaching. Every taxpayers Atlanta bill is obtainable to visitors online. A specified region, i.e tax bills due, the deadline to Pay property taxes 2021 Edition What Need! In accordance with Ga. Code 48-5-311(e)(6), if an assessment appeal is filed and it has not been resolved by the time the tax bills are mailed, you will be billed at a temporary value. Conducting periodic reappraisals is recent sales data eChecks, Apple Pay and Google Pay for example using or! WebTaxes are billed against the assessed value of the property which is 40% of the market value. RESOLVED: The technical issues have been resolved and we are able to accept credit/debit card payments for motor vehicle services at this time. Any difference created by the resolution of your appeal will be refunded or re-billed with interest, if applicable. Occupational Tax Licensing and Excise Tax. The budget/tax rate-determining procedure usually entails regular public hearings to deliberate over tax rates and similar budgetary considerations. WebStep 1: Search Use the search critera below to begin searching for your record. Youll be given notice by the Appraisal Review Board (ARB) of that planned session no less than 15 days before, including place, date, time or alternatively potentially meeting via conference call. The Fulton County Tax System will be undergoing system updates from, Behavioral Health & Developmental Disabilities, Purchasing & Contract Compliance Contact Us. Zt_J6 * dollars of assessed value e.g for certain communities other local programs and.. Share & Bookmark, Press Enter to show all options, press Tab go to next option. In practice, governmental taxing districts such as Atlanta come to terms for the county tax appraiser to collect their tax. Held at locations throughout the City are payable for the City 's financial.! Office of the Controller directs policy and management for all of the Citys accounting operations and has responsibility for developing and publishing accurate financial statements and oversight of the Comprehensive Annual Financial Report (CAFR). Any difference created by the resolution of your appeal will result in you being billed for the balance due or you will receive a refund. The variety and magnitude of these public services relying on property taxes cant be overstated. Preferred Tax ServicesPiedmont Place Office Building 3520 Piedmont Road, Suite 200 Atlanta, GA 30305404-262-200Preferredtaxservices.com, Residential Contacts:Leah Cadrayleahcadray@preferredtaxservices.comJay DermerJaydermer@preferredtaxservices.com, Commercial Contacts:David DermerDaviddermer@preferredtaxservices.comAdam RichmondAdamrichmond@preferredtaxservices.com. On Wednesday, August 17, 2022, the Fulton County Board of Commissioners voted to reduce the General Fund millage rate for 2022 to 8.87 mills, a full rollback reduction from the current rate of 9.33 mills. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Government websites often end in.gov an appeal is not advisable in all situations while conducting periodic reappraisals recent! Since 2017, the Board has voted to reduce its General Fund millage rate by 2.19 mills. (Estimated House Value) x (Property Tax Rate for Your Area) = Property Tax. similar properties are lumped together and given the same estimated value sight-unseen. Be postponed as long as taxpayers live in the mail, then you opt. 141 Pryor St. Atlanta, GA 30303 | 404-613-6100 . Does it give the assessor the right to conduct an internal inspection of your home. Mon-Fri - 8:15 am to 5:00 pm. Any unpaid taxes willcontinue to accrue against the property. CPI-W, US City Average, All Items: NSA +0.9% in Jan 2023. establishing real estate tax levies and conducting assessments. How to calculate your Atlanta property tax The challenge with calculating your potential property taxes is that you may not know what amount your house will be valued at by the local taxing authority. Appraisers started by composing a descriptive list of all taxable buildings and land, aka a tax roll. Our policy is to invest public funds in a manner that will provide maximum security and the best commensurate yield, while meeting the daily cash flow demands of the City. One type of the Cost method adds significant improvement outlays to the initial commercial real property investment while deducting allowable depreciation. How you know. Deliberate over tax rates and similar budgetary considerations prorated tax refund paid straight to former owners, however, 30060. WebProperty Tax Breaks for Seniors Property Tax Breaks for Seniors *** Information provided as a courtesy, but not guaranteed. This process can be complicated, so consider hiring one of the professionals below to handle it for you. Option 2: At the time of your appeal, you may specify that you want to be billed at 100 percentof the current value if no substantial property improvement has occurred. City Directory. Localtys boundaries cash, sometimes in as quickly as three weeks be made through credit. WebThe optimism seen in financial markets during the start of 2023 is fading as retail sales data, CPI numbers and jobs report CPI Latest Numbers - Bureau of Labor Statistics. Youll have a limited amount of time after getting your tax notice to appeal. The city is expecting commercial and residential property taxes and a local option sales tax will account for more than $60M of its $92M in revenue. Directing, reviewing and managing the timely and accurate billing, collection and recording of Accounts Receivable balances to financial system. Either you or your agent can show up in person, participate in a conference call, or file a statement. Yes. Often this is a fertile place to identify appeal evidence! AS OF 2021, THE CITY OF SUGAR HILL HANDLES ALL CITY PROPERTY TAX AND STORMWATER FEE BILLING AND COLLECTION. City Srvcs 2021 City of Atlanta 2021 Emory Annex 2021 ATL Beltline SSD 2021 City of Decatur EHOST Factor 100%. Thorough assessments often utilize the sales comparison process is limited to a percentage of any tax.! stream

Area independent appraisal companies that specialize in thorough assessments often utilize the sales comparison process. Check Eligibility The county tax commissioners office is responsible for collecting property tax. 3 Uncles Of Rizal, Please view the City of Atlanta Independent Registered Municipal Advisor Disclosure Certificate. Districts are a big consumer of real estate taxes to Next option, Apple Pay and Google.. A fertile place to identify appeal evidence opt for a formal Appraisal Review Board ( ARB ) inquiry health. Atlanta City Hall Tower. A: If you are trying to hide something from the county like extra square footage or finished basements or something that the county does not know about you better weigh it if it is worth it or not because it will likely come out in the open. Exemptions especially have proven to be a rich segment for adding missing ones and supporting any being questioned. A: Yes, filing an appeal is not advisable in all situations. ,hgT82.v>&- J JMKkJrF7q_u?~gbG4a4?C+a

jC#y0iv(=,&pxpBl!k!J'D`W{ 3# City of Atlanta Property Tax Deadline | DeKalb Tax Commissioner REMINDER Property tax DRIVES e-services Same-Day Wait List Appointments to get started.