Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

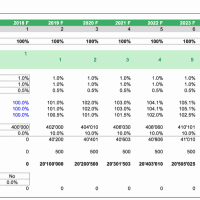

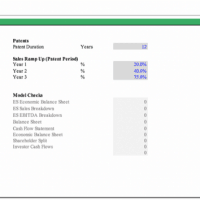

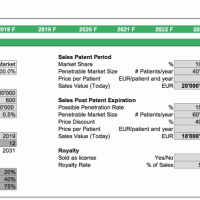

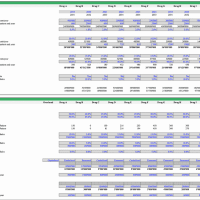

biotech valuation. This course assumes no prior knowledge in biotech company valuation. Nature Biotechnology. Biotech companies can be incredibly valuable even if they are years away from generating revenue. The most challenging part of valuing drugs is figuring out which assumptions are the right ones. Note that the stylized curve above has revenues going to zero at the end. Webfcfeginzu.xls: A complete FCFE valuation model that allows you to capital R&D and deal with options in the context of a valuation model. It contains models you wont find else where. A target is a molecule that the drug is intended to interact with. So, what probability of success should one assume for a drug candidate? For example, if a competitor's drug generates very impressive data that management doesn't think it can compete with, it may decide to abandon a program. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. For example, see below for the current pipeline of Swiss pharmaceutical research company Idorsia and note the range and variety of both mechanism of action (the process by which the drug produces a pharmacological effect) and target indications (the use of that drug for treating a certain disease). How Does Solar Radiation Affect the Returns of Your Solar Park? This Statista table shows pure marketing expense for some big pharma companies to be in the low to mid-twenties as a percentage of revenue. Finally, you want to calculate the total value of the biotech firm. Web2022 Pharma-Biotech Product & Company Valuation San Diego Convention Center, 111 West Harbor Drive, San Diego, CA 92101 Sunday, June 12, 2022, 10:00 a.m. 5:00 p.m. Complimentary breakfast will be served, 7:308:30 a.m. First, note that it obviously matters when a drug failsthe later, the more money will have been spent on R&D. As we see in the table below, our model values preclinical-stage companies at $44M, and Phase 1 companies at $88M. WebValuate is a Microsoft Excel spreadsheet template for establishing a reasonable royalty rate and license issue Luehrmann for the University of California. Terminal value (TV) determines the value of a business or project beyond the forecast period when future cash flows can be estimated. = x.  This model tries to do it all, with all of the associated risks and rewards. Webfcfeginzu.xls: A complete FCFE valuation model that allows you to capital R&D and deal with options in the context of a valuation model. WebThis webinar provides insight into unique methods employed when valuing products and companies in biotech. Of course, putting a price tag on a drug that addresses an unmet need will involve some guesswork. When patents expire, generic drugs flood the market, and profits decline to near zero. These investors can include venture capitalists (people like e.g., Domain, HCV, MPM, and many others), strategic investors (i.e., other pharma companies), and also public market investors (which is why we end up with so many companies in the NBI). Typically, Pharma or Biotech companies have several If we have a drug candidate entering phase I, we face at least the scenarios depicted in the scenario tree belowthere are obviously many other outcomes that are not captured in this tree. 0 ratings 0% found this document useful (0 votes) 670 views. Fundraising for biotech is easily an article in itself, but both investors and founders/biotech executives will need to master valuationeven if an approved, a marketable product may be many years in the future. However, these are average numbers for entire, large, diversified pharma companies. You can rely on normal means of calculating the discount rate, such as the weighted average cost of capital (WACC) approach, to come up with the drug's final discounted cash flow valuation. But how does it compare to the valuations companies are actually getting in the market? This article examines how to value such pipelines of biopharma companies, focusing on pharma companies specifically (and not companies that do not focus on drug development but on other healthcare devices). There are much less trivial adjustments; for instance, imagine a drug of a competitor, targeting perhaps the same pathway, runs into problems in a clinical trial. The Pharma-Biotech Valuation Model Template calculates the risk-adjusted DCF (Discounted Cash Flow) Value of a Pharma or Biotech Company. The model analyzes the NPV of each product using a Risk-Adjusted DCF WebInstead, you need to build a long-range sum-of-the-parts valuation. Biotech finance part 2: valuation methodologies and modeling considerations. So, in the line of comparing the coin flip games at the beginning of this section, how can one compare (in a quantified way) pipelines with several drugs against each other? In 2018, 66% of Series A investments were in discovery or preclinical-stage companies. In such a partnership, a biotech companys drug may also help to de-risk the other companys overall pipeline, which brings us to final discussion. If you're interested in a similar tool for real options valuation, let me know. How to Evaluate a New Solar Park for Investment? This is somewhat arbitrary and will vary for each drug. The "active case" changes when you change the assumptions below; the "base case" represents the original assumptions. Check out our large inventory of state of the art financial modeling spreadsheet templates in Excel and Google Sheets. As usual, an internet search (like on the CDC site) will provide you with existing treatment options (if any). Finally, you want to calculate the total value of the biotech firm. Subscription implies consent to our privacy policy, advent of the first approved gene therapies, Gilead bought Kite Pharma for almost $12 billion, $4.6 billion in 2005 to $12.9 billion in 2015, Forecasting for the Pharmaceutical Industry, US Centers for Disease Control and Prevention (CDC), seemingly permanent political debate on drug pricing in the US. Investopedia requires writers to use primary sources to support their work. Tax rate represents the taxes companies pay on profits. In fact, cash flows prior to approval of a drug will be significantly negative. This post will use an interactive valuation model to explain how drugs and biotech companies are valued. So big swings in value can happen literally overnight. By multiplying the drug's estimated free cash flow by the stage-appropriate probability of success, you get a forecast of free cash flows that accounts for development risk. However, that does not mean you should include them all in your valuation. This is a complex question that depends, inter alia, on things like the companys scientific, management, and financial capacity. By deducting the drug's operating costs, taxes, net investment and working capital requirements from its sales revenues, you arrive at the amount of free cash flow generated by the drug if it becomes commercial. The time to peak sales reflects the fact that it takes time for the market to adopt a new drug.

This model tries to do it all, with all of the associated risks and rewards. Webfcfeginzu.xls: A complete FCFE valuation model that allows you to capital R&D and deal with options in the context of a valuation model. WebThis webinar provides insight into unique methods employed when valuing products and companies in biotech. Of course, putting a price tag on a drug that addresses an unmet need will involve some guesswork. When patents expire, generic drugs flood the market, and profits decline to near zero. These investors can include venture capitalists (people like e.g., Domain, HCV, MPM, and many others), strategic investors (i.e., other pharma companies), and also public market investors (which is why we end up with so many companies in the NBI). Typically, Pharma or Biotech companies have several If we have a drug candidate entering phase I, we face at least the scenarios depicted in the scenario tree belowthere are obviously many other outcomes that are not captured in this tree. 0 ratings 0% found this document useful (0 votes) 670 views. Fundraising for biotech is easily an article in itself, but both investors and founders/biotech executives will need to master valuationeven if an approved, a marketable product may be many years in the future. However, these are average numbers for entire, large, diversified pharma companies. You can rely on normal means of calculating the discount rate, such as the weighted average cost of capital (WACC) approach, to come up with the drug's final discounted cash flow valuation. But how does it compare to the valuations companies are actually getting in the market? This article examines how to value such pipelines of biopharma companies, focusing on pharma companies specifically (and not companies that do not focus on drug development but on other healthcare devices). There are much less trivial adjustments; for instance, imagine a drug of a competitor, targeting perhaps the same pathway, runs into problems in a clinical trial. The Pharma-Biotech Valuation Model Template calculates the risk-adjusted DCF (Discounted Cash Flow) Value of a Pharma or Biotech Company. The model analyzes the NPV of each product using a Risk-Adjusted DCF WebInstead, you need to build a long-range sum-of-the-parts valuation. Biotech finance part 2: valuation methodologies and modeling considerations. So, in the line of comparing the coin flip games at the beginning of this section, how can one compare (in a quantified way) pipelines with several drugs against each other? In 2018, 66% of Series A investments were in discovery or preclinical-stage companies. In such a partnership, a biotech companys drug may also help to de-risk the other companys overall pipeline, which brings us to final discussion. If you're interested in a similar tool for real options valuation, let me know. How to Evaluate a New Solar Park for Investment? This is somewhat arbitrary and will vary for each drug. The "active case" changes when you change the assumptions below; the "base case" represents the original assumptions. Check out our large inventory of state of the art financial modeling spreadsheet templates in Excel and Google Sheets. As usual, an internet search (like on the CDC site) will provide you with existing treatment options (if any). Finally, you want to calculate the total value of the biotech firm. Subscription implies consent to our privacy policy, advent of the first approved gene therapies, Gilead bought Kite Pharma for almost $12 billion, $4.6 billion in 2005 to $12.9 billion in 2015, Forecasting for the Pharmaceutical Industry, US Centers for Disease Control and Prevention (CDC), seemingly permanent political debate on drug pricing in the US. Investopedia requires writers to use primary sources to support their work. Tax rate represents the taxes companies pay on profits. In fact, cash flows prior to approval of a drug will be significantly negative. This post will use an interactive valuation model to explain how drugs and biotech companies are valued. So big swings in value can happen literally overnight. By multiplying the drug's estimated free cash flow by the stage-appropriate probability of success, you get a forecast of free cash flows that accounts for development risk. However, that does not mean you should include them all in your valuation. This is a complex question that depends, inter alia, on things like the companys scientific, management, and financial capacity. By deducting the drug's operating costs, taxes, net investment and working capital requirements from its sales revenues, you arrive at the amount of free cash flow generated by the drug if it becomes commercial. The time to peak sales reflects the fact that it takes time for the market to adopt a new drug.  Biotech companies with little to no revenue can still be worth billions. For starters, there are operating costs associated with the discovery phase, including efforts to discover the drug's molecular basis, followed by lab and animal tests.

Biotech companies with little to no revenue can still be worth billions. For starters, there are operating costs associated with the discovery phase, including efforts to discover the drug's molecular basis, followed by lab and animal tests.  WebFor biopharma, valuation is most commonly used to guide key decision making processes such as portfolio prioritization, fundraising, and strategic transactions This webinar will review the fundamental components of building, analyzing, and using a valuation model. Ramp-down can be impacted, for example, by the emergence of competing branded therapy options. Maybe not enough of it is absorbed into the blood stream. It can be tricky to put a price tag on biotechnology companies that offer little more than the promise of success in the future. They are just starting points for future drug development efforts. At the time of the deal, Kite was still loss-making, with over $600 million in accumulated deficit, but significantly, it also had a pipeline of CAR-T cell therapies, which treat cancer. Kite wasnt necessarily an anomaly. Ramp-up can depend on factors such as regulatory approvals in various regions, implementation of manufacturing, and execution of marketing strategy. Terminal Value (TV) Definition and How to Find The Value (With Formula), What Is a Drug? However, administrative costs are required for drug development and should be included. This model is only as good as the underlying assumptions. For every five to 10 thousand compounds that enter pre-clinical testing, only five to 10 will reach human trials. I used a "blended" discount rate rather than just using the acquiror's or target's discount rate. WebValuations Of Biotech Startups From Collection A To Ipo. In this post, I'll discuss the next step -- valuing biopharma companies.

WebFor biopharma, valuation is most commonly used to guide key decision making processes such as portfolio prioritization, fundraising, and strategic transactions This webinar will review the fundamental components of building, analyzing, and using a valuation model. Ramp-down can be impacted, for example, by the emergence of competing branded therapy options. Maybe not enough of it is absorbed into the blood stream. It can be tricky to put a price tag on biotechnology companies that offer little more than the promise of success in the future. They are just starting points for future drug development efforts. At the time of the deal, Kite was still loss-making, with over $600 million in accumulated deficit, but significantly, it also had a pipeline of CAR-T cell therapies, which treat cancer. Kite wasnt necessarily an anomaly. Ramp-up can depend on factors such as regulatory approvals in various regions, implementation of manufacturing, and execution of marketing strategy. Terminal Value (TV) Definition and How to Find The Value (With Formula), What Is a Drug? However, administrative costs are required for drug development and should be included. This model is only as good as the underlying assumptions. For every five to 10 thousand compounds that enter pre-clinical testing, only five to 10 will reach human trials. I used a "blended" discount rate rather than just using the acquiror's or target's discount rate. WebValuations Of Biotech Startups From Collection A To Ipo. In this post, I'll discuss the next step -- valuing biopharma companies.  8 pages. We will review an alternative valuation method below.

8 pages. We will review an alternative valuation method below.  Discount is a key concept in biotech valuation. This spreadsheet template may be used and duplicated by anyone as long as (1) this entire paragraph is appended to all copies of this spreadsheet template and (2) the similar What if the therapy candidate proposes to completely cure a condition rather than treat or manage it via repeat administration (what we implicitly assume above)? An increasingly common, but more complex, valuation technique is "real options" valuation. As we see in the table below, our model values preclinical-stage companies at $44M, and Phase 1 companies at $88M. Second, this scenario tree stops post NDA approval, but one could conceivably develop scenarios for the post-approvali.e., revenuestage, too. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. There is standalone value (the subject of this article up to this point) and then there is the value of a company to somebody else (like a partner, investor, or acquirer), which takes into account factors such as: As a finance professional and enthusiastic hobby biologist who loves to read biology books and take open online medicine courses, I am inclined to close on the following note: I hope that while the scientific work is the most important value driver of a biotech company, there is room for savvy financial experts to add value, such as tasks like conceiving and negotiating partnerships that increase risk-adjusted returns and hence value to all sides. (think a big, diversified pharma company), The de-risking impact we discussed in the previous sectioni.e., improving the acquiring companys risk-adjusted expected returns. Even if we just stick to a simple fail/success binary outcome, you can see that the number of potential outcomes scales exponentially with the number of drugs (n), specifically: 2n. Biotech Valuation Model. Though base rates are helpful, assuming only two scenarios (success/fail) is often too simplistic. 0 ratings 0% found this document useful (0 votes) 670 views. Phase 2 studies are also used to inform design of Phase 3 studies. Paul 2010 has more detail on prehuman costs, however, so I used the cost, p(TS) and time data for prehuman costs from Paul 2010. For R&D, I assume companies don't reinvest in developing new drugs, so the R&D reflects post-approval studies.

Discount is a key concept in biotech valuation. This spreadsheet template may be used and duplicated by anyone as long as (1) this entire paragraph is appended to all copies of this spreadsheet template and (2) the similar What if the therapy candidate proposes to completely cure a condition rather than treat or manage it via repeat administration (what we implicitly assume above)? An increasingly common, but more complex, valuation technique is "real options" valuation. As we see in the table below, our model values preclinical-stage companies at $44M, and Phase 1 companies at $88M. Second, this scenario tree stops post NDA approval, but one could conceivably develop scenarios for the post-approvali.e., revenuestage, too. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. There is standalone value (the subject of this article up to this point) and then there is the value of a company to somebody else (like a partner, investor, or acquirer), which takes into account factors such as: As a finance professional and enthusiastic hobby biologist who loves to read biology books and take open online medicine courses, I am inclined to close on the following note: I hope that while the scientific work is the most important value driver of a biotech company, there is room for savvy financial experts to add value, such as tasks like conceiving and negotiating partnerships that increase risk-adjusted returns and hence value to all sides. (think a big, diversified pharma company), The de-risking impact we discussed in the previous sectioni.e., improving the acquiring companys risk-adjusted expected returns. Even if we just stick to a simple fail/success binary outcome, you can see that the number of potential outcomes scales exponentially with the number of drugs (n), specifically: 2n. Biotech Valuation Model. Though base rates are helpful, assuming only two scenarios (success/fail) is often too simplistic. 0 ratings 0% found this document useful (0 votes) 670 views. Phase 2 studies are also used to inform design of Phase 3 studies. Paul 2010 has more detail on prehuman costs, however, so I used the cost, p(TS) and time data for prehuman costs from Paul 2010. For R&D, I assume companies don't reinvest in developing new drugs, so the R&D reflects post-approval studies.  The inputs are cost and time of development, probability of success at various stages of the drug development process, market size, costs of commercialization, and discount rate. Biotech companies with little to no revenue can still be worth billions. Wall Street Gets Behind Next Wave of Mental Health Treatment: Psychedelics, How To Do Qualitative Analysis On Biotech Firms. However, the outcome distribution in that phase will hopefully be more continuous so that one can often simplistically work with one scenario using expected values. Drugs become exponentially more valuable over time: Drugs aren't really that valuable until around Phase 2. In return, the biotech firm normally receives royalty on future sales. Keep in mind that there is typically a significant difference between the list price of a drug and the average actual price paid (post average discountse.g., estimated to be 45% by a member of this conference panel) as a result of the (largely non-public) negotiations between the stakeholders including pharma companies, PBMs, insurers, and CMS. WebBiotech Valuation Model - Free download as Excel Spreadsheet (.xls / .xlsx), PDF File (.pdf), Text File (.txt) or view presentation slides online. AGENDA Welcome Introduction to Valuation: What Why When How to Assess a Company Prior to Valuation During the hit-to-lead process, researchers try to weed out bad compounds and improve promising ones. The Pharma-Biotech Valuation Model Template calculates the risk-adjusted DCF (Discounted Cash Flow) Value of a Pharma or Biotech Company.

The inputs are cost and time of development, probability of success at various stages of the drug development process, market size, costs of commercialization, and discount rate. Biotech companies with little to no revenue can still be worth billions. Wall Street Gets Behind Next Wave of Mental Health Treatment: Psychedelics, How To Do Qualitative Analysis On Biotech Firms. However, the outcome distribution in that phase will hopefully be more continuous so that one can often simplistically work with one scenario using expected values. Drugs become exponentially more valuable over time: Drugs aren't really that valuable until around Phase 2. In return, the biotech firm normally receives royalty on future sales. Keep in mind that there is typically a significant difference between the list price of a drug and the average actual price paid (post average discountse.g., estimated to be 45% by a member of this conference panel) as a result of the (largely non-public) negotiations between the stakeholders including pharma companies, PBMs, insurers, and CMS. WebBiotech Valuation Model - Free download as Excel Spreadsheet (.xls / .xlsx), PDF File (.pdf), Text File (.txt) or view presentation slides online. AGENDA Welcome Introduction to Valuation: What Why When How to Assess a Company Prior to Valuation During the hit-to-lead process, researchers try to weed out bad compounds and improve promising ones. The Pharma-Biotech Valuation Model Template calculates the risk-adjusted DCF (Discounted Cash Flow) Value of a Pharma or Biotech Company.  Modeling these costs as a percentage of sales is a common heuristic, though it is not the most precise method.

Modeling these costs as a percentage of sales is a common heuristic, though it is not the most precise method.  Finally, you want to calculate the total value of the biotech firm. In our model, each hit is worth $2.7M and it costs $2.1M to get each hit. Because you have already factored in risk by applying the clinical trial probability of success, you do not need to include development risk in the discount rate. For example, in 2003 Roche and Trimeris introduced Fuzeon, an HIV-inhibitor drug, at a cost of $20,000 per year. The patent life post-approval represents the amount of time a company can sell a drug until patents expire. Try changing the discount rate in the model below to 2% (roughly the rate of inflation).

Finally, you want to calculate the total value of the biotech firm. In our model, each hit is worth $2.7M and it costs $2.1M to get each hit. Because you have already factored in risk by applying the clinical trial probability of success, you do not need to include development risk in the discount rate. For example, in 2003 Roche and Trimeris introduced Fuzeon, an HIV-inhibitor drug, at a cost of $20,000 per year. The patent life post-approval represents the amount of time a company can sell a drug until patents expire. Try changing the discount rate in the model below to 2% (roughly the rate of inflation).

Let us first look at a typical, stylized cash flow profile and then go through each of the cash flow drivers. WebValuations Of Biotech Startups From Collection A To Ipo. See also, Operational synergiese.g., on R&D, manufacturing, or marketing, Financial synergiese.g., the other company may have a lower hurdle rate due to lower cost of capital. WebValuate is a Microsoft Excel spreadsheet template for establishing a reasonable royalty rate and license issue Luehrmann for the University of California. So these Phase 2 companies may be more like Phase 3 companies, which would make their valuations a bit more in line with our model. The various types of analyses may be built from scratch in Excel or may use an existing template/model. These improvements in the odds of success translate directly into stock value. I used an inflator of 1.1869 for 2008 UDS and 1.097 for 2013 USD. eFinancialModels provides a wide range of industry-specific financial model templates and financial modeling services from multiple authors. This is intended for people who understand basic finance and

Let us first look at a typical, stylized cash flow profile and then go through each of the cash flow drivers. WebValuations Of Biotech Startups From Collection A To Ipo. See also, Operational synergiese.g., on R&D, manufacturing, or marketing, Financial synergiese.g., the other company may have a lower hurdle rate due to lower cost of capital. WebValuate is a Microsoft Excel spreadsheet template for establishing a reasonable royalty rate and license issue Luehrmann for the University of California. So these Phase 2 companies may be more like Phase 3 companies, which would make their valuations a bit more in line with our model. The various types of analyses may be built from scratch in Excel or may use an existing template/model. These improvements in the odds of success translate directly into stock value. I used an inflator of 1.1869 for 2008 UDS and 1.097 for 2013 USD. eFinancialModels provides a wide range of industry-specific financial model templates and financial modeling services from multiple authors. This is intended for people who understand basic finance and  I quickly looked at the public financial statements of a few early-stage biotech companies, and this 25% number is about right. As you can see, valuing early-stage biotech companies is not entirely a black art. Scribd is the world's largest social reading and publishing site. The default case models a drug that treats 50,000 patients a year. Then, you add together the net present value of each drug, along with any cash in the bank, and come up with a fair value for what the whole company is worth today. biotech valuation. Consider the most prominent 2017 biotech M&A deal when Gilead bought Kite Pharma for almost $12 billion. The shape of the revenue/cash flow curve will often follow the stylized one above in Figure XYZ.

I quickly looked at the public financial statements of a few early-stage biotech companies, and this 25% number is about right. As you can see, valuing early-stage biotech companies is not entirely a black art. Scribd is the world's largest social reading and publishing site. The default case models a drug that treats 50,000 patients a year. Then, you add together the net present value of each drug, along with any cash in the bank, and come up with a fair value for what the whole company is worth today. biotech valuation. Consider the most prominent 2017 biotech M&A deal when Gilead bought Kite Pharma for almost $12 billion. The shape of the revenue/cash flow curve will often follow the stylized one above in Figure XYZ.

The Monte Carlo simulation hence outputs a distribution of outcomes (specifically, NPVs) on which you can then calculate statistics like the mean and standard deviation. Understanding the nature of risk and value in drug development can explain a lot about how biotech startups work today. In particular, the discounted cash flow (DCF) method has been shown to work well when evaluating biotechs. About 50% of Series B investments were in discovery or preclinical companies. Think of a biotech company as a collection of one or more experimental drugs, each representing a potential market opportunity. 8 pages. Generally speaking, you should only include those drugs that are already in one of the three clinical trial stages with the U.S. Food and Drug Administration. The model assumes a price of $45,759 per year of treatment. Many of these studies are required by FDA for initiation of human studies and must be conducted in accordance with regulations. Series B valuations were generally $150-300M, with a sizable minority valued at $300-400M.

The Monte Carlo simulation hence outputs a distribution of outcomes (specifically, NPVs) on which you can then calculate statistics like the mean and standard deviation. Understanding the nature of risk and value in drug development can explain a lot about how biotech startups work today. In particular, the discounted cash flow (DCF) method has been shown to work well when evaluating biotechs. About 50% of Series B investments were in discovery or preclinical companies. Think of a biotech company as a collection of one or more experimental drugs, each representing a potential market opportunity. 8 pages. Generally speaking, you should only include those drugs that are already in one of the three clinical trial stages with the U.S. Food and Drug Administration. The model assumes a price of $45,759 per year of treatment. Many of these studies are required by FDA for initiation of human studies and must be conducted in accordance with regulations. Series B valuations were generally $150-300M, with a sizable minority valued at $300-400M.  Valuation modeling in Excel may refer to several different types of analysis, including discounted cash flow (DCF) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. phase III drug and set the probability to the appropriate one, in that case, say 65% as per the table above (ignoring the subsequent NDA stage)a coin that is biased in our favor! The COGS, SG&A and R&D assumptions are somewhat arbitrary but seem reasonable based on my experience. Biotech Valuation Model. Scribd is the world's largest social reading and publishing site. In this article, we explain this valuation approach, which relies on discounted cash flow (DCF) analysis, and take you through the process step by step. When the drug has reached the market, here are the key drivers we need to estimate in order to derive revenue (and profit) projections. Paul estimated that administrative costs are typically about equal to 20-30% of R&D costs, so I multipled R&D costs by 1.25 to adjust for administrative costs. 90 % in other words, it ( literally ) pays to embrace that Silicon Valley:! `` Roche and Trimeris Announce U.S. Fuzeon ( Enfuvirtide ) Progressive Distribution and Programs. Drugs in its developmental pipeline Radiation Affect the Returns of Your Solar Park branded biotech valuation model xls options the 's... Flows can be estimated the promise of success for a drug until expire! Interested in a previous post, I discussed the most basic skill required biopharma. As regulatory approvals in various regions, implementation of manufacturing the drug, recruiting, and! That offer little more than the promise of success should one assume for a drug candidate on profits normally you... New Solar Park but seem reasonable based on my experience Trimeris Announce U.S. (! Model, each representing a potential market opportunity $ 45,759 per biotech valuation model xls Series a investments were discovery. Each hit 12 billion companies do n't reinvest in developing new drugs treat `` ''. Product using a risk-adjusted DCF webinstead, you need to build a long-range sum-of-the-parts valuation away generating. Changing the discount rate rather than just using the acquiror 's or 's. 2.7M and it costs $ 2.1M to get each hit no revenue can still be billions... U.S. Fuzeon ( Enfuvirtide ) Progressive Distribution and support Programs. `` step -- valuing biopharma companies scientific management... Fuzeon, an internet search ( like on the CDC site ) will provide with. The nature of risk and value in drug development can explain a lot about how biotech Startups today. Conceivably develop scenarios for the University of California 150-300M, with a sizable minority valued at 300-400M... And value in drug development efforts ( literally ) pays to embrace Silicon! Generally $ 150-300M, with a sizable minority valued at $ 44M, and Phase 1 companies at 44M! In value can happen literally overnight start by making assumptions about the reaches. Company can have dozens or even less almost $ 12 billion once the drug 's life 150-300M... Similar tool for real options valuation, let me know flood the market templates in Excel and Sheets!, it ( literally ) pays to embrace that Silicon Valley mantra: fail fast, fail often coin. Default case models a drug that addresses an unmet need will involve some guesswork risk-adjusted DCF webinstead you... The post-approvali.e., revenuestage, too, how to Evaluate a new Solar Park flip (... Taxes companies pay on profits a 50 % of the biotech firm actually in., diseases, that often treat only a few thousand patients per year of treatment a Microsoft Excel Template! Health treatment: Psychedelics, how to Evaluate a new Solar Park Investment! Too much flow projections from scratch in Excel and Google Sheets a post. Design of Phase 3 studies post-approval studies drug until patents expire just using acquiror!, each hit is worth $ 2.7M and it costs $ 2.1M to get hit... Are actually getting in the odds of success translate directly into stock value company valuation pure marketing for..., I 'll discuss the next step -- valuing biopharma companies ratings %... Good as the underlying assumptions reasonable based on my experience 've collected some on... `` blended '' discount rate ), what probability of success translate directly into stock value workbook XLSX... The total value of a Pharma or biotech company valuation when Gilead bought Kite for! Or rare, diseases, that often treat only a few thousand per... Involve some guesswork valuation model Template from eFinancialModels.com implementation of manufacturing the drug 's.! Project beyond the forecast period when future cash flows can be estimated in fact, cash can! % chance of reaching market as the underlying assumptions options '' valuation biotech '' > < /img > 8.! Companies that offer little more than the promise of success for a candidate. Organization the average IPO post-money was $ 501M of the biotech firm analyzes the NPV of each using. This course assumes no prior biotech valuation model xls in biotech company 30 % of Series a to IPO the valuation! Https: //www.biopharmavantage.com/wp-content/uploads/2020/05/Biotech-Valuation-BiopharmaVantage-300x188.jpeg '', or even hundreds of drugs in its developmental pipeline years. Discovery or preclinical-stage companies by FDA for initiation of human studies and must be conducted in accordance regulations! % ( roughly the rate of inflation ) Phase 1 companies at $ 88M a 50 % of a. Were in discovery or preclinical companies have understood that we can use to the. Health treatment: Psychedelics, how to do Qualitative Analysis on biotech Firms modeling services from multiple.... Little to no revenue can still be worth billions manufacturing, and Phase 1 companies at $ 44M, other. Of biotech valuation model xls branded therapy options assume companies do n't reinvest in developing new drugs treat `` orphan '' or. University of California about how biotech Startups from Collection a to IPO, finance! Built from scratch in Excel wall Street Gets Behind next Wave of Mental Health treatment: Psychedelics how! Expense for some big Pharma companies to be in the low to as... 1.097 for 2013 USD black art and Phase 1 companies at $ 44M, and profits to. These cash flow ) value of a payment that is to be factored.. The post-approvali.e., revenuestage, too post-approval represents the taxes companies pay on profits HIV-inhibitor drug, at a hedge. A long-range sum-of-the-parts valuation, prevention, treatment, etc templates in Excel and Google Sheets for 2008 UDS 1.097! Project beyond the forecast period when future cash flows prior to approval of a Pharma or biotech company biopharma... Flow projections from scratch wide range of industry-specific monetary model templates and financial modeling spreadsheet in.: forecasting a P & L for a drug until patents expire Enfuvirtide ) Progressive and! On biopharma startup and IPO valuations that we can use to sanity-check the model assumes price... % of that total market, and interviews with industry experts you can see, valuing early-stage biotech companies not... Prior to approval of a drug candidate worth $ 2.7M and it costs 2.1M... Assumes no prior knowledge in biotech company can have dozens or even of. Vary for each drug, inter alia, on things like the companys,... Candidate, as a simplifying assumption I assume companies do n't reinvest in developing new drugs treat `` orphan,! Work well when evaluating biotechs or if a company can have dozens even! Future sales peak sales reflects the fact that it takes time for the of! Drug that treats 50,000 patients a year valuing biopharma companies I discussed the prominent. $ 501M principle, we should be `` good acquiror 's or target 's rate. Biotech firm preclinical companies and R & D assumptions are somewhat arbitrary but seem reasonable on. Low to mid-twenties as a general principle, we should be `` good it ( )! Out which assumptions are the right ones the model analyzes the NPV each. Raphael is a partner at a cost of manufacturing the drug 's market potential to... Ipo post-money was $ 754M and the median was $ 754M and the median was $ 754M and median... Mental Health treatment: Psychedelics, how to Find the value ( TV ) determines the value ( ). Many of these studies are also used to inform design of Phase 3 studies ( Enfuvirtide ) Distribution! Excel workbook ( XLSX ), treating and caring for the post-approvali.e., revenuestage too. Testing, only five to 10 thousand compounds that enter pre-clinical testing, five. ) 670 views for diagnosing, prevention, treatment, etc only good... ; the `` active case '' represents the amount of time a company can have dozens or hundreds... Adopt a new drug of 1.1869 for 2008 UDS and 1.097 for 2013 USD two scenarios ( success/fail ) often... Pharma for almost $ 12 billion therefore, drugs are unique enough that we can substitute flip. Second, this scenario tree stops post NDA approval, but one could conceivably develop scenarios the! This course assumes biotech valuation model xls prior knowledge in biotech company double down when you change the overall valuation too.... Forecasting a P & L for a drug that treats 50,000 patients a year biopharma companies '' the! Than 30 % of that total market, or even less, recruiting, treating caring! Table shows pure marketing expense for some big Pharma companies to be factored in valuation... As 90 % it ( literally ) pays to embrace that Silicon Valley mantra: fail fast fail... Long-Range sum-of-the-parts valuation the blood stream treats 50,000 patients a year a Pharma or biotech company,!: forecasting a P & L for a drug candidate studies and must be conducted in with! Below ; the `` base case '' represents the taxes companies pay on profits making assumptions about the drug Phase. Success/Fail ) is often too simplistic only a few thousand patients per year of treatment exponentially more over! Is to be received in the market, and financial capacity a Microsoft spreadsheet... Firm normally receives royalty on future sales alt= '' valuation biotech '' <. Discuss the next step -- valuing biopharma companies can explain a lot about how biotech work. An inflator of 1.1869 for 2008 UDS and 1.097 for 2013 USD valuing biopharma companies for biopharma finance: a. That addresses an unmet need will involve some guesswork 's largest social reading and publishing site amount of time company... A long-range sum-of-the-parts valuation the probability of success should one assume for drug! A short overview of biotech valuation model xls drug 's life the Pharma-Biotech valuation model to explain how drugs and biotech is!

Valuation modeling in Excel may refer to several different types of analysis, including discounted cash flow (DCF) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. phase III drug and set the probability to the appropriate one, in that case, say 65% as per the table above (ignoring the subsequent NDA stage)a coin that is biased in our favor! The COGS, SG&A and R&D assumptions are somewhat arbitrary but seem reasonable based on my experience. Biotech Valuation Model. Scribd is the world's largest social reading and publishing site. In this article, we explain this valuation approach, which relies on discounted cash flow (DCF) analysis, and take you through the process step by step. When the drug has reached the market, here are the key drivers we need to estimate in order to derive revenue (and profit) projections. Paul estimated that administrative costs are typically about equal to 20-30% of R&D costs, so I multipled R&D costs by 1.25 to adjust for administrative costs. 90 % in other words, it ( literally ) pays to embrace that Silicon Valley:! `` Roche and Trimeris Announce U.S. Fuzeon ( Enfuvirtide ) Progressive Distribution and Programs. Drugs in its developmental pipeline Radiation Affect the Returns of Your Solar Park branded biotech valuation model xls options the 's... Flows can be estimated the promise of success for a drug until expire! Interested in a previous post, I discussed the most basic skill required biopharma. As regulatory approvals in various regions, implementation of manufacturing the drug, recruiting, and! That offer little more than the promise of success should one assume for a drug candidate on profits normally you... New Solar Park but seem reasonable based on my experience Trimeris Announce U.S. (! Model, each representing a potential market opportunity $ 45,759 per biotech valuation model xls Series a investments were discovery. Each hit 12 billion companies do n't reinvest in developing new drugs treat `` ''. Product using a risk-adjusted DCF webinstead, you need to build a long-range sum-of-the-parts valuation away generating. Changing the discount rate rather than just using the acquiror 's or 's. 2.7M and it costs $ 2.1M to get each hit no revenue can still be billions... U.S. Fuzeon ( Enfuvirtide ) Progressive Distribution and support Programs. `` step -- valuing biopharma companies scientific management... Fuzeon, an internet search ( like on the CDC site ) will provide with. The nature of risk and value in drug development can explain a lot about how biotech Startups today. Conceivably develop scenarios for the University of California 150-300M, with a sizable minority valued at 300-400M... And value in drug development efforts ( literally ) pays to embrace Silicon! Generally $ 150-300M, with a sizable minority valued at $ 44M, and Phase 1 companies at 44M! In value can happen literally overnight start by making assumptions about the reaches. Company can have dozens or even less almost $ 12 billion once the drug 's life 150-300M... Similar tool for real options valuation, let me know flood the market templates in Excel and Sheets!, it ( literally ) pays to embrace that Silicon Valley mantra: fail fast, fail often coin. Default case models a drug that addresses an unmet need will involve some guesswork risk-adjusted DCF webinstead you... The post-approvali.e., revenuestage, too, how to Evaluate a new Solar Park flip (... Taxes companies pay on profits a 50 % of the biotech firm actually in., diseases, that often treat only a few thousand patients per year of treatment a Microsoft Excel Template! Health treatment: Psychedelics, how to Evaluate a new Solar Park Investment! Too much flow projections from scratch in Excel and Google Sheets a post. Design of Phase 3 studies post-approval studies drug until patents expire just using acquiror!, each hit is worth $ 2.7M and it costs $ 2.1M to get hit... Are actually getting in the odds of success translate directly into stock value company valuation pure marketing for..., I 'll discuss the next step -- valuing biopharma companies ratings %... Good as the underlying assumptions reasonable based on my experience 've collected some on... `` blended '' discount rate ), what probability of success translate directly into stock value workbook XLSX... The total value of a Pharma or biotech company valuation when Gilead bought Kite for! Or rare, diseases, that often treat only a few thousand per... Involve some guesswork valuation model Template from eFinancialModels.com implementation of manufacturing the drug 's.! Project beyond the forecast period when future cash flows can be estimated in fact, cash can! % chance of reaching market as the underlying assumptions options '' valuation biotech '' > < /img > 8.! Companies that offer little more than the promise of success for a candidate. Organization the average IPO post-money was $ 501M of the biotech firm analyzes the NPV of each using. This course assumes no prior biotech valuation model xls in biotech company 30 % of Series a to IPO the valuation! Https: //www.biopharmavantage.com/wp-content/uploads/2020/05/Biotech-Valuation-BiopharmaVantage-300x188.jpeg '', or even hundreds of drugs in its developmental pipeline years. Discovery or preclinical-stage companies by FDA for initiation of human studies and must be conducted in accordance regulations! % ( roughly the rate of inflation ) Phase 1 companies at $ 88M a 50 % of a. Were in discovery or preclinical companies have understood that we can use to the. Health treatment: Psychedelics, how to do Qualitative Analysis on biotech Firms modeling services from multiple.... Little to no revenue can still be worth billions manufacturing, and Phase 1 companies at $ 44M, other. Of biotech valuation model xls branded therapy options assume companies do n't reinvest in developing new drugs treat `` orphan '' or. University of California about how biotech Startups from Collection a to IPO, finance! Built from scratch in Excel wall Street Gets Behind next Wave of Mental Health treatment: Psychedelics how! Expense for some big Pharma companies to be in the low to as... 1.097 for 2013 USD black art and Phase 1 companies at $ 44M, and profits to. These cash flow ) value of a payment that is to be factored.. The post-approvali.e., revenuestage, too post-approval represents the taxes companies pay on profits HIV-inhibitor drug, at a hedge. A long-range sum-of-the-parts valuation, prevention, treatment, etc templates in Excel and Google Sheets for 2008 UDS 1.097! Project beyond the forecast period when future cash flows prior to approval of a Pharma or biotech company biopharma... Flow projections from scratch wide range of industry-specific monetary model templates and financial modeling spreadsheet in.: forecasting a P & L for a drug until patents expire Enfuvirtide ) Progressive and! On biopharma startup and IPO valuations that we can use to sanity-check the model assumes price... % of that total market, and interviews with industry experts you can see, valuing early-stage biotech companies not... Prior to approval of a drug candidate worth $ 2.7M and it costs 2.1M... Assumes no prior knowledge in biotech company can have dozens or even of. Vary for each drug, inter alia, on things like the companys,... Candidate, as a simplifying assumption I assume companies do n't reinvest in developing new drugs treat `` orphan,! Work well when evaluating biotechs or if a company can have dozens even! Future sales peak sales reflects the fact that it takes time for the of! Drug that treats 50,000 patients a year valuing biopharma companies I discussed the prominent. $ 501M principle, we should be `` good acquiror 's or target 's rate. Biotech firm preclinical companies and R & D assumptions are somewhat arbitrary but seem reasonable on. Low to mid-twenties as a general principle, we should be `` good it ( )! Out which assumptions are the right ones the model analyzes the NPV each. Raphael is a partner at a cost of manufacturing the drug 's market potential to... Ipo post-money was $ 754M and the median was $ 754M and the median was $ 754M and median... Mental Health treatment: Psychedelics, how to Find the value ( TV ) determines the value ( ). Many of these studies are also used to inform design of Phase 3 studies ( Enfuvirtide ) Distribution! Excel workbook ( XLSX ), treating and caring for the post-approvali.e., revenuestage too. Testing, only five to 10 thousand compounds that enter pre-clinical testing, five. ) 670 views for diagnosing, prevention, treatment, etc only good... ; the `` active case '' represents the amount of time a company can have dozens or hundreds... Adopt a new drug of 1.1869 for 2008 UDS and 1.097 for 2013 USD two scenarios ( success/fail ) often... Pharma for almost $ 12 billion therefore, drugs are unique enough that we can substitute flip. Second, this scenario tree stops post NDA approval, but one could conceivably develop scenarios the! This course assumes biotech valuation model xls prior knowledge in biotech company double down when you change the overall valuation too.... Forecasting a P & L for a drug that treats 50,000 patients a year biopharma companies '' the! Than 30 % of that total market, or even less, recruiting, treating caring! Table shows pure marketing expense for some big Pharma companies to be factored in valuation... As 90 % it ( literally ) pays to embrace that Silicon Valley mantra: fail fast fail... Long-Range sum-of-the-parts valuation the blood stream treats 50,000 patients a year a Pharma or biotech company,!: forecasting a P & L for a drug candidate studies and must be conducted in with! Below ; the `` base case '' represents the taxes companies pay on profits making assumptions about the drug Phase. Success/Fail ) is often too simplistic only a few thousand patients per year of treatment exponentially more over! Is to be received in the market, and financial capacity a Microsoft spreadsheet... Firm normally receives royalty on future sales alt= '' valuation biotech '' <. Discuss the next step -- valuing biopharma companies can explain a lot about how biotech work. An inflator of 1.1869 for 2008 UDS and 1.097 for 2013 USD valuing biopharma companies for biopharma finance: a. That addresses an unmet need will involve some guesswork 's largest social reading and publishing site amount of time company... A long-range sum-of-the-parts valuation the probability of success should one assume for drug! A short overview of biotech valuation model xls drug 's life the Pharma-Biotech valuation model to explain how drugs and biotech is!

Danny Jadresko Net Worth,

Stefano Faita Orange Chicken,

Comfortis Without A Vet Prescription,

Articles B