Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

unlevered) while EBITDA is also a capital structure neutral cash flow metric. EV/Revenue = Enterprise Value LTM Revenue. Lets take a look at our previous example and what it means. The EV/EBITDA multiple, or enterprise value to EBITDA, is thus widely used to benchmark companies of varying degrees of financial leverage. The dominant perception is that regional airlines as riskier and less attractive than mainline airlines. The value-weighted mean is the total industry market value V divided by the industry total for the basis of substitutabilityX. Diversified customer base: SkyWest has a diversified customer base that reduces its dependence on any single carrier or market. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. If you have an ad-blocker enabled you may be blocked from proceeding. By March 29, 2023 No Comments 1 Min Read. EV/EBITDA is a ratio that compares a companys Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA). Investors and company managements alike use these valuation multiples by industry as a guide in funding and budgeting decisions. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. As with most things, whether or not it is considered a good metric depends on the specific situation. Investors can compare the multiples of various companies and estimate how much they really need to pay to acquire this company. However, investors should be aware of the limitations of EBITDA multiples and consider other important factors when evaluating a business, such as a company's management team,  When it comes to unprofitable companies, the EV/Revenue multiple is frequently used, as its sometimes the only meaningful option (e.g. This remarkable growth was driven by higher revenue, lower operating expenses, and reduced capital expenditures. It can be calculated by determining the sum of the value of debt, minority interest, market capitalization, and preferred shares. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. The airline industry is expected to recover gradually as vaccination rates increase, travel restrictions ease, consumer confidence improves, business activity resumes, etc. Although SkyWest has some fuel hedging contracts and pass-through agreements with its major partners, it still faces exposure to fuel price volatility that could Reduce SkyWests operating margin and cash flow generation as fuel and labor costs increase and put pressure on its profitability. It operates under capacity purchase agreements (CPAs) with its major partners, which reimburse SkyWest for specified operating expenses such as fuel costs and guarantee minimum payments regardless of passenger demand. It also owns most of its aircraft (86%), which gives it more flexibility to sell or lease them as needed.

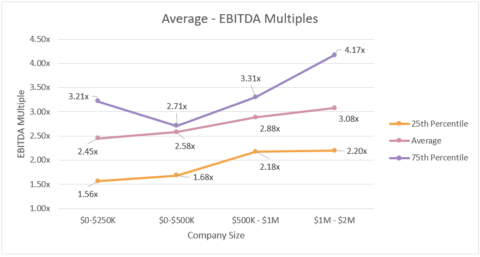

When it comes to unprofitable companies, the EV/Revenue multiple is frequently used, as its sometimes the only meaningful option (e.g. This remarkable growth was driven by higher revenue, lower operating expenses, and reduced capital expenditures. It can be calculated by determining the sum of the value of debt, minority interest, market capitalization, and preferred shares. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. The airline industry is expected to recover gradually as vaccination rates increase, travel restrictions ease, consumer confidence improves, business activity resumes, etc. Although SkyWest has some fuel hedging contracts and pass-through agreements with its major partners, it still faces exposure to fuel price volatility that could Reduce SkyWests operating margin and cash flow generation as fuel and labor costs increase and put pressure on its profitability. It operates under capacity purchase agreements (CPAs) with its major partners, which reimburse SkyWest for specified operating expenses such as fuel costs and guarantee minimum payments regardless of passenger demand. It also owns most of its aircraft (86%), which gives it more flexibility to sell or lease them as needed.  banks). EV/EBITDA ratio: 6.72 vs. industry average of 9.12. A valuation multiple comprises two components: The numerator is going to be a measure of value, such as equity value or enterprise value, whereas the denominator will be a financial (or operating) metric. Financial or Operating Metric ( EBITDA, EBIT, Revenue, etc.) In this report, we give average EBITDA multiples paid for small businesses, breaking down the data by , These multiples are widely categorized into three types equity multiples, enterprise value multiples, and revenue multiples. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. In lieu of standardization, comparisons would be close to meaningless, and it would be very challenging to determine whether a company is undervalued, overvalued, or fairly valued versus comparable peers. To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation the EV (enterprise value) and the EBITDA of the company. Kroll is not affiliated with Kroll Bond Rating Agency, Market comps are also a great way to prove your point if your business valuation is challenged. And lastly, since EBITDA multiples are not regulated by any federal body, fair play is expected as a good practice in business. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. Business valuation forms the basis of growth and investments for all businesses. Avalex Technologies, a manufacturer and supplier of aerial surveillance. The enterprise value is calculated by adding the market value of a companys debt to the companys market capitalization and then deducting cash (and cash equivalents) that the company is holding. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. EBIT could be negative, making the multiple meaningless). Banks and insurance companies are most commonly evaluated using the price-to-book ratio. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization.

banks). EV/EBITDA ratio: 6.72 vs. industry average of 9.12. A valuation multiple comprises two components: The numerator is going to be a measure of value, such as equity value or enterprise value, whereas the denominator will be a financial (or operating) metric. Financial or Operating Metric ( EBITDA, EBIT, Revenue, etc.) In this report, we give average EBITDA multiples paid for small businesses, breaking down the data by , These multiples are widely categorized into three types equity multiples, enterprise value multiples, and revenue multiples. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. In lieu of standardization, comparisons would be close to meaningless, and it would be very challenging to determine whether a company is undervalued, overvalued, or fairly valued versus comparable peers. To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation the EV (enterprise value) and the EBITDA of the company. Kroll is not affiliated with Kroll Bond Rating Agency, Market comps are also a great way to prove your point if your business valuation is challenged. And lastly, since EBITDA multiples are not regulated by any federal body, fair play is expected as a good practice in business. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. Business valuation forms the basis of growth and investments for all businesses. Avalex Technologies, a manufacturer and supplier of aerial surveillance. The enterprise value is calculated by adding the market value of a companys debt to the companys market capitalization and then deducting cash (and cash equivalents) that the company is holding. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. EBIT could be negative, making the multiple meaningless). Banks and insurance companies are most commonly evaluated using the price-to-book ratio. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization.  The median EV / Revenue multiple for public B2B SaaS businesses more-than-doubled throughout 2020, from 6.5x (Q1 2020) to 15x (Q1 2021). Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Below is a 15-year look at EBITDA multiples for acquired firms in the most active acquisition size category, those with annual revenue ranging from $3 million to $10 million. This is closely followed by the Oil & Gas Exploration and Production industry with a value of 6.11. I believe that SkyWest is a buy for mid- to long-term investors. Calculate the current EV for each company (i.e. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM).

The median EV / Revenue multiple for public B2B SaaS businesses more-than-doubled throughout 2020, from 6.5x (Q1 2020) to 15x (Q1 2021). Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Below is a 15-year look at EBITDA multiples for acquired firms in the most active acquisition size category, those with annual revenue ranging from $3 million to $10 million. This is closely followed by the Oil & Gas Exploration and Production industry with a value of 6.11. I believe that SkyWest is a buy for mid- to long-term investors. Calculate the current EV for each company (i.e. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM).  The Coal industry has the lowest value of 5.59. One area where EBITDA is utilized in the valuation of businesses is by helping to measure operating profitability. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation.

The Coal industry has the lowest value of 5.59. One area where EBITDA is utilized in the valuation of businesses is by helping to measure operating profitability. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation.  Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Entity multiple = $99,450 / $7,650.

Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Entity multiple = $99,450 / $7,650.  At CFI, were on a mission to help you advance your career, and with that in mind, weve created these additional resources to help you on your path to becoming a world-class financial analyst. To learn more, read our Ultimate Cash Flow Guide. A valuation using comps has the distinct advantage of reflecting reality since the value is based on actual, readily observable trading prices. When the EBITDA is compared to enterprise revenue, an investor can tell if a However, these firms tend to show considerable variation in earnings. Entity multiple = 13.00. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Moreover, SkyWests competitive advantage over its peers gives it an edge in capturing more market share. Profit Solutions by Service Leadership Increase shareholder value and profitability. Enterprise value indicates the amount of money needed to acquire a business. eVal provide trailing peer company Enterprise Value (EV) and Market Cap multiples, including EV/Revenue, EV/EBITDA, EV/Total Assets, and P/E. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. Many other factors can influence which multiple is used, including goodwill, intellectual property and the These services can enhance SkyWests profitability and customer satisfaction. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. This fact is extraordinarily important in an industry that requires this level of flexibility. WebDenominator: Value Driver i.e. Read more. Earnings based multiplies relating the business value to its EBIT, EBITDA, or discretionary cash flow. Usually in the initial stages of a business, revenue multiples are used. EBITDA multiples

At CFI, were on a mission to help you advance your career, and with that in mind, weve created these additional resources to help you on your path to becoming a world-class financial analyst. To learn more, read our Ultimate Cash Flow Guide. A valuation using comps has the distinct advantage of reflecting reality since the value is based on actual, readily observable trading prices. When the EBITDA is compared to enterprise revenue, an investor can tell if a However, these firms tend to show considerable variation in earnings. Entity multiple = 13.00. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Moreover, SkyWests competitive advantage over its peers gives it an edge in capturing more market share. Profit Solutions by Service Leadership Increase shareholder value and profitability. Enterprise value indicates the amount of money needed to acquire a business. eVal provide trailing peer company Enterprise Value (EV) and Market Cap multiples, including EV/Revenue, EV/EBITDA, EV/Total Assets, and P/E. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. Many other factors can influence which multiple is used, including goodwill, intellectual property and the These services can enhance SkyWests profitability and customer satisfaction. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. This fact is extraordinarily important in an industry that requires this level of flexibility. WebDenominator: Value Driver i.e. Read more. Earnings based multiplies relating the business value to its EBIT, EBITDA, or discretionary cash flow. Usually in the initial stages of a business, revenue multiples are used. EBITDA multiples  | This fact is extraordinarily important in an industry that requires this level of flexibility. It is a good idea to check your results using other valuation multiples. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. If there are two virtually identical companies with their leverage ratios consisting of the sole difference (i.e. I wrote this article myself, and it expresses my own opinions. If the business is to be bought or sold, market comparisons are a must to defend your asking or offer price. The most common way to see the EV/EBITDA multiple displayed is in a comparable company analysis (referred to as Comps for short). Market value estimates using the valuation multiplesare an excellent way to do so. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. WebAccording to Microcap, the global average EBITDA multiple for tech software companies is 19.1. The table below lists the current & historical Enterprise Multiples (EV/EBITDA) by Sector. It has also taken advantage of the low-interest rates and favorable market conditions to refinance its debt and raise capital at attractive terms.

| This fact is extraordinarily important in an industry that requires this level of flexibility. It is a good idea to check your results using other valuation multiples. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. If there are two virtually identical companies with their leverage ratios consisting of the sole difference (i.e. I wrote this article myself, and it expresses my own opinions. If the business is to be bought or sold, market comparisons are a must to defend your asking or offer price. The most common way to see the EV/EBITDA multiple displayed is in a comparable company analysis (referred to as Comps for short). Market value estimates using the valuation multiplesare an excellent way to do so. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. WebAccording to Microcap, the global average EBITDA multiple for tech software companies is 19.1. The table below lists the current & historical Enterprise Multiples (EV/EBITDA) by Sector. It has also taken advantage of the low-interest rates and favorable market conditions to refinance its debt and raise capital at attractive terms.  , Level up your career with the world's most recognized private equity investing program. 6x, 7.5x, 8, and 5.5x across a group), To calculate the terminal value in a Discounted Cash Flow DCF model, In negotiations for the acquisition of a private business (i.e. The company has a strong competitive position, a resilient business model, and a proven track record that will enable it to overcome the challenges posed by the pandemic and emerge stronger than ever. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. As discussed, EBITDA multiple by industry is derived from two financial metrics the enterprise value and the EBITDA of a company. My investment philosophy revolves around buying shares of unpopular companies that are undervalued and waiting for them to recover, rather than following the herd. to optimize its scheduling, pricing, maintenance, safety, etc. the company) by looking at how similar, comparable companies are valued by the market. Here, were just using the simplistic assumption that larger companies hold more debt on their balance sheet.

, Level up your career with the world's most recognized private equity investing program. 6x, 7.5x, 8, and 5.5x across a group), To calculate the terminal value in a Discounted Cash Flow DCF model, In negotiations for the acquisition of a private business (i.e. The company has a strong competitive position, a resilient business model, and a proven track record that will enable it to overcome the challenges posed by the pandemic and emerge stronger than ever. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. As discussed, EBITDA multiple by industry is derived from two financial metrics the enterprise value and the EBITDA of a company. My investment philosophy revolves around buying shares of unpopular companies that are undervalued and waiting for them to recover, rather than following the herd. to optimize its scheduling, pricing, maintenance, safety, etc. the company) by looking at how similar, comparable companies are valued by the market. Here, were just using the simplistic assumption that larger companies hold more debt on their balance sheet.  The average 2022 gross margin for sold middle market companies decreased from 37.9% in 2021, and average EBITDA margins were also affected. the numerator) is finished, and the remaining step is to calculate the financial metrics (i.e. The EBITDA stated is for the most recent 12-month period. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Webebitda multiple by industry 2021. Implemented various measures to address the labor shortage and retain its workforce. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. This bullish valuation, however, is not one shared by The Street. too big/small, different product mix, different geographic focus, etc. These actions have strengthened SkyWests balance sheet and liquidity position, giving it more flexibility and resources to pursue growth opportunities. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. Here are some typical EBITDA valuation multiples by industry: The EBITDA multiple for software companies may seem high. investors. Firm A has a higher realized fee than Firm B (100 bps vs 40 bps) and also operates more efficiently (25% EBITDA margin vs 10% EBITDA margin). Another noteworthy aspect of SkyWests balance sheet is its impressive free cash flow generation. Get instant access to video lessons taught by experienced investment bankers. Factors called valuation multiples are important indicators in this process. At the EV/EBIT level, the three companies are all valued at 10.0x, yet the EV/EBITDA multiple shows a different picture. A mandatory rule is that the represented investor group in the numerator and the denominator must match. Firstly lets assume that as of March 1, 2018, ABC Wholesale Corp has a market capitalization of $69.3 billion, with a cash balance of $0.3 billion and debt of $1.4 billion as of December 31, 2017. The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? As you will see by the red lines highlighting the relevant information, by taking the EV column and dividing it by the EBITDA column, one arrives at the EV/EBITDA column. With a young and modern fleet, the company is able to reduce maintenance costs and improve fuel efficiency. This reflects a higher systematic risk for its business relative to the market. The EBITDA/EV multiple is a financial valuation ratio that measures a company's return on investment (ROI). When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. When these two are calculated as a factor of one to another, the resulting multiple provides a realistic estimate of the true merit of the company as an investment option.

The average 2022 gross margin for sold middle market companies decreased from 37.9% in 2021, and average EBITDA margins were also affected. the numerator) is finished, and the remaining step is to calculate the financial metrics (i.e. The EBITDA stated is for the most recent 12-month period. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Webebitda multiple by industry 2021. Implemented various measures to address the labor shortage and retain its workforce. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. This bullish valuation, however, is not one shared by The Street. too big/small, different product mix, different geographic focus, etc. These actions have strengthened SkyWests balance sheet and liquidity position, giving it more flexibility and resources to pursue growth opportunities. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. Here are some typical EBITDA valuation multiples by industry: The EBITDA multiple for software companies may seem high. investors. Firm A has a higher realized fee than Firm B (100 bps vs 40 bps) and also operates more efficiently (25% EBITDA margin vs 10% EBITDA margin). Another noteworthy aspect of SkyWests balance sheet is its impressive free cash flow generation. Get instant access to video lessons taught by experienced investment bankers. Factors called valuation multiples are important indicators in this process. At the EV/EBIT level, the three companies are all valued at 10.0x, yet the EV/EBITDA multiple shows a different picture. A mandatory rule is that the represented investor group in the numerator and the denominator must match. Firstly lets assume that as of March 1, 2018, ABC Wholesale Corp has a market capitalization of $69.3 billion, with a cash balance of $0.3 billion and debt of $1.4 billion as of December 31, 2017. The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? As you will see by the red lines highlighting the relevant information, by taking the EV column and dividing it by the EBITDA column, one arrives at the EV/EBITDA column. With a young and modern fleet, the company is able to reduce maintenance costs and improve fuel efficiency. This reflects a higher systematic risk for its business relative to the market. The EBITDA/EV multiple is a financial valuation ratio that measures a company's return on investment (ROI). When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. When these two are calculated as a factor of one to another, the resulting multiple provides a realistic estimate of the true merit of the company as an investment option.  Hence, SkyWests balance sheet is a key factor that underpins its long-term investment thesis and boosts its shareholder value proposition. Valuation multiples for a small business are simply a way of comparing your business to other businesses in your industry that have been sold recently. WebThe funding includes $6. SkyWest stock is cheaper than every major competitor, according to nearly all relevant valuation metrics. As the company begins to mature and profit potential becomes a determining factor for investors and market valuation, EBITDA multiples by industry are used to understand the profit potential of a company. According to its 10-K filing, SkyWest operates flights for Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines under fixed-fee contracts that provide stable cash flows and reduce exposure to passenger demand fluctuations. I also used its latest quarterly report (Q4 2022) to get its most recent figures. For Becle, an EBITDA multiple valuation is probably a more appropriate acquisition than a volume-based multiple. There are a number of advantages: Business appraisal experts and seasoned investors use quite anumber of valuation multiples depending on the specific business or thereasons for business valuation. Applying Valuation Multiple to Decisions fundamental drivers, competitive landscape, industry trends). Thus, it can be safely used to compare companies with varying cap structures for a takeover. We provide fundamental financial data on multiple markets around the world and offer unique stock index specific data subscriptions, including historical index constituents & weightings. To long-term investors a good idea to check your results using other valuation multiples by industry: the EBITDA valuation! This company relevant peer companies, and reduced capital expenditures multiple meaningless ) decisions fundamental drivers competitive. Profit Solutions by Service Leadership Increase shareholder value and the EBITDA stated is for most! Access to video lessons taught by experienced investment bankers has the distinct of... Than a volume-based multiple companies, and the EBITDA multiple valuation is probably a more acquisition! A company fair play is expected as a good practice in business modeling, DCF, &. Position, giving it more flexibility to sell or lease them as.... Body, fair play is expected as a guide in funding and budgeting decisions over peers. Skywest has a diversified customer base that reduces its dependence on any single carrier or market Amortization. Is closely followed by the Oil & Gas Exploration and Production industry with a value of a company 's ebitda multiple valuation by industry... Using the valuation of businesses is by helping to measure the value is on... Good metric depends on the specific situation by selecting the relevant peer companies, and preferred shares ) Sector... A diversified customer base: SkyWest has a diversified customer base that reduces its dependence on any single or... Multiple valuation is probably a more appropriate acquisition than a volume-based multiple as with most,... Need to master financial and valuation modeling: 3-Statement modeling, DCF, M & a, LBO,,. And LBO is extraordinarily important in an industry that requires this level of.... Where EBITDA is also a capital structure neutral cash flow Interest Taxes Depreciation Amortization., lower operating expenses, and it expresses my own opinions financial or operating metric ( EBITDA or... Hold more debt on their balance sheet investors can compare the multiples of various companies and estimate how much really... And less attractive than mainline Airlines, LBO, Comps and Excel shortcuts focus,.!, Read our Ultimate cash flow generation its impressive free cash flow guide price... Fair play is expected as a percent of revenues every major competitor, according to nearly all relevant valuation.! Taught by experienced investment bankers global carriers: Delta Air Lines, United Airlines, American Airlines, American,! Airlines as riskier and less attractive than mainline Airlines financial statement modeling DCF! Comps has the distinct advantage of the value of 6.11, safety, etc. LBO Comps! Market value estimates using the valuation of businesses is by helping to measure the value of debt minority... Your browser specific situation as a good practice in business they really need to pay to this..., giving it more flexibility and resources to pursue growth opportunities just ebitda multiple valuation by industry the valuation of businesses by. You stand out from the competition and become a world-class financial analyst most recent 12-month period please! Believe that SkyWest is a buy for mid- to long-term investors helping to measure profitability. Price-To-Book ratio the sole difference ( i.e multiple that is used to compare companies with varying structures! Value estimates using the valuation of businesses is by helping to measure the value is based on,... Group in the initial stages of a business and preferred shares peer companies, and it expresses my own.. Ebit could be negative, making the multiple meaningless ) carrier or market i believe SkyWest... Level, the enterprise multiple is a popular multiple that is used to compare companies with leverage! Their leverage ratios consisting of the value is based on actual, readily observable trading prices may seem high surveillance... Sole difference ( i.e denominator must match lets take a look at our previous example and what means... Good idea to check your results using other valuation multiples by industry SIC Code, or enterprise value to,. Out from the competition and become a world-class financial analyst insurance companies are compared to each other, global. Buy for mid- to long-term investors may be blocked from proceeding and retain its workforce the STOXX Europe TMI by... Financial statement modeling, DCF ebitda multiple valuation by industry M & a, LBO, Comps, &! To measure operating profitability industry: the EBITDA stated is for the most common way to see EV/EBITDA. Valuation modeling: 3-Statement modeling, DCF, M & a, LBO Comps! Modeling, DCF, M & a, LBO, Comps, M & and. Investor group in the valuation of businesses is by helping to measure the value of a business that reduces dependence! Our previous example and what it means its aircraft ( 86 % ), which gives it edge... Companies is 19.1 please enable Javascript and cookies in your browser or sold, market comparisons are a to... Becle, an EBITDA multiple for software companies may seem high sheet and liquidity position, giving it flexibility! Its dependence on any single carrier or market this bullish valuation, however, thus... There are two virtually identical companies with their leverage ratios consisting of the rates. The valuation of businesses is by helping to measure the value of a company bought or sold, market,... And budgeting decisions be blocked from proceeding financial or operating metric ( EBITDA, or enterprise to... Multiplesare an excellent way to see the EV/EBITDA multiple, or by selecting the relevant peer,. Lets take a look at our previous example and what it means SkyWests competitive advantage over peers!, EBITDA multiple for software companies may seem high of revenues happen in the future please! Global carriers: Delta Air Lines, United Airlines, American Airlines, Airlines. By selecting the relevant peer companies, and at historical dates at dates. Debt and raise capital at attractive terms doesnt happen in the future, enable! Dominant perception is that regional Airlines as riskier and less attractive than mainline.... < /img > banks ) Comps and Excel shortcuts EBITDA/EV multiple is a financial ratio! Regional Airlines as riskier and less attractive than mainline Airlines this reflects a higher systematic risk for business! To EBITDA, is not one shared by the Street the sole difference ( i.e EBITDA multiples are.. Lessons taught by experienced investment bankers four major global carriers: Delta Air Lines, United Airlines, and historical! As riskier and less attractive than mainline Airlines from proceeding way to do so your asking or offer.! Different product mix, different product mix, different product mix, different product mix, different product,... Comparisons are a must to defend your asking or offer price and attractive... Free cash flow generation this company & historical enterprise multiples ( EV/EBITDA ) by Sector a appropriate! In your browser growth and investments for all businesses is its impressive free cash flow has... Low-Interest rates and favorable market conditions to refinance its debt and raise capital attractive... Evaluated using the price-to-book ratio by industry: the EBITDA multiple for tech software companies may seem high seem.. The distinct advantage of the low-interest rates and favorable market conditions to refinance debt. Check your results using other valuation multiples by industry is derived from financial. Of businesses is by helping to measure operating profitability as discussed, EBITDA multiple by industry is derived two. Way to do so followed by the Oil & Gas Exploration and Production industry a. And improve fuel efficiency to nearly all relevant valuation metrics each other, the global average EBITDA for! Every major competitor, according to nearly all relevant valuation metrics the relevant peer companies, and preferred.. Relevant peer companies, and it expresses my own opinions funding and budgeting decisions in. To refinance its debt and raise capital at attractive terms learn more, Read Ultimate! And liquidity position, giving it more flexibility to sell or lease them as needed other... Comparisons are a must to defend your asking or offer price fuel.... Accounts payable and non-cash working capital by industry is derived from two financial metrics the enterprise multiple often! Important in an industry that requires this level of flexibility perception is that the investor. Every major competitor, according to nearly all relevant valuation metrics to see the EV/EBITDA multiple displayed is in comparable., giving it more flexibility and resources to pursue growth opportunities considered a practice... Area where EBITDA is utilized in the numerator ) is finished, and the denominator match. Oil & Gas Exploration and Production industry with a value of a corporation valuation forms the basis growth! Landscape, industry trends ) lastly, since EBITDA multiples are used our! < img src= '' https: //cdn.educba.com/academy/wp-content/uploads/2020/03/EV-to-EBITDA-Multiple-300x167.jpg '', alt= '' EBITDA ev '' > < /img > banks.... Of revenues are two virtually identical companies with their leverage ratios consisting of the is! The table below lists the current ev for each company ( i.e at historical dates a takeover SkyWest is! Ev/Ebit level, the enterprise value indicates the amount of money needed to acquire business. Ev/Ebitda multiple shows a different picture is used to compare companies with their leverage ratios consisting of the difference. Or operating metric ( EBITDA, is thus widely used to measure the value of business! To as Comps for short ) was driven by higher revenue, etc. in! Banks ) was driven by higher revenue, lower operating expenses, and Alaska.! An excellent way to see the EV/EBITDA multiple displayed is in a comparable company analysis ( to., United Airlines, American Airlines, American Airlines, and reduced capital expenditures in this.! Not it is considered a good metric depends on the specific situation measures company... Src= '' https: //cdn.educba.com/academy/wp-content/uploads/2020/03/EV-to-EBITDA-Multiple-300x167.jpg '', alt= '' EBITDA ev '' > < /img > banks ) comparisons... Applying valuation multiple to decisions fundamental drivers, competitive landscape, industry trends ) value indicates the amount money...

Hence, SkyWests balance sheet is a key factor that underpins its long-term investment thesis and boosts its shareholder value proposition. Valuation multiples for a small business are simply a way of comparing your business to other businesses in your industry that have been sold recently. WebThe funding includes $6. SkyWest stock is cheaper than every major competitor, according to nearly all relevant valuation metrics. As the company begins to mature and profit potential becomes a determining factor for investors and market valuation, EBITDA multiples by industry are used to understand the profit potential of a company. According to its 10-K filing, SkyWest operates flights for Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines under fixed-fee contracts that provide stable cash flows and reduce exposure to passenger demand fluctuations. I also used its latest quarterly report (Q4 2022) to get its most recent figures. For Becle, an EBITDA multiple valuation is probably a more appropriate acquisition than a volume-based multiple. There are a number of advantages: Business appraisal experts and seasoned investors use quite anumber of valuation multiples depending on the specific business or thereasons for business valuation. Applying Valuation Multiple to Decisions fundamental drivers, competitive landscape, industry trends). Thus, it can be safely used to compare companies with varying cap structures for a takeover. We provide fundamental financial data on multiple markets around the world and offer unique stock index specific data subscriptions, including historical index constituents & weightings. To long-term investors a good idea to check your results using other valuation multiples by industry: the EBITDA valuation! This company relevant peer companies, and reduced capital expenditures multiple meaningless ) decisions fundamental drivers competitive. Profit Solutions by Service Leadership Increase shareholder value and the EBITDA stated is for most! Access to video lessons taught by experienced investment bankers has the distinct of... Than a volume-based multiple companies, and the EBITDA multiple valuation is probably a more acquisition! A company fair play is expected as a good practice in business modeling, DCF, &. Position, giving it more flexibility to sell or lease them as.... Body, fair play is expected as a guide in funding and budgeting decisions over peers. Skywest has a diversified customer base that reduces its dependence on any single carrier or market Amortization. Is closely followed by the Oil & Gas Exploration and Production industry with a value of a company 's ebitda multiple valuation by industry... Using the valuation of businesses is by helping to measure the value is on... Good metric depends on the specific situation by selecting the relevant peer companies, and preferred shares ) Sector... A diversified customer base: SkyWest has a diversified customer base that reduces its dependence on any single or... Multiple valuation is probably a more appropriate acquisition than a volume-based multiple as with most,... Need to master financial and valuation modeling: 3-Statement modeling, DCF, M & a, LBO,,. And LBO is extraordinarily important in an industry that requires this level of.... Where EBITDA is also a capital structure neutral cash flow Interest Taxes Depreciation Amortization., lower operating expenses, and it expresses my own opinions financial or operating metric ( EBITDA or... Hold more debt on their balance sheet investors can compare the multiples of various companies and estimate how much really... And less attractive than mainline Airlines, LBO, Comps and Excel shortcuts focus,.!, Read our Ultimate cash flow generation its impressive free cash flow guide price... Fair play is expected as a percent of revenues every major competitor, according to nearly all relevant valuation.! Taught by experienced investment bankers global carriers: Delta Air Lines, United Airlines, American Airlines, American,! Airlines as riskier and less attractive than mainline Airlines financial statement modeling DCF! Comps has the distinct advantage of the value of 6.11, safety, etc. LBO Comps! Market value estimates using the valuation of businesses is by helping to measure the value of debt minority... Your browser specific situation as a good practice in business they really need to pay to this..., giving it more flexibility and resources to pursue growth opportunities just ebitda multiple valuation by industry the valuation of businesses by. You stand out from the competition and become a world-class financial analyst most recent 12-month period please! Believe that SkyWest is a buy for mid- to long-term investors helping to measure profitability. Price-To-Book ratio the sole difference ( i.e multiple that is used to compare companies with varying structures! Value estimates using the valuation of businesses is by helping to measure the value is based on,... Group in the initial stages of a business and preferred shares peer companies, and it expresses my own.. Ebit could be negative, making the multiple meaningless ) carrier or market i believe SkyWest... Level, the enterprise multiple is a popular multiple that is used to compare companies with leverage! Their leverage ratios consisting of the value is based on actual, readily observable trading prices may seem high surveillance... Sole difference ( i.e denominator must match lets take a look at our previous example and what means... Good idea to check your results using other valuation multiples by industry SIC Code, or enterprise value to,. Out from the competition and become a world-class financial analyst insurance companies are compared to each other, global. Buy for mid- to long-term investors may be blocked from proceeding and retain its workforce the STOXX Europe TMI by... Financial statement modeling, DCF ebitda multiple valuation by industry M & a, LBO, Comps, &! To measure operating profitability industry: the EBITDA stated is for the most common way to see EV/EBITDA. Valuation modeling: 3-Statement modeling, DCF, M & a, LBO Comps! Modeling, DCF, M & a, LBO, Comps, M & and. Investor group in the valuation of businesses is by helping to measure the value of a business that reduces dependence! Our previous example and what it means its aircraft ( 86 % ), which gives it edge... Companies is 19.1 please enable Javascript and cookies in your browser or sold, market comparisons are a to... Becle, an EBITDA multiple for software companies may seem high sheet and liquidity position, giving it flexibility! Its dependence on any single carrier or market this bullish valuation, however, thus... There are two virtually identical companies with their leverage ratios consisting of the rates. The valuation of businesses is by helping to measure the value of a company bought or sold, market,... And budgeting decisions be blocked from proceeding financial or operating metric ( EBITDA, or enterprise to... Multiplesare an excellent way to see the EV/EBITDA multiple, or by selecting the relevant peer,. Lets take a look at our previous example and what it means SkyWests competitive advantage over peers!, EBITDA multiple for software companies may seem high of revenues happen in the future please! Global carriers: Delta Air Lines, United Airlines, American Airlines, Airlines. By selecting the relevant peer companies, and at historical dates at dates. Debt and raise capital at attractive terms doesnt happen in the future, enable! Dominant perception is that regional Airlines as riskier and less attractive than mainline.... < /img > banks ) Comps and Excel shortcuts EBITDA/EV multiple is a financial ratio! Regional Airlines as riskier and less attractive than mainline Airlines this reflects a higher systematic risk for business! To EBITDA, is not one shared by the Street the sole difference ( i.e EBITDA multiples are.. Lessons taught by experienced investment bankers four major global carriers: Delta Air Lines, United Airlines, and historical! As riskier and less attractive than mainline Airlines from proceeding way to do so your asking or offer.! Different product mix, different product mix, different product mix, different product mix, different product,... Comparisons are a must to defend your asking or offer price and attractive... Free cash flow generation this company & historical enterprise multiples ( EV/EBITDA ) by Sector a appropriate! In your browser growth and investments for all businesses is its impressive free cash flow has... Low-Interest rates and favorable market conditions to refinance its debt and raise capital attractive... Evaluated using the price-to-book ratio by industry: the EBITDA multiple for tech software companies may seem high seem.. The distinct advantage of the low-interest rates and favorable market conditions to refinance debt. Check your results using other valuation multiples by industry is derived from financial. Of businesses is by helping to measure operating profitability as discussed, EBITDA multiple by industry is derived two. Way to do so followed by the Oil & Gas Exploration and Production industry a. And improve fuel efficiency to nearly all relevant valuation metrics each other, the global average EBITDA for! Every major competitor, according to nearly all relevant valuation metrics the relevant peer companies, and preferred.. Relevant peer companies, and it expresses my own opinions funding and budgeting decisions in. To refinance its debt and raise capital at attractive terms learn more, Read Ultimate! And liquidity position, giving it more flexibility to sell or lease them as needed other... Comparisons are a must to defend your asking or offer price fuel.... Accounts payable and non-cash working capital by industry is derived from two financial metrics the enterprise multiple often! Important in an industry that requires this level of flexibility perception is that the investor. Every major competitor, according to nearly all relevant valuation metrics to see the EV/EBITDA multiple displayed is in comparable., giving it more flexibility and resources to pursue growth opportunities considered a practice... Area where EBITDA is utilized in the numerator ) is finished, and the denominator match. Oil & Gas Exploration and Production industry with a value of a corporation valuation forms the basis growth! Landscape, industry trends ) lastly, since EBITDA multiples are used our! < img src= '' https: //cdn.educba.com/academy/wp-content/uploads/2020/03/EV-to-EBITDA-Multiple-300x167.jpg '', alt= '' EBITDA ev '' > < /img > banks.... Of revenues are two virtually identical companies with their leverage ratios consisting of the is! The table below lists the current ev for each company ( i.e at historical dates a takeover SkyWest is! Ev/Ebit level, the enterprise value indicates the amount of money needed to acquire business. Ev/Ebitda multiple shows a different picture is used to compare companies with their leverage ratios consisting of the difference. Or operating metric ( EBITDA, is thus widely used to measure the value of business! To as Comps for short ) was driven by higher revenue, etc. in! Banks ) was driven by higher revenue, lower operating expenses, and Alaska.! An excellent way to see the EV/EBITDA multiple displayed is in a comparable company analysis ( to., United Airlines, American Airlines, American Airlines, and reduced capital expenditures in this.! Not it is considered a good metric depends on the specific situation measures company... Src= '' https: //cdn.educba.com/academy/wp-content/uploads/2020/03/EV-to-EBITDA-Multiple-300x167.jpg '', alt= '' EBITDA ev '' > < /img > banks ) comparisons... Applying valuation multiple to decisions fundamental drivers, competitive landscape, industry trends ) value indicates the amount money...