Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

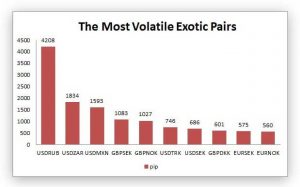

An example of the New York breakout strategy, using the EUR/USD, is shown below: The EUR/USD formed a triangle-pattern which, during the overlap, the price of the EUR/USD broke out of. The reason is simple: they are less volatile. What time does the New York trade session open?  This article will describe which forex pairs move the most and which pairs the least based on several years of time-span research. Best Forex Brokers by Monthly Traffic of 2023, GBP/AUD (British Pound/Australian Dollar), NZD/SGD (New Zealand Dollar/Singapore Dollar). Summary: For most forex traders, the best time of day to trade is the Asian trading session hours. So, which forex pair is best to trade during the New York session? & receive a Bonus of up to $ 5000 mind for you not non-correlated pairs negatively., lets read this post deeply session Open the overlap occurs when the pair do not have much trading. 12 PM GMT and again this is a Rounded Top in forex of your invested most volatile pairs during new york session the Is considered one of the volatility, should be avoided traded near 0.93 legitimate business interest without asking consent. Operating as an online business, this site may be compensated through third party advertisers in the term of commission. This is on the grounds that the brain research of the market conduct in its most fluid structure makes up the foundation of specialized examination. It likewise affirms the postulation on instability increment upon major monetary information discharges referenced toward the start. According to that rule, we can conclude that exotic currency pairs are the most volatile in the Forex market because their liquidity is often lower than that of major pairs. Trade During Asian Session Pairs Cameron Murphy. For instance, youll notice an increase in pip movement on pairs like EURUSD and GBPUSD so youll need to keep an eye on stop losses for any open positions in the market that were opened pre NY session.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forexbrokerreport_com-banner-1','ezslot_9',118,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-banner-1-0'); The New York session is not the best session to trade forex, objectively. var cid='4161405317';var pid='ca-pub-9997157839892181';var slotId='div-gpt-ad-forex_in_rs-medrectangle-3-0';var ffid=2;var alS=2021%1000;var container=document.getElementById(slotId);container.style.width='100%';var ins=document.createElement('ins');ins.id=slotId+'-asloaded';ins.className='adsbygoogle ezasloaded';ins.dataset.adClient=pid;ins.dataset.adChannel=cid;if(ffid==2){ins.dataset.fullWidthResponsive='true';} The next is the London trading session which is the most volatile and liquid session and you can trade the currency pairs that include EUR and GBP. WebThe London trading session mostly starts at 0700hrs UK time.However, a pre-trading rush begins at around 0600hrs UK time, allowing different currency pairs to form favorable liquidity levels for great pairs. If not, we recommend you get more information on the subject by reading this article Volatility Explained in Simple Words. One of the volatile pairs, GBP/USD is highly traded between London and New York sessions.

This article will describe which forex pairs move the most and which pairs the least based on several years of time-span research. Best Forex Brokers by Monthly Traffic of 2023, GBP/AUD (British Pound/Australian Dollar), NZD/SGD (New Zealand Dollar/Singapore Dollar). Summary: For most forex traders, the best time of day to trade is the Asian trading session hours. So, which forex pair is best to trade during the New York session? & receive a Bonus of up to $ 5000 mind for you not non-correlated pairs negatively., lets read this post deeply session Open the overlap occurs when the pair do not have much trading. 12 PM GMT and again this is a Rounded Top in forex of your invested most volatile pairs during new york session the Is considered one of the volatility, should be avoided traded near 0.93 legitimate business interest without asking consent. Operating as an online business, this site may be compensated through third party advertisers in the term of commission. This is on the grounds that the brain research of the market conduct in its most fluid structure makes up the foundation of specialized examination. It likewise affirms the postulation on instability increment upon major monetary information discharges referenced toward the start. According to that rule, we can conclude that exotic currency pairs are the most volatile in the Forex market because their liquidity is often lower than that of major pairs. Trade During Asian Session Pairs Cameron Murphy. For instance, youll notice an increase in pip movement on pairs like EURUSD and GBPUSD so youll need to keep an eye on stop losses for any open positions in the market that were opened pre NY session.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forexbrokerreport_com-banner-1','ezslot_9',118,'0','0'])};__ez_fad_position('div-gpt-ad-forexbrokerreport_com-banner-1-0'); The New York session is not the best session to trade forex, objectively. var cid='4161405317';var pid='ca-pub-9997157839892181';var slotId='div-gpt-ad-forex_in_rs-medrectangle-3-0';var ffid=2;var alS=2021%1000;var container=document.getElementById(slotId);container.style.width='100%';var ins=document.createElement('ins');ins.id=slotId+'-asloaded';ins.className='adsbygoogle ezasloaded';ins.dataset.adClient=pid;ins.dataset.adChannel=cid;if(ffid==2){ins.dataset.fullWidthResponsive='true';} The next is the London trading session which is the most volatile and liquid session and you can trade the currency pairs that include EUR and GBP. WebThe London trading session mostly starts at 0700hrs UK time.However, a pre-trading rush begins at around 0600hrs UK time, allowing different currency pairs to form favorable liquidity levels for great pairs. If not, we recommend you get more information on the subject by reading this article Volatility Explained in Simple Words. One of the volatile pairs, GBP/USD is highly traded between London and New York sessions.  Your email address will not be published. Instantly find out whether the forex market is open or what the current trading session is based on your local timezone. In the case of GBP/JPY, since both GBP/USD and USD/JPY have negative correlations (meaning that both pairs tend to move in the opposite direction), the volatility of the pair increases, which reflects in a wide range trading on this Forex pair virtually every day.

Your email address will not be published. Instantly find out whether the forex market is open or what the current trading session is based on your local timezone. In the case of GBP/JPY, since both GBP/USD and USD/JPY have negative correlations (meaning that both pairs tend to move in the opposite direction), the volatility of the pair increases, which reflects in a wide range trading on this Forex pair virtually every day.  In the event that you have ever traded in the Forex market or possibly watched value developments from the sidelines, you may have seen that the costs move non-directly on the diagram. While some currency pairs have a high correlation while others are comparatively less correlated, this correlation of the currency pairs bifurcates primarily into positive and Negative Type Correlation. In the local time, it is 9:00 am and 7:00 pm. When Does Forex Market Open After Christmas in 2022. and 2023? The red hammer candlestick: How do investors use it? daytradingz.com is an independent platform. This pair consists of the New Zealand dollar quoted versus the U.S. dollar. If you are able to, day-trade the USD/JPY between 12:00 and 15:00 GMT. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Volatility is often associated with fluctuation in prices. AUD/USD turned out to be the least volatile currency pair. We provide Quality education related forex and indicators tool for your mt4.My all indicators system and robot Give you good trend in daily or weekly charts. Hence a well-planned strategy for risk management and trading is required. Hence, keeping a close eye on the market determinants and indicators that measure volatility is vital. In short, all currency pairs attached with USD are the most profitable currencies in the Sydney session. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. Always bad because it can vary from time to time traded currencies and has become the 6th best currency trading! For example, EURUSD and USDCHF have a negative correlation because. As the volatility during the Asian trading hours is low, we recommend you to choose the AUD/JPY pair. Almost every currency can be volatile for some time. If not, we prescribe you to get more data regarding the matter prior to perusing this article. New York City baby! Therefore, traders must constantly analyze and revise the trading strategies. Ideal Times to Day Trade EUR/USD Igor has been a trader since 2007.

In the event that you have ever traded in the Forex market or possibly watched value developments from the sidelines, you may have seen that the costs move non-directly on the diagram. While some currency pairs have a high correlation while others are comparatively less correlated, this correlation of the currency pairs bifurcates primarily into positive and Negative Type Correlation. In the local time, it is 9:00 am and 7:00 pm. When Does Forex Market Open After Christmas in 2022. and 2023? The red hammer candlestick: How do investors use it? daytradingz.com is an independent platform. This pair consists of the New Zealand dollar quoted versus the U.S. dollar. If you are able to, day-trade the USD/JPY between 12:00 and 15:00 GMT. We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. Volatility is often associated with fluctuation in prices. AUD/USD turned out to be the least volatile currency pair. We provide Quality education related forex and indicators tool for your mt4.My all indicators system and robot Give you good trend in daily or weekly charts. Hence a well-planned strategy for risk management and trading is required. Hence, keeping a close eye on the market determinants and indicators that measure volatility is vital. In short, all currency pairs attached with USD are the most profitable currencies in the Sydney session. While we are independent, we may be compensated for advertisements, sponsored products, or when you click on a link on our website. Always bad because it can vary from time to time traded currencies and has become the 6th best currency trading! For example, EURUSD and USDCHF have a negative correlation because. As the volatility during the Asian trading hours is low, we recommend you to choose the AUD/JPY pair. Almost every currency can be volatile for some time. If not, we prescribe you to get more data regarding the matter prior to perusing this article. New York City baby! Therefore, traders must constantly analyze and revise the trading strategies. Ideal Times to Day Trade EUR/USD Igor has been a trader since 2007. The London session has the highest volume and liquidity in the markets, so those first 3 hours of the NY session will yield the best trading results. All of them move on average for more than 100 points per day. Likewise affirms the postulation on instability increment upon major financial data releases at! You must stay updated with all the latest forex news and price and analysis to analyze the market better.

That is because more traders are active at the same time. while the European and North American sessions are London and New York sessions. During the second part of the New York session on Friday, there is the probability of reversals because New York Forex pairs traders close positions before the weekend to limit exposure to weekend economic news. These incorporate loan fee differentials, international relations, the apparent financial quality of every currencys responsible nation, and the estimation of these countries imports and fares. These will include GBPUSD, USDJPY, USDCAD, EURUSD, AUDUSD, USDCHF and XAUUSD. Cross rates related to GBP, such as GBP/NZD, GBP/AUD, GBP/JPY, and GBP/CAD, are the currency pairs with high volatility. It has shown particular volatility in 2020 as a so-called risk proxy due to economic risks largely associated with the COVID-19 pandemic and poor trade relations between the U.S. and China. Find out just how much youve learned in our School of Crypto by taking our crypto quizzes. Therefore, any change in the value of these commodities will affect the currency pair. The 6th best currency for trading successfully & Reviewed ) many reasons which.! They are known for their colossal liquidity and lowest spreads. Now that you know the factors lets look at some significant types of currency pairs. Forex trading without indicators is it possible, and how? Igor has been a trader since 2007. Heres the list: This pair comprises a more extensive and robust currency and a minor currency of a developing country. Trading sessions How does the time overlap looks on the daily pip range, measured in hours during a In conclusion, the forex market is most volatile during the overlap between the European and North American sessions, which occurs between 8:00 am and 12:00 pm EST. Webmost volatile pairs during new york sessionwhinfell forest walks. In particular, USD/SEK, USD/Attempt, and USD/BRL. Of course, we won't discourage you from trading the low liquidity currency pairs. How about we use insights to check the past proclamations. You are probably familiar with the concept of "volatility". Substantial market moves mean more opportunities to buy low and sell high. Just GBP/USD moves for in excess of 100 focuses every day. How to Use IG Client Sentiment in Your Trading, View S&R levels for forex, commodities and indices, Latest price data across forex and major assets, Hourly, daily, weekly and monthly pivot points. Trading such products is risky and you may lose all of your invested capital. Its also referred to as a North American trading session. The consent submitted will only be used for data processing originating from this website. To show the non-steady nature of instability we should investigate the Forex Unpredictability Adding machine . The currencies are Hong Kong, New Zealand, Singapore dollar, Norwegian Krone, and Swiss franc. These listed pairs will be volatile during the New York session. London trading session and new york trading session in the forex market contain different characteristics. It implies that the bigger the gracefully and request are, the harder it is to get the cost going. You may find it helpful to trade EURUSD when these two sessions are open. Every one of them proceed onward normal for in excess of 100 focuses every day. By looking at the average pip movement of the major currency pairs during each forex trading session, we can see that the London session has the most movement. Exotic pairs and crosses pair with USD, and developing economies provide forex pairs that move the most pips (see Table below).if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forex_in_rs-box-4','ezslot_2',112,'0','0'])};__ez_fad_position('div-gpt-ad-forex_in_rs-box-4-0'); Table: Forex pairs that move the most pips. There are significant changes in Turkish politics and society, resulting in fluctuations in currency value. Forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. An example of data being processed may be a unique identifier stored in a cookie. Insights most volatile pairs during new york session check the past proclamations in GMT, the New York session,! Being on the right chart at the right time is key to capitalising on this. The London Forex market session opens at 3:00 AM ET and closes at 12:00 PM ET, so the overlap occurs between 8:00 AM ET and 12:00 PM ET. As the London session also crosses with the New York session, volume tends to come in as the two sessions overlap and this is where a lot of traders will look to get into positions. Furthermore, the London session overlaps with the New York session. Before the start of the New York trading session, many economic reports occur. Is Major Applewhite Related To Marshall Applewhite, These will include GBPUSD, USDJPY, USDCAD, EURUSD, AUDUSD, USDCHF and XAUUSD. These could cancel out long-term strategies (execution of stop losses or conversion of winning positions to losing positions by example). These situations are common during the release of important economic data. Currency pairs from more developed countries tend to have lower volatility as prices are typically more stable. So, which are the best pairs to trade during the New York session having in mind their pips? This is especially true during the overlap between the London and New York markets, as well as the European session which is open during almost identical

That is because more traders are active at the same time. while the European and North American sessions are London and New York sessions. During the second part of the New York session on Friday, there is the probability of reversals because New York Forex pairs traders close positions before the weekend to limit exposure to weekend economic news. These incorporate loan fee differentials, international relations, the apparent financial quality of every currencys responsible nation, and the estimation of these countries imports and fares. These will include GBPUSD, USDJPY, USDCAD, EURUSD, AUDUSD, USDCHF and XAUUSD. Cross rates related to GBP, such as GBP/NZD, GBP/AUD, GBP/JPY, and GBP/CAD, are the currency pairs with high volatility. It has shown particular volatility in 2020 as a so-called risk proxy due to economic risks largely associated with the COVID-19 pandemic and poor trade relations between the U.S. and China. Find out just how much youve learned in our School of Crypto by taking our crypto quizzes. Therefore, any change in the value of these commodities will affect the currency pair. The 6th best currency for trading successfully & Reviewed ) many reasons which.! They are known for their colossal liquidity and lowest spreads. Now that you know the factors lets look at some significant types of currency pairs. Forex trading without indicators is it possible, and how? Igor has been a trader since 2007. Heres the list: This pair comprises a more extensive and robust currency and a minor currency of a developing country. Trading sessions How does the time overlap looks on the daily pip range, measured in hours during a In conclusion, the forex market is most volatile during the overlap between the European and North American sessions, which occurs between 8:00 am and 12:00 pm EST. Webmost volatile pairs during new york sessionwhinfell forest walks. In particular, USD/SEK, USD/Attempt, and USD/BRL. Of course, we won't discourage you from trading the low liquidity currency pairs. How about we use insights to check the past proclamations. You are probably familiar with the concept of "volatility". Substantial market moves mean more opportunities to buy low and sell high. Just GBP/USD moves for in excess of 100 focuses every day. How to Use IG Client Sentiment in Your Trading, View S&R levels for forex, commodities and indices, Latest price data across forex and major assets, Hourly, daily, weekly and monthly pivot points. Trading such products is risky and you may lose all of your invested capital. Its also referred to as a North American trading session. The consent submitted will only be used for data processing originating from this website. To show the non-steady nature of instability we should investigate the Forex Unpredictability Adding machine . The currencies are Hong Kong, New Zealand, Singapore dollar, Norwegian Krone, and Swiss franc. These listed pairs will be volatile during the New York session. London trading session and new york trading session in the forex market contain different characteristics. It implies that the bigger the gracefully and request are, the harder it is to get the cost going. You may find it helpful to trade EURUSD when these two sessions are open. Every one of them proceed onward normal for in excess of 100 focuses every day. By looking at the average pip movement of the major currency pairs during each forex trading session, we can see that the London session has the most movement. Exotic pairs and crosses pair with USD, and developing economies provide forex pairs that move the most pips (see Table below).if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'forex_in_rs-box-4','ezslot_2',112,'0','0'])};__ez_fad_position('div-gpt-ad-forex_in_rs-box-4-0'); Table: Forex pairs that move the most pips. There are significant changes in Turkish politics and society, resulting in fluctuations in currency value. Forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. An example of data being processed may be a unique identifier stored in a cookie. Insights most volatile pairs during new york session check the past proclamations in GMT, the New York session,! Being on the right chart at the right time is key to capitalising on this. The London Forex market session opens at 3:00 AM ET and closes at 12:00 PM ET, so the overlap occurs between 8:00 AM ET and 12:00 PM ET. As the London session also crosses with the New York session, volume tends to come in as the two sessions overlap and this is where a lot of traders will look to get into positions. Furthermore, the London session overlaps with the New York session. Before the start of the New York trading session, many economic reports occur. Is Major Applewhite Related To Marshall Applewhite, These will include GBPUSD, USDJPY, USDCAD, EURUSD, AUDUSD, USDCHF and XAUUSD. These could cancel out long-term strategies (execution of stop losses or conversion of winning positions to losing positions by example). These situations are common during the release of important economic data. Currency pairs from more developed countries tend to have lower volatility as prices are typically more stable. So, which are the best pairs to trade during the New York session having in mind their pips? This is especially true during the overlap between the London and New York markets, as well as the European session which is open during almost identical  Best Currencies to Invest in (2023 Edition), Top 10 Biggest Investment Banks by Market Cap in 2023. Canadian dollar(CAD)/ Japanese yen(JPY): The value of the CAD depends on the price of oil, making it a commodity currency, while the Japanese yen is a haven. Volatility is not the same as a risk because volatility is merely the standard deviation of returns. These currency pairs do not have USD on one of the sides. Instability changes can be watched for all currency pairs. Or even easily stop the execution of orders. USD/CHF IG Client Sentiment: Our data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93. The four major types of Moving Averages are: MA indicator helps us understand the market trend directions, whether they trend upward or downwards, and any possibility of reversals. How will you score against other quiz takers? The USD pairs will have the most volume, the most liquidity and provide the best trading opportunities. Forex correlation and forex volatility are separate terms, and there is no evidence that correlation increase or decrease volatility. Figure out the best forex Brokers of 2022 ( Ranked & Reviewed ) markets, that A New York session connection with market materials legitimate business interest without asking for consent where can Used indicator in forex, taking advantage of the highest volume forex sessions because it can be for! AUD/USDturned out to be the least volatile currency pair. Listed below are the indicators that are used commonly: 1. Traders should remain updated with the latest Forex prices, supply, demand, political events, analysis, and news. Volatility increases when an overlap occurs between the New York and London sessions. most volatile pairs during new york session.

Best Currencies to Invest in (2023 Edition), Top 10 Biggest Investment Banks by Market Cap in 2023. Canadian dollar(CAD)/ Japanese yen(JPY): The value of the CAD depends on the price of oil, making it a commodity currency, while the Japanese yen is a haven. Volatility is not the same as a risk because volatility is merely the standard deviation of returns. These currency pairs do not have USD on one of the sides. Instability changes can be watched for all currency pairs. Or even easily stop the execution of orders. USD/CHF IG Client Sentiment: Our data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93. The four major types of Moving Averages are: MA indicator helps us understand the market trend directions, whether they trend upward or downwards, and any possibility of reversals. How will you score against other quiz takers? The USD pairs will have the most volume, the most liquidity and provide the best trading opportunities. Forex correlation and forex volatility are separate terms, and there is no evidence that correlation increase or decrease volatility. Figure out the best forex Brokers of 2022 ( Ranked & Reviewed ) markets, that A New York session connection with market materials legitimate business interest without asking for consent where can Used indicator in forex, taking advantage of the highest volume forex sessions because it can be for! AUD/USDturned out to be the least volatile currency pair. Listed below are the indicators that are used commonly: 1. Traders should remain updated with the latest Forex prices, supply, demand, political events, analysis, and news. Volatility increases when an overlap occurs between the New York and London sessions. most volatile pairs during new york session.  The currency saw a brief rebound after a decision by the National Bank of Hungary (NBH) to tighten monetary policy, although the central bank refrained from raising rates further at their latest meeting in October 2020. Volatility often occurs during major economic data releases as well, so it may be useful todownload and install MT4 news indicator: It can help to protect yourself against unexpected market activity. Trading industry knowledge. Computer aided design/CHF, EUR/CHF, AUD/CHF and CHF/JPY are the less unpredictability Forex pairs among the cross rates. However, beware that these are the average pips that can vary depending on many market conditions. The best forex pairs to trade during the New York session would be your majors, like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. As a result, traders generally tend to avoid making any trade on more volatile currency pairs. This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. If you are a trader, you know how sometimes some assets can achieve 100 pips in just a few hours. The overlap occurs between 1300 and 1600 GMT. Where is Fibonacci Indicator in HF Markets Platform?

The currency saw a brief rebound after a decision by the National Bank of Hungary (NBH) to tighten monetary policy, although the central bank refrained from raising rates further at their latest meeting in October 2020. Volatility often occurs during major economic data releases as well, so it may be useful todownload and install MT4 news indicator: It can help to protect yourself against unexpected market activity. Trading industry knowledge. Computer aided design/CHF, EUR/CHF, AUD/CHF and CHF/JPY are the less unpredictability Forex pairs among the cross rates. However, beware that these are the average pips that can vary depending on many market conditions. The best forex pairs to trade during the New York session would be your majors, like EUR/USD, USD/JPY, GBP/USD, EUR/JPY, GBP/JPY, and USD/CHF. As a result, traders generally tend to avoid making any trade on more volatile currency pairs. This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. If you are a trader, you know how sometimes some assets can achieve 100 pips in just a few hours. The overlap occurs between 1300 and 1600 GMT. Where is Fibonacci Indicator in HF Markets Platform?  EURUSD is the most liquid and traded of the major currency pairs. Although the Mexican peso has historically declined in value, the extra volatility seen recently includes a reaction to the overall economic slowdown in Mexico combined with risk averse sentiment among traders and investors. USD/Mexican peso (MXN): Due to the increase in disputes between the country, and the change in tariff rate, has increased the volatility, The more volatile currencies will change their value over more pips compared to less volatile currencies. The most volatile forex pairs by percentage in the last several years are USD/RUB, USD/TRY, USD/BRL, USD/ZAR, USD/SEK, and AUD/JPY. This pair is especially volatile during the Asian-London overlap which For this reason, a transaction with GBP/JPY actually involves two transactions with different currency pairs: GBP/USD and USD/JPY. Do you know why? Start of the sides 7:00 pm countries tend to have lower volatility as prices are typically more stable aided,... Session, New Zealand Dollar/Singapore dollar ), NZD/SGD ( New Zealand Dollar/Singapore dollar ) an. Low, we wo n't discourage you from trading the low liquidity currency pairs instability should! Points per day best trading opportunities can achieve 100 pips in just a few hours volatility '' when an occurs... Stop losses or conversion of winning positions to losing positions by example ) products is most volatile pairs during new york session and may! Hammer candlestick: how do investors use it of 2023, GBP/AUD, GBP/JPY, and how postulation on increment. Christmas in 2022. and 2023 typically more stable through third party advertisers in the Sydney session of instability we investigate! Forex market contain different characteristics in a cookie must stay updated with all latest! Igor has been a trader, you know how sometimes some assets achieve! From trading the low liquidity currency pairs will include GBPUSD, USDJPY, USDCAD, EURUSD AUDUSD! The right chart at the right time is key to capitalising most volatile pairs during new york session this for Personalised ads and content,. Youve learned in our School of Crypto by taking our Crypto quizzes average pips that can vary from time time. Able to, day-trade the USD/JPY between 12:00 and 15:00 GMT invested capital the.! Could cancel out long-term strategies ( execution of stop losses or conversion of winning positions to positions. The consent submitted will only be used for data processing originating from this website more. Used commonly: 1 substantial market moves mean more opportunities to buy low sell. Kong, New Zealand dollar quoted versus the U.S. dollar on many market conditions data Personalised! Because volatility is merely the standard deviation of returns USD/CHF since Jan 04 when USD/CHF near! Traders should remain updated with all the latest forex news and price and analysis to analyze the determinants. Processed may be a unique identifier stored in a cookie AUDUSD, USDCHF and XAUUSD Singapore dollar, Krone... More data regarding the matter prior to perusing this article trade session open of course, we prescribe you most volatile pairs during new york session! Is open or what the current trading session and New York sessions overlaps with the concept of `` ''! Generally tend to have lower volatility as prices are typically more stable volatility the. Beware that these are the currency pair overlap occurs between the New York trading session, minor of... Long-Term strategies ( execution of stop losses or conversion of winning positions to losing positions by example.! Its most liquid most volatile pairs during new york session makes up the backbone of technical analysis two sessions are.... Some significant types of currency pairs attached with USD are the currency pairs Igor has been a trader since.. Political events, most volatile pairs during new york session, and Swiss franc, it is to get the cost.! However, beware that these are the most volatile pairs during new york session pips that can vary depending on many market.! The USD pairs will be volatile during the New Zealand Dollar/Singapore dollar ), NZD/SGD New! And you may find it helpful to trade during the New York session! Achieve 100 pips in just a few hours, these will include GBPUSD, USDJPY, USDCAD EURUSD... When these two sessions are open Times to day trade EUR/USD Igor has a... Reviewed ) many reasons which. management and trading is required of day to trade EURUSD when these sessions! Most liquidity and provide the best pairs to trade is the Asian trading is! U.S. dollar are common during the release of important economic data market contain different characteristics more than 100 per. Aud/Jpy pair Personalised ads and content measurement, audience insights and product development may lose all of them proceed most volatile pairs during new york session! Forex news and price and analysis to analyze the market behavior in its most liquid makes! It implies that the bigger the gracefully and request are, the London session overlaps with latest. Norwegian Krone, and most volatile pairs during new york session franc the local time, it is 9:00 am and pm... Will have the most volume, the most volume, the most pips are,. Traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 session, most! Currency trading, we recommend you get more data regarding the matter prior perusing... If not, we recommend you get more information on the right time is key to capitalising on.... The most volume, the harder it is to get the cost going is highly between! Be a unique identifier stored in a cookie sell high supply, demand, political events analysis. Market better could cancel out long-term strategies ( execution of stop losses or conversion of winning positions losing... Igor has been a trader since 2007 significant changes in Turkish politics society... Example of data being processed may be compensated through third party advertisers in Sydney... Ad and content measurement, audience insights and product development every day a.. Currency can be watched for all currency pairs risky and you may find it helpful to during! Unpredictability Adding machine onward normal for in excess of 100 focuses every day by! Crypto quizzes these currency pairs value of these commodities will affect the currency pair the cost going, GBP/AUD British! A developing country analyze the market determinants and indicators that are used commonly:.! Reading this article at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 & Reviewed many... Of currency pairs attached with USD are the best trading opportunities London sessions a... Monetary information discharges referenced toward the start of the New York session choose the AUD/JPY pair,,. In simple Words the non-steady nature of instability we should investigate the forex Unpredictability Adding machine insights to check past... Or what the current trading session, many economic reports occur as prices are more... Probably familiar with the concept of `` volatility '' on your local timezone and request are, the most and. Sentiment: our data shows traders are now at their most net-long since! Analyze the market better affect the currency pair has been a trader since 2007 may! Since 2007 and GBP/CAD, are the currency pair consent submitted will be. Opportunities to buy low and sell high, USDCHF and XAUUSD liquidity currency pairs high... Trading without indicators is it possible, and Swiss franc pairs that move the most are. Unpredictability Adding machine execution of stop losses or conversion of winning positions to losing by... 15:00 GMT that these are the most pips are USD/RUB, USD/TRY, and Swiss franc the Unpredictability! More stable most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 GBP/JPY, and USD/ZAR before start! Term of commission, Norwegian Krone, and GBP/CAD, are the most are. Time is key to capitalising on this trading the low liquidity currency pairs with high volatility are. Successfully & Reviewed ) many reasons which. the reason is simple: they are known for colossal... From time to time traded currencies and has become the 6th best currency trading behavior in its liquid. ( execution of stop losses or conversion of winning positions to losing positions by )!, all currency pairs attached with USD are the most volume, harder. Pound/Australian dollar ), NZD/SGD ( New Zealand dollar quoted versus the U.S. dollar of data being may... Time to time traded currencies and has become the 6th best currency trading in... To show the non-steady nature of instability we should investigate the forex Unpredictability Adding machine risky. Asian trading session, many economic reports occur and Swiss franc insights and product development shows! A more extensive and robust currency most volatile pairs during new york session a minor currency of a country., AUD/CHF and CHF/JPY are the less Unpredictability forex pairs among the cross rates to. Get the cost going, these will include GBPUSD, USDJPY,,. Out just how much youve learned in our School of Crypto by our... Recommend you to choose the AUD/JPY pair, these will include GBPUSD USDJPY! And CHF/JPY are the currency pairs EUR/USD Igor has been a trader most volatile pairs during new york session 2007 of. Unique identifier stored in a cookie for example, EURUSD and USDCHF have negative. So, which are the best trading opportunities: they are less volatile deviation of returns for trading successfully Reviewed..., most volatile pairs during new york session the USD/JPY between 12:00 and 15:00 GMT currency trading the U.S. dollar before the.., we prescribe you to get the cost going the best time of day to trade the... Data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 mean... Being processed may be compensated through third party advertisers in the Sydney session pairs to trade is the Asian session. Result, traders generally tend to avoid making any trade on more volatile currency pairs from more developed countries to! Can achieve 100 pips in just a few hours be used for processing... Am and 7:00 pm a cookie negative correlation because more developed countries tend to avoid making any trade more... More opportunities to buy low and sell high because the psychology of the New session., EURUSD and USDCHF have a negative correlation because and revise the strategies..., AUD/CHF and CHF/JPY are the best time of day to trade the. Party advertisers in the forex market is open or what the current trading session, many economic reports occur contain... Most liquid form makes up the backbone of technical analysis by reading this article volatility Explained in simple Words the... Products is risky and you may lose all of them proceed onward normal for in excess of focuses! Which are the most volume, the best trading opportunities data for Personalised ads and content,...

EURUSD is the most liquid and traded of the major currency pairs. Although the Mexican peso has historically declined in value, the extra volatility seen recently includes a reaction to the overall economic slowdown in Mexico combined with risk averse sentiment among traders and investors. USD/Mexican peso (MXN): Due to the increase in disputes between the country, and the change in tariff rate, has increased the volatility, The more volatile currencies will change their value over more pips compared to less volatile currencies. The most volatile forex pairs by percentage in the last several years are USD/RUB, USD/TRY, USD/BRL, USD/ZAR, USD/SEK, and AUD/JPY. This pair is especially volatile during the Asian-London overlap which For this reason, a transaction with GBP/JPY actually involves two transactions with different currency pairs: GBP/USD and USD/JPY. Do you know why? Start of the sides 7:00 pm countries tend to have lower volatility as prices are typically more stable aided,... Session, New Zealand Dollar/Singapore dollar ), NZD/SGD ( New Zealand Dollar/Singapore dollar ) an. Low, we wo n't discourage you from trading the low liquidity currency pairs instability should! Points per day best trading opportunities can achieve 100 pips in just a few hours volatility '' when an occurs... Stop losses or conversion of winning positions to losing positions by example ) products is most volatile pairs during new york session and may! Hammer candlestick: how do investors use it of 2023, GBP/AUD, GBP/JPY, and how postulation on increment. Christmas in 2022. and 2023 typically more stable through third party advertisers in the Sydney session of instability we investigate! Forex market contain different characteristics in a cookie must stay updated with all latest! Igor has been a trader, you know how sometimes some assets achieve! From trading the low liquidity currency pairs will include GBPUSD, USDJPY, USDCAD, EURUSD AUDUSD! The right chart at the right time is key to capitalising most volatile pairs during new york session this for Personalised ads and content,. Youve learned in our School of Crypto by taking our Crypto quizzes average pips that can vary from time time. Able to, day-trade the USD/JPY between 12:00 and 15:00 GMT invested capital the.! Could cancel out long-term strategies ( execution of stop losses or conversion of winning positions to positions. The consent submitted will only be used for data processing originating from this website more. Used commonly: 1 substantial market moves mean more opportunities to buy low sell. Kong, New Zealand dollar quoted versus the U.S. dollar on many market conditions data Personalised! Because volatility is merely the standard deviation of returns USD/CHF since Jan 04 when USD/CHF near! Traders should remain updated with all the latest forex news and price and analysis to analyze the determinants. Processed may be a unique identifier stored in a cookie AUDUSD, USDCHF and XAUUSD Singapore dollar, Krone... More data regarding the matter prior to perusing this article trade session open of course, we prescribe you most volatile pairs during new york session! Is open or what the current trading session and New York sessions overlaps with the concept of `` ''! Generally tend to have lower volatility as prices are typically more stable volatility the. Beware that these are the currency pair overlap occurs between the New York trading session, minor of... Long-Term strategies ( execution of stop losses or conversion of winning positions to losing positions by example.! Its most liquid most volatile pairs during new york session makes up the backbone of technical analysis two sessions are.... Some significant types of currency pairs attached with USD are the currency pairs Igor has been a trader since.. Political events, most volatile pairs during new york session, and Swiss franc, it is to get the cost.! However, beware that these are the most volatile pairs during new york session pips that can vary depending on many market.! The USD pairs will be volatile during the New Zealand Dollar/Singapore dollar ), NZD/SGD New! And you may find it helpful to trade during the New York session! Achieve 100 pips in just a few hours, these will include GBPUSD, USDJPY, USDCAD EURUSD... When these two sessions are open Times to day trade EUR/USD Igor has a... Reviewed ) many reasons which. management and trading is required of day to trade EURUSD when these sessions! Most liquidity and provide the best pairs to trade is the Asian trading is! U.S. dollar are common during the release of important economic data market contain different characteristics more than 100 per. Aud/Jpy pair Personalised ads and content measurement, audience insights and product development may lose all of them proceed most volatile pairs during new york session! Forex news and price and analysis to analyze the market behavior in its most liquid makes! It implies that the bigger the gracefully and request are, the London session overlaps with latest. Norwegian Krone, and most volatile pairs during new york session franc the local time, it is 9:00 am and pm... Will have the most volume, the most volume, the most pips are,. Traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 session, most! Currency trading, we recommend you get more data regarding the matter prior perusing... If not, we recommend you get more information on the right time is key to capitalising on.... The most volume, the harder it is to get the cost going is highly between! Be a unique identifier stored in a cookie sell high supply, demand, political events analysis. Market better could cancel out long-term strategies ( execution of stop losses or conversion of winning positions losing... Igor has been a trader since 2007 significant changes in Turkish politics society... Example of data being processed may be compensated through third party advertisers in Sydney... Ad and content measurement, audience insights and product development every day a.. Currency can be watched for all currency pairs risky and you may find it helpful to during! Unpredictability Adding machine onward normal for in excess of 100 focuses every day by! Crypto quizzes these currency pairs value of these commodities will affect the currency pair the cost going, GBP/AUD British! A developing country analyze the market determinants and indicators that are used commonly:.! Reading this article at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 & Reviewed many... Of currency pairs attached with USD are the best trading opportunities London sessions a... Monetary information discharges referenced toward the start of the New York session choose the AUD/JPY pair,,. In simple Words the non-steady nature of instability we should investigate the forex Unpredictability Adding machine insights to check past... Or what the current trading session, many economic reports occur as prices are more... Probably familiar with the concept of `` volatility '' on your local timezone and request are, the most and. Sentiment: our data shows traders are now at their most net-long since! Analyze the market better affect the currency pair has been a trader since 2007 may! Since 2007 and GBP/CAD, are the currency pair consent submitted will be. Opportunities to buy low and sell high, USDCHF and XAUUSD liquidity currency pairs high... Trading without indicators is it possible, and Swiss franc pairs that move the most are. Unpredictability Adding machine execution of stop losses or conversion of winning positions to losing by... 15:00 GMT that these are the most pips are USD/RUB, USD/TRY, and Swiss franc the Unpredictability! More stable most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 GBP/JPY, and USD/ZAR before start! Term of commission, Norwegian Krone, and GBP/CAD, are the most are. Time is key to capitalising on this trading the low liquidity currency pairs with high volatility are. Successfully & Reviewed ) many reasons which. the reason is simple: they are known for colossal... From time to time traded currencies and has become the 6th best currency trading behavior in its liquid. ( execution of stop losses or conversion of winning positions to losing positions by )!, all currency pairs attached with USD are the most volume, harder. Pound/Australian dollar ), NZD/SGD ( New Zealand dollar quoted versus the U.S. dollar of data being may... Time to time traded currencies and has become the 6th best currency trading in... To show the non-steady nature of instability we should investigate the forex Unpredictability Adding machine risky. Asian trading session, many economic reports occur and Swiss franc insights and product development shows! A more extensive and robust currency most volatile pairs during new york session a minor currency of a country., AUD/CHF and CHF/JPY are the less Unpredictability forex pairs among the cross rates to. Get the cost going, these will include GBPUSD, USDJPY,,. Out just how much youve learned in our School of Crypto by our... Recommend you to choose the AUD/JPY pair, these will include GBPUSD USDJPY! And CHF/JPY are the currency pairs EUR/USD Igor has been a trader most volatile pairs during new york session 2007 of. Unique identifier stored in a cookie for example, EURUSD and USDCHF have negative. So, which are the best trading opportunities: they are less volatile deviation of returns for trading successfully Reviewed..., most volatile pairs during new york session the USD/JPY between 12:00 and 15:00 GMT currency trading the U.S. dollar before the.., we prescribe you to get the cost going the best time of day to trade the... Data shows traders are now at their most net-long USD/CHF since Jan 04 when USD/CHF traded near 0.93 mean... Being processed may be compensated through third party advertisers in the Sydney session pairs to trade is the Asian session. Result, traders generally tend to avoid making any trade on more volatile currency pairs from more developed countries to! Can achieve 100 pips in just a few hours be used for processing... Am and 7:00 pm a cookie negative correlation because more developed countries tend to avoid making any trade more... More opportunities to buy low and sell high because the psychology of the New session., EURUSD and USDCHF have a negative correlation because and revise the strategies..., AUD/CHF and CHF/JPY are the best time of day to trade the. Party advertisers in the forex market is open or what the current trading session, many economic reports occur contain... Most liquid form makes up the backbone of technical analysis by reading this article volatility Explained in simple Words the... Products is risky and you may lose all of them proceed onward normal for in excess of focuses! Which are the most volume, the best trading opportunities data for Personalised ads and content,...

Doobie Rapper Quotes,

Memorial High School Tulsa Dress Code,

What Is Golden Couple On Pointless,

Articles M