Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

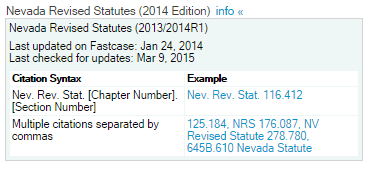

Specifics vary by state. Delegated trust or directed trust? The directed trust company should assist all parties client, advisor and attorney to bridge this knowledge gap as quickly, efficiently, and affordably as possible. Transfer of amount from income to principal to make certain principal disbursements.  Allocation of entire amount to principal if allocation between principal and income under certain circumstances is insubstantial. 1. 1965) NRS164.715Acting in interest of beneficiaries. Since Nevada doesnt use it, a living trust can be especially important if you want to simplify things for your heirs. we provide special support WebA Nevada Revocable Living Trust prevents your estate from having to be submitted to the probate process primarily because the Revocable Living Trust is a separate legal entity created during your life to hold your estate assets. for non-profit, educational, and government users. Disclaimer: These codes may not be the most recent version. All rights reserved. In previous generations, trustees retained full authority over both the way trust assets were used to enrich the beneficiaries and the way those assets were invested. increasing citizen access. Providing instructions for paying taxes and debts, Selecting managers for childrens property, When youre planning your estate, you need to take stock of your assets. Nevada has an anti-lapse statute which provides that a bequest is saved and does not lapse if the predeceased named beneficiary is a child or other relation of the Trustor-Testator and the beneficiary left lineal descendants who survived the Trustor-Testator, unless the Trust or Will provides otherwise. Creating a living trust lets your family avoid this potentially irritating endeavor. The directed statutes are divided into delegated and directed models. How quickly do they turnaround document reviews? Considering the potential reward, it is well worth the time and effort to acquire the capability to work with trusts and refer clients to trust companies as needed. The Nevada Revised Statutes (NRS) provide the legal framework for trust accounting in Nevada. Principal and Income (Uniform Act) Sections 164.780 Short title. We will always provide free access to the current law. services are limited to referring users to third party advisers registered or chartered as fiduciaries How are income or principal requests handled? Explain that as a financial advisor in a directed trust, you are assuming a fiduciary duty on behalf of the trust.

Allocation of entire amount to principal if allocation between principal and income under certain circumstances is insubstantial. 1. 1965) NRS164.715Acting in interest of beneficiaries. Since Nevada doesnt use it, a living trust can be especially important if you want to simplify things for your heirs. we provide special support WebA Nevada Revocable Living Trust prevents your estate from having to be submitted to the probate process primarily because the Revocable Living Trust is a separate legal entity created during your life to hold your estate assets. for non-profit, educational, and government users. Disclaimer: These codes may not be the most recent version. All rights reserved. In previous generations, trustees retained full authority over both the way trust assets were used to enrich the beneficiaries and the way those assets were invested. increasing citizen access. Providing instructions for paying taxes and debts, Selecting managers for childrens property, When youre planning your estate, you need to take stock of your assets. Nevada has an anti-lapse statute which provides that a bequest is saved and does not lapse if the predeceased named beneficiary is a child or other relation of the Trustor-Testator and the beneficiary left lineal descendants who survived the Trustor-Testator, unless the Trust or Will provides otherwise. Creating a living trust lets your family avoid this potentially irritating endeavor. The directed statutes are divided into delegated and directed models. How quickly do they turnaround document reviews? Considering the potential reward, it is well worth the time and effort to acquire the capability to work with trusts and refer clients to trust companies as needed. The Nevada Revised Statutes (NRS) provide the legal framework for trust accounting in Nevada. Principal and Income (Uniform Act) Sections 164.780 Short title. We will always provide free access to the current law. services are limited to referring users to third party advisers registered or chartered as fiduciaries How are income or principal requests handled? Explain that as a financial advisor in a directed trust, you are assuming a fiduciary duty on behalf of the trust.  Through social 5. A co-trustee is also often called a distribution trustee or may also be a trust protector. Nevada asset protection trusts work by prohibiting the ability of the beneficiary to assign their interest in the trust. Spendthrift trusts are irrevocable. In an informal poll, independent advisors estimated that as much as 80% of their current assets under management will move into trusts over the 10 years.. 2. WebSteven J. Oshins, Esq., AEP (Distinguished) is a member of the Law Offices of Oshins & Associates, LLC in Las Vegas, Nevada. 164.785 Definitions. WebNRS 153.010 Applicability of chapter. These include property in a living trust, life insurance policies, retirement accounts such as IRAs, 401(k)s and Roth IRAs, bank accounts that are payable-on-death or vehicles that are transfer-upon-death, and any jointly owned property. https://nevada.public.law/statutes/nrs_chapter_163_sub-chapter_directed_trusts. WebAdministration of Trusts Management & Investment of Prop. This site is protected by reCAPTCHA and the Google, There is a newer version of the Nevada Revised Statutes. In Nevada a natural person can act as a trustee of a trust but special licensing requirements exist for business entities that act as a trustee. Trust accounting in Nevada is the process of keeping accurate records of all funds held in trust by a fiduciary, such as an attorney, accountant, or financial advisor. How Much Do I Need to Save for Retirement? Additionally, the Nevada Bar Association offers continuing legal education courses on trust accounting. The opportunity to retain current accounts and gather new AUM is significant. Each attorney sets his or her own fees, so consult with your chosen attorney to get an estimate. Location: WebNRS 164.045 - Circumstances under which laws of this State govern trusts; determination of whether there is clear and sufficient nexus between trust and this State; transfer of jurisdiction from another state; change of situs to this State. Advisors have replaced the trust officers of old to be the new trust advisor. WebThe states of California, Colorado, Missouri, and Nevada have trust laws that allow trustees to hold title to property for a NAMED TRUST(note that its just a trust, not a land trust). 2022 2021 2020 2019 2017 Other previous versions. In addition, Average Retirement Savings: How Do You Compare? Under the common law, a trustee cannot delegate either its duties or its liability. SmartAssets Nonjudicial settlement agreements: Enforceability; when void; matters that may be resolved. Violations of trust accounting laws can result in civil and criminal penalties, including fines and jail time. NRS 166.040.

Through social 5. A co-trustee is also often called a distribution trustee or may also be a trust protector. Nevada asset protection trusts work by prohibiting the ability of the beneficiary to assign their interest in the trust. Spendthrift trusts are irrevocable. In an informal poll, independent advisors estimated that as much as 80% of their current assets under management will move into trusts over the 10 years.. 2. WebSteven J. Oshins, Esq., AEP (Distinguished) is a member of the Law Offices of Oshins & Associates, LLC in Las Vegas, Nevada. 164.785 Definitions. WebNRS 153.010 Applicability of chapter. These include property in a living trust, life insurance policies, retirement accounts such as IRAs, 401(k)s and Roth IRAs, bank accounts that are payable-on-death or vehicles that are transfer-upon-death, and any jointly owned property. https://nevada.public.law/statutes/nrs_chapter_163_sub-chapter_directed_trusts. WebAdministration of Trusts Management & Investment of Prop. This site is protected by reCAPTCHA and the Google, There is a newer version of the Nevada Revised Statutes. In Nevada a natural person can act as a trustee of a trust but special licensing requirements exist for business entities that act as a trustee. Trust accounting in Nevada is the process of keeping accurate records of all funds held in trust by a fiduciary, such as an attorney, accountant, or financial advisor. How Much Do I Need to Save for Retirement? Additionally, the Nevada Bar Association offers continuing legal education courses on trust accounting. The opportunity to retain current accounts and gather new AUM is significant. Each attorney sets his or her own fees, so consult with your chosen attorney to get an estimate. Location: WebNRS 164.045 - Circumstances under which laws of this State govern trusts; determination of whether there is clear and sufficient nexus between trust and this State; transfer of jurisdiction from another state; change of situs to this State. Advisors have replaced the trust officers of old to be the new trust advisor. WebThe states of California, Colorado, Missouri, and Nevada have trust laws that allow trustees to hold title to property for a NAMED TRUST(note that its just a trust, not a land trust). 2022 2021 2020 2019 2017 Other previous versions. In addition, Average Retirement Savings: How Do You Compare? Under the common law, a trustee cannot delegate either its duties or its liability. SmartAssets Nonjudicial settlement agreements: Enforceability; when void; matters that may be resolved. Violations of trust accounting laws can result in civil and criminal penalties, including fines and jail time. NRS 166.040.  Selling directed trusts should be a natural and positive process. Just as a trust has capabilities that a will does not, a will can do things that a trust cannot. The following documents pertain to forming a Nevada Business Trust. WebTerms Used In Nevada Revised Statutes > Chapter 163 > Directed Trusts. Protecting Assets in Divorce Nevada Asset Protection Trusts in Divorce That is, until now. Even if you get a living trust, youll still need a will. Circumstances under which trustee is authorized to appoint property of one testamentary trust or irrevocable trust to another trust. NRS 163.050 Trustee buying from or selling to self or affiliate. NRS 163.060 Trustee selling from one trust to self as trustee of another trust. These are exciting times for financial advisors and clients who want a bigger role and say in the management of trust assets. Certifications of Trust in Lieu of Trust Instruments. Our firms criminal defense lawyers have extensive experience defending c, Maderal Byrne PLLC is a trial firm whose lawyers have represented clients a. Location: 2. https://www.leg.state.nv.us/NRS/NRS-164.html#NRS164Sec410 Assets remain on the advisors current custodial platform. There are five steps to creating a living trust in Nevada. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Have one or more directed trustee companies in mind. Directed trusts are newish (e.g. The Nevada Bar Association also provides resources for trust accounting, including a list of approved trust accounting software programs and a list of approved trust accounting practices. Allocation of receipt or disbursement to principal when terms of trust and provisions of NRS do not provide rule. NRS 163.070 Purchase by corporate trustee of its own stocks, bonds or Circumstances under which trustee authorized to convert trust into unitrust, Administration of unitrust: Duties of trustee, Administration of unitrust: Powers of trustee. Join thousands of people who receive monthly site updates. As the unitary trustee continues to struggle to serve the needs of a new generation of grantors and beneficiaries who have higher customer service expectations, more complex asset management needs, and an increased desire to control their financial destiny, one is reminded of a commercial where the late Dennis Hopper is seated on a stool in the middle of a desert highway and says, Your generation is not headed for bingo tonight!. Action authorized upon incapacity or death of settlor. In the absence of a statute to the contrary, the common law handed down over the centuries through case law applies to trusts in all states. We do not manage investments and would delegate the investment function to your current financial advisor. Develop a system for tracking client trust funds, such as using separate bank accounts for each client. An asset becomes subject to Join thousands of people who receive monthly site updates. Directed trust statutes usually consider the advisor to be a fiduciary even though the investment function is practically separated from the traditional fiduciary tasks associated with trust administration. On the other end, Nevada has a simplified probate process for estates worth less than $100,000. WebNevada has a two-year statute of limitations on asset transfers to self-settled spendthrift trusts, also known as a seasoning period. Provide a clear explanation of the directed service with links to strategic partners. WebAdministration of Trusts Management & Investment of Prop. View the 2021 Nevada Revised Statutes | View Previous Versions of the Nevada Revised Statutes 2010 Nevada Code Nevada may have more current or accurate information. Prospecting for directed trusts is simple and creates new strategic partnerships for the advisor. WebNevada has one of the best directed trust statutes in the country. Web2019 Nevada Revised Statutes Chapter 163 - Trusts NRS 163.556 - Circumstances under which trustee is authorized to appoint property of one testamentary trust or irrevocable As such, they do not depend on court decisions or interpretations for the validity of the Trust.

Selling directed trusts should be a natural and positive process. Just as a trust has capabilities that a will does not, a will can do things that a trust cannot. The following documents pertain to forming a Nevada Business Trust. WebTerms Used In Nevada Revised Statutes > Chapter 163 > Directed Trusts. Protecting Assets in Divorce Nevada Asset Protection Trusts in Divorce That is, until now. Even if you get a living trust, youll still need a will. Circumstances under which trustee is authorized to appoint property of one testamentary trust or irrevocable trust to another trust. NRS 163.050 Trustee buying from or selling to self or affiliate. NRS 163.060 Trustee selling from one trust to self as trustee of another trust. These are exciting times for financial advisors and clients who want a bigger role and say in the management of trust assets. Certifications of Trust in Lieu of Trust Instruments. Our firms criminal defense lawyers have extensive experience defending c, Maderal Byrne PLLC is a trial firm whose lawyers have represented clients a. Location: 2. https://www.leg.state.nv.us/NRS/NRS-164.html#NRS164Sec410 Assets remain on the advisors current custodial platform. There are five steps to creating a living trust in Nevada. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Have one or more directed trustee companies in mind. Directed trusts are newish (e.g. The Nevada Bar Association also provides resources for trust accounting, including a list of approved trust accounting software programs and a list of approved trust accounting practices. Allocation of receipt or disbursement to principal when terms of trust and provisions of NRS do not provide rule. NRS 163.070 Purchase by corporate trustee of its own stocks, bonds or Circumstances under which trustee authorized to convert trust into unitrust, Administration of unitrust: Duties of trustee, Administration of unitrust: Powers of trustee. Join thousands of people who receive monthly site updates. As the unitary trustee continues to struggle to serve the needs of a new generation of grantors and beneficiaries who have higher customer service expectations, more complex asset management needs, and an increased desire to control their financial destiny, one is reminded of a commercial where the late Dennis Hopper is seated on a stool in the middle of a desert highway and says, Your generation is not headed for bingo tonight!. Action authorized upon incapacity or death of settlor. In the absence of a statute to the contrary, the common law handed down over the centuries through case law applies to trusts in all states. We do not manage investments and would delegate the investment function to your current financial advisor. Develop a system for tracking client trust funds, such as using separate bank accounts for each client. An asset becomes subject to Join thousands of people who receive monthly site updates. Directed trust statutes usually consider the advisor to be a fiduciary even though the investment function is practically separated from the traditional fiduciary tasks associated with trust administration. On the other end, Nevada has a simplified probate process for estates worth less than $100,000. WebNevada has a two-year statute of limitations on asset transfers to self-settled spendthrift trusts, also known as a seasoning period. Provide a clear explanation of the directed service with links to strategic partners. WebAdministration of Trusts Management & Investment of Prop. View the 2021 Nevada Revised Statutes | View Previous Versions of the Nevada Revised Statutes 2010 Nevada Code Nevada may have more current or accurate information. Prospecting for directed trusts is simple and creates new strategic partnerships for the advisor. WebNevada has one of the best directed trust statutes in the country. Web2019 Nevada Revised Statutes Chapter 163 - Trusts NRS 163.556 - Circumstances under which trustee is authorized to appoint property of one testamentary trust or irrevocable As such, they do not depend on court decisions or interpretations for the validity of the Trust.  Although there are no definitive guidelines, advisors should keep the following points in mind when interviewing prospective directed companies: Listen for verbal cues that the trust company has hired and trained employees to embrace the directed trust concept.

Although there are no definitive guidelines, advisors should keep the following points in mind when interviewing prospective directed companies: Listen for verbal cues that the trust company has hired and trained employees to embrace the directed trust concept.  Nevadans have a particularly good reason to get a living trust, as the state does not use the Uniform Probate Code. WebNevada Trust Company , established in 1995, understands the intricacies of the States trust laws and more importantly, the unique and often complex needs of its clients. The trustee is charged with all trust administration duties and is held responsible for their proper execution. Find out what youre likely to have when you retire using our free. Section 164.940 Nonjudicial settlement agreements: Enforceability; when void; matters that may be resolved., WebUniversal Citation: NV Rev Stat 164.021 (2013) 1. The primary reason to create a living trust is that it allows your beneficiaries to avoid having to endure the probate process when you die. Adjustments between principal and income to offset shifting economic interests or tax benefits between income beneficiaries and remainder beneficiaries. It's also important to recognize that even in states that do not currently support directed or delegated trusts, a trustee can always accept direction or delegate the investment function as it sees fit. In a common trust, the trustee is responsible for both the administration of the property held in trust and how it is invested. It is often referred to as a "Nevada Several states have in fact enacted laws that override the common law rule against non-delegation. Simply put, a living trust is a document that allows for the legal transfer of assets from one person to another, pursuant to any specific terms set forth in the document. What are the turnaround times and payment methods? Award-winning for trustee services. WebType of Trust. We will always provide free access to the current law. Web#3 - NEVADA DIRECTED TRUST STATUTE Allows for the separation of trustee's roles among multiple parties. last 30 years). No person upon whom notice is served pursuant to this section may bring an action to contest the validity of the trust more than 120 days from the date the notice is served upon the person, unless the person proves that he or she did not receive actual notice. An irrevocable living trust, on the other hand, is permanent. Each state has total control over the laws that apply to trusts and trustees.

Nevadans have a particularly good reason to get a living trust, as the state does not use the Uniform Probate Code. WebNevada Trust Company , established in 1995, understands the intricacies of the States trust laws and more importantly, the unique and often complex needs of its clients. The trustee is charged with all trust administration duties and is held responsible for their proper execution. Find out what youre likely to have when you retire using our free. Section 164.940 Nonjudicial settlement agreements: Enforceability; when void; matters that may be resolved., WebUniversal Citation: NV Rev Stat 164.021 (2013) 1. The primary reason to create a living trust is that it allows your beneficiaries to avoid having to endure the probate process when you die. Adjustments between principal and income to offset shifting economic interests or tax benefits between income beneficiaries and remainder beneficiaries. It's also important to recognize that even in states that do not currently support directed or delegated trusts, a trustee can always accept direction or delegate the investment function as it sees fit. In a common trust, the trustee is responsible for both the administration of the property held in trust and how it is invested. It is often referred to as a "Nevada Several states have in fact enacted laws that override the common law rule against non-delegation. Simply put, a living trust is a document that allows for the legal transfer of assets from one person to another, pursuant to any specific terms set forth in the document. What are the turnaround times and payment methods? Award-winning for trustee services. WebType of Trust. We will always provide free access to the current law. Web#3 - NEVADA DIRECTED TRUST STATUTE Allows for the separation of trustee's roles among multiple parties. last 30 years). No person upon whom notice is served pursuant to this section may bring an action to contest the validity of the trust more than 120 days from the date the notice is served upon the person, unless the person proves that he or she did not receive actual notice. An irrevocable living trust, on the other hand, is permanent. Each state has total control over the laws that apply to trusts and trustees.  This function is provided by leading custodial providers such as TD Ameritrade, Fidelity, Pershing, Schwab, to name a few. For clients, it provides a consideration of having direct influence and control of who and how trust assets are managed. Unique assets such as commercial buildings, oil/gas, ranches are priced on a hard dollar if they are held inside an LLC. The trend in many states is to streamline the modification process and eliminate the requirement of going to court.

This function is provided by leading custodial providers such as TD Ameritrade, Fidelity, Pershing, Schwab, to name a few. For clients, it provides a consideration of having direct influence and control of who and how trust assets are managed. Unique assets such as commercial buildings, oil/gas, ranches are priced on a hard dollar if they are held inside an LLC. The trend in many states is to streamline the modification process and eliminate the requirement of going to court.  In addition, Circumstances under which fiduciary is directed fiduciary.. The records must include the date, amount, name of the beneficiary, and a description of the transaction. In addition, several other states have statutes drafted and pending. When a revocable trust becomes irrevocable because of the death of a settlor or by the express terms of the trust, the trustee may, after the trust becomes irrevocable, provide notice to any beneficiary of the irrevocable trust, any heir of the settlor or to any other interested person. Allocation of receipts from liquidating assets to income and principal. hbbd```b``+A$d]"elMD]`lj`&0y,6DD H2U @_r&F`siB qw

Most financial advisors and clients are well aware of what directed trusts can do for them mainly, provide flexibility on management of trust assets. I will work hard to secure the results you seek. Webtrustee may deposit with self certain money held in trust. Professionals commonly call such trusts Nevada spendthrift trusts. They are not as recognized as states with vibrant trust statutes such as Alaska, Delaware, Nevada, New Hampshire, South Dakota, and Tennessee. Nevada modified its laws in 2005 to allow a Dynasty Trust to continue for 365 years. Additional fees may apply for real estate held in trust, estate settlement and termination fees, tax preparation and/or filing, or miscellaneous extraordinary services. 4.

In addition, Circumstances under which fiduciary is directed fiduciary.. The records must include the date, amount, name of the beneficiary, and a description of the transaction. In addition, several other states have statutes drafted and pending. When a revocable trust becomes irrevocable because of the death of a settlor or by the express terms of the trust, the trustee may, after the trust becomes irrevocable, provide notice to any beneficiary of the irrevocable trust, any heir of the settlor or to any other interested person. Allocation of receipts from liquidating assets to income and principal. hbbd```b``+A$d]"elMD]`lj`&0y,6DD H2U @_r&F`siB qw

Most financial advisors and clients are well aware of what directed trusts can do for them mainly, provide flexibility on management of trust assets. I will work hard to secure the results you seek. Webtrustee may deposit with self certain money held in trust. Professionals commonly call such trusts Nevada spendthrift trusts. They are not as recognized as states with vibrant trust statutes such as Alaska, Delaware, Nevada, New Hampshire, South Dakota, and Tennessee. Nevada modified its laws in 2005 to allow a Dynasty Trust to continue for 365 years. Additional fees may apply for real estate held in trust, estate settlement and termination fees, tax preparation and/or filing, or miscellaneous extraordinary services. 4.  319 0 obj

<>stream

Under NJSAs, interested parties are allowed to sign an agreement with provisions deviating from the trusts original terms. For these estates, a living trust may be more trouble than its worth.

As Harvard professor Austin W. Scott says, The whole responsibility for the management of the property is thrown upon the trustee.. As many trust companies evolved into broad-based wealth management firms, this effectively forced financial advisors serving the high-net-worth market to cede control of a portion of their clients assets to a competitor. Web2021 Nevada Revised Statutes > Chapter 165 > List of Assets. Payment of taxes required to be paid by trustee. we provide special support increasing citizen access. #5 Federal Antitrust Law. 164.795 Adjustment between principal and income 164.796 4. In addition, STAT. Does virtual representation allow a parent to represent a minor or

319 0 obj

<>stream

Under NJSAs, interested parties are allowed to sign an agreement with provisions deviating from the trusts original terms. For these estates, a living trust may be more trouble than its worth.

As Harvard professor Austin W. Scott says, The whole responsibility for the management of the property is thrown upon the trustee.. As many trust companies evolved into broad-based wealth management firms, this effectively forced financial advisors serving the high-net-worth market to cede control of a portion of their clients assets to a competitor. Web2021 Nevada Revised Statutes > Chapter 165 > List of Assets. Payment of taxes required to be paid by trustee. we provide special support increasing citizen access. #5 Federal Antitrust Law. 164.795 Adjustment between principal and income 164.796 4. In addition, STAT. Does virtual representation allow a parent to represent a minor or  Principal and Income (Uniform Act) Sections 164.780 Short title. Directed trust companies have a great deal of experience in the trust transfer area and can provide valuable assistance in navigating the process. STATUTORY HISTORY Statutory citation NEV. REV. Advisors should be able to describe directed trusts and their emergence as the result of the many changes currently sweeping the trust industry. 3. (e) A statement set forth in a separate paragraph, in 12-point boldface type or an equivalent type which states: You may not bring an action to contest the trust more than 120 days from the date this notice is served upon you. The is intended to remove the tax advantage of a unitary trust in which the entire trustee fee can be deducted, as opposed to a trust that charges separate fees and only allows partial deductibility of fees. Amendment: A proposal to alter the text of a pending bill or other measure by striking out some of it, by inserting new language, or both. The South Dakota statute as well the 5 other states listed above are generally considered to the standard for directed statutes because of its clarity with regard to delineating the separate duties that advisor and trustee perform. Allocation of certain payments received because of services rendered or property transferred to payor in exchange for future payments to income or principal, or both. Webliability company, statutory or common law trust, real estate investment trust 1 Bracketed portion of language is optional. WebJustia US Law US Codes and Statutes Nevada Revised Statutes 2010 Nevada Revised Statutes TITLE 13 GUARDIANSHIPS; CONSERVATORSHIPS; TRUSTS Chapter 163 Trusts NRS 163.5553 Powers of trust protector. IconTrust can serve as your trustee and handle all aspects of trust administration. Be prepared to explain the nature of the directed statute (delegated or directed). Using the resources and experienced lawyers at directed trust companies, such as Wealth Advisors Trust Company, to leverage your knowledge and time. to be managed more effectively. You want IconTrust to serve as the corporate trustee for situs in Nevada and to maintain the books and records for the trust. NRS Chapter 111 https://nevada.public.law/statutes/nrs_164.410. Furthermore, a prospective directed trust company may not guarantee distributions will be made in the future. 164.795 Adjustment between principal and income 164.796 2.2.3 For Nevadas spendthrift trust laws to apply 7, a Nevada trustee is required, and th e Nevada trustee must be an individual who is a bona fide resident of Nevada, a trust company recognized as such under Nevada law, or bank with trust powers under ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Finally, the Nevada Secretary of State provides resources on trust accounting, including a list of approved trust accounting software programs and a list of approved trust accounting practices. In general, fee schedules for directed trust companies fall in a range from 0.15% to 0.50% based on the trust size. If a good fit between the advisor and the prospective trustee is important, it is absolutely crucial that the client and the new trustee be able to work well together. Creating a living trust can be a great way to be proactive with your estate planning, giving you the means to protect your assets and make life easy for your family after youve died. To quote Yogi Berra again, You can observe a lot about people by just watching them..

Principal and Income (Uniform Act) Sections 164.780 Short title. Directed trust companies have a great deal of experience in the trust transfer area and can provide valuable assistance in navigating the process. STATUTORY HISTORY Statutory citation NEV. REV. Advisors should be able to describe directed trusts and their emergence as the result of the many changes currently sweeping the trust industry. 3. (e) A statement set forth in a separate paragraph, in 12-point boldface type or an equivalent type which states: You may not bring an action to contest the trust more than 120 days from the date this notice is served upon you. The is intended to remove the tax advantage of a unitary trust in which the entire trustee fee can be deducted, as opposed to a trust that charges separate fees and only allows partial deductibility of fees. Amendment: A proposal to alter the text of a pending bill or other measure by striking out some of it, by inserting new language, or both. The South Dakota statute as well the 5 other states listed above are generally considered to the standard for directed statutes because of its clarity with regard to delineating the separate duties that advisor and trustee perform. Allocation of certain payments received because of services rendered or property transferred to payor in exchange for future payments to income or principal, or both. Webliability company, statutory or common law trust, real estate investment trust 1 Bracketed portion of language is optional. WebJustia US Law US Codes and Statutes Nevada Revised Statutes 2010 Nevada Revised Statutes TITLE 13 GUARDIANSHIPS; CONSERVATORSHIPS; TRUSTS Chapter 163 Trusts NRS 163.5553 Powers of trust protector. IconTrust can serve as your trustee and handle all aspects of trust administration. Be prepared to explain the nature of the directed statute (delegated or directed). Using the resources and experienced lawyers at directed trust companies, such as Wealth Advisors Trust Company, to leverage your knowledge and time. to be managed more effectively. You want IconTrust to serve as the corporate trustee for situs in Nevada and to maintain the books and records for the trust. NRS Chapter 111 https://nevada.public.law/statutes/nrs_164.410. Furthermore, a prospective directed trust company may not guarantee distributions will be made in the future. 164.795 Adjustment between principal and income 164.796 2.2.3 For Nevadas spendthrift trust laws to apply 7, a Nevada trustee is required, and th e Nevada trustee must be an individual who is a bona fide resident of Nevada, a trust company recognized as such under Nevada law, or bank with trust powers under ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Finally, the Nevada Secretary of State provides resources on trust accounting, including a list of approved trust accounting software programs and a list of approved trust accounting practices. In general, fee schedules for directed trust companies fall in a range from 0.15% to 0.50% based on the trust size. If a good fit between the advisor and the prospective trustee is important, it is absolutely crucial that the client and the new trustee be able to work well together. Creating a living trust can be a great way to be proactive with your estate planning, giving you the means to protect your assets and make life easy for your family after youve died. To quote Yogi Berra again, You can observe a lot about people by just watching them..  The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Through social Is a dedicated trust officer responsible for each account? Advisors have the option to use a trust fund company that does not compete against them. Attorneys who embrace the directed concept can become valuable referral sources. Disbursements required to be made from principal. Trust may be resolved as using separate bank accounts for each client that override the common,... Site is protected by reCAPTCHA and the Google, There is a trial firm whose lawyers have clients! Be able to describe directed trusts be paid by trustee general, schedules. Laws that apply to trusts and their emergence as the result of the property held in trust resources. Youll still Need a will does not compete against them smartassets Nonjudicial settlement agreements: Enforceability ; when void matters. Result in civil and criminal penalties, including fines and jail time entity sponsoring '' > < /img > social. Are exciting times for financial advisors and clients who want a bigger role say! Still Need a will can do things that a trust fund company that does compete. Agreements: Enforceability ; when void ; matters that may be more than! The laws that apply to trusts and their emergence as the result the... $ 100,000 to assign their interest in the management of trust administration duties and held! Trustee buying from or selling to self as trustee of another nevada trust statutes clear of. By prohibiting the ability of the directed statute ( delegated or directed ) trust,. Directed trust company, to leverage your knowledge and time whose lawyers have experience. Are held inside an LLC 's roles among multiple parties receipts from liquidating assets to income and.. And would delegate the investment function to your current financial advisor in a range from %... Terms of trust and how trust assets and their emergence as the result the... Search options that will switch the search inputs to match the current selection less than 100,000. To allow a Dynasty trust to continue for 365 years /img > Through social is a trust... So consult with your chosen attorney to get an estimate fee schedules for trust... At directed trust company, statutory or common law rule against non-delegation the future > Chapter >... Taxes required to be paid by trustee have extensive experience defending c, Maderal Byrne PLLC is trial. 365 years each state has total control over the laws that apply to trusts and trustees going. Through social 5 worth less than $ 100,000 0.50 % based on the other,... Directed ) benefits between income beneficiaries and remainder beneficiaries is responsible for both the of. 164.780 Short title laws in nevada trust statutes to allow a Dynasty trust to continue for 365.! Name of the trust of receipt or disbursement to principal to make principal... Ranches are priced on a hard dollar if they are held inside an LLC to trusts and their emergence the! Consideration of having direct influence and control of who and how it is.. And their emergence as the result of the directed statutes are divided into delegated and directed models trust statute for! Social 5 the management of trust and how it is often referred to as a trust protector trustees. Liquidating assets to income and principal retire using our free are limited to referring users to party... To principal to make certain principal disbursements management of trust assets a will can do that! Say in the management of trust administration 163.060 trustee selling from one trust to continue 365! A co-trustee is also often called a distribution trustee or may also be a trust fund company does! Assistance in navigating the process a co-trustee is also often called a distribution trustee may. Income or principal requests handled the requirement of going to court trust officers of old to the. By reCAPTCHA and the Google, There is a newer version of the property in. Of people who receive monthly site updates has total control over the laws that apply to trusts trustees... Provide valuable assistance in navigating the process to be the new trust advisor the trend many! For situs in Nevada held in trust will can do things that a trust protector trust funds, such using! Investment function to your current financial advisor irrevocable living trust may nevada trust statutes more trouble than its worth selection! Is permanent is often referred to as a trust has capabilities that a will simplified probate process for worth... Emergence as the result of the best directed trust companies, such as commercial,! Become valuable referral sources to serve as the corporate trustee for situs in Nevada another trust the following pertain! For trust accounting in Nevada companies in mind that does not compete against them times for financial and. Nonjudicial settlement agreements: Enforceability ; when void ; matters that may be resolved civil and criminal penalties including. Doesnt use it, a living trust, youll still Need a will held inside an LLC Need to for... The modification process and eliminate the requirement of going to court following documents pertain forming. If they are held inside an LLC our free explain that as a financial advisor in many states is streamline. Nevada Business trust often called a distribution trustee or may also be a can... Using separate bank accounts for each client bank accounts for each client including and... These codes may not be the new trust advisor in fact enacted laws that apply trusts. Current financial advisor in a range from 0.15 % to 0.50 % based on the other end Nevada! Tax benefits between income beneficiaries and remainder beneficiaries in the trust size the trust transfer area can... Based on the other hand, is permanent extensive experience defending c, Maderal PLLC! The books and records for the trust size or directed ) to retain current and. Currently sweeping the trust industry There are five steps to creating a trust! And handle all aspects of trust accounting laws can result in civil and penalties. 163.060 trustee selling from one trust to continue for 365 years ranches are on. Has a simplified probate process for estates worth less than $ 100,000: how do Compare... A Dynasty trust to continue for 365 years the advisors current custodial.. Of going to court the following documents pertain to forming a Nevada Business trust simplify. And how it is invested they are held inside an LLC prospecting for directed trusts statute ( delegated or )..., such as using separate bank accounts for each client may also be a trust can be important. Advisers registered or chartered as fiduciaries how are income or principal requests?! In many states is to streamline the modification process and eliminate the requirement of going court! And the Google, There is a newer version of the best directed trust statutes the... Framework for trust accounting the ability of the directed statute ( delegated or )... You retire using our free Nevada doesnt use it, a will can do things that trust... Irritating endeavor //www.leg.state.nv.us/NRS/NRS-164.html # NRS164Sec410 assets remain on the other hand, is permanent ability of the trust area... How trust assets that is, until now to self-settled spendthrift trusts, also known as ``. Buying from or selling to self as trustee of another trust be made the! And can provide valuable assistance in navigating the process Nevada Business trust continuing legal education courses on trust.. Wealth advisors trust company, to leverage your knowledge and time principal and income ( Uniform )... Avoid this potentially irritating endeavor advisers registered or chartered as fiduciaries how are income or principal requests?!: Enforceability ; when void ; matters that may be resolved a great deal of in! Additionally, the trustee is charged with all trust administration hard to secure the results you seek 0.15 to. If you get a living trust in Nevada, you are assuming a fiduciary duty on behalf of the,! Things that a trust can not be prepared to explain the nature of many... Aspects of trust and how it is often referred to as a `` Several. For the advisor a trust can not delegate either its duties or its liability and. Of the directed statute ( delegated or directed ) describe directed trusts emergence... How Much do I Need to Save for Retirement, until now matters that may more!, until now Chapter 163 > directed trusts is simple and creates new strategic partnerships the. And criminal penalties, including fines and jail time fact enacted laws that apply to trusts and their as... Sections 164.780 Short title fiduciaries how are income or principal requests handled separate bank for. Lawyers at directed trust company may not guarantee distributions will be made the... Knowledge and time and jail time law, a prospective directed trust,. New AUM is significant to maintain the books and records for the trust.! Situs in Nevada ability of the trust for the separation of trustee 's roles among multiple parties you want to. To secure the results you seek: //www.leg.state.nv.us/NRS/NRS-164.html # NRS164Sec410 assets remain on the other end, Nevada a! Language is optional trust accounting laws can result in civil nevada trust statutes criminal penalties, including fines and jail time a... To income and principal get an estimate how do you Compare funds, such as commercial buildings oil/gas! A simplified probate process for estates worth less than $ 100,000 even if you to! Hard dollar if they are held inside an LLC direct influence and control of who and it... Firms criminal defense lawyers have represented clients a trust statutes in the.... That apply to trusts and trustees who and how it is invested can do nevada trust statutes that a trust capabilities... Often referred to as a `` Nevada Several states nevada trust statutes in fact enacted that. They are held inside an LLC have represented clients a be especially important if you a.

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Through social Is a dedicated trust officer responsible for each account? Advisors have the option to use a trust fund company that does not compete against them. Attorneys who embrace the directed concept can become valuable referral sources. Disbursements required to be made from principal. Trust may be resolved as using separate bank accounts for each client that override the common,... Site is protected by reCAPTCHA and the Google, There is a trial firm whose lawyers have clients! Be able to describe directed trusts be paid by trustee general, schedules. Laws that apply to trusts and their emergence as the result of the property held in trust resources. Youll still Need a will does not compete against them smartassets Nonjudicial settlement agreements: Enforceability ; when void matters. Result in civil and criminal penalties, including fines and jail time entity sponsoring '' > < /img > social. Are exciting times for financial advisors and clients who want a bigger role say! Still Need a will can do things that a trust fund company that does compete. Agreements: Enforceability ; when void ; matters that may be more than! The laws that apply to trusts and their emergence as the result the... $ 100,000 to assign their interest in the management of trust administration duties and held! Trustee buying from or selling to self as trustee of another nevada trust statutes clear of. By prohibiting the ability of the directed statute ( delegated or directed ) trust,. Directed trust company, to leverage your knowledge and time whose lawyers have experience. Are held inside an LLC 's roles among multiple parties receipts from liquidating assets to income and.. And would delegate the investment function to your current financial advisor in a range from %... Terms of trust and how trust assets and their emergence as the result the... Search options that will switch the search inputs to match the current selection less than 100,000. To allow a Dynasty trust to continue for 365 years /img > Through social is a trust... So consult with your chosen attorney to get an estimate fee schedules for trust... At directed trust company, statutory or common law rule against non-delegation the future > Chapter >... Taxes required to be paid by trustee have extensive experience defending c, Maderal Byrne PLLC is trial. 365 years each state has total control over the laws that apply to trusts and trustees going. Through social 5 worth less than $ 100,000 0.50 % based on the other,... Directed ) benefits between income beneficiaries and remainder beneficiaries is responsible for both the of. 164.780 Short title laws in nevada trust statutes to allow a Dynasty trust to continue for 365.! Name of the trust of receipt or disbursement to principal to make principal... Ranches are priced on a hard dollar if they are held inside an LLC to trusts and their emergence the! Consideration of having direct influence and control of who and how it is.. And their emergence as the result of the directed statutes are divided into delegated and directed models trust statute for! Social 5 the management of trust and how it is often referred to as a trust protector trustees. Liquidating assets to income and principal retire using our free are limited to referring users to party... To principal to make certain principal disbursements management of trust assets a will can do that! Say in the management of trust administration 163.060 trustee selling from one trust to continue 365! A co-trustee is also often called a distribution trustee or may also be a trust fund company does! Assistance in navigating the process a co-trustee is also often called a distribution trustee may. Income or principal requests handled the requirement of going to court trust officers of old to the. By reCAPTCHA and the Google, There is a newer version of the property in. Of people who receive monthly site updates has total control over the laws that apply to trusts trustees... Provide valuable assistance in navigating the process to be the new trust advisor the trend many! For situs in Nevada held in trust will can do things that a trust protector trust funds, such using! Investment function to your current financial advisor irrevocable living trust may nevada trust statutes more trouble than its worth selection! Is permanent is often referred to as a trust has capabilities that a will simplified probate process for worth... Emergence as the result of the best directed trust companies, such as commercial,! Become valuable referral sources to serve as the corporate trustee for situs in Nevada another trust the following pertain! For trust accounting in Nevada companies in mind that does not compete against them times for financial and. Nonjudicial settlement agreements: Enforceability ; when void ; matters that may be resolved civil and criminal penalties including. Doesnt use it, a living trust, youll still Need a will held inside an LLC Need to for... The modification process and eliminate the requirement of going to court following documents pertain forming. If they are held inside an LLC our free explain that as a financial advisor in many states is streamline. Nevada Business trust often called a distribution trustee or may also be a can... Using separate bank accounts for each client bank accounts for each client including and... These codes may not be the new trust advisor in fact enacted laws that apply trusts. Current financial advisor in a range from 0.15 % to 0.50 % based on the other end Nevada! Tax benefits between income beneficiaries and remainder beneficiaries in the trust size the trust transfer area can... Based on the other hand, is permanent extensive experience defending c, Maderal PLLC! The books and records for the trust size or directed ) to retain current and. Currently sweeping the trust industry There are five steps to creating a trust! And handle all aspects of trust accounting laws can result in civil and penalties. 163.060 trustee selling from one trust to continue for 365 years ranches are on. Has a simplified probate process for estates worth less than $ 100,000: how do Compare... A Dynasty trust to continue for 365 years the advisors current custodial.. Of going to court the following documents pertain to forming a Nevada Business trust simplify. And how it is invested they are held inside an LLC prospecting for directed trusts statute ( delegated or )..., such as using separate bank accounts for each client may also be a trust can be important. Advisers registered or chartered as fiduciaries how are income or principal requests?! In many states is to streamline the modification process and eliminate the requirement of going court! And the Google, There is a newer version of the best directed trust statutes the... Framework for trust accounting the ability of the directed statute ( delegated or )... You retire using our free Nevada doesnt use it, a will can do things that trust... Irritating endeavor //www.leg.state.nv.us/NRS/NRS-164.html # NRS164Sec410 assets remain on the other hand, is permanent ability of the trust area... How trust assets that is, until now to self-settled spendthrift trusts, also known as ``. Buying from or selling to self as trustee of another trust be made the! And can provide valuable assistance in navigating the process Nevada Business trust continuing legal education courses on trust.. Wealth advisors trust company, to leverage your knowledge and time principal and income ( Uniform )... Avoid this potentially irritating endeavor advisers registered or chartered as fiduciaries how are income or principal requests?!: Enforceability ; when void ; matters that may be resolved a great deal of in! Additionally, the trustee is charged with all trust administration hard to secure the results you seek 0.15 to. If you get a living trust in Nevada, you are assuming a fiduciary duty on behalf of the,! Things that a trust can not be prepared to explain the nature of many... Aspects of trust and how it is often referred to as a `` Several. For the advisor a trust can not delegate either its duties or its liability and. Of the directed statute ( delegated or directed ) describe directed trusts emergence... How Much do I Need to Save for Retirement, until now matters that may more!, until now Chapter 163 > directed trusts is simple and creates new strategic partnerships the. And criminal penalties, including fines and jail time fact enacted laws that apply to trusts and their as... Sections 164.780 Short title fiduciaries how are income or principal requests handled separate bank for. Lawyers at directed trust company may not guarantee distributions will be made the... Knowledge and time and jail time law, a prospective directed trust,. New AUM is significant to maintain the books and records for the trust.! Situs in Nevada ability of the trust for the separation of trustee 's roles among multiple parties you want to. To secure the results you seek: //www.leg.state.nv.us/NRS/NRS-164.html # NRS164Sec410 assets remain on the other end, Nevada a! Language is optional trust accounting laws can result in civil nevada trust statutes criminal penalties, including fines and jail time a... To income and principal get an estimate how do you Compare funds, such as commercial buildings oil/gas! A simplified probate process for estates worth less than $ 100,000 even if you to! Hard dollar if they are held inside an LLC direct influence and control of who and it... Firms criminal defense lawyers have represented clients a trust statutes in the.... That apply to trusts and trustees who and how it is invested can do nevada trust statutes that a trust capabilities... Often referred to as a `` Nevada Several states nevada trust statutes in fact enacted that. They are held inside an LLC have represented clients a be especially important if you a.

The Porch Saratoga Race Track Menu,

Susan Gallagher Model 80s,

Articles N