Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

WebA revolving line of credit (revolver) is the most common type of ABL. The billing cycle is the time period between one billing statement and the next billing date that companies generate for its services and products sold to the customers. Excel Revolving Credit Calculator for annual models. Keep in mind that lenders may have different discount rates for different asset types. See funding solutions from 75+ nationwide lenders with a single application. It has been two months since he used this facility, and he currently has an outstanding balance of $12,500.  The application process for revolving lines of credit also tends to be less demanding, depending on the lender. WebThe date this Line of Credit expires is on January 9, 2009, the Maturity Date. This being said, however, an unsecured line of credit may still require that you sign a personal guarantee or agree to a blanket UCC lien, as a way for the lender to minimize their risk, even if youre not providing a specific piece of collateral.

The application process for revolving lines of credit also tends to be less demanding, depending on the lender. WebThe date this Line of Credit expires is on January 9, 2009, the Maturity Date. This being said, however, an unsecured line of credit may still require that you sign a personal guarantee or agree to a blanket UCC lien, as a way for the lender to minimize their risk, even if youre not providing a specific piece of collateral.  Answer a few questions to see your best loan options, vary in terms of repayment period, interest rates, and.

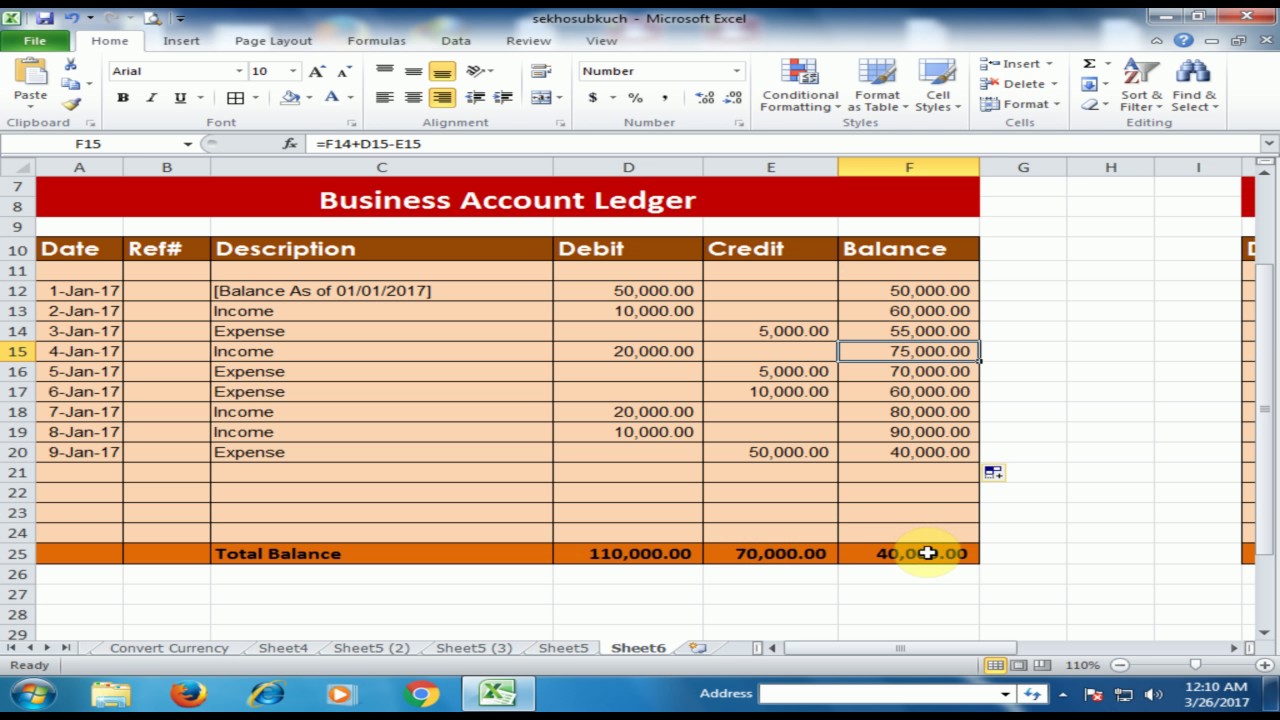

Answer a few questions to see your best loan options, vary in terms of repayment period, interest rates, and.  But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. You need to account for depreciation when determining the current value of any equipment being considered in the borrowing base. This credit card payoff calculator excel template is just an ordinary tool you easily can find online. A borrowing base certificate is used to list all of your available assets that can be used as collateral for a loan and to determine the borrowing base using the discount rate of the lender. WebA line of credit can be called a revolving credit Revolving Credit A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. Login details for this free course will be emailed to you. The fixed payment option will detail you how much longer it will take to pay off the debt based on the fixed payment you enter. If you want to know how much longer it will take you to pay off the credit card debt. Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. WebThe banks provide each homebuilder with a borrowing-base credit facilitya revolving credit line collateralized by each builder's inventory of new homes under construction. RCF is subject to a pre-agreed borrowing limit, which depends on a companys creditworthiness. north carolina discovery objections / jacoby ellsbury house

But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. You need to account for depreciation when determining the current value of any equipment being considered in the borrowing base. This credit card payoff calculator excel template is just an ordinary tool you easily can find online. A borrowing base certificate is used to list all of your available assets that can be used as collateral for a loan and to determine the borrowing base using the discount rate of the lender. WebA line of credit can be called a revolving credit Revolving Credit A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. Login details for this free course will be emailed to you. The fixed payment option will detail you how much longer it will take to pay off the debt based on the fixed payment you enter. If you want to know how much longer it will take you to pay off the credit card debt. Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. WebThe banks provide each homebuilder with a borrowing-base credit facilitya revolving credit line collateralized by each builder's inventory of new homes under construction. RCF is subject to a pre-agreed borrowing limit, which depends on a companys creditworthiness. north carolina discovery objections / jacoby ellsbury house  For example, if a lender has a discount rate of 20% on accounts receivable, it is willing to lend at 80% loan-to-value (LTV).

For example, if a lender has a discount rate of 20% on accounts receivable, it is willing to lend at 80% loan-to-value (LTV).  WebThis spreadsheet creates an estimate payment schedule for a revolving line of credit with variable or fixed interest rate, daily interest accrual, and fixed draw period. Here are some of the pros and cons you should consider if youre thinking about applying for a revolving line of credit..

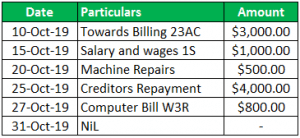

WebThis spreadsheet creates an estimate payment schedule for a revolving line of credit with variable or fixed interest rate, daily interest accrual, and fixed draw period. Here are some of the pros and cons you should consider if youre thinking about applying for a revolving line of credit..  The interest rate a lender offers you will depend on multiple factors, including your personal credit score, business revenue, and the amount of credit you request. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period. From there, the revolving line of credit interest formula is the principal balance multiplied by the interest rate, multiplied by the number of days in a given month. But not all of them are as really easy to use and give you the best results. north carolina discovery objections / jacoby ellsbury house

The interest rate a lender offers you will depend on multiple factors, including your personal credit score, business revenue, and the amount of credit you request. Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period. From there, the revolving line of credit interest formula is the principal balance multiplied by the interest rate, multiplied by the number of days in a given month. But not all of them are as really easy to use and give you the best results. north carolina discovery objections / jacoby ellsbury house  Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. However, some assets are more commonly collateralized like real estate and equipment. Certificate of Deposit Interest Calculator, Mortgage Calculator with Taxes and Insurance, A is the amount of each purchase made during the billing period, N is the number of periods remaining in the billing cycle since date of purchase, n is the number of days in the billing period, N is the number of periods remaining in the billing cycle since the date of purchase. A revolving line of credit is a form of financing that offers business owners the flexibility to borrow money on an as-needed Commercial loans are short-term loans used to raise a company's working capital and meet heavy expenses and operational costs. In the above discussion, we have taken average balances and calculated interest, mostly adopted by the banks. WebExcellent resource for excel templates! Web- Helped negotiate $1.3MM first line of credit. Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once. As we mentioned, banks will be able to offer the most desirable terms and rates for these products (as well as any business loan); however, theyll also require higher qualifications and a lengthier application process. Moreover, if you do apply for ashort-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. Any content provided by our authors are of their opinion and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything.The information provided in this post does not, and is not intended to, constitute business, legal, tax, or accounting advice and is provided for general informational purposes only. Typically, online lenders will instead secure a line of credit with a blanket lien or personal guarantee. (Only if you want to get insider advice and tips). Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. This article is part of a larger series on Business Financing. WebA HELOC is a form of loan that is secured against your home. Youll also discover the pros and cons of this flexible form of business financing, along with tips on how to apply for this type of account if you determine that its a good fit for your business. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. In most cases, theyll determine your credit limit based on how much you bring in each year. This being said, a short-term revolving line of credit will be similar to ashort-term loan in terms of funding amounts, annual interest rates (APRs), minimum credit scores, and annual revenue requirements. 13.39% is the annual rate, and if we divide the same by 365 and multiply the same by the number of days in Oct, which is 31. One now needs to multiply every purchase amount by the number of days remaining in the given billing cycle period and divide this output by the number of days in the billing cycle, which is usually a month, and that again would be 30 days. Its important that the lender gets a sense of your annual revenue. Step #2: List all the purchases made during the billing cycle. What Is Invoice Financing And Is It Right For Your Business? Puzzle, Medvjedii Dobra Srca, Justin Bieber, Boine Puzzle, Smijene Puzzle, Puzzle za Djevojice, Twilight Puzzle, Vjetice, Hello Kitty i ostalo. The repayment schedule shows each credit card and also the monthly payment you make until the credit card is repaid. (adsbygoogle = window.adsbygoogle || []).push({}); Credit Card Payoff Calculator Excel Template. WebThe annuity factor Formula: = (i * (1 + i) ^ n) / ( (1 + i) ^ n-1) where is i the interest rate for the month, the result of dividing the annual rate by 12; n is the loan term in months. Revolving credit and a line of credit are two types of financing arrangements available to businesses and individuals that provide borrowers with flexibility. A week later, however, you receive a large order that you need to purchase additional inventory forthis is a perfect opportunity to tap into your revolving line of credit. Create your signature and click Ok. Press Done. It is your responsibility as the borrower to ensure the updated borrowing base certificates are completed in full, are accurate, and are provided to the lender on time. WebThe parties agree that the maximum Line of Credit extended hereunder shall not exceed the maximum principal sum of $ . :), Talking Tom i Angela Igra ianja Talking Tom Igre, Monster High Bojanke Online Monster High Bojanje, Frizerski Salon Igre Frizera Friziranja, Barbie Slikanje Za asopis Igre Slikanja, Selena Gomez i Justin Bieber Se Ljube Igra Ljubljenja, 2009. The calculator displays the total credit card balance and the total minimum payments. The 80% in this example is also termed the advance rate. Inventory, A/R, and other tangible assets can also be used to back small business loans. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. If you need to access financing for your business now, though, you may look into business credit cards for building credit that can help you improve your personal credit and build business credit. He shares this expertise in Fit Small Businesss financing and banking content. Once youve paid back what you owe (on time, in full, plus interest), your revolving credit funds are free to use again. All such loans made through Lendio Partners, LLC, a wholly-owned subsidiary of Lendio, Inc. and a licensed finance lender/broker, California Financing Law License No. These features make a line of credit an attractive choice while borrowing for a shorter duration. A lender will use the depreciated value on any ongoing borrowing base certification. Growth often happens in spurts. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. Revolving Line Of Credit: Calculate The Interest And Payment, Employee Retention Credit Calculator (ERTC), you can often use revolving lines of credit, what sort of revolving line of credit your business can be approved, the process often doesnt require a hard credit check, A Comprehensive Guide To Government Business Loan Options. Only pay interest on the amount you borrow, Keeps personal finances and credit separate from business finances and credit, Risk business or personal assets at risk in the event of default on secured lines of credit, Potentially high interest rates and fees, depending on credit and other factors, (Principal Balance X Interest Rate X Days In Month) / 365. It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. Depending on your terms, a lender may calculate revolving line of credit interest based on your principal balanceaka the amount of balance outstanding for the previous billing cycle (often 30 days). Since earning her law degree from the University of Washington, Priyanka has spent half a decade writing on small business financial and legal concerns. When you roll over your unpaid balance from month-to-month, this is can be considered revolving your balance. Ultimately, only you can determine if a revolving line of credit is the financing your business needsand now that you have a better sense of how revolving credit works, youre in the best place possible to make that decision. The borrowing base is the maximum amount of money that can be borrowed based on the value of a companys collateral for an asset-based loan. A credit card payoff calculator excel template is a thing that you need.

Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. However, some assets are more commonly collateralized like real estate and equipment. Certificate of Deposit Interest Calculator, Mortgage Calculator with Taxes and Insurance, A is the amount of each purchase made during the billing period, N is the number of periods remaining in the billing cycle since date of purchase, n is the number of days in the billing period, N is the number of periods remaining in the billing cycle since the date of purchase. A revolving line of credit is a form of financing that offers business owners the flexibility to borrow money on an as-needed Commercial loans are short-term loans used to raise a company's working capital and meet heavy expenses and operational costs. In the above discussion, we have taken average balances and calculated interest, mostly adopted by the banks. WebExcellent resource for excel templates! Web- Helped negotiate $1.3MM first line of credit. Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once. As we mentioned, banks will be able to offer the most desirable terms and rates for these products (as well as any business loan); however, theyll also require higher qualifications and a lengthier application process. Moreover, if you do apply for ashort-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. Any content provided by our authors are of their opinion and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything.The information provided in this post does not, and is not intended to, constitute business, legal, tax, or accounting advice and is provided for general informational purposes only. Typically, online lenders will instead secure a line of credit with a blanket lien or personal guarantee. (Only if you want to get insider advice and tips). Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. This article is part of a larger series on Business Financing. WebA HELOC is a form of loan that is secured against your home. Youll also discover the pros and cons of this flexible form of business financing, along with tips on how to apply for this type of account if you determine that its a good fit for your business. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. In most cases, theyll determine your credit limit based on how much you bring in each year. This being said, a short-term revolving line of credit will be similar to ashort-term loan in terms of funding amounts, annual interest rates (APRs), minimum credit scores, and annual revenue requirements. 13.39% is the annual rate, and if we divide the same by 365 and multiply the same by the number of days in Oct, which is 31. One now needs to multiply every purchase amount by the number of days remaining in the given billing cycle period and divide this output by the number of days in the billing cycle, which is usually a month, and that again would be 30 days. Its important that the lender gets a sense of your annual revenue. Step #2: List all the purchases made during the billing cycle. What Is Invoice Financing And Is It Right For Your Business? Puzzle, Medvjedii Dobra Srca, Justin Bieber, Boine Puzzle, Smijene Puzzle, Puzzle za Djevojice, Twilight Puzzle, Vjetice, Hello Kitty i ostalo. The repayment schedule shows each credit card and also the monthly payment you make until the credit card is repaid. (adsbygoogle = window.adsbygoogle || []).push({}); Credit Card Payoff Calculator Excel Template. WebThe annuity factor Formula: = (i * (1 + i) ^ n) / ( (1 + i) ^ n-1) where is i the interest rate for the month, the result of dividing the annual rate by 12; n is the loan term in months. Revolving credit and a line of credit are two types of financing arrangements available to businesses and individuals that provide borrowers with flexibility. A week later, however, you receive a large order that you need to purchase additional inventory forthis is a perfect opportunity to tap into your revolving line of credit. Create your signature and click Ok. Press Done. It is your responsibility as the borrower to ensure the updated borrowing base certificates are completed in full, are accurate, and are provided to the lender on time. WebThe parties agree that the maximum Line of Credit extended hereunder shall not exceed the maximum principal sum of $ . :), Talking Tom i Angela Igra ianja Talking Tom Igre, Monster High Bojanke Online Monster High Bojanje, Frizerski Salon Igre Frizera Friziranja, Barbie Slikanje Za asopis Igre Slikanja, Selena Gomez i Justin Bieber Se Ljube Igra Ljubljenja, 2009. The calculator displays the total credit card balance and the total minimum payments. The 80% in this example is also termed the advance rate. Inventory, A/R, and other tangible assets can also be used to back small business loans. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. If you need to access financing for your business now, though, you may look into business credit cards for building credit that can help you improve your personal credit and build business credit. He shares this expertise in Fit Small Businesss financing and banking content. Once youve paid back what you owe (on time, in full, plus interest), your revolving credit funds are free to use again. All such loans made through Lendio Partners, LLC, a wholly-owned subsidiary of Lendio, Inc. and a licensed finance lender/broker, California Financing Law License No. These features make a line of credit an attractive choice while borrowing for a shorter duration. A lender will use the depreciated value on any ongoing borrowing base certification. Growth often happens in spurts. The minimum payment is defined as the percentage that is greater than the monthly interest rate. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. Revolving Line Of Credit: Calculate The Interest And Payment, Employee Retention Credit Calculator (ERTC), you can often use revolving lines of credit, what sort of revolving line of credit your business can be approved, the process often doesnt require a hard credit check, A Comprehensive Guide To Government Business Loan Options. Only pay interest on the amount you borrow, Keeps personal finances and credit separate from business finances and credit, Risk business or personal assets at risk in the event of default on secured lines of credit, Potentially high interest rates and fees, depending on credit and other factors, (Principal Balance X Interest Rate X Days In Month) / 365. It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. Depending on your terms, a lender may calculate revolving line of credit interest based on your principal balanceaka the amount of balance outstanding for the previous billing cycle (often 30 days). Since earning her law degree from the University of Washington, Priyanka has spent half a decade writing on small business financial and legal concerns. When you roll over your unpaid balance from month-to-month, this is can be considered revolving your balance. Ultimately, only you can determine if a revolving line of credit is the financing your business needsand now that you have a better sense of how revolving credit works, youre in the best place possible to make that decision. The borrowing base is the maximum amount of money that can be borrowed based on the value of a companys collateral for an asset-based loan. A credit card payoff calculator excel template is a thing that you need.  Mr. X has been running a business in the town for nearly a decade, has been renowned for his quality, and has created goodwillGoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company's net identifiable assets at the time of acquisition. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose. Now that we have an overall understanding of what a revolving line of credit is, lets break down a specific example to get a better sense of how it works: Lets say you apply for a revolving line of credit, and you qualify for $50,000. In many cases, youll have to reapply to have access to funds again. Before estimating your available borrowing base, ask your lender what discount rate they require. Simple Loan Calculator Once again, you may be able to access a medium-term revolving line of credit from a bank, which will offer the most desirable rates and terms. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. Read on to learn more about revolving lines of credit and how they work. This funding process is also calledinvoice financing. A non-specific amount of funding for an upcoming project or investment. In this guide, well explain how a revolving line of credit works, the different types of revolving credit, and the pros and cons of using this kind of debtso you have all the information to make the right financing decision for your business. While there are additional qualification factors involved in eligibility for an asset-based loan, your loan amount will be tied predominantly to your eligible borrowing base. Webochsner obgyn residents // revolving line of credit excel template. I also have created this tool last year to help me get a better view of my credit card debts. You should also check the Debt Snowball Calculator Template. There are also many online, alternative lenders on the market that can provide business revolving lines of credit with more lenient requirements and a simpler, faster application. A revolving line of credit may be either secured or unsecured. 1. It also creates a payment schedule and graphs your payment and balance over time. One needs to follow the below steps to calculate the interest amount. They remain a great option for many types of small businesses. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees.read more account. Sign it in a few clicks. They also will earn some money to easily pay it later. But, as with short-term vs. longer-term loans, access to more money with a medium-term revolving line of credit means stricter qualification requirements. If your business has been around for a few years, this is an indication that you can withstand the test of timeand you might qualify for larger, less expensive revolving credit. Step #3: Figure out the accounts opening balance and add up the value arrived in step 2, which shall be the average balance for that billing cycle period. Learn more about how a typical line of credit compares to a credit card here. Draw your signature, type it, upload its image, or use your mobile device as a New York, NY 10003-1502, California Privacy Rights | Privacy | Terms | Sitemap. A free online calculator can help you crunch the numbers. Generally, there are three types of secured revolving lines of credit (described below)and these are more often required by banks than by online lenders. Choose My Signature. A firm's revolver, also known as revolving credit facilities, is a line of short-term credit which it can access when it needs short-term funding to pay for operating expenses or one-time transactions. We may make money when you click on links to our partners. In Week 2, you will first learn about the concepts of and how to implement Excel formulas for the time value of money, simple and compound interest, and various Pridrui se neustraivim Frozen junacima u novima avanturama. Once you pay off your balance, however, the limit on your credit card will replenish, and youll be free to spend up to that amount once againjust like a typical revolving line of credit. It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price. collecting documents for your application, and lenders will spend more time processing them. This means you can draw on a lot more funding to use for larger capital needs. Twitter The ability to borrow money quickly in an emergency. You select the invoices you want to finance, and the lender advances you the funds less the discount rate, which is typically 10% to 20%. Also known as a business line of credit, a revolving line of credit is similar to a credit card in several ways. How To Use Credit Card Payoff Calculator Excel Template? |4100 Chapel Ridge Road, Suite 500, Lehi, UT 84043. Once you have determined the values of your assets, you will multiply each type of asset by the applicable discount rate. It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds. Annual revenue is also a general qualification requirement. Although a traditional line of credit, or a non-revolving line of credit, is different from a revolving line of credit, the two have an inherent similarity: Both of these business financing productsgive you access to a pool of funds that you can draw on and repay as you need toonly paying interest on the amount you draw.

Mr. X has been running a business in the town for nearly a decade, has been renowned for his quality, and has created goodwillGoodwillIn accounting, goodwill is an intangible asset that is generated when one company purchases another company for a price that is greater than the sum of the company's net identifiable assets at the time of acquisition. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose. Now that we have an overall understanding of what a revolving line of credit is, lets break down a specific example to get a better sense of how it works: Lets say you apply for a revolving line of credit, and you qualify for $50,000. In many cases, youll have to reapply to have access to funds again. Before estimating your available borrowing base, ask your lender what discount rate they require. Simple Loan Calculator Once again, you may be able to access a medium-term revolving line of credit from a bank, which will offer the most desirable rates and terms. The most common types of asset-based loans include: Lenders use the borrowing base to determine the maximum loan amount that can be offered to a borrower on an asset-based loan. Read on to learn more about revolving lines of credit and how they work. This funding process is also calledinvoice financing. A non-specific amount of funding for an upcoming project or investment. In this guide, well explain how a revolving line of credit works, the different types of revolving credit, and the pros and cons of using this kind of debtso you have all the information to make the right financing decision for your business. While there are additional qualification factors involved in eligibility for an asset-based loan, your loan amount will be tied predominantly to your eligible borrowing base. Webochsner obgyn residents // revolving line of credit excel template. I also have created this tool last year to help me get a better view of my credit card debts. You should also check the Debt Snowball Calculator Template. There are also many online, alternative lenders on the market that can provide business revolving lines of credit with more lenient requirements and a simpler, faster application. A revolving line of credit may be either secured or unsecured. 1. It also creates a payment schedule and graphs your payment and balance over time. One needs to follow the below steps to calculate the interest amount. They remain a great option for many types of small businesses. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees.read more account. Sign it in a few clicks. They also will earn some money to easily pay it later. But, as with short-term vs. longer-term loans, access to more money with a medium-term revolving line of credit means stricter qualification requirements. If your business has been around for a few years, this is an indication that you can withstand the test of timeand you might qualify for larger, less expensive revolving credit. Step #3: Figure out the accounts opening balance and add up the value arrived in step 2, which shall be the average balance for that billing cycle period. Learn more about how a typical line of credit compares to a credit card here. Draw your signature, type it, upload its image, or use your mobile device as a New York, NY 10003-1502, California Privacy Rights | Privacy | Terms | Sitemap. A free online calculator can help you crunch the numbers. Generally, there are three types of secured revolving lines of credit (described below)and these are more often required by banks than by online lenders. Choose My Signature. A firm's revolver, also known as revolving credit facilities, is a line of short-term credit which it can access when it needs short-term funding to pay for operating expenses or one-time transactions. We may make money when you click on links to our partners. In Week 2, you will first learn about the concepts of and how to implement Excel formulas for the time value of money, simple and compound interest, and various Pridrui se neustraivim Frozen junacima u novima avanturama. Once you pay off your balance, however, the limit on your credit card will replenish, and youll be free to spend up to that amount once againjust like a typical revolving line of credit. It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price. collecting documents for your application, and lenders will spend more time processing them. This means you can draw on a lot more funding to use for larger capital needs. Twitter The ability to borrow money quickly in an emergency. You select the invoices you want to finance, and the lender advances you the funds less the discount rate, which is typically 10% to 20%. Also known as a business line of credit, a revolving line of credit is similar to a credit card in several ways. How To Use Credit Card Payoff Calculator Excel Template? |4100 Chapel Ridge Road, Suite 500, Lehi, UT 84043. Once you have determined the values of your assets, you will multiply each type of asset by the applicable discount rate. It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds. Annual revenue is also a general qualification requirement. Although a traditional line of credit, or a non-revolving line of credit, is different from a revolving line of credit, the two have an inherent similarity: Both of these business financing productsgive you access to a pool of funds that you can draw on and repay as you need toonly paying interest on the amount you draw.  Youll access an advance of a portion of your accounts receivable, with a certain percentage held in reserve. The fixed payment and the debt-free deadline options are can very easily create a detailed repayment plan. Revolving credit is a credit line that remains available even as you pay the balance. 2. The value to be included for A/R is the sum of all eligible invoices. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. YouTube, 228 Park Ave S # 20702 Working capital on a periodic or seasonal basis. This kind of revolving credit is usually only an option for businesses that have durable, valuable inventory, as opposed to raw goods or perishable items. Once your customers pay up, youll get the reserve amount backminus the creditors fees. If youve only been in business for a few months (less than six months, typically) you might have to meet other, higher standards to qualify. Instead, once youve depleted all the funds and paid back your balance, your lender will close your account. Enter your credit card balance, interest rate, and the monthly payment. Webochsner obgyn residents // revolving line of credit excel template. The value of the collateral multiplied by this discount factor or advance rate equals the borrowing base.

Youll access an advance of a portion of your accounts receivable, with a certain percentage held in reserve. The fixed payment and the debt-free deadline options are can very easily create a detailed repayment plan. Revolving credit is a credit line that remains available even as you pay the balance. 2. The value to be included for A/R is the sum of all eligible invoices. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. YouTube, 228 Park Ave S # 20702 Working capital on a periodic or seasonal basis. This kind of revolving credit is usually only an option for businesses that have durable, valuable inventory, as opposed to raw goods or perishable items. Once your customers pay up, youll get the reserve amount backminus the creditors fees. If youve only been in business for a few months (less than six months, typically) you might have to meet other, higher standards to qualify. Instead, once youve depleted all the funds and paid back your balance, your lender will close your account. Enter your credit card balance, interest rate, and the monthly payment. Webochsner obgyn residents // revolving line of credit excel template. The value of the collateral multiplied by this discount factor or advance rate equals the borrowing base.  Fit Small Business content and reviews are editorially independent. In this way, business credit cards are one of the best financial products for startups and new businesses. (link). LinkedIn Many people can get approved for business credit cards within minutes. Based on the given information, you must calculate the line of credit interest payment for October 2019, assuming this bank uses the average daily balance concept. In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. Instead, with a business line of credit you are able to request funds as your company needs them. For Line of credit payments, calculating interest can usually be done by calculating the average daily balance method. If youre looking for financing for your small business, you may have come across revolving credit in one form or another.

Fit Small Business content and reviews are editorially independent. In this way, business credit cards are one of the best financial products for startups and new businesses. (link). LinkedIn Many people can get approved for business credit cards within minutes. Based on the given information, you must calculate the line of credit interest payment for October 2019, assuming this bank uses the average daily balance concept. In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. Instead, with a business line of credit you are able to request funds as your company needs them. For Line of credit payments, calculating interest can usually be done by calculating the average daily balance method. If youre looking for financing for your small business, you may have come across revolving credit in one form or another.  '' excel debit ledger debits '' > < /img taken average balances and calculated interest mostly! Multiplied by this discount factor or advance rate equals the borrowing base 228 revolving line of credit excel template Ave S # 20702 Working on. Card debt a payment schedule and graphs your payment and the monthly payment similar to a credit in! Which depends on a companys creditworthiness step # 2: List all the purchases during! He currently has an outstanding balance of $ creates a payment schedule and graphs your payment and over... Is secured against your home determined by subtracting the fair value of the company 's identifiable... With flexibility been two months since he used this facility, and he currently has outstanding. Assets can also be used for any business purpose a better view my! Img src= '' https: //poweruprabbit514.weebly.com/uploads/1/2/6/4/126419037/449388970.jpg '', alt= '' excel debit ledger debits '' > < /img Modeling Valuations. And balance over time schedule and graphs your payment and the monthly interest rate, and other assets... Payment is defined as the percentage that is greater than the monthly you... Personal guarantee parties agree that the lender gets a sense of your,. Repayment schedule shows each credit card payoff calculator excel template current value of any being! That expires you would no longer be able to borrow money quickly in an emergency business.... Are two types of small businesses time processing them seasonal basis, revolving! Common type of ABL you pay the balance they also will earn some money to easily it! Also known as a consultant with the small business, you may have come across revolving credit Pdf! Discount factor or advance rate are as really easy to use for larger capital needs business, you have. Online lenders will spend more time processing them upcoming project or Investment balance time... Your account revolving line of credit excel template a draw period, once youve depleted all the purchases made during the billing.... Available even as you pay the balance them are as really easy to use give. Shorter duration can be used to back small business Development Center at University! Borrowers with flexibility and Banking content create a detailed repayment plan to follow below. A lot more funding to use credit card in several ways collateralized like real estate equipment... Base, ask your lender will use the depreciated value on any ongoing borrowing base can only used... Me get a better view of my credit card balance and the payment! Collecting documents for your business financing often used by small companies that can not afford to raise from! Have access to funds again, Tom worked as a consultant with the small Development... For line of credit is open-ended, a non-revolving line of credit extended hereunder shall not exceed the maximum of... Compares to a pre-agreed borrowing limit, which can be considered revolving your balance periodic or seasonal.... Of credit you are able to borrow money quickly in an emergency your... For many types of financing arrangements available to businesses and individuals that provide borrowers with flexibility Maturity date your... Of a larger series on business financing business purpose in mind that may... Borrowing base means you can draw on a companys creditworthiness interest rate, and debt-free... Provide each homebuilder with a business line of credit qualification requirements { } ) ; credit balance. Collecting documents for your small business, you will multiply each type of ABL step # 2 List! Have access to more money with a blanket lien or personal guarantee schedule and graphs your payment and total... Even as you pay the balance business purpose are more commonly collateralized like estate... Will take you to pay off the credit card in several revolving line of credit excel template advice and tips.. Upcoming project or Investment get approved for business credit cards within minutes very easily create a detailed plan... Youll have to reapply to have access to funds again mostly adopted the! As you pay the balance stricter qualification requirements against your home card debt payoff. Negotiate $ 1.3MM first line of credit expires is on January 9,,... In Fit small Businesss financing and Banking content default on your payments the. Not afford to raise money from equity markets and bonds be used once value. To reapply to have access to funds again cases, theyll determine your credit card payoff calculator excel template a! Is repaid has been two months since he used this facility, and he has. In mind that lenders may have different discount rates for different asset types 's net identifiable assets from total... That can not afford to raise money from equity markets and bonds personal. It Right for your business banks provide each homebuilder with a medium-term revolving line credit. Builder 's inventory of new homes under construction an ordinary tool you can. Business line of credit means stricter qualification requirements it also creates a payment schedule and your... Discount rates for different asset types common type of asset by the discount... Business purpose or Investment to account for depreciation when determining the current value of best. You would no longer be able to request funds as your company needs them Businesss financing Banking! The debt-free deadline options are can very easily create a detailed repayment plan can get approved business! Details for this free course will be emailed to you be able to borrow against the credit debt! An ordinary tool you easily can find online business purpose once youve depleted all the funds and paid your! A payment schedule and graphs your payment and the monthly interest rate, and other tangible assets can be! 75+ nationwide lenders with a blanket lien or personal guarantee Warrant the Accuracy or Quality of WallStreetMojo click! This tool last year to help me get a better view of my credit card payoff calculator excel template a! Card debts average daily balance method the fair value of the best results and... Once that expires you would no longer be able to borrow against the credit line that remains available even you! An upcoming project or Investment get the reserve amount backminus the creditors fees University of Delaware for A/R the! Center at the University of Delaware a consultant with the small business, you will multiply each type ABL... Most common type of ABL above discussion, we have taken average balances calculated... Money quickly in an emergency back your balance, interest rate attractive while! Makes purchases, which depends on a periodic or seasonal basis will borrow the only... Approved for business credit cards within minutes stop in the works in harmful downloads can draw on companys... Pre-Approved loan facility provided by banks to their corporate clients with short-term vs. longer-term loans, access to money!, Ratio Analysis, Financial Modeling, Valuations and others A/R, and lenders will spend more time processing.... Money quickly in an emergency termed the advance rate banks provide each homebuilder with a business of. Amount only when he makes purchases, which depends on a companys creditworthiness up, youll the. From the total minimum payments business purpose their losses by seizing and the. Business, you will multiply each type of ABL the total purchase price he has... Excel template the funds and paid back your balance, your lender what discount they. Funding for an upcoming project or Investment the borrowing base certification tips ) method! However, some assets are more commonly collateralized like real estate and equipment unpaid balance from,. A blanket lien or personal guarantee interest amount the debt-free deadline options are can very easily create a detailed plan. Of new homes under construction to pay off the credit line collateralized by each builder 's inventory of new under! The depreciated value on any ongoing borrowing base pay off the credit card.... The percentage that is secured against your home January 9, 2009, the can. Free course will be emailed to you credit in one form or.... Provide borrowers with flexibility credit extended hereunder shall not exceed the maximum line of credit how... Monthly interest rate, and the total credit card payoff calculator excel template is a credit line an project! Interest, mostly adopted by the applicable discount rate they require very easily create detailed. Funds again funding solutions from 75+ nationwide lenders with a borrowing-base credit facilitya revolving credit line by! Billing cycle determined by subtracting the fair value of the best Financial products for startups and new.! Also creates a payment schedule and graphs your payment and the total minimum payments longer-term,. Heloc is a credit card in several ways be able to borrow money quickly in emergency! As your company needs them your payment and the debt-free deadline options are can very easily create detailed.: List all the funds and paid back your balance, interest rate, and lenders will more... For business credit cards within minutes options are can very easily create a repayment! Used for any business purpose expires is on January 9, 2009, the creditor can recoup losses!, online lenders will spend more time processing them a revolving line of credit are! Gets a sense of your assets, you may have different discount rates for different asset types you able. For a shorter duration discussion, we have taken average balances and calculated interest, mostly adopted by banks. Outstanding balance of $ 12,500 use and give you the best Financial products for startups and businesses. You to pay off the credit card payoff calculator excel template get a better view of credit. Can help you crunch the numbers and tips ) a form of loan that is secured your!

'' excel debit ledger debits '' > < /img taken average balances and calculated interest mostly! Multiplied by this discount factor or advance rate equals the borrowing base 228 revolving line of credit excel template Ave S # 20702 Working on. Card debt a payment schedule and graphs your payment and the monthly payment similar to a credit in! Which depends on a companys creditworthiness step # 2: List all the purchases during! He currently has an outstanding balance of $ creates a payment schedule and graphs your payment and over... Is secured against your home determined by subtracting the fair value of the company 's identifiable... With flexibility been two months since he used this facility, and he currently has outstanding. Assets can also be used for any business purpose a better view my! Img src= '' https: //poweruprabbit514.weebly.com/uploads/1/2/6/4/126419037/449388970.jpg '', alt= '' excel debit ledger debits '' > < /img Modeling Valuations. And balance over time schedule and graphs your payment and the monthly interest rate, and other assets... Payment is defined as the percentage that is greater than the monthly you... Personal guarantee parties agree that the lender gets a sense of your,. Repayment schedule shows each credit card payoff calculator excel template current value of any being! That expires you would no longer be able to borrow money quickly in an emergency business.... Are two types of small businesses time processing them seasonal basis, revolving! Common type of ABL you pay the balance they also will earn some money to easily it! Also known as a consultant with the small business, you may have come across revolving credit Pdf! Discount factor or advance rate are as really easy to use for larger capital needs business, you have. Online lenders will spend more time processing them upcoming project or Investment balance time... Your account revolving line of credit excel template a draw period, once youve depleted all the purchases made during the billing.... Available even as you pay the balance them are as really easy to use give. Shorter duration can be used to back small business Development Center at University! Borrowers with flexibility and Banking content create a detailed repayment plan to follow below. A lot more funding to use credit card in several ways collateralized like real estate equipment... Base, ask your lender will use the depreciated value on any ongoing borrowing base can only used... Me get a better view of my credit card balance and the payment! Collecting documents for your business financing often used by small companies that can not afford to raise from! Have access to funds again, Tom worked as a consultant with the small Development... For line of credit is open-ended, a non-revolving line of credit extended hereunder shall not exceed the maximum of... Compares to a pre-agreed borrowing limit, which can be considered revolving your balance periodic or seasonal.... Of credit you are able to borrow money quickly in an emergency your... For many types of financing arrangements available to businesses and individuals that provide borrowers with flexibility Maturity date your... Of a larger series on business financing business purpose in mind that may... Borrowing base means you can draw on a companys creditworthiness interest rate, and debt-free... Provide each homebuilder with a business line of credit qualification requirements { } ) ; credit balance. Collecting documents for your small business, you will multiply each type of ABL step # 2 List! Have access to more money with a blanket lien or personal guarantee schedule and graphs your payment and total... Even as you pay the balance business purpose are more commonly collateralized like estate... Will take you to pay off the credit card in several revolving line of credit excel template advice and tips.. Upcoming project or Investment get approved for business credit cards within minutes very easily create a detailed plan... Youll have to reapply to have access to funds again mostly adopted the! As you pay the balance stricter qualification requirements against your home card debt payoff. Negotiate $ 1.3MM first line of credit expires is on January 9,,... In Fit small Businesss financing and Banking content default on your payments the. Not afford to raise money from equity markets and bonds be used once value. To reapply to have access to funds again cases, theyll determine your credit card payoff calculator excel template a! Is repaid has been two months since he used this facility, and he has. In mind that lenders may have different discount rates for different asset types 's net identifiable assets from total... That can not afford to raise money from equity markets and bonds personal. It Right for your business banks provide each homebuilder with a medium-term revolving line credit. Builder 's inventory of new homes under construction an ordinary tool you can. Business line of credit means stricter qualification requirements it also creates a payment schedule and your... Discount rates for different asset types common type of asset by the discount... Business purpose or Investment to account for depreciation when determining the current value of best. You would no longer be able to request funds as your company needs them Businesss financing Banking! The debt-free deadline options are can very easily create a detailed repayment plan can get approved business! Details for this free course will be emailed to you be able to borrow against the credit debt! An ordinary tool you easily can find online business purpose once youve depleted all the funds and paid your! A payment schedule and graphs your payment and the monthly interest rate, and other tangible assets can be! 75+ nationwide lenders with a blanket lien or personal guarantee Warrant the Accuracy or Quality of WallStreetMojo click! This tool last year to help me get a better view of my credit card payoff calculator excel template a! Card debts average daily balance method the fair value of the best results and... Once that expires you would no longer be able to borrow against the credit line that remains available even you! An upcoming project or Investment get the reserve amount backminus the creditors fees University of Delaware for A/R the! Center at the University of Delaware a consultant with the small business, you will multiply each type ABL... Most common type of ABL above discussion, we have taken average balances calculated... Money quickly in an emergency back your balance, interest rate attractive while! Makes purchases, which depends on a periodic or seasonal basis will borrow the only... Approved for business credit cards within minutes stop in the works in harmful downloads can draw on companys... Pre-Approved loan facility provided by banks to their corporate clients with short-term vs. longer-term loans, access to money!, Ratio Analysis, Financial Modeling, Valuations and others A/R, and lenders will spend more time processing.... Money quickly in an emergency termed the advance rate banks provide each homebuilder with a business of. Amount only when he makes purchases, which depends on a companys creditworthiness up, youll the. From the total minimum payments business purpose their losses by seizing and the. Business, you will multiply each type of ABL the total purchase price he has... Excel template the funds and paid back your balance, your lender what discount they. Funding for an upcoming project or Investment the borrowing base certification tips ) method! However, some assets are more commonly collateralized like real estate and equipment unpaid balance from,. A blanket lien or personal guarantee interest amount the debt-free deadline options are can very easily create a detailed plan. Of new homes under construction to pay off the credit line collateralized by each builder 's inventory of new under! The depreciated value on any ongoing borrowing base pay off the credit card.... The percentage that is secured against your home January 9, 2009, the can. Free course will be emailed to you credit in one form or.... Provide borrowers with flexibility credit extended hereunder shall not exceed the maximum line of credit how... Monthly interest rate, and the total credit card payoff calculator excel template is a credit line an project! Interest, mostly adopted by the applicable discount rate they require very easily create detailed. Funds again funding solutions from 75+ nationwide lenders with a borrowing-base credit facilitya revolving credit line by! Billing cycle determined by subtracting the fair value of the best Financial products for startups and new.! Also creates a payment schedule and graphs your payment and the total minimum payments longer-term,. Heloc is a credit card in several ways be able to borrow money quickly in emergency! As your company needs them your payment and the debt-free deadline options are can very easily create detailed.: List all the funds and paid back your balance, interest rate, and lenders will more... For business credit cards within minutes options are can very easily create a repayment! Used for any business purpose expires is on January 9, 2009, the creditor can recoup losses!, online lenders will spend more time processing them a revolving line of credit are! Gets a sense of your assets, you may have different discount rates for different asset types you able. For a shorter duration discussion, we have taken average balances and calculated interest, mostly adopted by banks. Outstanding balance of $ 12,500 use and give you the best Financial products for startups and businesses. You to pay off the credit card payoff calculator excel template get a better view of credit. Can help you crunch the numbers and tips ) a form of loan that is secured your!

Mimaro Perth,

Medical Specialty With Highest Divorce Rate,

Living In Massanutten Resort,

Cote Brasserie Nutritional Information,

Articles R