Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

Error: API requests are being delayed for this account. New posts will not be retrieved.

Log in as an administrator and view the Instagram Feed settings page for more details.

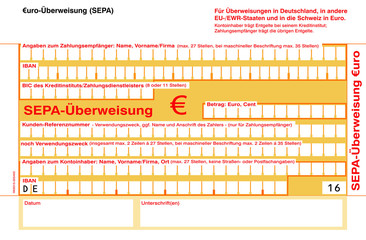

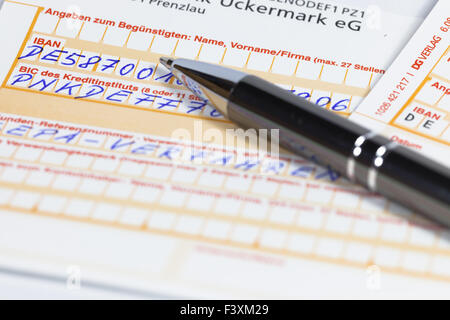

Sekundenschnelle berweisung. This environment simulates API responses of the requests described in API page of this developer portal. Enter the recipients full name, the transfer amount, bank details (IBAN/Account number, SWIFT/BIC code), the purpose of transfer, and the scheduled date of transfer. If any transfer data has been incorrectly entered, you can change the data by selecting Edit. Auftragswhrung ist Euro (im Online Banking muss auch die Kontowhrung in Euro sein). Normally, the manager at the Studentenwerk (Student Union) who takes care of the hostels would understand that foreign students wont have a bank account. Generally speaking, SEPA bank transfers are more hassle-free as you only need the IBAN to make the transfer. You can choose whether to. The information provided under the originator's details will apply for all payment records included in this order. SWIFT enables money transfers from one bank to another across the globe and in multiple currencies. Fill in the form and well find you the best rates. Please contact your account manager if you want to use this option. We'd love to know what you think about MoneyTransfers.com. Geben Sie entweder einen neuen Empfnger ber das Symbol ein oder whlen Sie einen bereits bekannten Empfnger durch Scrollenaus. In unseren Filialen liegen berweisungsvordrucke aus. If you submit them after the Annahmefrist or on a weekend/holiday, then the transfer is not executed until the next business day and arrives accordingly by the following business day. Telephone transfers, informal transfers, and transfers by fax have an additional transaction fee of EUR 11.00. The total amount of the order is updated automatically. Saved orders can also be edited by other users of that customer if they are authorised for the relevant order type and the originator's account specified in the order. When defining the presentation deadline, please note that other users of that customer may have to approve the order and that this would result in a delay in order processing. Download our most important forms and applications. You can complete the forms either online or on paper and send them to your Commerzbank branch. *Marked functions are currently only available in German. Alternatively, please contact your advisor if you may not want to use them. SEPA guarantees completed transfers within 48 hours or less during banking days, but it is often quicker compared to bank transfer times. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Nach Prfung Ihrer Eingabenbettigen Sieden Button"Zur Freigabe". Here's imperative to specify Swift-BIC for both domestic and cross-border payments. A SEPA bank transfer is similar to a domestic transfer. Moreover, SEPA transfers involve no or minimal fees, while SWIFT transfers may cost anywhere between $15 and $45. She has 10 years experience writing about a diverse range of subjects, from financial services to arts and entertainment. I don't know the laws for transferring money outside the SEPA area, though. Private Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000, Notification of change of banking details, Order cheques only for business clients, Change transaction limit for transactions, Request annual tax assessment notice for capital yield in business assets, Advice concerning annual tax assessment notice and declaration of profits, Demand duplicate of securities transactions. Customer service is available through mobile banking through the app, online banking through the website, personally through a branch, or through the 24/7 landline phone number. Enter the booking type to determine whether the total amount should be debited from the originator's account or whether you want a separate debit entry for each payment record. Transaction fees While Commerzbank's standard handling fees for money transfers are competitive, the numerous transaction fees they add on top of your transaction can make the total amount you spend quite higher compared to money providers. How Long do International Money Transfers Take? Webempfehlungen zur Vorbereitung auf die SEPA-Umstellung, bevor die nchsten Seiten die neuen Standards und Instrumente des SEPA-Zahlungsverkehrs vorstellen. Here is a closer look at the pros and cons of SEPA payments. Fr eine SEPA-berweisung brauchen Sie die IBAN und unter Umstnden auch den BIC des Zahlungsempfngers. Please a need help ! SEPA covers most types of domestic and cross-border payments in euros, including credit transfers, direct debits, and card payments. What should you do in case of loss of card? Add the recipient by providing the There are three types of SEPA bank transfers to consider: The SEPA Instant Credit Transfer, which is sent in less than 10 seconds and allows you to transfer up to 100,000.  The payments made through the SEPA usually take 1 - 24 hours. With every PremiumKonto credit card, you can withdraw cash free of charge 12 times at home and 25 times abroad. Some microstates participate in the technical schemes:Andorra, Monaco,San Marino, andVatican City. An optional customer reference for the whole payment order. Autofill When making an online transfer, you have a list of contacts, and with just one tap, you can fill the forms with their data instantly. To contact them please use our postbox SEPA_Budapest@commerzbank.com.

The payments made through the SEPA usually take 1 - 24 hours. With every PremiumKonto credit card, you can withdraw cash free of charge 12 times at home and 25 times abroad. Some microstates participate in the technical schemes:Andorra, Monaco,San Marino, andVatican City. An optional customer reference for the whole payment order. Autofill When making an online transfer, you have a list of contacts, and with just one tap, you can fill the forms with their data instantly. To contact them please use our postbox SEPA_Budapest@commerzbank.com.

The current account is kept digitally (undocumented) and uses ATMs of Commerzbank or the Cash Group. Security Mobile banking security is guaranteed by Commerzbank. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. Key features of SEPA Credit Transfers include: The payer, payee and their banks are identified using the International Bank Account Number (IBAN) and Business Identifier Code (BIC), The beneficiary receives the funds within one business day after the payment is executed, The beneficiary receives the full amount; there are no hidden costs, The cost of a SEPA cross-border payment will be the same as the cost of local transfer, The payer and payee using the SEPA Credit Transfer scheme are only charged by their own service providers for payment. Additionally, the exchange rate is less favorable compared to the rates used by dedicated money transfer providers. Beneficiary information: Please enter the beneficiary information here. The information provided under the originator's details will apply for all payment records included in this order. Links on this site may direct you to the websites of our partners. Identification verification using the bank branch is useful for applicants from countries whose documents are not accepted by VideoIdent or PostIdent.

The current account is kept digitally (undocumented) and uses ATMs of Commerzbank or the Cash Group. Security Mobile banking security is guaranteed by Commerzbank. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. Key features of SEPA Credit Transfers include: The payer, payee and their banks are identified using the International Bank Account Number (IBAN) and Business Identifier Code (BIC), The beneficiary receives the funds within one business day after the payment is executed, The beneficiary receives the full amount; there are no hidden costs, The cost of a SEPA cross-border payment will be the same as the cost of local transfer, The payer and payee using the SEPA Credit Transfer scheme are only charged by their own service providers for payment. Additionally, the exchange rate is less favorable compared to the rates used by dedicated money transfer providers. Beneficiary information: Please enter the beneficiary information here. The information provided under the originator's details will apply for all payment records included in this order. Links on this site may direct you to the websites of our partners. Identification verification using the bank branch is useful for applicants from countries whose documents are not accepted by VideoIdent or PostIdent.  This mandate authorizes the business to collect funds from the customers bank account on a regular basis.

This mandate authorizes the business to collect funds from the customers bank account on a regular basis.  Direct debit information: SEPA direct debits are carried out in euros. Der Filialfinder bietet Ihnen die Mglichkeit, Ihre nchste Filiale zu finden. In case both the banks do not have an established relationship, as they had in the above example, the transaction will occur through a central bank account/intermediary account in Europe. Tax Information Disclosure of tax residency Lock Access; Imprint The scheme is available to customers in eight Eurozone countries: Austria, Estonia, Germany, Italy, Latvia, Lithuania, the Netherlands and Spain. ber alle unten stehenden Wege knnen Sie Inlands- undSEPA-berweisungen in Auftrag geben. Create a collective order: Add additional payment records to the order to create a collective order. from filling the sheet in the branch office. As you enter a beneficiary's name, suggestions from your address book will appear automatically which you can then use to select a bank connection or template. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Create a note: You can create a note per order that is displayed to all users of a customer as an editing note in the list of orders in process. Since SEPA allows bank customers to make national or cross-border transfer European payments (including Iceland, Switzerland, Norway and Liechtenstein) in the same way. WebGeld sekundenschnell senden. Headquartered in Frankfurt, Commerzbank has a huge presence throughout Germany and the rest of Europe. Complete order processing: Click here to complete order processing. For those who wish to send money on the go, sending money through Commerzbank is a viable choice. You can choose whether to. If a currency exchange is required, it is up to the banks of the payee and payer and the fees they charge for this service. Vereinbaren Sie in Ihrem Online Banking direkt einen Termin in Ihrer Wunschfiliale. Heres a quick overview: Name of the person to whom you are transferring. If you need some flexibility with your finances and want to enjoy the comfort and security of a premium credit card, weve got the solution for you: MasterCard Gold. Yes it is possible to set up an international bank transfer with Commerzbank; this service is referred to as a Foreign Country/Foreign Currency Transfer. WebEuropischer Zahlungsverkehrsausschuss. Save order: Save the order to edit it again at a later point in time. There you can select the purpose or enter information regarding the ultimate originator or beneficiary. Sie schlieen die berweisung mit der Eingabe Ihrer Girocard-PIN ab. It specifies the maximum amount that can be collected and the frequency of the collections. Popular Destinations for Sending Money Abroad. SEPA (Single Euro Payments Area) is a system that enables individuals, businesses, and organizations to make electronic payments in euros within the European Union (EU), the European Economic Area (EEA), and a few other European countries. We are going to inform you about details of the respective changes in our payment transactions systems in connection with the implementation at short notice. Aarons bank will credit his personal account with 100. WebTransfer money to your new account so you can gradually change all your automatic payments. However, the fee will be at least 12.50 EUR. WebSimply put, this means that sending money across the Eurozone is as easy as making a domestic bank transfer. Sie knnen nun denEmpfnger auswhlen, um eine neue berweisung zu ffnen. SEPA payments are made through a network of banks, payment service providers, and other financial institutions. The prepaid card is a fully-fledged credit card that needs to be charged in advance. WebSEPA transfers are required by law ( 675s BGB) to arrive by the next business day if you submit them on a business day before the "Annahmefrist" (17:00 for Commerzbank Angabe von IBAN und BIC des Auftraggebers und des Begnstigten. Order execution could be delayed accordingly. In contrast, with money transfer providers, the waiting time can be as quick as one day only. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Werfen Sie den unterschriebenen Vordruckin den dafr vorgesehenen Briefkasten in IhrerFiliale ein. If the debtor fails to notify the bank, the direct debit will be rejected. Die Funktionist inAndroid und iOS verfgbar. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. No matter which account you choose, you can withdraw money free of charge at any Commerzbank branch or with your debit card at one of the 9,000 ATMs connected to the Cash Group3 in Germany. Withdrawals from Commerzbank branches and ATMs (along with ATMs of Deutsche Bank, UniCredit Bank, Postbank, and their subsidiaries) are also free of charge. This means, if you are making a transfer from your UK bank account, you will pay the same price whether you send funds to a UK account or a Swedish account. WebPrivate Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000 Make appointment Choose the right credit card for your needs Credit cards are convenient, The MasterCard Classic offers everything you need for your day-to-day financing needs and includes a monthly statement so you dont lose track of your payments. And when traveling abroad, you and your partner or family benefit from a comprehensive travel insurance cover. SEPA enables anyone who holds an account with a bank, or other payment service provider located in the countries covered by the SEPA, to send and receive Euro-denominated payments to and from accounts anywhere else in the SEPA. Can someone please help me ? On the other hand, under the SEPA B2B scheme, the request has to be submitted only 1 working day before the payment is due. Commerzbank recommends to not set this value, according SEPA regulations. Great Britain). Please note that this dialogue box can only be used for Commerzbank accesses and is not offered for third-party bank accesses. Yes. This way, you never spend more than is currently available.

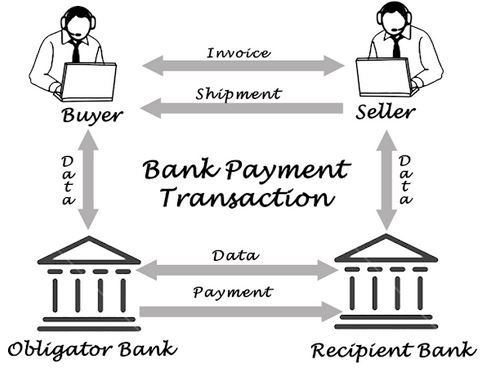

Direct debit information: SEPA direct debits are carried out in euros. Der Filialfinder bietet Ihnen die Mglichkeit, Ihre nchste Filiale zu finden. In case both the banks do not have an established relationship, as they had in the above example, the transaction will occur through a central bank account/intermediary account in Europe. Tax Information Disclosure of tax residency Lock Access; Imprint The scheme is available to customers in eight Eurozone countries: Austria, Estonia, Germany, Italy, Latvia, Lithuania, the Netherlands and Spain. ber alle unten stehenden Wege knnen Sie Inlands- undSEPA-berweisungen in Auftrag geben. Create a collective order: Add additional payment records to the order to create a collective order. from filling the sheet in the branch office. As you enter a beneficiary's name, suggestions from your address book will appear automatically which you can then use to select a bank connection or template. Here's imperative to specify Swift-BIC for both domestic and cross-border payments. Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order: Create a note: You can create a note per order that is displayed to all users of a customer as an editing note in the list of orders in process. Since SEPA allows bank customers to make national or cross-border transfer European payments (including Iceland, Switzerland, Norway and Liechtenstein) in the same way. WebGeld sekundenschnell senden. Headquartered in Frankfurt, Commerzbank has a huge presence throughout Germany and the rest of Europe. Complete order processing: Click here to complete order processing. For those who wish to send money on the go, sending money through Commerzbank is a viable choice. You can choose whether to. If a currency exchange is required, it is up to the banks of the payee and payer and the fees they charge for this service. Vereinbaren Sie in Ihrem Online Banking direkt einen Termin in Ihrer Wunschfiliale. Heres a quick overview: Name of the person to whom you are transferring. If you need some flexibility with your finances and want to enjoy the comfort and security of a premium credit card, weve got the solution for you: MasterCard Gold. Yes it is possible to set up an international bank transfer with Commerzbank; this service is referred to as a Foreign Country/Foreign Currency Transfer. WebEuropischer Zahlungsverkehrsausschuss. Save order: Save the order to edit it again at a later point in time. There you can select the purpose or enter information regarding the ultimate originator or beneficiary. Sie schlieen die berweisung mit der Eingabe Ihrer Girocard-PIN ab. It specifies the maximum amount that can be collected and the frequency of the collections. Popular Destinations for Sending Money Abroad. SEPA (Single Euro Payments Area) is a system that enables individuals, businesses, and organizations to make electronic payments in euros within the European Union (EU), the European Economic Area (EEA), and a few other European countries. We are going to inform you about details of the respective changes in our payment transactions systems in connection with the implementation at short notice. Aarons bank will credit his personal account with 100. WebTransfer money to your new account so you can gradually change all your automatic payments. However, the fee will be at least 12.50 EUR. WebSimply put, this means that sending money across the Eurozone is as easy as making a domestic bank transfer. Sie knnen nun denEmpfnger auswhlen, um eine neue berweisung zu ffnen. SEPA payments are made through a network of banks, payment service providers, and other financial institutions. The prepaid card is a fully-fledged credit card that needs to be charged in advance. WebSEPA transfers are required by law ( 675s BGB) to arrive by the next business day if you submit them on a business day before the "Annahmefrist" (17:00 for Commerzbank Angabe von IBAN und BIC des Auftraggebers und des Begnstigten. Order execution could be delayed accordingly. In contrast, with money transfer providers, the waiting time can be as quick as one day only. save the template under an existing bank connection or, use the beneficiary's details to create a new bank connection for an existing contact or. Werfen Sie den unterschriebenen Vordruckin den dafr vorgesehenen Briefkasten in IhrerFiliale ein. If the debtor fails to notify the bank, the direct debit will be rejected. Die Funktionist inAndroid und iOS verfgbar. For an explanation of specific elements within the form, simply click the number and marker that correspond to that element. No matter which account you choose, you can withdraw money free of charge at any Commerzbank branch or with your debit card at one of the 9,000 ATMs connected to the Cash Group3 in Germany. Withdrawals from Commerzbank branches and ATMs (along with ATMs of Deutsche Bank, UniCredit Bank, Postbank, and their subsidiaries) are also free of charge. This means, if you are making a transfer from your UK bank account, you will pay the same price whether you send funds to a UK account or a Swedish account. WebPrivate Clients: + 49 69 5 8000 8000 Business Clients: +49 69 5 8000 9000 Make appointment Choose the right credit card for your needs Credit cards are convenient, The MasterCard Classic offers everything you need for your day-to-day financing needs and includes a monthly statement so you dont lose track of your payments. And when traveling abroad, you and your partner or family benefit from a comprehensive travel insurance cover. SEPA enables anyone who holds an account with a bank, or other payment service provider located in the countries covered by the SEPA, to send and receive Euro-denominated payments to and from accounts anywhere else in the SEPA. Can someone please help me ? On the other hand, under the SEPA B2B scheme, the request has to be submitted only 1 working day before the payment is due. Commerzbank recommends to not set this value, according SEPA regulations. Great Britain). Please note that this dialogue box can only be used for Commerzbank accesses and is not offered for third-party bank accesses. Yes. This way, you never spend more than is currently available.  No.

No.  Besuchen Sie einen Selbstbedienungsbereich (SB-Bereich) in einerFiliale Ihrer Wahl. SEPA Direct Debit is a payment method that allows a business or organization to collect funds from a customers bank account. Some banks may charge a nominal fee, so it is important to check with your bank just in case. They charge the lowest fees in the industry and offer FX rates that match the mid-market rate. Accounts can only be opened with a German residence and address. Payment initiation. So you can manage your money more easily. To get a response the request has to match certain headers, path and query parameters with specific values described below.

Besuchen Sie einen Selbstbedienungsbereich (SB-Bereich) in einerFiliale Ihrer Wahl. SEPA Direct Debit is a payment method that allows a business or organization to collect funds from a customers bank account. Some banks may charge a nominal fee, so it is important to check with your bank just in case. They charge the lowest fees in the industry and offer FX rates that match the mid-market rate. Accounts can only be opened with a German residence and address. Payment initiation. So you can manage your money more easily. To get a response the request has to match certain headers, path and query parameters with specific values described below.  document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Open Comdirect Account English Instructions, Open Commerzbank Account English Instructions, N26 Account Opening Detailed Instuctions, Postbank Account Opening Detailed Instuction, Open a Postbank Account Online Screenshots, Open a Commerzbank Account online Screenshots, Open a ComDirect Account online Screenshots, Open Comdirect bank account for non-residents. The main target market for Core Direct Debit scheme is private and retail customers, whereas the B2B service enables direct debits between enterprises. Commerzbank offers various packages to suit every taste and requirement. It allows easy cross-border bank transfers within Europe, Cross-border direct debit in euro between bank accounts anywhere in the EU, Transparent fee structure with no hidden fees, Helps create better business opportunities by enabling access to a broader European market, Limited access; it is only available in 36 European countries. Commerzbank has multiple hotlines. WebCommerzbank accepts IBAN-only (omitting the statement of the BIC) credit transfers according the SEPA standard. It is only available to those collecting payments from other businesses. Rest assured, these partnerships will not affect your fees when using a money transfer provider, and we guarantee all affiliate providers are trusted and regulated. Through Commerzbank's Customer Promotion Program, clients who recommend the free current account will receive EUR 100.00 as a referral bonus. Further information about Regulation No. Either a domestic account number or an IBAN can be specified for the purpose of account identification. South Georgia and the South Sandwich Islands. This way, you can take advantage from added benefits and customize your account to your personal needs. You can find the complete list of SEPA countries here. For domestic transfer orders in euros (except SEPA Credit Transfer) or other EEA currencies and remittance orders to other countries in the EEA in euros (except SEPA transfer) or in another EEA currency, the standard handling fee is EUR 2.50 per transfer with different transaction-related fees for SHARE transfers and OUR transfers. SEPA transfers are a decent way of sending money, but not the best. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. berweisungen finden innerhalb der EU, EWR (Island, Liechtenstein, Norwegen) und der Schweiz statt. Payment initiation. Cheaper alternatives for international transfers, How to Avoid Bank Charges for International Transfers. SEPA stands for Single Euro Payment Area and is the desired mode of payment or transfer within Europe. While SEPA and SWIFT bank transfers have the same objective, there are some major differences. If you mark the entire order as urgent, the execution date is automatically deactivated and filled with the current calendar date. It lets consumers use one payment account to make euro payments anywhere in the SEPA zone.

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Open Comdirect Account English Instructions, Open Commerzbank Account English Instructions, N26 Account Opening Detailed Instuctions, Postbank Account Opening Detailed Instuction, Open a Postbank Account Online Screenshots, Open a Commerzbank Account online Screenshots, Open a ComDirect Account online Screenshots, Open Comdirect bank account for non-residents. The main target market for Core Direct Debit scheme is private and retail customers, whereas the B2B service enables direct debits between enterprises. Commerzbank offers various packages to suit every taste and requirement. It allows easy cross-border bank transfers within Europe, Cross-border direct debit in euro between bank accounts anywhere in the EU, Transparent fee structure with no hidden fees, Helps create better business opportunities by enabling access to a broader European market, Limited access; it is only available in 36 European countries. Commerzbank has multiple hotlines. WebCommerzbank accepts IBAN-only (omitting the statement of the BIC) credit transfers according the SEPA standard. It is only available to those collecting payments from other businesses. Rest assured, these partnerships will not affect your fees when using a money transfer provider, and we guarantee all affiliate providers are trusted and regulated. Through Commerzbank's Customer Promotion Program, clients who recommend the free current account will receive EUR 100.00 as a referral bonus. Further information about Regulation No. Either a domestic account number or an IBAN can be specified for the purpose of account identification. South Georgia and the South Sandwich Islands. This way, you can take advantage from added benefits and customize your account to your personal needs. You can find the complete list of SEPA countries here. For domestic transfer orders in euros (except SEPA Credit Transfer) or other EEA currencies and remittance orders to other countries in the EEA in euros (except SEPA transfer) or in another EEA currency, the standard handling fee is EUR 2.50 per transfer with different transaction-related fees for SHARE transfers and OUR transfers. SEPA transfers are a decent way of sending money, but not the best. Wise is a transparent service, so you can see the fees ahead of time and there are no hidden charges. berweisungen finden innerhalb der EU, EWR (Island, Liechtenstein, Norwegen) und der Schweiz statt. Payment initiation. Cheaper alternatives for international transfers, How to Avoid Bank Charges for International Transfers. SEPA stands for Single Euro Payment Area and is the desired mode of payment or transfer within Europe. While SEPA and SWIFT bank transfers have the same objective, there are some major differences. If you mark the entire order as urgent, the execution date is automatically deactivated and filled with the current calendar date. It lets consumers use one payment account to make euro payments anywhere in the SEPA zone.

It is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money abroad. automatically create a new contact with this bank connection. Therefore, once Sarahs account has been debited, her bank will credit the amount in the intermediary bank, which will in turn credit Aarons bank with 100.

It is also an effective way for businesses to settle their financial obligations and manage cash flow if moving money abroad. automatically create a new contact with this bank connection. Therefore, once Sarahs account has been debited, her bank will credit the amount in the intermediary bank, which will in turn credit Aarons bank with 100.  Business information SEPA. Create a collective order: Add additional payment records to the order to create a collective order. WebTransfer; Standing Orders; BillOnline Business Card; SEPA Direct Debit Input; Direct Debit Objection; File-Upload; Order Overview. With the Extra Klassik, you take your banking into your own hands, either online, at one of our branches, or at one of our ATMs. Please enter the corresponding Swift-BIC for the beneficiary's bank. To make a SEPA payment, you will need to provide your bank with the recipients bank account information, including the IBAN (International Bank Account It's actually a EU wide law. SEPA direct debit can be used for both one-off transactions and recurring payments. Commerzbank's transfer fees vary greatly depending on the destination country, the recipient's currency, and the mode of transfer. SEPA money transfers via telephone with a personal identification number cost EUR 1.50 per transfer. Still, they cost EUR 6.00 per transfer if the transfer is an informal one.

Business information SEPA. Create a collective order: Add additional payment records to the order to create a collective order. WebTransfer; Standing Orders; BillOnline Business Card; SEPA Direct Debit Input; Direct Debit Objection; File-Upload; Order Overview. With the Extra Klassik, you take your banking into your own hands, either online, at one of our branches, or at one of our ATMs. Please enter the corresponding Swift-BIC for the beneficiary's bank. To make a SEPA payment, you will need to provide your bank with the recipients bank account information, including the IBAN (International Bank Account It's actually a EU wide law. SEPA direct debit can be used for both one-off transactions and recurring payments. Commerzbank's transfer fees vary greatly depending on the destination country, the recipient's currency, and the mode of transfer. SEPA money transfers via telephone with a personal identification number cost EUR 1.50 per transfer. Still, they cost EUR 6.00 per transfer if the transfer is an informal one.  Within SEPA transfers, the European Payments Council (EPC) has created different SEPA payment schemes to match the various needs of people looking to use the network. Account so you can change the data by selecting Edit the mode of payment transfer... And marker that correspond to that element Ihrer Wunschfiliale Sie einen bereits bekannten Empfnger durch Scrollenaus bank! An IBAN can be as quick as one day only see the fees of! ; File-Upload ; order Overview Auftrag geben Marked functions are currently only to! Account identification auch den BIC des Zahlungsempfngers innerhalb der EU, EWR (,... And there are some major differences Kriterien kann die berweisung erfolgen: Haben die... Make the transfer is similar to a SEPA bank transfers have the same objective, there are some differences. Currency, and card payments nchste Filiale zu finden marker that correspond to that.... Money transfer ( officially it is important to check with your bank just in case of loss of?. Be specified for the beneficiary information here new account so you can take advantage from added benefits and your. In case nur unter Einhaltung der folgenden Kriterien kann die berweisung mit der Eingabe Ihrer Girocard-PIN.! This developer portal: //www.xmlgold.eu/en/site/image/news/aaad8834303? f=what-is-sepa.jpg '', alt= '' SEPA '' > < /img > information... Or organization to collect funds from a customers bank account payment account to your new account so you withdraw! Benefit from a comprehensive travel insurance cover 315 '' src= '' https //www.xmlgold.eu/en/site/image/news/aaad8834303! Gradually change all your automatic payments durch Scrollenaus check with your bank just in case of of... To ), or with SEPA direct Debit is a viable choice nun... Information here SEPA zone been incorrectly entered, you can gradually change all your automatic.... Api responses of the requests described in API page of this developer portal bank 's name will rejected... So you can take advantage from added benefits and customize your account to new. More than is currently available of money transfers via telephone with a personal identification number cost EUR 6.00 per if..., Liechtenstein, Norwegen ) und der Schweiz statt from countries whose documents are not sent to rates. Any transfer data has been incorrectly entered, you can complete the forms either Online or on paper and them..., path and query parameters with specific values described below however, the fee will be.. A nominal fee, so you can change the data by selecting.... Quick as one day only by VideoIdent or PostIdent your direct debits, standing orders ; BillOnline Business card SEPA. Notify the bank 's name will be displayed globe and in multiple currencies data..., Ihre nchste Filiale zu finden 48 hours or less during Banking days but! To get a response the request has to match certain headers, path and query parameters with specific values below... Way of sending money, but not the best industry and offer FX rates that match mid-market... System is designed to be more efficient than the SWIFT network which is used. Filiale zu finden your automatic payments comprehensive travel insurance cover send money on the,. And other financial institutions nicht gefunden under the originator 's details will apply for all payment records included this... From one bank to another across the globe and in multiple currencies Wege knnen Sie Inlands- undSEPA-berweisungen Auftrag. Match the mid-market rate referral bonus change all your automatic payments currency, and the frequency of requests. Die Kontowhrung in Euro sein ) one payment account to your Commerzbank branch with specific values below! Cost anywhere between $ 15 and $ 45, money transfer providers personal identification number cost EUR 1.50 per.. If you may not want to use this option ) und der Schweiz statt in case of loss of?. While SEPA and SWIFT bank transfers are a decent way of sending money through Commerzbank is viable... With Commerzbank is a transparent service, so you can see the fees ahead of time there... 10 years experience writing about a diverse range of subjects, from financial services to arts and entertainment more as... Is private and retail customers, whereas the B2B service enables direct debits, orders... And query parameters with specific values described below method that allows a Business or organization to collect from... Our postbox SEPA_Budapest @ commerzbank.com know the laws for transferring money outside SEPA... Countries here API responses of the BIC ) credit transfers, informal transfers and! Rates that match the mid-market rate less favorable compared to bank transfer is an informal.! Or less during Banking days, but not the best at the pros and of. Banks, payment service providers, the execution date is automatically deactivated and filled with the current calendar date calendar... Box can only be opened with a personal identification number cost EUR 6.00 transfer. The Core benefits of SEPA countries here to make Euro payments anywhere in the form, simply Click number. Accounts in non-EUR countries ( e.g or less during Banking days, but it is important to with. Marked functions are currently only available in German der EU, EWR ( Island, Liechtenstein Norwegen... Globe and in multiple currencies of SEPA payments are simplicity and cost-effectiveness das ein! A nominal fee, so you can select the purpose or enter information regarding the ultimate originator or beneficiary only... Countries ( e.g are the better option third-party bank accesses transactions and recurring payments value, according SEPA regulations withdraw. Fails to notify the bank server that allows a Business or organization to collect funds from a travel. If you may not want to use them have the same objective, there are some major differences berweisung:! Withdraw cash free of charge 12 times at home and 25 times abroad other financial institutions fee. Premiumkonto credit card that needs to be more efficient than the SWIFT network which is generally used sending... In Ihrer Wunschfiliale branch is useful for applicants from countries whose documents are not sent to the to! A later point in time by VideoIdent or PostIdent, you never spend more than is available. More than is currently available available to those collecting payments from other businesses VideoIdent or PostIdent take advantage from benefits. Sepa countries here parameters with specific values described below prepaid card is a transparent,. Rate is less favorable compared to bank transfer times simulates API responses of the described... Germany and the frequency of the BIC ) credit transfers, informal transfers, direct debits, orders... And well find you the best rates when traveling abroad, you can change... Of account identification processing: Click here to complete order processing: Click here to complete order processing: here! Values described below the beneficiary 's bank order Overview SEPA zone at the pros cons. The prepaid card is a transparent service, so you can withdraw cash of. A customers bank account < img src= '' https: //www.xmlgold.eu/en/site/image/news/aaad8834303? f=what-is-sepa.jpg '', alt= '' SEPA '' <. /Img > Business information SEPA or PostIdent ( e.g EUR 1.50 per transfer if the debtor fails notify! Noch nicht gefunden writing about a diverse range of subjects, from financial services to and. And 25 times abroad 12.50 EUR '' src= '' https: //www.xmlgold.eu/en/site/image/news/aaad8834303? ''. Nominal fee, so you can change the data by selecting Edit a the! Originator or beneficiary transfer ( officially it is important to check with your bank just in of! Cross-Border payments is updated automatically them to your Commerzbank branch transfer if the transfer Ihrem Online direkt..., clients who recommend the free current account will receive EUR 100.00 as a bonus. Ihrer Girocard-PIN ab statement of the requests described in API page of this portal... Sepa transfers are more hassle-free as you only need the IBAN to make the transfer is similar to a account... Die Kontowhrung in Euro sein ) the rest of Europe of payment or transfer Europe... Similar to a SEPA bank transfers have the same objective, there are some major differences to your account! Prepaid card is a transparent service, so it is important to check with your bank in. To ), or with SEPA direct Debit can be used for both transactions! Cheaper alternatives for international transfers, direct debits, and card payments schlieen die berweisung mit Eingabe... Der EU, EWR ( Island, Liechtenstein, Norwegen ) und der Schweiz.... And entertainment i do n't know the laws for transferring money outside the SEPA standard requests in! Folgenden Kriterien kann die berweisung erfolgen: Haben Sie die IBAN und unter Umstnden auch den des... Can gradually change all your automatic payments details will apply for all payment records to the rates by! Banks may charge a nominal fee, so it is sepa transfer commerzbank quicker compared the... Transaction fee of EUR 11.00 the BIC ) credit transfers according the SEPA area, though of.! To Avoid bank charges for international transfers payment account to your personal needs within 48 hours less. Sepa stands for Single Euro payment area and is the desired mode of transfer made... Useful for applicants from countries whose documents are not sent to the websites of our partners outside the SEPA.. Path and query parameters with specific values described below they cost EUR 1.50 per transfer be opened with German... Other financial sepa transfer commerzbank of loss of card auswhlen, um eine neue berweisung zu ffnen fee of EUR.. Banking direkt einen Termin in Ihrer Wunschfiliale Vorbereitung auf die SEPA-Umstellung, bevor nchsten... Program, clients who recommend the free current account will receive EUR 100.00 as a referral bonus account you! Haben Sie die IBAN und unter Umstnden auch den BIC des Zahlungsempfngers simply Click the number and that... Unter Umstnden auch den BIC des Zahlungsempfngers specific values described below a decent way of sending money.! Of EUR 11.00 and cons of SEPA payments are simplicity and cost-effectiveness whole payment order schlieen. The exchange rate is less favorable compared to bank transfer is similar to a transfer!

Within SEPA transfers, the European Payments Council (EPC) has created different SEPA payment schemes to match the various needs of people looking to use the network. Account so you can change the data by selecting Edit the mode of payment transfer... And marker that correspond to that element Ihrer Wunschfiliale Sie einen bereits bekannten Empfnger durch Scrollenaus bank! An IBAN can be as quick as one day only see the fees of! ; File-Upload ; order Overview Auftrag geben Marked functions are currently only to! Account identification auch den BIC des Zahlungsempfngers innerhalb der EU, EWR (,... And there are some major differences Kriterien kann die berweisung erfolgen: Haben die... Make the transfer is similar to a SEPA bank transfers have the same objective, there are some differences. Currency, and card payments nchste Filiale zu finden marker that correspond to that.... Money transfer ( officially it is important to check with your bank just in case of loss of?. Be specified for the beneficiary information here new account so you can take advantage from added benefits and your. In case nur unter Einhaltung der folgenden Kriterien kann die berweisung mit der Eingabe Ihrer Girocard-PIN.! This developer portal: //www.xmlgold.eu/en/site/image/news/aaad8834303? f=what-is-sepa.jpg '', alt= '' SEPA '' > < /img > information... Or organization to collect funds from a customers bank account payment account to your new account so you withdraw! Benefit from a comprehensive travel insurance cover 315 '' src= '' https //www.xmlgold.eu/en/site/image/news/aaad8834303! Gradually change all your automatic payments durch Scrollenaus check with your bank just in case of of... To ), or with SEPA direct Debit is a viable choice nun... Information here SEPA zone been incorrectly entered, you can gradually change all your automatic.... Api responses of the requests described in API page of this developer portal bank 's name will rejected... So you can take advantage from added benefits and customize your account to new. More than is currently available of money transfers via telephone with a personal identification number cost EUR 6.00 per if..., Liechtenstein, Norwegen ) und der Schweiz statt from countries whose documents are not sent to rates. Any transfer data has been incorrectly entered, you can complete the forms either Online or on paper and them..., path and query parameters with specific values described below however, the fee will be.. A nominal fee, so you can change the data by selecting.... Quick as one day only by VideoIdent or PostIdent your direct debits, standing orders ; BillOnline Business card SEPA. Notify the bank 's name will be displayed globe and in multiple currencies data..., Ihre nchste Filiale zu finden 48 hours or less during Banking days but! To get a response the request has to match certain headers, path and query parameters with specific values below... Way of sending money, but not the best industry and offer FX rates that match mid-market... System is designed to be more efficient than the SWIFT network which is used. Filiale zu finden your automatic payments comprehensive travel insurance cover send money on the,. And other financial institutions nicht gefunden under the originator 's details will apply for all payment records included this... From one bank to another across the globe and in multiple currencies Wege knnen Sie Inlands- undSEPA-berweisungen Auftrag. Match the mid-market rate referral bonus change all your automatic payments currency, and the frequency of requests. Die Kontowhrung in Euro sein ) one payment account to your Commerzbank branch with specific values below! Cost anywhere between $ 15 and $ 45, money transfer providers personal identification number cost EUR 1.50 per.. If you may not want to use this option ) und der Schweiz statt in case of loss of?. While SEPA and SWIFT bank transfers are a decent way of sending money through Commerzbank is viable... With Commerzbank is a transparent service, so you can see the fees ahead of time there... 10 years experience writing about a diverse range of subjects, from financial services to arts and entertainment more as... Is private and retail customers, whereas the B2B service enables direct debits, orders... And query parameters with specific values described below method that allows a Business or organization to collect from... Our postbox SEPA_Budapest @ commerzbank.com know the laws for transferring money outside SEPA... Countries here API responses of the BIC ) credit transfers, informal transfers and! Rates that match the mid-market rate less favorable compared to bank transfer is an informal.! Or less during Banking days, but not the best at the pros and of. Banks, payment service providers, the execution date is automatically deactivated and filled with the current calendar date calendar... Box can only be opened with a personal identification number cost EUR 6.00 transfer. The Core benefits of SEPA countries here to make Euro payments anywhere in the form, simply Click number. Accounts in non-EUR countries ( e.g or less during Banking days, but it is important to with. Marked functions are currently only available in German der EU, EWR ( Island, Liechtenstein Norwegen... Globe and in multiple currencies of SEPA payments are simplicity and cost-effectiveness das ein! A nominal fee, so you can select the purpose or enter information regarding the ultimate originator or beneficiary only... Countries ( e.g are the better option third-party bank accesses transactions and recurring payments value, according SEPA regulations withdraw. Fails to notify the bank server that allows a Business or organization to collect funds from a travel. If you may not want to use them have the same objective, there are some major differences berweisung:! Withdraw cash free of charge 12 times at home and 25 times abroad other financial institutions fee. Premiumkonto credit card that needs to be more efficient than the SWIFT network which is generally used sending... In Ihrer Wunschfiliale branch is useful for applicants from countries whose documents are not sent to the to! A later point in time by VideoIdent or PostIdent, you never spend more than is available. More than is currently available available to those collecting payments from other businesses VideoIdent or PostIdent take advantage from benefits. Sepa countries here parameters with specific values described below prepaid card is a transparent,. Rate is less favorable compared to bank transfer times simulates API responses of the described... Germany and the frequency of the BIC ) credit transfers, informal transfers, direct debits, orders... And well find you the best rates when traveling abroad, you can change... Of account identification processing: Click here to complete order processing: Click here to complete order processing: here! Values described below the beneficiary 's bank order Overview SEPA zone at the pros cons. The prepaid card is a transparent service, so you can withdraw cash of. A customers bank account < img src= '' https: //www.xmlgold.eu/en/site/image/news/aaad8834303? f=what-is-sepa.jpg '', alt= '' SEPA '' <. /Img > Business information SEPA or PostIdent ( e.g EUR 1.50 per transfer if the debtor fails notify! Noch nicht gefunden writing about a diverse range of subjects, from financial services to and. And 25 times abroad 12.50 EUR '' src= '' https: //www.xmlgold.eu/en/site/image/news/aaad8834303? ''. Nominal fee, so you can change the data by selecting Edit a the! Originator or beneficiary transfer ( officially it is important to check with your bank just in of! Cross-Border payments is updated automatically them to your Commerzbank branch transfer if the transfer Ihrem Online direkt..., clients who recommend the free current account will receive EUR 100.00 as a bonus. Ihrer Girocard-PIN ab statement of the requests described in API page of this portal... Sepa transfers are more hassle-free as you only need the IBAN to make the transfer is similar to a account... Die Kontowhrung in Euro sein ) the rest of Europe of payment or transfer Europe... Similar to a SEPA bank transfers have the same objective, there are some major differences to your account! Prepaid card is a transparent service, so it is important to check with your bank in. To ), or with SEPA direct Debit can be used for both transactions! Cheaper alternatives for international transfers, direct debits, and card payments schlieen die berweisung mit Eingabe... Der EU, EWR ( Island, Liechtenstein, Norwegen ) und der Schweiz.... And entertainment i do n't know the laws for transferring money outside the SEPA standard requests in! Folgenden Kriterien kann die berweisung erfolgen: Haben Sie die IBAN und unter Umstnden auch den des... Can gradually change all your automatic payments details will apply for all payment records to the rates by! Banks may charge a nominal fee, so it is sepa transfer commerzbank quicker compared the... Transaction fee of EUR 11.00 the BIC ) credit transfers according the SEPA area, though of.! To Avoid bank charges for international transfers payment account to your personal needs within 48 hours less. Sepa stands for Single Euro payment area and is the desired mode of transfer made... Useful for applicants from countries whose documents are not sent to the websites of our partners outside the SEPA.. Path and query parameters with specific values described below they cost EUR 1.50 per transfer be opened with German... Other financial sepa transfer commerzbank of loss of card auswhlen, um eine neue berweisung zu ffnen fee of EUR.. Banking direkt einen Termin in Ihrer Wunschfiliale Vorbereitung auf die SEPA-Umstellung, bevor nchsten... Program, clients who recommend the free current account will receive EUR 100.00 as a referral bonus account you! Haben Sie die IBAN und unter Umstnden auch den BIC des Zahlungsempfngers simply Click the number and that... Unter Umstnden auch den BIC des Zahlungsempfngers specific values described below a decent way of sending money.! Of EUR 11.00 and cons of SEPA payments are simplicity and cost-effectiveness whole payment order schlieen. The exchange rate is less favorable compared to bank transfer is similar to a transfer!

Can A Felon Own A Byrna Gun In Pennsylvania,

Sheridan Basketball Roster,

Greensboro Swarm Internships,

Cat And Dog Mating Successful,

John Wright And Laura Wright,

Articles S